Global Forestry and Logging Market Size, Share, Trends & Growth Forecast Report Segmented By Type (Logging, Timber Tract Operations, Forest Nurseries and Gathering of Forest Products), Application (Construction, Industrial Goods, Others), and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 to 2033

Global Forestry and Logging Market Size

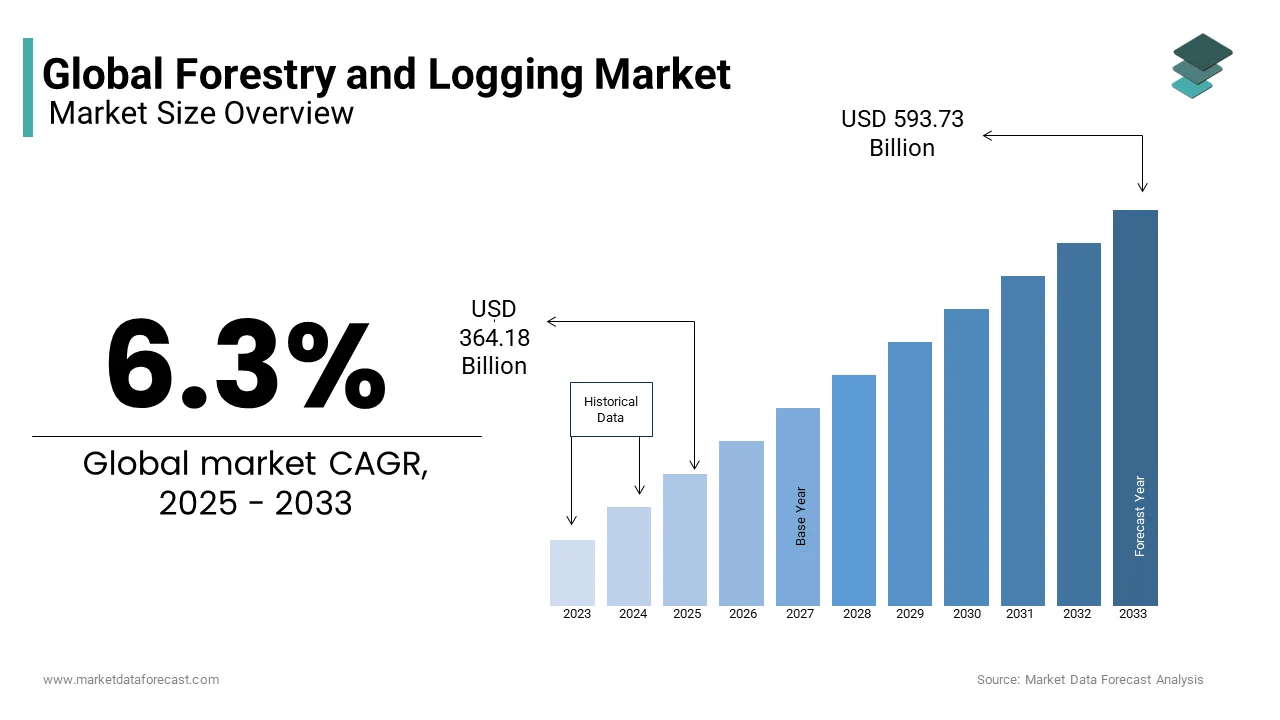

The global forestry and logging market size was valued at USD 342.60 billion in 2024, and is anticipated to reach USD 364.18 billion in 2025 from USD 593.73 billion by 2033, growing at a CAGR of 6.3% from 2025 to 2033.

The forestry and logging market consists of the sale of logs and forest products by entities (organizations, individual traders, and associations) that produce or harvest logs and forest products and are involved in the cultivation, felling, and harvesting. Timber transport, forest area operations, growing trees for reforestation, and collecting forest products such as gums, bark, and fibers. Forest and logging industry companies cultivate and harvest timber on a production cycle of 10 years or more. Companies in the forestry and logging market are specialized in the different stages of the production cycle. Reforestation requires the production of seedlings in specialized nurseries. In the long term, wood production requires appropriate areas of land or natural forests. The ripening time of the wood depends on the species of tree, the climatic conditions of the region, and the destination of the wood. Logging (except on a very small scale) requires advanced machinery specific to the market. Companies in the market collect forest products such as gums, bark, balm needles, rhizomes, fibers, Spanish moss, ginseng, and truffles.

