Global Healthcare Data Storage Market Size, Share, Trends & Growth Forecast Report By Deployment, Architecture, Type, Storage System, End user and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Healthcare Data Storage Market Size

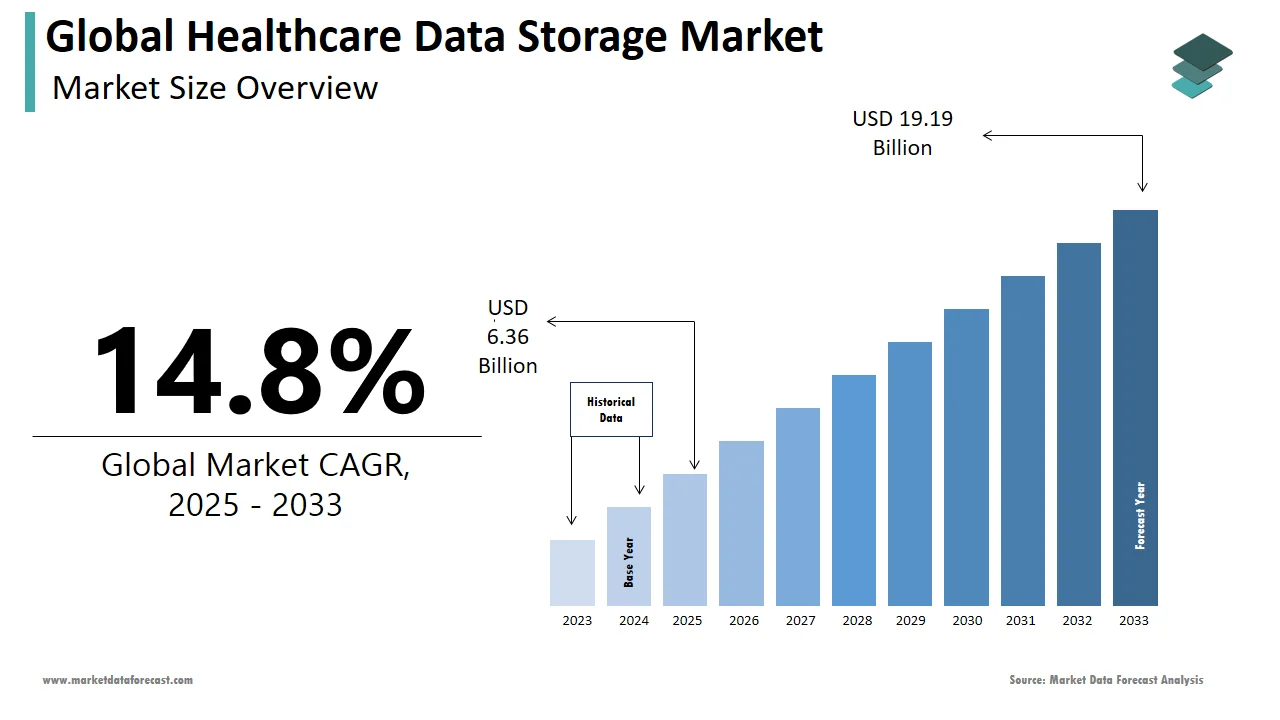

The global healthcare data storage market was worth US$ 5.54 billion in 2025 and is anticipated to reach a valuation of US$ 19.19 billion by 2033 from US$ 6.36 billion in 2025, and it is predicted to register a CAGR of 14.8% during the forecast period 2025-2033.

Data is priceless. As cliche as it may sound, data in healthcare is critical for providing up-to-date medical care and driving preventive healthcare in general. Healthcare data management is an unavoidable requirement for comprehensive medical care. Smart hospitals encourage using cutting-edge technologies to collect, analyze, and implement patient data. They combine IoT-based healthcare devices with traditional healthcare data collected via CT scans, MRIs, X-Ray reports, and other medical test reports to generate massive amounts of healthcare data. There are numerous benefits to incorporating public, private, and hybrid clouds into a company's long-term storage strategy. Healthcare organizations are building their IT infrastructures to be more flexible and scalable to meet the growing data demand. The volume of data collected and stored will increase as healthcare organizations embrace advanced health IT infrastructure technology. To protect patient data, organizations must ensure that their data is securely stored and accessible. Clinicians must also have access to data where and when needed for data storage to be successful. Analysts expect the healthcare cloud will become the preferred choice for healthcare back-office applications, backup and disaster recovery, revenue cycle management, and patient engagement in the coming years.

MARKET DRIVERS

The growing adoption of hybrid data storage solutions is one of the primary factors driving the growth of the global healthcare data storage market.

