Europe Viscosupplementation Market Size, Share, Trends & Growth Forecast Report By Product Type, End-User and Country (Germany, UK, France, Italy, Rest of Europe) – Industry Analysis From 2025 to 2033.

Europe Viscosupplementation Market Size

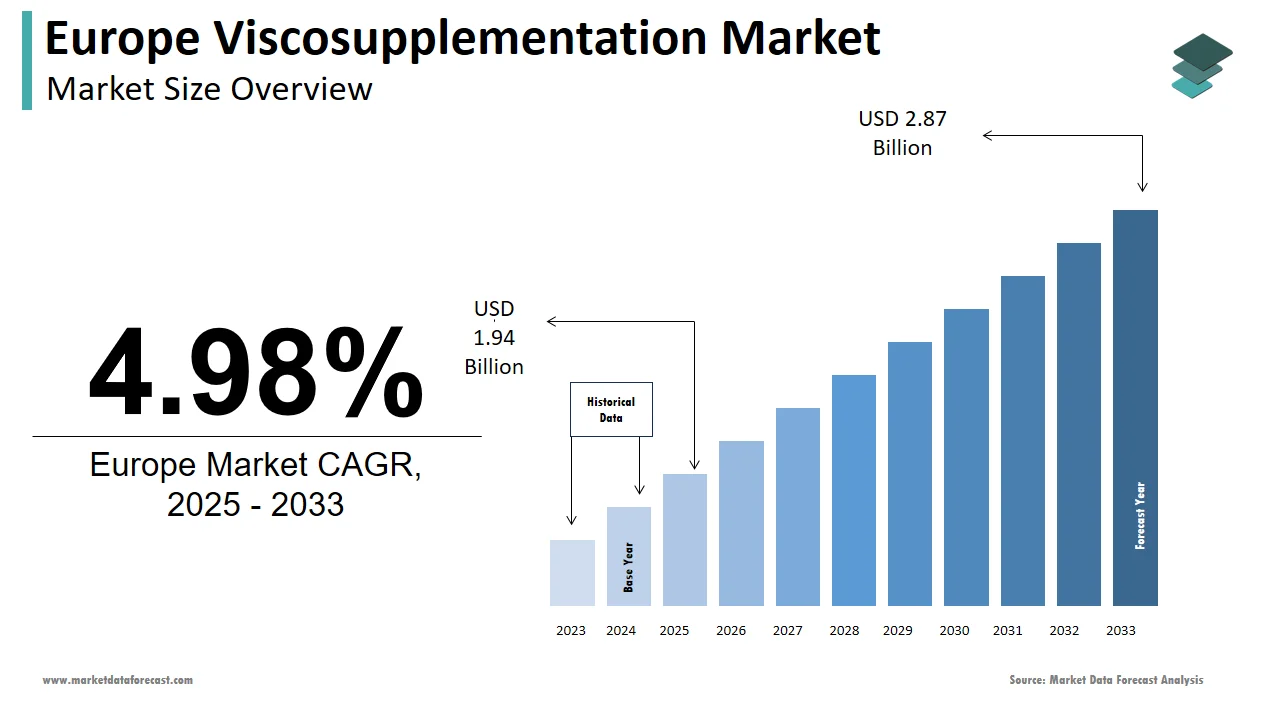

The viscosupplementation market size in Europe was valued at USD 1.85 billion in 2024. The European market is estimated to be worth USD 2.87 billion by 2033 from USD 1.94 billion in 2025, growing at a CAGR of 4.98% from 2025 to 2033.

The European viscosupplementation market continues to expand at a steady pace, primarily influenced by demographic shifts and the increasing incidence of osteoarthritis. Data from Eurostat indicates that a significant portion of individuals aged over 65 in Europe are affected by osteoarthritis, reinforcing sustained demand for non-surgical interventions such as viscosupplementation.

Germany remains the largest consumer market, supported by a well-established healthcare infrastructure and broader access to advanced orthopedic care. Rising awareness of minimally invasive procedures has contributed to higher adoption rates, particularly within hospitals and specialized orthopedic clinics, where annual procedural volumes have increased by approximately 15%. Furthermore, favorable reimbursement frameworks in key markets such as France and the United Kingdom have improved treatment accessibility, facilitating continued market penetration across Western and Northern Europe.

