Global Meal Replacement Market Size, Share, Trends, & Growth Forecast Report - Segmented By Product (Ready to Drink, Powder, and Protein Bar), Distribution Channel (Online Store, Offline Store, Supermarkets, Specialized Stores and Others), And Region (North America, Europe, APAC, Latin America, Middle East And Africa) – Industry Analysis From 2025 To 2033

Global Meal Replacement Market Size

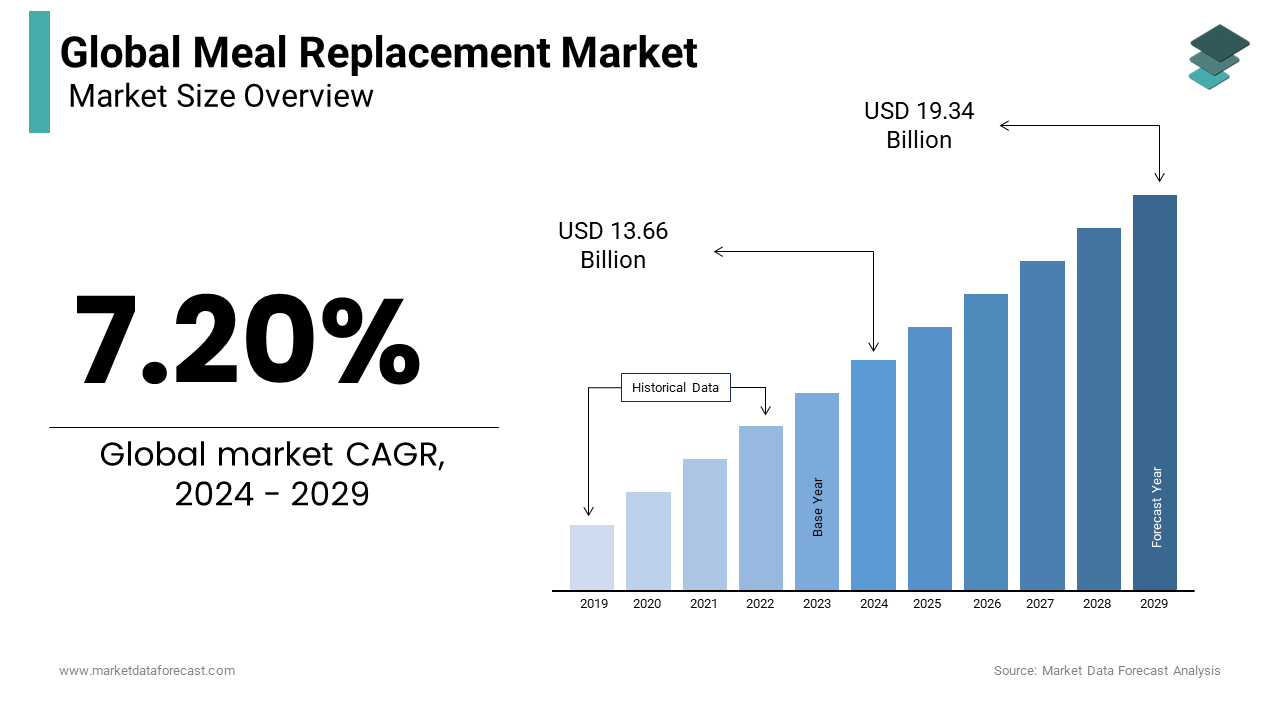

The global meal replacement market size was expected to be worth US$ 13.66 billion in 2024 and is anticipated to be worth USD 25.53 billion by 2033 from USD 14.64 billion In 2025, growing at a CAGR of 7.20% during the forecast period.

