North America Aesthetic Medicine Market Size, Share, Trends & Growth Forecast Report By Product Type (Aesthetic Laser Devices, Energy Devices, Body Contouring Devices, Facial Aesthetic Devices, Aesthetic Implants, Skin Aesthetic Devices), Application (Anti-Aging and Wrinkles, Facial and Skin Rejuvenation, Breast Enhancement, Body Shaping and Cellulite, Tattoo Removal, Vascular Lesions, Scars, Pigment Lesions, Reconstructive, Psoriasis and Vitiligo), End User (Cosmetic Centers, Dermatology Clinics, Hospitals, Medical Spas and Beauty Centers), Distribution Channel (Direct, Retail), and Country (United States, Canada, Mexico, Rest of North America) Industry Analysis From 2025 to 2033.

North America Aesthetic Medicine Market Size

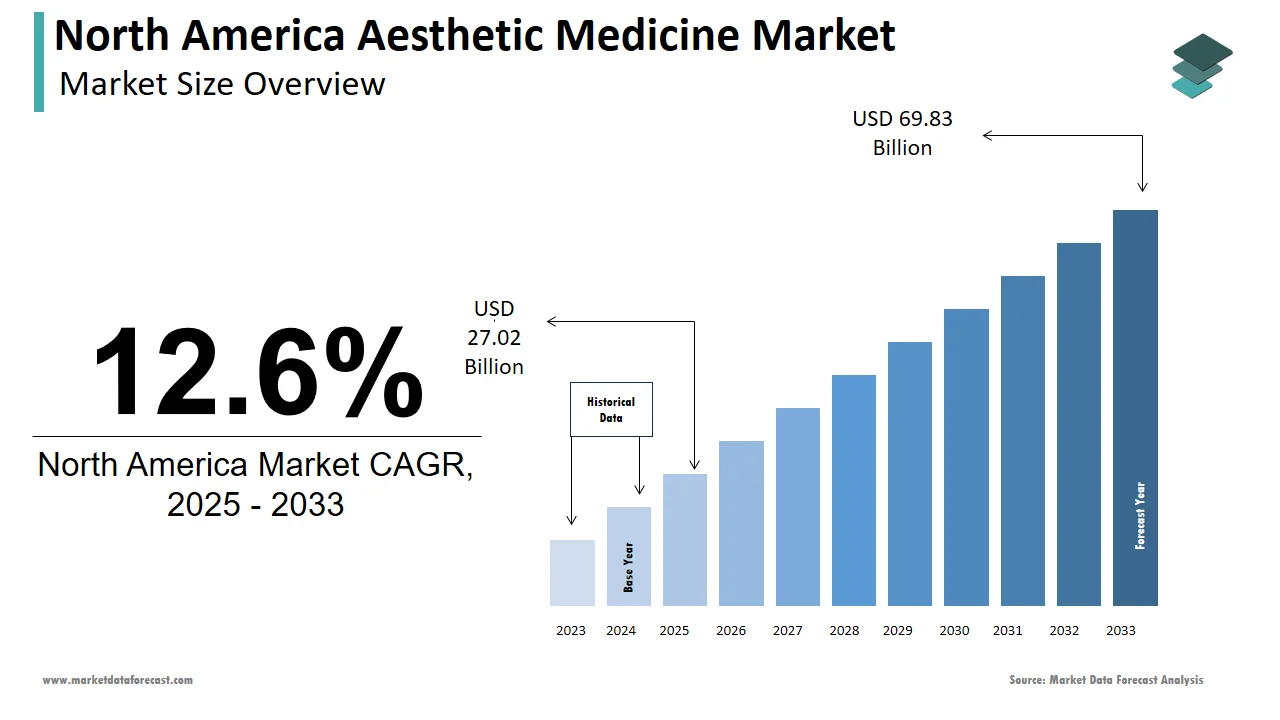

The size of the aesthetic medicine market in North America was valued at USD 24 billion in 2024. This market is expected to grow at a CAGR of 12.6 % from 2025 to 2033 and be worth USD 69.83 billion by 2033 from USD 27.02 billion in 2025.

The North America aesthetic medicine market involves a wide range of non-surgical and minimally invasive procedures designed to enhance physical appearance, improve skin health, and delay signs of aging. These treatments include injectables such as botulinum toxin and dermal fillers, laser therapies, chemical peels, body contouring procedures, and advanced skincare formulations.

