Latin America Starter Culture Market Size, Share, Growth, Trends, and Forecast Report - Segmented By Product (Bacteria, Yeast, Molds), Application [Alcoholic Beverages (Wine, Beer, Whisky, Vodka, Gin and Tequila), Non-Alcoholic Beverages (Cereal-based, Dairy-based, Kombucha)], and By Region - Industry Analysis (2025 to 2033)

Latin America Starter Culture Market Size

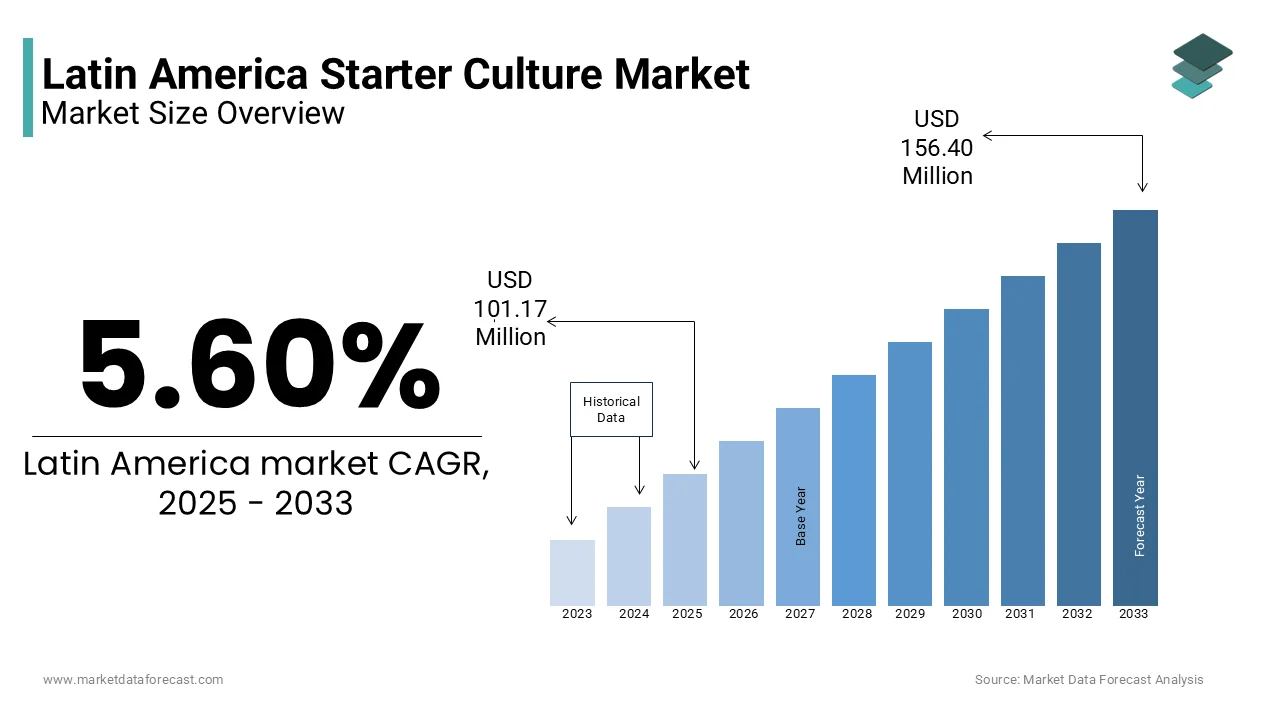

The Latin American starter culture market size was valued at USD 95.81 million in 2024. The global market size is expected to reach USD 101.17 million in 2025 and USD 156.40 million by 2033, with a CAGR of 5.60% during the forecast period.

The Latin America Starter Culture Market refers to the industry involved in the production and supply of microbial strains—such as bacteria, yeast, and molds—that are used to initiate fermentation processes in food and beverage manufacturing. These cultures play a crucial role in enhancing flavor, texture, shelf life, and nutritional value across various products including dairy, meat, alcoholic beverages, and plant-based alternatives. The market is witnessing growing traction due to rising consumer interest in fermented foods, functional beverages, and natural preservation methods. Countries such as Brazil, Mexico, and Argentina are emerging as key contributors to this regional growth.

A significant development shaping the region's fermentation landscape is the increasing domestic consumption of yogurt and cheese, particularly in urban centers where health awareness is on the rise.

