Global Frozen Processed Food Market Size, Share, Trends & Growth Forecast Report - Segmented By Product (Frozen Fruits & Vegetables, Frozen Potatoes, Frozen Ready Meals, Frozen Meat, Frozen Fish/Seafood, Frozen Soup, Other Products), Type, Distribution Type, and Region (North America, Europe, APAC, Latin America, Middle East and Africa) - Industry Analysis 2025 to 2033

Global Frozen Processed Food Market Size

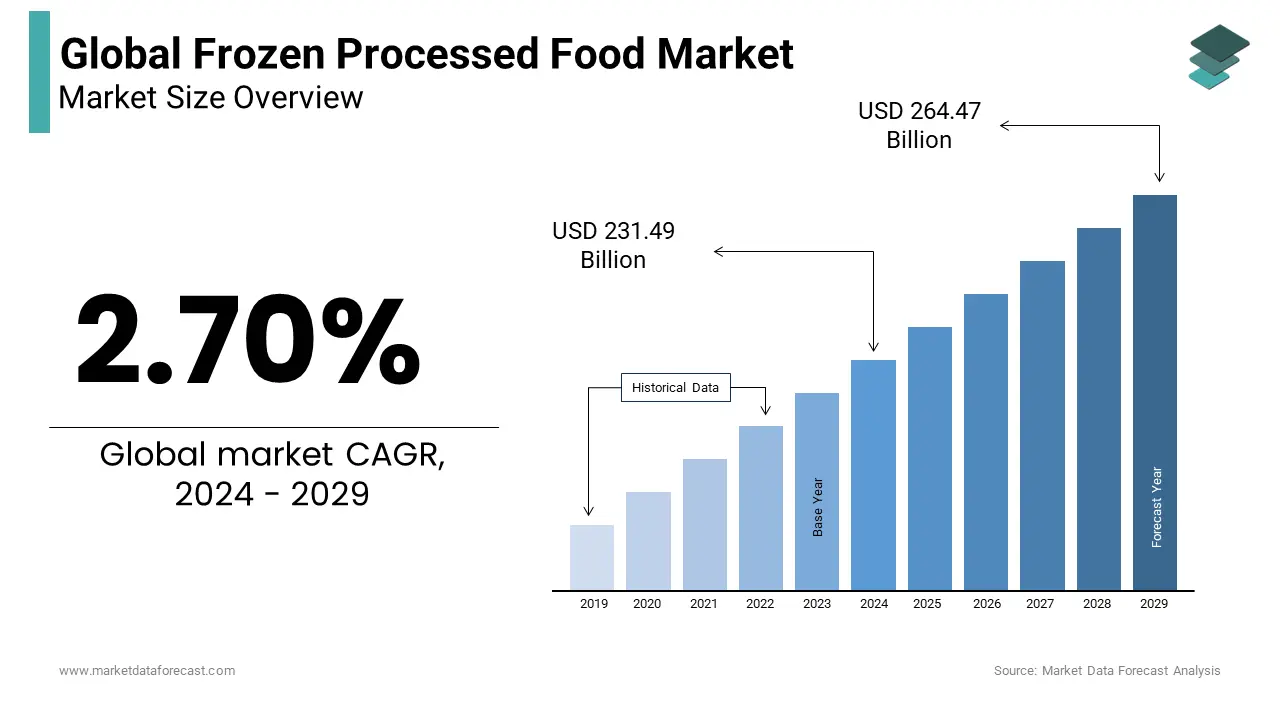

The global frozen processed food market size was valued at 231.49 billion USD in 2024, and the market size is expected to reach USD 294.22 billion by 2033 from USD 237.74 billion in 2025. The market is growing at a CAGR of 2.7% during the forecast period.

Due to the busy lifestyle, coupled with changing preferences among consumers towards ready-to-cook meals due convenience and hygiene, is anticipated to remain a main driving factor for the overall industry. Compared to the fresh ones, these products contain maximum vitamins and minerals because freezing preserves the products for prolonged periods without any preservatives and deters any microbial growth that causes food spoilage. Frozen Processed Foods are prepared from fresh food items by cleaning, grouping, and freezing them in closed containers. These are frozen to a specific temperature to ensure the preservation of the products. Compared to fresh foods, frozen food products are made up of peak vitamins. This is due to the freezing that maintains the products for an extended period without any preservatives and prevents any microbial development that creates food waste.

