Global Frozen Potatoes Market Size, Share, Trends, & Growth Forecast Report – Segmented By Product (French Fries, Hash Brown, Shapes, Mashed, Sweet Potatoes, Battered/Cooked, Twice Baked And Topped/Stuffed), End User (Residential And Commercial), And Region (North America, Europe, Asia Pacific, Latin America, And Middle East & Africa) - Industry Analysis (2025 To 2033)

Global Frozen Potatoes Market Size

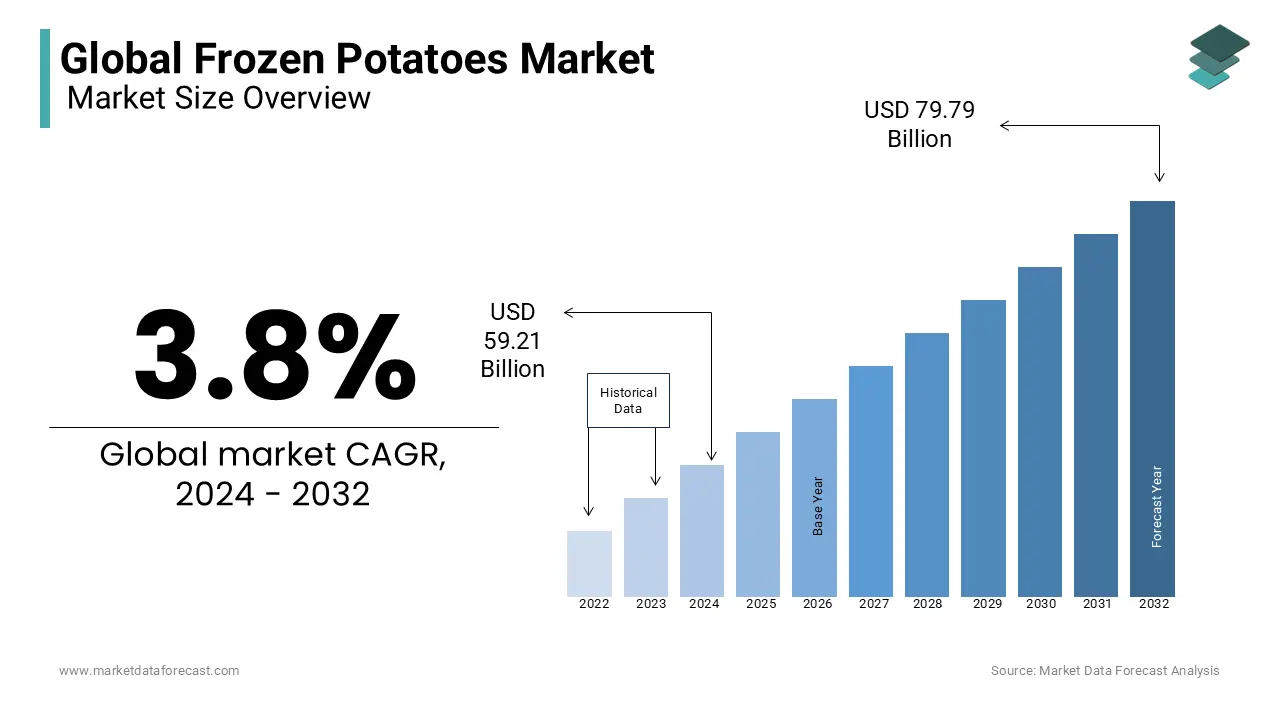

The global frozen potatoes market was touted to be USD 59.21 billion in 2024. The global market is predicted to reach USD 82.83 billion by 2033 from USD 61.46 billion in 2025, growing at a CAGR of 3.8% from 2025 to 2033.

Frozen vegetables have relatively more nutrients than fresh vegetables. Potatoes are the main staple food, followed by wheat, rice, and corn, which rank fourth in world production. They are consumed as fresh or processed in both households and restaurants. Frozen potatoes are one of the main types of processed potatoes, and they are very convenient and flexible in terms of preparation time. They have a long storage time and a naturally preserved form, containing various nutrients and vitamins. Frozen potatoes and various products are obtained by processing fresh potatoes using a variety of advanced machines and very low temperatures. These are available in a variety of shapes on the market, such as potato chips, french fries, shapes, mashed potatoes, sweet potatoes, cooking, twice baked, covered/stuffed, and other frozen potato products. These products are consumed at QSR (Quick Service Restaurants) or by customers at home through retail stores.

MARKET DRIVERS

The growing consumption of prepared and ready-to-eat foods is significantly contributing to the growing demand for frozen potatoes and driving the global market growth.

The demand for frozen potatoes is growing rapidly worldwide. The increase in the number of fast-food restaurants, the increased demand for processed foods, urbanization, and the increase in exports and imports of frozen potatoes are a few crucial factors driving the growth of this market. In the future, the rapid increase in the female workforce is expected to drive demand for ready-made foods like potato chips and hash browns and is expected to boost the global frozen potatoes market over the forecast period.

