Global Pharmaceutical Isolator Market Size, Share, Trends & Growth Forecast Report By Product Type (Closed and Open), Configuration (Floor-standing, Modular, Mobile, Compact, Tabletop and Portable), Application (Aseptic, Containment, Sampling & Weighing And Fluid Dispensing) and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Pharmaceutical Isolator Market Size

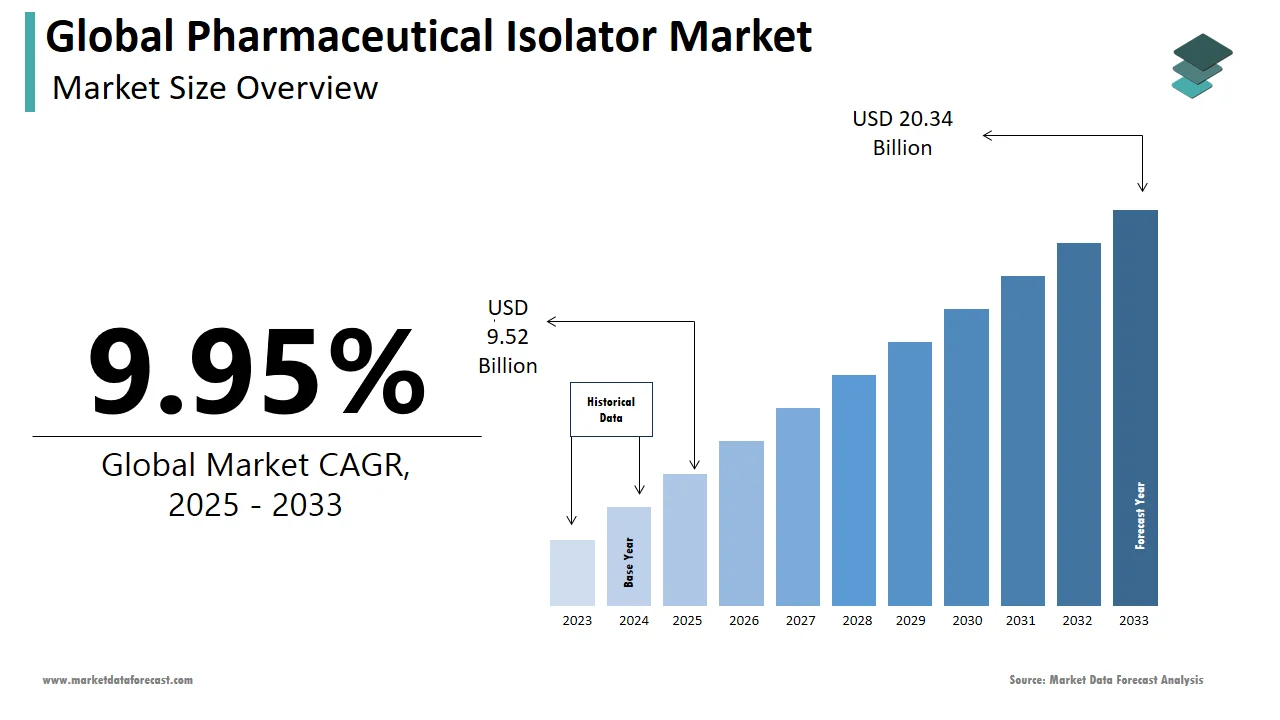

The size of the global pharmaceutical isolator market was worth USD 8.66 billion in 2024. The global market is anticipated to grow at a CAGR of 9.95% from 2025 to 2033 and be worth USD 20.34 billion by 2033 from USD 9.52 billion in 2025.

Pharmaceutical isolators are also called containment isolators or glove boxes. These are used in the pharmaceutical industry for the harmless manufacturing of products. Pharmaceutical isolators aid in providing highly controlled environments that can limit the contamination of the product and protect the workforce and the environment from exposure to hazardous materials. The usage of pharmaceutical isolators can be majorly seen in activities such as sterile compounding, material handling, and testing of pharmaceutical products. These are further primarily used for the manufacturing of potency drugs. The manufacturing of potency drugs is complex and can cause significant damage to the operator and the environment if exposed. Pharmaceutical isolators are available in various sizes and configurations that majorly depend on the application.

MARKET DRIVERS

The rising demand for sterile drug manufacturing is majorly propelling the pharmaceutical isolator market growth.