With growing consumer awareness and acceptance of cosmetic interventions, the market has evolved beyond traditional plastic surgery into a more accessible, patient-friendly domain catering to both men and women across different age groups. The convergence of medical science and beauty has positioned North America as a key hub for aesthetic medicine, driven by evolving consumer preferences and expanding indications for therapeutic use.

MARKET DRIVERS

Rising Consumer Awareness and Acceptance of Non-Invasive Aesthetic Procedures

The most significant drivers fueling the growth of the North America aesthetic medicine market is the heightened awareness and growing social acceptance of non-invasive cosmetic treatments. Over the past decade, there has been a notable shift in perception, particularly among younger demographics, who increasingly view aesthetic procedures as routine components of personal grooming and self-care.

According to the American Academy of Facial Plastic and Reconstructive Surgery (AAFPRS), a significant portion of surveyed millennials expressed openness to undergoing injectable treatments like Botox or dermal fillers, compared to that in 2015. This change is largely attributed to increased visibility through digital media, influencer marketing, and celebrity endorsements that normalize aesthetic enhancements.

Furthermore, the rise of telemedicine platforms and virtual consultations has made it easier for individuals to explore treatment options without the stigma once associated with cosmetic procedures. This trend underscores how shifting societal attitudes and enhanced access are significantly propelling demand across the North American aesthetic medicine landscape.

Technological Advancements Enhancing Treatment Efficacy and Safety

Technological innovation has played a pivotal role in driving the expansion of the North America aesthetic medicine market by improving treatment outcomes, reducing recovery times, and enhancing procedural safety. Manufacturers and research institutions have continuously introduced next-generation devices and formulations that offer greater precision, longer-lasting results, and minimal side effects. For instance, the development of hyaluronic acid-based fillers with improved cross-linking technology has extended their duration from six months to over a year, as reported by Allergan in its 2023 clinical updates.

In addition, advancements in laser and radiofrequency systems have enabled more targeted skin rejuvenation with reduced risk of complications, making these procedures attractive even to first-time users. The U.S. Food and Drug Administration (FDA) has approved several novel energy-based devices in recent years, including picosecond lasers for pigmentation removal and high-intensity focused ultrasound (HIFU) for non-surgical facelifts.

MARKET RESTRAINTS

Regulatory Scrutiny and Compliance Challenges Across Procedures

A major restraint impacting the North America aesthetic medicine market is the increasing level of regulatory scrutiny surrounding the approval, administration, and advertising of aesthetic treatments. While the U.S. Food and Drug Administration (FDA) and Health Canada maintain rigorous standards for device clearance and pharmaceutical approvals, inconsistencies in state-level regulations create operational complexities for providers. In the United States, for example, licensing requirements for administering injectables vary significantly across states, with some mandating physician oversight while others allow trained nurse practitioners to perform procedures independently.

According to the National Council of State Boards of Nursing, at least 12 states revised their scope-of-practice laws between 2021 and 2023, affecting how aesthetic services can be legally delivered.

Moreover, the FDA has issued multiple warning letters to companies promoting unapproved cosmetic products or making misleading efficacy claims, which has led to product recalls and reputational damage. These regulatory hurdles, although essential for patient safety, pose financial and logistical challenges that may hinder market expansion, especially for smaller operators and independent med spas.

High Procedure Costs and Limited Insurance Coverage

Despite the rising popularity of aesthetic medicine, the high cost of many procedures remains a significant barrier to broader market penetration in North America. Unlike reconstructive or medically necessary surgeries, most aesthetic treatments are considered elective and therefore not covered by standard health insurance plans.

Even minimally invasive treatments such as Botox injections, which are often perceived as relatively affordable, depending on dosage and provider location. The American Society of Plastic Surgeons (ASPS) reports that in 2023, only 4% of aesthetic patients received partial reimbursement for procedures deemed to have functional benefits, such as scar revision or post-bariatric body contouring. The lack of insurance coverage limits accessibility for middle-income consumers, restricting the market primarily to affluent individuals. Moreover, economic fluctuations and inflationary pressures observed in 2023 and early 2024 have led to cautious spending behaviors, with some consumers opting for lower-cost alternatives or delaying treatments altogether.

MARKET OPPORTUNITIES

Expansion of Medical Tourism and Cross-Border Aesthetic Treatments

An emerging opportunity in the North America aesthetic medicine market lies in the growing trend of medical tourism, particularly within the United States and Canada, where high-quality healthcare infrastructure and certified professionals attract international patients seeking premium cosmetic treatments.

