Global Exploration Diamond Drilling Market Research Report By Drilling Type (Rotary Drilling and Wireline Drilling), By Mine Type (Open Pit Mines and Closed Pit Mines) By End Use Industry (Industrial And Construction), By Technique (Stitch Drilling And Underwater Diamond Drilling), and Region, Industry Forecast of 2024 to 2033

Global Exploration Diamond Drilling Market Size

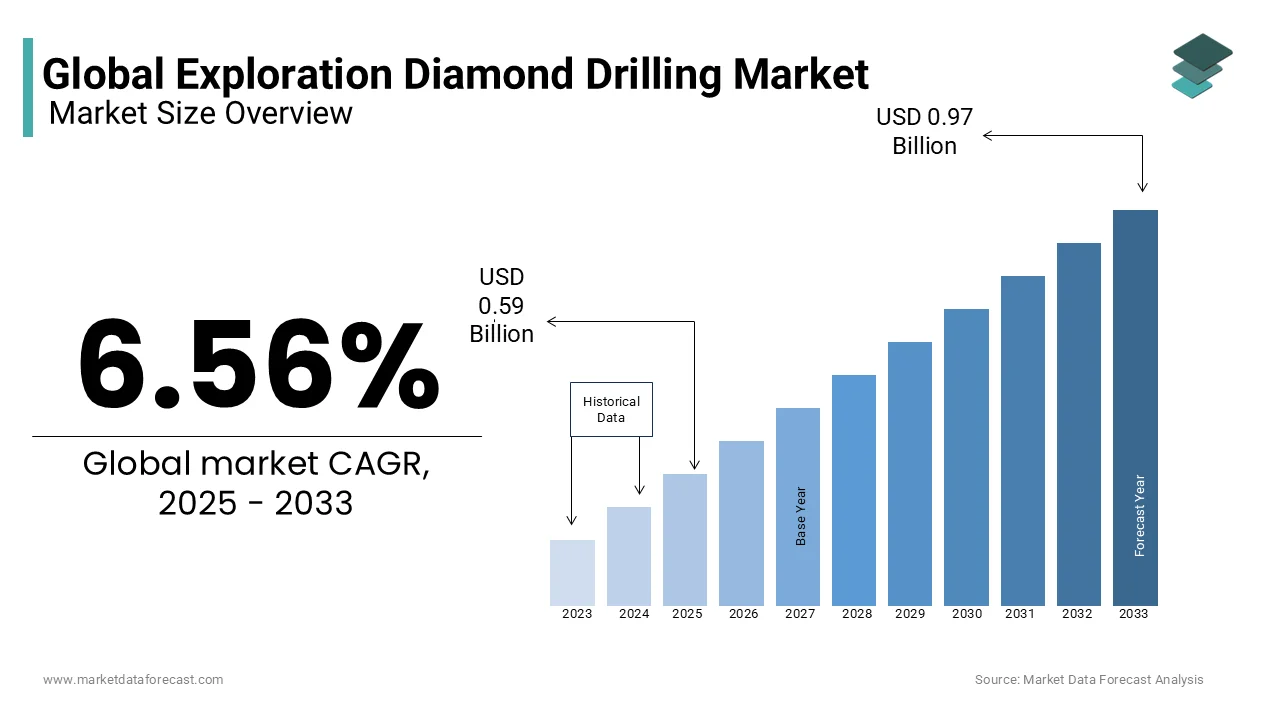

The Global Exploration Diamond Drilling Market was at USD 0.55 billion in 2024 and is predicted to reach USD 0.97 billion by 2033 from USD 0.59 billion in 2025, growing with a CAGR of 6.56% during the forecast 2025-2033.

Diamond drilling offers significant advantages over conventional drilling. With this technique, the cut is more precise than the other techniques. It also reduces the risk of damage. This is boosting the market for exploration diamond drilling. The equipment is very portable and lightweight and can be employed in situations where space is limited. In addition, the diamond drilling technique can be performed anywhere without fear of excessive noise. It is also predicted to be a major driver of the diamond exploration drilling market.

MARKET TRENDS

Diamond drilling is widely employed as a diamond workpiece. The diamond bit features advanced and workmanship small diamonds. Diamond drilling research is different from different geographic drilling. The bit uses a diamond-coated bit piece to drill the hardcore. To achieve this, the government is collecting remarkable liquidity to build solid roads. To examine the standard of the road, some builders use a diamond drill core to take the sample and project the existence of the road. It is estimated that all these factors will increase the sales of the diamond core market in the coming years. The advent of diamond drilling rigs is nothing short of an insurgency, primarily for the manufacturing industry, which has been through a period of resource-consuming chisels and hammers.

MARKET DRIVERS

The growing call for base metals like nickel, lead, copper, and zinc and precious metals like gold, silver, and diamonds is predicted to drive investment in metal mining activities.

