Global Medical Scheduling Software Market Size, Share, Trends & Growth Forecast Report By Software, Type (Scheduling software, Patient communication software, Invoice/Billing software, Insurance management software & others), End-User & Region (North America, Europe, Asia-Pacific, Latin America, Middle East & Africa), Industry Analysis From 2025 to 2033.

Global Medical Scheduling Software Market Size

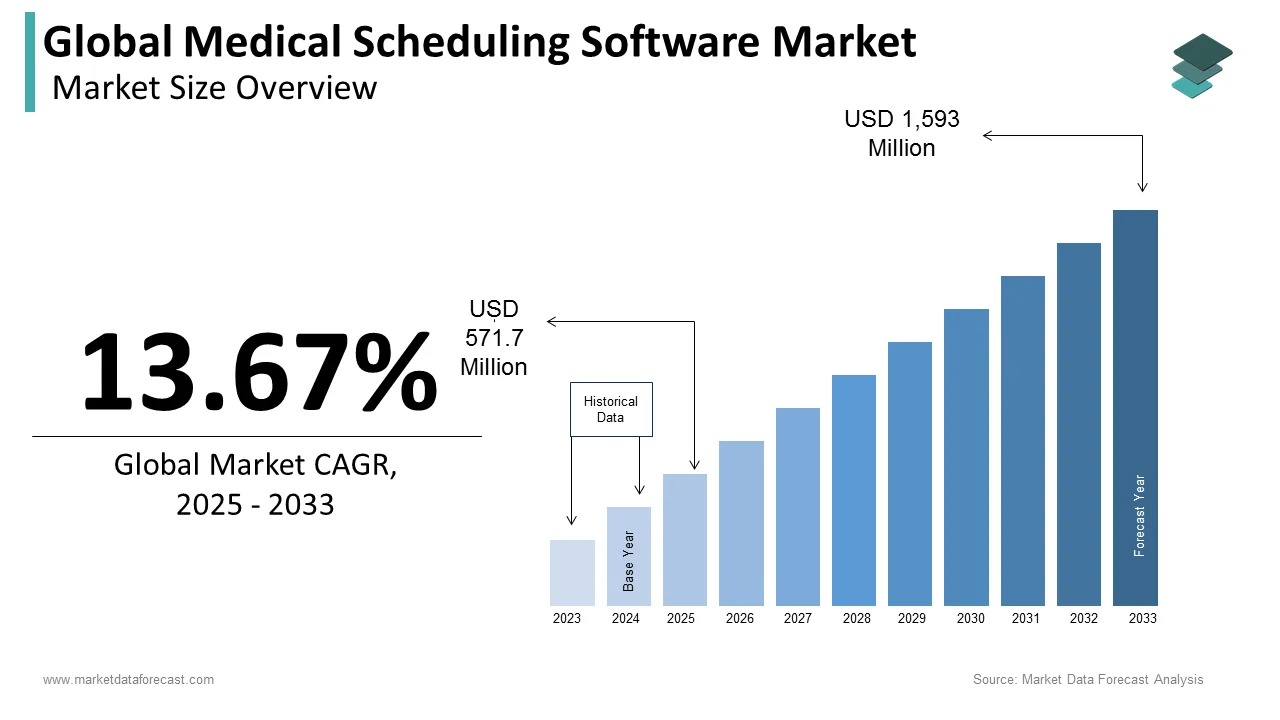

The global medical scheduling software market size was valued at USD 503 million in 2024 and the global market is estimated to be worth USD 571.7 million in 2025 and is projected to reach a valuation of USD 1,593 million by 2033. it is predicted to register a CAGR of 13.67% from 2025 to 2033.

Today, the IT sector plays an immense role in contributing various applications for the medical industry. This software enables the user to plan all inappropriate work periods. It also helps monitor schedule timings and notifies them accordingly. Medical scheduling software ensures that reminders and notifications are sent via e-mail or SMS. The web-based platform provides feasibility for the users. It accurately offers various benefits for the application, and this software handles customer service centers where they provide 24/7 services for the customers. It customizes the timings and appointments, which reduces pressure on the management. It sets hassle-free booking solutions in hospitals and clinics.