The demand for frozen potatoes worldwide is increasing rapidly due to increased fast-food restaurants, increased global food processing capacity, increased imports, increased urbanization, and a reduction in tariffs from the WTO to import and export these products. The Asia Pacific is foreseen to develop as a promising market for frozen potatoes because of the expansion of QSRs. The increase in the female workforce increases the demand for prepared foods, which significantly increases the consumption of convenience products, such as frozen potato chips and dehydrated potato products.

An increase in the number of fast-service restaurants is further boosting the growth rate of the global frozen potatoes market.

In addition, increasing food spending, increasing the food and beverage sector, increasing the number of commercial restaurants, increasing demand for multi-food foods, and increasing demand in the food processing industry are some of the other factors supposed to drive growth in terms of revenue in the coming years. The main advantage of frozen potatoes is that they take less time to cook and are easier to prepare. In addition, the introduction of new product variants with different flavors has greatly boosted the consumer base for frozen potato products and has accelerated market growth. The notable growth of fast-service restaurants and the increase in the disposable income of consumers are some of the factors that contribute to the growth of the frozen potato market.

Furthermore, advances in refrigeration technology have accelerated the growth of the frozen potato market. Due to the busy lifestyle, expanding income levels, and high purchasing power of consumers in the region, the transition to food products that are easy to cook is intensifying, keeping the market growing. Many people, including potato chips, nuggets, kibble, and grated potato chips, are on the rise due to lifestyle changes and consumer adoption of the Western diet culture. This is a major trend currently underway in many developed and developing countries around the world. Furthermore, the acceptance of Western culture and the growing demand for fresh food in developing countries of Asia Pacific and LAMEA are considered a common reason for the growth of prepared foods, which offer a wide range of opportunities for market expansion of frozen potatoes.

MARKET RESTRAINTS

High-cost requirements for storage and transportation and product recall are some of the key factors that can significantly inhibit growth in the target market.

Furthermore, a greater interest in health and greater consumption of other healthy foods, such as fruits and vegetables, in developing and developed countries can reduce the demand for frozen potato products. Furthermore, the constant low-temperature requirements for keeping potato products frozen and the high costs associated with this will limit the growth of the global frozen potato market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

3.8% |

|

Segments Covered |

By Product, End User, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

McCain Foods, Lamb-Weston, J.R. Simplot Company, Aviko, Bart's Potato Company, Agrarfrost GmbH & Co. KG, Agristo NV, Himalya International Ltd, TaiMei Potato Industry Limited and Others. |

SEGMENTAL ANALYSIS

Global Frozen potatoes market Analysis By Product

The French fries segment is thriving and leading the highest share of the frozen potatoes market. They are more convenient and ready-to-eat food products, and many people mostly prefer these food products in their daily lives, which is ascribed to boosting the growth rate of the market. The growing disposable income is ascribed to leveraging the demand for restaurant food products. In developed and developing countries, many people rely on fast food products that can be made at home in a very short amount of time. Kids and adults usually like French fries across the world, which is significantly elevating the growth rate of the market.

The sweet potatoes segment is next in leading the prominent share of the market. These have many health benefits that include boosting the immunity system. It is a rich source of vitamin A, which is highly important to increase the immune system and help fight against germs. Recent studies reveal that eating one sweet potato a day improves the health of the kidney and heart. The battered/cooked segment is ascribed to leveraging the growth rate

Global Frozen potatoes market Analysis By End User

The commercial segment has been gaining huge traction over the share of the market for the past many years. Frozen potatoes are mostly used in many commercial sectors like restaurants, food stalls, and others. Potatoes are one of the most popular dishes in plant-based recipes. Many people do like to eat potatoes in various forms, which is attributed to leveraging the growth rate of the market. The launch of innovative recipes using potatoes according to the people’s interest is all set to elevate the growth rate of the market to the extent. The residential segment is likely to have prominent growth opportunities throughout the forecast period. Frozen potatoes, in various ways, are readily available and convenient for residential use. They can be easily made by following certain instructions mentioned appropriately in the packing. Therefore, the demand for frozen potatoes is steadily growing from time to time, which is augmented by gearing up the growth rate of the market in the coming years.

