Global Medical Cannabis Market Size, Share, Trends & Growth Forecast Report By Species (Indica, Sativa and Hybrid), Derivatives (Cannabidiol (CBD), Tetrahydrocannabinol (THC) and Others), Application (Cancer, Arthritis, Epilepsy and Migraine), Route of Administration & Region (North America, Europe, Latin America, Asia Pacific, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Medical Cannabis Market Size

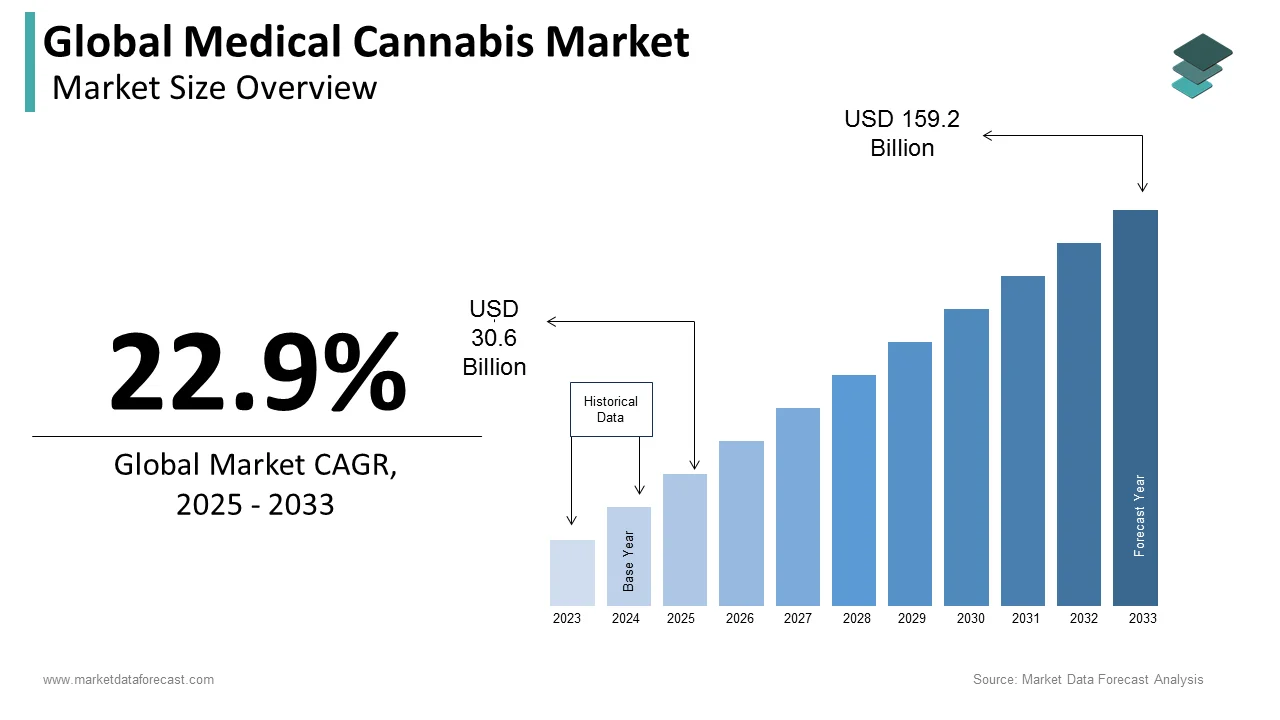

The size of the global medical cannabis market was worth USD 24.9 billion in 2024. The global market is anticipated to grow at a CAGR of 22.9% from 2025 to 2033 and be worth USD 159.2 billion by 2033 from USD 30.6 billion in 2025.

The medical cannabis market is experiencing rapid growth globally, driven by increasing legalization, expanding medical research, and rising demand for alternative therapies. In particular, the Asia Pacific region is witnessing increased interest as countries like Thailand and Australia have moved forward with regulatory frameworks allowing the use of cannabis for medical purposes. Medical cannabis is being used to treat a range of conditions, including chronic pain, epilepsy, and nausea associated with chemotherapy, further driving market demand. The growth of the medical cannabis market is fueled by ongoing clinical trials exploring the efficacy of cannabis in treating a wider array of diseases, including neurological disorders and mental health conditions like anxiety and depression. However, regulatory challenges remain, as many countries still restrict or strictly control medical cannabis use. As more research validates its therapeutic benefits and governments loosen restrictions, the medical cannabis market is expected to expand significantly, with North America currently leading, followed by Europe and emerging markets in the Asia Pacific region.