Current Scenario of the Global Frozen Processed Food Market

Frozen processed foods are food products that have undergone various processing techniques like blanching, freezing, and packaging, extending their shelf-life by maintaining the nutritional value of the food. The global market revenue of frozen processed food is expected to account for a significant market share in the past years. It is estimated to have prominent growth in the coming years. The busy lifestyle, coupled with changing preferences among consumers towards ready-to-cook meals due convenience and hygiene, is anticipated to be the main driving factor for the expansion of the global market. Compared to the fresh ones, these products contain maximum vitamins and minerals because freezing preserves the products for prolonged periods without any preservatives and deters any microbial growth that causes food spoilage. Frozen Processed Foods are prepared from fresh food items by cleaning, grouping, and freezing them in closed containers. These are frozen to a specific temperature to ensure the preservation of the products. Compared to fresh foods, frozen food products are made up of peak vitamins. This is due to the freezing that maintains the products for an extended period without any preservatives and prevents microbial development, leading to food waste.

MARKET DRIVERS

Adopting people's busy lifestyles enhances the adoption of frozen and convenient foods, driving the growth of global markets. The growing demand for ready-to-eat and cooked food products worldwide among consumers, as it saves time in food preparation and changes food patterns of the people, is contributing to the global market expansion. The rapid growth in demand for packaged food, where consumers prefer clean-label products, is expected to impact the global market positively. The presence of vast distribution networks for the food and beverages industry worldwide, particularly across developed regions like the U.S, Canada, the U.K., and others, where consumers seek convenient, nutritional, and frozen food, boosts the adoption of frozen processed food products. In addition, the benefits of frozen food, like improved texture, longer shelf-life, and freezing of nutritional components, will augment the growth opportunities in the coming years. Emerging nations like China and India will result in tremendous opportunities for market expansion. The standard of living in these countries has increased quite a lot in the last decade; the urbanization and changing lifestyle patterns, growing health consciousness, and the presence of a high non-vegetarian population are all estimated to increase the demand for frozen meat and seafood, which leads to expansion of the market size. The rising disposable incomes of the people and the expanding trade of processed foods will provide significant growth opportunities for the frozen processed food market. The primary benefit of frozen processed food is the availability of the food in any season, irrespective of the seasonal availability, which fuels the global market revenue due to broader adoption. The rising innovations by the manufacturers to develop clean-label and nutrition-beneficial frozen food and the introduction of innovative processing methods are escalating the global market revenue.

MARKET RESTRAINTS

The rising preference for natural, organic, and fresh food products is restraining the global frozen processed food market. The increase in consumer health consciousness encourages them to avoid preserved or frozen food due to the health effects of processed foods, hampering the market growth. This is a rising challenge for market players to convince consumers of the health benefits of frozen food over fresh food alternatives. The rising trend of farm-to-table, where farmers market fresh food products that are locally grown, is gaining traction among consumers, hindering the frozen processed food market growth. Limited cold chain infrastructure in developing countries and underdeveloped areas due to economic instability across the regions is estimated to restrict global market expansion opportunities. The high costs associated with the initial establishment and maintenance of cold chain infrastructure impede the global market expansion.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

2.7% |

|

Segments Covered |

By Product, Type, Distribution Channel, and Region. |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

ConAgra Foods, Inc., Nestle S.A., Tyson FoodsInc.c, Unilever plc, BRS.A..A, General Mills Inc.Inc., Ajinomoto Inc., Unilever Plc, Allens, Inc., Heinz, Amy’s Kitchen Inc. |

SEGMENTAL ANALYSIS

By Product Insights

The meat and seafood segment dominates the global market revenue with significant share growth due to vast consumption worldwide. The extended shelf-life and high nutrition content of frozen non-veg products are gaining traction among consumers, leading to segment growth.

The convenience and ready meals segments are expected to grow prominently in the frozen processed food market in the coming years. This is due to the evolving and busy lifestyles of individuals worldwide, which have increased the consumption of frozen food globally. Consumers are seeking convenience foods that limit the food preparation time, and the other properties of convenience foods, like ease of packaging, nutritional value, variety, and safety, are attracting consumers and boosting segment growth.

By Type Insights

The Half-cooked segment held the largest market share in global market revenue. Half-cooked food improves the texture of products, allowing vegetables to retain crispness, proteins to remain tender, and grains to avoid the risk of becoming mushy, augmenting the segment's growth.

The Ready-to-Eat segment is projected to grow at the fastest CAGR and lead the market in the coming years. Factors such as altered lifestyles and the growing working women population drive the adoption of ready-to-eat frozen foods, propelling the market worldwide.

