Global Feminine Hygiene Market Size, Share, Trends & Growth Forecast Report Segmented By Type and Distribution channel and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Feminine Hygiene Market Size

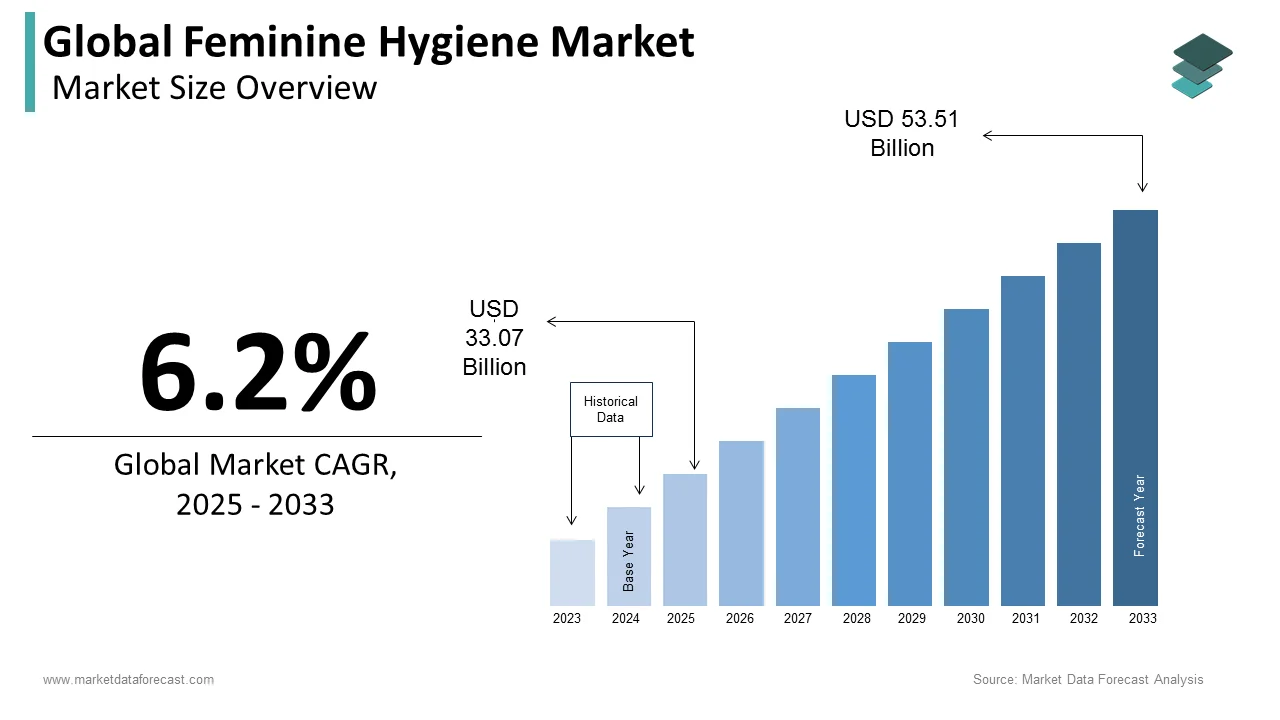

The size of the global feminine hygiene market was worth USD 31.14 billion in 2024. The global market is anticipated to grow at a CAGR of 6.2% from 2025 to 2033 and be worth USD 53.51 billion by 2033 from USD 33.07 billion in 2025.

Feminine hygiene products comprise the personal care products used by women to improve and maintain their personal hygiene. In 2018, the menstrual care products segment occupied the largest market share and is projected to maintain a significant share through the forecast period. Various manufacturers are shifting to innovative products that are organic, comfortable, and scented to gain customer attention. In addition, NGOs have been working towards providing the underprivileged with critical sanitary products for affordable prices. However, environmental risks still pose a significant problem due to the disposal of sanitary products that release harmful gas, cause water contamination, and drainage clogging.

MARKET DRIVERS

The growing awareness regarding the importance of hygiene and women's health has recently led to more market demand.

However, according to worldbank.org, nearly 500 million women across the globe lack access to standard period products and hygiene products during their menstrual cycles. Additionally, according to womenshealth.gov, women are 30 times more likely to contract UTIs, with around 25% - 40% of women in the US aged 20-40 years having a UTI. Several women worldwide, especially in third-world countries, still do not have proper access to menstrual products and bathrooms and cannot afford expensive products. Additionally, the need for more accessible hygiene resources supports the market's growth. Period products like tampons and sanitary pads often impose value-added or sales tax on them, unlike other products that do not have them, as and when they are considered a basic necessity. The ongoing efforts to make hygiene care more convenient for women are leading to growth in the market.