MARKET TRENDS

Increasing Legalization and Regulatory Approvals

A key driver in the medical cannabis market is the expanding legalization and regulatory support for cannabis-based treatments worldwide. As of 2023, more than 40 countries have legalized medical cannabis to varying extents, allowing patients to use cannabis-based products for specific medical conditions. This includes countries in North America, Europe, and Asia-Pacific, where nations like Thailand and Australia have developed frameworks allowing medical cannabis for treatments like chronic pain, epilepsy, and nausea related to chemotherapy. This trend is expected to accelerate, with analysts projecting that countries across Asia-Pacific and Latin America could potentially adopt more permissive cannabis laws, boosting the market. The increasing regulatory acceptance of cannabis for medical use is anticipated to push the market to grow rapidly in the coming years.

Rising Demand for Cannabis in Chronic Pain Management

Medical cannabis is increasingly used for chronic pain management as patients seek alternatives to opioids, which carry a high risk of addiction. Chronic pain conditions, including arthritis, neuropathic pain, and cancer-related pain, account for the majority of cannabis prescriptions. In a recent clinical survey, about 60% of medical cannabis users reported using it for chronic pain management. As the global burden of chronic pain increases, particularly in aging populations, cannabis is seen as a safer, non-addictive option compared to traditional painkillers. Governments and healthcare providers are increasingly supporting cannabis for pain relief, which is expected to be one of the fastest-growing segments in the medical cannabis market.

Innovation in Cannabis-Based Product Development

The medical cannabis market is evolving rapidly with a focus on innovation. Companies are developing new cannabis-derived products, including oils, capsules, sprays, and topical formulations, to provide more versatile treatment options. For example, CBD-infused products have gained popularity for their ability to treat a range of conditions, from anxiety to inflammation, without psychoactive effects. This innovation extends to personalized treatments, where cannabis products are tailored to the specific needs of patients with conditions such as epilepsy or multiple sclerosis. These developments not only offer more convenience and choice for patients but also improve the accessibility of cannabis treatments for a wider range of medical conditions.

MARKET DRIVERS

Growing Legalization and Government Support

The global expansion of medical cannabis legalization is a major driver of market growth. Over the last decade, more countries have developed legal frameworks to allow medical cannabis use, especially for treating chronic conditions like cancer, epilepsy, and multiple sclerosis. As of 2023, more than 40 countries have legalized medical cannabis in some form. This regulatory shift has unlocked access to cannabis treatments for millions of patients. In the Asia-Pacific region, Thailand became the first Southeast Asian country to legalize medical cannabis in 2018, followed by Australia and New Zealand, which are actively expanding their medical cannabis markets. This trend of legalization, especially in countries previously opposed to cannabis, is expected to continue, driving the market to expand rapidly.

Increasing Demand for Alternative Therapies in Chronic Pain Management

The rising use of medical cannabis for chronic pain management is a key factor driving market growth. As concerns over opioid addiction increase globally, many patients and healthcare providers are turning to cannabis as a safer, non-addictive alternative for managing chronic pain. Studies suggest that nearly 60% of medical cannabis prescriptions are for chronic pain conditions, including arthritis, neuropathic pain, and cancer-related pain. The growing recognition of cannabis as an effective pain management option, combined with the need to reduce opioid use, is expected to boost demand for medical cannabis over the next decade significantly.

Advancements in Cannabis-Based Pharmaceutical Products

Innovation in cannabis-based pharmaceutical products is rapidly expanding the market. Companies are developing diverse product forms, including oils, capsules, sprays, and topical applications, to meet the needs of patients with varying medical conditions. For example, CBD-based products have gained popularity as non-psychoactive treatments for conditions like anxiety, epilepsy, and inflammation. The development of personalized cannabis treatments for specific diseases, such as multiple sclerosis or epilepsy, is also driving the market. By 2022, the global market for cannabis-based pharmaceuticals was estimated to be worth over $1.2 billion, and this number is projected to grow as more advanced formulations enter the market.

MARKET RESTRAINTS

Complex and Inconsistent Regulatory Frameworks

One of the biggest restraining factors in the medical cannabis market is the complex and inconsistent regulatory landscape across different countries. While more than 40 countries have legalized some form of medical cannabis, the regulatory frameworks vary widely, making it challenging for companies to operate internationally. In countries like Japan and South Korea, for example, medical cannabis use is strictly controlled, and obtaining approvals for cannabis-based products is difficult. These regulatory barriers slow market entry and expansion as companies face challenges in complying with different legal standards and obtaining licenses. The lack of harmonized global regulations also limits cross-border trade in cannabis-based products, constraining the market’s growth potential.

Limited Clinical Evidence and Medical Acceptance

Despite growing legalization, medical cannabis still faces resistance from parts of the medical community due to limited large-scale clinical trials and standardized dosing guidelines. Many healthcare providers remain hesitant to prescribe cannabis, citing the need for more robust scientific evidence on its long-term efficacy and safety. A 2021 survey found that only 30% of doctors in the United States felt comfortable prescribing medical cannabis due to these concerns. Additionally, the lack of standardized dosing protocols complicates treatment plans, making it harder for physicians to adopt cannabis therapies widely. This skepticism within the medical field continues to restrain the growth of the medical cannabis market.

