Generative Design Market Size, Share, Trends, & Growth Forecast Report By Application (Product Design & Development and Cost Optimization), Component (Software and Services), End-User (Automotive, Aerospace & Defense, Industrial Manufacturing), & Region - Industry Forecast From 2025 to 2033

Global Generative Design Market Size

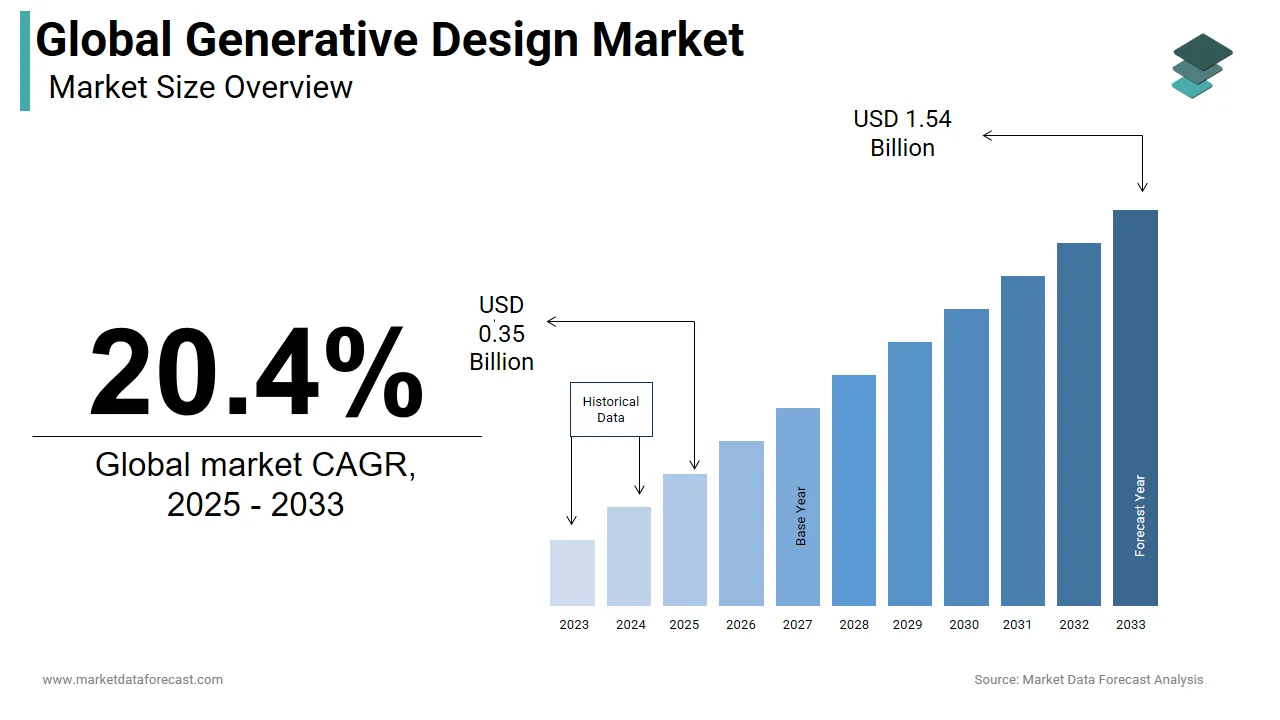

The global generative design market was worth USD 0.29 billion in 2024. The global market is predicted to reach USD 0.35 billion in 2025 and USD 1.54 billion by 2033, growing at a CAGR of 20.4% during the forecast period.

The market size is fragmented with evolutionary approaches based on technologies like artificial intelligence (AI) and cloud computing. Leading companies like Tesla, Toyota, BMW, Mercedes, and GM have already incorporated generative design into their research and development and final products. For instance, to improve vehicle designers' abilities Toyota Research Institute (TRI) has launched a unique gen AI technique. It also uses publicly available text-to-image AI tools. This has significantly improved productivity by augmenting design procedures and lowering expenditure by optimally utilizing material and lead time.

MARKET DRIVERS

The growing trend in light vehicle products has created demand for generative design technology.

