Global Pyrethroid Market Size, Share, Trends, & Growth Forecast Report, Segmented By Active Ingredient Type (Bifenthrin, Deltamethrin, Permethrin, Cypermethrin, Cyfluthrin and Lambda-cyhalothrin), Crop Type (Cereals & Grains, Oilseeds & Pulses, Fruits & Vegetables) and Region (North America, Europe, Asia Pacific, Latin America, Middle East and Africa), Industrial Analysis From (2025 to 2033)

Global Pyrethroid Market Size

The global pyrethroid market was valued at USD 9.66 billion in 2024 and is anticipated to reach USD 10.19 billion in 2025, from USD 15.64 billion by 2033, growing at a CAGR of 5.5% during the forecast period from 2025 to 2033.

Pyrethroid plays a pivotal role in global pest management. This insecticide class is widely used in agriculture, public health programs, and household applications due to its effectiveness against a broad spectrum of pests. Agricultural applications dominate the market, accounting for over 65% of total revenue, driven by the rising need for crop protection against invasive insects. According to the Food and Agriculture Organization (FAO), global crop losses due to pests exceed 40% annually, underscoring the critical role of pyrethroids in safeguarding yields. Asia-Pacific leads the pyrethroid market globally, while stringent regulations in Europe and North America have pushed manufacturers to innovate safer formulations. For instance, the European Union’s REACH regulation mandates rigorous testing for chemical residues, influencing product development trends. The growing adoption of bio-based pyrethroids further reflects shifting consumer preferences toward eco-friendly solutions.

MARKET DRIVERS

Rising Demand for Crop Protection

The escalating need for effective crop protection solutions is one of the major factors propelling the growth of the global pyrethroid market. As per the International Pesticide Benefits Group, pyrethroids are among the most widely used insecticides globally. Their ability to control pests like aphids, beetles, and caterpillars makes them indispensable for high-value crops such as cotton, fruits, and vegetables. For example, India’s cotton production, valued at USD 30 billion annually, relies heavily on pyrethroids to combat bollworm infestations. Climate change exacerbates pest proliferation, further boosting demand. According to the Intergovernmental Panel on Climate Change (IPCC), warmer temperatures have expanded the geographic range of invasive species, increasing crop vulnerability. Farmers in sub-Saharan Africa, for instance, face annual losses exceeding USD 3 billion due to pest damage, driving the adoption of pyrethroids as a cost-effective solution.

Public Health Applications

Pyrethroids are also critical in combating vector-borne diseases, particularly malaria. For instance, pyrethroid-treated bed nets as a primary tool in malaria prevention, with over 1.8 billion nets distributed globally since 2004. These nets have contributed to a 50% reduction in malaria cases in endemic regions like sub-Saharan Africa. Additionally, urbanization has increased demand for pyrethroid-based sprays and fogging agents to control mosquitoes and flies in densely populated areas. In 2022, Brazil allocated USD 50 million to combat dengue fever, which includes pyrethroid-based interventions, showcasing their importance in public health.

MARKET RESTRAINTS

Stringent Regulatory Frameworks

Regulatory restrictions are one of the major restraints to the pyrethroid market. In Europe, the EU Biocidal Products Regulation (BPR) bans certain pyrethroids due to their potential impact on aquatic ecosystems. According to the European Chemicals Agency, these regulations have led to a 15% decline in pyrethroid usage in the region since 2019. Compliance with such frameworks increases operational costs for manufacturers, forcing them to invest in reformulation efforts or alternative chemistries. In the United States, the Environmental Protection Agency (EPA) mandates extensive toxicity testing, which delays product approvals. For instance, the EPA’s review process for new pyrethroid formulations can take up to three years, hindering market growth. These regulatory hurdles create barriers for smaller players unable to afford compliance investments.