High Costs of Medical Cannabis Treatments

The high cost of medical cannabis, particularly in countries where it is newly legalized or highly regulated, serves as a significant barrier for patients. In many regions, medical cannabis is not covered by insurance, forcing patients to bear out-of-pocket costs. For instance, in Germany, where medical cannabis is legal, patients can spend up to €2,000 per year on cannabis treatments if insurance coverage is not approved. These high costs limit access to medical cannabis, particularly for lower-income patients, and hinder widespread adoption. The lack of insurance reimbursement in several countries adds to the financial burden on patients, further restraining the market.

MARKET OPPORTUNITIES

Expansion of Legalization in Emerging Markets

The ongoing expansion of medical cannabis legalization in emerging markets presents a significant growth opportunity. Countries in regions like Latin America, Africa, and parts of Asia-Pacific are beginning to adopt more permissive regulatory frameworks for medical cannabis. For example, Thailand became the first Southeast Asian country to legalize medical cannabis in 2018. Since then, other nations in the region, such as Malaysia and South Korea, have initiated discussions on regulatory reforms. With governments in these regions exploring the potential economic and therapeutic benefits of cannabis, the global market is expected to grow rapidly. By 2029, the Asia-Pacific medical cannabis market is expected to achieve a CAGR of over 25.13%, driven by new legislation in emerging markets. This expanding legal landscape will open up new opportunities for producers, distributors, and healthcare providers.

Development of Cannabis-Derived Pharmaceuticals

The pharmaceutical sector represents a major growth opportunity in the medical cannabis market. With advancements in research, cannabis-derived drugs such as Epidiolex (approved for treating epilepsy) are paving the way for the development of more cannabis-based pharmaceuticals. Companies are increasingly investing in clinical trials to develop formulations targeting specific medical conditions, including multiple sclerosis, epilepsy, and cancer-related symptoms. By 2022, the global cannabis-based pharmaceutical market was worth over $1.2 billion, and this segment is expected to expand as more drugs receive regulatory approval. As these treatments gain acceptance in mainstream medicine, they will create a new, high-value segment in the medical cannabis market.

Growing Consumer Awareness and Acceptance

Increasing awareness about the therapeutic benefits of medical cannabis is another key opportunity driving market growth. Patients and healthcare providers are becoming more informed about the potential uses of cannabis for treating chronic pain, neurological disorders, and mental health conditions. A 2021 survey showed that nearly 70% of patients who had tried medical cannabis reported positive outcomes for managing chronic pain and anxiety. This growing consumer awareness, coupled with media coverage and advocacy efforts, is reducing the stigma associated with cannabis use. As public acceptance continues to grow, the demand for medical cannabis is expected to rise, particularly in regions where it is becoming more accessible.

MARKET CHALLENGES

Regulatory Uncertainty and Complexities

One of the biggest challenges facing the medical cannabis market is the ongoing regulatory uncertainty in many regions. Although legalization is expanding, each country has its own complex and often restrictive rules surrounding the production, distribution, and sale of medical cannabis. For instance, while medical cannabis is legal in countries like Germany and Canada, many regions in Asia, Africa, and Latin America have inconsistent or unclear regulations. This regulatory fragmentation makes it difficult for companies to scale operations globally. Furthermore, changes in political leadership can lead to sudden shifts in cannabis policy, as seen in countries that have reversed or stalled cannabis legalization efforts. This inconsistent regulatory environment complicates compliance and increases operational risks for businesses entering the medical cannabis space.

Stigma and Social Acceptance Issues

Despite the growing body of research supporting the therapeutic benefits of medical cannabis, the stigma surrounding its use remains a major challenge. Cannabis has long been associated with recreational drug use, and in many cultures, especially in Asia and the Middle East, cannabis is still viewed negatively. A global survey found that over 30% of respondents in conservative regions oppose the use of cannabis, even for medical purposes. This social stigma affects not only patient acceptance but also the willingness of healthcare professionals to prescribe cannabis. Additionally, governments in certain regions are hesitant to fully embrace medical cannabis due to concerns about misuse and the societal perception of cannabis, limiting market growth potential.

Limited Research and Standardization

The lack of extensive clinical research and standardized dosing guidelines poses a significant challenge to the widespread adoption of medical cannabis. While there is increasing evidence supporting the benefits of cannabis for certain conditions, large-scale clinical trials are still limited. This gap in research makes it difficult for healthcare providers to confidently prescribe cannabis, as there are no universal standards for dosage, efficacy, or long-term safety. Moreover, the cannabis plant contains hundreds of cannabinoids, each with different effects, and there is still insufficient knowledge about how these compounds interact with various medical conditions. A report from 2021 indicated that only 22% of doctors in the U.S. and Europe felt they had enough information to prescribe medical cannabis effectively. This lack of standardization and research slows the integration of cannabis into mainstream medicine.