MARKET DRIVERS

Growing Demand for Healthcare Services Worldwide

The healthcare industry is growing rapidly. Factors such as population growth, increasing chronic disease prevalence and aging demographics are accelerating the need for healthcare services. The same growth can be seen in the growing number of patients seeking medical care and scheduling appointments with healthcare professionals. In such situations, medical scheduling software can potentially help healthcare professionals manage tasks such as streamlining appointment scheduling and reducing wait times, which can further improve patient access to care. The benefits associated with using medical scheduling software for healthcare professionals, such as the automation of appointment scheduling, sending appointment reminders to patients, and managing cancellations and rescheduling, are another major factor that boosts the adoption and contributes to market growth. This trend is likely to fuel in the coming years due to the rising demand for healthcare services and the increasing need for healthcare professionals to optimize their operations and improve patient outcomes and support the medical scheduling software market growth.

Cost savings associated with medical scheduling software for healthcare professionals support the market growth. Time and money can be saved for healthcare professionals by automating appointment scheduling, reducing administrative workload, and improving staff productivity by using medical scheduling software. Medical scheduling software further helps healthcare professionals to offer improved patient experience by offering self-service appointment scheduling and online appointment reminders. Such factors eventually result in the increasing adoption of medical scheduling software and propel the market growth.

Technological advancements are further contributing to the growth of the medical scheduling software market. The recent technological advancements have helped the medical scheduling software to see several advancements such as the integration with other healthcare IT platforms such as EHR, telehealth platforms and mobile apps. These integration possibilities of medical scheduling software have resulted in the increased adoption of this software by healthcare professionals and resulted in market growth.

In addition, the growing awareness among healthcare professionals and people regarding the availability of various software developments in the healthcare industry worldwide favors the medical scheduling software market growth. The growing patient population suffering from various diseases visiting hospitals fuels the market's growth rate. In addition, the increasing prevalence of providing effective treatment for patients and the decreasing availability of staff members in the medical sector accelerate the medical scheduling software market growth. The shortage of physicians worldwide is impacting the market growth favorably. Association of America Medical Colleges (AAMC) studies stated that by the end of 2024, a shortage of 120,000 physicians might impact patient care globally.

Furthermore, growing awareness of IoT, the increasing patient population of chronic diseases and the growing aging population boost the growth rate of the medical scheduling software market. The growing utilization of smartphones and laptops, increasing adoption of cloud-based technology in the healthcare industry, and rising need to store high-capacity data further drive the market growth. Factors such as the growing aging population, increasing patient population of chronic diseases, rising emphasis on patient engagement solutions by healthcare professionals and the emergence of AI further aid the market growth.

MARKET RESTRAINTS

Resistance from healthcare organizations to implement new technology due to concerns about the cost, training, and potential disruptions to their existing workflows is one of the major factors hampering the medical scheduling software market. The shortage of skilled workforce to operate with the medical scheduling software, cyber threats and risks associated with using medical scheduling software further hinder the market growth. Lack of interoperability between different healthcare systems and software, privacy and security concerns associated with using medical scheduling software, and high costs associated with the implementation, maintenance, and upgrades of using the software impede the market growth. Poor awareness among healthcare organizations regarding the benefits of medical scheduling software is another significant roadblock to the growth rate of the market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Software, Type, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis; Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

TimeTrade, AdvancedMD, Inc., StormSource, LLC, MPN Software Systems, Inc., American Medical Software, Daw Systems, Inc., WellSky, Voicent Communications Inc., Yocale Network Corporation, and ByteBloc Software |

SEGMENTAL ANALYSIS

By Software Insights

The web-based segment had the leading share of the global market in 2024 and is expected to grow at a prominent CAGR during the forecast period. The accessibility and convenience of web-based solutions are majorly propelling segmental growth. The cost-effectiveness of web-based solutions compared to installed ones is another key factor driving segmental growth.

The installed segment is expected to witness healthy growth during the forecast period. The customization options, ability to provide greater control over their data, specific security requirements, and regulatory compliance of installed solutions majorly drive segmental growth.

