Latin America Fraud Detection and Prevention Market Size, Share, Trends & Growth Forecast Report By Platform (Web-Based Platform, App-Based Platform), Purchase Type (Subscription-Based Purchase Model, One-Time Purchase Model), Deployment Mode (Cloud-Based Deployment, On-Premise Deployment), and Country (Brazil, Mexico, Argentina, Chile, Rest of Latin America) – Industry Analysis From 2025 to 2033.

Latin America Fraud Detection and Prevention Market Size

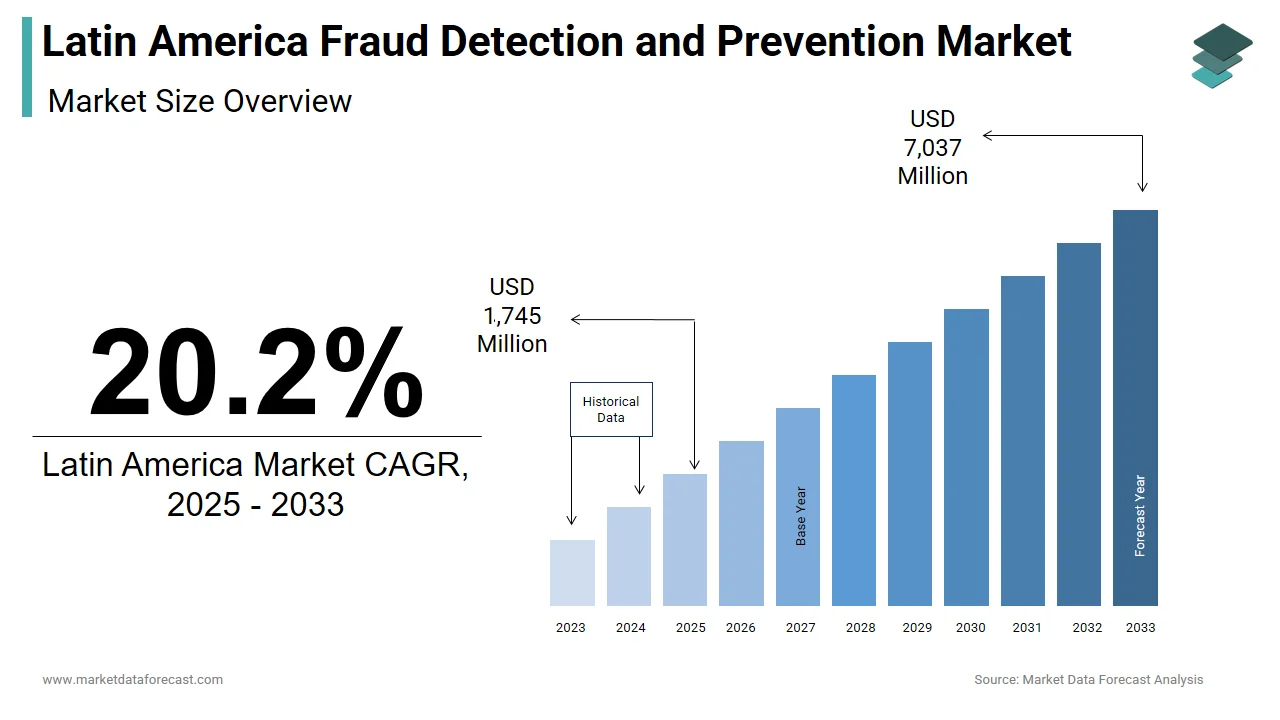

The size of the Latin America fraud detection and prevention market was valued at USD 1,466 million in 2024. This market is expected to grow at a CAGR of 20.2% from 2025 to 2033 and be worth USD 7,037 million by 2033 from USD 1,745 million in 2025.

The Latin America fraud detection and prevention market covers a range of technological solutions and services aimed at identifying, mitigating, and managing fraudulent activities across financial institutions, e-commerce platforms, telecom providers, and government agencies. As digital transformation accelerates in the region, so too does the sophistication of cyber-enabled financial crime, necessitating robust security frameworks to protect consumer data and institutional assets.

