Global Hospice Market Size, Share, Trends & Growth Forecast Report By Service Type (Nursing Services, Medical Supply Services, Counseling Services, Short-Term Inpatient Services, Physician Services, Physical Therapy, Speech Therapy and Spiritual Therapy), Care Type (Acute Care and Respite Care), End-User and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Hospice Market Size

The size of the global hospice market was worth USD 83.07 billion in 2024. The global market is anticipated to grow at a CAGR of 9.10% from 2025 to 2033 and be worth USD 181.92 billion by 2033 from USD 90.63 billion in 2025.

Hospice care is a unique type of care that focuses on the personal satisfaction of individuals and their guardians dealing with a propelled, life-limiting disease. Hospice care is becoming more prevalent in patients nearing the end of their lives, including those with ESLD, but it is a distinct type of PC used when patients are terminally ill. In hospice care, Family physicians play critical roles. Compared to the prevalence of hospice care in the UK and other developed countries, hospice care in Taiwan can expand in the future.

MARKET DRIVERS

The growing usage of hospice services and the adoption of several hospice organizations are propelling the growth of the global hospice market.

According to the CDC, there are 4,300 hospice care agencies in the United States (2016). The percentage of hospice care agencies owned for profit is 63% (2016). About 1.4 million patients are receiving hospice care (2015). According to the CDC, there are 15,600 nursing homes (2016), 69.3% of nursing homes are for-profit, and 1.7 million licensed beds are available (2016). According to the CDC, the number of home health agencies in the United States is 12,200 (2016), with 80.6% of agencies owned for profit (2016). About 4.5 million patients received and ended care at some point during the year (2015).

Growing long-term care services for chronic diseases worldwide boosts the global hospice market.

Percentage of people receiving long-term care services who have Alzheimer's disease or another dementia. According to CDC, the percentage of hospice patients is 44.5% (2015), the percentage of home health agency patients is 32.3% (2015), and the percentage of nursing home residents is 47.8% (2016). According to WHO, Palliative care is an integral part of cancer treatment for adults and children. The first global resolution on palliative care was passed in 2014. Every year, 40 million people require palliative care. However, only 14% of people in need of palliative care are receiving it at the end of life, as reported by WHO.

The growing prevalence of chronic disorders such as cancers, COPD, heart failure, end-stage renal disease, and other diseases globally is expected to accelerate the need for hospice services.

According to the Global Burden of Disease Study, there were 251 million COPD cases worldwide in 2016. Over 90% of COPD deaths occur in low- and middle-income countries reported by WHO. According to WHO, CVDs killed an estimated 17.9 million people in 2016, accounting for 31% of all global deaths. A heart attack or stroke is the cause of 85% of these deaths. According to the CDC, approximately 655,000 Americans die from heart disease yearly, accounting for one out of every four deaths. Cancer is one of the leading causes of death globally, accounting for 9.6 million deaths in 2018. Africa, Asia, and Central and South America account for more than 60% of the world's total new annual cases. These regions account for 70% of all cancer deaths worldwide. Chronic kidney disease (CKD) affects 10% of the world's population, and millions die yearly due to a shortage of affordable treatment options. The United States, Japan, Germany, Brazil, and Italy treat most of the 2 million people suffering from kidney failure. However, these five countries account for only 12% of the world's population.

According to OECD, Multi-morbidity is far more common in older age groups. On average, 58% of adults 65 and older reported having two or more chronic diseases, with this figure rising to 70% or higher in Portugal, Hungary, Poland, the Slovak Republic, and Germany. This compares to 24% of people under 65 with two or more chronic conditions.

MARKET RESTRAINTS

However, factors such as the high cost of hospice care treatment, a shortage of skilled professionals or nurses, and a lack of community awareness of the home healthcare system are expected to hamper the hospice market growth. In addition, strict regulatory frameworks and misuse of public funds provided by various organizations hamper the growth of the Hospice care market. Hospice care enables collaboration between patients and healthcare providers. Lack of hospice care system adoption in rural areas. Rising side effects of hospice care and palliative care medicines.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Service Type, Care Type, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities, COVID-19 Impact |

|

Regions Covered |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Market Leader Profiled |

Amedisys, Covenant Care., Dierksen Hospice, National Association for Home Care & Hospice. |

SEGMENTAL ANALYSIS

Global Hospice Market Analysis By Service Type

The nursing services segment is predicted to account for the largest share in the global hospice market during the forecast period owing to the high prevalence of chronic disease, cancer, dementia, cardiovascular, and kidney diseases.

On the other hand, the physician services segment is anticipated to showcase a healthy CAGR during the forecast period.