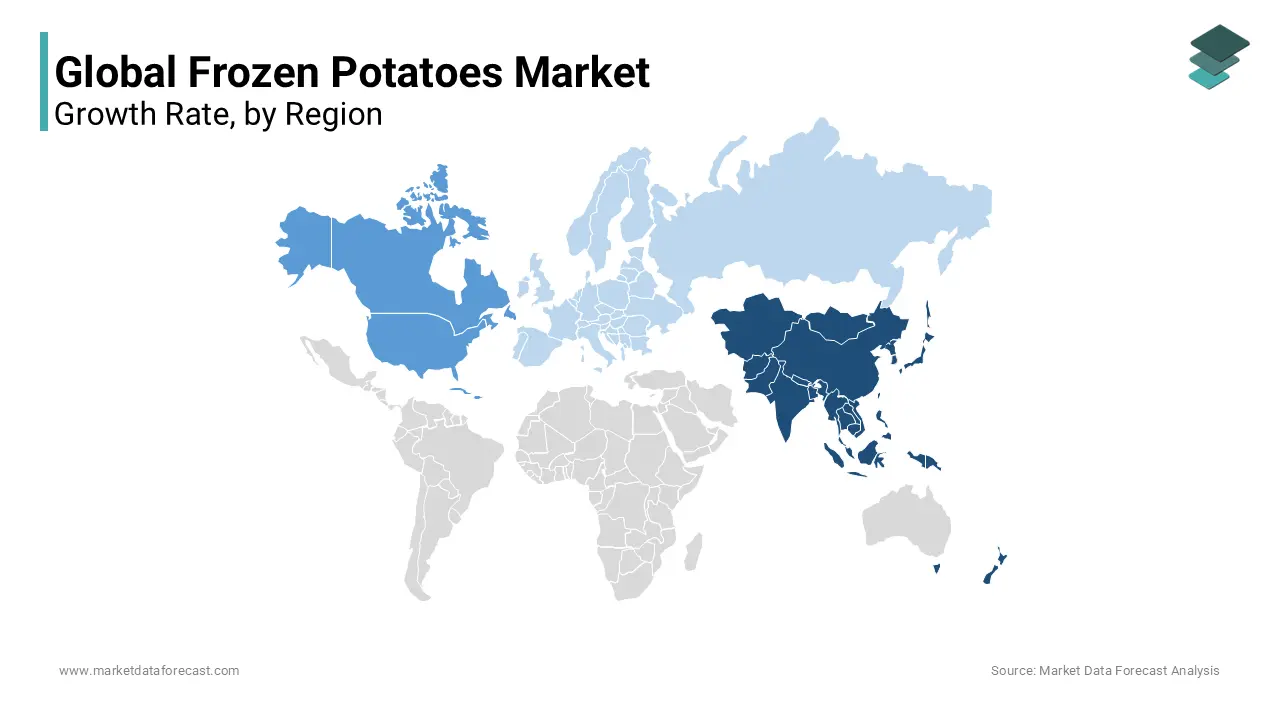

REGIONAL ANALYSIS

Asia Pacific and North America are the prominent areas boosting the growth of the frozen potato market. As consumption rates increase, North America and Europe have been the main regions of the frozen potato market, and this will continue for years to come. The North American market is expected to generate high returns in terms of global market value, followed by the European market. This is mainly due to the high per capita consumption of frozen potato products in countries like Canada and the United States. Demand for frozen potatoes from restaurants and other fast food vendors and outlets is also expected to increase as consumers in the countries of this region, especially young people in society, have an increasing preference for fast food and other convenient foods, driving the growth of the frozen potato market in North America. Markets in the Asia-Pacific region are expected to grow at the fastest annual rate in the future due to the entry of retail fast food conglomerates into countries such as India, China, and Japan, as rapid urbanization changes patterns and food consumption preferences.

KEY PLAYERS IN THE GLOBAL FROZEN POTATOES MARKET

Companies playing a significant role in the global frozen potatoes market include McCain Foods, Lamb-Weston, J.R. Simplot Company, Aviko, Bart's Potato Company, Agrarfrost GmbH & Co. KG, Agristo NV, Himalya International Ltd., and TaiMei Potato Industry Limited.

RECENT HAPPENINGS IN THE MARKET

- At the Idaho Potato Commission (IPC), the foreign trade mission will leave Taiwan in the week it started and is expected to discuss the possibility of using the technology in the frozen potato business abroad for almost a week.

DETAILED SEGMENTATION OF GLOBAL FROZEN POTATOES MARKET INCLUDED IN THIS REPORT

This research report on the global frozen potatoes market has been segmented and sub-segmented based on product, end user, & region.

By Product

- French Fries

- Hash Brown

- Shapes

- Mashed

- Sweet Potatoes

- Battered/Cooked

- Twice Baked

- Topped/Stuffed

- Others

By End User

- Residential

- Commercial

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

1. What is driving the growth of the frozen potatoes market?

Several factors contribute to the growth of the frozen potato market, including the increasing demand for convenient and ready-to-cook food products, busy lifestyles that lead to a preference for quick meal solutions, and advancements in freezing technologies that help maintain the quality of frozen potatoes.

2. What are the major market trends in the frozen potatoes industry?

Some current trends in the frozen potatoes market include introducing healthier options like low-sodium or baked varieties, using natural and organic ingredients, and innovative packaging designs for better convenience and sustainability.

3. What are the challenges faced by the frozen potatoes industry?

The frozen potato industry challenges include competition from other convenience food products, concerns about using additives or preservatives, fluctuations in raw material prices (potatoes), and environmental sustainability issues related to packaging and waste management.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com