Brazil remains at the forefront of this market due to its advanced banking infrastructure and high volume of digital transactions. According to the International Telecommunication Union (ITU), internet penetration in Brazil reached approximately 78% in 2023, significantly increasing exposure to online fraud risks. Mexico is also witnessing a surge in demand for fraud analytics tools. The Mexican Banking Association reported that digital banking transactions grew by more than 25% in 2023 compared to the previous year.

Meanwhile, governments across the region are enacting stricter financial regulations and promoting cybersecurity awareness programs.

MARKET DRIVERS

Rising Digital Financial Transactions and E-Commerce Expansion

One of the primary drivers fueling the Latin America fraud detection and prevention market is the rapid expansion of digital financial transactions and e-commerce platforms. This shift toward digital commerce has increased the attack surface for fraudsters, compelling merchants and financial institutions to invest in advanced detection tools. In Brazil, the widespread adoption of PIX, the country's instant payment system introduced by the Central Bank, has transformed transaction behavior but also exposed users to new forms of fraud, such as phishing and account takeover attacks. According to the Brazilian Federation of Banks (FEBRABAN), losses from digital fraud rose by nearly 17% in 2023, prompting banks to deploy real-time fraud monitoring and biometric authentication systems. Companies are increasingly adopting machine learning algorithms and behavioral analytics to detect anomalies and flag suspicious activities in real time.

Regulatory Push for Enhanced Cybersecurity and Data Protection

A key factor driving the Latin America fraud detection and prevention market is the tightening of data protection and cybersecurity regulations across multiple jurisdictions. Governments in the region are responding to rising cybercrime incidents by implementing comprehensive legal frameworks to safeguard consumer data and ensure secure digital transactions. Brazil’s General Data Protection Law (LGPD), fully enforced since 2021, mandates strict compliance measures for organizations handling personal information. This regulatory environment has incentivized companies to invest in fraud detection systems capable of identifying unauthorized access and preventing breaches. Similarly, Colombia has strengthened its cybersecurity policies through the Superintendence of Industry and Commerce (SIC), which actively audits financial institutions for fraud control mechanisms.

MARKET RESTRAINTS

Limited Awareness and Adoption Among Small and Medium Enterprises

Despite the growing threat landscape, many small and medium enterprises (SMEs) across Latin America remain underprotected against fraud due to limited awareness and budget constraints. According to the World Bank, SMEs constitute over 90% of all businesses in Latin America, yet only a fraction have implemented formal fraud detection mechanisms. This lack of preparedness leaves them vulnerable to cyberattacks and financial losses, while also slowing the overall adoption of fraud prevention solutions. In countries like Peru and Bolivia, where digital transformation is still in early stages, many SMEs rely on outdated or manual processes for financial transactions, making them easy targets for fraudsters. Moreover, the absence of government-led awareness campaigns tailored to smaller businesses exacerbates the issue.

Fragmented Legal Frameworks and Enforcement Challenges

Another major constraint affecting the Latin America fraud detection and prevention market is the inconsistency in legal frameworks and enforcement mechanisms across different countries. While some nations have made substantial progress in regulating digital security and fraud, others lack cohesive policies, resulting in uneven implementation and enforcement. In countries like Venezuela and Nicaragua, weak judicial systems and political instability hinder effective prosecution of cybercriminals, discouraging private sector investment in fraud detection technologies. Apart from these, cross-border cooperation in fraud investigations remains limited due to differing legal procedures and data-sharing restrictions. For instance, discrepancies between Brazil’s LGPD and Mexico’s Federal Law on the Protection of Personal Data Held by Private Parties complicate multinational fraud cases, reducing the effectiveness of coordinated responses.