Meal replacement products are a wide variety of foods, including nutritious energy bars, soups, drinks, and powders. Meal replacement products should replace meals with nutritionally balanced foods or shakes. This product is rich in fiber and protein and is specifically intended to replace solid foods and provide the desired amount of protein and other nutrients. Meal replacement products are gaining popularity mainly among consumers who are on special diets that control weight or blood sugar levels due to diabetes. Additionally, the market is targeting consumers with time constraints, busy lifestyles, and busy work schedules, helping them to replace meals with healthier and more nutritious products than traditional snacks. Meal replacement products are commercially available in the form of bars or borders that help reduce the burden of preparing meals. It contains the same vitamins and minerals as solid foods along with the dough. The most interesting part of meal replacement is that there is no weight loss. It just balances the nutrient content in the body. In addition to bodybuilders, everyday workers and busy programmers often enjoy this diet.

MARKET DRIVERS

The growing consumer demand for easy-to-prepare nutritional products is primarily driving the growth of the global meal replacement market.

Rapid urbanization, busy lifestyles, changing healthy food habits, and other aspects are key factors driving the global meal replacement market. Consumers are becoming more health conscious and looking for practical and more nutritious food. The rapid growth of the e-commerce segment will also aid market growth by offering a variety of protein shakes and protein bars for online purchases. Numerous meal replacement products have been used in weight loss therapy and have become widespread in recent years.

Increased health awareness and growing disposable income are complimenting the growth rate of the global market. With the increasing popularity of bottled energy drinks, the meal replacement beverage industry is also anticipated to be revitalized. The growing consumer preference for ready-to-drink foods is gaining support from packaging, digital marketing, and celebrities. Many providers of nutritional products and specialty meal replacements have also established their businesses, seeing favorable growth potential and increased consumer response. The need to replace whole foods with readily available and equivalent nutritional value fuels the growth of the global market for meal replacement products. The availability of products with various combinations of nutrients is also supposed to meet demand.

Consumers are looking for meal replacement bars and shakes as a healthy alternative to fast food. The propensity for vegan food is foreseen to foster innovation in the meal replacement market. Major manufacturers, such as Soylent, produce plant-based meals to meet the growing demand for vegetarian options. General mealtimes have been shortened due to busy lifestyles and the increasing number of working women in the urban population. There is an increasing prevalence of diabetes, obesity, and other health problems among consumers. So, to address these health issues, people turn to meal replacement nutrition. Organic foods are preferred over meals in a rapidly changing life. As an alternative to meals, organic foods are a new trend in the industry due to their high nutritional value. The increasing call for organic products as meal replacement products increases business growth. Humans can develop nutritional deficiencies if too many meals are replaced with shakes or protein. Given the high demand for alternatives, the lucrative growth opportunities created in the global market with meal replacement products have paved the way for many well-known food and beverage companies to enter the nutritional food industry in recent years. People's busy lifestyles have altered their eating habits, and as a result, the demand for mobile nutrition has increased over the years.

MARKET RESTRAINTS

Health-related issues such as digestive problems and expensive products are hampering the global meal replacement market compared to others.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

7.20% |

|

Segments Covered |

By Product, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Amway Corporation, Abbott Labs, General Mills Inc., Bariatrix Europe, Mianxian Jintai Industrial Co. Ltd, Glaxo Smith Kline, Campbell Food Service Company, Sara Lee Foodservice, Herbalife Inc., and Blue Diamond Growers. |

SEGMENTAL ANALYSIS

Global Meal Replacement Market Analysis By Product

By product type, the Meal Replacement market is segmented into bars, powders, beverages, ready-to-drink bottles, and more. Meal replacement powders accounted for the largest share in 2020. A fast-paced lifestyle and easy storage of powdered products are foreseen to drive growth in this sector. Also, manufacturers offer free glass shakers with powder packets. The availability of different flavors is anticipated to attract more consumers with a focus on weight management and a healthy lifestyle. Ready-to-drink bottles are determined to have the fastest CAGR of 7.0% from 2024 to 2032. As bottled energy drinks become more popular, demand for meal-replacement beverages is also determined to increase. Protein bars have been one of the less popular meal replacements. These products are expensive compared to powdered and ready-to-drink foods.

