Global Hemostats Market Size, Share, Trends & Growth Forecast Report By Product Type (Topical Hemostats, Tissue Sealants, Cyanoacrylate-Based Tissue Adhesives and Adhesion Prevention Products), Application, Distribution Channel, End-User and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Hemostats Market Size

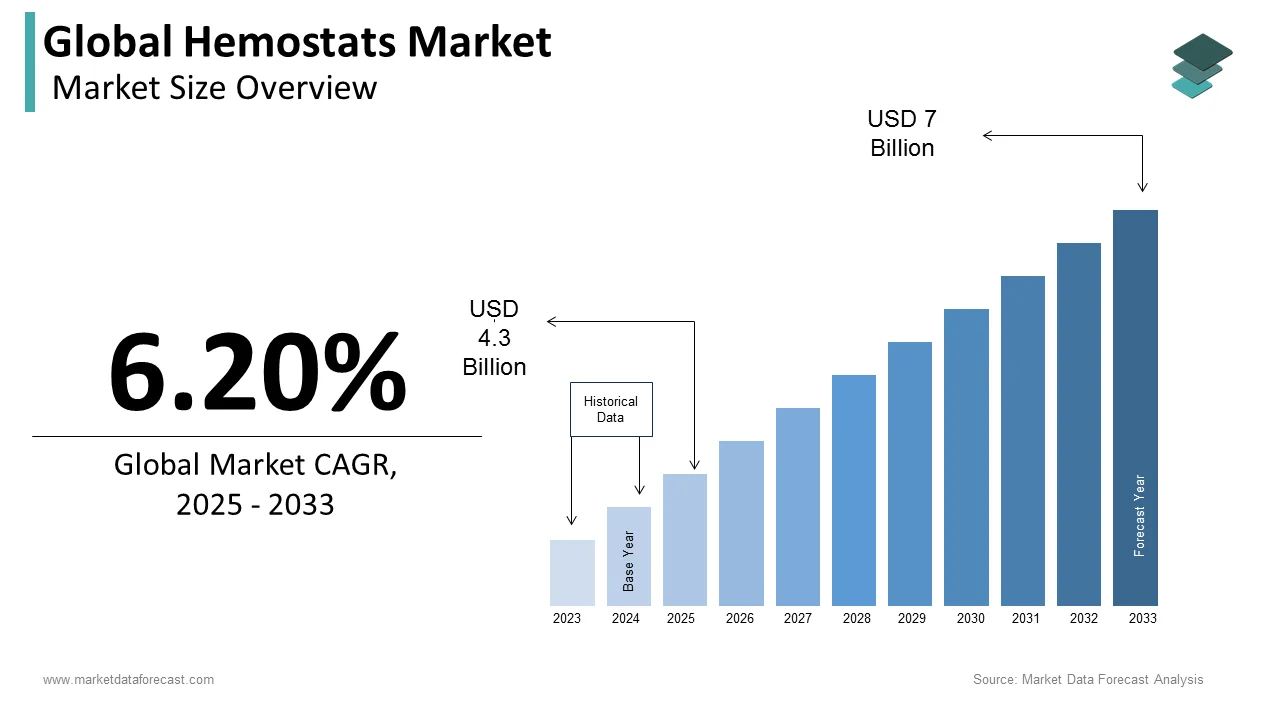

The size of the global hemostats market was worth USD 4.05 billion in 2024. The global market is anticipated to grow at a CAGR of 6.20% from 2025 to 2033 and be worth USD 7 billion by 2033 from USD 4.3 billion in 2025.

Hemostasis is the process of blood clotting. Hemostats are surgical agents that regulate and control the bleeding process during surgical procedures. Blood clotting is essential in many surgeries to achieve positive results and reduce blood loss. Hemostasis helps to shorten surgery time and reduces the need for blood transfusion. The importance of hemostasis has led to the developing of a wide range of surgical agents. Also, hemostats are surgical tools employed to control bleeding. Hemostatic agents are essential in establishing hemostasis in prehospital conditions and preventing bleeding-related death. As a result, they are widely used in surgical centers, hospitals, and nursing positions. Hemostatic agents can also be used in the civil and military sectors.

MARKET DRIVERS

The increase in the number of surgical procedures is one of the major factors propelling the global hemostats market growth.

The growing number of regulatory approvals, YOY growth in the incidence of accidents, and low genetic conditions are further fuelling the growth rate of the global hemostats market. As the WHO and several other international agencies recognize, hemostasis is critical in managing surgical inventions and accidents, such as cardiovascular disease, congenital disabilities, etc. In addition, managing blood loss in patients during surgeries is also driving the hemostats market; this includes surgical hemostasis instruments such as artery forceps, clamps, mosquito forceps, staples, etc., and local hemostatic products such as alum powder, surgiseal/fibrin glue, or drugs such as injectable factor VIII. Hemostatic agents containing thrombin and collagen are superior to surgical hemostasis for controlling bleeding.