When scaling up or implementing a more advanced storage solution, most organizations opt for hybrid data storage. Organizations may choose to keep more bandwidth-intensive data, such as images, on-premises so that it can be accessed quickly. Hybrid data storage uses more than one cloud or server option to access data shared by two or more infrastructure hosting solutions. Data backup and recovery also benefit from hybrid solutions. Many cloud data storage solutions provide backup and recovery services and the ability to duplicate on-premises data into the cloud in the event of a disaster where the on-premises data is destroyed.

Growing healthcare cloud data storage options resulting from data storage system adoption are anticipated to accelerate the market’s growth rate.

Cloud data storage options have become popular in healthcare over the last few years as the stigma associated with hosting data off-site has faded. As more organizations adopt mobile apps, storing clinical data in the cloud provides users with more comprehensive access. Cloud data storage also saves organizations money by allowing them to buy more storage space as needed rather than investing in it upfront. Healthcare organizations are demanding more storage space for big data analytics and the increased volume of unstructured data required for analytics initiatives. According to an earlier SADA Systems survey, 89 percent of healthcare organizations use cloud-based health IT infrastructure, including cloud-based apps. Over the next few years, many providers are likely to increase their investment in these tools. Cost savings, scalability, speed, freed-up internal storage, a mobilized workforce, and improved user applications are all advantages of the cloud. According to another study, healthcare data will exceed 250,000 Petabytes by 2020. As a result, it is critical to store and manage this data effectively.

Additionally, factors such as the growing adoption of the Internet of Things (IoT), artificial intelligence, and the emergence of social media are further expected to promote the global healthcare data storage market. The quick and simple deployment of cloud storage solutions is rising, which is expected to favor the global healthcare data storage market. The demand for cloud computing has resulted in various cloud deployment models. These models use similar technology, but they differ in scalability, cost, performance, and privacy. Over the last decade, more businesses have relied on it for faster time to market, improved efficiency, and scalability. As part of their digital strategy, it assists them in achieving long-term digital goals. Alongside this, a growing number of initiatives and programs from various governments are expected to boost the market’s growth rate. Amid the COVID-19 pandemic, there is a growing demand for virtual healthcare worldwide.

MARKET RESTRAINTS

One of the most difficult data storage challenges that healthcare organizations face is putting legacy systems back together while integrating new systems into the infrastructure.

HIPAA compliance is also a concern for organizations considering cloud migration. Many organizations still hesitate to entrust EHRs and PHI to a third-party vendor, fearing that lax security will result in a data breach. In addition, many organizations cannot afford to migrate data in bulk from one storage system to another, so interoperability between cloud vendors is essential for a smooth transition. Additionally, Inadequate scalability, the larger infrastructure required, data security, increased maintenance costs, and risk of latency & downtime are expected to hamper the growth of the healthcare data storage market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2025 to 2033 |

|

Base Year |

2025 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

14.8% |

|

Segments Covered |

By Deployment, Architecture, Type, Storage System, End-user, and Region. |

|

Various Analyses Covered |

Global, Regional, and country-level analysis; Segment-Level Analysis, DROC; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

IBM Corporation, Samsung Electronics Co., Ltd, Dell Technologies, Drobo, Huawei Technologies Co., Ltd, Cloudian, Hewlett Packard Enterprise (HPE), Fujitsu Limited, Scality, Hitachi, Ltd., Pure Storage, NetApp, Tintri, Toshiba Corporation, and Western Digital, and Others. |