IMPACT OF COVID-19 ON THE MEDICAL CANNABIS MARKET

The COVID-19 pandemic had a mixed impact on the medical cannabis market. On the one hand, disruptions in supply chains and restrictions on production affected the availability of cannabis products in some regions. Countries with strict lockdowns, such as Canada and the U.S., faced temporary shortages, which slowed market growth. However, on the demand side, the pandemic increased consumer interest in alternative therapies, including medical cannabis, for managing anxiety, chronic pain, and stress-related conditions. In fact, several surveys indicated that over 30% of patients using medical cannabis during the pandemic reported an increased frequency of use to manage mental health issues. Furthermore, many countries classified medical cannabis as an essential service during lockdowns, allowing dispensaries to remain operational. This shift accelerated the adoption of online sales and delivery models, which are expected to continue growing post-pandemic, enhancing the market’s accessibility and overall expansion.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Species, Derivatives, Application, End User, Route of Administration & Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter's Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

BOL Pharma, Tilray, Medreleaf Corporation, Aurora Cannabis, Canopy Growth Corporation, Insys Therapeutics, Inc., Aphria, Inc., MGC Pharmaceuticals Limited, G.W. Pharmaceuticals, plc. |

SEGMENTAL ANALYSIS

By Species Insights

The indica segment dominated the medical cannabis market, accounting for 45.8% of the global market share in 2023. Indica is widely preferred for its therapeutic effects, particularly in managing chronic pain, insomnia, and anxiety. The sedative and relaxing properties of Indica strains make them popular among patients who seek relief from conditions that affect sleep and mood. This strain is often recommended for evening use due to its calming effects. The growth of the indica segment is further driven by the rising demand for non-opioid pain management options and the increasing number of patients using cannabis for anxiety and sleep disorders. As more healthcare providers recognize Indica's benefits in chronic conditions, the demand for this strain is likely to grow further.

The sativa segment is another promising segment in the worldwide market. Sativa strains are known for their energizing and uplifting effects, making them suitable for daytime use. Sativa strains are typically used to manage conditions such as depression, fatigue, and attention deficit disorders. Sativa’s stimulating effects help improve focus and mood, which is why it is often preferred by patients who need daytime symptom relief without sedation. The demand for Sativa is also increasing among patients managing chronic fatigue or nausea, especially those undergoing chemotherapy.

Hybrid strains combine characteristics of both Indica and Sativa. The hybrid segment is the fastest-growing segment and is expected to grow at a CAGR of 18.4% over the forecast period. These strains are customized to provide balanced therapeutic effects, allowing patients to target specific symptoms with more precision. Hybrid strains are often tailored to individual patient needs, offering a combination of pain relief, mood enhancement, and energy stimulation. The customization potential and versatility of hybrid strains are driving their popularity, especially as personalized medicine becomes more integral to cannabis-based treatments.

By Derivatives Insights

CBD is the dominant derivative in the medical cannabis market. The CBD segment accounted for 55.8% of the global market share in 2023. CBD is non-psychoactive and has gained significant popularity for its therapeutic benefits without the “high” associated with THC. It is widely used to treat conditions such as anxiety, epilepsy, chronic pain, and inflammation. In 2018, the FDA approved Epidiolex, a CBD-based drug for epilepsy, highlighting the increasing acceptance of CBD in medical treatments. Rising consumer awareness, along with research supporting CBD’s efficacy in managing neurological disorders and mental health conditions, is expected to boost its demand further globally.

The THC segment is estimated to register a CAGR of 16.44% over the forecast period. The growth of the segment is primarily supported by ongoing research into its applications for chronic conditions such as multiple sclerosis, neuropathic pain, and glaucoma. THC is the psychoactive component of cannabis. THC is primarily used for pain management, nausea control (particularly in chemotherapy patients), and appetite stimulation in patients with AIDS or cancer. Despite its psychoactive effects, THC is valued for its potent therapeutic properties, particularly for patients with severe pain or in palliative care. However, THC’s psychoactive nature has led to stricter regulatory control compared to CBD, limiting its broader market adoption.

Medical Cannabis Market Analysis By Application

The cancer led the market and captured 40.4% of the global market share in 2023. Medical cannabis, particularly THC, is widely used to alleviate chemotherapy-induced nausea, vomiting, and pain and to stimulate appetite in cancer patients. Cannabis-based treatments provide relief for patients undergoing aggressive cancer therapies, and ongoing research is expanding its application in palliative care. According to recent clinical trials, around 25-30% of cancer patients using medical cannabis report improved quality of life during treatment. The growth of the cancer segment is driven by increased cannabis acceptance in palliative care and the expansion of legalization across more countries. With rising cancer incidences globally, the demand for alternative treatments like medical cannabis is expected to continue growing.

