Global Sleep Apnea Devices Market Size, Share, Trends & Growth Forecast Report By Diagnostic Devices (Positive Airway Pressure (PAP) Devices, Facial Interfaces, Adaptive Servo-Ventilation Instruments (ASV), Airway Clearance Systems, Oxygen Concentrators, Accessories and Oral Appliances), Therapeutic Devices (Polysomnography Devices, Respiratory Polygraphs, Oximeters and Actigraphy Systems), End-User and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa), Industry Analysis From 2025 to 2033

Global Sleep Apnea Devices Market Size

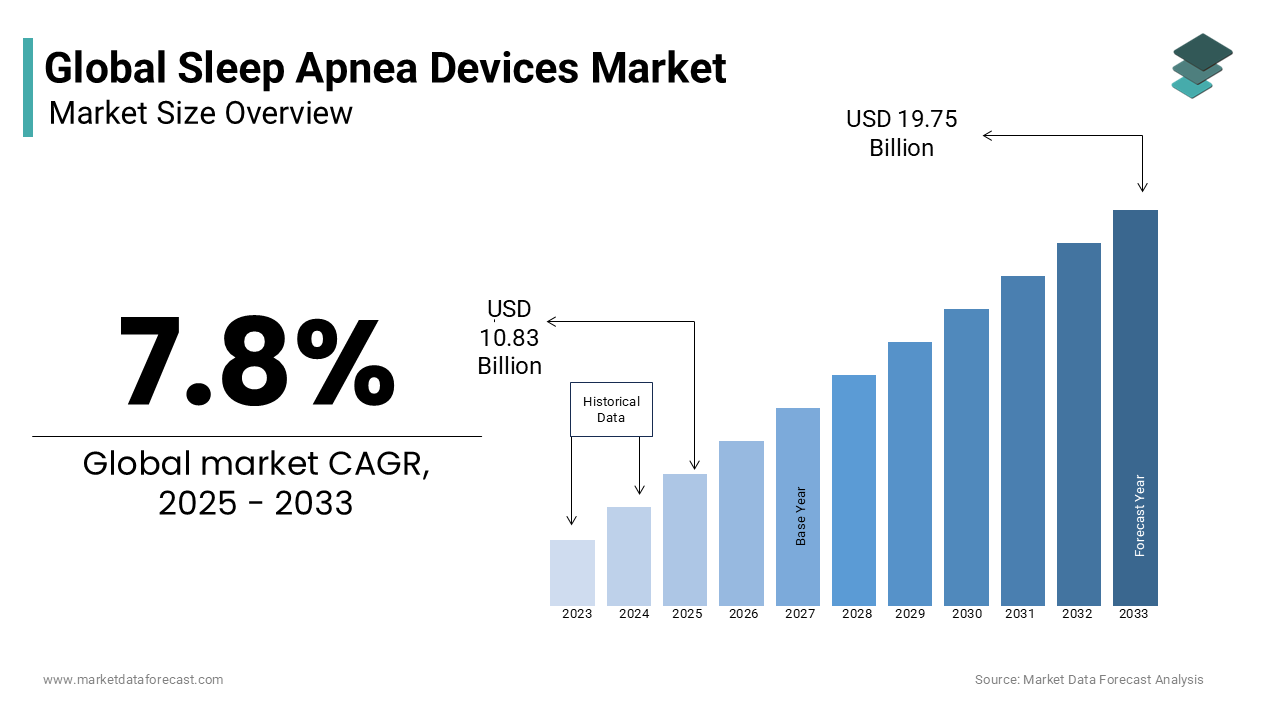

In 2024, the global sleep apnea devices market was valued at USD 10.05 billion and it is expected to reach USD 19.75 billion by 2033 from USD 10.83 billion in 2025, growing at a CAGR of 7.8% during the forecast period.

Sleep apnea is a dangerous condition in which breathing regularly stops during sleep. It can sometimes stop breathing a hundred times, resulting in less oxygen intake. It is primarily due to airways being closed or collapsing at night. When a person's breathing ceases, the body immediately wakes up, resulting in insufficient sleep. As a result, people are exhausted throughout the day, which affects their performance. Sleep apnea is classified into three types, which are central sleep apnea (CSA), obstructive sleep apnea (OSA), and combined sleep apnea. Morning headaches, Forgetfulness, mood changes, Sleepiness or lack of energy during the day, and loud snoring are some symptoms found in persons with sleep apnea.