Emergence of Pest Resistance

The growing prevalence of pyrethroid-resistant pests is also impeding the growth of the global pyrethroid market. According to a study published in PLOS ONE, over 500 pest species have developed resistance to pyrethroids, reducing their efficacy in both agricultural and public health applications. For example, in Southeast Asia, pyrethroid resistance in mosquitoes has rendered treated bed nets less effective, leading to a resurgence of malaria cases. The WHO reports that resistant mosquito populations have caused a substantial increase in malaria transmission in affected regions. Farmers in the United States face similar issues, with pyrethroid-resistant bollworms causing cotton yield losses of up to 25% annually. This resistance forces growers to adopt more expensive pest management strategies, impacting the overall demand for pyrethroids.

MARKET OPPORTUNITIES

Development of Eco-Friendly Formulations

The shift toward sustainable agriculture presents significant opportunities for the pyrethroid market. Manufacturers are increasingly focusing on developing bio-based pyrethroids derived from natural sources like chrysanthemum flowers. The demand for biopesticides, including bio-based pyrethroids, is rapidly growing. These formulations not only comply with stringent environmental regulations but also appeal to eco-conscious consumers. For instance, companies like Sumitomo Chemical have launched bio-pyrethroid products tailored for organic farming, gaining traction in markets like Europe and North America. As per the estimation of the USDA, the organic farmland in the U.S. increased considerably between 2018 and 2022, creating a niche for sustainable pest control solutions.

Expansion into Emerging Markets

Emerging markets offer lucrative opportunities for pyrethroid manufacturers, driven by rising agricultural activities and urbanization. For instance, Africa’s agricultural sector is expected to grow at a CAGR of 6% through 2030, fueled by investments in commercial farming. Countries like Nigeria and Kenya are adopting pyrethroids to protect crops from pests, with the Kenyan government allocating USD 20 million in 2022 for pest management initiatives. Latin America also presents untapped potential, particularly in Brazil and Argentina, where soybean and corn cultivation rely heavily on pyrethroids. The Brazilian Association of Vegetable Oil Industries states that soybean exports reached USD 40 billion in 2022, underscoring the importance of effective pest control measures.

MARKET CHALLENGES

Environmental Concerns and Public Perception

Environmental concerns surrounding pyrethroids are one of the major challenges to the expansion of the global pyrethroid market. These chemicals can persist in soil and water, negatively impacting non-target organisms like bees and aquatic life. According to the Xerces Society for Invertebrate Conservation, pyrethroid exposure has been linked to a 30% decline in bee populations in certain regions. Such findings have fueled public backlash, leading to reduced acceptance of pyrethroid-based products. Negative publicity further compounds this issue. For example, a 2022 campaign by environmental NGOs in Europe highlighted the adverse effects of pyrethroids on biodiversity, prompting calls for stricter regulations. This growing awareness creates pressure on manufacturers to innovate safer alternatives while addressing consumer skepticism.

Supply Chain Disruptions

Supply chain disruptions have emerged as another notable challenge, particularly during the post-pandemic recovery phase. For instance, global trade disruptions caused a 20% increase in raw material costs for agrochemicals in 2022. Key ingredients like chrysanthemum extracts, essential for pyrethroid production, faced shortages due to logistical bottlenecks and geopolitical tensions. For instance, China, the largest producer of pyrethroid intermediates, imposed export restrictions during the pandemic, affecting global supply chains. These disruptions forced manufacturers to raise prices, impacting affordability for small-scale farmers in developing regions. Addressing these vulnerabilities requires investment in localized production facilities and diversified sourcing strategies.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.5% |

|

Segments Covered |

Active ingredient type, Crop type, And Region. |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

FMC Corporation, Bayer CropScience AG, Monsanto, Dow AgroSciences, United Phosphorus Limited, Sumitomo Chemical Co., Ltd, Syngenta AG, Nufarm Ltd., BASF SE, Adama Agricultural Solutions. |