Like, over 1.2 million medical tourists visited North America in 2023, with a significant portion opting for aesthetic procedures such as liposuction, breast augmentation, and facial contouring. Canadian clinics have also seen an uptick in visitors from Europe and Asia, drawn by competitive pricing and shorter wait times compared to domestic markets.

To capitalize on this trend, leading aesthetic providers are offering bundled packages that include accommodation, transportation, and multilingual concierge services.

Integration of Artificial Intelligence and Digital Tools in Personalized Aesthetic Consultations

The integration of artificial intelligence (AI) and digital tools into aesthetic medicine is unlocking new opportunities for personalized patient engagement and treatment planning in North America. AI-powered simulation software now allows patients to visualize potential outcomes before undergoing procedures, enhancing decision-making and improving satisfaction rates. Companies such as Canfield Scientific and L’Oréal’s ModiFace have developed augmented reality (AR) applications that enable real-time previews of injectable effects, hair restoration results, and skin rejuvenation outcomes.

Besides, machine learning algorithms are being used to analyze patient history and recommend customized treatment regimens, optimizing long-term outcomes. Also, AI-assisted diagnostics are improving pre-treatment assessments, particularly in identifying contraindications and predicting adverse reactions.

MARKET CHALLENGES

Shortage of Trained Professionals and Standardization Gaps in Aesthetic Practice

One of the most pressing challenges facing the North America aesthetic medicine market is the shortage of adequately trained professionals and the lack of standardized educational pathways for practitioners entering the field. Unlike traditional medical specialties, aesthetic medicine often lacks formal accreditation programs, leading to variability in skill levels and treatment quality across providers.

According to the American Board of Aesthetic Medicine (ABAM), only limited share of physicians performing injectables or laser treatments have completed structured postgraduate training in aesthetic techniques. This gap is exacerbated by the rapid evolution of technologies and procedures, requiring continuous education to stay updated on best practices and safety protocols.

In response, organizations such as the American Society for Laser Medicine and Surgery (ASLMS) have called for stronger credentialing frameworks to ensure consistency in practitioner competence. Additionally, staffing shortages in med spas and dermatology clinics have led to reliance on nurse practitioners and physician assistants, some of whom receive limited hands-on instruction before performing complex procedures.

Increasing Incidence of Complications and Adverse Events from Unregulated Providers

Another critical challenge confronting the North America aesthetic medicine market is the rising incidence of complications and adverse events linked to unregulated or poorly supervised aesthetic treatments. With the proliferation of pop-up clinics, mobile injectors, and beauty salons offering cosmetic procedures without appropriate medical oversight, patient safety concerns have intensified.

The U.S. Food and Drug Administration (FDA) has issued multiple warnings about the risks associated with unauthorized cosmetic injectables, particularly those imported illegally from overseas sources. In response, several states have enacted legislation requiring clearer labeling, provider licensing, and facility inspections for aesthetic service providers.

However, enforcement remains inconsistent, allowing substandard practices to persist.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Product Type, Application, End User, Distribution Channel, and Region. |

|

Various Analyses Covered |

Global, Regional and Country-Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

United States, Canada, Mexico, and the Rest of North America. |

|

Market Leaders Profiled |

Mentor WorldWide LLC (a subsidiary of Johnsons & Johnsons) (U.S.), Cutera, Inc. (U.S.), Densply Sirona (U.S.), Institut Straumann AG (U.S.), Candela Corporation (U.S.), BioHorizons(U.S.), Cynosure, LLC (U.S.), Alma Lasers (U.S.), 3M (U.S), Sciton (California), and Others. |

SEGMENT ANALYSIS

By Product Type Insights

Aesthetic laser devices hold the largest share of the North America aesthetic medicine market, accounting for approximately 28% of total revenue in 2024. This dominance is primarily driven by the widespread adoption of laser-based treatments for skin rejuvenation, tattoo removal, and vascular lesion correction.

One key factor fueling this growth is the continuous innovation in laser technology, including the development of fractional CO₂ lasers and picosecond systems that offer enhanced precision and reduced recovery times. Also, rising consumer demand for non-invasive solutions with minimal downtime has further bolstered the popularity of laser treatments.

Moreover, the integration of laser therapy into combination treatment protocols—such as those involving injectables or chemical peels—has expanded their utility in comprehensive aesthetic care.

