Global Food Pathogen Testing Market Size, Share, Trends & Growth Forecast Report By Type, Food Type, Technology and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Food Pathogen Testing Market Size

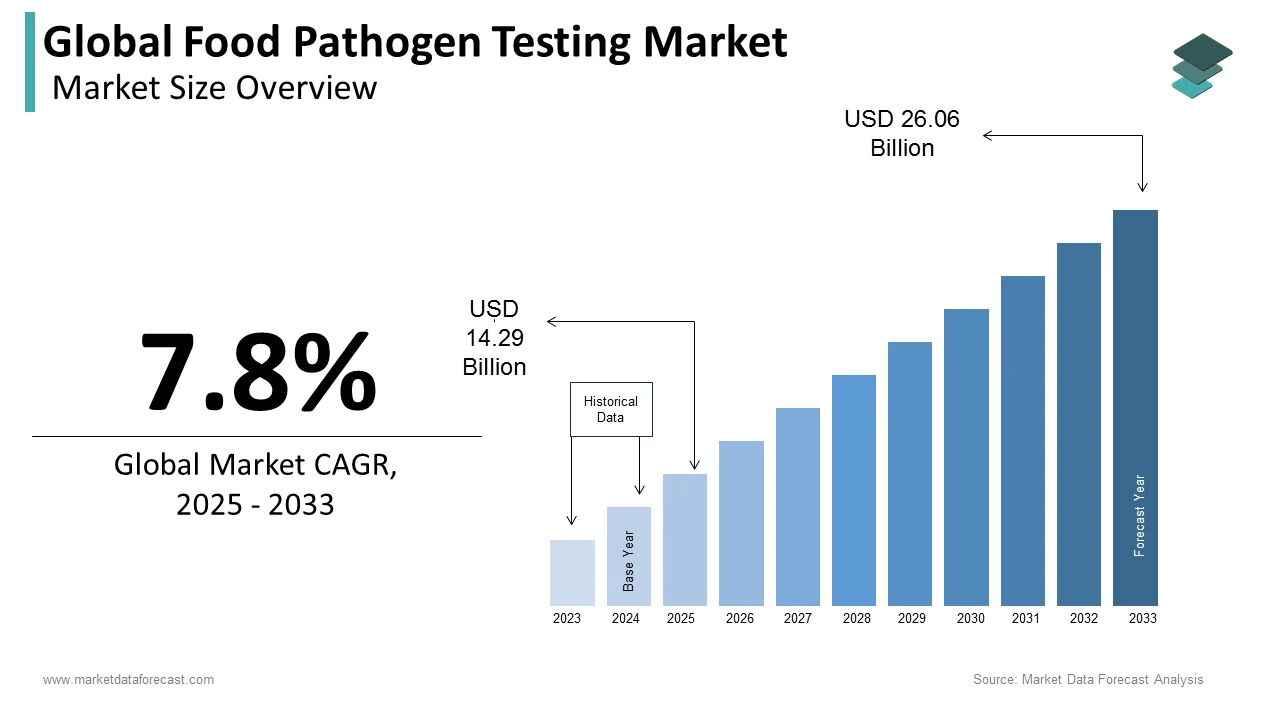

The size of the global food pathogen testing market was worth USD 13.26 billion in 2024. The global market is anticipated to grow at a CAGR of 7.8% from 2025 to 2033 and be worth USD 26.06 billion by 2033 from USD 14.29 billion in 2025.

Food pathogen testing detects any microbes and bacteria in food that may endanger one's existence. The primary and sole responsibility of a responsible food manufacturer and food safety bodies is to make only that food available to consumers and safe from disease-causing. Any health-related incident or mortality associated with a food-borne pathogen may be fatal to the consumer, the product, and the brand associated with the outbreak, as well as the future commercial viability of the processor's business.

MARKET DRIVERS

The growing number of food poisoning incidents, raising consumer awareness of food safety, the use of genetically modified organisms, and government agencies' strict food safety regulations propel the food safety testing market.

According to the Centers for Disease Control and Prevention (CDC), an estimated 48000 million people in the U.S. fall sick each year. The global food pathogen testing market is further driven by increased food poisoning incidents, rising consumer awareness about food safety, and the usage of genetically modified organisms. In addition, the food pathogen testing market is expected to grow due to advancements in food testing instruments and methods. Stringent regulation by governments worldwide for testing food and food items on the market and recent advances in testing technologies such as immunogenic separation and PCR support the growth of the global food pathogen testing market by reducing testing time and increasing pathogen sensitivity. In addition, the food pathogen testing market is also being propelled forward by early detection and faster, more accurate testing periods.