MARKET OPPORTUNITIES

Growth of Fintech and Digital Banking Ecosystems

The rapid expansion of fintech and digital banking ecosystems in Latin America presents a significant opportunity for the fraud detection and prevention market. According to Finnovista, the region is home to over 2,800 active fintech startups, with Brazil, Mexico, and Colombia leading the way. These firms offer innovative financial services such as peer-to-peer lending, mobile wallets, and digital credit, all of which require robust fraud mitigation mechanisms. Fintechs operate primarily in online environments, making them highly susceptible to identity theft, synthetic fraud, and malware-based attacks. As a result, many startups are investing heavily in artificial intelligence-driven fraud detection platforms to enhance transaction security and maintain user trust. Furthermore, regulators are encouraging fintechs to adopt advanced fraud prevention tools by mandating adherence to Know Your Customer (KYC) and Anti-Money Laundering (AML) protocols.

Increasing Adoption of Biometric Authentication Technologies

The growing deployment of biometric authentication technologies is emerging as a key opportunity for the Latin America fraud detection and prevention market. As traditional password-based systems prove increasingly vulnerable to cyber threats, financial institutions and digital service providers are turning to biometrics, such as fingerprint recognition, facial scans, and voice authentication to enhance security and reduce fraud risk. In Brazil, several banks have integrated facial recognition into their mobile apps to verify user identities during login and high-value transactions. Mexico is also experiencing a surge in biometric adoption, particularly among neobanks and payment processors. Banco Santander México launched a biometric verification feature in 2023, allowing customers to authorize transactions via fingerprint or face scan.

MARKET CHALLENGES

Sophistication and Evolving Nature of Fraud Techniques

One of the most pressing challenges facing the Latin America fraud detection and prevention market is the increasing sophistication and adaptability of fraud techniques employed by cybercriminals. Traditional rule-based detection systems are proving inadequate against modern tactics such as deepfake fraud, synthetic identity creation, and AI-generated phishing schemes. According to Kaspersky Lab, Latin America experienced an increase in ransomware attacks, many of which were linked to organized fraud networks leveraging encrypted communication channels and cryptocurrency laundering. These evolving threats require continuous updates to detection algorithms and greater integration of machine learning and anomaly detection models. Moreover, fraudsters are exploiting gaps in digital onboarding processes, particularly in the fintech and e-commerce sectors. Fake identity documents and stolen credentials are frequently used to bypass KYC checks, posing a major challenge for fraud analysts.

High Implementation Costs and Resource Constraints

The high cost of deploying and maintaining advanced fraud detection systems poses a significant challenge for businesses in Latin America, particularly in mid-sized and developing economies. Implementing AI-driven analytics platforms, cloud-based fraud monitoring tools, and real-time transaction surveillance systems requires substantial capital expenditure and technical expertise. According to McKinsey, only a limited portion of mid-sized financial institutions in Latin America have the internal resources to manage enterprise-grade fraud prevention systems, forcing them to rely on third-party vendors at considerable expense. This financial burden limits scalability and deters smaller players from adopting cutting-edge solutions. Besides, the shortage of skilled cybersecurity professionals further complicates implementation efforts.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Platform, Purchase Type, and Region. |

|

Various Analyses Covered |

Global, Regional and Country-Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, Rest of APAC |

|

Market Leaders Profiled |

IBM Corporation (US), Uplexis (Brazil), Experian Information Solutions, Inc. (Brazil), Accenture PLC (Ireland), Tata Communications (India), Clearsale LLC (US), Neoway (Brazil), Konduto (Brazil), Inovamind (Brazil), Único (Brazil), Cred Defense (Brazil), HS Prevent (Brazil), BrScan Tecnologia (Brazil), IDWALL TECNOLOGIA LTDA (Brazil), Gemalto - Thales Group (France), Boa Vista Serviços (Brazil), Amdocs (US), Oiti Technologies (Brazil), Fullface Biometric Solutions (Brazil), Incognia (US)., and others. |

SEGMENTAL ANALYSIS

By Platform Insights

The Web-Based platform segment dominated the Latin America fraud detection and prevention market by capturing 56.2% of total platform usage in 2024. This dominance is largely attributed to the widespread deployment of web-based fraud analytics tools by banks, payment processors, and government institutions that require centralized access to real-time data dashboards and threat intelligence reports. A key driver behind this preference is the integration capability of web-based systems with existing enterprise architectures. Additionally, regulatory bodies mandate centralized reporting mechanisms for fraud incidents, which are more efficiently handled through web-accessible interfaces. Moreover, enterprises value the ability to monitor cross-channel threats from a unified dashboard accessible via any device with internet connectivity.