The arthritis segment holds about 25.4% of the global market share in 2023, as more patients turn to medical cannabis for pain and inflammation relief. Cannabidiol (CBD) is particularly effective in treating symptoms of arthritis without the psychoactive effects of THC, making it a popular option for patients seeking non-addictive, long-term treatment options. As the global population ages and the prevalence of arthritis rises, the demand for cannabis-based therapies is expected to increase. The growing research into cannabis as a safer alternative to traditional nonsteroidal anti-inflammatory drugs (NSAIDs), which often have adverse side effects with prolonged use is further contributing to the expansion of the arthritis segment in the global market.

The epilepsy segment is expected to register a CAGR of 19.5% over the forecast period. This growth is driven by ongoing clinical trials and increased medical acceptance of cannabis for neurological disorders. The approval of cannabis-based drugs such as Epidiolex, which uses cannabidiol (CBD) for the treatment of epilepsy, especially rare forms like Dravet syndrome and Lennox-Gastaut syndrome, has driven significant growth in this segment. Clinical studies have shown that CBD reduces the frequency and severity of seizures in patients with epilepsy.

The migraine segment accounts for a considerable share of the worldwide market as medical cannabis has become a recognized option for patients who suffer from chronic migraine pain. Both THC and CBD are used to treat migraine symptoms, with patients often reporting reduced pain intensity and frequency of attacks. A study in 2021 indicated that nearly 40% of migraine sufferers who used cannabis-based therapies experienced significant relief.

By End-User Insights

The pharmaceutical segment occupied 60.8% of the global market share in 2023. Pharmaceutical companies are heavily investing in the development of cannabis-derived drugs for a range of conditions, including epilepsy, chronic pain, and cancer-related symptoms. The approval of cannabis-based pharmaceuticals, such as Epidiolex (CBD-based) for epilepsy, has driven this segment’s growth. These companies are leading efforts to standardize formulations, develop clinical trial protocols, and secure regulatory approvals for cannabis-based therapies. The rising demand for cannabinoid-based medications and ongoing research into their therapeutic applications are propelling the expansion of the pharmaceutical segment. As more cannabis-derived drugs receive regulatory approval, the pharmaceutical sector is expected to continue leading the market.

The R&D centers segment is likely to register at 17.9% over the forecast period owing to the increasing government support for cannabis research, the establishment of dedicated cannabis research centers, and collaborations with pharmaceutical companies. Research and Development (R&D) centers are critical to advancing the understanding of medical cannabis. R&D centers, including academic institutions and private research organizations, are focusing on the therapeutic potential of cannabinoids for treating conditions such as multiple sclerosis, neurodegenerative diseases, and mental health disorders. The growing number of clinical trials and scientific studies aimed at validating the efficacy of cannabis-based treatments has bolstered this segment.

By Route of Administration Insights

The oral solutions and capsules segment had 35.3% of the global market share in 2023. This route of administration is popular due to its ease of use, precise dosing, and non-invasive nature. Patients prefer oral solutions and capsules for managing chronic conditions such as epilepsy, pain, and anxiety, where long-term, consistent dosing is required. Medications like Epidiolex, a CBD-based oral solution for epilepsy, have driven the popularity of this route. The growth of the oral solutions and capsules segment is further driven by ongoing pharmaceutical advancements and increased patient demand for controlled, long-lasting relief without psychoactive effects. As more cannabis-based oral medications gain regulatory approval, this segment is expected to maintain its leadership.

The vaporizers segment is the fastest-growing segment in the medical cannabis market and is likely to grow at a CAGR of 18.8% over the forecast period. Vaporizers offer an alternative to smoking, providing patients with immediate symptom relief while reducing the harmful effects of inhaling combusted materials. This route is gaining popularity among patients with conditions like chronic pain, where fast-acting relief is necessary. Vaporizers also allow for better control over dosage compared to smoking. The demand for vaporizers is particularly high in North America and Europe, where patients are seeking safer inhalation methods for cannabis use. Innovations in vaporizer technology, including portable and user-friendly designs, are driving the growth of this segment.