Global Hospice Market Analysis By Care Type

The acute care segment is estimated to grow at an aggressive CAGR during the forecast period owing to the significant rise in the number of patients with chronic diseases such as heart disease, stroke, cancer, and diabetes. However, technological advancements for improving the quality of treatment are further expected to fuel the growth of this segment.

The respite care segment is anticipated to be another lucrative segment during the forecast period.

Global Hospice Market Analysis By End User

The home settings segment is growing faster due to the rising prevalence of chronic diseases and the increasing geriatric population across the globe. As per the Centre for Disease Control and Prevention data, 40 million people aged 65 accounted for 13% of the global population. Also, several diverse programs related to the patient's disease and economic condition influence market growth.

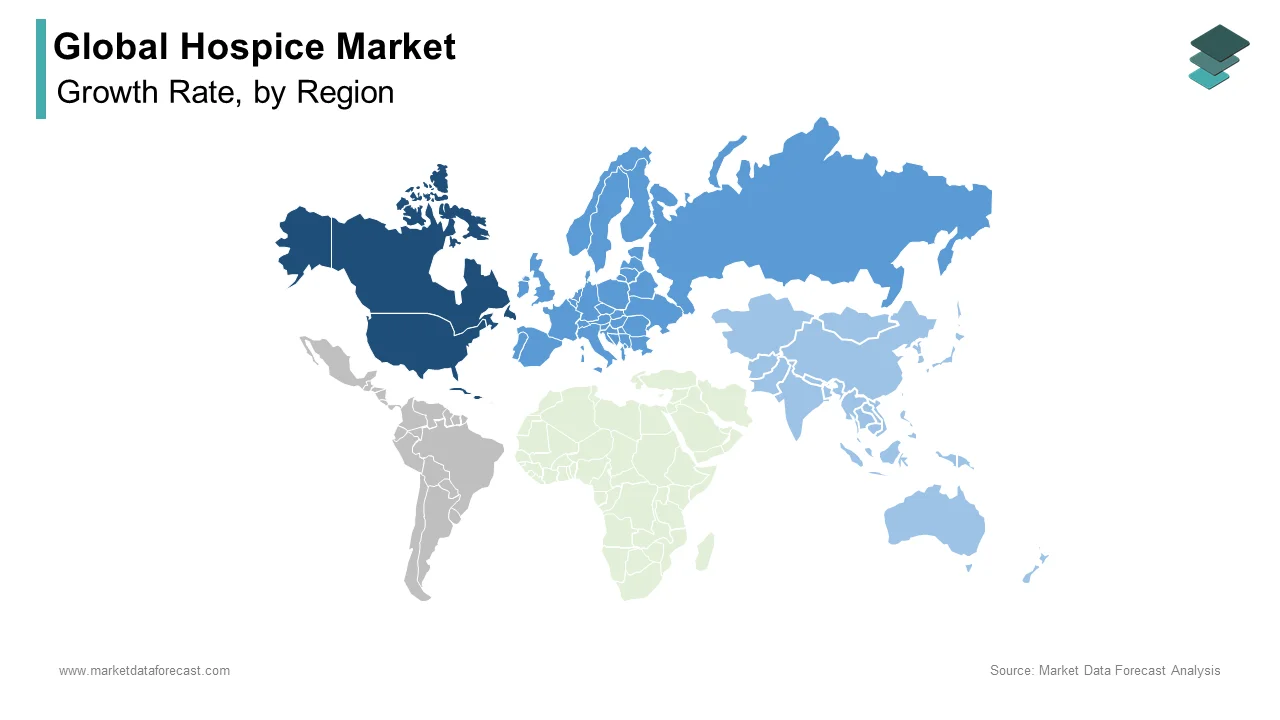

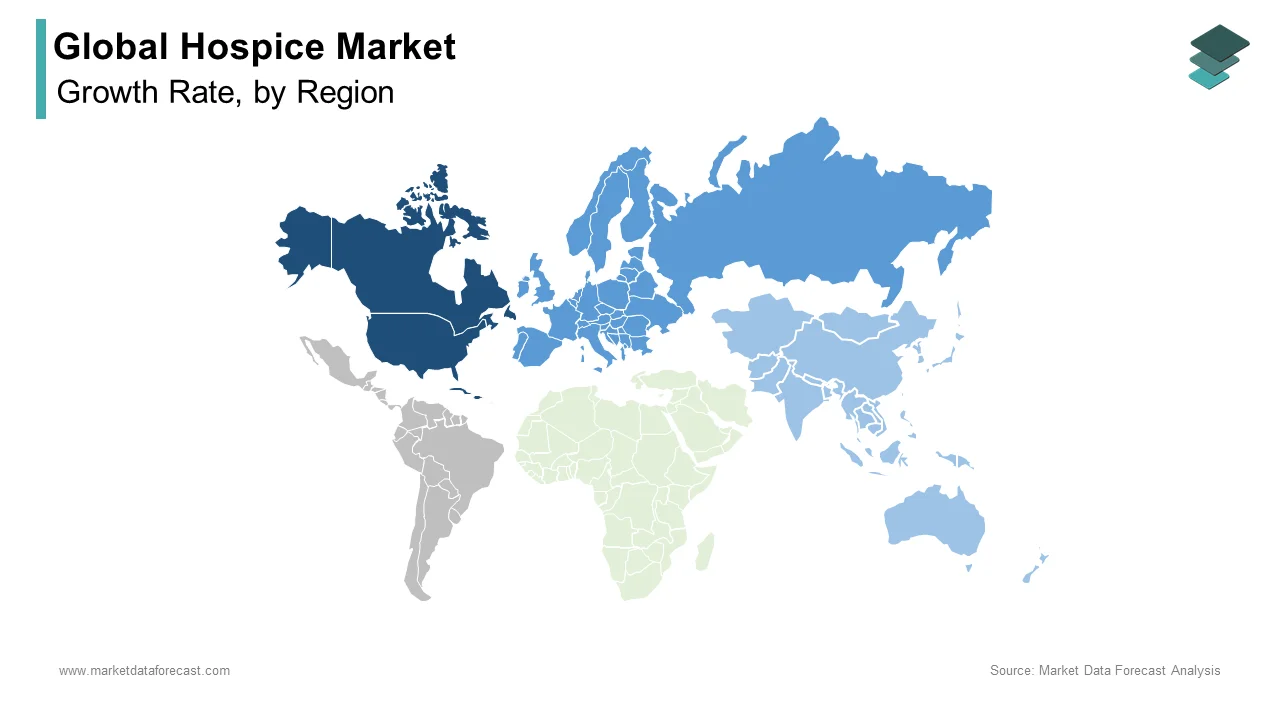

REGIONAL ANALYSIS

The North American hospice market is expected to hold the largest market share during the forecast period. Factors such as growing investments by the government and private individuals for improving healthcare infrastructure and cardiac disorders are majorly promoting the growth rate of the North American market.

The European market was the second-largest regional market globally in 2024 and is estimated to grow at an increasing CAGR of 6.7% during the forecast period. Increasing healthcare expenditure and advanced home care services are majorly attributing to the market growth in Europe. In Europe, The United Kingdom held the largest market share over the forecast period and is projected to continue its share throughout the forecast period.

The Asia Pacific is one of the fastest-growing regional markets globally. The major contributors in this region are China, India, Japan, and the rest of the world. India and China have dominated the hospice market during the forecast period. The growing number of patients with chronic diseases further accelerates the market's growth.