SEGMENT ANALYSIS

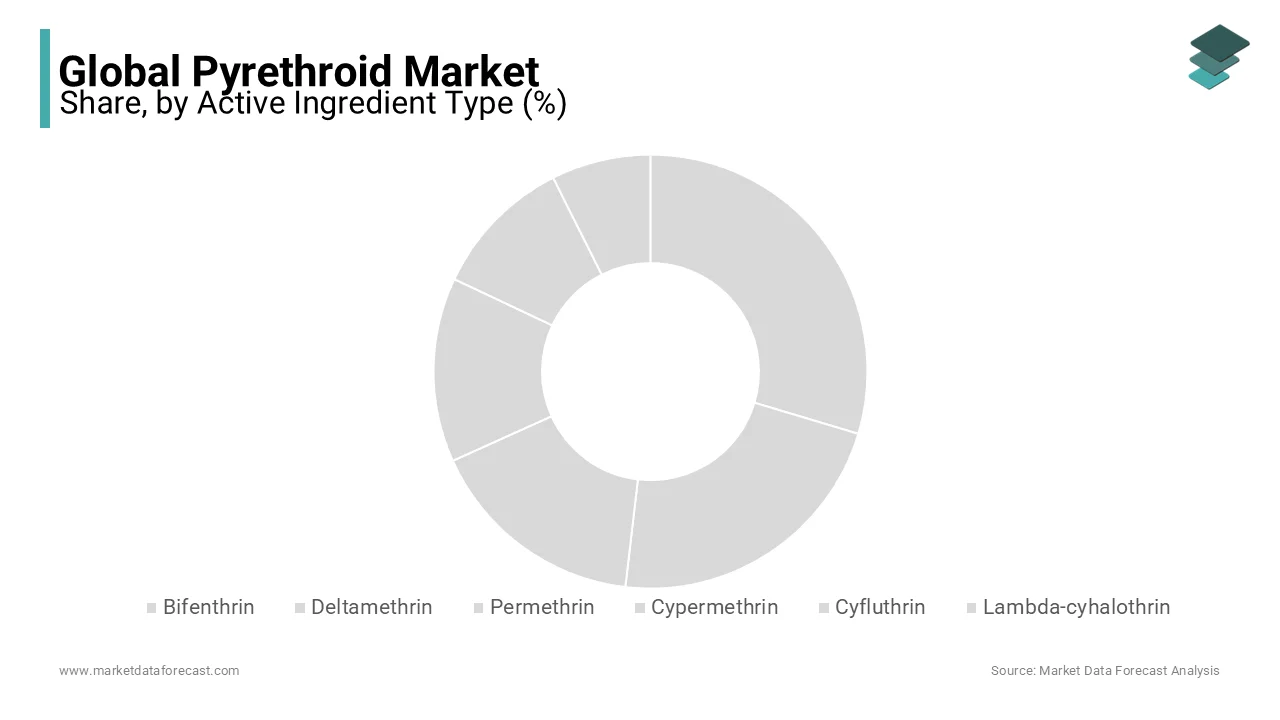

By Active Ingredients Insights

The cypermethrin segment led the pyrethroid market by capturing 29.3% of the global market share in 2024. The leading position of cypermethrin segment in the global market is attributed to its broad-spectrum efficacy against a wide range of pests, including aphids, beetles, and caterpillars, making it indispensable for agricultural applications. For instance, cypermethrin is used on over 50 million hectares of farmland globally, particularly in cereals like wheat and rice. The cost-effectiveness of cypermethrin compared to other pyrethroids is one of the major factors contributing to the domination of the cypermethrin segment in the global market. As per a study by the International Pesticide Benefits Group, cypermethrin reduces pest-related crop losses by up to 30%, while costing 20% less than alternatives like deltamethrin. Additionally, its versatility across diverse climates enhances adoption rates. For instance, in India, cypermethrin is extensively used in cotton farming, which accounts for 70% of the country’s pesticide consumption, as per the Indian Ministry of Agriculture. In addition, the compatibility of cypermethrin with integrated pest management (IPM) strategies is further aiding the expansion of the segment in the global market. For instance, IPM adoption has grown by 15% annually since 2019, with cypermethrin playing a critical role due to its low residual toxicity and effectiveness when combined with biocontrol agents.