In addition, the craft brewing movement has gained momentum, especially in Brazil and Mexico, with microbreweries adopting specialized yeast strains to meet evolving consumer preferences for artisanal flavors. This trend aligns with global shifts toward clean-label ingredients and sustainable food systems.

MARKET DRIVERS

One of the major drivers of the Latin America Starter Culture Market is the rising popularity of probiotic-enriched foods, particularly in the dairy sector. Consumers across the region are increasingly recognizing the health benefits associated with probiotics, such as improved digestion, immunity, and gut health. This shift in dietary preference has led to higher demand for fermented dairy products like yogurt, kefir, and cultured milk, which rely heavily on bacterial starter cultures. In Brazil, one of the largest dairy producers in Latin America, per capita yogurt consumption has seen a steady increase over the past decade, supported by aggressive marketing campaigns from major dairy companies emphasizing digestive wellness.

Additionally, government-backed initiatives promoting nutrition and food safety have encouraged the use of controlled microbial cultures in food production. For example, ANVISA, Brazil’s national health surveillance agency, has implemented stricter guidelines for probiotic labeling and efficacy claims, prompting manufacturers to adopt high-quality, well-documented starter cultures. This regulatory environment ensures that only reliable and scientifically backed microbial strains enter the market, fostering consumer trust and brand loyalty. Moreover, private research institutions and agricultural cooperatives across the region are collaborating to develop locally adapted bacterial strains that perform optimally under tropical climatic conditions.

Another key driver of the Latin America Starter Culture Market is the expansion of the craft brewing industry, particularly in countries like Mexico, Brazil, and Colombia. Over the past few years, there has been a noticeable surge in the number of microbreweries and independent breweries producing specialty beers that require specific yeast strains for unique fermentation profiles. Unlike mass-produced beers that often rely on generic yeast blends, craft brewers prioritize proprietary or custom-developed yeast cultures to achieve distinct flavor notes, aroma characteristics, and fermentation efficiencies.

According to data from the Latin American Brewers Association, the number of registered craft breweries in the region increased between 2018 and 2023, with Mexico leading the way in terms of both production volume and export value. This growth trajectory has directly influenced the demand for high-performance yeast cultures, especially those sourced from reputable suppliers offering strain purity, stability, and traceability. Breweries are increasingly partnering with starter culture providers to access tailored yeast strains that can withstand varying fermentation temperatures and produce consistent results. Furthermore, the introduction of sour beers and barrel-aged brews has expanded the use of non-conventional yeast and bacterial cultures, further diversifying the starter culture application landscape.

MARKET RESTRAINTS

One of the major restraints affecting the Latin America Starter Culture Market is the limited availability of technical expertise and infrastructure for microbial research and development. While demand for high-quality starter cultures is rising, many local manufacturers and food producers lack the necessary knowledge and facilities to properly handle, store, and apply these biological agents. Starter cultures require precise temperature control, sterile handling, and expert formulation to maintain viability and effectiveness—factors that are often overlooked in smaller-scale operations or rural processing units.

This challenge is particularly pronounced in countries with less developed agri-food innovation ecosystems. According to reports from the Inter-American Development Bank, only a small percentage of food and beverage enterprises in Latin America invest in advanced microbiology training or facility upgrades for fermentation technologies. As a result, many businesses continue to rely on traditional or unregulated fermentation practices, limiting the adoption of commercial starter cultures. Besides, the absence of standardized protocols for microbial strain validation and performance testing hampers market growth.

Another significant restraint impacting the Latin America Starter Culture Market is the high cost and limited accessibility of imported microbial strains , which restricts widespread adoption among small and medium-sized food processors. Most high-performance starter cultures used in the region are sourced from international biotech firms based in Europe or North America, making them relatively expensive compared to locally available alternatives. Currency fluctuations and import duties further inflate procurement costs, discouraging smaller manufacturers from investing in premium microbial solutions.

For instance, in countries like Argentina and Venezuela, where economic instability affects purchasing power, local dairy and beverage producers often opt for cheaper, less reliable fermentation methods rather than importing certified starter cultures. Even in more stable economies such as Mexico and Brazil, cost remains a barrier for artisanal cheesemakers and independent breweries seeking to scale up while maintaining product authenticity. This situation underscores the need for localized production or partnerships with international suppliers to develop affordable, climate-adapted starter culture options tailored to the region’s diverse fermentation needs.