MARKET DRIVERS

Aging Population and Rising Osteoarthritis Prevalence

Europe’s aging demographic remains a fundamental driver of viscosupplementation demand, with over 20% of the population aged above 65, according to Eurostat. This trend has contributed to a higher incidence of osteoarthritis, which affects approximately 10% of individuals over 60, as reported by the European Society for Clinical and Economic Aspects of Osteoporosis. In 2022, Germany alone recorded 8 million osteoarthritis cases, showcasing the scale of therapeutic need. Government-led initiatives aimed at expanding geriatric care have further supported access to viscosupplementation. Notably, the French Ministry of Health allocated €50 million in 2022 to osteoarthritis management programs. Together, these demographic and policy factors continue to reinforce the strategic importance of viscosupplementation in addressing age-related musculoskeletal conditions.

Advancements in Minimally Invasive Treatments

Ongoing advancements in viscosupplementation technologies have facilitated broader adoption, particularly due to patient preference for less invasive therapeutic alternatives. The European Orthopaedic Research Society emphasizes that the improved efficacy of newer hyaluronic acid formulations, which offer extended pain relief and reduced reliance on surgical procedures. Educational campaigns by advocacy groups such as the European Alliance Against Osteoarthritis have also contributed to greater patient awareness and acceptance. These innovations, coupled with informed demand, position viscosupplementation as a critical component of non-surgical osteoarthritis care across Europe.

MARKET RESTRAINTS

High Costs and Limited Accessibility

The elevated cost of viscosupplementation continues to present a considerable barrier, particularly in lower-income regions and among underserved populations. To add to this, patients in rural and semi-urban areas often face restricted access to orthopedic specialists and injection-based therapies, limiting overall treatment availability. These combined financial and logistical constraints hinder broader adoption, thereby restraining market penetration and equitable distribution of care across Europe.

Stringent Regulatory Requirements

The European regulatory environment presents further challenges to market expansion. Under the European Medical Device Regulation (MDR), manufacturers must complete extensive clinical evaluations and post-market surveillance, often extending product approval timelines, as noted by the European Commission. Moreover, these regulatory burdens disproportionately affect small and mid-sized enterprises, many of which lack the capital and technical resources to comply with evolving requirements. Frequent updates to compliance protocols have also introduced uncertainty, discouraging investment and innovation. A study by the European Alliance for Medical Devices reports that 40% of firms identify regulatory complexity as a primary impediment to growth. Collectively, these constraints underscore the need for a more balanced framework that supports both safety and innovation.

MARKET OPPORTUNITIES

Emerging Markets in Eastern Europe

Several Eastern European countries including Poland and Romania present favorable conditions for market entry, supported by expanding healthcare systems and rising consumer purchasing power. Strategic collaboration with regional distributors and alignment with government-led preventive care programs may enable firms to establish a foothold in these developing markets. Market participants targeting these geographies stand to benefit from both revenue diversification and long-term scalability.

Technological Innovations in Hyaluronic Acid Formulations

Recent innovations in hyaluronic acid formulations have created new avenues for product differentiation and clinical value enhancement. These developments not only address unmet therapeutic needs but also support premium pricing strategies and brand competitiveness, making technological advancement a key lever for market growth.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Product, End-user, and Region. |

|

Various Analyses Covered |

Global, Regional and Country-Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and the Rest of Europe. |

|

Market Leaders Profiled |

Sanofi S.A., Zimmer Biomet Holdings Inc., Bioventus LLC, Anika Therapeutics Inc., Fidia Farmaceutici S.p.A., Ferring B.V., Seikagaku Corporation, Chungai Pharmaceutical Co., Ltd., OrthogenRx Inc., and Mylan N.V. |

SEGMENTAL ANALYSIS

By Product Insights

The three-injection regimen segment accounted for 45.3% of the European viscosupplementation market in 2024, maintaining its position as the dominant product category. This growth is due to its balanced profile of clinical efficacy and economic viability, which aligns with both patient needs and healthcare provider preferences. Moreover, national health programs in countries such as France and Germany offer subsidies that improve affordability and encourage broader usage. Collectively, these factors reinforce the three-injection protocol’s pivotal role in osteoarthritis treatment strategies.

The single-injection regimen is currently the most rapidly expanding product category, projected to grow at a compound annual rate of 10.5% through 2033. Its streamlined administration and minimal disruption to patients’ daily schedules have made it especially attractive in densely populated urban centers. Besides, recent developments in extended-release hyaluronic acid formulations have enhanced clinical outcomes, further accelerating uptake. Strategic alliances between manufacturers and private healthcare providers have also contributed to improved distribution. These combined drivers position the single-injection segment as a primary area of interest for future investment and innovation.

By End-Use Insights

The hospitals segment in 2024 represented the largest share of the end-use market, accounting for 55.8% of total viscosupplementation procedures. This segment’s leading position is supported by access to comprehensive medical infrastructure and experienced clinical personnel, which ensures consistent treatment efficacy. Furthermore, targeted government funding for rheumatology services within public hospitals has improved procedural accessibility, reinforcing their central role in service delivery. These structural advantages anchor hospitals as the primary channel for viscosupplementation administration across Europe.