The lambda-cyhalothrin segment is anticipated to exhibit a CAGR of 7.22% over the forecast period, owing to its superior potency and longer residual activity, making it ideal for high-value crops like fruits and vegetables. For example, lambda-cyhalothrin requires 50% less application frequency compared to older pyrethroids, reducing labor costs and environmental impact. The growing use of lambda-cyhalothrin in pest-resistant regions is also propelling the growth of the segment in the global market. According to the World Health Organization (WHO), lambda-cyhalothrin-treated bed nets have shown high effectiveness in malaria prevention, even in areas with resistant mosquitoes. Furthermore, its adoption in soybean farming, particularly in Brazil, has surged due to its ability to combat invasive species like the fall armyworm. The Brazilian Association of Vegetable Oil Industries states that soybean exports reached USD 40 billion in 2022, underscoring the importance of effective pest control measures.

By Crop Type Insights

The cereals and grains segment accounted for the leading share of 46.4% of the global market in 2024. The prominence of the cereals and grains segment in the global market is attributed to the extensive cultivation of staple crops like wheat, rice, and corn, which are highly susceptible to pest infestations. According to the FAO, global cereal production exceeded 2.8 billion metric tons in 2022, creating robust demand for pyrethroid-based pest control solutions. The rising prevalence of invasive pests is also promoting the domination of the cereals and grains segment in the global market. The Intergovernmental Panel on Climate Change (IPCC) states that climate change has expanded the geographic range of pests like the fall armyworm, causing annual losses of USD 13 billion in maize production across sub-Saharan Africa. Pyrethroids like cypermethrin and lambda-cyhalothrin are widely used to mitigate these losses, ensuring food security and economic stability.

The fruits and vegetables segment is another major segment and is set to expand at a CAGR of 8.3% over the forecast period, owing to the increasing consumer demand for fresh produce and the need for effective pest management in high-value crops. For example, strawberries, tomatoes, and peppers are highly vulnerable to pests like aphids and thrips, driving the adoption of pyrethroids like deltamethrin and permethrin. The rise of organic farming is also boosting the expansion of the fruits and vegetables segment in the global market. The Organic Trade Association reports that organic food sales in the U.S. grew by 12.4% annually between 2020 and 2022, reaching USD 61.9 billion. While organic certification restricts synthetic pesticides, certain bio-based pyrethroids are permitted under specific guidelines, creating opportunities for manufacturers to innovate eco-friendly formulations. Additionally, urbanization has increased demand for pest-free produce in cities. According to the United Nations, urban populations consume 30% more fruits and vegetables than their rural counterparts, further propelling the need for reliable pest control solutions.

