Global Fragrance Ingredients Market Size, Share, Trends, COVID-19 Impact & Growth Forecast Report, Segmented By Ingredients (Essentials Oils, And Aroma Chemicals and Hybrid Ingredients), Application (Cosmetics & Toiletries, Fine Fragrances, Soaps and Detergents) and Region (North America, Europe, Latin America, Asia-Pacific, Middle East and Africa), Industry Analysis From 2025 to 2033

Global Fragrance Ingredients Market Size

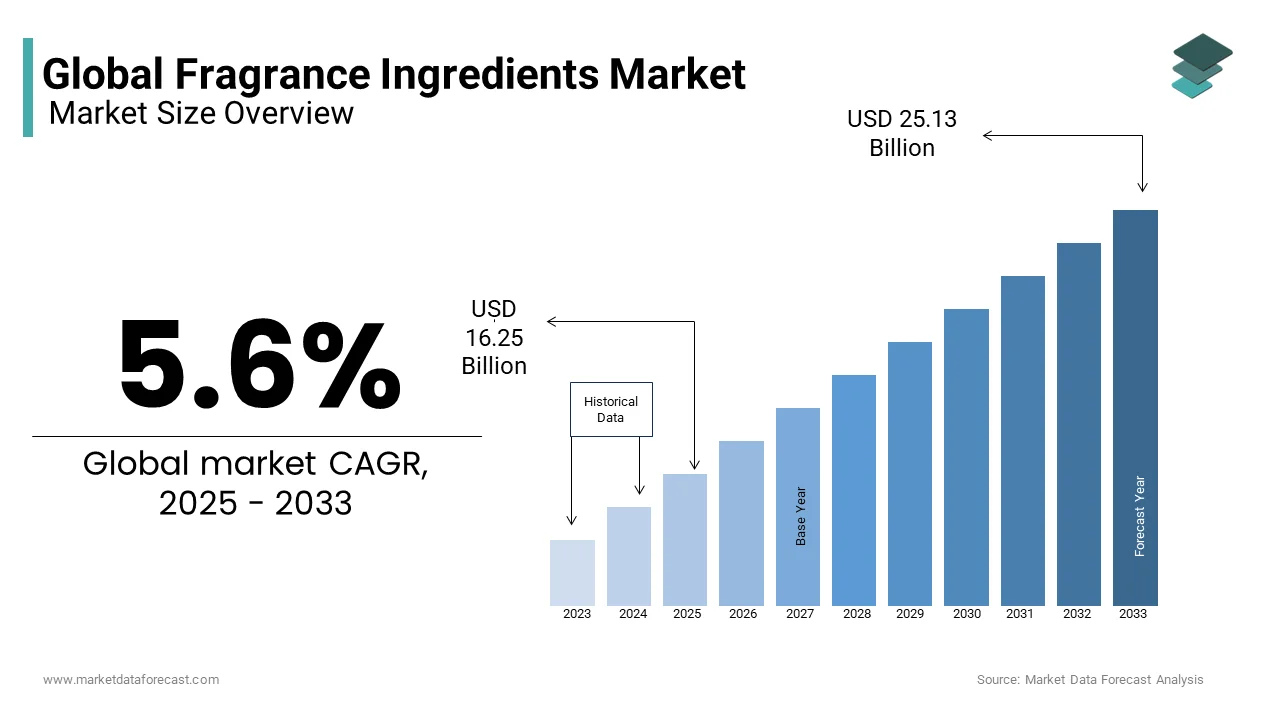

The global fragrance ingredients market was valued at USD 15.39 billion in 2024 and is anticipated to reach USD 16.25 billion in 2025 from USD 25.13 billion by 2033, growing at a compound annual growth rate (CAGR) of 5.6% during the forecast period from 2025 to 2033.