This is possible to increase the call for diamond bits employed in underground hard rock mining. Diamond bits are mainly employed in the exploration industry, especially for hard rock, because the penetration of diamond bits is high compared to other materials. In 2018, Halliburton Company launched the Cerebro Bit Sensor Package, a new advanced technology that takes performance data directly from the bit and analyzes it to optimize bit engagement, reduce uncertainty and increase drilling efficiency. More and more residents are also training manufacturing companies around the world. The new facility underway requires restorations at manufacturing companies, which is predicted to increase the need for diamond coring in the coming years. Governments are focusing on escalating spending in the infrastructure framework and some administrations have suggested rules and regulations to link rural areas with urban areas.

MARKET RESTRAINTS

The size of the drill bits limits the size of the hole (1500mm), which should hamper the market.

MARKET OPPORTUNITIES

Order intake for underground diamond drilling rigs, for example, wireline drilling, has escalated worldwide due to the continued calls for these drilling solutions among underground mine operators. Diamond drilling offers notable advantages over traditional reaming. With this method, the cultivation is more correct than the different methods. It also reduces the chance of destruction. This is how the exploration diamond drilling market works. The devices are extremely transferable and not substantial and can be employed in circumstances where the scope is paid. Additionally, diamond drilling processes can be performed in any position without the fuss of excess manufacturing noise. It is also believed to be one of the leading players in the global exploration drilling market.

MARKET CHALLENGES

The dimension of the perforation portions limits the dimensions of the hole (1500 mm). This should restrict the market. However, this item can be overridden by a method called nuisance spasm.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.56% |

|

Segments Covered |

By Drilling Type, Mine Type, End Use Industry, Technique, and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Rodren Drilling, Adamas Drilling and Exploration, Hilti, BOSUN, Atlas Copco, Diaset, and Others. |

SEGMENTAL ANALYSIS

By Drilling Type Insights

By Technique Insights

The Stich drilling technique overcomes the bit size issue when exploring diamond drilling as diamond bits typically do not exceed 1500mm. This makes it difficult to drill large holes. Point drilling is primarily employed when a site is too small for other cutting methods. Diamond drilling is also suitable for underwater use, such as working in water treatment facilities or offshore platforms.

REGIONAL ANALYSIS

Asia-Pacific is the key region for the global exploration drilling market, followed by North America and Europe. Russia is the leading country in the making of diamonds around the world. The ALROSA group dominates the total diamond production of the Russian Federation. Large mining companies are involved in the extraction of diamonds in the main producing countries, except Zimbabwe and the Democratic Republic of Congo (DRC) in Africa, where diamond deposits are industrialized by prospectors and small companies. The market for mined diamonds is predicted to contract at a slow pace as existing mines are depleted, and no significant new reserves of deposits are found. Therefore, the supply of mined diamonds is also supposed to decline.

Latin America is the main region of the world market for diamond drilling for underground mining. Escalated investment in underground mineral extraction is predicted to increase the call for hard rock mining in Latin America. Latin American countries are beginning to move to underground mining from open pit mining.

South Africa was the moderate-income region in the underground diamond drilling market in 2017 compared to worldwide averages, exploration spending in South Africa is more focused on gold and diamonds. Geographically, more than 50% of South Africa's non-ferrous exploration expenditures are concentrated in South Africa, the Democratic Republic of the Congo, Burkina Faso, Ghana, and Zambia.

KEY PLAYERS IN THE MARKET

Companies playing a prominent role in the global exploration diamond drilling market include Rodren Drilling, Adamas Drilling and Exploration, Hilti, BOSUN, Atlas Copco, Diaset, and Others.

RECENT HAPPENINGS IN THE MARKET

- Norcat launches a new diamond drilling program. Norcat's technology, innovation, and training group is taking advantage of the growing call for diamond drills with its joint underground and surface diamond drilling assistant program.

- Epiroc is now launching the second-generation underground drilling rig with a mobile operator. A specially designed conveyor for calling underground operations with an extremely stable yet flexible boom.

MARKET SEGMENTATION

This research report on the global exploration diamond drilling market has been segmented and sub-segmented based on drilling type, mine type, end use industry, technique, and region.

By Drilling Type

- Rotary Drilling

- Wireline Drilling

By Mine Type

- Open Pit Mines

- Closed Pit Mines

By End Use Industry

- Industrial

- Construction

By Technique

- Stitch Drilling

- Underwater Diamond Drilling

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions

What are the key factors driving the growth of the global exploration diamond drilling market?

The primary drivers include the rising demand for precious metals such as gold and diamonds, technological advancements in drilling equipment, and increased investments in mining and exploration activities globally.

Which end-user industries contribute most to the demand for exploration diamond drilling?

The mining industry is the largest contributor, with significant demand from sectors such as gold, copper, diamond, and rare earth metal mining. Additionally, increasing demand for construction materials like limestone and aggregates also supports market growth.

What technological innovations are shaping the exploration diamond drilling market?

Recent innovations include the development of automated drilling systems, real-time data collection technologies, and enhanced core sampling tools that improve efficiency, accuracy, and safety during exploration activities.

How are geopolitical factors influencing the exploration diamond drilling market?

Geopolitical stability in mineral-rich regions promotes investment and exploration activities. However, trade restrictions, political instability, or conflicts in key mining regions can disrupt supply chains and negatively affect market growth.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com