Reduced time, better material utilization, and the growing trend in light vehicle products are driving the generative design market. It’s already been implemented to produce lighter parts by reducing the use of mass and materials while maintaining high-performance standards and engineering limits. Fresh progress in generative AI technology, ML, and AI involving algorithms like Variational Autoencoders, U-Nets, and MeshGraphNets have facilitated the way towards boosting the design procedure through rapid ML interface. This allows companies to function with fewer full-fidelity physics-based HPS simulations, which often require hours, and at the same time, collect insights into big design spaces.

Weight reduction has become a critical concern for the efficiency of electric vehicles. Factors such as the growing need for advanced design software to stimulate product innovation, the growing demand for environmentally friendly architecture, and increased production efficiency are expected to stimulate the global generative design market during the forecast period.

Also, due to the growing demand for advanced manufacturing with complex designs and the need to downsize while improving the automotive industry's performance, automakers must increase their R&D investments and adopt a generative design.

MARKET RESTRAINTS

The main objective of the generative design solution is to provide companies with the best form or topology of the product according to their contributions.

Inaccurate or incomplete information, biased data, and their limited availability are restricting the generative design market. A substantial amount of the population has experienced generalised information or popular design options presented by the tool, which decreases efficiency and uniqueness. Also, the shapes created by this solution can be appealing but practically difficult and complex to reproduce. This is due to the company's limited manufacturing capacity.

MARKET OPPORTUNITIES

The generative design market is expected to experience increased adoption in several industries. This includes construction, automotive, and aerospace. According to a study conducted in North America and Europe, over 150 senior decision-makers in automotive engineering are looking forward to the use of Engineering AI (EngAI) in EV battery development. It also discovered that close to two-thirds of automotive leadership predict the potential consequences of artificial intelligence to be exceedingly or highly significant with more than 50 per cent signalling that EngAI is important to remain competitive in developing EV batteries.

MARKET CHALLENGES

There are several obstacles in the generative design market, including a lack of experienced professionals. Since the industry is still in its early phase of development, the initial operators are encountering particular problems. This will affect its adoption rate among the industry players, ultimately impacting the market expansion. Though Gen AI assists in curbing carbon emissions by making capabilities, that compute energy and resources applications also cause emissions. Hence, it is one of the key challenges for the Generative design market growth.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

20.4% |

|

Segments Covered |

By Component, Application, End User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Autodesk (United States), Altair (United States), ANSYS (United States), MSC Software (United States), Dassault Systèmes (France), ESI Group (France), Bentley Systems (United States), Desktop Metal (United States), nTopology (United States), Paramatters (United States), and others. |

SEGMENTAL ANALYSIS

By Component

The software segment is predicted to have a noticeable competitive edge in the generative design market. Over half of the automotive leaders look at AI as important to battery development. However, few are concerned about its potential aftereffects. As of now, the world’s population is getting old, and the global economy and high food and necessary inflation have exerted considerable pressure on customer pockets. The impact of this has already been shown in some countries, so it has become extremely crucial for companies to reduce R&D, physical testing, and other costs. For instance, in June 2023, Monolith introduced a new key update for its product called Next Test and Recommender (NTR) for engineers to provide active suggestions on the validation test.

By Application

The product design and development segment is anticipated to propel further during the forecast period for the generative design market. However, the cost optimization segment is expected to grow at a substantial pace, considering the trends in the emerging Asian markets and the inclination towards internal combustion engine (ICE) vehicles. For example, in the United States, the company's sales of EVs have dipped, and hybrid-electric and battery-electric vehicles (BEV) have also decreased. However, the combination of product design and development with cost optimization will ultimately be the game changer for companies operating in the APAC economies.

By End User

The automotive segment accounts for the maximum portion of the generative design market owing to the growing adoption by original equipment manufacturers (OEMs). The use cases include Advanced Driver Assistance Systems (ADAS), Human-Machine Interface (HMI), Connected Car technologies, Autonomous driving technologies, and other applications. Likewise, as per a 2022 study, GM utilises generative design to make lightweight vehicle components, Mercedes for its customer driving experience department has launched the GPT model in 900000 cars under their beta program. This version can be found via the organization's voice assistant. This enables drivers to explore their destination and look for suggestions for various purposes, such as unique dinner recipes or solving complicated questions. BMW integrated an AI model that considers accurate design specifications such as load capacity, connection point, and weight optimization.

