Global Healthcare Distribution Market Size, Share, Trends & Growth Forecast Report By Type, End-user, and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Healthcare Distribution Market Size

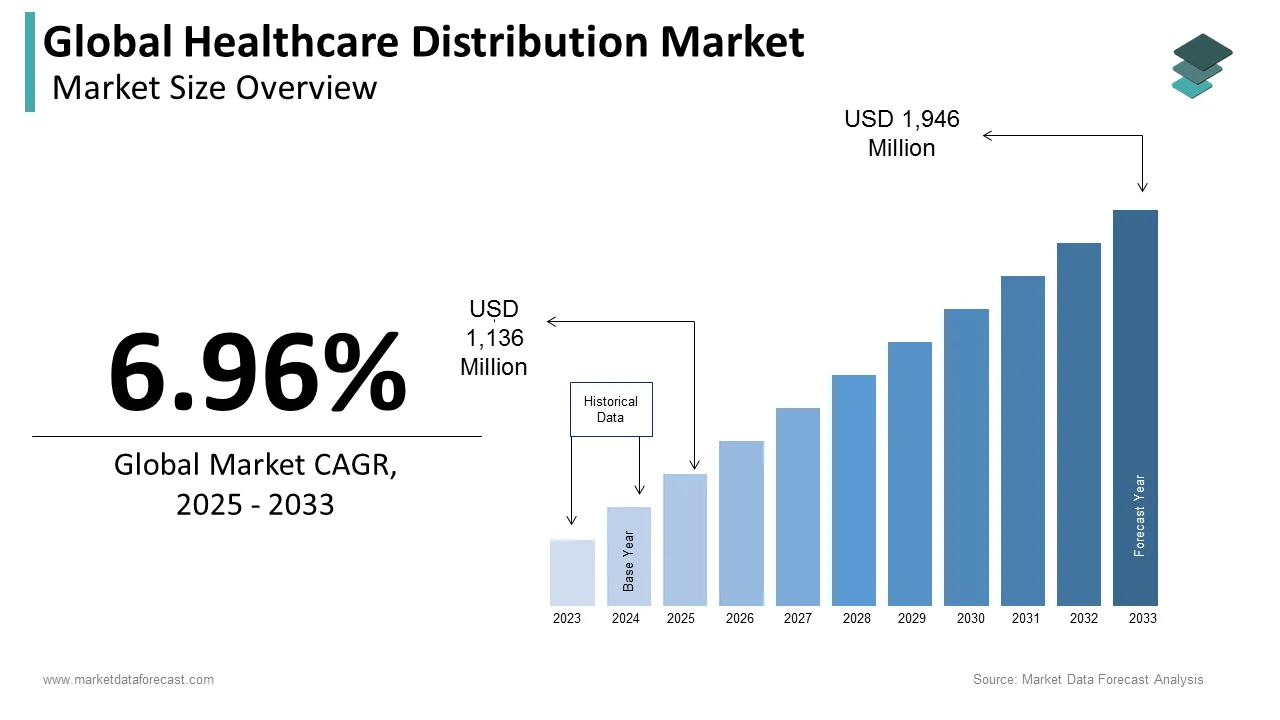

The size of the global healthcare distribution market was worth USD 1,062 million in 2024. The global market is anticipated to grow at a CAGR of 6.96% from 2025 to 2033 and be worth USD 1,946 million by 2033 from USD 1,136 million in 2025.

Current Scenario of the Global Healthcare Distribution Market

The practice of disseminating medical supplies and devices over the market quickly and thoroughly is known as healthcare distribution. To manage the supply chain effectively, healthcare distribution is crucial. Pharmaceutical distributors are primarily responsible for distributing OTC medications/vitamins, generic medications, and brand-name/innovator medications. In addition, they also distribute biopharmaceutical products such as monoclonal antibodies, vaccines, recombinant proteins, blood and blood products, cellular and gene therapy products, stem cell products, and tissue and tissue products. The retail pharmacy obtains these items from the stockist or sub-stockist, who then distributes them to the customers (patients).

