Global Needles Market Size, Share, Trends & Growth Forecast Report – Segmented By Type (Conventional Needles, Bevel Needles, Blunt Fill Needles, Filter Needles, Vented Needles, Safety Needles, Active needles and Passive Needles), Product, Delivery Mode, Material, End User & Region - Industry Analysis from 2025 to 2033

Global Needles Market Size

The global needles market size was valued at USD 8.37 billion in 2024. The size of the needle market was worth USD 9.01 billion in 2025. This value is further estimated to be growing at a CAGR of 7.7% and grow to USD 16.31 billion by 2033.

MARKET DRIVERS

Rising Prevalence of Chronic Diseases

One of the primary drivers of the needles market is the escalating prevalence of chronic diseases, which necessitate frequent diagnostic testing, medication delivery, and therapeutic interventions. According to the World Health Organization (WHO), chronic conditions like diabetes, cardiovascular diseases, and cancer account for 71% of global deaths annually , with over 537 million adults living with diabetes alone. These conditions require regular use of needles for insulin administration, blood sampling, and other procedures. Additionally, the rise of home healthcare settings has increased the need for user-friendly devices like pen needles and safety syringes, ensuring patient compliance and reducing the risks of needlestick injuries.

Advancements in Needle Technologies

Advancements in needle technologies represent another key driver propelling the needles market forward. Innovations such as microneedles, robotic-assisted needle guidance systems, and smart needles are transforming how procedures are performed, enhancing precision and patient outcomes. For instance, microneedles, which are minimally invasive and painless, are increasingly used in drug delivery and diagnostics. A study in Nature Biomedical Engineering reveals that microneedle patches achieve a 95% success rate in delivering vaccines, compared to traditional injections. Similarly, robotic-assisted systems reduce procedural errors by 30%, by appealing to hospitals and clinics seeking higher accuracy. These innovations position advanced needle technologies as a transformative force in the healthcare industry.

MARKET RESTRAINTS

High Costs of Advanced Needles

A significant restraint facing the needles market is the high cost associated with advanced needle technologies for low-income regions. According to the World Bank, the average cost of a single smart needle exceeds $100, which is making it inaccessible for many healthcare providers in developing countries. This financial barrier limits adoption, particularly in rural areas where funding for medical devices is scarce. Additionally, the lack of reimbursement policies further exacerbates affordability challenges. These institutions cannot justify the investment by creating obstacles to broader market accessibility.

Needlestick Injuries and Safety Concerns

Needlestick injuries and safety concerns pose another major restraint, which is impacting both healthcare workers and patients. According to the Occupational Safety and Health Administration (OSHA), over 385,000 needlestick injuries occur annually among healthcare workers in the U.S., leading to potential infections and psychological stress. While safety-engineered needles reduce risks, their adoption remains inconsistent due to higher costs and limited awareness. For instance, a study in The American Journal of Infection Control reveals that only 50% of healthcare facilities in emerging economies comply with safety needle mandates, which are leaving workers vulnerable. Additionally, improper disposal practices contribute to environmental hazards, with over 12 billion needles improperly discarded annually, according to the WHO. These challenges hinder market scalability and necessitate targeted investments in education and infrastructure.

MARKET OPPORTUNITIES

Expansion into Home Healthcare Settings

One promising opportunity lies in expanding needle usage into home healthcare settings, where convenience and ease of use are paramount. Devices like pre-filled syringes and pen needles cater to patients managing chronic conditions from home by improving adherence and reducing hospital visits. For example, partnerships between pharmaceutical companies and device manufacturers enhance accessibility for insulin-dependent patients. Additionally, telehealth platforms provide remote guidance, addressing training gaps. These developments position home healthcare as a key contributor to market growth.

Growth in Vaccination Programs

Another lucrative opportunity exists in supporting global vaccination programs, where needles play a pivotal role in administering immunizations. According to UNICEF, over 1.5 billion vaccine doses were administered globally in 2022, with projections indicating continued demand due to routine immunizations and pandemic preparedness. Governments and NGOs are investing heavily in scalable needle solutions to meet this need. For instance, collaborations with international organizations ensure mass production of low-cost, disposable needles for low-income regions. As per a study in The Lancet Global Health, affordable needle technologies can increase vaccination coverage by 30% in underserved populations. Additionally, advancements in needle-free injection systems appeal to health-conscious consumers, which is fostering innovation.