By Type Insights

The scheduling software segment had the largest share of the medical scheduling software market in 2024 and the segmental domination is anticipated to continue throughout the forecast period owing to the growing demand to manage the flow of patients and promote effective treatment procedures. Factors such as the growing for efficient scheduling systems to optimize patient flow and provider utilization, the increasing number of advancements in technology, the rise of cloud-based solutions and the growing need to reduce appointment no-shows and improve patient satisfaction further boost the growth rate of the segment.

However, the insurance management software is also expected to show significant growth during the forecast period due to the rising need to manage proper insurance and claim all the insurance required because of the growing costs of healthcare settings. The growing complexity of insurance regulations and requirements, the increasing need for efficient and accurate claims processing, and the integration of insurance management software with other healthcare systems, such as EHRs and billing software, further fuel the segmental growth.

By End-User Insights

The hospital segment accounted for the most significant share of the global market in 2024 and is expected to grow at a promising CAGR during the forecast period. The growing demand for efficient patient scheduling and management systems to improve patient care, increasing to optimize healthcare provider utilization and reduce wait times, rising focus on patient-centric healthcare models that prioritize patient engagement and satisfaction and increasing need to comply with regulatory requirements and ensure data security contributes to the segmental growth.

The clinics segment is expected to grow at a steady pace during the forecast period owing to the growing need for efficient and accurate scheduling and appointment management and the rising adoption of EHRs and other healthcare technology solutions.

