Global Light Beer Market Size, Share, Trends,& Growth Forecast Report – Segmented By Production (Micro-Brewery, Macro-Brewery, Chips, Craft Brewery and Others), Package (Metal Can, PET Bottle, Glass, and Others), Distribution Channel (On-Trade, Hypermarkets & Supermarket, Convenience Store, Specialty Stores, and Others), And Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) - Industry Analysis (2025 to 2033)

Global Light Beer Market Size

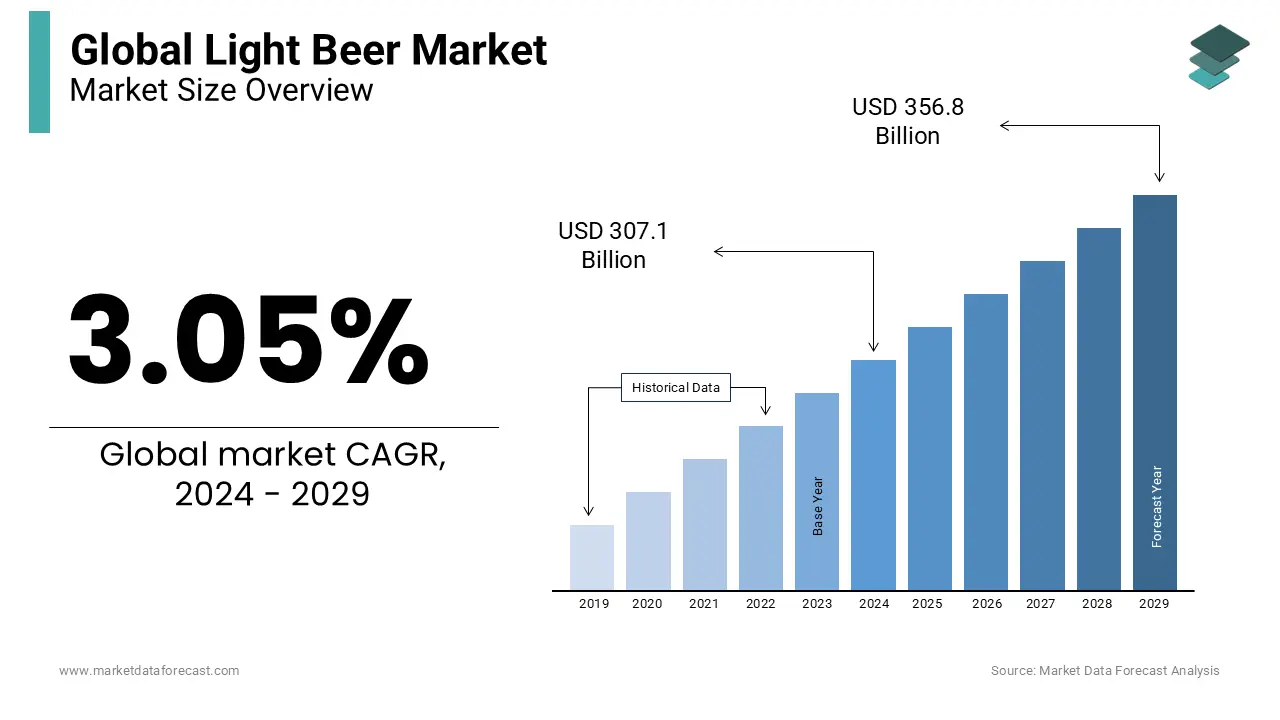

The global light beer market size was calculated to be USD 307.01 billion in 2024 and is anticipated to be worth USD 402.33 billion by 2033 from USD 316.37 billion In 2025, growing at a CAGR of 3.05% during the forecast period. North America held the largest share of the worldwide light beer market

Beer is one of the most consumed alcoholic beverages all around the world. A light beer market is prepared with malt cereal, hops and water. Light beer has long been shunned by craft brewers who consistently refused to sacrifice flavor on low calorie altars.

MARKET DRIVERS

The growth of the global light beer market is majorly driven by the rising concern for health conditions among people around the world, and the increasing need to eat healthy food and follow a healthy lifestyle.