The App-Based platform segment is projected to grow at the highest CAGR of 14.8%. This rapid expansion is driven by the increasing use of mobile banking applications and fintech-driven digital wallets across the region, particularly among younger demographics who prefer on-the-go financial services. Additionally, consumers are becoming more aware of digital fraud risks, prompting demand for immediate visibility into account activity and suspicious logins. Mobile-first fraud detection vendors are responding by integrating AI-driven anomaly detection within native apps, enhancing security without compromising user experience.

By Purchase Type Insights

The Subscription-based purchase model had the largest share of the Latin America fraud detection and prevention market by accounting for 63.9% of total revenue streams in 2024. This model includes recurring payments for Software-as-a-Service (SaaS), managed fraud detection services, and cloud-based analytics platforms that offer continuous updates and support. One key factor driving its dominance is the shift toward scalable, pay-as-you-go IT spending models, particularly among mid-sized financial institutions and fintech firms. Furthermore, subscription-based fraud detection systems allow for real-time threat intelligence updates, automatic rule adjustments, and seamless integration with evolving digital ecosystems. Regulatory mandates requiring ongoing compliance with anti-fraud standards also make continuous service access essential for businesses operating in high-risk sectors such as e-commerce and online lending.

The One-Time Purchase model is expected to register a CAGR of 9.6%. While less dominant than subscription-based offerings, this model remains relevant for large enterprises and government agencies that prefer full ownership of fraud detection software and long-term cost predictability. A primary growth catalyst is the increasing procurement of proprietary fraud analytics engines by national banking authorities and central financial regulators seeking to maintain control over sensitive data and algorithms. Additionally, some organizations prefer the one-time purchase approach to avoid vendor lock-in and reduce dependency on external providers for system upgrades. Customizable on-premise deployments also allow for deeper integration with legacy banking infrastructures, particularly in countries with stringent data localization laws.

COUNTRY-LEVEL ANALYSIS

Brazil maintained the largest share of the Latin America fraud detection and prevention market i.e., 38% in 2024. Positioned as the region’s most technologically advanced economy, Brazil experiences high levels of digital financial activity, making it a prime target for cybercriminals. One key growth enabler is the widespread adoption of PIX, Brazil’s instant payment system, which recorded over USD 1.5 trillion in monthly transactions in 2023, according to the Central Bank of Brazil. While PIX has revolutionized digital payments, it has also exposed users to increased fraud risks such as phishing, social engineering, and account takeovers. To combat these threats, financial institutions are investing heavily in fraud analytics and biometric authentication. Apart from these, regulatory enforcement under Brazil’s General Data Protection Law (LGPD) has intensified, mandating stronger data protection and fraud monitoring mechanisms.

Mexico is placed as a key player in North-South financial connectivity. Mexico faces rising digital fraud due to expanding e-commerce and mobile banking usage. A major growth driver is the rapid proliferation of fintech startups and digital banks. Moreover, the rise in card-not-present (CNP) fraud has prompted banks and payment processors to adopt real-time transaction monitoring and biometric verification.

Argentina is a notable participant in South America’s financial ecosystem and is witnessing increased investment in fraud management systems due to rising digital banking adoption and regulatory reforms. One notable growth factor is the increasing number of venture capital-backed startups seeking international exposure. Also, Argentina’s growing role in cryptocurrency and remittance services has attracted cybercriminals, prompting financial institutions to enhance fraud detection capabilities. Despite economic volatility, the country continues to strengthen its cybersecurity posture through initiatives.

Chile is one of the region’s most digitally mature economies, Chile benefits from a stable regulatory environment and a growing fintech ecosystem. A key growth driver is Santiago’s emergence as a regional innovation and investment hub. Additionally, Chile’s leadership in clean energy and cross-border trade has drawn multinational firms that prioritize secure digital operations. The country also benefits from well-developed legal frameworks governing data protection and financial crime. The Chilean Financial Analysis Unit (UAF) actively collaborates with international agencies to track illicit financial flows, reinforcing the need for advanced fraud detection systems.