Various devices on the market can be used to cure sleep apnea, including continuous positive airway pressure (CPAP), nerve stimulation devices, and oral appliances. The continuous positive airway pressure (CPAP) machine treats mild to extreme sleep apnea and obstructive sleep apnea. CPAP blasts oxygen by increasing air in the local area and keeping the airways open while sleeping. A nerve stimulator may assist when the tongue or other tissue obstructs the airway. Occasionally, oral appliances such as a mandibular advancement device and a tongue-retaining device are used. In addition, some patients use a dental device instead of PAP therapy to treat obstructive sleep apnea (OSA).

MARKET DRIVERS

Growing Prevalence of Sleep Apnea

The growing number of patients suffering from sleep apnea is a significant driver of the sleep apnea industry. Sleep apnea may affect anybody, but older people, men, and overweight people are at a higher risk. Obstructive sleep apnea affects about 1 billion people worldwide. According to a 2020 American Sleep Association survey, about 22 million Americans suffer from sleep apnea, with about 80 % of moderate to extreme obstructive sleep apnea being undiagnosed. Sleep apnea also affected approximately 66 million Chinese, 29 million Indians, and 20 million Russians in 2020. These statistics suggest that many individuals need sleep apnea diagnosis and treatment. As a result, the need for sleep apnea devices rises. Growing awareness regarding hypertension and other prevalent chronic diseases and rapid technological advancements, resulting in enhanced development, are the significant factors driving the market growth.

Technological Advancements

Owing to technological enhancements, innovative products that can acquire and analyze the signal and smartphones with in-built sensors flow into the market. These devices help monitor sleep at home with improved comfort and diagnose various sleeping disorders like obstructive sleep apnea. Also, self-management platforms, mobile applications, regular assessments of patients with mHealth, and telemedicine will likely offer lucrative opportunities during the forecast period. Furthermore, improved care and support to patients with telemedicine help patients lean towards convenient and productive interactions with a sleep doctor, which is expected to boost the sleep apnea devices market. Additionally, factors like initiatives by governments and private organizations in R & D to develop innovative products and increasing adoptions of therapeutic devices are fuelling the demand for the sleep apnea devices market. Furthermore, comorbidities to prevent obstructive sleep apnea in geriatric patients, patient adherence, and increasing healthcare expenditure are also helping the market grow further.

Advancements of Innovative Sleep Apnea Devices

The growing number of health complications caused by untreated sleep apnea raises the market for sleep apnea products. Sleep apnea causes severe health problems such as high blood pressure, diabetes, heart disease, irregular heartbeats, and stroke, leading to a lack of breathing. In addition, sleep apnea, which induces elevated blood pressure, can lead to cardiac arrhythmias and heart failure. Furthermore, according to Yale University research, people with sleep apnea for up to 5 years have a 30% elevated risk of having a heart attack or dying. Besides this, since it induces insufficient sleep, it affects everyday activities such as education and work. As a result, people have become more interested in diagnosing and treating sleep apnea, and the demand for sleep apnea devices has risen exponentially, indicating market expansion.

MARKET RESTRAINTS

High Cost of Sleep Apnea Devices

The high cost associated with sleep apnea devices restricts the sleep apnea market growth. According to the American Sleep Association, the retail price of a CPAP system varies between $500 and $3000, with an annual average price of $850. In Singapore, the cost of a CPAP machine also varies from $500 to $1,000 or more, depending on the model and brand. This expense discourages people from using the devices, limiting the development of the sleep apnea market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

Segments Covered |

By Product, Diagnostic Devices, End-User, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis, Drivers, Restraints, Challenges, Opportunities, PESTLE Analysis; Porter's Five Forces Analysis; Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Market Players |

ResMed, Inc. (U.S.), Philips Healthcare (Netherlands), Fisher & Paykel Healthcare Ltd. (New Zealand), SomnoMed Ltd. (Australia), Compumedics Limited (Australia), Weinmann Medical Devices GmbH (Germany) and Whole You, Inc. (U.S.) |

SEGMENTAL ANALYSIS

By Product Insights

The positive airway pressure (PAP) devices segment is estimated to grow at a CAGR of 10.2% during the forecast period. The increasing prevalence of quality treatment procedures is leveling up the market's growth rate. Moreover, supportable insurance coverage for treating sleep apnea and other disorders boosts the market growth. The American Sleep Apnea Association (ASAA) delivered more than 5,000 Continuous Positive Airway Pressure (CPAP) device packages to the past through its CPAP Assistance Program (CAP) in July 2017.