REGIONAL ANALYSIS

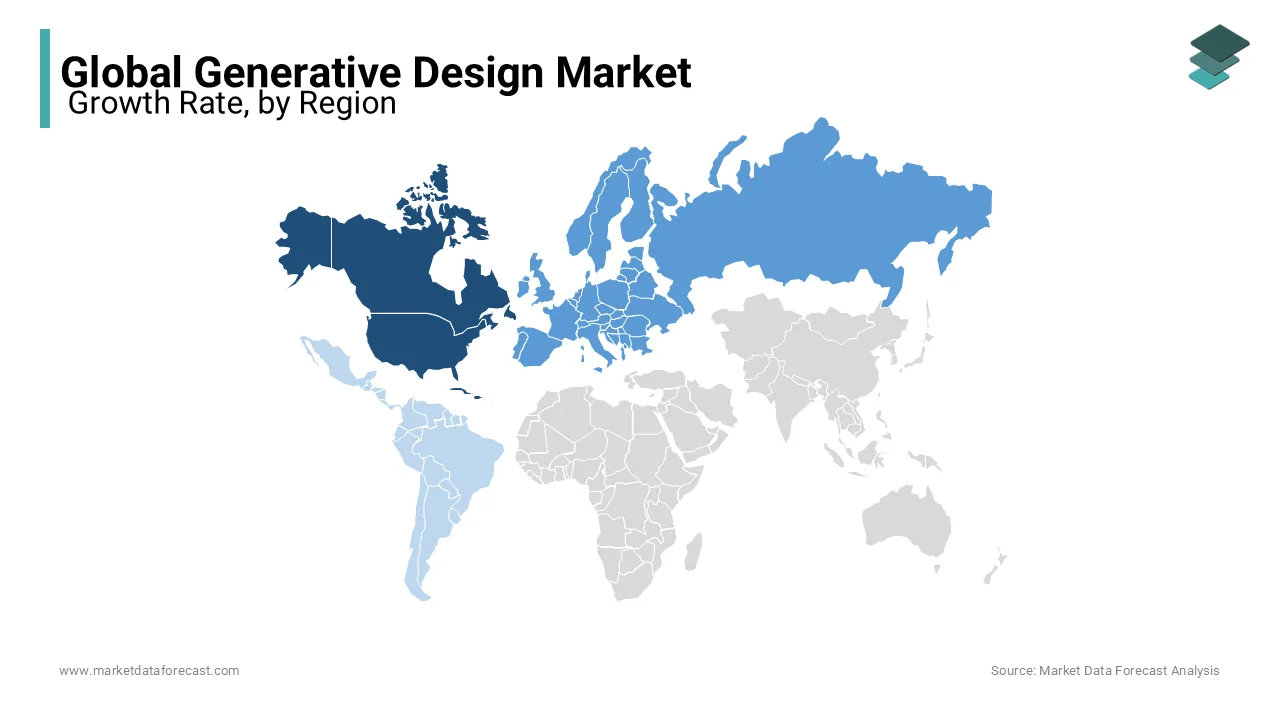

North America dominated the generative design market due to the technology adoption during the forecast period. The stronghold of prominent companies in this area to persistently deliver technologically advanced and unique products is pushing the regional industry forward. Also, the US Department of Transportation’s Advanced Research Projects Agency - Infrastructure (ARPA-I) is collecting data from stakeholders interested in the prospective usage of artificial intelligence in transportation coupled with new problems and opportunities in developing and implementing AI technologies in use cases throughout all transportation modes. Additionally, the EV momentum has slowed down so that of hybrid-electric and battery-electric vehicles (BEV), and instead, only internal combustion engine vehicles have gone up by 9 percent.

Europe region is experiencing growth in electric vehicle sales, a crucial consumer for generative design solutions. Electric vehicle sales are increasing in Europe, and diesel vehicle sales continue downward. There has been a surge in the sales of electric vehicles across the European Union in the review period. The increase in BEV registrations was most notable in Scandinavian countries such as Denmark, which experienced a quadrupling of BEV sales, and Sweden and Finland, which tripled, followed by Poland, Belgium, and Greece. Additional modifications to electric vehicles, like increasing battery life and reducing vehicle weight, would require generative design software.