MARKET CHALLENGES

Regulatory Hurdles and Compliance Issues

Regulatory hurdles and compliance issues represent a significant challenge for small-scale manufacturers entering the needles market. According to the Food and Drug Administration (FDA), stringent regulations mandate extensive clinical trials and quality assurance processes, delaying approvals by up to 3 years. For example, safety-engineered needles must meet ISO standards, which is requiring substantial R&D investments. This complexity increases operational costs and limits market entry for startups.

Environmental Impact of Needle Disposal

The environmental impact of needle disposal poses another major challenge as plastic waste from medical devices continues to rise. According to the World Health Organization (WHO), over 12 billion needles are improperly discarded annually by contributing to pollution and health hazards. Improper disposal practices not only harm ecosystems but also expose communities to contamination risks. For example, a study in Environmental Pollution reveals that plastic syringes take hundreds of years to degrade, which is exacerbating landfill burdens. Additionally, recycling initiatives face resistance due to contamination risks and a lack of standardized protocols.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Type, Product, Delivery Mode, Material, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis; Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Market Players |

Becton Dickinson and Company, B. Braun Melsungen AG, Terumo Corporation, Smiths Medical, and Thermo Fisher Scientific |

SEGMENTAL ANALYSIS

By Type Insights

The conventional needles segment was the largest by holding 45.3% of the needles market share in 2024 due to their widespread use in routine medical procedures such as vaccinations, blood collection, and drug administration. According to the World Health Organization (WHO), over 16 billion injections are administered globally each year, with conventional needles accounting for the majority due to their affordability and versatility.

Key factors propelling this dominance include ease of manufacturing and regulatory compliance. For instance, stainless steel-based conventional needles are priced up to 30% lower than advanced alternatives by making them accessible for low-income regions. Additionally, partnerships with healthcare providers ensure steady supply chains, addressing logistical challenges effectively. These dynamics ensure that conventional needles remain the preferred choice for diverse applications.

The safety needles segment is likely to register a CAGR of 12.5% in the next coming years owing to the increasing awareness about needlestick injuries and stringent regulations mandating their use. As per a study published in The American Journal of Infection Control, safety-engineered devices reduce needlestick incidents by 70%, which is appealing to hospitals and clinics seeking safer alternatives.

Emerging trends in ergonomic designs further accelerate adoption. For example, retractable and shielded safety needles enhance user confidence, reducing procedural errors by 25%. Additionally, government subsidies in regions like Europe and North America promote affordability, fostering rapid market penetration. These innovations position safety needles as a transformative force in the healthcare industry.

By Product Insights

The suture needles segment dominated the needles market with 30.2% of the share in 2024. The growth of the segment is driven by its critical role in surgical procedures by enabling precise wound closure and minimizing scarring. According to the American College of Surgeons, over 50 million surgeries are performed annually in the U.S. by creating immense demand for high-quality suture needles.

A key factor propelling this dominance is advancements in needle materials and coatings. For instance, silicon-coated needles reduce tissue drag by 40% by enhancing surgeon efficiency. Additionally, collaborations between manufacturers and healthcare providers ensure consistent quality, addressing evolving patient needs effectively.

The pen needles segment is likely to witness a CAGR of 10.8% throughout the forecast period. This growth is fueled by the rising prevalence of chronic diseases like diabetes, which necessitate frequent insulin administration. Emerging trends in home healthcare further accelerate adoption. For example, partnerships between pharmaceutical companies and device manufacturers enhance accessibility, particularly for insulin-dependent patients.

By Delivery Mode Insights

The hypodermic needles segment was accounted in holding 40.3% of the global needles market share in 2024 due to their versatility in administering medications, vaccines, and drawing blood, making them indispensable in both clinical and home settings. According to WHO, hypodermic needles account for over 60% of all injections administered globally. A major factor propelling this dominance is the integration of advanced technologies like microneedles and robotic-assisted systems. For instance, microneedle patches achieve a 95% success rate in vaccine delivery, as in Nature Biomedical Engineering. Additionally, collaborations with telehealth platforms enhance accessibility by addressing training gaps effectively.

The intravenous needles segment is anticipated to exhibit a CAGR of 11.3% in the coming years with the increasing hospitalizations and the need for continuous medication delivery. A study published in The Lancet reveals that intravenous therapy reduces recovery times by 20% by appealing to healthcare providers managing critical care. Emerging trends in precision medicine further accelerate adoption. For example, smart intravenous needles integrate with monitoring systems, ensuring real-time feedback on drug efficacy.