In addition, hemostasis is widely growing owing to the rising number of cardiac surgeries and orthopedic surgeries, the high number of injuries and accidents, the large population and development in R&D activities, the increasing number of hospitals and surgical centers, and the increasing emerging markets. According to the American Heart Association statistics, cardiovascular disease is responsible for over 18 million deaths annually in 2086, and the number is expected to rise to over 24.2 million by 2030. Furthermore, according to WHO, the high density of surgeries performed per million inhabitants has grown over person-years. Hence, all these factors are expected to drive global market growth.

Furthermore, growing public awareness of minimally invasive surgical procedures drives the use of certain sealants and hemostatic adhesives that contribute to global hemostats market growth. According to the 2016 American Joint Replacement Registry, approximately 427,181 total surgeries have been reported for joint replacement surgery in the United States. Furthermore, growing incidences of chronic diseases and rising support from the government are escalating the market's growth rate. In addition, escalated R&D activities initiated by the government and private organizations to produce effective hemostatic agents, coupled with advanced technological innovations in the healthcare sector, will lead to substantial commercial benefits during the forecast period timeline.

MARKET RESTRAINTS

However, the increase in product recalls, poor reimbursement reductions, high costs of surgical procedures, limited products available in certain underdeveloped regions, and strict administrative approvals pose enormous difficulties for developing the hemostats market. In addition, the highly consolidated market is a significant factor, among others, which is forecasted to hamper the growth of the market and further question the growth of the global hemostats market during the forecast period.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Product Type, Application, Distribution Channel, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis; Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

3M, ADCO Global, Inc., and Abbott Laboratories. Other players in the market include Advanced Medical Solutions Group, Plc., and Dymax Corporation. |

SEGMENTAL ANALYSIS

By Product Type Insights

The thrombin-based hemostats segment accounted for the largest share of the global hemostats market in 2024 and is projected to register a healthy CAGR during the forecast period. A wide range of applications for thrombin-based hemostats is propelling the market's growth.

The tissue sealants segment has been soaring higher for the past few years. In addition, rising investments in developing new products are escalating the market's growth rate.

Gelatine-based topical hemostats are growing in demand because they are economical. However, they are available in powder form.

By Application Insights

Based on the application, the wound closure segment is estimated to hold the most significant global market share during the forecast period due to the increasing number of minimally invasive surgeries. In addition, surgical hemostats have prominent growth opportunities during the forecast period with the growing number of surgeries associated with the rising chronic illness.

By End User Insights

Based on the end-user, the hospital segment led the market in 2024 and is predicted to be the market leader during the forecast period. Growing incidences of chronic diseases and the increasing geriatric population visiting hospitals with various health disorders are projected to propel the market's growth rate. Clinics are next to the hospital segment accounting for a significant share of the global hemostats market. In addition, growing prominence for better diagnostics procedures among people and raising awareness over the availability of different treatment procedures are likely to promote the growth of the hemostats market.