SEGMENTAL ANALYSIS

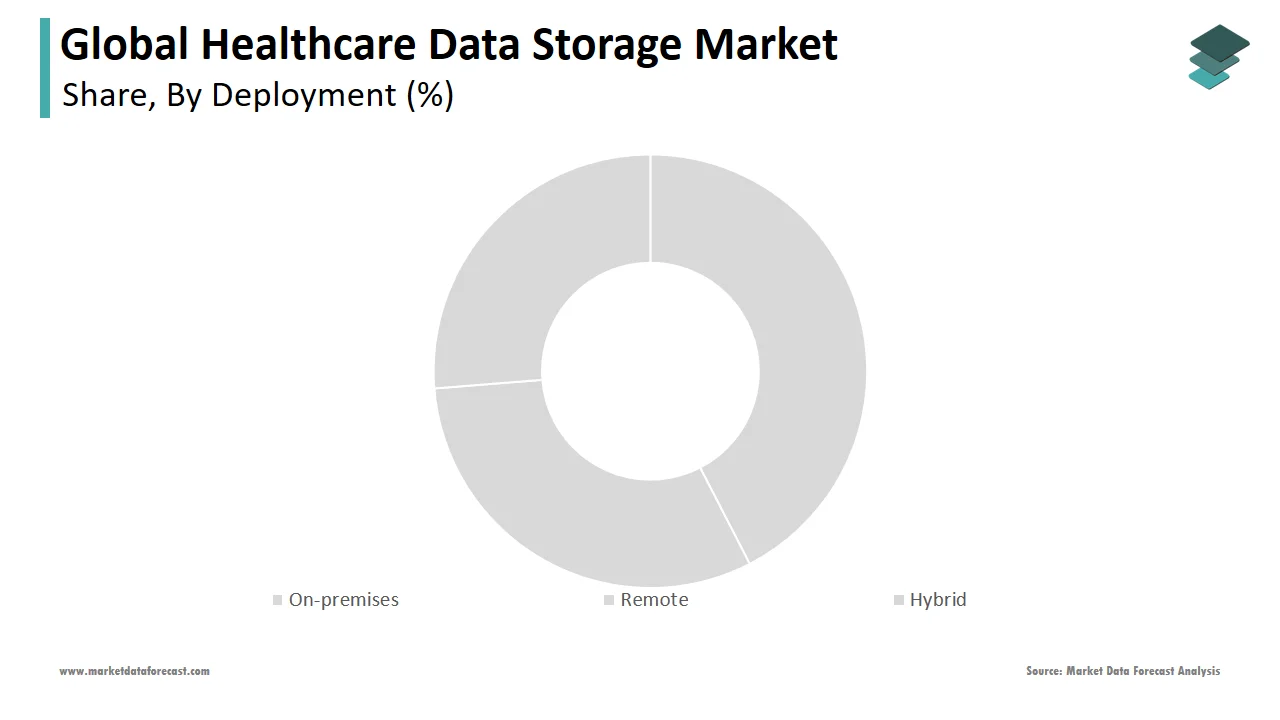

By Deployment Insights

The on-premises segment is expected to account for most of the market share in the global healthcare data storage market during the forecast period. The most extensively used storage solutions on the market are on-premises systems. This deployment methodology may take advantage of multi-vendor architecture while reducing the risk of a data breach and external attacks. Users also control their deployment, backup, and data recovery systems because they own on-premises storage. These benefits are propelling the market for on-premises solutions forward.

By Architecture Insights

Based on the architecture, during the forecast period, the object storage segment is expected to perform well.

By Type Insights

The flash and solid-state storage segment held the biggest market share in 2025 and is predicted to grow fastest throughout the forecast period. End-users increasingly adopt flash and solid-state drives due to their higher capacity and lower prices than magnetic discs.

By Storage System Insights

The storage area network segment will lead the market during the forecast period based on the storage system.

By End-User Insights

The pharmaceutical and biotechnology companies, contract research organizations (CROs), and contract manufacturing organizations (CMOs) segment accounted for the greatest proportion of the market. This is because pharmaceutical and biotechnology businesses conduct intensive drug development research, which creates a large amount of data.