MARKET DRIVERS

The fragrance ingredients market is experiencing a transformation due to the rising consumer demand for natural and sustainable ingredients. As consumers are increasingly aware of environmental factors, they are favoring fragrance ingredients derived from natural sources like essential oils and plant extracts. This demand is not only a passing trend but also a fundamental change in consumer preferences, with eco-friendly products being at the forefront. As regulations tighten and consumers seek transparency, fragrance manufacturers are adapting, focusing on sustainability and safety compliance. Innovations in natural ingredient sourcing, processing, and packaging are also driving this shift. In this evolving rate, the fragrance Ingredients market is in a pivotal position, where embracing sustainability and meeting the demand for natural ingredients are not only ethical imperatives but also lucrative opportunities. Companies that align with these changing consumer values are poised to thrive in this environmentally conscious era.

Technological advancements are a driving force in the dynamic realm of the fragrance ingredients market due to the continuous evolution of fragrance technology, particularly through the development of cutting-edge encapsulation and delivery systems. These innovations are revolutionizing the way fragrances are created, enhancing not only their longevity but also their efficiency. This not only meets consumer expectations for enduring fragrances but also minimizes the need for frequent reapplication. The efficiency and precision offered by these advancements are breathing new life into the industry, sparking interest and enthusiasm among manufacturers and consumers alike. As fragrance technology continues to evolve, it opens up uncharted possibilities for formulators to craft novel, high-performance fragrances. Embracing these innovations is becoming increasingly essential to staying competitive and relevant in the ever-evolving fragrance ingredients market.

MARKET RESTRAINTS

In the fragrance ingredients market, regulatory compliance and safety concerns stand as significant restraints. These regulations, driven by growing apprehensions regarding allergens, sensitization, and potential health risks, cast a substantial shadow over the industry. Adhering to these regulations demands not only financial resources but also extensive time investments, constraining the utilization of specific ingredients and necessitating continual reformulation. This stringent oversight, while crucial for consumer well-being, can pose significant challenges to manufacturers, impacting their ability to innovate and bring new products to market swiftly. The continuous need for reformulation and testing can strain resources and hinder the development of certain fragrances. Nonetheless, these regulatory constraints also propel the industry towards safer, more transparent practices, fostering a commitment to consumer well-being and promoting sustainable, eco-friendly ingredients. Navigating this complex landscape requires a delicate balance between compliance and innovation to meet evolving consumer expectations while ensuring product safety and regulatory alignment.

Impact of COVID-19 on the Fragrance Ingredients Market

The COVID-19 pandemic had a dual impact on the fragrance Ingredients market, characterized by both demerits and merits. Initially, the market suffered a significant setback as consumer priorities shifted towards essential products, and lockdown measures reduced the demand for non-essential items like fragrances. This resulted in decreased sales and disrupted supply chains, affecting production and distribution. Additionally, the closure of physical stores and reduced foot traffic in shopping areas hampered fragrance sales. But over time, the pandemic also increased focus on personal hygiene and wellness, driving demand for specific fragrance products like hand sanitizers and soaps. Fragrance manufacturers swiftly adapted by producing these essential items. Moreover, the crisis accelerated the industry's digital transformation, with companies increasingly engaging with consumers through e-commerce and digital marketing. As restrictions eased, there was a rebound in fragrance sales, driven by consumers seeking comfort and a sense of well-being through scents, ultimately shaping new consumer behaviors and preferences.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.6% |

|

Segments Covered |

By Ingredients, Application, and Region |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Firmenich, Givaudan, Symrise, International Flavors & Fragrances (IFF), Sensient Technologies, Takasago, Robertet Group, BASF SE, Vigon International, Solvay, Kao Corporation, Naturals Together, Bell Flavors & Fragrances, Mane, IFFCO, Lionel Hitchen (Essential Oils) Ltd, Arylessence, Gulf Flavours & Food Ingredients, Synerzine |