REGIONAL ANALYSIS

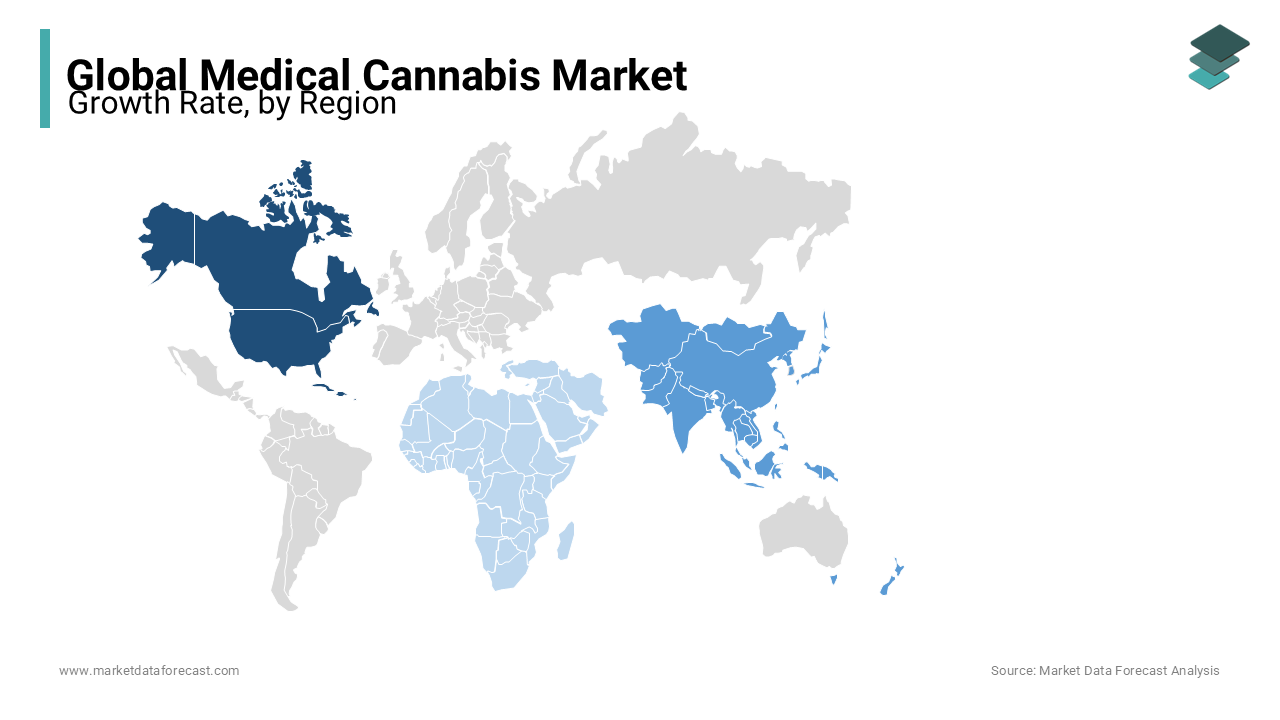

North America dominated the global medical cannabis market, accounting for 45.1% of the global market share in 2023. This leadership is driven primarily by the widespread legalization of medical cannabis in the United States and Canada. In the U.S., medical cannabis is legal in over 36 states, with over 3.5 million registered medical cannabis patients. Canada fully legalized cannabis for medical use in 2001 and later for recreational use in 2018, positioning it as a leading player in the market. The growth of the medical cannabis market in North America is also fueled by strong patient demand, ongoing research, and the availability of a wide range of cannabis-derived products. Additionally, advancements in cannabis-derived pharmaceuticals and increased investment in research are driving growth. Both countries have well-established cannabis industries, with robust regulatory frameworks ensuring product safety and quality, further boosting the market's expansion.

Europe is the second-largest medical cannabis market worldwide. Germany leads the region, accounting for more than 30% of the European market, with strong government support for medical cannabis use. Germany legalized medical cannabis in 2017, and by 2022, there were over 100,000 registered patients receiving cannabis-based treatments. Other key countries in Europe include Italy, the Netherlands, and the United Kingdom. Ongoing legislative developments and increasing acceptance of cannabis-based treatments among healthcare professionals propel the European market growth. However, regulatory frameworks vary significantly between countries, creating a fragmented market that can pose challenges for companies trying to scale operations across the continent. Nonetheless, the growing use of cannabis for pain management and palliative care is expected to drive growth in this region.

The Asia Pacific medical cannabis market is still in its early stages, but it is projected to grow rapidly, with a CAGR of 25.13% from 2024 to 2033, the highest of any region. Countries such as Thailand and Australia are leading the way in the legalization and regulation of medical cannabis. Thailand became the first Southeast Asian country to legalize medical cannabis in 2018, and its government has actively promoted the cultivation and export of cannabis products. Australia legalized medical cannabis in 2016, and by 2022, over 100,000 patients had access to cannabis-based treatments. China and India remain cautious, with highly restrictive policies, although there is growing interest in the potential benefits of medical cannabis. As more countries in the region explore cannabis reforms, the Asia Pacific market is expected to expand significantly, driven by rising awareness of cannabis therapeutic potential and increased investment in R&D.

Latin America holds a considerable share of the global market, with countries like Uruguay and Colombia playing a pioneering role in cannabis legalization. Uruguay was the first country in the world to fully legalize cannabis in 2013, including for medical use. Colombia followed suit by legalizing medical cannabis in 2015 and has since become a key player in the global cannabis supply chain, particularly in cultivating cannabis for export. Brazil is another important market, with medical cannabis legalized in 2019 and the number of registered patients steadily rising. The CAGR for Latin America is forecasted at 18%, supported by favorable growing conditions, low production costs, and increasing government interest in developing the medical cannabis industry. The region’s potential as a low-cost producer of cannabis is drawing international investments, positioning Latin America as a key supplier to other regions.