MARKET OPPORTUNITIES

MARKET OPPORTUNITIES

One of the major opportunities driving the Latin America Starter Culture Market is the growing demand for plant-based and alternative protein products, which require microbial fermentation to enhance taste, texture, and nutritional value. As consumers become more health-conscious and environmentally aware, the consumption of plant-based milks, yogurts, and meat substitutes is on the rise across the region. These products often depend on lactic acid bacteria and other microbial strains to mimic the sensory properties of traditional dairy and meat items while offering longer shelf life and enhanced digestibility.

In Brazil and Mexico, several startups and established food companies have launched plant-based brands targeting health-focused and vegan consumers. According to the Latin American Plant-Based Foods Association, sales of alternative dairy products in the region grew by over 25% in the last three years. This expansion creates a favorable environment for starter culture suppliers to introduce customized microbial blends designed specifically for soy, oat, almond, and coconut-based formulations. Besides, collaborations between academic institutions and food tech firms are exploring native bacterial strains that can thrive in plant-based matrices, improving fermentation efficiency and reducing dependency on imported cultures.

Another notable opportunity in the Latin America Starter Culture Market is the expanding use of microbial solutions in food safety and natural preservation , particularly in response to consumer demand for minimally processed and chemical-free products. With rising concerns about synthetic preservatives and artificial additives, food manufacturers are turning to fermentation-based techniques to extend shelf life and inhibit pathogen growth without compromising flavor or texture.

Starter cultures, particularly those containing bacteriocin-producing strains like Lactobacillus and Pediococcus, are being increasingly integrated into meat, dairy, and ready-to-eat food production to serve as natural antimicrobials. This approach aligns with the broader regional push for clean-label food products that appeal to health-conscious consumers. In Argentina and Chile, for example, meat processors have started incorporating lactic acid bacteria into sausages and cured meats to reduce reliance on nitrates and chemical preservatives. Similarly, in Brazil, dairy companies are leveraging controlled fermentation to enhance food safety and prolong freshness without refrigeration challenges in remote areas.

MARKET CHALLENGES

One of the major challenges facing the Latin America Starter Culture Market is the lack of standardized regulations governing microbial strain usage and labeling , which creates inconsistencies in product quality and consumer perception. Unlike in Europe or North America, where strict guidelines exist for starter culture classification, performance claims, and traceability, Latin American countries exhibit varying levels of regulatory oversight. This fragmentation makes it difficult for international suppliers and local producers to ensure uniformity in microbial formulations and compliance with food safety standards.

For example, in some countries, starter culture labeling does not specify strain identity or functional attributes, making it challenging for end-users to assess product efficacy. According to the Pan American Health Organization, discrepancies in microbial regulation across the region hinder the development of a cohesive market framework and discourage investment in advanced fermentation technologies.

Chine, inconsistent enforcement of hygiene and storage requirements for microbial products further complicates their adoption.

Another critical challenge confronting the Latin America Starter Culture Market is the impact of climate variability on microbial performance and fermentation consistency . Temperature fluctuations, humidity changes, and seasonal variations can significantly affect the behavior of bacterial and yeast strains used in food and beverage production. Many commercially available starter cultures are developed under controlled European or North American conditions and may not perform optimally in the tropical and subtropical climates prevalent across much of Latin America.

This issue is particularly relevant in dairy and brewing sectors, where deviations in fermentation parameters can lead to inconsistent product quality and spoilage risks. According to a study conducted by the Brazilian Agricultural Research Corporation (EMBRAPA), certain lactic acid bacteria strains commonly used in yogurt production exhibited reduced viability when exposed to prolonged heat and moisture levels typical of the Amazon basin. Similarly, in the brewing industry, yeast stress caused by high ambient temperatures can result in off-flavors and extended fermentation times, affecting batch reliability. To address this, researchers and industry players are working on developing climate-resilient microbial strains better suited to local environmental conditions.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.60% |

|

Segments Covered |

By Product, Application, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

Latin America include Brazil, Argentina, Mexico, and the Rest of Latin America |

|

Market Leaders Profiled |

Chr. Hansen A/S., CSK Food Enrichment B.V., Lesaffre Group, Lallemand Inc, LB Bulgaricum Plc, Wyeast Laboratories Inc., Danisco A/S, Lactina Ltd., and Angel Yeast Co. Ltd., and others |

SEGMENT ANALYSIS

By application Insights

The alcoholic beverages segment dominated the Latin American starter culture market, accounting for a 62.5% of total market share in 2024, with beer and distilled spirits being the primary contributors. This dominance is rooted in the region’s deep-rooted cultural ties to fermented and distilled drinks, particularly in countries like Mexico, Brazil, and Argentina, where brewing and distillation are integral parts of both local consumption and export industries.