Energy-based devices are projected to be the fastest-growing segment in the North America aesthetic medicine market, with a compound annual growth rate (CAGR) of 12.6%. This rapid expansion is attributed to the increasing preference for non-surgical body contouring, facial tightening, and cellulite reduction procedures using radiofrequency (RF), ultrasound, and cryolipolysis technologies.

According to data from the International Society of Aesthetic Plastic Surgery (ISAPS), energy-based body sculpting procedures saw a notable year-over-year increase in 2023, particularly among patients seeking alternatives to liposuction. Devices such as high-intensity focused ultrasound (HIFU) and bipolar RF systems are gaining traction due to their ability to deliver visible results without incisions or extended recovery periods.

The growing availability of at-home and professional-grade energy devices has also contributed to market acceleration. In addition, leading manufacturers like Cutera and InMode have introduced modular platforms that allow practitioners to customize treatments based on individual patient needs, enhancing clinical efficacy and repeat usage.

By Application Insights

Anti-aging and wrinkle reduction remained the most popular application segment in the North America aesthetic medicine market, capturing 32.3% of total revenue in 2024. The aging population in the region, where individuals increasingly seek minimally invasive treatments to maintain a youthful appearance, is the main reason behind this dominance. Like, the number of Americans aged 50 and above surpassed 120 million in 2024, forming a substantial demographic for injectable treatments such as Botox and dermal fillers.

Data from the American Society of Plastic Surgeons (ASPS) indicates that in 2023, botulinum toxin injections remained the most commonly performed non-surgical cosmetic procedure in the U.S., with over 4.4 million treatments administered. Dermal fillers followed closely, with nearly 3 million procedures recorded in the same period. These figures underscore the high demand for wrinkle-reduction therapies across both genders and various age groups.

Moreover, the expansion of anti-aging treatment indications beyond facial aesthetics—such as neck lines, hand rejuvenation, and brow lifts—has broadened the scope of application. Technological advancements, including longer-lasting hyaluronic acid formulations and micro-focused injectables, have further reinforced consumer confidence in these procedures.

Body shaping and cellulite reduction is rising as the booming application segment in the North America aesthetic medicine market, exhibiting a CAGR of 13.3%. This quick surge is driven by increasing consumer focus on overall body aesthetics and the rising popularity of non-invasive fat reduction techniques. According to the International Society of Aesthetic Plastic Surgery (ISAPS), body contouring procedures in North America grew in 2023 compared to the previous year, with a notable rise in demand for treatments targeting localized fat deposits and dimpled skin texture.

One major catalyst behind this surge is the growing prevalence of obesity and post-pregnancy body image concerns, particularly among younger adults. Cryolipolysis, radiofrequency-assisted contouring, and laser-based body sculpting have gained traction due to their ability to reduce fat layers without anesthesia or downtime.

Furthermore, technological advancements have led to the development of multi-modal treatment systems capable of addressing both cellulite and adipose tissue simultaneously. Companies such as Allergan and Lumenis have introduced FDA-cleared devices that combine suction, heat, and mechanical stimulation for improved skin texture and contour definition.

By End User Insights

Medical spas and beauty centers were the top performing end-user segment in the North America aesthetic medicine market, accounting for 38.4% of total revenue in 2024. Increasing accessibility of aesthetic treatments outside traditional healthcare settings along with consumers preferring convenient, spa-like environments that offer personalized service and shorter wait times drives the segment forward.

According to the American Med Spa Association (AMSA), there was large number of medical spas operating across the United States, marking a key increase from from 8,899 in 2022 to 10,488 in 2023. These facilities provide a wide array of non-invasive procedures, including laser treatments, injectables, and skincare therapies, often under the supervision of licensed aestheticians or nurse practitioners. The Canadian Medical Aesthetic Association (CMAA) reports a similar upward trajectory in Canada, with over 800 certified medical spas active nationwide as of early 2024.

A key driver of this segment's growth is the rising consumer preference for outpatient aesthetic care, which allows for greater flexibility in scheduling and lower procedural costs compared to hospital or clinic settings. Also, the proliferation of franchise-based med spa chains and mobile aesthetic services has expanded geographic reach, particularly in suburban and rural areas.

Cosmetic centers are identified as the quickest developing end-user segment in the North America aesthetic medicine market, with a projected CAGR of 11.9%. These specialized facilities focus exclusively on elective aesthetic procedures, offering a streamlined experience for patients seeking surgical and non-surgical enhancements under one roof.

