Global Fertility Test Market Size, Share, Trends & Growth Analysis Report By Testing Devices, Mode of Purchase, Application, End-User and Region (North America, Europe, Asia Pacific, Latin America, Middle East & Africa) – Industry Forecast from 2025 to 2033.

Global Fertility Test Market Size

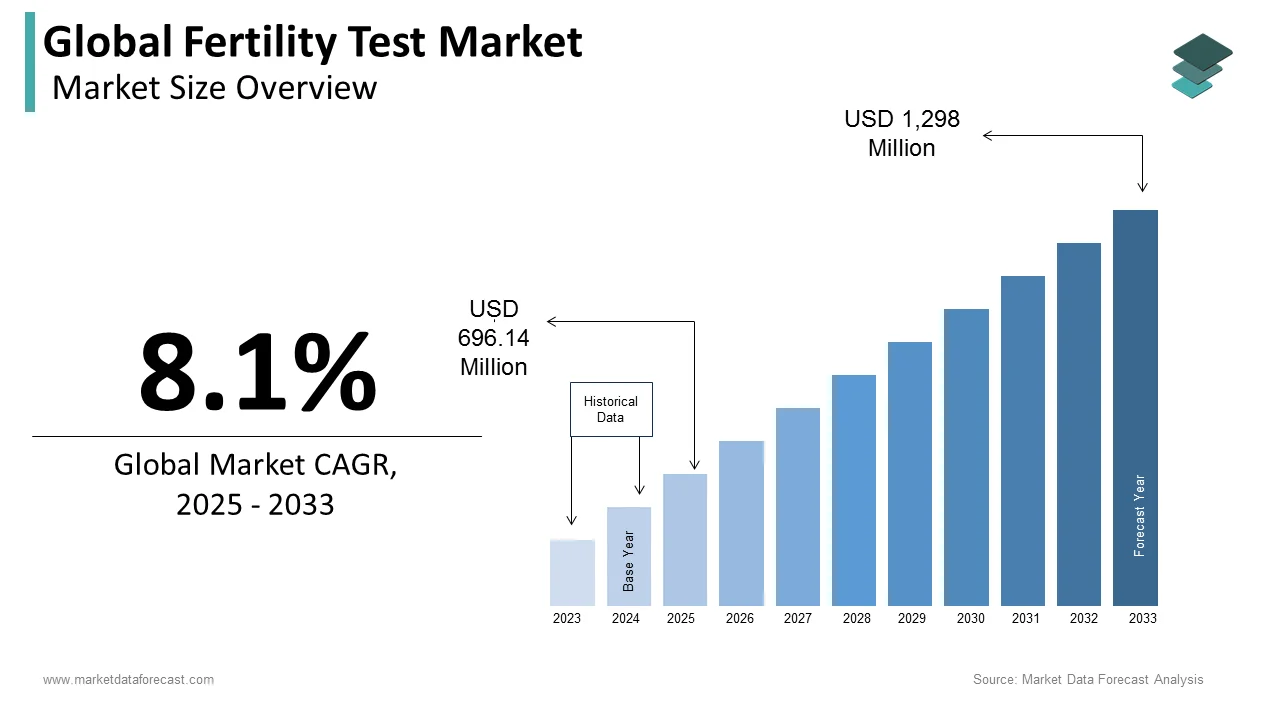

The size of the global fertility test market was worth USD 644 million in 2024. The global market is anticipated to grow at a CAGR of 8.1% from 2025 to 2033 and be worth USD 1,298 million by 2033 from USD 696.14 million in 2025.

The fertility test assesses fertility, and several conditions are linked to it in both men and women. Infertility is a condition of a rational duration of unprotected sex without conception. Couples perform fertility tests to identify the main reason for infertility. The general practitioner or gynecologist first assesses the fertility test results to analyze the specific problem and recommends corrective treatment. Therefore, owing to the increasing demand for fertility testing devices, the global market is expected to increase soon.

MARKET DRIVERS

The growing incidence of fertility issues both in men and women due to changes in lifestyle and food habits and awareness of the use of fertility monitors at home are propelling the global fertility test market growth.