Rest of Latin America (RoLA) includes countries such as Colombia, Peru, Ecuador, and Costa Rica, each experiencing varying degrees of fraud prevention adoption based on economic conditions and digital transformation progress. Colombia is emerging as a focal point within RoLA, supported by government-backed initiatives promoting digital trust and financial inclusion. Peru is also witnessing growth due to improved regulatory clarity and increased awareness of cybercrime risks. These developments highlight the potential of RoLA to become a stronger contributor to the Latin America fraud detection and prevention market in the coming years.

KEY MARKET PLAYERS

Noteworthy Companies dominating the Latin America fraud detection and prevention market profiled in the report are IBM Corporation (US), Uplexis (Brazil), Experian Information Solutions, Inc. (Brazil), Accenture PLC (Ireland), Tata Communications (India), Clearsale LLC (US), Neoway (Brazil), Konduto (Brazil), Inovamind (Brazil), Único (Brazil), Cred Defense (Brazil), HS Prevent (Brazil), BrScan Tecnologia (Brazil), IDWALL TECNOLOGIA LTDA (Brazil), Gemalto - Thales Group (France), Boa Vista Serviços (Brazil), Amdocs (US), Oiti Technologies (Brazil), Fullface Biometric Solutions (Brazil), Incognia (US)., and others.

TOP LEADING PLAYERS IN THE MARKET

IBM Security plays a pivotal role in the Latin America fraud detection and prevention market by delivering advanced cognitive security solutions tailored to financial institutions, telecom providers, and government agencies. The company leverages artificial intelligence and machine learning to offer real-time fraud monitoring and predictive analytics that help organizations identify suspicious activities before they escalate. IBM collaborates with regional banks and fintech firms to enhance cybersecurity postures and align with evolving regulatory requirements. Its integration of Watson-powered threat intelligence enhances adaptive fraud detection capabilities across digital banking and e-commerce platforms. IBM’s global expertise, combined with localized consulting service,s makes it a trusted partner in the region’s ongoing fight against financial crime.

Experian is a leading global player in risk mitigation and identity verification, with a strong presence in the Latin America fraud detection and prevention market. The company provides comprehensive identity and fraud solutions that enable businesses to authenticate users, detect anomalies, and manage digital risk effectively. Experian’s data-driven approach allows financial institutions and online merchants to assess transactional behavior and flag potential fraud without compromising customer experience. In Latin America, Experian works closely with banks, telecom operators, and insurance companies to enhance KYC processes and reduce onboarding fraud. By integrating local consumer data with global fraud intelligence, Experian supports secure digital transformation across key sectors in the region.

LexisNexis Risk Solutions is a major contributor to the Latin America fraud detection and prevention landscape, offering advanced analytics and digital identity verification tools designed to combat financial crime. The company specializes in linking disparate data points to build robust risk profiles, enabling real-time decision-making for banks, insurers, and payment processors. LexisNexis has been instrumental in helping Latin American institutions implement cross-border fraud controls and comply with emerging AML and KYC regulations. Its suite of fraud detection technologies includes device fingerprinting, behavioral analytics, and network analysis, which are particularly effective in detecting synthetic identities and organized fraud rings. With a growing focus on digital trust, LexisNexis continues to expand its footprint across Latin America through strategic partnerships and localized product offerings.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

One of the most prevalent strategies among key players in the Latin America fraud detection and prevention market is deepening regional partnerships and collaborations. Companies are forming alliances with local financial institutions, telecom providers, and regulatory bodies to better understand fraud patterns unique to the region and develop more targeted solutions. These collaborations also facilitate compliance with local laws and improve market penetration.

Another crucial strategy involves leveraging artificial intelligence and machine learning for predictive fraud analytics. Leading vendors are investing heavily in AI-powered systems that can analyze vast volumes of transactional data in real time, identifying anomalies and adapting to new fraud tactics. This enables financial institutions to respond swiftly and minimize losses while maintaining seamless user experiences.