Global Meal Replacement Market Analysis By Distribution Channel:

The meal replacement market based on distribution channels is segmented into supermarkets, online stores, specialized stores, etc. Huge offline distribution network leading the sale of meal replacement products through offline channels. Given that manufacturers have control over how and where to put their products in supermarket stores, this segment is estimated to maintain the number one market share during the forecast period. Many gym owners also sell substantial gym food supplies and offline sales are expected to increase. As e-commerce grows, it is easy for manufacturers to reach a wider audience with minimal cost. This has led manufacturers to create websites and sign contracts with major e-commerce platforms to drive online sales.

REGIONAL ANALYSIS

North America has a high growth rate in the global meal replacement market and is expected to grow at a significant rate as consumers become health-conscious and healthy consumption habits increase in the market. Demand in the US is likely to have a positive impact on growth as the global meal replacement market raises awareness of the nutritional benefits and health issues related to diabetes, obesity, the cardiovascular system, and others. The Asia Pacific region is projected to have the fastest CAGR of 8.3% from 2022 - 2027. Rapid urbanization, population growth, and awareness of the various nutritional requirements of developing countries, including China and India, accelerate growth. The main use of meal replacement products is for weight control. Therefore, many gym enthusiasts and fitness trainers recommend these products for effective weight loss. This is anticipated to boost regional market growth. Additionally, the growing e-commerce in the region is foreseen to accelerate sales of meal replacement products. Many manufacturers choose digital channels for advertising and reach out to undeveloped or physically impenetrable markets to improve market penetration. This is determined to have a positive impact on market growth. European countries are also contributing significantly to their market share, with increased awareness of the benefits of meal replacements. Major countries in Latin America, the Middle East, and Africa are determined to experience steady growth as manufacturers enter these markets through e-commerce.

KEY PLAYERS IN THE GLOBAL MEAL REPLACEMENT MARKET

Major key players in the global meal replacement market are Amway Corporation, Abbott Labs, General Mills Inc., Bariatrix Europe, Mianxian Jintai Industrial Co. Ltd, Glaxo Smith Kline, Campbell Food Service Company, Sara Lee Foodservice, Herbalife Inc., and Blue Diamond Growers.

RECENT HAPPENINGS IN THE MARKET

- In September 2019, Kraft Heinz partnered with Bailey's brand Diageo P.L.C. To launch the line of non-alcoholic coffee products, the portfolio includes ground coffee, ready-to-drink coffee, and a K-cup format with the flavor of Bailey's original Irish cream.

- In April 2019, Kraft Heinz acquired Primal Nutrition, a manufacturer of Primal Kitchen brand products. This acquisition complements the Kraft Heinz product portfolio. Primal's portfolio consists of sandwiches, sauces, condiments and dressings.

- In June 2019, Abbott launched Zone Perfect Keto, a line of products made with 5% carbohydrates, 75% fat and 20% protein. This product line provides a balanced combination of macronutrients in a way that helps the body enter ketosis to burn fat.

DETAILED SEGMENTATION OF THE GLOBAL MEAL REPLACEMENTS MARKET INCLUDED IN THIS REPORT

This research report on global meal replacements has been segmented and sub-segmented based on product, distribution channel and region.

By Product

- Ready to Drink

- Powder

- Protein Bar

By Distribution Channel

- Online Store

- Offline Store

- Supermarkets

- Specialized Stores

- Others

By Region

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Frequently Asked Questions

1. What are some emerging trends in the meal replacement market?

Emerging trends include the development of personalized meal replacement solutions, the using natural and plant-based ingredients, and the incorporation of innovative delivery formats like ready-to-drink shakes.

2. How do meal replacements differ from protein shakes?

While protein shakes primarily focus on delivering protein, meal replacements are designed to replace a whole meal and provide a broader spectrum of nutrients, including carbohydrates, fats, and vitamins.

3. What are the key nutritional components in meal replacement products?

Meal replacement products usually contain a mix of proteins, carbohydrates, healthy fats, vitamins, and minerals to offer a well-rounded and balanced nutritional profile.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com