Factors such as cultural change and the penetration of Western culture have influenced consumer behavior and propensity for light beer. In addition, changes in the social lifestyle of the working class and increased disposable income, especially in developing countries in Asia, have driven the growth of the market. Beer consumption among 18–25-year-old has increased significantly. The approximate number of middle-aged and older men remains about the same, while the number of women is increasing. According to the United Nations, the global youth population is expected to grow 7% in 2025 to 1.3 million, which in turn is expected to lead the global light beer market.

The trend of women to drink is accepted around the world due to financial independence and the increase in social and professional gatherings, which is fuelling the demand for light beer products and contributing to the global market growth. According to surveys, an estimated 75% of the countries worldwide have noticed an increase in the trend of women drinking. Internal distribution channels, such as cafes, clubs, restaurants and bars, offer specialty cocktails including beers and light beers. On-premises distribution channels have seen increased demand due to rising disposable income and changing consumer preferences. The increasing number of restaurants and bars has led to increased consumption of these beverages, as people increasingly prefer drinking at home to drinking at home. As health awareness among drinkers rises, light beer is getting more popular than soft drinks, which is propelling the growth of the global light beer market.

On the other hand, the development of naturally sweet and healthy alcoholic beverages offers new opportunities in the coming years. The market is growing with the growing concern for health conditions among people around the world, increasing the need to eat healthy food and follow a healthy lifestyle. Also, factors such as a growing elderly population are likely to spur the growth of healthy beverages and are prompting beverage industry manufacturers to invest more and more in different types of beverages. Factors such as the growing elderly population are expected to drive the growth of healthy beverages and are prompting manufacturers in the beverage industry to increasingly invest in different types of beverages.

The growth of the world's youth population, changes in consumer preferences and an increase in local distribution channels are driving the growth of the global light beer market. Rapid urbanization along with changing customer trends will take advantage of the light beer market trends. The introduction of new technologies to improve beer performance and quality will diffuse the expansion of the brewing industry during the planned schedule. Increased public relations activities coupled with strong marketing strategies are also estimated to strengthen the growth of the global light beer market. The growing beer-consuming population and the social perception of beer, considered beer, are among the main drivers of growth in the global light beer market. However, as the economy comes in after the financial crisis, the beer market is expected to expand. Additionally, investments in innovative breweries and a smart marketing approach are likely to provide beneficial opportunities for brewers in the future. However, the high demand for light beer, especially among emerging countries in the Asia Pacific region, will provide new opportunities for the development of the light beer market in the future. The business is estimated to accelerate during the conjecture period as light beer is part of the culture in some Western countries and beer festivals become a social tradition.

As consumers learn more about the benefits of beer consumption, the light beer market is likely to see further growth during the foreseen period. The ever-younger population and the number of female drinkers directly drive the global light beer market. As more women become socially and professionally equated with men, this is leading to an increase in the market for light beer. When people's disposable income increases, they can drink high-quality premium beers, as well as traditional beers and rums. The increasing number of restaurants and bars has led to increased consumption of these beverages, as people increasingly prefer drinking at home to drinking at home. Brewers and distributors around the world are working to attract millennials famous for binge drinking. Along with rising obesity rates and rising lifestyle disorders, growing health concerns will drive demand for light beer varieties.

MARKET RESTRAINTS

The decline in demand for light beer in developing countries is one of the main constraints on the world market. Volatility in raw material prices and high taxes and excise duties on imported and local beers are hampering the growth of the global light beer market. Factors such as strict government regulations, climate change, high taxes in various regions, social and demographic norms, and the emergence of cheaper alternatives are also estimated to hamper beer sales in the future.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

3.05% |

|

Segments Covered |

By Production, Package, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

MillerCoors, ABInBev, Pabst, Heineken USA, Carlsberg, Diageo-Guinness, Suntory Beer, Asahi Breweries, Arpanoosh and Others. |

SEGMENTAL ANALYSIS

Global Light Beer Market Analysis By Production

Based on the production, the macro-brewery segment dominated the market and held for a share of 64.1% of the worldwide light beer market in 2023. The macro-brewery segment is also expected to register a healthy CAGR during the forecast period owing to the extensive marketing campaigns and brand recognition of the manufacturers. Anheuser-Busch InBev, Heineken and SABMiller are popular macro-brewery companies and have extensive distribution networks across the world. The macro-breweries have been receiving strong competition from the craft breweries from the last few years, however, the companies that operate in the macro-breweries have been investing significant amounts and efforts in product innovation, marketing strategies and mergers and acquisitions to hold the domination in the light beer market.