SEGMENTAL ANALYSIS

By ingredients Insights

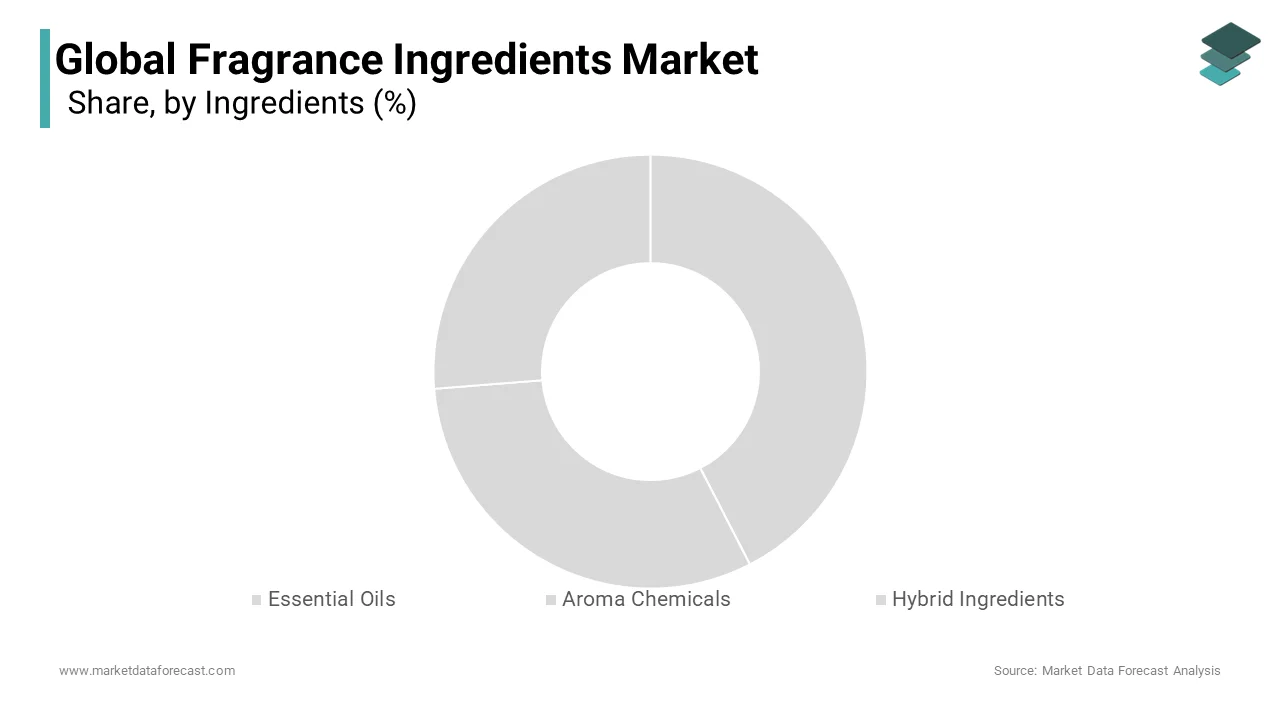

Essential oils dominate the fragrance ingredients market as they are natural and plant-derived fragrance ingredients that have been in use for centuries. They are highly valued for their authenticity and complexity of scents. Essential oils are especially prevalent in the natural fragrance segments, capturing consumers seeking a holistic and organic approach to scent. This is attributed to the increasing demand for natural and sustainable fragrances. As consumers become more eco-conscious and prioritize clean-label products, essential oils, which are derived from botanical sources, align perfectly with these preferences. Their perceived health and wellness benefits also contribute to their popularity.

Aroma chemicals hold the second largest share in the market due to their synthetic fragrance ingredients, often produced through chemical processes. They offer consistency, reproducibility, and the ability to replicate specific scents accurately. Aroma chemicals are widely used in the mainstream fragrance industry. Aroma chemicals are favored for their versatility and cost-effectiveness.

Hybrid ingredients also represent a third growing trend in the fragrance industry, as they provide the authenticity of natural scents with the consistency and affordability of synthetics. This category is gaining prominence as it addresses the demand for clean, sustainable, and cost-effective fragrances. Hybrid ingredients bridge the gap between natural and synthetic fragrances.