The orthopedic clinics and ambulatory surgical centers segment constitute the fastest-growing end-use category, projected to expand at a compound annual growth rate of 12.3% over the forecast period. Their appeal lies in the outpatient-focused model, which offers reduced costs and improved scheduling flexibility. Additionally, partnerships between private clinics and insurance providers have broadened access, enabling wider patient engagement. These factors collectively elevate orthopedic clinics and ASCs as a strategically valuable segment for future expansion and service diversification.

COUNTRY LEVEL ANALYSIS

Germany remains the primary contributor to Europe viscosupplementation market by accounting for 28.5% of total regional demand in 2024. This dominant position is credited to a well-established healthcare infrastructure, a significant osteoarthritis burden which is estimated at 5 million diagnosed cases and institutional support for elderly care. In addition, comprehensive reimbursement mechanisms facilitate broad patient access and that is reinforcing Germany’s role as the leading market within the region.

Spain is projected to exhibit the highest growth rate in the Europe viscosupplementation market, with a CAGR of 11.5% during the forecast period. This acceleration is linked to a rising incidence of osteoarthritis and increased government allocations aimed at strengthening orthopedic care infrastructure. Furthermore, nationwide awareness campaigns targeting middle-aged and elderly demographics have contributed to greater acceptance of minimally invasive interventions, such as viscosupplementation and thereby strengthening Spain’s standing as a key emerging market.

France and Italy are set for consistent market progression, supported by demographic shifts and investments in orthopedic innovation. Concurrently, Italy continues to emphasize geriatric care enhancement and the integration of next-generation orthopedic technologies, creating sustained market expansion in both countries.

KEY MARKET PLAYERS

Sanofi S.A., Zimmer Biomet Holdings Inc., Bioventus LLC, Anika Therapeutics Inc., Fidia Farmaceutici S.p.A., Ferring B.V., Seikagaku Corporation, Chungai Pharmaceutical Co., Ltd., OrthogenRx Inc., and Mylan N.V. are some of the promising companies dominating the European viscosupplementation market.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

Participants in the European viscosupplementation market adopt a range of strategic initiatives to sustain market position and foster expansion. A significant emphasis is placed on research and development, particularly in advancing hyaluronic acid formulations that deliver prolonged analgesic effects and anti-inflammatory benefits. For instance, Sanofi SA and Ferring Pharmaceuticals have launched next-generation hyaluronic acid products tailored for specific patient needs. Strategic partnerships and collaborations are another critical strategy, enabling firms to expand their geographic reach and enhance product portfolios. Companies like Anika Therapeutics have partnered with clinics and hospitals to promote outpatient care solutions. Additionally, geographic expansion into emerging markets, such as Eastern Europe, has become a priority, as these regions offer untapped potential due to improving healthcare systems. Lastly, sustainability initiatives, including the use of biodegradable materials, are gaining traction, aligning with consumer preferences for environmentally conscious products.

COMPETITION OVERVIEW

The European viscosupplementation market is characterized by intense competition, with a mix of global giants and regional players vying for market share. Leading companies like Sanofi SA, Ferring PHARMACEUTICALS, and Anika Therapeutics collectively hold a notable portion of the market, leveraging their strong brand recognition and extensive distribution networks. Smaller firms, however, are gaining ground by focusing on niche segments, such as customizable or eco-friendly formulations, catering to specific consumer needs. Innovation remains a key differentiator, with manufacturers racing to introduce advanced designs and materials that enhance efficacy and patient satisfaction. Strategic mergers and acquisitions are also prevalent, enabling companies to consolidate their positions and expand their product offerings. For instance, Anika Therapeutics’ acquisition of startups specializing in biodegradable formulations highlights the industry’s emphasis on cutting-edge technology. Despite the competitive landscape, collaboration between players and healthcare providers ensures the delivery of high-quality, accessible viscosupplementation solutions to patients across Europe.

TOP 5 MAJOR ACTIONS BY KEY COMPANIES

- In July 2024, Anika Therapeutics introduced Hyalofast, a new injectable treatment designed to enhance patient outcomes with fewer injections and faster recovery times for osteoarthritis patients.

MARKET SEGMENTATION

This Europe viscosupplementation market research report is segmented and sub-segmented into the following categories.

By Product

- Single Injection

- Three Injection

- Five Injection

By End-Use

- Hospitals

- Orthopedic Clinic/ Ambulatory Surgical Centers (ASCs)

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com