In addition, medical types of equipment are also distributed through distribution channels by distributors, who often have contracts with numerous manufacturers. Not only does healthcare distribution guarantee that the correct drugs are delivered to the right patients at the right time, safely and efficiently, but it also guarantees that the right drugs are delivered to the right patients at the right time. Pharmacies, hospitals, long-term care facilities, clinics, and other healthcare providers are involved in healthcare distribution. As a result, these institutions maintain their shelves supplied with the prescriptions and goods that patients require.

MARKET DRIVERS

The rising incidence of numerous diseases boosts the global healthcare distribution market growth.

The increasing prevalence of illnesses is the primary driver of the healthcare distribution industry. With rising life expectancy, changing lifestyles, and various reasons, the prevalence of a range of chronic and infectious illnesses is on the rise. To tackle these disorders, cellular treatments, biomarker imaging, regenerative medicines, generics, biosimilars, medical devices, and a wide range of other goods and services have been created in recent years. These created items necessitated the establishment of a secure healthcare distribution network. Generics are also in high demand in the healthcare business because of their cost-efficiency. Besides, as illnesses become more prevalent, medical equipment such as vitro diagnostic (IVD) equipment, diagnostic imaging equipment, endoscopic devices, ultrasound, MRI machines, wound care equipment, and others are in higher demand. Furthermore, there is a growing need for medical devices in healthcare institutions for a variety of functions. As a result of this need, a healthcare distribution network that assures effective and safe delivery is required.

Technological advancements are expected to promote the growth rate of the global healthcare distribution market even further during the forecast period.

Technological advancements in distribution are boosting the healthcare distribution industry. Every aspect of the healthcare sector, including distribution, is changing as a result of technological advancements. Artificial intelligence, machine learning, the Internet of Things, and other technologies have improved the quality of healthcare distribution. For example, temperature control and data recording have the power to protect the value of healthcare items, minimize pollution, save resources, and promote health and safety, minimize the amount of work required. Warehouses employ technology like IoT, sensors, and barcode scanners to digitize operations and improve inventory management. Also, because some vaccinations, tissues, and medications are temperature sensitive, temperature control sensors simplify healthcare distribution. Adopting IoT technology can assist distributors in giving real-time information to their pharmacy and provider clients, allowing them to devote more effort to ensure a consistent supply schedule. IoT technology may also aid in detecting diversion by using algorithms to assess if the delivery route is no longer being followed or if an unusual delay has occurred. As a result, the healthcare distribution industry is experiencing increased safety, accuracy, speed, and confidence.

MARKET RESTRAINTS

The global healthcare distribution market is being impeded by product pricing pressure and government regulations. Many authorities enforced the regulation for healthcare distribution networks. Like, the Healthcare Distribution Alliance pushed key pharmaceutical distributors to supply drugs in a safe, secure, and timely manner. Importers of medical equipment have requirements that the Health Products Regulatory Authority enforces. Trade costs are also rising due to increased tariffs, anti-dumping levies, non-tariff obstacles, and stricter compliance.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Type, End-user, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Market Leader Profiled |

McKesson Corporation, AmerisourceBergen Corporation, Morris, and Dickson |

SEGMENTAL ANALYSIS

Global Healthcare Distribution Market Analysis By Type

Due to the rising pharmaceutical formulation production, rising pharmaceutical expenditure, pharmaceutical manufacturing outsourcing to Asian countries, and global pharmaceutical giants establishing new manufacturing facilities in newer geographies, the pharmaceutical product distribution services segment held the most market share. Other factors Increasing the demand for and use of pharmaceutical product distribution services are fueled by favorable investments in research and development efforts for the creation of pharmaceutical goods. In addition, pharmaceutical distributors are increasingly adopting emerging technologies such as Blockchain, Artificial Intelligence (AI), and robotics to improve supply chain transparency and reduce warehouse operational costs and human error, which is expected to drive further pharmaceutical product distribution services development.