The Middle East and Africa represent the smallest share of the global medical cannabis market. However, the region is witnessing gradual growth as countries explore cannabis legalization for medical purposes. South Africa is the leading market in Africa, having legalized medical cannabis in 2017, with an emerging industry focused on cultivation and exports. Other African countries, such as Lesotho and Zimbabwe, have also legalized the cultivation of medical cannabis, aiming to position themselves as major suppliers in the global cannabis market. In the Middle East, countries like Israel are driving market growth. Israel has been a global leader in cannabis research for decades and has an established medical cannabis program with over 100,000 registered patients. The CAGR for the Middle East and Africa is projected to be 13%, driven by increasing governmental interest in developing the industry, particularly for export opportunities and scientific research.

KEY MARKET PLAYERS

Companies playing a prominent role in the global medical cannabis market include BOL Pharma, Tilray, Medreleaf Corporation, Aurora Cannabis, Canopy Growth Corporation, Insys Therapeutics, Inc., Aphria, Inc., MGC Pharmaceuticals Limited and G.W. Pharmaceuticals, plc.

TOP 3 PLAYERS IN THE MARKET

Curaleaf Holdings, Inc.

Curaleaf is recognized as the world's largest cannabis company by revenue. In 2021, it became the first cannabis company to surpass $1 billion in annual revenue, reporting $1.35 billion in trailing 12-month revenue. The company's extensive operations span 19 U.S. states, encompassing cultivation, processing, and distribution facilities, as well as numerous dispensaries. Curaleaf's growth is driven by strategic acquisitions and a broad product portfolio, catering to a wide patient base seeking medical cannabis treatments.

Green Thumb Industries Inc.

Green Thumb Industries (GTI) is a leading player in the medical cannabis sector, with a reported revenue of $750 million. Headquartered in Chicago, Illinois, GTI operates across multiple states, focusing on the cultivation, manufacturing, and distribution of cannabis products. The company's commitment to quality and patient-centric approaches has solidified its position in the market.

Aurora Cannabis Inc.

Aurora Cannabis, based in Alberta, Canada, is a significant contributor to the global medical cannabis market. The company has expanded its reach through strategic acquisitions and a focus on research and development. Aurora's diverse product offerings and commitment to advancing medical cannabis applications have reinforced its standing in the industry.

TOP STRATEGIES USED THE MARKET PARTICIPANTS

Mergers & Acquisitions (M&A)

Mergers and acquisitions are a key strategy for market leaders to enhance their competitive advantage and expand their reach. One of the most notable M&A deals in the medical cannabis market was the $4 billion merger between Tilray and Aphria in 2021, which created the world's largest cannabis company by revenue. This consolidation allowed the newly formed entity to strengthen its market position in North America and Europe, improve operational efficiencies, and scale its production capacity. Similarly, Canopy Growth’s $345 million acquisition of Supreme Cannabis in 2021 enabled the company to expand its premium cannabis offerings and broaden its consumer base. These strategic acquisitions help companies gain a stronger foothold in the rapidly expanding medical cannabis sector.

Geographic Expansion

Expanding into new regions is a critical growth strategy as more countries legalize medical cannabis. Aurora Cannabis has strategically expanded its presence in Europe, setting up production and distribution facilities in Germany, Poland, and the UK, where demand for medical cannabis is growing. The company is leveraging its global footprint to cater to an increasing number of patients seeking cannabinoid-based treatments. Curaleaf, a major U.S. player, has entered the European market through its acquisition of EMMAC Life Sciences, allowing it to become a dominant force in the European medical cannabis industry. These expansion strategies enable companies to access new patient markets and benefit from favorable regulatory shifts worldwide.

Product Innovation & Research

Leading medical cannabis companies focus on research and development (R&D) to introduce innovative products that improve patient outcomes. GW Pharmaceuticals, acquired by Jazz Pharmaceuticals for $7.2 billion, developed Epidiolex, the first FDA-approved cannabis-derived drug for treating epilepsy. This breakthrough established a new medical standard for cannabis-based treatments, paving the way for further research. Tilray is also investing in pharmaceutical-grade cannabis formulations to address chronic pain and neurological disorders. By focusing on R&D, companies strengthen their credibility within the healthcare industry and differentiate themselves in the competitive cannabis market.

COMPETITIVE LANDSCAPE

The global medical cannabis market is highly competitive, driven by increasing legalization, evolving regulatory frameworks, and growing consumer demand for alternative treatments. Companies compete based on product innovation, geographic expansion, strategic partnerships, and mergers & acquisitions to establish a strong foothold in the industry. North America, particularly the United States and Canada, leads the market due to widespread legalization and well-developed distribution channels. Companies such as Canopy Growth, Tilray, Aurora Cannabis, and Curaleaf dominate the space through extensive cultivation, research, and retail operations.