REGIONAL ANALYSIS

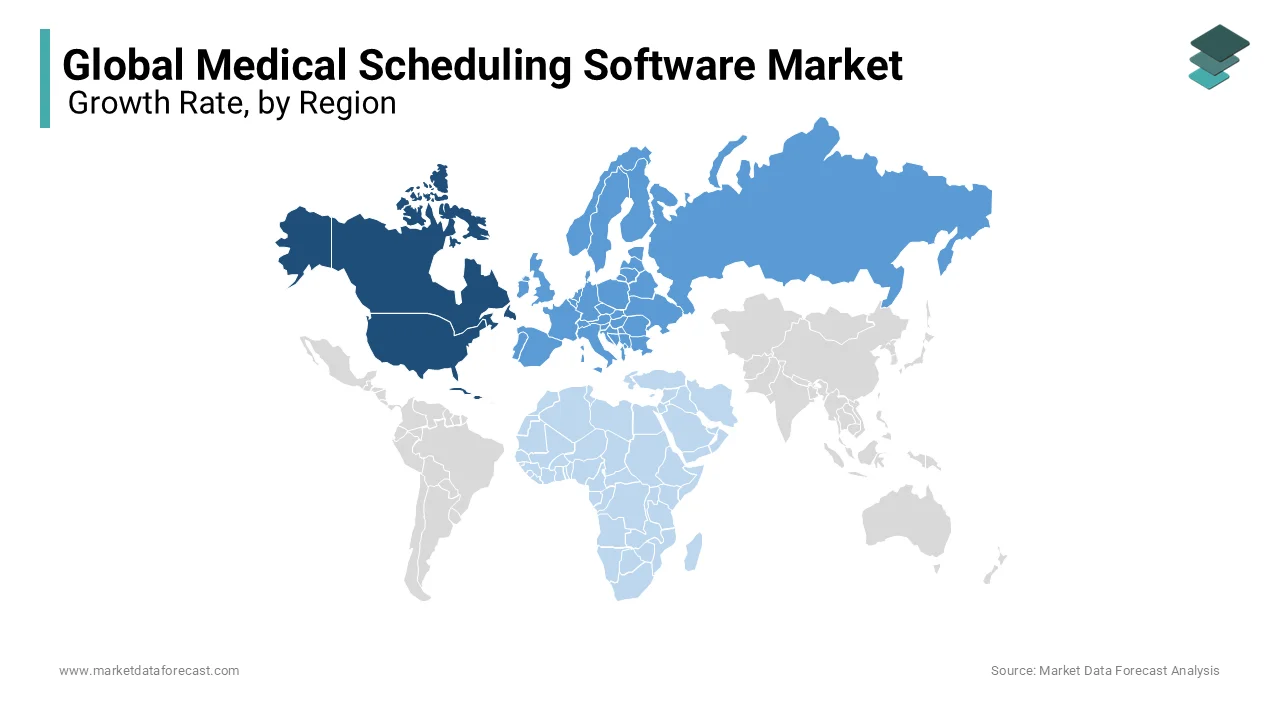

North America dominated the medical scheduling software market in 2024 and is expected to grow at a healthy CAGR during the forecast period. The presence of established healthcare infrastructure and advanced healthcare technology and the growing adoption of healthcare IT solutions, including medical scheduling software, primarily fuels the regional market growth. In addition, the growing demand for efficient healthcare delivery systems and patient-centric care and favorable government initiatives and policies to promote healthcare IT adoption contribute to the growth rate of the North American market. The U.S. held the major share of the North American market in 2024 and is expected to continue the domination during the forecast period owing to the presence of notable market participants such as Epic Systems Corporation, Allscripts Healthcare Solutions, and Cerner Corporation and the presence of a well-established healthcare IT industry.

Europe accounted for a substantial share of the global market in 2024 and is expected to grow at a notable CAGR during the forecast period. Factors such as the growing focus on patient engagement and satisfaction in healthcare, the presence of a well-established healthcare system, the rising aging population, favorable government initiatives and policies to promote healthcare IT adoption and increasing demand for efficient healthcare delivery systems and revenue cycle management primarily propel the European market growth. CompuGroup Medical, Cerner Corporation, and Agfa-Gevaert NV play the leading role in the European market. Germany is anticipated to hold the leading share of the European market during the forecast period.

APAC is a lucrative regional market for medical scheduling software worldwide and is expected to grow at the fastest CAGR during the forecast period. Rapidly developing healthcare infrastructure, increasing adoption of healthcare IT solutions and rising demand for efficient healthcare delivery systems in countries such as China and India majorly boost the medical scheduling software market in the Asia-Pacific region. In addition, the growing number of government initiatives to promote healthcare IT adoption and digitalization and growing healthcare spending and investments in healthcare technology fuel the growth rate of the regional market.

Latin America is expected to grow at a steady CAGR during the forecast period. The growing healthcare spending and investments in healthcare infrastructure and rising demand for healthcare IT solutions to optimize healthcare delivery systems and improve patient outcomes are anticipated to support the market growth in Latin America during the forecast period.

MEA is predicted to witness a sluggish growth rate in the coming years.

KEY MARKET PLAYERS

Companies such as TimeTrade, AdvancedMD, Inc., StormSource, LLC, MPN Software Systems, Inc., American Medical Software, Daw Systems, Inc., NueMD, WellSky, Voicent Communications Inc., Yocale Network Corporation, and ByteBloc Software are a few of the leading players in the medical scheduling software market.

RECENT HAPPENINGS IN THE MARKET

- In October 2022, National Medical Billing Services acquired MedTek, LLC, a leading provider of RCM solutions. Through this relationship, National Medical will be better able to serve ASCs, surgical practices, and anesthesia groups as a complete end-to-end supplier of outsourced revenue cycle solutions.

- In October 2022, Signify Health was purchased by CVS Health for an astounding $8 billion.

- In October 2022, Exer Urgent Care and Intent formed a strategic business partnership. With this cooperation, Intend's patient-centered user interface platform will be available at 29 of Exer's sites across Southern California, making it easier for patients to receive treatment and information before and after a visit.

- In July 2018, AdvancedMD Inc. acquired Nuesoft Technologies, Marietta, Georgia-based SaaS platform. This acquisition has simplified many tasks in the medical sector, especially in clinical and medical billing.

- In 2018, WellSky company expanded its customer-based applications and broadened its headquarters in Kansas with the latest technology.

MARKET SEGMENTATION

This research report on the global medical scheduling software market has been segmented and sub-segmented based on software type, end-user, and region.

By Software

- Web-Based Software

- Installed Software

By Type

- Scheduling Software

- Patient Communication Software

- Invoice/Billing Software

- Insurance Management Software

- Others

By End-User

- Hospitals

- Clinics

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

Which region had the major share in the global medical scheduling software market?

North America led the medical scheduling software market in 2024.

What is the growth rate of the medical scheduling software market?

The global medical scheduling software market is anticipated to be growing at a CAGR of 13.67% from 2025 to 2033.

What are the companies playing a leading role in the medical scheduling software market?

The global medical scheduling software market size was valued at USD 503 million in 2024.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com