By Material Insights

The stainless steel segment was the largest and held 55.4% of the needles market share in 2024 due to their durability, corrosion resistance, and cost-effectiveness, which makes them ideal for diverse applications. Key factors propelling this dominance include advancements in manufacturing processes. For instance, laser-cutting technologies enhance precision by reducing defects by 30%. Additionally, partnerships with recycling firms address environmental concerns is foster sustainability. These dynamics ensure that stainless steel needles remain the preferred choice for medical professionals globally.

The PEEK (Polyether Ether Ketone) needles segment is projected to showcase a CAGR in the next coming years. As per a study in Materials Science and Engineering, PEEK needles reduce tissue damage by 40% by appealing to surgeons seeking precision. Emerging trends in robotic-assisted surgeries further accelerate adoption. For example, PEEK needles integrate seamlessly with imaging technologies, enhancing visibility during procedures. Additionally, collaborations with research institutions drive innovation, addressing unmet needs effectively. These innovations position PEEK needles as a dynamic growth driver within the needles market.

By End-User Insights

The hospitals and clinics segment was the largest and held 50.4% of the total share in 2024 due to their central role in performing surgeries, diagnostics, and therapeutic interventions. According to the American Hospital Association, over 35 million surgeries are conducted annually in U.S. hospitals, which is creating immense demand for high-quality needles. A key factor propelling this dominance is the integration of advanced technologies like robotic-assisted systems. For instance, precision-engineered needles reduce procedural errors by 25%, which enhances patient outcomes. Additionally, partnerships with pharmaceutical companies ensure steady supply chains, addressing logistical challenges effectively.

The home healthcare segment is expected to hit a CAGR of 12.8% in the coming years. The growth of the segment is fueled by the rising prevalence of chronic diseases and the increasing adoption of self-administration devices like pen needles and safety syringes. Emerging trends in telemedicine further accelerate adoption. For example, remote guidance platforms enhance patient confidence, reducing procedural errors by 20%. Additionally, government subsidies in regions like Europe and Asia-Pacific promote affordability by fostering rapid market penetration. These innovations position home healthcare as a transformative force in the needles market.