During the forecast period, the revenue growth rate of the Biopharmaceutical product distribution services segment is expected to accelerate. Vaccines, monoclonal antibodies, blood and blood products, and recombinant proteins are distributed among the biopharmaceutical goods.

Global Healthcare Distribution Market Analysis By End-User

The retail pharmacies segment held the highest share of the global market in 2024. Daily, these pharmacies deal with a high number of prescriptions. Furthermore, programs to assure affordable healthcare for residents in the United States and other developed nations have greatly boosted prescriptions at retail pharmacies. Increased government measures to reduce healthcare spending have resulted in a large increase in the number of prescriptions reaching retail pharmacies, which is likely to continue to fuel the segment's revenue growth over the projected period. As a consequence of the changing trend toward more affordable generic drugs, retail pharmacies see an increase in demand. Government initiatives to establish and maintain standards in the retail pharmacy business are expected to boost the retail pharmacy segment's growth throughout the forecast period.

REGIONAL ANALYSIS

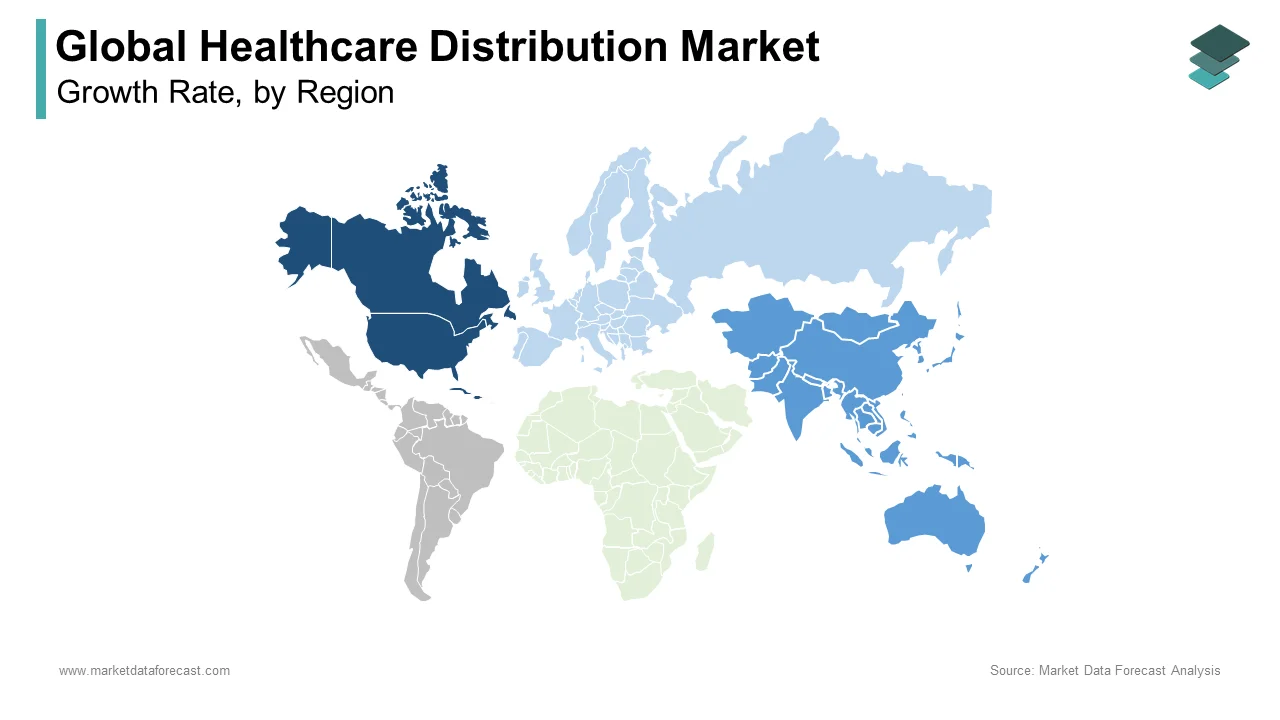

Due to its strong position in the healthcare industry and rapid adoption of new and advanced technologies, North America dominated the regional healthcare distribution market in 2024. Due to its ongoing participation and growth in the healthcare sector, the market is likely to continue its dominance during the forecast period. The United States has significantly increased the number of prescriptions filled at retail pharmacies by implementing programs to ensure that individuals access health care. In addition, as the need for effective supply chain management has become more evident, distributors have turned to modern industrial technologies such as artificial intelligence (AI) and machine learning to influence big data and standardize progressions. This has improved predictability, supply optimization, and a reduction in wastage and expenses in this region.

The APAC market is expected to grow at the fastest CAGR during the forecast period, owing to rising regulatory requirements in the healthcare industries of several APAC countries to maintain compliance with good manufacturing and distribution practices, as well as an increase in the number of pharmaceutical and biotechnology companies in this region. China and India are the region's fastest-growing markets, owing to their developing pharmaceutical industry and severe regulations to improve pharmaceutical medication quality and dependability.

KEY PARTICIPANTS IN THE HEALTHCARE DISTRIBUTION MARKET