One of the key drivers behind this segment's leadership is the established presence of large-scale breweries and distilleries , especially in Mexico and Brazil. According to the Latin American Brewers Association, Mexico produced over 120 million hectoliters of beer in 2023 , making it one of the top five beer-producing nations globally. Mexican breweries such as Grupo Modelo and Cuauhtémoc Moctezuma rely heavily on standardized yeast cultures to maintain product consistency and flavor profile across their vast international distribution networks.

In addition to beer, tequila and other distilled spirits play a crucial role in shaping demand for microbial fermentation solutions. The fermentation stage in tequila manufacturing depends on specific yeast strains to convert agave sugars into ethanol efficiently. As producers seek higher yields and more sustainable processes, they increasingly adopt commercial yeast cultures rather than relying solely on wild or indigenous strains.

Furthermore, Brazil has seen a rise in artisanal and craft brewing , with the number of microbreweries surpassing 1,200 in 2023, as reported by the Brazilian Brewers Association.

Among applications, the non-alcoholic beverages segment is projected to grow at the fastest compound annual growth rate (CAGR) of 8.7%. This rapid expansion is primarily fueled by rising health consciousness, increasing demand for functional beverages, and the growing popularity of fermented plant-based drinks across the region.

A major contributor to this growth is the surge in kombucha and probiotic-rich beverage consumption, particularly in urban centers across Brazil and Mexico. Brands such as Zao Kombucha and Água do Bem have capitalized on the wellness movement, offering naturally fermented products that utilize acetic acid bacteria and yeast strains for fermentation, flavor development, and gut health benefits.

Another driving factor is the expansion of plant-based dairy alternatives, which often require lactic acid bacteria for texture enhancement and shelf-life extension. In response, food manufacturers are incorporating tailored microbial blends to improve taste, nutritional content, and microbial stability in these beverages.

Additionally, fermented dairy-based drinks such as kefir and cultured buttermilk are gaining popularity due to their perceived digestive and immune-boosting properties. As awareness of gut microbiota and dietary health continues to grow, the demand for non-alcoholic fermented beverages—and consequently, the need for high-quality starter cultures—is expected to accelerate significantly.

REGIONAL ANALYSIS

REGIONAL ANALYSIS

Brazil

Brazil had the largest share of the Latin American starter culture market, accounting for 35.1% of regional demand in 2024, driven by its robust dairy industry, expanding craft brewing sector, and growing interest in functional foods. As one of the top milk producers in the world, Brazil plays a central role in shaping fermentation dynamics across the continent.

The country’s dairy industry remains a cornerstone of agricultural output. This volume supports a thriving yogurt and cheese manufacturing base, both of which depend heavily on bacterial starter cultures for fermentation, texture development, and flavor consistency. Domestic brands such as Itambé and Vigor have integrated advanced microbial solutions to enhance product quality and extend shelf life, reinforcing the demand for standardized cultures.

Simultaneously, the craft brewing movement in Brazil has gained momentum, . Breweries are increasingly adopting proprietary yeast strains to differentiate their offerings in a competitive market, further boosting the demand for premium fermentation cultures. Additionally, the rise of sour beers and barrel-aged brews has introduced new opportunities for specialty yeast and bacterial strains.

Moreover, Brazil is witnessing a surge in plant-based and probiotic beverages , particularly among younger, health-conscious consumers.

Argentina

Argentina is maintaining a strong presence due to its well-established dairy and wine sectors, along with an expanding food fermentation industry. The country’s agricultural prowess and long-standing tradition of fermentation-based food production make it a key player in the regional market.

Dairy remains a vital component of Argentina’s agri-food economy, with annual milk production reaching over 12 billion liters in 2023 , according to the National Institute of Agricultural Technology (INTA). This steady supply supports a significant domestic yogurt and cheese manufacturing base, which relies on bacterial cultures for fermentation efficiency, flavor development, and microbial safety. Companies like Mastellone Hnos and SanCor have been integrating controlled microbial strains to meet evolving consumer demands for clean-label and probiotic-enriched products.