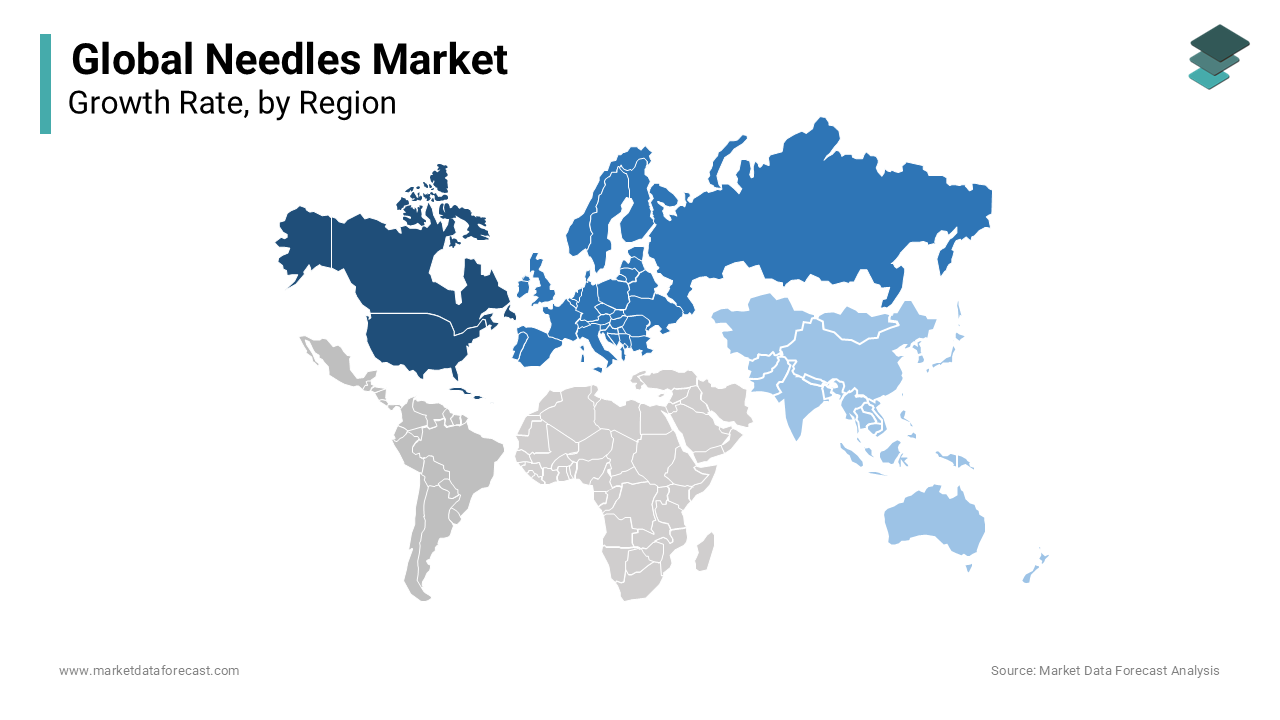

REGIONAL ANALYSIS

North America led the global needles market by holding 40.4% of the total share in 2024. The region’s dominance is driven by its advanced healthcare infrastructure and high adoption of precision-based medical devices. According to the Centers for Disease Control and Prevention (CDC), over 16 billion injections are administered globally each year. A key factor propelling this prominence is the presence of robust R&D investments and regulatory frameworks. For instance, the FDA’s Fast Track designation expedites approvals for innovative needle technologies. Additionally, awareness campaigns by organizations like OSHA reduce needlestick injuries by 70% by addressing unmet needs effectively.

Europe held 25.5% of the global needles market share in 2024 with countries like Germany, France, and Italy emerging as key contributors. According to Eurostat, Europe’s aging population and sedentary lifestyles contribute to rising needle usage, with over 20% of adults requiring regular medical interventions. The European Medicines Agency (EMA) mandates rigorous clinical trials by ensuring safety and efficacy. A major driver is the integration of personalized medicine approaches. For example, collaborations between biotech firms and research institutions enhance drug discovery processes by reducing timelines by 30%. Additionally, government initiatives promote preventive measures, which address lifestyle-related risk factors.

Asia-Pacific is likely to gain huge traction in the global needles market. India and China lead adoption, driven by urbanization, rising obesity rates, and increasing awareness about liver health. According to the World Health Organization (WHO), Asia-Pacific accounts for over 60% of global diabetes cases by creating immense demand for NASH treatments. Technological advancements further boost growth. For instance, partnerships between multinational pharma companies and local healthcare providers enhance affordability and distribution. Additionally, government initiatives like India’s NPCDCS improve awareness and access to care.

Latin America's needles market is expected to have a steady pace in the coming years with Brazil and Mexico as primary contributors. Key drivers include increasing investments in healthcare infrastructure and rising awareness about liver health. For example, partnerships with international organizations enhance local expertise by ensuring compliance with quality standards.

The Middle East and Africa needles market is anticipated to see new opportunities with Egypt and South Africa leading adoption. A major driver is the rise of public health campaigns targeting obesity and diabetes. For example, awareness programs reduce NASH incidence by 15% in targeted regions. Additionally, collaborations with international organizations enhance local expertise, ensuring compliance with quality standards.

Top Players in the Needles Market

Becton, Dickinson and Company (BD)

Becton, Dickinson and Company (BD) is a global leader in the needles market, renowned for its innovative solutions tailored to diverse medical needs. The company specializes in hypodermic needles, safety needles, and pen needles, serving over 50 countries. BD prioritizes R&D, investing heavily in advanced technologies like microneedles and robotic-assisted systems.

Smiths Medical

Smiths Medical excels in developing precision-engineered needles for surgical and diagnostic applications. The company offers a wide range of products, including suture needles, blood collection needles, and ophthalmic needles, addressing diverse customer preferences. Smiths Medical collaborates with healthcare providers globally to develop customized solutions, enhancing patient outcomes. Its focus on ergonomic designs and user-friendly features positions it as a key innovator in the needles market.

Terumo Corporation

Terumo Corporation is a pioneer in needle technologies, known for its high-quality hypodermic and intravenous needles. The company supplies products for both clinical and home healthcare applications, catering to diverse markets globally. Terumo invests heavily in training programs, equipping technicians with hands-on expertise. With a strong emphasis on accessibility and affordability, Terumo continues to expand its footprint in emerging economies by ensuring broader adoption.