Product differentiation and research & development (R&D) play a crucial role in gaining a competitive edge. Firms like GW Pharmaceuticals (acquired by Jazz Pharmaceuticals) have pioneered pharmaceutical-grade cannabis-based medications, such as Epidiolex, which received FDA approval for epilepsy treatment. Other companies focus on new delivery methods such as vaporizers, edibles, and capsules to cater to diverse patient needs.

Additionally, international expansion is a key strategy, with companies entering emerging markets in Europe, Asia-Pacific, and Latin America where medical cannabis legalization is progressing. Despite opportunities, regulatory hurdles, pricing pressures, and supply chain challenges create significant barriers. As competition intensifies, market leaders continue investing in R&D, branding, and strategic collaborations to sustain growth.

RECENT HAPPENINGS IN THE MARKET

- In May 2024, Green Thumb Industries (GTI) entered the Virginia medical cannabis market by opening its first cultivation facility and dispensary in the state. This move enables GTI to capitalize on the growing demand for medical cannabis in newly legalized markets.

- In April 2024, Tilray completed its acquisition of HEXO Corp, a Canadian cannabis producer. This acquisition increased Tilray’s cultivation capacity, further consolidating its leadership in both medical and recreational cannabis markets across North America.

- In February 2024, GW Pharmaceuticals (Jazz Pharmaceuticals) received FDA approval to expand the use of Epidiolex for treating Tuberous Sclerosis Complex (TSC). This approval strengthens GW’s leadership in the cannabis-based pharmaceutical sector.

- In January 2024, Trulieve Cannabis Corp opened 10 new medical cannabis dispensaries in Florida, bringing its network to over 150 locations. This expansion further solidified Trulieve’s position as a leading medical cannabis provider in the state.

- In March 2023, Canopy Growth Corporation announced the divestiture of its retail operations across Canada to concentrate on its premium medical cannabis products. This move was part of a strategic effort to reduce operational costs and enhance profitability in the medical segment.

- In September 2023, Aurora Cannabis expanded its presence in the European market by signing an exclusive distribution agreement with a major pharmaceutical distributor in Germany, aiming to capitalize on the growing demand for medical cannabis in Europe’s largest market.

- In November 2023, Cronos Group announced the successful production of cannabinoids through fermentation technology in collaboration with Ginkgo Bioworks. This innovative method allows Cronos to lower production costs, improving its competitive position in the global market.

- In July 2023, Curaleaf Holdings completed its acquisition of Tryke Companies, expanding its footprint across key states, including Nevada, Utah, and Arizona. This acquisition bolstered Curaleaf’s production capabilities, allowing the company to better serve its medical cannabis patients.

- In October 2023, Organigram Holdings Inc. extended its partnership with British American Tobacco (BAT) to accelerate the development of new cannabis-infused products, including beverages and edibles, targeted at both the medical and wellness markets.

- In August 2023, Tilray (Aphria) launched a new line of medical cannabis-infused beverages in Canada designed to help patients manage insomnia and chronic pain. This product diversification strategy reflects Tilray’s efforts to offer a broader range of consumption options to medical cannabis users.

MARKET SEGMENTATION

This research report on the global medical cannabis market has been segmented and sub-segmented based on species, derivatives, applications, end users, route of administration, and region.

By Species

- Indica

- Sativa

- Hybrid

By Derivatives

- Cannabidiol (CBD)

- Tetrahydrocannabinol (THC)

- Others

By Application

- Cancer

- Arthritis

- Epilepsy

- Migraine

By End-User

- Pharmaceutical Industry

- Research and Development Centers

- Others

By Route of Administration

- Oral Solutions and Capsules

- Smoking

- Vaporizers

- Topicals

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions

Which region accounted for the largest revenue share for the medical cannabis market?

North America is likely to account for the largest revenue share for the global market during the forecast period.

At what CAGR, the medical cannabis market is projected to grow during the forecast period?

The medical cannabis market is projected to grow at a CAGR of 22.9% during the forecast period.

Who are the key players in the medical cannabis market?

BOL Pharma, Tilray, Medreleaf Corporation, Aurora Cannabis, Canopy Growth Corporation, Insys Therapeutics, Inc., Aphria, Inc., MGC Pharmaceuticals Limited, GW Pharmaceuticals, plc., are the keyplayers in the medical cannabis market.

How big is the medical cannabis market?

The global medical cannabis market is expected to reach USD 159.2 Billion by 2033.

What are the factors that driving the medical cannabis market growth?

Key factors that are driving the medical cannabis market are increasing in geriatric population, growing prevalence of chronic diseases and other medical disorders fuels the market growth.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com