Equally important is the wine industry , which is a major export earner for Argentina. The National Institute of Viticulture (INV) reported that Argentine wine exports totaled over $1.2 billion in 2023 , with Malbec leading global demand. Winemakers increasingly use selected yeast strains to ensure stable fermentation, especially under varying climatic conditions, reinforcing the need for reliable starter cultures.

Additionally, the craft brewing scene is gaining traction. These breweries rely on specialized yeast strains to develop unique flavor profiles, supporting the broader adoption of commercial starter cultures. With government-backed initiatives promoting fermentation science and food safety, Argentina is well-positioned to sustain its growth in the starter culture market.

Mexico

Mexico accounted for a notable share of the Latin American starter culture market, driven by its extensive brewing industry, robust dairy sector, and growing interest in fermented food innovations. As one of the largest beer exporters globally, Mexico plays a critical role in shaping yeast-based culture demand in the region.

The beer industry remains a dominant force. Major players such as Grupo Modelo and Heineken operate large-scale breweries that depend on consistent yeast performance for fermentation efficiency and flavor stability. In addition, the rise of independent craft breweries has increased demand for specialized yeast strains tailored to niche brewing styles.

Beyond beer, the dairy sector is also expanding. Fermented dairy products like yogurt and queso fresco are popular among consumers, necessitating the use of bacterial cultures for texture, taste, and preservation.

Moreover, interest in plant-based and probiotic beverages is rising , particularly in urban areas where health-conscious consumers are seeking natural and functional alternatives. As the country continues to embrace fermentation technology, its influence on the regional starter culture market will likely expand.

Chile

Chile is positioning itself as a growing participant due to its strong wine industry, progressive dairy sector, and increasing focus on fermentation-based food innovation. Known for its stringent food safety regulations and high-quality agricultural exports, Chile is fostering an environment conducive to the adoption of controlled microbial cultures.

The country ranks among the top ten wine exporters globally, and winemakers increasingly rely on selected yeast strains to ensure fermentation consistency, aroma complexity, and resistance to climate variability. This preference for premium yeast cultures has strengthened the demand for starter culture solutions in the viticulture sector.

In addition, the dairy industry is steadily modernizing , with milk production reaching over 3.5 billion liters annually , as reported by the Agricultural and Livestock Service of Chile (SAG). Processors are adopting bacterial cultures to enhance product quality and shelf life, particularly in yogurt and cheese manufacturing.

The craft brewing movement is also gaining ground. These breweries are increasingly sourcing specialized yeast strains to differentiate their products, further stimulating market growth. With a strong emphasis on food safety and technological advancement, Chile is poised to become a stronger regional player in the starter culture market.

Rest of Latin America

The remaining Latin American countries collectively account for a notable share of the regional starter culture market , with Colombia, Peru, Ecuador, and Costa Rica showing promising growth trajectories. While still in early stages compared to Brazil, Argentina, and Mexico, these markets are experiencing gradual adoption of fermentation technologies due to rising consumer awareness and increasing investments in food processing infrastructure.

Colombia, in particular, has seen a notable increase in craft brewery numbers. This expansion is driving demand for specialty yeast strains tailored to local brewing conditions. Similarly, in Peru, the growth of plant-based beverage startups is influencing fermentation practices, with companies exploring bacterial cultures for oat and quinoa-based drinks.

Local processors are beginning to integrate microbial cultures for yogurt and cheese production, enhancing product consistency and shelf life. Meanwhile, in Central America, Costa Rican food manufacturers are investing in fermentation-based preservation techniques to reduce reliance on chemical additives, aligning with global clean-label trends.

Despite challenges such as limited technical expertise and regulatory inconsistencies, these markets are gradually embracing controlled fermentation solutions.

KEY MARKET PLAYERS IN THE MARKET

Key players in the Latin America Starter Culture Market are Chr. Hansen A/S., CSK Food Enrichment B.V., Lesaffre Group, Lallemand Inc, LB Bulgaricum Plc, Wyeast Laboratories Inc., Danisco A/S, Lactina Ltd., and Angel Yeast Co. Ltd.