The craft brewery segment is expected to grow at the highest CAGR among all the segments in the global market during the forecast period. This is due to a 5% increase in craft beer production in the US in the first half of 2019. The United States and Europe accounted for 86% of all craft breweries in the world. This is mainly due to the increased preference of consumers for craft beer.

Global Light Beer Market Analysis By Package

Based on packaging, the PET bottle segment accounted for 38.88% of the global light beer market share in 2023 and emerged as the top performer in the worldwide market. This is because several brewers have started to switch from glass bottles to PET containers due to their good physical properties, such the high design. PET bottles are lightweight, shatter-resistant and contain recyclable properties. Popular brewery brands such as Carlsberg Group and Constellation Brands have been offering their light beer products in PET bottles. The demand for PET bottles is growing significantly in the emerging markets such as the Asia-Pacific and Latin American regions as these are considered as a cost effective packaging solutions for light beer products in these regions, which is one of the key factors propelling the expansion of the PET segment.

The metal can and glass segments held substantial share of the global light beer market in 2023 and are anticipated to grow at a steady CAGR during the forecast period.

Global Light Beer Market Analysis By Distribution Channel

Based on the distribution channel, the hypermarket and supermarket segment captured a share of 40.8% of the worldwide market in 2023. Hypermarkets and supermarkets have the ability to offer a wide selection of beverages to consumers during their routine shopping trips, which is primarily boosting the growth of the segment in the global market. Additionally, increasing urbanization, increasing working-class populations, and competitive prices augment the popularity of hypermarkets in developed and developing countries. Popular supermarket chains such as Walmart, Carrefour and Tesco have extensive retail networks and drive huge sales of light beer products in terms of volume.

REGIONAL ANALYSIS

North America led the light beer market worldwide market in 2023 and recorded the largest share in terms of revenue, with almost two-fifths of the global light beer market and is estimated to maintain the spot of top performer throughout the forecast period. The growth of the North American market is majorly driven by the growing social media and events/local promotions.

However, the Asia Pacific region is foreseen to record the highest CAGR during the forecast period. This is due to the limited access to light beer distribution channels. Asia-Pacific has the chances to showcase the domination in the global market during the forecast timeline as the sales for the light beer products among the Asia-Pacific countries have grown significantly in the recent years. The requirements for light beer have developed notably in the developing countries of the Asia Pacific. Changes in lifestyle are driving the market mainly for light beer in the region.

Europe is a notable regional market for light beer and held for a substantial share of the global light beer market in 2023 and is anticipated to register a prominent CAGR during the forecast period. Latin America is one of the other important regional markets and significant developments in the light beer market are likely within the forecast period.

KEY PLAYERS IN THE GLOBAL LIGHT BEER MARKET

Companies playing a major role in the global light beer market include MillerCoors, ABInBev, Pabst, Heineken USA, Carlsberg, Diageo-Guinness, Suntory Beer, Asahi Breweries and Arpanoosh.

DETAILED SEGMENTATION OF THE GLOBAL LIGHT BEER MARKET INCLUDED IN THIS REPORT

This research report on the global light beer market has been segmented and sub-segmented based on production, package, distribution channel and region.

By Production

- Micro-Brewery

- Macro-Brewery

- Chips

- Craft Brewery

- Others

By Package

- Metal Can

- PET Bottle

- Glass

- Others

By Distribution Channel

- On-Trade

- Hypermarkets & Supermarket

- Convenience Store

- Specialty Stores

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions

1. What are the key drivers of the Light Beer Market in the world?

The Light Beer Market is predicted to register a CAGR of 3.2% during forecast

2. Which region holds the largest market share for the Light Beer Market?

Heineken, ABInBev and Carlsberg are some of the key market players in the global Light Beer Market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]