Currently, the need for sterile drug manufacturing is growing significantly owing to the growing patient population suffering from chronic diseases and increasing demand for quality drugs. The growing usage of pharmaceutical isolators to provide a sterile environment for drug manufacturing is expected to result in market growth. The demand for sterile drugs has increased notably in recent years. The growing aging population, increasing patient count suffering from chronic diseases, and rising emphasis on patient safety propel the need for sterile drugs. The manufacturing, packaging, and handling of sterile drugs are complex and require a highly controlled environment to do so. Pharmaceutical isolators can help build such types of environments, and the adoption of pharmaceutical isolators has also grown with the growing demand for sterile drugs. Stringent regulations for pharmaceutical manufacturing are further fuelling the pharmaceutical isolators market growth.Several countries have imposed strict regulations for the manufacturing of pharmaceutical products to ensure the safety and effectiveness of the drugs. Pharmaceutical isolators can help develop highly controlled environments for manufacturers that can comply with the available regulations related to drug production and handling. For instance, regulatory bodies such as the USFDA and European Medicine Agency (EMA) recommend using isolators in manufacturing procedures to prevent contamination in sterile drug manufacturing and aseptic processing.

Increasing adoption of personalized medicine is expected to promote the pharmaceutical isolator market growth.

The awareness and adoption of personalized medicine have grown significantly in recent years owing to the advantages of personalized medicine, such as improved patient life and quality outcomes. The manufacturing of personalized medicine requires the high precision and sterility that pharmaceutical isolators can offer. Likewise, the growing demand for personalized medicine is contributing to the growth of the pharmaceutical isolators market.In addition, many pharmaceutical companies are willing to outsource their manufacturing and testing activities to CMOs and CROs due to the benefits associated, such as cost savings and improved efficiency, and this trend is anticipated to accelerate in the coming years and boost the demand levels for pharmaceutical isolators among the contract organizations. Furthermore, the growing emphasis on occupational health and safety by companies to safeguard their workers is estimated to support market growth. Furthermore, factors such as increasing healthcare expenditure, rapid adoption of technological advancements in manufacturing pharmaceutical isolators, rising demand for biologics, increasing investments for R&D, and growing emphasis on quality assurance are anticipated to fuel the growth rate of the pharmaceutical isolators market.

MARKET RESTRAINTS

The expense of pharmaceutical isolators is one of the key factors hampering the market growth. These costs are comparatively much higher than the traditional cleanrooms and becoming difficult for smaller companies to adopt. In addition, the availability of alternative technologies is expected to limit the adoption of pharmaceutical isolators and hamper the market’s growth rate. In addition, the scarcity of skilled professionals with expertise in executing the systems that work pharmaceutical isolators in some countries and the presence of a stringent regulatory landscape for pharmaceutical isolators are further hindering market growth.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

9.95% |

|

Segments Covered |

By Product Type, Configuration, Application, End-user, and Region. |

|

Various Analyses Covered |

Global, Regional, and country-level analysis; Segment-Level Analysis, DROC; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

SKAN, Getinge, Extract Technology (Walker), Comecer, Hosokawa Micron, ZHEJIANG TALIN Bioengineering, Fedegari Autoclave, Telstar, Syntegon, Bioquell, Shanghai Tofflon Science and Technology, Wenzhou Weike Biological Laboratory Equipment, IsoTech Design and Flow Sciences, Inc. (FSI), and Others. |

SEGMENTAL ANALYSIS

By Product Type Insights

Based on product type, the open isolator systems segment had the largest share of the worldwide market in 2024 and is predicted to witness the fastest CAGR over the forecast period. The benefits of open isolator systems, such as flexibility and easier access to the workspace, are majorly propelling segmental growth.However, the closed isolator systems segment is anticipated to hold a considerable share of the worldwide market during the forecast period. Installing closed isolator systems is simple and provides benefits such as substantial air flow, accurate air classification, and validation for door locks.

By Configuration Insights

Based on the configuration, the floor-standing segment is expected to hold the most significant share of the global market and register the highest CAGR during the forecast period. The growing adoption of floor-standing isolators for high-volume manufacturing is one of the key factors fuelling segmental growth. Furthermore, the benefits associated with floor-standing isolators such as durability, stability, higher capacity, and ease of use, further contribute to the segment’s growth rate. In addition, floor-standing isolators are customizable and offer a high degree of safety to the product and operators, which further supports segmental growth. Furthermore, the growing demand for pharmaceutical manufacturing processes in developing countries propels the segment’s growth rate.