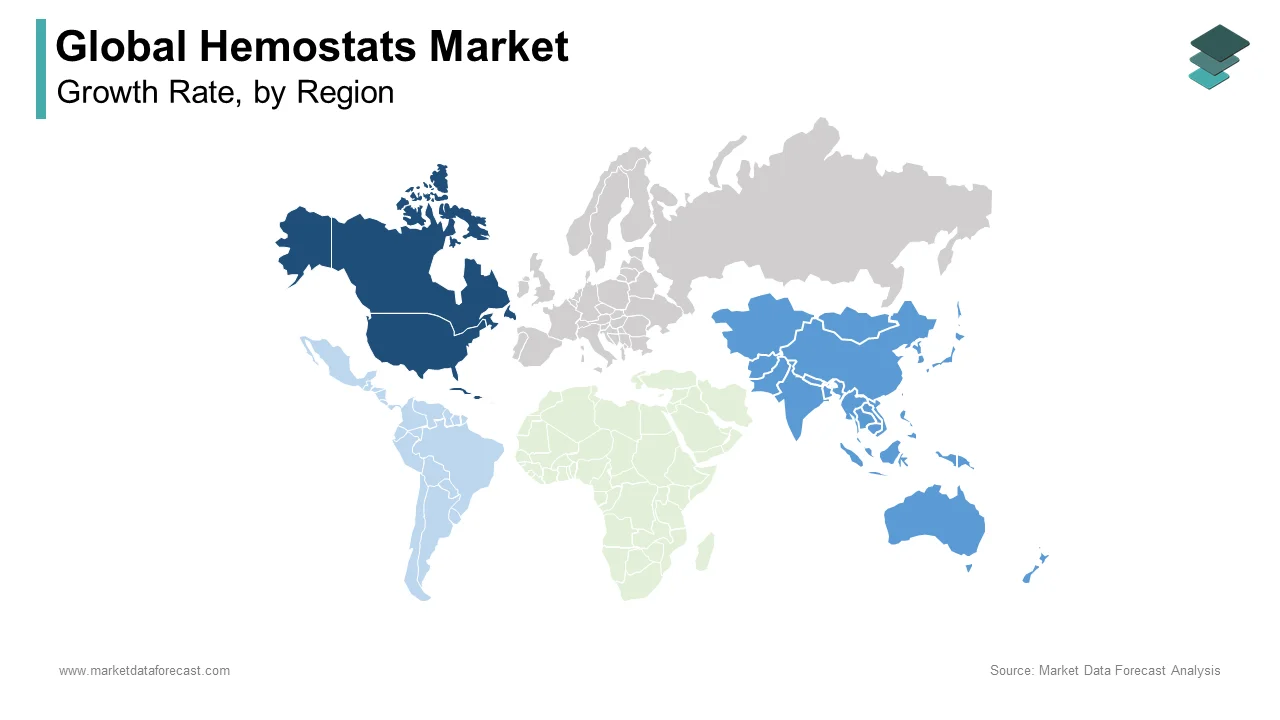

REGIONAL ANALYSIS

Geographically, the North American hemostats market accounted for the largest share of the global market in 2024.

In this region, highly advanced healthcare systems and ready adoption are attributable to the trend above. As a result, the North American hemostat market is well established, with the United States being an essential market in this region. The growing geriatric population and the escalating number of surgeries mainly drive the North American market expansion.

The European Hemostats market was the second-largest regional market in 2024. It forecasted a substantial share in the global market during the forecast period due to its constantly growing economy. In addition, the rising prevalence of promoting excellence in healthcare is ascribed to bolstering the demand of the European hemostats market.

The Asia Pacific hemostats market is on a high growth trajectory in the above forecast period. The reasons are the booming medical tourism industry, rising disposable income resulting in higher purchasing power, and rising awareness regarding better health infrastructure. The Asia Pacific is predicted to see lucrative expansion during the foreseen period due to escalated medical tourism and surgeries. Liberal policies combined with a profitable environment are the main engines of regional development. India, China, and Japan have relatively more developed healthcare infrastructure, advanced treatments, and a large patient base. The market in Malaysia, Singapore, and other Asian countries is growing rapidly with the rise of the medical tourism industry and improving health services with the government's support.

The Latin American hemostats market is estimated to grow at a moderate CAGR during the forecast period. Brazil dominated the Latin American hemostats market in 2024, which is expected to continue during the forecast period. The primary factor responsible for the growth of the Brazilian market is the increasing rate of road traffic accidents in the region. According to the latest WHO data released in 2019, the number of deaths caused by traffic accidents in Brazil had reached 43,999, or 3.99% of total deaths. On average, the age-adjusted death rate is 20.22 per 100,000 population and ranks 76th in Brazil globally. Other factors, such as the developed healthcare industry, increased demand for hemostasis agents, and new product launches, are expected to drive the market in Brazil. Additionally, the increasing geriatric population in the large population and unhealthy lifestyle choices will drive the market growth.

Mexico is expected to be a very lucrative market, growing at a CAGR of 5.5% during the forecast period. According to police data, Mexico recorded 14,673 road deaths in 2019, down 5.8% from 2018. The fatality rate is 11.6 deaths per 100,000 population. Mexico will grow owing to a strong presence of leading players in the region, a preference for minimally invasive surgeries, rapid medical tourism, technological progress, and increased investments in research and development activities. In addition, the preference for minimally invasive surgeries has significantly increased in recent years. These factors are anticipated to allow the market to grow and generate new growth opportunities for this regional market.

The hemostats market in the MEA region is predicted to showcase a CAGR of 5.89% during the forecast period.

KEY MARKET PARTICIPANTS

A few promising companies dominating the global hemostats market include 3M, ADCO Global, Inc., and Abbott Laboratories. Other players in the market include Advanced Medical Solutions Group, Plc., and Dymax Corporation.

MARKET SEGMENTATION

This market research report on the global hemostats market has been segmented and sub-segmented based on the product type, application, distribution channel, end-user, and region.

By Product Type

- Topical Hemostats

- Collagen-Based Topical Hemostats

- Oxidized Regenerated Cellulose-Based Topical Hemostats

- Gelatin-Based Topical Hemostats

- Thrombin-Based Topical Hemostats

- Combination Topical Hemostats

- Tissue Sealants

- Fibrin Sealants

- Protein-Based Sealants

- Cyanoacrylate-Based Tissue Adhesives

- Adhesion Prevention Products

By Application

- Wound Closure

- Surgical Hemostats

By Distribution Channel

- Direct Tenders

- Retail

By End User

- Hospitals

- Ambulatory Centers

- Community Healthcare

- Clinics

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

What was the size of the hemostats market worldwide in 2024?

The global hemostats market size was valued at USD 4.05 billion in 2024.

Which region had the major share in the global hemostats market in 2024?

The North American region accounted for the leading share of the global hemostats market in 2024.

Which segment based on product led the hemostats market in 2024?

Based on the product, the thrombin-based topical segment dominated the market in 2024.

Who are some of the promising players in the hemostats market?

3M, ADCO Global, Inc., and Abbott Laboratories. Other players in the market include Advanced Medical Solutions Group, Plc., and Dymax Corporation are a few of the prominent companies in the global hemostats market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]