Asia Pacific is estimated to grab a considerable share of the generative design market by 2029. China, South Korea, and Japan are the leading regional industries, while India is a big market for economical mid-size SUVs and even for compact SUVs. For example, in April 2024, the top compact SUV in India are TATA Punch with 75 per cent year-on-year growth, the Maruti Suzuki Brezza with 45 per cent Y-0-Y growth and the Maruti Suzuki Fronx at 63 per cent Y-O-Y rise. So, cost optimization is a major factor for Indian companies and customers. Whereas in China and South Korea, vehicle performance is the highest priority with 53 per cent and 55 per cent respectively.

Latin America and the Middle East & Africa regions are believed to witness an upward development trend in the generative design market during the forecast period. Brazil and Mexico are taking the LA industry forward with an increased focus on cost optimization across the automotive sector and the use of 3D printing and additive manufacturing. In the Middle East, the emphasis is on enhancing production infrastructure. In Africa, overall domestic vehicle manufacturing has surged on an annual basis since 2021, and exports of vehicles and parts have also increased yearly. South Africa is anticipated to drive the regional market further in the coming years.

KEY MARKET PARTICIPANTS

The major companies operating the global generative design market include Autodesk (United States), Altair (United States), ANSYS (United States), MSC Software (United States), Dassault Systèmes (France), ESI Group (France), Bentley Systems (United States), Desktop Metal (United States), nTopology (United States), and Paramatters (United States).

RECENT MARKET HAPPENINGS

- In June 2024, Decathlon announced the development of a diving fin which is twice as light and releases 50 per cent less carbon emissions. This ambitious initiative shows considerable technological developments but also includes a sustainable vision that revolutionises our relationship with the goods we consume.

- In May 2024, the Centre for Cellular & Molecular Biology (CCMB) and Aganitha inked a framework contract to employ Generative Artificial Intelligence (AI) products to develop new therapeutics and study tools and solve requirements in several disease regions.

- In January 2024, Poliark launches a new generative AI-based design platform. Earlier this month, the company also introduced its first subscription-based product.

MARKET SEGMENTATION

This research report on the global generative design market has been segmented and sub-segmented based on the component, application, end-user, and region.

By Component

- Software

- Services

By Application

- Product Design and Development

- Cost Optimization

By End User

- Automotive

- Aerospace & Defense

- Industrial Manufacturing

By Region

-

North America

-

The United States

-

Canada

-

Rest of North America

-

-

Europe

-

The United Kingdom

-

Spain

-

Germany

-

Italy

-

France

-

Rest of Europe

-

-

The Asia Pacific

-

India

-

Japan

-

China

-

Australia

-

Singapore

-

Malaysia

-

South Korea

-

New Zealand

-

Southeast Asia

-

-

Latin America

-

Brazil

-

Argentina

-

Mexico

-

Rest of LATAM

-

-

The Middle East and Africa

-

Saudi Arabia

-

UAE

-

Lebanon

-

Jordan

-

Cyprus

-

Frequently Asked Questions

What are the primary benefits of using generative design in product development?

The primary benefits of using generative design in product development include increased design efficiency, reduced material usage, optimized performance, and shorter development cycles. It allows designers to explore thousands of design permutations quickly, leading to innovative solutions that might not be possible through traditional design methods.

What challenges are faced by the generative design market globally?

Challenges faced by the generative design market include high initial implementation costs, the need for skilled professionals to operate complex software, integration issues with existing design workflows, and data security concerns. Additionally, there is a learning curve associated with adopting new technologies which can hinder rapid adoption.

What role does artificial intelligence play in generative design?

Artificial intelligence plays a crucial role in generative design by enabling the creation of numerous design alternatives based on predefined constraints and objectives. AI algorithms can analyze vast amounts of data to identify optimal solutions, making the design process faster and more efficient. This integration enhances the ability to solve complex design problems and innovate beyond human capabilities.

What future trends are expected in the generative design market?

Future trends in the generative design market include the increasing integration of cloud computing and machine learning, the development of more user-friendly software interfaces, expansion into new industries such as healthcare and consumer electronics, and enhanced collaboration tools for real-time design iterations. As technology advances, generative design is expected to become more accessible and widely adopted across various sectors.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]