By Diagnostic Devices Insights

The polysomnography devices segment is estimated to be the top-performing segment during the forecast period. The polysomnography test is the most widely used test for diagnosing obstructive sleep apnea, and the respiratory polygraphs help diagnose sleep apnea in home environments. This respiratory polygraph is considered a substitute for polysomnography. Therefore, their affordability is increasing their adoption among patients. The increasing number of patients diagnosed with respiratory disease is one factor that drives segment growth over the forecast period.

By End-Users Insights

Based on end-users, the homecare settings segment accounted for the largest market share in 2023 and remained so until 2029.

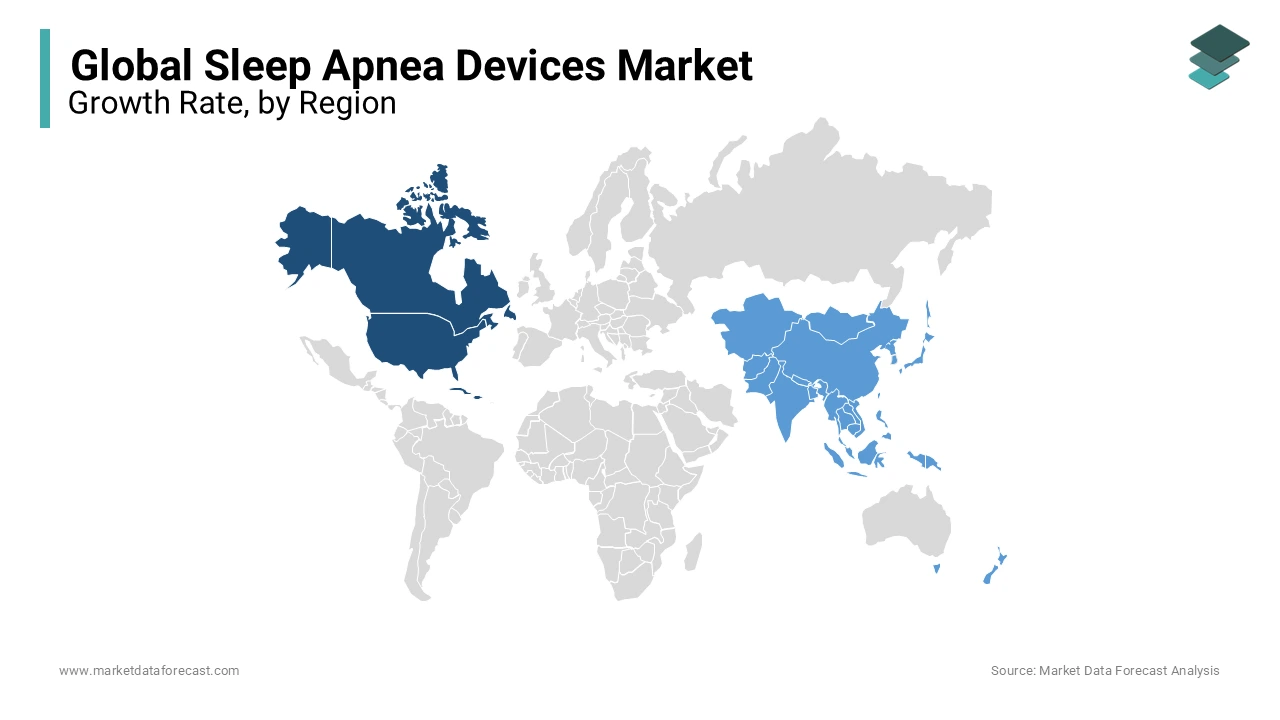

REGIONAL ANALYSIS

North America dominated the global sleep apnea device market with a market share of 51.5% in 2023. Sleep apnea, large patient pools, and increased awareness of international manufacturers' existence strengthen regional market share. Also, the number of treatment tests conducted to confirm sleep apnea is increasing rapidly. In addition, many people are more concerned about the health risks that result from this condition, so the prediction period is driving the market growth globally.

In 2023, the U.K. market accounted for 14.7% as more companies manufacture sleep apnea devices count is high in this country. In addition, increasing demand for sleep apnea diagnostics and treatment devices from the population will also add to the growth of the U.K. market over the next few years.

