Global Healthcare Analytics Market Size, Share, Trends & Growth Forecast Report - Segmented By Type (Predictive Analytics, Descriptive/Retrospective Analytics & Prescriptive Analytics), Application (Financial Analytics, Clinical Analytics, Operational & Administrative Analytics), End-user and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) - Industry Analysis (2025 to 2033)

Global Healthcare Analytics Market Size

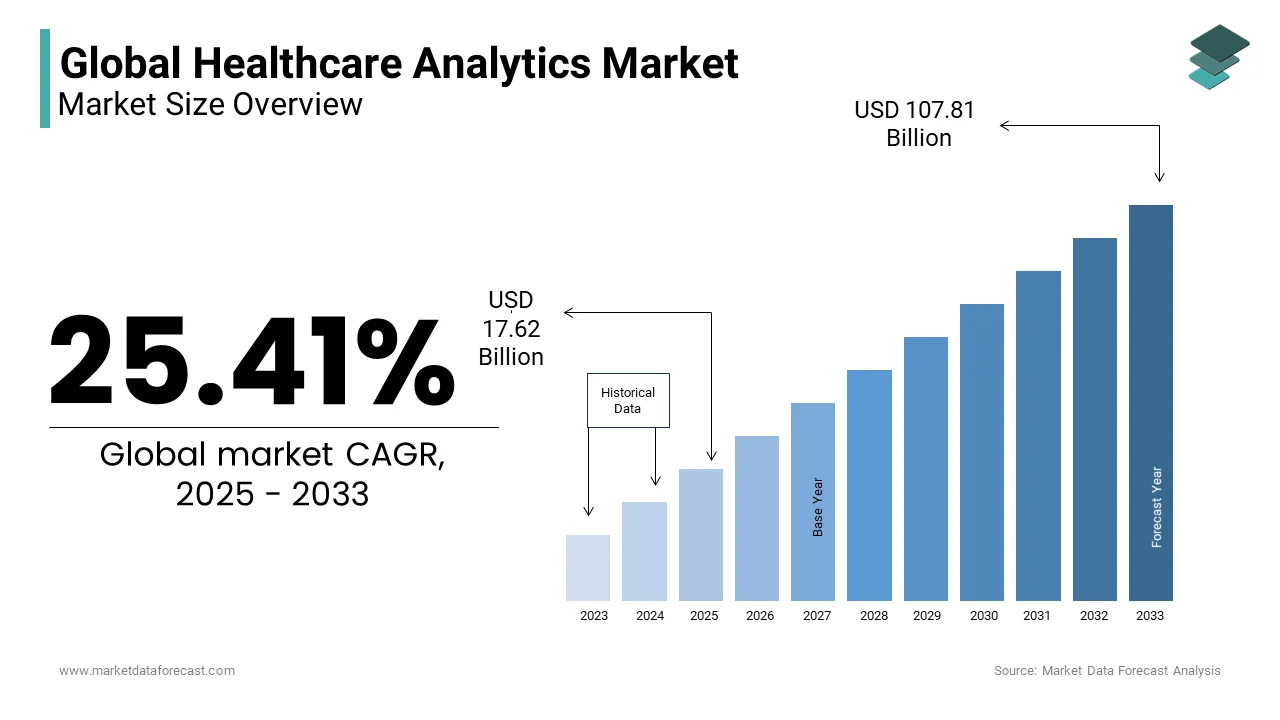

The global healthcare analytics market size was valued at USD 14.05 billion in 2024. The healthcare analytics market size is expected to have 25.41% CAGR from 2025 to 2033 and be worth USD 107.81 billion by 2033 from USD 17.62 billion in 2025.

Healthcare analytics measures improved healthcare delivery, patient outcomes, and clinical performance by analyzing large data sets. The patterns, relationships, and insights generated from healthcare analytics help healthcare providers make effective decisions that can provide quality patient care. For instance, by using the data from electronic health records (EHR), healthcare providers can predict the possibility of patient readmission and take steps toward preventing it. In addition, the insights from healthcare analytics can help reduce healthcare costs significantly. Healthcare analytics is also helpful in identifying the patterns and trends in the population's health and provides essential real-time data for healthcare providers that can assist in improved clinical decision-making.

MARKET DRIVERS

The rapid adoption of the latest technologies in the healthcare industry and the implementation of new healthcare devices are propelling the global healthcare analytics market growth.