The decreasing rate of fertility in men and women and the increasing prevalence of first-time pregnancy in women favor the fertility test market growth. In addition, factors such as the increasing population of women affected with PCOS, rising awareness regarding fertility tests among people in developed and developing countries, and the growing adoption rate of technologically advanced ovulation monitors are promoting the market’s growth rate. Furthermore, the rise in demand for remote monitoring and self-testing in young women is a big plus to the market growth. Furthermore, the growing adoption of online pharmacies, increasing availability of cost-friendly fertility kits, and growing focus on initiatives from private and public organizations to develop novel techniques and devices to test fertility rates in men and women are expected to boost the fertility test market growth.

The integration of smart technologies in healthcare, the growing adoption rate of ovulation monitoring devices due to growing awareness among people regarding the benefits of monitoring systems, and the evolution of marketing strategies such as e-commerce sites and social media are further anticipated to result in the growth of the fertility test market.

MARKET RESTRAINTS

However, issues associated with the accuracy of ovulation prediction kits and urine-based ovulation monitors for women affected by PCOS are major factors hampering the market’s growth rate. In addition, lack of awareness of these kits in rural areas, lack of standardization, and rapid changes in the economic strategies remain further inhibiting the growth of the fertility test market worldwide.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

8.1% |

|

Segments Covered |

By Testing Device, Mode of Purchase, Application, End User, and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Advacare Pharma, AVA, Babystart, Biozhena, Church & Dwight (US), Fairhaven Health, Fertility Focus, Geratherm Medical, Hilin Life Products, Prestige Brands Holdings (A Part of Gregory Pharmaceutical Holdings) (US), Sensiia, Swiss Precision Diagnostics (SPD) (Switzerland), Taidoc, Uebe Medical and Valley Electronics, and Others. |

SEGMENTAL ANALYSIS

Global Fertility Test Market Analysis By Testing Device

- Ovulation Predictor Kits

- Fertility Monitors

- Urine-based Monitors

- Saliva-based Monitors

- Other Fertility Monitors

- Male Fertility Testing Products

Based on the testing devices, the ovulation predictor kits segment contributes a significant share of revenues to the global fertility test market. It is anticipated to continue its dominion during the outlook period. The factors boosting the growth of this segment are that ovulation predictor kits are highly efficient and sufficient to control costs, the increasing prevalence of pregnancies in middle-aged women, and the growing demand for OPK kits.

Global Fertility Test Market Analysis By Mode of Purchase

- Non-Prescription/OTC-based

- Prescription-based

Global Fertility Test Market Analysis By Application

- Female Fertility Testing

- Male Fertility Testing

Based on the application, the female fertility testing segment is leading the global market. It is anticipated to expand further during the estimated period due to the factors such as the availability of various testing procedures, the increasing prevalence of fertility issues in women, and the expensive nature of IVF testing techniques.

Global Fertility Test Market Analysis By End User

- Home care settings

- Hospitals, Fertility Clinics, & Others

Based on end-users, in 2024, the home care settings segment dominated the market and is likely to display significant growth over the forecast period due to the factors such as increasing demand for fertility tests due to the drop-in fertility rate in men and women, increasing demand, and availability of home and remote monitoring options in the market.