Recent advances in nanobiotechnology and pathogen testing methods, such as immunomagnetic separation and polymerase chain reaction, which reduce pathogen detection time and sensitivity, are expected to favor the food pathogen testing market. The market is also estimated to be propelled by government-enforced food laws and cost-effective and time-saving new fast technologies. Furthermore, improvements in various food pathogen testing technologies and shorter detection times favor the use of food pathogen testing by various food industry players. Increased investment in research & development by different government agencies and pharmaceutical and biotechnology businesses are driving the expansion of the food pathogen testing market. In addition, the food pathogen testing market is expected to be driven by advances in testing kits, quick results, and accuracy in the coming years.

MARKET RESTRAINTS

The global food pathogen testing market is expected to be hampered by a lack of awareness about safety standards, technical skills, and inefficient execution of laws. In addition, food price declines, food manufacturing industry losses, and a lack of stronger government rules and regulations for food industry implementation and monitoring are a few challenges to the food pathogen testing market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Type, Food Type, Technology, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis; Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

SGS S.A., Bureau Veritas S.A., Intertek Group PLC, Eurofins Scientific, Silliker, Inc., IFP Institut Für Produktqualität GmbH, ALS Limited, Asurequality, Microbac Laboratories, Inc. and Genetic Id Na Inc. |

SEGMENTAL ANALYSIS

Global Food Pathogen Testing Market Analysis By Type

The salmonella segment is estimated to register the most significant share of the global market during the forecast period owing to the rise in food infection prevalence. Salmonella is one of the major responsible factors for food infections and food-borne diseases globally, resulting in the increased focus of governments to control it by introducing several food testing techniques and enforcing the rules strictly to maintain the safety of food products. These contribute to the salmonella segment's growth, which eventually reflects the growth rate of the food pathogen testing market.

Global Food Pathogen Testing Market Analysis By Food Type

The meat and poultry segment is expected to dominate the global food pathogen testing market by contributing the largest share and is expected to grow at a promising CAGR during the forecast period owing to factors such as the high prevalence of contamination of meat and poultry, and implementation of stringent food safety regulations for testing food in various stages of the food supply chain like packaging, processing, and storing to curb the contamination of food.

On the other hand, the fruits and vegetables segment is estimated to register a healthy growth rate and is likely to proliferate during the forecast period.

Global Food Pathogen Testing Market Analysis By Technology

The rapid segment is forecasted to proliferate during the forecast period. In contrast, the Traditional category will have a significant growth rate in the coming years. Increasing consumer awareness of safe food products will likely accelerate the segmental expansion.

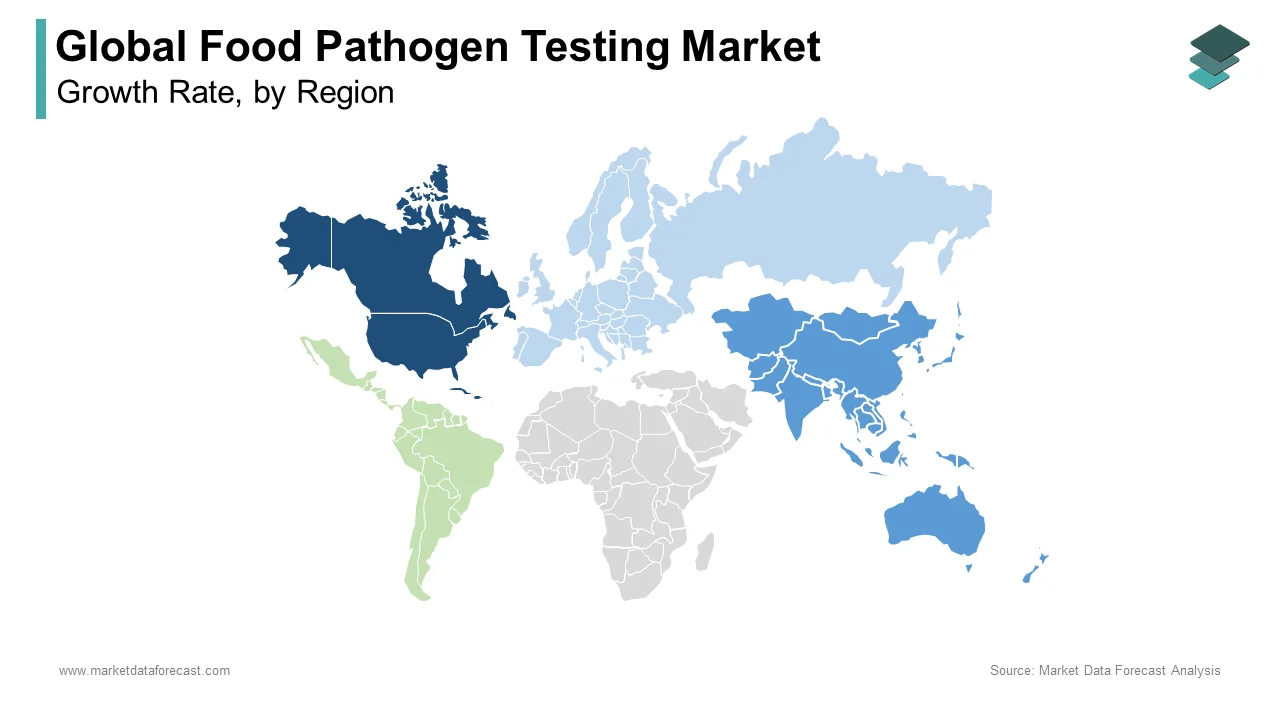

REGIONAL ANALYSIS

Owing to the rapid adoption of technological advancements, North America led the worldwide market for food pathogen testing in 2024.