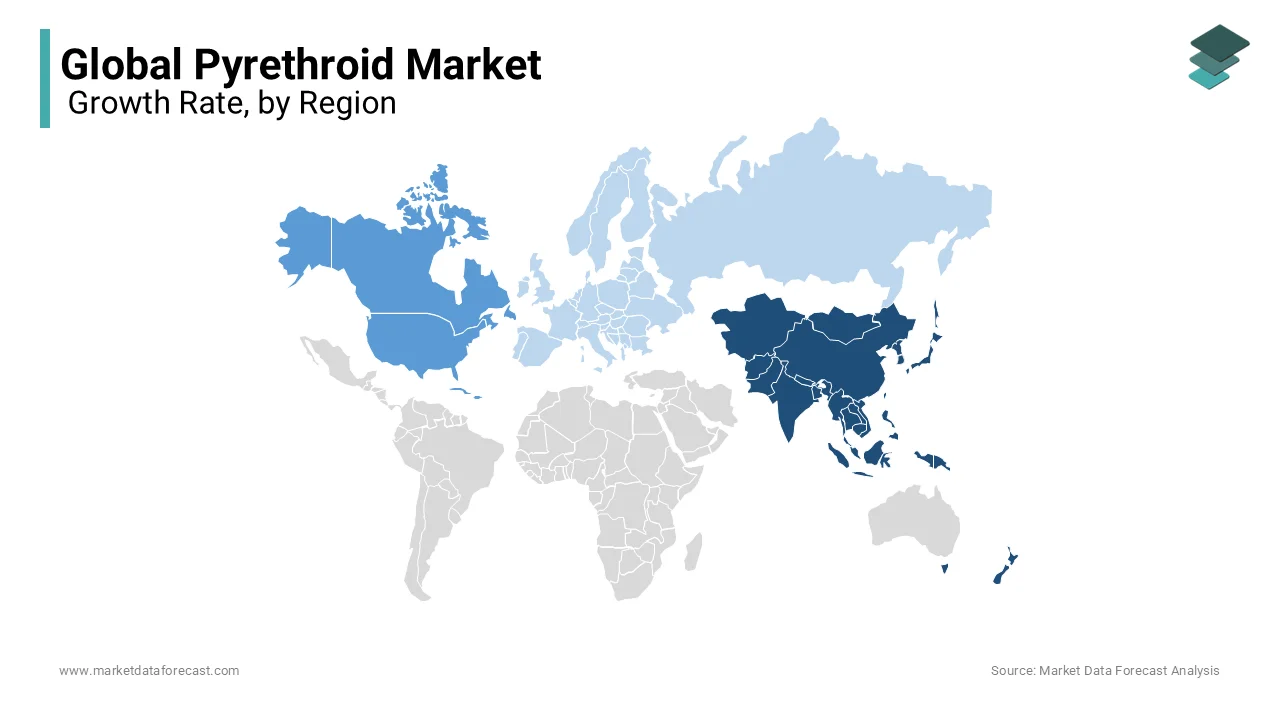

REGIONAL ANALYSIS

Asia-Pacific had the largest share of 39.6% of the global market in 2024 and is also predicted to register the fastest CAGR in the global market over the forecast period. In this region, China is leading the market by producing over 60% of the world’s pyrethroid intermediates, fueled by intensive farming practices. For instance, rice production in China alone accounts for 30% of the country’s pesticide consumption, making pyrethroids indispensable. India follows closely, with its cotton and vegetable farming sectors driving demand. Permethrin and cypermethrin are widely used in India, where pest-related losses exceed USD 30 billion annually, as per the Indian Council of Agricultural Research. Government initiatives, such as the USD 2 billion crop protection scheme, encourage farmers to adopt modern pest control solutions. Southeast Asia’s tropical climate creates ideal conditions for pest proliferation, further propelling pyrethroid usage. Vietnam’s rice exports reached USD 3.2 billion in 2022, underscoring the importance of effective pest management in maintaining productivity.

North America holds a significant position in the pyrethroid market. The United States is playing the leading role in the North American market, with its agricultural sector relying heavily on pyrethroids for pest management in crops like corn, soybeans, and cotton. According to the USDA, U.S. corn production exceeded 13.7 billion bushels in 2022, with pyrethroids playing a critical role in combating pests like corn rootworms. The stringent regulatory framework governing pesticide use in North America is also favoring the North American market expansion. The Environmental Protection Agency (EPA) mandates rigorous testing for environmental safety, encouraging manufacturers to innovate eco-friendly formulations. For instance, bio-based pyrethroids have gained traction, with the growing demand for biopesticides in the U.S. in the next few years. Additionally, urbanization has increased demand for household insecticides, with pyrethroids accounting for 60% of residential pest control products in North America. Canada complements this growth with its focus on sustainable agriculture. The Canadian government allocated CAD 1 billion in 2022 to promote integrated pest management (IPM), further boosting pyrethroid adoption.

Europe captured a prominent share of the global pyrethroid market in 2024. The advanced agricultural practices and strong emphasis on environmental protection in Europe are driving the European market growth. The European Union’s REACH regulation has restricted certain pyrethroids, pushing manufacturers to develop safer alternatives. The rising demand for pest-resistant crop varieties in Europe is also boosting the European market growth. According to Eurostat, cereals account for 50% of Europe’s farmland, with wheat production exceeding 150 million metric tons annually. Pyrethroids like lambda-cyhalothrin are widely used to combat pests such as aphids and beetles. Additionally, public health applications play a vital role, with pyrethroid-treated bed nets distributed across Southern Europe to combat malaria resurgence. The WHO reports that these nets have reduced malaria cases by 90% in affected regions. France and Spain also contribute significantly, with their vineyards and orchards relying on pyrethroids for pest control. Government subsidies, such as France’s EUR 500 million pesticide innovation fund, further support market expansion.