A few of the notable players operating in the healthcare distribution market profiled in this report are McKesson Corporation, AmerisourceBergen Corporation, Morris and Dickson Co., FFF Enterprises, Inc., Dakota Drug, Cardinal Health, Inc., Owens & Minor, Inc., Curascript Specialty Distribution, Medline Industries, Attain Med, Inc., KeySource Medical, Inc, Henry Schein Inc., Patterson Companies Inc., Shanghai Pharmaceutical Group Co, Rochester Drug Cooperative, Smith Drug Company, PHOENIX Group, and others.

These players focus on launches, mergers, acquisitions, and partnerships to gain a competitive advantage.

RECENT MARKET DEVELOPMENTS

-

On 29 March 2021, Cardinal Health (NYSE: CAH) and FourKites® have established global cooperation to improve the tracking of medical equipment, pharmaceutical items, first-aid supplies, and personal protective equipment (PPE) in transit to hospitals, pharmacies, and other care facilities throughout the world.

-

1 April 2021, DKSH has completed the acquisitions of Korean life sciences distributor Bosung to further solidify DKSH's position as a leading Pan-Asian provider of scientific instrumentation and acquisition of Singapore-based medical device distributor MedWorkz to expand its medical device business in Singapore.

DETAILED SEGMENTATION OF THE GLOBAL HEALTHCARE DISTRIBUTION MARKET INCLUDED IN THIS REPORT

This research report on the global healthcare distribution market has been segmented and sub-segmented based on type, end-user, and region.

By Type

- Pharmaceutical Product Distribution Services

- OTC Drugs/Vitamins

- Generic Drugs

- Brand-name/Innovator Drugs

- Biopharmaceutical Product Distribution Services

- Monoclonal Antibodies

- Vaccines

- Recombinant Proteins

- Blood and Blood Products

- Others

- Medical Device Distribution Services

By End-User

- Retail Pharmacies

- Hospital Pharmacies

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

What are some of the challenges faced by companies operating in the healthcare distribution market?

The healthcare distribution market is highly competitive, and companies face a variety of challenges, including rising costs, supply chain disruptions, and regulatory hurdles.

What is the current size of the healthcare distribution market?

The global healthcare distribution market was worth USD 1,062 million in 2024.

What are the emerging trends in the healthcare distribution market?

Some of the emerging trends in the healthcare distribution market include the growing importance of specialty drugs, increased demand for personalized medicine, and the shift towards value-based care models.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com