Middle East Africa is anticipated to have better growth in the coming years. Increasing respiratory problems and kidney issues are expected to propel the market growth.

KEY PARTICIPANTS IN THE HOSPICE MARKET

Some of the major market players in the global hospice market are Amedisys, Covenant Care., Dierksen Hospice, National Association for Home Care & Hospice., LHC Group, Inc, Oklahoma Palliative & Hospice Care., Alzheimer's Association, Curo Health Services, VITAS Healthcare, Seasons Hospice and Palliative Care, Samaritan Health Services., Accord Palliative and Hospice Care, Inc, EXTENDICARE., HCR ManorCare USA, Inc., AccentCare, and Others.

DETAILED SEGMENTATION OF THE GLOBAL HOSPICE MARKET INCLUDED IN THIS REPORT

This research report on the global hospice market has been segmented and sub-segmented based on service type, care type, end-user, and region.

By Service Type

- Nursing Services

- Medical Supply Services

- Counseling Services

- Short-Term Inpatient Services

- Physician Services

- Physical Therapy

- Speech Therapy

- Spiritual Therapy

By Care Type

- Acute Care

- Respite Care

By End User

- Home Settings

- Hospitals

- Specialty Nursing Homes

- Hospice Care Centres

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

Which region is growing the fastest in the global hospice market?

The Asia-Pacific region is anticipated to grow the fastest in the global market during the forecast period.

What are the companies playing a key role in the hospice market?

Amedisys, Covenant Care., Dierksen Hospice, National Association for Home Care & Hospice., LHC Group, Inc, Oklahoma Palliative & Hospice Care., Alzheimer's Association, Curo Health Services, VITAS Healthcare, Seasons Hospice, and Palliative Care, Samaritan Health Services., Accord Palliative and Hospice Care, Inc, EXTENDICARE., HCR ManorCare USA, Inc. and AccentCare are playing a leading role in the hospice market.

Which region accounted for the leading share in the global hospice market in 2024?

North America dominated the market in 2024.

How much was the global hospice market worth in 2024?

The global hospice market size was worth USD 83.07 billion in 2024.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com