Latin America is anticipated to account for a considerable share of the global pyrethroid market over the forecast period. Brazil leads the region, with its vast agricultural landscape and high reliance on pesticides for crops like soybeans, sugarcane, and coffee. The Brazilian Association of Vegetable Oil Industries states that soybean exports exceeded USD 40 billion in 2022, driven by effective pest control measures using pyrethroids like lambda-cyhalothrin. Argentina complements this growth with its focus on maize and wheat farming, both vulnerable to invasive pests. The fall armyworm, for instance, causes annual losses of USD 3 billion in maize production, as per the FAO. Pyrethroids are widely adopted to mitigate these losses, ensuring consistent yields. Government programs further bolster the adoption of pyrethroid in Latin America. For example, Mexico launched a USD 500 million initiative in 2022 to combat locust infestations, promoting pyrethroid-based solutions while fostering sustainable practices.

The Middle East and Africa represent an emerging segment in the pyrethroid market, capturing a moderate share of the global market. South Africa dominates this region, with its maize and sugarcane industries driving demand. The South African Department of Agriculture reports that maize production reached 16 million metric tons in 2022, creating steady demand for pyrethroid-based pest control solutions.

KEY MARKET PLAYERS

FMC Corporation, Bayer CropScience AG, Monsanto, Dow AgroSciences, United Phosphorus Limited, Sumitomo Chemical Co. Lt Ltd., Syngenta AG, Nufarm Ltd., BASF SE, and Adama Agricultural Solutions are some of the primary vital players involved in the global Pyrethroid market.

Top Players in the Market

Bayer AG

Bayer AG is a global leader in the pyrethroid market, renowned for its innovative crop protection solutions. The company specializes in producing high-quality pyrethroids like deltamethrin and lambda-cyhalothrin, widely used in agriculture and public health programs. Bayer’s commitment to sustainability is evident in its development of bio-based pyrethroids that comply with stringent environmental regulations. Its collaboration with farmers and governments ensures tailored pest management strategies, enhancing productivity while minimizing ecological impact. Additionally, Bayer invests heavily in R&D to address emerging challenges like pest resistance.

Syngenta AG

Syngenta AG plays a pivotal role in the pyrethroid market, offering advanced formulations like cypermethrin and permethrin. The company focuses on precision agriculture, integrating digital tools to optimize pesticide application and reduce costs. Syngenta’s global presence allows it to cater to diverse agricultural needs, from cereals in Europe to fruits and vegetables in Asia-Pacific. Its partnership with local governments and NGOs promotes sustainable farming practices, aligning with global efforts to combat food insecurity. Syngenta’s emphasis on innovation ensures its position as a trusted name in pest control.

FMC Corporation

FMC Corporation contributes significantly to the pyrethroid market through its focus on eco-friendly solutions. The company produces active ingredients like bifenthrin, which are highly effective against invasive pests while maintaining low toxicity levels. FMC’s strategic investments in research enable it to develop formulations that meet evolving regulatory standards. Its strong distribution network ensures widespread availability of products, particularly in emerging markets like Latin America and Asia-Pacific. By prioritizing sustainability and customer-centric solutions, FMC has established itself as a key player in the global pyrethroid industry.

Top Strategies Used by Key Market Participants

Expansion into Emerging Markets

Key players are increasingly targeting emerging markets to capitalize on growing agricultural activities. For example, companies like Syngenta have established partnerships with governments in Africa and Southeast Asia to promote pyrethroid usage in staple crops like rice and maize. This strategy not only expands their geographic footprint but also addresses food security concerns in these regions. By offering localized solutions and training programs, manufacturers enhance farmer adoption rates while building long-term relationships with stakeholders.

Development of Bio-Based Formulations

Sustainability is a cornerstone of modern pest control, with leaders investing in bio-based pyrethroids to meet consumer demand for eco-friendly alternatives. Bayer, for instance, has launched bio-pyrethroid products derived from natural sources like chrysanthemum flowers. These formulations comply with stringent environmental regulations while appealing to environmentally conscious consumers. The global biopesticides market, including bio-pyrethroids, is projected to grow at a CAGR of 14.7% from 2023 to 2030, underscoring the potential of this strategy.