Increasing venture capital investments and healthcare spending, growing R&D activities, improving patient outcomes, and introducing big data in healthcare influence the growth of the global healthcare analytics market. Furthermore, the investment expenditure on healthcare, particularly in urban areas with increasing disposable income, boosts the market growth. In addition, adopting analytics for sales and marketing applications, increasing the widespread chronic diseases, and growing pressure to minimize healthcare expenditure is expected to promote the growth rate of the healthcare analytics market during the forecast period. However, adopting big data applications in healthcare and ensuring standardization in numerous internal processes while accommodating regulatory needs further accelerates the growth of the healthcare analytics market. Furthermore, increasing demand to reduce healthcare costs, including medical product defects and damages associated with inefficient hospital workflows, is expected to grow big data in the healthcare sector. As a result, the digitization of healthcare data is also one of the notable drivers of the global healthcare analytics market.

The tremendous growth of patient data in the global healthcare system provides a strong foundation for healthcare analytics.

The need to improve healthcare decisions with insights backed by global data drives healthcare analytics adoption. However, the global healthcare analytics market is deteriorating with the increasing use of analytical tools to reduce the performance gap in healthcare delivery systems. The tremendous potential of the healthcare analytics process and strategy can help stakeholders better assess public health priorities and make credible, data-driven healthcare decisions to fuel market growth. In addition, insights from healthcare analytics can help improve relationships between caregivers and healthcare providers, including insurance providers. Therefore, adopting healthcare analytics tools and strategies is a valuable claim. Good potential healthcare analytics for national preventive health strategies and plans drive their adoption in developed countries. The digitization of healthcare systems, especially in growing regions, is fuelling the market growth for healthcare analytics. The growing popularity of big data analytics in healthcare transformation in developing and developed countries has contributed significantly to the growth of the healthcare analytics market.

MARKET RESTRAINTS

The primary factor restraining the global healthcare analytics market is the expense of healthcare analytics solutions. The high cost of implementation and maintenance can be a significant barrier for many small-scale organizations due to budget restrictions, which hampers the adoption rate of healthcare analytics. The presence of limited technical expertise in healthcare organizations can make purchasing and deploying these solutions complex, which will limit market growth. The need for highly specialized skills and knowledge to be used correctly in analytical solutions is estimated to hinder market size expansion. These requirements may limit the adoption of healthcare analytics solutions, which will restrain market growth. Another primary factor is the issues related to data privacy and security, as the complete patient data is stored, and there are high chances of data breaches, which impedes the market growth rate. The issues related to data integrity in emerging countries will be challenging to the healthcare analytics market in the coming years. The rising concerns regarding inaccurate and inconsistent data can lead to inaccurate or misleading decisions and insights, which may limit the market share growth. The presence of limited IT professionals in the healthcare industry will restrict the expansion of the market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

Based on Type, Application, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa |

|

Market Leaders Profiled |

SAS Institute Inc., McKesson, Optum Inc., IBM Corporation, Truven Health Analytics Inc., Cerner Corporation, Verisk Analytics Inc., Allscripts Health Solutions, Oracle Corporation, MedeAnalytics Inovalon Inc., and Health Catalyst. |

SEGMENTAL ANALYSIS

By Type Insights

Based on type, the healthcare predictive analytics segment held the major share of the global healthcare analytics market in 2024 and is expected to pose a healthy CAGR during the forecast period. The growing usage of Artificial Intelligence (AI) and big data analytics in the healthcare industry propels segmental growth. Furthermore, the benefits associated with predictive analytics for healthcare organizations, such as identifying potential health risks, predicting patient outcomes, and optimizing resource utilization, further fuel the segment’s growth rate. In addition, the growing adoption of personalized medicine, increasing healthcare expenditure, growing disposable income, and increasing need to reduce costs for healthcare organizations are favoring the segment's growth.

The healthcare prescriptive analytics segment is predicted to showcase a promising CAGR during the forecast period. Healthcare organizations can optimize clinical outcomes and resource utilization by leveraging prescriptive analytics. Factors such as increasing demand for quality healthcare and the rising need for patient outcomes primarily contribute to the segment's growth. In addition, the rising emphasis on population health management and the increasing demand for real-time data analytics are further promoting segmental growth.

The healthcare descriptive analytics segment is estimated to hold a considerable share of the worldwide market during the forecast period. By using the insights from descriptive analytics, healthcare organizations can understand patient behavior, identify trends, and evaluate the effectiveness of treatment strategies. Data integration and interoperability among healthcare organizations drive the segment's growth.

By Application Insights

Based on application, the clinical analytics segment captured the leading share of the global healthcare analytics market in 2024 and its dominance is expected to continue during the forecast period. Increasing emphasis on population health management, quality healthcare, and growing demand for precision medicine propel segmental growth. In addition, factors such as the benefits associated with clinical analytics, such as improved clinical decision-making, optimized patient outcomes, and reduced healthcare costs, further fuel the segment's growth rate. Furthermore, the growing adoption of electronic health records (EHR) and the increasing need to integrate healthcare data are estimated to boost the segment's growth rate during the forecast period.