By Distribution Type Insights

The supermarkets/hypermarkets segment dominated the global frozen processed food market revenue with a significant share of 38.4% in 2024. The primary factor driving the segment growth is the ability to offer consumers various products in one place. Most consumers prefer to shop for most of their grocery needs in a single place, which supermarkets and hypermarkets fulfill due to their expanded store housing where meat to dairy, and all frozen foods are available. Supermarkets and hypermarkets offer competitive product pricing due to their high-volume outlets, where the pricing fuels the expansion of this segment's growth.

Online retailing is expected to witness prominent growth during the forecast period due to the rising adoption of digital platforms and the expanding influence of social media on consumers.

REGIONAL ANALYSIS

North America held the largest share in the frozen processed food market, followed by the Asia Pacific, but is anticipated to dominate the processed food market in the future. Consumer preference towards hygiene-related frozen products, coupled with the new trend of online grocerpurchasesse is expected to have a positive impact on the regional growth over the forecast period.

The Asia Pacific is expected to witness significant growth over the coming years due to the swift expansion of fast food outlets in countries such as India, Singapore, Indonesia, Malaysia, and China. Growth in urbanization coupled with a rise in disposable income are the key factors in these countries, which have augmented consumers’ preference towards fast food. Emerging economies such as South Africa and Brazil are expected to register high growth in demand for these products. The emergence of supermarkets and online stores is projected to ensure product availability in these countries.

Europe has been dominating the Frozen Processed Food Market with a 35% revenue share. Customer preference for hygiene frozen products is expected to drive the European frozen foods market. Asia Pacific is anticipated to see significant CAGR development of 5.0 percent over the next five years, owing to the rapid growth of fast-food stores in nations such as India, Singapore, Indonesia, Malaysia, and China. Growing urbanization, combined with increasing disposable income, is a critical variable in these nations that have boosted consumer preference for fast food.

The Middle East & Africa are anticipated to see the highest development in the forecast era. Population growth, fast urbanization, and increased customer understanding of the advantages of frozen food are primary factors driving demand for frozen food in the region.

KEY MARKET PLAYERS

Key Players In Frozen Processed Food Market are ConAgra Foods Incc, Nestle S.A., Tyson FInc.sInc.c, Unileveplc.A.RF S.A., General Inc, .LLS Inc., Ajinomoto Inc., Unilever Plc, Inc.Lens, Inc., Heinz, Amy’s Kitchen Inc.

RECENT HAPPENINGS IN THE MARKET

- With the chilled beef import allowance from Australia, ttheChinese Government has had a positive effect on top-end food services and retail consumers. Food chains such as Pizza Hut, McDonald's, and Burger King are involved in the maintenance of an inventory in frozen media that helps to cater to quick food demand and ensure the same accessibility for more extended periods.

- MorningStar Farms, the manufacturer of American No.1 veggie burger 1, announced that it would introduce a fresh addition to its strong plant-based portfolio, with the introduction of Incogneato by MorningStar Farms. This new next-generation product line includes the company's first ready-to-cook plant-based burger to be presented in the defrosted meat cabinet and frozen, fully-prepared plant-based Chicken tenders and nuggets, with the help of lending a hand by the industry giant, "Kellogg's".

MARKET SEGMENTATION

This research report on the global Frozen Processed Food Market has been segmented and sub-segmented based on Product, Type, Distribution Channel, and Region.

By Product

- Fruits & Vegetables

- Dairy

- Meat & Seafood

- Convenient

- Ready Meals

By Type

- Half-Cooked

- Raw Material

- Ready-to-eat

By Distribution Type

- Retail

- Supermarket/Hypermarket

- Department Store

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

1.What are frozen processed foods?

Frozen processed foods are food products that have been processed, packaged, and frozen to extend their shelf life and maintain their quality. These products often undergo various cooking, preserving, and packaging methods before being frozen, allowing consumers to store them for longer periods and conveniently prepare them when needed.

2.What types of frozen processed foods are available?

Frozen processed foods encompass a wide range of products, including frozen fruits and vegetables, frozen meals and entrees, frozen pizza, frozen snacks and appetizers, frozen desserts, frozen meat and poultry products, frozen seafood, and frozen bakery items like bread and pastries

3.What are the main benefits of frozen processed foods?

Frozen processed foods offer several benefits to consumers, including convenience, longer shelf life, preservation of nutrients and flavors, reduced food waste, and the ability to access seasonal or out-of-season produce year-round. They also provide quick and easy meal solutions for busy lifestyles.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com