The rising population of women who need hygiene products is supporting the market's growth.

Around half of the world's female population is of the age to require these care products, and around 29% of women globally require feminine hygiene products. Therefore, the growing consumer base for these products supports the market's growth. However, there are several taboos and myths associated with periods and the use of hygiene products, and the need to eradicate such taboos and make periods a more openly discussed topic supports the market's growth. In several regions worldwide, hygiene products are considered taboo and not spoken about publicly. As a result, many women shy away from speaking about it, as they are conditioned to think it is an unhygienic routine that must be hidden. The need to keep a clean appearance, especially in recent generations, also supports market growth. More disposable razors and blades are becoming popular as women prefer to be shaved appropriately to appear prim and proper.

The growing literacy rates among women worldwide are increasing the demand for feminine hygiene products.

In addition, as the female population gains more knowledge about their overall health and well-being, the demand for several hygiene products also increases. According to UNESCO, the adult female literacy rate is around 79%, and this percentage is expected to increase in the coming years. Furthermore, a growing number of employed and educated women promote the concept of feminine hygiene, leading to market growth. In addition, the growing contribution of government organizations in spreading awareness and providing supplies to women in need worldwide through several funding and programs supports the market's growth. Additionally, global brands are creating more awareness of menstrual health through multiple campaigns leading to more growth in the market. For example, global menstrual hygiene day is celebrated every May 28. In addition, brands like RIO, Paree, Nua, etc., have launched multiple events like "RIO listens" and "Go with the flow," leading to more awareness of the matter.

MARKET RESTRAINTS

Even though several feminine hygiene products are available, like douche and ph balancers, to maintain your vaginal area, a woman's vagina has a self-cleaning mechanism and usually does not need exterior cleaning products.

Additionally, douching is sometimes considered bad for the vagina as it creates an imbalance of fluids in the area leading to more harm than good. Furthermore, several studies suggest that long-term use of pads can harm women's overall health and may even lead to cancer, making populations more skeptical about their usage. Several women going against the taboo that women have to be properly maintained by shaving unwanted hair and always maintaining an image is leading to a drawback for the market. The growing ideology of the society imposing these rules on women leads to restraints as there is a change in mentality. Additionally, it is proven that it can be more harmful and unhygienic to share your pubic hair as it could lead to burns and rashes while shaving and a more manageable risk of infection due to exposure. Pubic hair protects the vagina from infections and keeps it clean.

Therefore, the growing education toward this ideology leads to a decline in pubic shave product demands. Additionally, there have been several reports of tampons and menstrual cups being stuck in the vagina and inserted incorrectly, leading to inconvenience. Therefore, the several problems that women still face with these products are a restraint to market growth. Furthermore, even though efforts have been made to spread awareness, a sizeable female population still cannot afford the products, are unaware of them, or have a taboo surrounding them, leading to more drawbacks for the market. Several hygiene products also contribute to land pollution as they are not eco-friendly and can hurt the surroundings leading to more restraints for the market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Nature, Product Type, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Bristol-Myers Squibb Co., Merck and Co., F. Hoffmann-La Roche, Amgen Inc., Celgene Corp, Daiichi Sankyo, and Pfizer Inc. |

SEGMENTAL ANALYSIS

Global Feminine Hygiene Market Analysis By Nature

The disposable segment is expected to dominate the market during the forecast period due to the ease of using these products and their popularity among women. The growing market for the segment is the reason for its dominance. However, the recent awareness of the ill effects of the period stage is leading to many people shifting to reusable products, leading to expected growth in the segment.

Global Feminine Hygiene Market Analysis By Product Type

The Sanitary pads segment is expected to dominate the market during the forecast period due to high awareness about this period's products worldwide. Additionally, several women have reported feeling more comfortable using pads as they fear the mechanisms of a tampon or a menstrual cup, leading to more market in the subject. However, period pads come with several restrictions and risks of leakage. Therefore, as women become more aware of these disadvantages and the progressiveness and advantages of other products, there has been a gradual shift toward tampons and cups.