By Application Insights

Based on application, the aseptic isolators segment is predicted to hold a major share of the worldwide market during the forecast period. Aseptic isolators play a crucial role in providing a sterile environment while filling and packaging sterile products. The segmental growth is majorly driven by the growing demand for sterile products and the increasing focus on patient safety. In addition, a stringent regulatory environment for aseptic manufacturing is further contributing to the segment's growth rate. On the other hand, the containment isolators segment is predicted to have a considerable share of the global pharmaceutical isolators market during the forecast period.

By End-user Insights

Based on end-user, the pharmaceutical companies segment is predicted to occupy a major share of the global pharmaceutical isolators market during the forecast period. Pharmaceutical companies are the largest consumers of pharmaceutical isolators used in manufacturing drugs and biologics. In addition, pharmaceutical companies are investing significant amounts in the research and developmental activities of new drugs and require a wide range of equipment and technologies, including pharmaceutical isolators.The CROs segment accounted for the second-largest share of the global market in 2024 and is expected to hold a considerable share of the worldwide market during the forecast period.

REGIONAL ANALYSIS

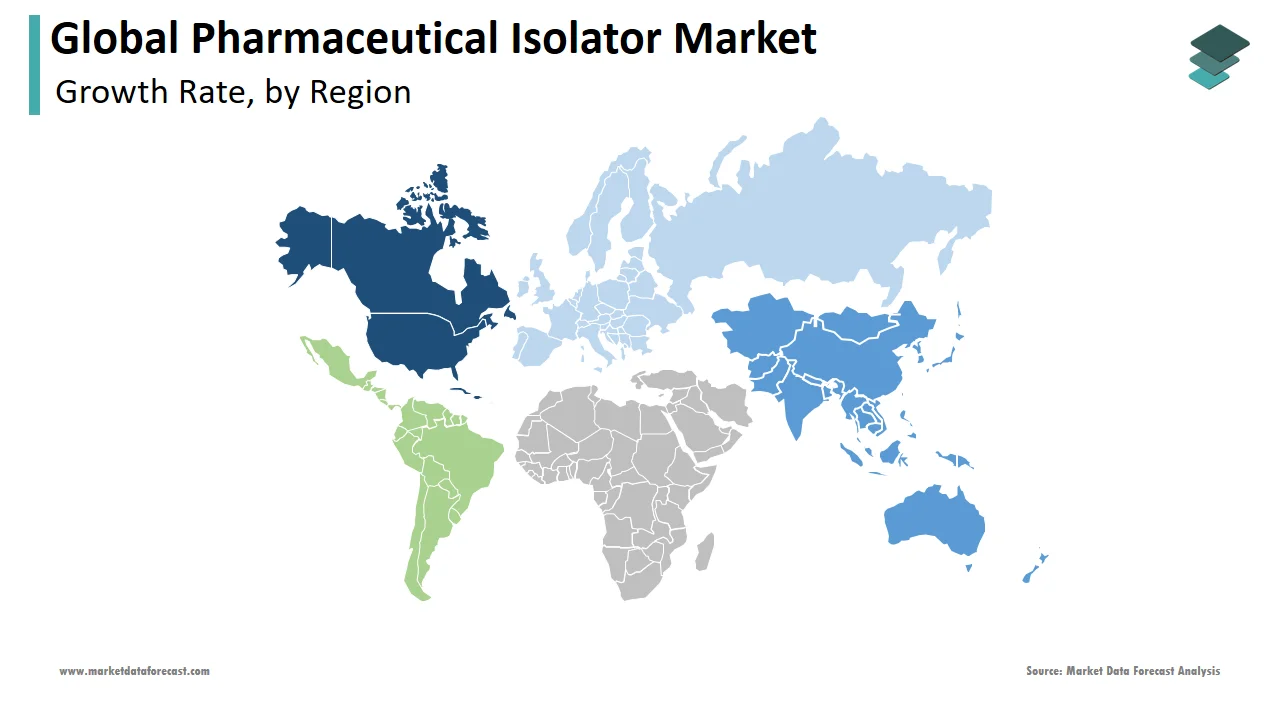

Geographically, the North American region was the largest regional segment for pharmaceutical isolators worldwide and is expected to hold dominating position in the global market during the forecast period. The presence of numerous pharmaceutical companies is majorly propelling the North American market. In addition, the stringent regulatory environment for pharmaceutical isolators for drug manufacturing and rising demand for sterile drugs and biologics are expected to boost the North American pharmaceutical isolators market growth. Furthermore, increasing investments by pharmaceutical companies for the R&D of new drugs and rapid adoption of technological advancements in manufacturing effective pharmaceutical isolators are anticipated to fuel the growth rate of the North American market. During the forecast period, the U.S. market is estimated to capture a major share of the North American market, followed by Canada.