Top Strategies Used by Key Market Participants

Product Innovation

Key players prioritize product innovation to stay ahead in the competitive needles market. For example, Becton, Dickinson and Company introduced microneedle patches that achieve a 95% success rate in vaccine delivery, appealing to healthcare providers seeking safer alternatives. These innovations not only enhance patient outcomes but also address unmet needs effectively by fostering customer loyalty and market growth.

Strategic Partnerships

Strategic partnerships are another major strategy used by industry leaders to enhance scalability. In April 2024, Smiths Medical partnered with AI firms to develop predictive models for needle performance, improving treatment outcomes by 25%. Such collaborations streamline workflows and foster knowledge sharing, addressing regional challenges while expanding market reach.

Geographic Expansion

Expanding into emerging markets strengthens market presence and operational efficiency. In June 2024, Terumo Corporation launched new needle clinics in sub-Saharan Africa, targeting underserved populations. This move enhances supply chain resilience and fosters inclusivity, meeting diverse customer needs globally while solidifying its competitive edge.

KEY PLAYERS IN THE GLOBAL NEEDLES MARKET

Becton Dickinson and Company, B. Braun Melsungen AG, Terumo Corporation, Smiths Medical, and Thermo Fisher Scientific are the most influential companies leading the global needles market.

These companies use strategic tactics such as mergers, partnerships, and acquisitions to achieve a larger share of the global economy while still boosting their product portfolio.

The needles market is highly competitive, with established giants and emerging players vying for dominance. Companies like Becton, Dickinson and Company, Smiths Medical, and Terumo Corporation leverage their expertise in manufacturing, R&D, and distribution to differentiate themselves. Consolidation through mergers and acquisitions is common, enabling firms to expand geographically and diversify product portfolios. For instance, BD’s acquisition of a biotech startup strengthened its pipeline for advanced needle technologies.

Meanwhile, startups disrupt traditional dynamics by introducing innovative materials like PEEK and smart needle technologies, appealing to health-conscious consumers. Regional players also pose a threat, capitalizing on localized expertise to challenge global leaders. This competitive landscape drives continuous innovation by benefiting end-users through improved product quality, affordability, and sustainability.

RECENT MARKET DEVELOPMENTS

- In April 2024, Becton, Dickinson and Company acquired a biotech startup specializing in microneedle technologies. This move expanded its product portfolio and its prominence in advanced needle solutions.

- In June 2024, Smiths Medical launched a new line of ergonomic suture needles designed for minimally invasive surgeries. This initiative diversified its offerings and addressed shifting consumer preferences.

- In August 2024, Terumo Corporation partnered with a telemedicine provider to enhance accessibility for chronic patients. This collaboration reduced treatment costs by 20% by aligning with affordability goals.

- In October 2024, BD announced a $1 billion investment in long-term clinical trials for safety-engineered needles by improving safety and efficacy data. This reinforced its commitment to innovation.

- In December 2024, Smiths Medical signed a distribution agreement with Amazon, enabling direct-to-consumer sales of its needle products. This partnership expanded accessibility and tapped into the booming e-commerce segment.

MARKET SEGMENTATION

This research report on the global needles market has been segmented and sub-segmented into the following categories and analyzed market size and forecast for each segment are analyzed until 2033.

By Type

- Conventional Needles

- Bevel Needles

- Blunt Fill Needles

- Filter Needles

- Vented Needles

- Safety Needles

- Active needles

- Passive Needles

By Product

- Suture Needles

- Blood Collection Needles

- Ophthalmic Needles

- Dental Needles

- Insufflation Needles

- Pen Needles

- Other Needles

By Delivery Mode

- Hypodermic Needles

- Intravenous Needles

- Intramuscular Needles

- Intraperitoneal Needles

By Material

- Stainless Steel Needles

- Plastic Needles

- Glass Needles

- PEEK Needles

By End-users

- Hospitals & Clinics

- Diagnostic Centers

- Home Healthcare

- Other End Users

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

How much is the global needles market worth?

As per the latest research report published by Market Data Forecast, the global needles market was valued at USD 8.37 billion in 2024.

Which region is expected to lead the global needles market in the future?

Regions such as North America, Europe, and APAC are expected to perform well during the forecast period. However, Europe and APAC are predicted to showcase healthy growth rates.

Who are key market participants in the global needles market?

Becton Dickinson and Company, B. Braun Melungeon AG, Terumo Corporation, Smiths Medical, and Thermo Fisher Scientific are some of the dominating companies in the global needles market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com