In addition, due to the growing number of food poisoning outbreaks and public awareness of food safety, Salmonella and Campylobacter are among the widely tested pathogens in this region. The U.S. market is anticipated to dominate the North American region during the forecast period, followed by Canada.

The Asia-Pacific food pathogen testing market is projected to be the fastest-growing regional market worldwide. Growing investments from several multinational food producers, especially in China, India, and Southeast Asian countries, are propelling the food pathogen testing market in the Asia-pacific region. The strict safety and health regulations and the growing food trade between Asia-Pacific with the rest of the world further drive the market growth in APAC. Except for Japan, the Asia-Pacific region represents a significantly high-volume share in the global market for food pathogen testing. In addition, industries such as frozen poultry products, packaged vegetables, and others are growing considerably in APEJ due to consumer behavior shifts, which are expected to favor the food pathogen testing market in this region.

The European region accounted for a prominent global market share in 2024 and is forecasted to hold a decent occupancy in the global market during the forecast period.

Due to the modest growth rate in the food and beverage industry and growing population, developing economies such as the Middle East, Africa, and Latin America have had significant opportunities to increase their occupancy in the global market. Overall, the outlook for the worldwide food pathogen testing market will rise over the forecast period.

KEY PLAYERS IN THE GLOBAL FOOD PATHOGEN TESTING MARKET

A few of the notable companies dominating the global food pathogen testing market profiled in this report are SGS S.A., Bureau Veritas S.A., Intertek Group PLC, Eurofins Scientific, Silliker, Inc., IFP Institut Für Produktqualität GmbH, ALS Limited, Asurequality, Microbac Laboratories, Inc. and Genetic Id Na Inc.

RECENT HAPPENINGS IN THE MARKET

- In January 2020, Eurofins scientific company entered a strategic partnership with the food assurance business to expand its product portfolio and offer enhanced food testing solutions to its clients in Asia, Europe, and North America. Both companies collaborate under a new venture called Eurofins food assurance business line, which offers certification, auditing, labeling, and training and consultation services.

- In 2018, the Eurofins Scientific Company completed the acquisition of food analytical laboratories; this acquisition will help the food testing giant expand its business geographically.

- In 2019, Bureau Veritas entered a strategic partnership with AsureQuality. The key objective of this collaboration is to provide laboratory testing and analytical solutions to the food industries in Thailand, Vietnam, Indonesia, Singapore, and Malaysia. The collaboration contributed to expanding the size of the food pathogen testing market in Southeast Asian countries.

- In March 2017, SGS announced that it had acquired ILC, a laboratory expert in microbiology food testing services. This acquisition aims to improve the analysis of food manufacturing industries and produce quality food products for consumers.

- In December 2017, Eurofins Experchem, a food testing laboratory, achieved ISO 17025 certification by the Standards Council of Canada. Environmental monitoring, spoilage organism, and pathogen testing are some of the services offered by this new laboratory. In addition, it is to show excellence in nutritional and genetic analysis.

DETAILED SEGMENTATION OF THE GLOBAL FOOD PATHOGEN TESTING MARKET INCLUDED IN THIS REPORT

This research report on the global food pathogen testing market has been segmented and sub-segmented based on type, food type, technology, and region.

By Type

- E.Coli

- Salmonella

- Listeria

- Other pathogens

By Food Type

- Meat & Poultry

- Dairy

- Processed Food

- Fruits & Vegetables

- Cereals & Grains

By Technology

- Traditional

- Agar Culturing

- Rapid

- Convenience-Based

- PCR

- Immunoassay

- Other Molecular-Based Tests

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

How big is the food pathogen testing market?

As per our research report, the global food pathogen testing market size is estimated to value USD 26.06 billion by 2033.

Does this report include the impact of COVID-19 on the food pathogen testing market?

Yes, we have studied and included the COVID-19 impact on the global food pathogen testing market in this report.

Which region had the highest share in the food pathogen testing market in 2024?

The North American region accounted for the most significant share of the global food safety testing market in 2024.

Which are the prominent players operating in the food safety testing market?

Companies playing a major role in the global food safety testing market are SGS S.A., Bureau Veritas S.A., Intertek Group PLC, Eurofins Scientific, Silliker, Inc., IFP Institut Für Produktqualität GmbH, ALS Limited, Asurequality, Microbac Laboratories, Inc. and Genetic Id Na Inc.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com