By Application Insights

The cosmetic and toiletries segment is leading with the largest share of the market. Fragrances are a core component of personal care products, including perfumes, deodorants, shampoos, lotions, and cosmetics. Consumers have a daily reliance on these items, driving consistent demand for fragrances in this sector.

Fine fragrances are the second most dominating in the market, including luxury perfumes and colognes, which are known for their high-quality ingredients and complex scent profiles. These products are positioned as premium and often cater to a more discerning and luxury-oriented consumer base. They use the finest and most exquisite ingredients to create unique and long-lasting scents.

Fragrance ingredients are also a key component in soaps and detergents. These products rely on fragrances to provide a clean and fresh aroma after use. Fragrances in soaps and detergents play a crucial role in enhancing the perception of cleanliness and freshness. The choice of fragrance can influence consumer preferences and brand loyalty in this segment.

REGIONAL ANALYSIS

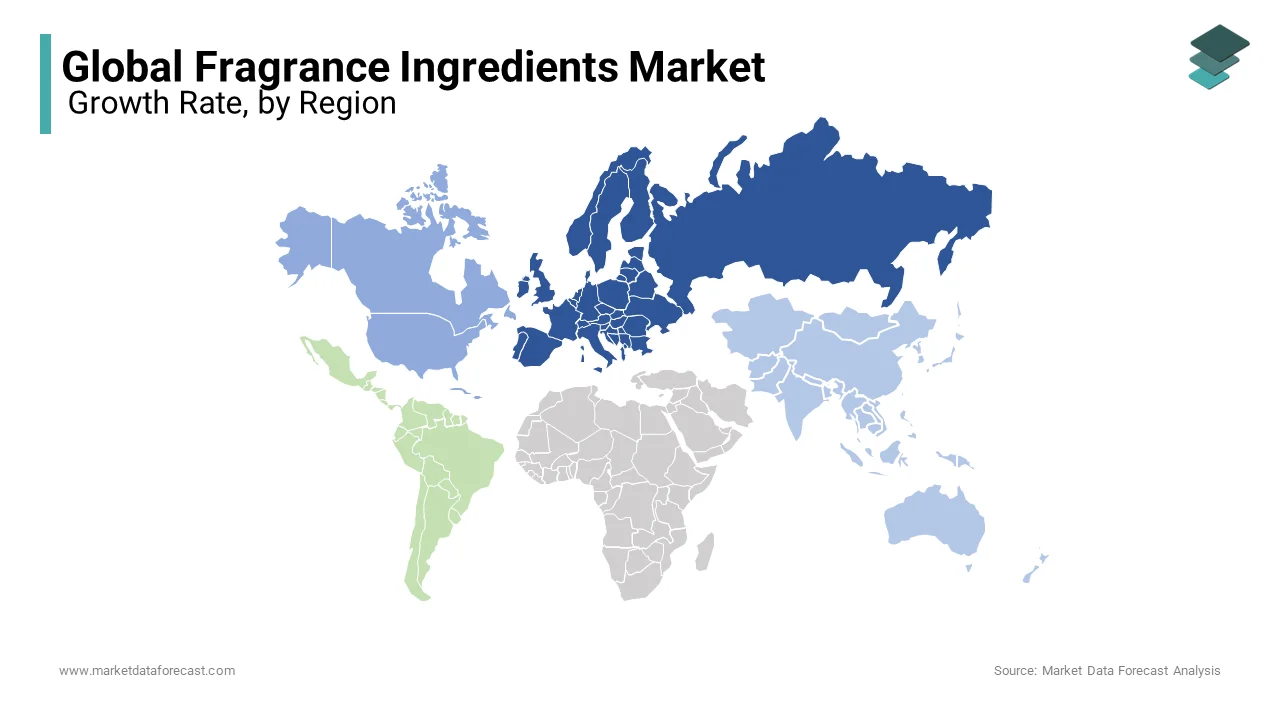

Europe has been dominating the fragrance industry as they have a 30% market share. It is also home to several well-established fragrance houses and perfumeries with a rich history of perfumery. European consumers have a strong appreciation for fine fragrances, and the region is a leader in luxury and niche fragrances.