Global Feminine Hygiene Market Analysis By Distribution Channel

The supermarkets and hypermarkets segment is expected to dominate the market during the forecast period due to the availability of multiple varieties of period and hygiene products in these sources. In addition, these giants of commercial products stock up on various brands and provide customers with several choices leading to segment growth.

The online stores and pharmacy segments are also expected to grow due to digitalization and internet penetration.

REGIONAL ANALYSIS

The market in North America is expected to dominate due to the high awareness and the presence of several educated and working women in the region. Furthermore, the growing efforts in making period products more organic to create less wastage in countries like the US and Canada also support the growth of the market. Furthermore, the laws and regulations toward feminine hygiene and their availability in the region also favor women supporting the growth of the market. Additionally, the significant presence of prominent industries producing these products in the region supports the growth of the market in the region. Therefore, key market players and a well-aware female population support the market's growth.

The market in the European region is also expected to grow due to the growing introduction and acceptance of sustainability in hygiene products in the countries like the UK, Germany, Italy, etc. Furthermore, the growing favorable government policies from the EU support the growth. Additionally, many feminine hygiene product sales in the European region are leading to market growth. The market in Asia-Pacific is expected to have excellent potential for growth due to the high population of young females in the region. In addition, the recently growing awareness among women about the need for hygiene products in countries like India, Japan, China, etc., is leading to market growth in the region. Furthermore, rising interest in maintaining personal hygiene in the women of this region leads to market growth.

KEY PLAYERS IN THE GLOBAL FEMININE HYGIENE MARKET

There are several prominent players in the feminine hygiene market. Here are a few of the most common players, Edgewell Personal Care Company, First Quality Enterprises, Incorporation, Hengan International Group Co. Limited, Johnson & Johnson, Kao Corporation, Kimberly-Clark Corporation, Procter & Gamble Company, Svenska Cellulosa Aktiebolaget (Essity Aktiebolag, Unicharm Corporation, and Unilever plc.

RECENT MARKET DEVELOPMENTS

-

In May 2023, As part of Menstrual Hygiene Week, Vedanta Aluminium, the largest producer of aluminium in India, engaged with over 2300 women throughout its operations in Odisha and Chhattisgarh to promote women's health awareness. In addition, the company launched several significant initiatives to improve the health of rural women in line with the UN theme for this year, "Making menstruation a normal fact of life by 2030".

-

In May 2023, A Texas Bill abolishing the sales tax on specific family care items is close to becoming a law. The list of goods exempt from state sales tax is expanded by Senate Bill 379 to include baby bottles, maternity apparel, adult and child diapers, baby wipes, feminine hygiene products, and adult and child diapers. The law became effective on September 1.

- In June 2023, To raise awareness of the problem of menstrual waste on World Environment Day, Sirona, India's top FEMTECH brand known for its award-winning feminine hygiene products, has launched the motivational #ReuseKaroSaveKaro campaign. The campaign aims to promote eco-friendly alternatives like the Sirona Menstrual Cup and increase awareness of the value of sustainability and reusability in menstrual care.

- In May 2023, Sirona Hygiene, a femtech firm sponsored by The Good Glamm Group, has bought the condom brand Bleu for total cash. The creator of Sirona, Deep Bajaj, confirmed the news. In addition, the company declared that both online and offline retail would use the brand's omnichannel scale approach.

DETAILED SEGMENTATION OF THE GLOBAL FEMININE HYGIENE MARKET INCLUDED IN THIS REPORT

This research report on the global feminine hygiene market has been segmented and sub-segmented based on the nature, product type, distribution channel, and region.

By Nature

- Reusable

- Disposable

By Product Type

- Tampons and Menstrual cups

- Panty liners and shields

- Internal cleansers and sprays

- Sanitary pads

- Disposable razors and blades

By Distribution Channel

- Pharmacy

- Supermarket/hypermarkets

- Online stores

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- MEA

Frequently Asked Questions

How much is the global feminine hygiene market going to be worth by 2033?

As per our research report, the global feminine hygiene market size is projected to be USD 53.51 billion by 2033.

At What CAGR, the global feminine hygiene market is expected to grow from 2025 to 2033?

The global feminine hygiene market is estimated to grow at a CAGR of 6.2% from 2025 to 2033.

Does this report include the impact of COVID-19 on the feminine hygiene market ?

Yes, we have studied and included the COVID-19 impact on the global feminine hygiene market in this report.

Which region is growing the fastest in the global feminine hygiene market ?

Geographically, the North American feminine hygiene market for the largest share of the global market in 2024.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]