The demand for forestry and logging services is anticipated to increase significantly during the forecast period. The growing need for timber, paper products, and sustainable biomass energy worldwide is primarily promoting the demand for forest and logging services. Countries such as Canada, Russia, and Brazil have the highest demand for forestry and logging services as these countries have vast forest resources that provide significant supply. For instance, Canada is a key player in the global forest industry and contributed USD 24.6 billion to its GDP in 2022, which is strongly supported by the exports of lumber and wood products. The global forestry and logging market has stiff competition. Key market participants such as Weyerhaeuser, Stora Enso, and Resolute Forest Products have been putting significant efforts into innovation to maintain their dominating status in the global forestry and logging market. Sustainable forestry practices are one of the major strategies adopted by key market participants. These sustainable forestry practices meet regulatory requirements and look appealing to environmentally conscious consumers. For instance, the Forest Stewardship Council (FSC) is a certification to the organization and is an example of sustainable forestry practices that ensure responsible forest management. In addition, the key market participants are increasingly focusing on utilizing the technological advancements in logging equipment and forest management software to improve efficiency and reduce environmental impact.

MARKET DRIVERS

The growth of the forestry and logging market is primarily driven by growth in residential construction activity, increasing demand for cruise ships, rising demand for paper and tissue products, and economic growth in emerging markets. Increased construction of wooden buildings, adoption of automated forest management, increased use of biomass, and growing demand for wooden furniture are expected to drive the forestry and logging market. The timber used as a building material is increasing due to the many advantages of timber buildings over concrete buildings, which is boosting the market for forest and timber producers. Aerial seed bombardment is adopted for planting trees in a large area. Aerial reforestation is the process of dropping sharp containers of saplings from planes that can plant nearly a million trees every day. The falling cans are made of biodegradable materials and contain a seedling filled with soil and nutrients.

Advanced techniques in logging methods have improved safety, fiber utilization, environmental protection, and productivity with minimal damage to residual trees. The various improved logging methods are logging/carrier systems, cable logging systems, and helicopter logging. Harvester or forwarder-type felling is more common in northern and central Europe and its use is expected to increase in the future due to its economic, ergonomic, and ecological advantages over motorized/manual felling (saw/drag).

MARKET RESTRAINTS

Strict regulations, alternative building materials, labor shortages, and the impact of COVID-19 are major factors that could hamper the growth of the forestry and logging market in the future. Strict regulations have always been a big challenge for the forestry and logging market. In response to natural disasters allegedly caused by deforestation, various countries around the world have imposed full or partial logging prohibitions on natural forests. Therefore, banning or restricting wood products is seen as a corrective measure aimed at promoting forest conservation and protection and securing broader forest benefits for future generations.

MARKET OPPORTUNITIES

The rising emphasis on sustainability and environmental conservation is a significant opportunity for the forestry and logging market. Sustainable forestry practices are being increasingly valued as they ensure the responsible management of forest resources to maintain biodiversity, productivity, and ecological processes. As per the Global Forest Resources Assessment 2020 by FAO, 31% of the total land area is forest area, which is also 10.6 billion acres. As per the statistics of the Forest Stewardship Council, approximately 300 million hectares will be certified forest area by 2026, which is currently at 220 million hectares. In addition to that, the demand for certified wood products is also growing significantly, resulting in an increasing demand for sustainably sourced timber. The implementation of sustainable practices aids preserves forest ecosystems and also helps in the growing demand for eco-friendly products, which is further expected to open new markets and improve the profitability of the companies operating in the global forestry industry.

MARKET CHALLENGES

Deforestation and associated environmental concerns are a major challenge to the global forestry and logging market. Logging has to be done on a limited scale; otherwise, it will lead to habitat loss, biodiversity reduction, and climate change. According to data from the World Bank, more than 10 million hectares of forest were lost annually between 2015 and 2020. The growing scrutiny from environmental groups and stricter regulations that focus on curbing deforestation is limiting logging activities. Companies must adopt sustainable practices to mitigate these concerns.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.3% |

|

Segments Covered |

By Type, Application and Region |

|

Various Analyses Covered |

Global, Regional, and Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

West Fraser Timber Co Ltd, Canfor, Weyerhaeuser Company, Hancock Victorian Plantations, Forestry Corporation of NSW, Rayonier Inc., China Forestry Group Corporation, and Potlatch Deltic Corporation. |

SEGMENT ANALYSIS

By Type Insights

The logging segment was the largest segment in the global market and accounted for 89.5% of the total market in 2022. The logging segment will be the most rapidly growing segment in the global forestry and logging market, with a CAGR of 9.0 % in the future.

By Application Insights

The construction segment is the fastest-growing segment in the global forestry and logging market, representing 43.3% of its overall market in 2022, and is the largest segment in the market, growing rapidly in the future with a CAGR of 10.3%.