North America holds the second share in the global fragrance market as it is linked to its strong presence in the global personal care and cosmetics industry. The U.S. fragrance market is known for its diverse consumer base and demand for a wide range of fragrance products.

The Asia Pacific region is an emerging powerhouse in the fragrance market. Rising disposable incomes and a growing middle class are driving increased demand for fragrances. The Asia Pacific is fuelled by its massive consumer base and growing interest in fragrances, particularly among the youth. The region is becoming a focal point for both mass-market and luxury fragrance brands.

Latin America is exhibiting a strong demand for fragrance, while others are still developing. Countries like Brazil have a well-established fragrance market. The variation in Latin America's dominance is due to differences in economic development, consumer preferences, and fragrance culture across countries in the region.

KEY MARKET PLAYERS

Firmenich, Givaudan, Symrise, International Flavors & Fragrances (IFF), Sensient Technologies, Takasago, Robertet Group, BASF SE, Vigon International, Solvay, Kao Corporation, Naturals Together, Bell Flavors & Fragrances, Mane, IFFCO, Lionel Hitchen (Essential Oils) Ltd, Arylessence, Gulf Flavours & Food Ingredients, Synerzine are playing a dominating role in global fragrance ingredients market.

RECENT HAPPENINGS IN THE MARKET

- In 2022, Firmenich continued to focus on sustainability, launching a range of natural and sustainable fragrance ingredients sourced from renewable materials.

- In 2023, Givaudan invested in biotechnology to develop novel fragrance ingredients, reducing reliance on traditional agricultural sources.

- In 2022, Symrise expanded its portfolio of clean and natural fragrance ingredients, catering to the growing demand for transparent labeling.

MARKET SEGMENTATION

This research report on the global fragrance ingredients market has been segmented and sub-segmented into the following categories.

By ingredients

- Essential Oils

- Aroma Chemicals

- Hybrid Ingredients

By Application

- Cosmetic and Toiletries

- Fine fragrances

- Soaps and Detergents

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

what is the size of global fragrance ingridients market?

The size of the fragrance ingredients market is expected to reach USD 16.25 billion in 2024.

What is driving the global demand for fragrance ingredient systems?

Increasing consumer focus on personal grooming, wellness, and luxury lifestyle products is fueling demand across industries such as cosmetics, personal care, home care, and fine fragrances.

what are key market players in fragrance ingridients market?

Firmenich, Givaudan, Symrise, International Flavors & Fragrances (IFF), Sensient Technologies, Takasago, Robertet Group, BASF SE, Vigon International, Solvay, Kao Corporation, Naturals Together, Bell Flavors & Fragrances, Mane, IFFCO, Lionel Hitchen (Essential Oils) Ltd, Arylessence, Gulf Flavours & Food Ingredients, Synerzine

How are fragrance ingredient systems used across different industries?

They are formulated into perfumes, skincare, household cleaners, air fresheners, and even industrial products to enhance user experience through scent, masking odors, or adding emotional appeal.

What innovations are transforming the fragrance ingredient systems market?

Advancements in biotechnology, AI-assisted scent design, and encapsulation technologies are enabling long-lasting, skin-friendly, and customizable fragrance experiences.

What challenges does the fragrance ingredient systems market face globally?

The market is challenged by regulatory restrictions on certain ingredients (e.g., allergens), shifting raw material availability, and growing pressure to move away from synthetic, non-biodegradable compounds

How is sustainability impacting fragrance ingredient development?

There's a strong shift toward plant-based, biodegradable, and ethically sourced ingredients, along with growing demand for transparent supply chains and carbon-neutral manufacturing practices.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com