The financial analytics segment is estimated to showcase a noteworthy CAGR during the forecast period. The growing emphasis on healthcare cost containment and the need to improve operational efficiency for healthcare organizations contribute to the segment's growth. In addition, the growing need for value-based reimbursement models and accurate financial reporting is fuelling the segment’s growth rate.

By End User Insights

Based on end-user, the public health systems segment held the largest global healthcare analytics market share in 2024. The growing number of initiatives by various governments in favor of public healthcare systems, increasing emphasis on population health management, and rising focus on resource optimization are propelling the segment's growth. In addition, the growing prevalence of quality diagnosis and treatment procedures at any cost, especially in urban areas, is fuelling segmental growth.

The healthcare providers segment is predicted to occupy a considerable global market share during the forecast period. The growing need to improve patient outcomes, reduce costs, and enhance operational efficiency drives the segment's growth.

REGIONAL ANALYSIS

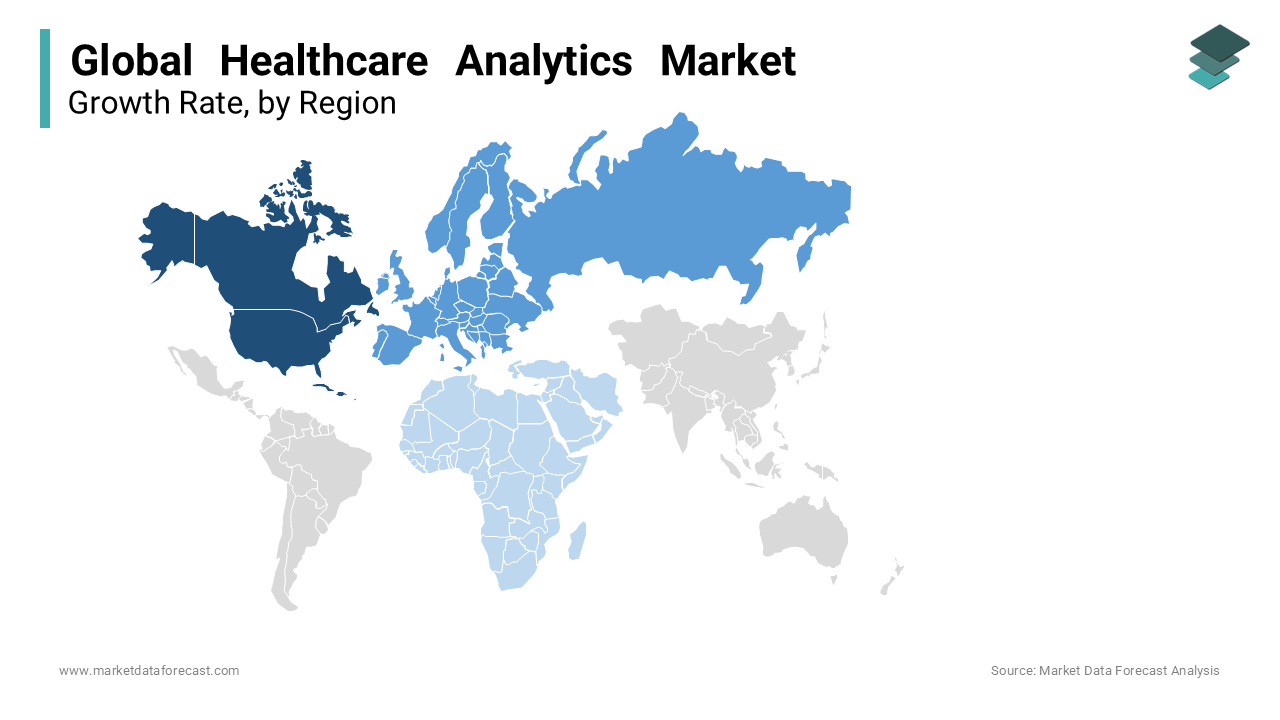

Regionally, the North American healthcare analytics market accounted for the largest share of the worldwide market in 2024. The region's domination will likely continue during the forecast period owing to the rapid adoption of the latest technologies and increasing usage of healthcare analytics in various healthcare sector applications. The availability of sophisticated healthcare infrastructure in North America is another major factor propelling regional market growth. Healthcare organizations in North American countries are keen to adopt healthcare technologies to optimize resources and improve patient safety. Furthermore, the growing demand for better techniques that are convenient and accurate in completing tasks is boosting the healthcare analytics market in North America.