REGIONAL ANALYSIS

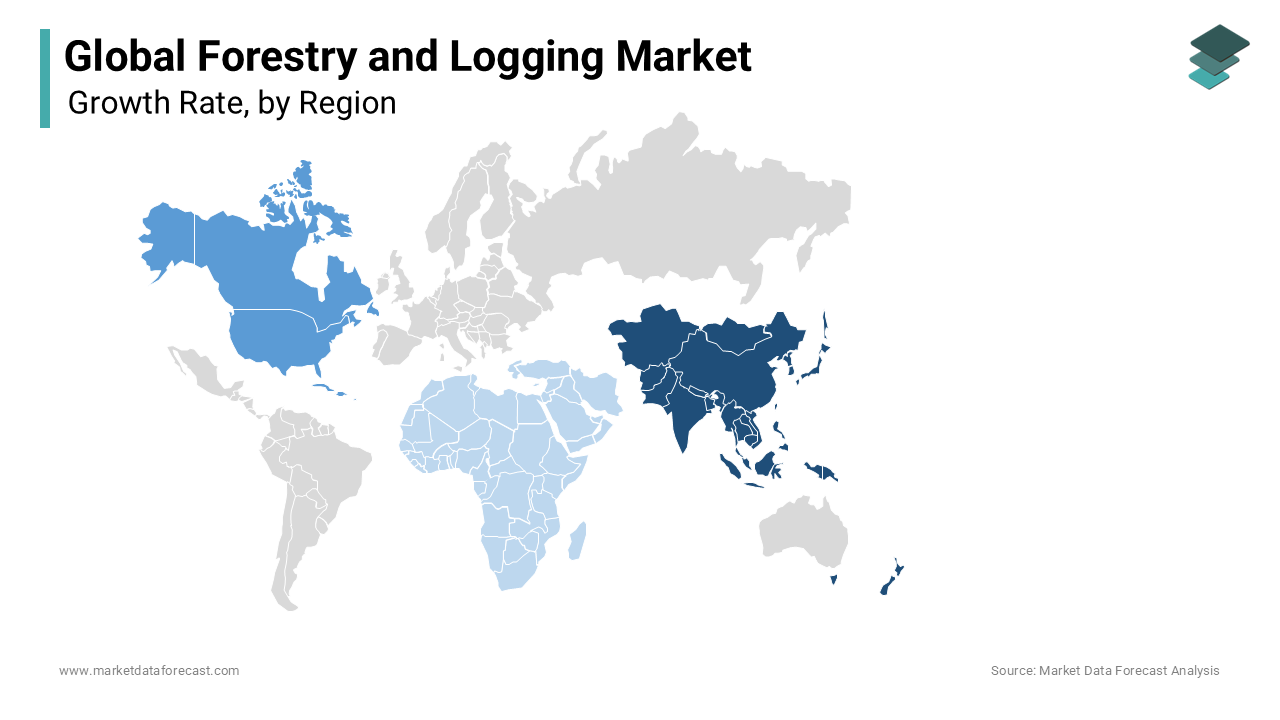

In 2022, Asia-Pacific was the largest region in the worldwide forestry and logging market, accounting for 38% of the total. North America was the second-largest region, with 22% of the world's market. Europe is expected to have the highest CAGR in the near future. Rising exports and imports and growing demand for various plant production are likely to leverage the growth rate of the market. Latin America is expected to have growth opportunities in the coming years. The Middle East & Africa was the smallest region in the world’s forestry and logging market.

KEY MARKET PLAYERS

The major key players in the global forestry and logging market include West Fraser Timber Co Ltd, Canfor, Weyerhaeuser Company, Hancock Victorian Plantations, Forestry Corporation of NSW, Rayonier Inc., China Forestry Group Corporation, And Potlatch Deltaic Corporation. West Fraser Timber Co Ltd is the world's largest timber producer, with 8,460,000 cubic meters produced annually, and is the leading company in the global forestry and logging market.

RECENT HAPPENINGS IN THIS MARKET

- In 2021, West Fraser Timber Co Ltd completed the acquisition of Norbord Inc. for a whopping 4 billion USD and is looking forward to lowering carbon emissions in the forestry and logging industry.

- In 2020, Rayonier Inc. entered into a definitive merger agreement with Pope Resources for 554 million USD to significantly expand and enhance their Pacific Northwest timberland and real estate portfolio.

MARKET SEGMENTATION

This research report on the global forestry and logging market has been segmented & sub-segmented into the following categories based on type, Application, and Region.

By Type

- Logging

- Timber Tract Operations

- Forest Nurseries

- Gathering of Forest Products

By Application

- Construction

- Industrial Goods

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

what is the current market size of the global forestry and logging market?

The global forestry and logging market is expected to be valued at USD 342.6 billion in 2025.

what is the expected growth value and CAGR of the forestry logging market?

The global forestry and logging market is expected to reach a valuation of USD 593.73 million by 2033, growing at a CAGR of 6.3% over the period 2025 to 2033.

what is the percentage of global forestry logging market in North America?

North America was the second-largest region, with 22% of the world's market.

what challenges are faced by the forestry logging market?

Strict regulations have always been a big challenge for the forestry and logging market.

what are the key market players involved in the global forestry logging market?

West Fraser Timber Co Ltd, Canfor, Weyerhaeuser Company, Hancock Victorian Plantations, Forestry Corporation of NSW, Rayonier Inc., China Forestry Group Corporation, And Potlatch Deltaic Corporation.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com