The Latin America starter culture market is characterized by a mix of global leaders and emerging regional players competing to meet the rising demand for fermented food and beverage products. While multinational corporations such as Chr. Hansen, DSM-Firmenich, and Lesaffre dominate due to their extensive product portfolios and technological expertise, local suppliers are gaining traction by offering cost-effective and climate-adapted microbial solutions. The competition is intensifying as more companies recognize the potential of Latin America’s expanding dairy, brewing, and plant-based food sectors. Additionally, shifting consumer preferences toward clean-label, probiotic-rich, and naturally preserved foods are influencing product development strategies across the industry. Companies are differentiating themselves through customized microbial blends, enhanced technical support, and localized R&D initiatives aimed at addressing specific fermentation challenges in the region. As awareness grows among food manufacturers about the benefits of controlled fermentation, the market is witnessing increased collaboration between international suppliers and domestic stakeholders to drive innovation and improve accessibility. Despite economic and logistical hurdles, the competitive landscape continues to evolve, with both global and regional players striving to capture greater market share through strategic expansion and value-added service offerings.

TOP PLAYERS IN THE MARKET

Chr. Hansen Holding A/S

Chr. Hansen is a global leader in natural microbial solutions and plays a pivotal role in shaping fermentation practices across Latin America. The company supplies high-quality bacterial and yeast cultures tailored for dairy, brewing, and plant-based food applications. With a strong focus on sustainability and health benefits, Chr. Hansen collaborates with regional producers to enhance product quality, consistency, and shelf life through customized microbial strains.

DSM-Firmenich AG

DSM-Firmenich combines biotechnological expertise with food innovation to deliver performance-driven starter cultures across Latin American markets. The company supports local dairy processors, beverage manufacturers, and functional food developers with reliable fermentation solutions. Its emphasis on probiotics, natural preservation, and clean-label formulations aligns with evolving consumer preferences, reinforcing its presence as a trusted partner in the region’s growing fermentation industry.

Lesaffre Group

Lesaffre is a key player in yeast-based starter cultures, particularly in brewing and wine production throughout Latin America. The company provides specialized yeast strains that cater to both large-scale breweries and artisanal producers seeking flavor complexity and fermentation efficiency. Lesaffre’s commitment to fermentation science and strain development has strengthened its foothold in the region, supporting growth in traditional and emerging beverage categories.

TOP STRATEGIES USED BY KEY MARKET PLAYERS

Localized Innovation and Customization

Leading players are increasingly tailoring their starter culture offerings to suit regional climatic conditions, raw material availability, and consumer taste preferences in Latin America. This includes developing microbial strains that perform optimally under tropical or subtropical environments, ensuring fermentation consistency and product quality.

Expansion Through Strategic Partnerships and Collaborations

To strengthen their market presence, companies are forming alliances with local research institutions, agricultural cooperatives, and food processing firms. These collaborations enable knowledge transfer, accelerate product development, and facilitate better alignment with regional fermentation trends and regulatory landscapes.

Investment in Technical Support and Education

Recognizing the gap in technical expertise among smaller producers, key players are investing in training programs, fermentation workshops, and on-site support services. By empowering local manufacturers with scientific knowledge and best practices, these firms aim to increase adoption rates of commercial starter cultures and build long-term customer relationships.

RECENT HAPPENINGS IN THE MARKET

- In March 2024, Chr. Hansen launched a new line of climate-resilient lactic acid bacteria specifically designed for dairy fermentation in tropical climates, targeting key markets in Brazil and Colombia to enhance yogurt and cheese production stability.

- In July 2023, DSM-Firmenich expanded its technical support team in Argentina to provide on-site fermentation consulting services for small and medium-sized dairy producers, aiming to increase adoption of standardized microbial cultures.

- In November 2023, Lesaffre Group established a regional yeast banking facility in Mexico to preserve and supply craft breweries with proprietary yeast strains, supporting the country’s growing microbrewery sector with fermentation expertise.

- In January 2024, Lallemand Inc. partnered with a Brazilian plant-based beverage manufacturer to co-develop fermentation solutions that improve texture and nutritional profile in oat-based drinks, aligning with rising demand for alternative dairy products.

- In May 2024, DuPont Nutrition & Biosciences introduced a series of probiotic starter cultures tailored for kefir and kombucha production in Latin America, responding to the increasing popularity of functional beverages in urban markets.

MARKET SEGMENTATION

This research report on the Latin America starter culture market is segmented and sub-segmented into the following categories.

By Product

- Bacteria

- Yeast

- Molds

By Application

- Alcoholic Beverages

- Wine

- Beer

- Whisky

- Vodka

- Gin And Tequila

- Non-Alcoholic Beverages

- Cereal-based

- Dairy-based

- Kombucha

By Country

- Brazil

- Argentina

- Mexico

- Rest of Latin America

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 1600

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com