Middle East and Africa Generic Drugs Market Size, Share, Trends & Growth Forecast Report By Type, Application, & Country (KSA, UAE, Israel, rest of GCC countries, South Africa, Ethiopia, Kenya, Egypt, Sudan, rest of MEA), Industry Analysis (2025 to 2033)

MEA Generic Drugs Market Size

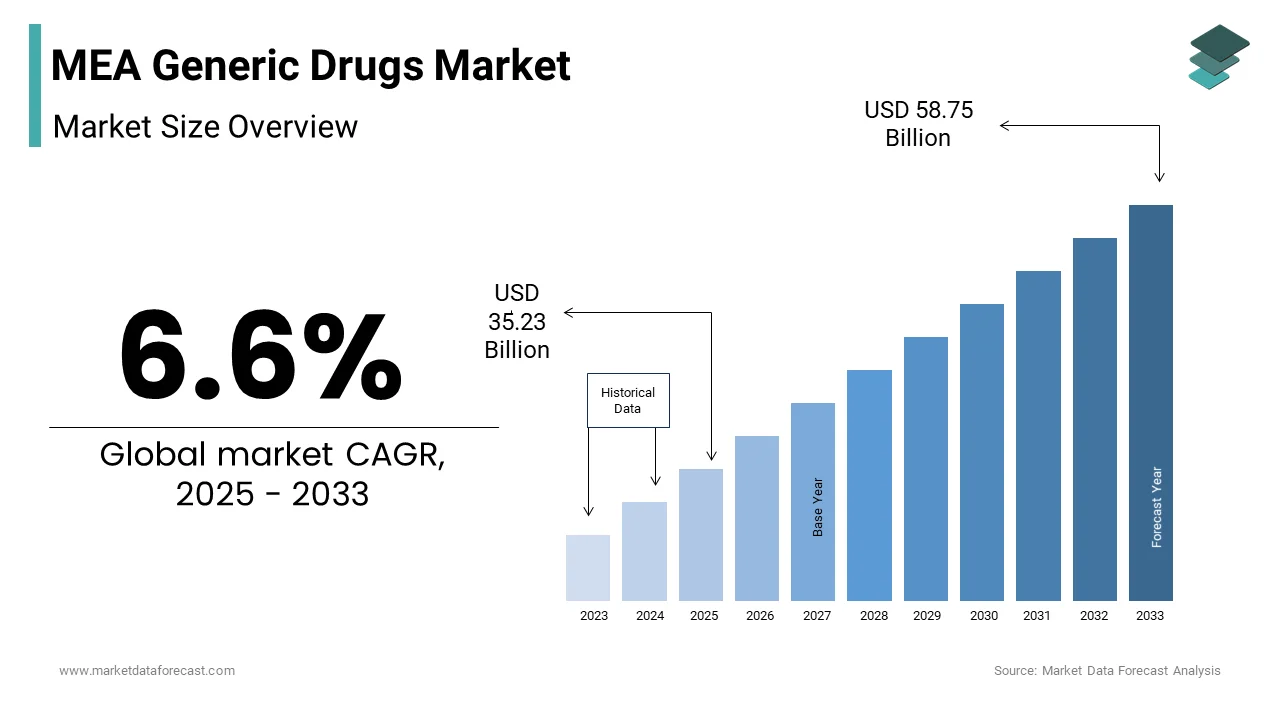

The generic drugs market size in the Middle East and Africa was valued at 33.05 billion in 2024. The regional market size is expected to be valued at USD 58.75 bn by 2033 from USD 35.23 bn in 2025, growing at a CAGR of 6.6% from 2025 to 2033.

MARKET DRIVERS

Medications with the same active component as brand-name drugs are known as generics. These pharmaceuticals also have the same therapeutic effect and are prescribed in the same dose, with the same quality, and are consumed and used in the same manner. Generic medications boost industry competitiveness, lowering generic medication prices and increasing the number of patients provided generic drugs by healthcare professionals. The generic drugs market in the MEA region is quite large. It is expected to continue to grow in the anticipated timeline, with the major aspects contributing to this growth such as rising chronic illness prevalence, rising elderly population, and rising healthcare spending. Every year, the number of chronic cases rises significantly in the central nervous system, cardiovascular diseases, oncology, diabetes, and various other diseases, increasing the number of people taking generic pharmaceuticals. Several demographic reasons drive the pharmaceutical business in the Middle East and Africa. These include quickly changing population dynamics, such as population growth, while concurrently aging populations. In addition, non-contagious chronic diseases and disorders, such as cardiovascular disease, obesity, and type-2 diabetes, have increased due to lifestyle changes.

MARKET RESTRAINTS

The existence of some significant players in this industry and emerging economics are some of the region’s driving forces. Outstanding is being used by vendors as a technique to save money, which will benefit generic drugs. Late-stage failures in the drug development process raise research and development expenses and reduce pharmaceutical companies' profit margins. As laws on the quality and safety of excipients and pharmaceuticals become more stringent, present manufacturing and quality assurance processes must be upgraded, increasing the overall manufacturing cost. Despite major investments in excipient and medication manufacture in recent years, market development is projected to be hampered by the need for large capital investments throughout the forecast period. Furthermore, growing regulatory stringency regarding medication and excipient approval during the projected period is expected to hinder the growth of the MEA generic drugs market.

REGIONAL ANALYSIS

Over the last decade, Africa’s pharmaceutical business has increased dramatically. This is largely due to urbanization, with more economically developed cities implying that more people can access medicines. Imports presently outnumber exports; thus, government policy encourages domestic drug manufacturing, the rise of non-communicable diseases, and rising healthcare costs. On the other hand, they are expected to draw international investment and expand domestic manufacturing capabilities. Morocco, Tunisia, and Algeria are three North African countries that have recently established pharmaceutical manufacturing enterprises. Other lifestyle disorders are also rising in the region, encouraging pharmaceutical company growth. Obesity-related and other cardiac illnesses are also on the rise. Although thrilled about the development prospects of a substantial compound annual growth rate, Middle Eastern generic producers confront stiff competition from multinational corporations. Academic and research institutes, R&D facilities, and advanced medical facilities proliferate in Israel. Therefore, biotech progress will almost certainly be a market driver in the future.

KEY MARKET PLAYERS

Some of the companies that are currently playing a dominant role in the MEA generic drugs market profiled in the report are Ranbaxy Laboratories, Ltd, Actavis, Mylan, Inc., Industries, Ltd., Dr. Reddy’s Laboratories, Par Pharmaceutical, Inc., Sandoz International GmbH, Hospira, Inc., Apotex, Inc., Watson Pharmaceuticals, Ltd. and Teva Pharmaceuticals.

MARKET SEGMENTATION

This Middle East and Africa generic drugs market report has been segmented and sub-segmented into the following categories

By Type

- Pure Generic Drugs

- Branded Generic Drugs

By Application

- The Central Nervous System (CNS)

- Cardiovascular

- Dermatology

- Oncology

- Respiratory

- Others

By Country

- KSA

- UAE

- Israel

- Rest of the GCC countries

- South Africa

- Ethiopia

- Kenya

- Egypt

- Sudan

- Rest of MEA

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 1600

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com