The European healthcare analytics market accounted for the second-largest worldwide market share in 2024 and is predicted to grow at a notable CAGR during the forecast period. Factors such as the growing capital income in both developed and developing countries and increasing government initiatives to accept hospital electronic health records promote the European market growth. In recent years, the European Union has launched numerous initiatives to promote healthcare analytics adoption. As a result, the growing demand for advanced healthcare technologies across the European region is propelling the regional market growth. Furthermore, the growing aging population, increasing chronic disease patient population, and rising demand for precision medicine are promoting the growth of the European healthcare analytics market.

The Asia Pacific healthcare analytics market has grown tremendously over the past decade. The growing population is anticipated to have the highest CAGR during the forecast period. In addition, factors such as increasing healthcare expenditure, the growing number of improvements in the healthcare infrastructure of APAC counties, and the rising prevalence of chronic diseases are contributing to the growth of the healthcare analytics market in APAC. In addition, increasing disposable income in urban areas is fuelling the growth rate of the APAC healthcare analytics market.

The Latin American healthcare analytics market held a considerable share of the worldwide market in 2024 and is predicted to showcase a steady CAGR during the forecast period. The expanding healthcare industry in the region, growing healthcare expenditure, increasing population, and the rising advanced technologies and their adoption propels the market growth opportunities in the region. The requirement for more efficiency in the region's healthcare sector is enhancing the adoption of advanced technologies such as AI and ML in healthcare to provide better patient care and medical research, which fuels the market growth in the region.

The MEA healthcare analytics market is estimated to capture a moderate global market share during the forecast period. The increasing IT utilization in the healthcare industry, the rising adoption of electronic health records, the increasing number of patients, rising government support initiatives, and investments by public and private organizations in the development of the healthcare industry across the region are estimated to provide growth opportunities in the coming years.

KEY MARKET PLAYERS

A list of notable companies playing a promising role in the Global Healthcare Analytics Market is SAS Institute Inc., McKesson, Optum Inc., IBM Corporation, Truven Health Analytics Inc., Cerner Corporation, Verisk Analytics Inc., Allscripts Health Solutions, Oracle Corporation, MedeAnalytics Inovalon Inc., and Health Catalyst.

RECENT HAPPENINGS IN THE MARKET

- In June 2024, McKesson Corporation acquired Rx Savings Solutions, a provider of prescription price transparency solutions. This acquisition aims to enhance McKesson's existing pharmacy solutions portfolio, enabling better patient cost-saving options and improving medication adherence through data-driven insights.

- In July 2024, IQVIA launched its new IQVIA Healthcare-grade AI, an advanced analytics platform designed to provide healthcare organizations with actionable insights. The platform integrates real-world data and machine-learning algorithms to enhance clinical development and patient care decision-making.

- In May 2024, IBM introduced the Watson Health Data Aggregator, a new product designed to unify healthcare data from multiple sources. The product aims to improve data interoperability and analytics capabilities, supporting healthcare providers in delivering personalized patient care and optimizing operational efficiencies.

- In March 2024, Cerner Corporation launched its Cerner Predictive Analytics Suite. This suite enhances Artificial Intelligence and Machine Learning to provide predictive insights for healthcare providers, helping them fulfill patient needs, improve care, and optimize resource collection.

- In February 2024, Oracle announced the completion of its acquisition of Health Management Systems, Inc., a leader in healthcare data and analytics solutions. This acquisition is estimated to enhance Oracle's cloud-based healthcare analytics offerings by improving decision-making and patient care.

MARKET SEGMENTATION

This research report on the global healthcare analytics market has been segmented and sub-segmented based on type, application, end-user, and region.

By Type

- Predictive Analytics

- Descriptive/Retrospective Analytics

- Prescriptive Analytics

By Application

- Financial Analytics

- Clinical Analytics

- Operational & Administrative Analytics

By End User

- Public Health Systems

- Healthcare Providers

- Private Healthcare Providers

- Monitoring Agencies

- Health Insurance Companies

- Clinical and Medical Research Bodies

- Technology Vendors

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

How much is the global healthcare analytics market going to be worth by 2033?

Yes, we have studied and included the COVID-19 impact on the global healthcare analytics market in this report.

Which region is growing the fastest in the global healthcare analytics market ?

As per our research report, the global healthcare analytics market size is projected to be USD 107.81 billion by 2033.

At What CAGR, the global healthcare analytics market is expected to grow from 2024 to 2033?

The global healthcare analytics market is estimated to grow at a CAGR of 25.41% during the forecast period.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com