Lastly, there is a growing emphasis on expanding managed services and cloud-based fraud detection offerings. As enterprises seek cost-effective ways to manage cyber risks, vendors are delivering scalable, hosted solutions that provide continuous monitoring and expert support. This shift toward service-oriented models enhances accessibility for mid-sized firms and accelerates adoption across diverse industry verticals in Latin America.

COMPETITION OVERVIEW

The Latin America fraud detection and prevention market is highly competitive, featuring a mix of global technology providers, regional specialists, and emerging fintech-focused startups. As digital transactions continue to rise across banking, insurance, and e-commerce, the demand for advanced fraud management solutions has intensified, prompting both established players and new entrants to innovate rapidly. Global firms such as IBM, Experian, and LexisNexis leverage their technological depth and international best practices to serve large financial institutions, while regional players offer tailored solutions that address specific fraud typologies prevalent in local markets.

In addition to traditional software vendors, a growing number of AI-driven fraud detection startups are disrupting the landscape by offering agile, cloud-native platforms optimized for real-time transaction monitoring and behavioral analytics. This diversification has led to increased competition not only in pricing but also in solution customization, deployment speed, and integration capabilities. Moreover, regulatory shifts emphasizing data protection and financial transparency have heightened the need for compliant, adaptable fraud control mechanisms. As a result, market participants must continuously refine their offerings, invest in local expertise, and enhance threat intelligence capabilities to maintain a competitive edge in this dynamic environment.

RECENT MARKET DEVELOPMENTS

- In February 2024, IBM Security expanded its operations in São Paulo by opening a dedicated cybersecurity innovation lab focused on developing AI-driven fraud detection models tailored to Latin American banking and digital commerce ecosystems.

- In May 2024, Experian launched a new digital identity verification platform specifically designed for the Brazilian market, enhancing its ability to support fintechs and neobanks in securely onboarding customers while reducing fraud risks.

- In July 2024, LexisNexis Risk Solutions partnered with a leading Mexican bank to deploy an enterprise-wide fraud analytics system that leverages network analysis and behavioral profiling to detect sophisticated financial crimes in real time.

- In September 2024, a global fraud detection vendor entered into a joint venture with a Colombian cybersecurity firm to deliver localized fraud prevention services to regional banks and digital lenders, strengthening its presence in Andean markets.

- In November 2024, a major U.S.-based cybersecurity company acquired a Chilean startup specializing in mobile fraud detection, aiming to integrate its proprietary technology into existing fraud prevention suites for enhanced protection across mobile banking applications in Latin America.

MARKET SEGMENTATION

This Latin America fraud detection and prevention market research report is segmented and sub-segmented into the following categories.

By Platform

- Web-Based Platform

- App-Based Platform

By Purchase Type

- Subscription-Based Purchase Model

- One-Time Purchase Model

By Deployment Mode

- Cloud-Based Deployment

- On-Premise Deployment

By Country

- Brazil

- Mexico

- Argentina

- Chile

- Rest of Latin America

Frequently Asked Questions

1. What is driving the rapid expansion of the Latin America fraud detection and prevention market?

The Latin America fraud detection and prevention market is expanding due to surging e-commerce, digital payments, and mobile banking, which have increased fraud risks and prompted businesses to invest in advanced analytics, AI, and cloud-based security solutions to protect transactions and build consumer trust

2. Which barriers are currently holding back the Latin America fraud detection and prevention market?

Barriers for the Latin America fraud detection and prevention market include high implementation costs, lack of integrated cybersecurity strategies, fragmented regulations, and limited resources, especially among fintechs and smaller enterprises

3. Where do the best opportunities for growth exist in the Latin America fraud detection and prevention market?

Opportunities in the Latin America fraud detection and prevention market lie in AI-powered fraud analytics, partnerships with localized security providers, expanding digital payment protection, and serving high-growth sectors like e-commerce and mobile banking

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 1600

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com