Meanwhile, the Asia Pacific market is projected to grow the fastest during the forecast period. A sizeable undiagnosed patient pool and increased healthcare infrastructure investment are to boost the market growth. Our competitors are also focusing on building strategies to deploy affordable devices for price-sensitive customers in the Asia Pacific region, further supporting growth in the area. In addition, establishing sleep laboratories to test sleep apnea patients in countries such as the Philippines, Singapore, and Malaysia, where awareness of OSA is growing, could drive market growth in the region. The Indian market records a favorable CAGR growth of 11.3% over the forecast period due to increased sleep apnea and other sleep disorders. Increasing disposable income in emerging markets such as India and China will continue to impact business growth. Besides, rising obesity rates through the acceptance of high levels of sedentary lifestyles is another crucial factor affecting the prevalence of sleep disorders and growing product demand.

KEY MARKET PLAYERS

Companies leading the global sleep apnea devices market are ResMed, Inc. (U.S.), Philips Healthcare (Netherlands), Fisher & Paykel Healthcare Ltd. (New Zealand), SomnoMed Ltd. (Australia), Compumedics Limited (Australia), Weinmann Medical Devices GmbH (Germany) and Whole You, Inc. (U.S.). These players focus on various strategies such as mergers, acquisitions, product launches, and partnerships.

RECENT HAPPENINGS IN THE MARKET

- In February 2021, the U.S. Food and Drug Administration approved the promotion of another treatment prescription-only designed to relieve snoring and mild obstructive sleep apnea. This device can be used while a person is awake.

- In October 2020, Acurable launched the AcuPebble SA100, a small wearable device that allows for a fully automatic and remote diagnosis of obstructive sleep apnea (OSA).

- In October 2019, ResMed Company released a new AirFit N30 for treating sleep apnea. AirFit N30 is the very lightest CPAP mask. It also features elastic headgear and a cradle cushion under the nasal bridge for a comfortable experience; irrespective of how the wearer moves or sleeps, the seal is secured due to the mask's innovative design's curved cushion.

- In September 2016, Respicardia, Inc., a medical technology company, received U.S. FDA approval for its Remede system. It is for the treatment of moderate to severe central sleep apnea. With this product approval, the company's market presence in the United States has seen significant growth, and its revenue generation flow has also rushed high.

- In October 2015, Koninklijke Philips Company released a sleep apnea solution containing a DreamMapper patient engagement app, DreamWear mask, and Dreamstation PAP device.

MARKET SEGMENTATION

This research report on the global sleep apnea devices market has been segmented and sub-segmented based on product type, diagnostic devices, end-users, and region.

By Product

- Positive Airway Pressure (PAP) Devices

- CPAP Devices

- APAP Devices

- BPAP Devices

- Facial Interfaces

- Masks

- Nasal Masks

- Nasal Pillow Masks

- Full-Face Masks

- Masks

- Adaptive Servo-Ventilation Instruments (ASV)

- Airway Clearance Systems

- Oxygen Concentrators

- Stationary Concentrators

- Portable Concentrators

- Accessories

- Pillows

- Chin Restraints

- Mask Cleaning Wipes

- Other Accessories

- Oral Appliances

- Mandibular Advancement Devices

- Tongue Retaining Devices

By Diagnostic Devices

- Polysomnography Devices

- Ambulatory PSG Devices

- Clinical PSG Devices

- Respiratory Polygraphs

- Oximeters

- Single-Channel Screening Devices (Pulse Oximeters)

- Fingertip Pulse Oximeters

- Handheld Pulse Oximeters

- Wrist-Worn Pulse Oximeters

- Tabletop Pulse Oximeters

- Actigraphy Systems

By End-User

- Home Care Setting

- Sleep Laboratories

- Hospitals

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

What is the projected value of the global sleep apnea devices market by 2033?

By 2033, the global market size for sleep apnea devices is estimated to value worth USD 19.75 billion.

What is the growth rate of the sleep apnea devices market?

With the growing prevalence of sleep apnea, the market for sleep apnea devices is estimated to rise at a CAGR of 7.8% CAGR during the forecast period worldwide.

Which region led the sleep apnea devices market in 2024?

The North American regional market dominated the sleep apnea devices market in 2024.

Which are the significant players operating in the sleep apnea devices market?

ResMed, Inc. (U.S.), Philips Healthcare (Netherlands), Fisher & Paykel Healthcare Ltd. (New Zealand), SomnoMed Ltd. (Australia), Compumedics Limited (Australia), Weinmann Medical Devices GmbH (Germany) and Whole You, Inc. (U.S.) are some of the promising companies in the global sleep apnea devices market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com