Strategic Collaborations and Acquisitions

Collaborations and acquisitions are instrumental in strengthening market position. For example, FMC Corporation acquired a biotech startup specializing in pest-resistant crop varieties, enabling it to integrate pyrethroid applications with genetic engineering solutions. Such partnerships foster innovation while addressing challenges like pest resistance and regulatory compliance. Additionally, joint ventures with regional distributors ensure wider product accessibility, particularly in underserved markets.

Competition Overview

The pyrethroid market is highly competitive, characterized by the presence of multinational giants like Bayer, Syngenta, and FMC Corporation, alongside numerous regional players. These companies leverage their R&D capabilities, global reach, and technological advancements to maintain dominance. However, the market is witnessing increased fragmentation due to the entry of smaller firms offering cost-effective and specialized solutions. Regulatory pressures, particularly in Europe and North America, have forced companies to innovate and adopt sustainable practices, intensifying rivalry.

Key players differentiate themselves through product quality, technological integration, and customer support. For instance, Bayer’s focus on bio-based formulations and Syngenta’s emphasis on precision agriculture set them apart from competitors. Meanwhile, emerging markets in Asia-Pacific and Latin America present lucrative opportunities, prompting companies to expand their geographic footprint. Strategic acquisitions, partnerships, and investments in alternative chemistries are common tactics to strengthen market position. Overall, the pyrethroid market remains dynamic, with innovation and sustainability serving as critical success factors.

RECENT HAPPENINGS IN THE MARKET

- In March 2024, Bayer announced the launch of its new bio-pyrethroid formulation designed for organic farming. This move aims to address the growing demand for sustainable pest control solutions and strengthen Bayer’s leadership in eco-friendly innovations.

- In June 2023, Syngenta partnered with the Kenyan government to establish a pest management training program for smallholder farmers. This initiative focuses on promoting safe pyrethroid usage while enhancing crop yields, reinforcing Syngenta’s presence in sub-Saharan Africa.

- In September 2022, FMC Corporation acquired a Brazilian agtech startup specializing in pest-resistant crop varieties. This acquisition enables FMC to integrate pyrethroid applications with genetic engineering solutions, addressing challenges like pest resistance.

- In December 2021, Bayer introduced its digital platform, PestControl+, which uses AI to analyze pest infestations and recommend optimal pyrethroid applications. This tool improves efficiency and reduces costs, positioning Bayer as a tech-driven innovator.

- In July 2020, Syngenta launched a joint venture with an Indian distributor to expand its reach in South Asia. This collaboration focuses on providing affordable pyrethroid-based pest control solutions to small-scale farmers, driving adoption in emerging markets.

MARKET SEGMENTATION

This research report on the global pyrethroid market has been segmented and sub-segmented into the following categories.

By Active Ingredient Type

- Bifenthrin

- Deltamethrin

- Permethrin

- Cypermethrin

- Cyfluthrin,

- Lambda-cyhalothrin

- Other types

By Crop Type

- Cereals & Grains

- Oilseeds & Pulses

- Fruits & Vegetables

- Other Crop Types

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What is the current size of the Global Pyrethroid Market?

The Global Pyrethroid Market is valued at USD 10.19 billion IN 2025.

Which region dominates the Global Pyrethroid Market in terms of market share?

Asia-Pacific region holds the largest share of the global market and dominates the global pyrethroid market.

What factors contribute to the growth of the Pyrethroid Market in North America?

The market growth for the global pyrethroid market is mainly driven by the need to increase crop yield and efficiency.

What are the key trends influencing the Pyrethroid Market in Latin America?

In Latin America, the Pyrethroid Market is witnessing a shift towards bio-based and organic pesticides due to a growing emphasis on eco-friendly agricultural practices.

who are the key market players involved in the Global Pyrethroid Market?

FMC Corporation, Bayer CropScience AG, Monsanto, Dow AgroSciences, United Phosphorus Limited, Sumitomo Chemical, Co. Ltd., Syngenta AG, and Nufarm Ltd., BASF SE, and Adama Agricultural Solutions.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]