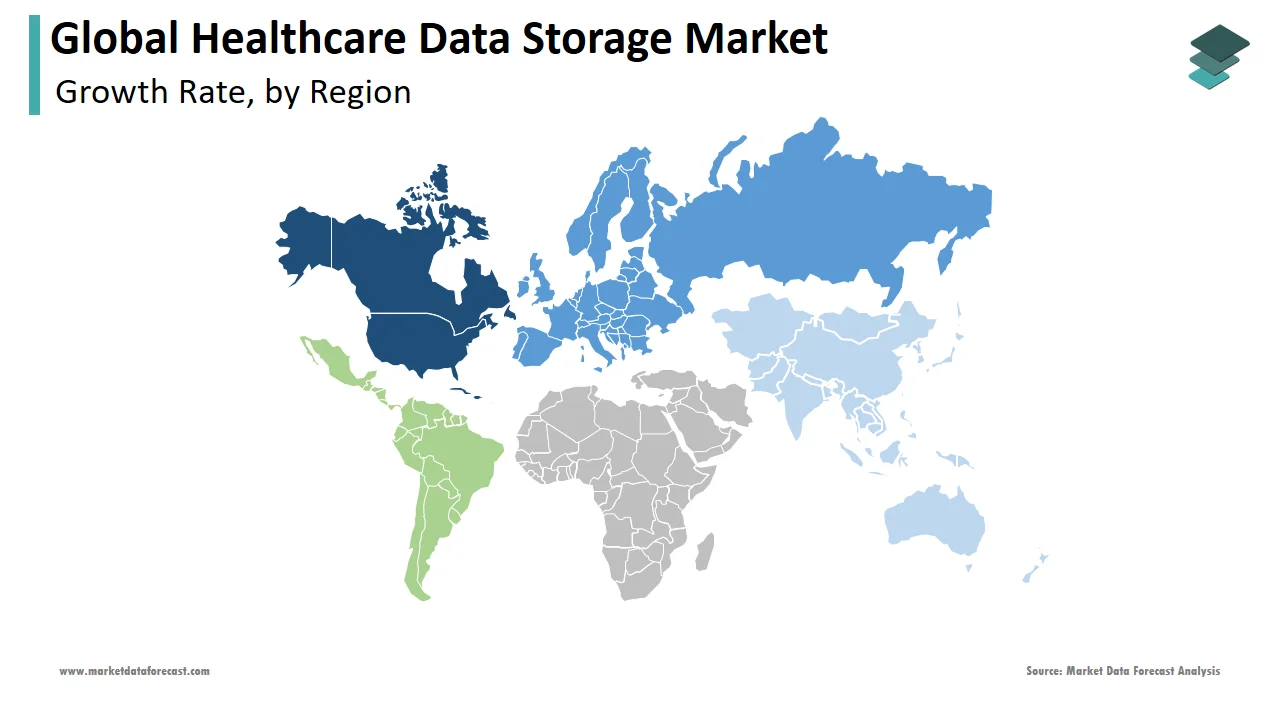

REGIONAL ANALYSIS

The North American healthcare data storage market accounted for most of the global market share in 2025, and this trend is likely to continue throughout the forecast period. This is due to the increased volume of unstructured healthcare data in the region and rapid technological advancements. As a result, demand for safe, dependable, and cost-effective storage infrastructure has increased in North America.

Due to several healthcare businesses providing diagnosis and treatment products, Europe holds the second-largest share in the global healthcare data storage market. It is expected to maintain its position during the forecast period, driving the healthcare data storage IT solutions market. In addition, the advent of a huge patient population suffering from arthritis, diabetes, and cancer is also fuelling market growth.

Because of rapid technological advancements and numerous growing nations, particularly China, India, and Japan, the APAC region's worldwide healthcare data storage market is expected to expand quickly throughout the forecast period. In addition, people are becoming more health conscious. As a result, they acquire healthcare wearables and smart gadgets, resulting in more data stored in the cloud and on-premises, resulting from market growth in this region.

KEY MARKET PLAYERS

IBM Corporation, Samsung Electronics Co., Ltd, Dell Technologies, Drobo, Huawei Technologies Co., Ltd, Cloudian, Hewlett Packard Enterprise (HPE), Fujitsu Limited, Scality, Hitachi, Ltd., Pure Storage, NetApp, Tintri, Toshiba Corporation, and Western Digital are some of the prominent companies operating in the global healthcare data storage market.

RECENT HAPPENINGS IN THE MARKET

- Egnyte, Inc.'s unique security features and independent cloud file-sharing were combined into a single content solution in February 2020. In addition, with machine learning technologies and tiered storage, the services provide greater insights.

- In July 2020, HPE acquired SD-WAN pioneer Silver Peak, accelerating its Edge-to-Cloud strategy. Aruba's Edge Services Platform will benefit from Silver Peak's self-driving WAN to accelerate WAN transformation for cloud-first enterprises.

MARKET SEGMENTATION

This research report on the global healthcare data storage market has been segmented and sub-segmented based on deployment, architecture, type, storage system, end-user, and region.

By Deployment

- On-premises

- Remote

- Hybrid

By Architecture

- Object Storage

- File Storage

- Block Storage

By Type

- Magnetic Storage

- Magnetic Disks

- Magnetic Tapes

- Flash & Solid-state Storage

By Storage System

- Direct-attached Storage

- Network-attached Storage

- Storage Area Network

By End User

- Pharmaceutical & Biotechnology Companies, CROs, and CMOS

- Research Centers, Academic & Government Institutes, and Clinical Research Labs

- Hospitals, Clinics, and ASCs

- Diagnostic & Clinical Laboratories

- Other End Users

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

What is the growth rate of the healthcare data storage market?

The global healthcare data storage market is expected to grow at a CAGR of 14.8% during the forecast period.

What are the key drivers of the healthcare data storage market?

The rising adoption of electronic health records (EHRs), the growing need for data interoperability, the rising volume of healthcare data, and the need for secure data storage and management are majorly propelling the healthcare data storage market growth.

What are the challenges facing the healthcare data storage market?

Data privacy and security concerns, regulatory compliance requirements, data interoperability issues, and the need for data standardization are some of the major challenges to the healthcare data storage market.

Who are the key players in the healthcare data storage market?

IBM Corporation, Dell Technologies Inc., Hewlett Packard Enterprise Development LP, NetApp Inc., and Hitachi Ltd. are some of the notable companies in the healthcare data storage market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com