The APAC regional market is estimated to register the fastest CAGR among all the regions in the worldwide market during the forecast period. The growing demand for pharmaceuticals in the APAC countries is one of the major factors propelling the regional market growth. Furthermore, the growing number of initiatives and investments by the APAC countries to develop the healthcare infrastructure and the growing adoption of technological advancements are promoting the growth rate of the APAC market. In addition, the growing number of initiatives by the APAC governments in favor of pharmaceutical isolators and the rising preference from pharmaceutical companies to outsource their drug development and manufacturing activities to countries such as India and China are further favoring regional market growth.

The European pharmaceutical isolator market is another potential regional market for pharmaceutical isolators. During the forecast period, the European region is expected to capture a substantial share of the global market.

The presence of an increasing number of pharmaceutical companies and research institutes and rising emphasis on patient safety are predicted to favor the European market growth.

The Latin American region is predicted to have decent occupancy in the worldwide market during the forecast period.

The MEA market is expected to showcase a moderate CAGR in the coming years.

KEY MARKET PLAYERS

SKAN, Getinge, Extract Technology (Walker), Comecer, Hosokawa Micron, ZHEJIANG TALIN Bioengineering, Fedegari Autoclave, Telstar, Syntegon, Bioquell, Shanghai Tofflon Science and Technology, Wenzhou Weike Biological Laboratory Equipment, IsoTech Design and Flow Sciences, Inc. (FSI) are some of the noteworthy companies operating in the global pharmaceutical isolator market.

RECENT MARKET HAPPENINGS

- Fedegari and Berkshire Sterile Manufacturing teamed together in April 2020 to develop new COVID-19 treatment drugs. BSM just completed the first fill and is now anticipating accelerating the manufacturing of the experimental medicines to combat the coronavirus and contribute to life-saving efforts.

- In December 2022, to increase its testing and development capabilities, Berkshire Sterile Manufacturing (BSM), a fill-finish CDMO with headquarters in Massachusetts, acquired and verified three new analytical instruments. While sterile filtration and parenteral filling is the company's leading service, BSM also offers analytical support for on-site drug product lots and extensive development services.

- In December 2022, Pfizer sent another large amount of money east into continental Europe shortly after making a significant growth commitment in Ireland. One day after announcing plans for an equivalent investment in Dublin, the business announced on Friday that it would invest 1.2 billion euros in its manufacturing facility in Puurs, Belgium.

- In October 2022, Tema Sinergie developed a brand-new pharmaceutical isolator for aseptically sampling sterile powders (API). The need for aseptic sampling of large quantities of sterile active components and for handling big containers led to the development of the Aseptic Sampling Isolator (AP-IS Series).

MARKET SEGMENTATION

This research report on the global pharmaceutical isolator market has been segmented and sub-segmented based on product type, configuration, application, end-user, and region.

By Product Type

- Closed Isolator Systems

- Open Isolator Systems

By Configuration

- Floor-standing

- Modular

- Mobile

- Compact

- Tabletop

- Portable

By Application

- Aseptic

- Containment

- Sampling and Weighing

- Fluid Dispensing

By End-user

- Pharmaceutical Companies

- Academic & Research Institutes

- Hospitals

- Contract Research Organizations

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- The Middle East and Africa

Frequently Asked Questions

Which region is growing the fastest in the global pharmaceutical isolator market?

Geographically, the North American pharmaceutical isolator market accounted for the largest share of the global market in 2024.

At What CAGR, the global pharmaceutical isolator market is expected to grow from 2025 to 2033?

The global pharmaceutical isolator market is estimated to grow at a CAGR of 9.95% from 2025 to 2033.

Which are the significant players operating in the pharmaceutical isolator market?

Fedegari Autoclave, Telstar, Syntegon, Bioquell, Shanghai Tofflon Science and Technology, Wenzhou Weike Biological Laboratory Equipment, and IsoTech Design, and Flow Sciences, Inc. are the significant players operating in the pharmaceutical isolator market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]