REGIONAL ANALYSIS

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

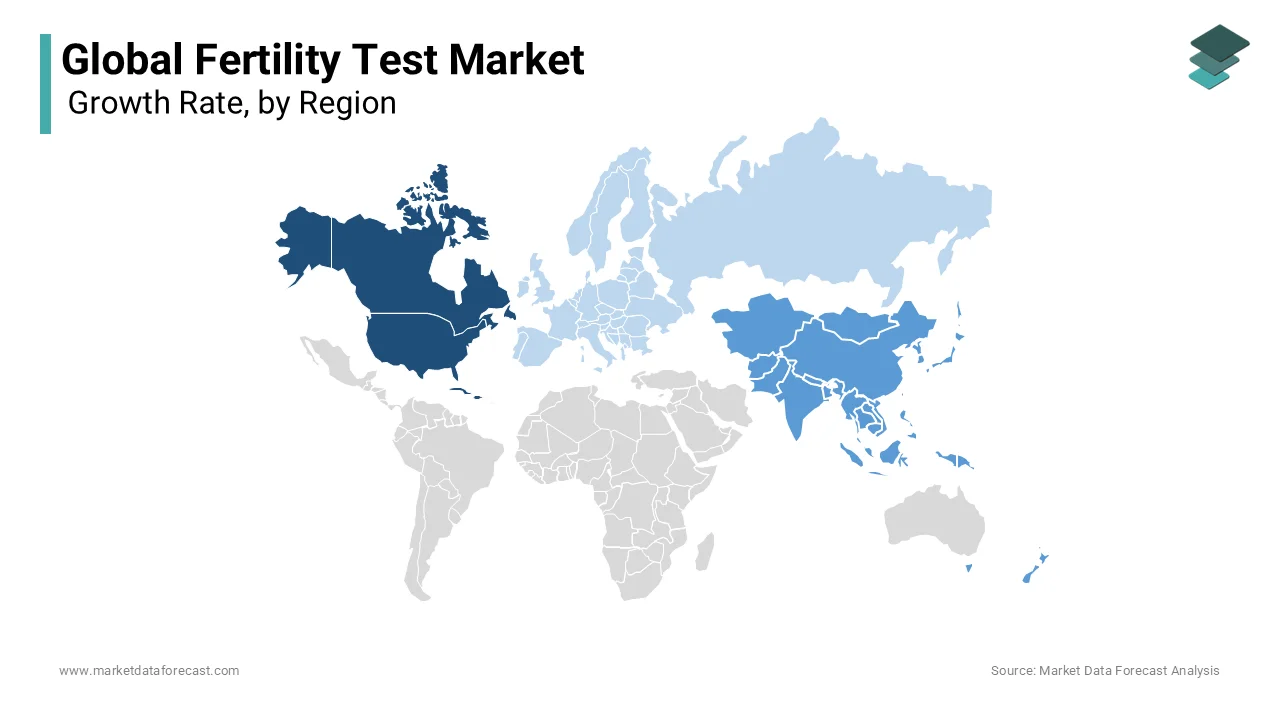

Regionally, North America held the largest share of the global market in 2024, owing to the rapid adoption of technological developments and the rise in pregnancy-age women. Furthermore, North America is expected to dominate the global fertility testing devices market throughout the forecast period due to several factors, such as declining fertility rate due to an increase in the age of first pregnancy and high incidence of polycystic ovaries syndrome in women of this region. The growing awareness of the benefits provided by fertility awareness methods and ovulation monitors for a successful conception in women.

The Asia Pacific and Europe are anticipated to hold a substantial share of the global market during the forecast period owing to the rise in investments by the government for the development of fertility and ovulation monitors. The growth of the Asia-Pacific is further driven by the increase in the number of women with lifestyle disorders, the growing attention of national and international actors, the increase in costs of setting up ovulation and fertility monitors, and the lowering of the fertility rate.

In Europe, the average fertility rate is 1.8. The lowest fertility rates were recorded in southern Europe, Italy, Spain, and Portugal, ranging between 1.65 and 1.41. China's fertility rates are also falling. In China, the low fertility rate is a bigger problem than the aging population. According to the National Bureau of Statistics, 18.14 million new-born babies were added to the Chinese population last year, a decrease of 645,200 year-on-year, and the birth rate fell from 13.42% in 2018 to 13.17% in 2019. Hence, declining fertility rates and increasing lifestyle disorders among women are expected to drive the market during the forecast period.

MARKET KEY PlAYERS

Notable companies leading the global fertility test market profiled in this report are Advacare Pharma, AVA, Babystart, Biozhena, Church & Dwight (US), Fairhaven Health, Fertility Focus, Geratherm Medical, Hilin Life Products, Prestige Brands Holdings (A Part of Gregory Pharmaceutical Holdings) (US), Sensiia, Swiss Precision Diagnostics (SPD) (Switzerland), Taidoc, Uebe Medical and Valley Electronics.

Frequently Asked Questions

How much is the global fertility test market going to be worth by 2033?

As per our research report, the global fertility test market size is estimated to be worth USD 1,298 million by 2033.

What is the growth rate of the global fertility test market?

The global fertility test market is estimated to grow at a CAGR of 8.1% from 2025 to 2033.

Which segment by testing device held the significant share in the fertility test market?

The ovulation predictor kits segment led the global fertility test market in 2024.

Which are the major companies in the fertility test market?

Companies playing a leading role in the global fertility test market are Advacare Pharma, AVA, Babystart, Biozhena, Church & Dwight (US), Fairhaven Health, Fertility Focus, Geratherm Medical, Hilin Life Products, Prestige Brands Holdings (A Part of Gregory Pharmaceutical Holdings) (US), Sensiia, Swiss Precision Diagnostics (SPD) (Switzerland), Taidoc, Uebe Medical and Valley Electronics

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com