One of the primary drivers of this growth is the increasing demand for customized treatment plans that integrate multiple modalities, such as injectables, laser therapies, and body contouring. Unlike general dermatology clinics, cosmetic centers emphasize a results-driven approach tailored to individual aesthetic goals, attracting a clientele base that prioritizes outcome consistency and brand reputation. Also, this growth reflects a shift in consumer behavior toward dedicated aesthetic hubs that provide premium services, exclusive access to advanced technologies, and personalized follow-up care.

Additionally, regulatory support for outpatient surgical centers has enabled faster approvals and cost-effective operations, encouraging private investment in this sector.

COUNTRY LEVEL ANALYSIS

The United States had the dominant position in the North America aesthetic medicine market, commanding over 75% of total regional revenue in 2024. This leadposition is primarily attributable to high consumer spending on personal appearance, an extensive network of aesthetic providers, and continuous technological innovation within the industry.

A key growth driver is the rising cultural acceptance of aesthetic treatments across different age groups and demographics. Millennials and Gen Z consumers, in particular, have emerged as major contributors to market expansion, with a growing inclination toward preventative aesthetics such as injectables and laser therapies.

Additionally, the presence of leading manufacturers and research institutions has fostered continuous product development and regulatory approvals for new aesthetic technologies. With strong consumer demand, a supportive regulatory environment, and expanding digital consultation platforms, the U.S. continues to set the pace for aesthetic medicine innovation and adoption in North America.

Canada is a key player with strong growth potential in the North America aesthetic medicine market, positioning it as the second-largest contributor in the region. This market position is supported by a growing emphasis on self-care, rising disposable incomes, and increasing investments in medical aesthetics infrastructure.

One of the primary factors driving market expansion is the increasing participation of dermatologists and plastic surgeons in aesthetic medicine, alongside the proliferation of independent medical spas. Moreover, provincial governments have implemented standardized licensing frameworks to ensure safe and ethical practice, reinforcing consumer confidence in aesthetic treatments.

Technological advancements have also played a crucial role in shaping Canada’s aesthetic medicine landscape. Manufacturers such as Allergan and Galderma have expanded their distribution networks, making innovative products more accessible to both urban and rural populations.

The Rest of North America is an emerging markets with high growth prospects. While historically overshadowed by the U.S. and Canada, this segment is witnessing increased adoption of aesthetic treatments due to rising disposable incomes, growing medical tourism, and expanding healthcare infrastructure.

Mexico has emerged as a key destination for cross-border aesthetic procedures, attracting international patients seeking cost-effective yet high-quality treatments. The country’s competitive pricing model, combined with a growing number of certified aesthetic professionals, has strengthened its appeal as a hub for medical tourism.

In addition, the introduction of regulatory reforms aimed at improving patient safety and device approvals has facilitated the entry of global aesthetic brands into the Mexican market. With expanding service offerings and strategic partnerships with global players, the Rest of North America presents promising opportunities for future market expansion.

KEY MARKET PLAYERS

A few of the notable companies operating in the North America aesthetic medicine market profiled in this report are Mentor WorldWide LLC (a subsidiary of Johnsons & Johnsons) (U.S.), Cutera, Inc. (U.S.), Densply Sirona (U.S.), Institut Straumann AG (U.S.), Candela Corporation (U.S.), BioHorizons(U.S.), Cynosure, LLC (U.S.), Alma Lasers (U.S.), 3M (U.S), Sciton (California), and Others.

TOP LEADING PLAYERS IN THE MARKET

Allergan Aesthetics (AbbVie Inc.)

Allergan Aesthetics is a global leader in the aesthetic medicine sector and holds a dominant position in North America. Known for its flagship products such as Botox Cosmetic and Juvederm dermal fillers, the company has significantly shaped consumer and professional perceptions of non-invasive aesthetics. Its extensive portfolio spans injectables, skincare, and body contouring solutions, making it a one-stop provider for practitioners and med spas. Allergan's commitment to innovation, regulatory compliance, and physician education has reinforced its leadership, while strategic partnerships and acquisitions have expanded its reach across diverse treatment categories.

Galderma

Galderma is a major player in the North America aesthetic medicine market, with a strong presence in both dermatology and cosmetic treatments. The company offers a comprehensive range of injectables, including Restylane and Sculptra, as well as advanced skincare formulations under brands like Cetaphil and Epiduo. Galderma’s focus on scientific research and product diversification has enabled it to cater to evolving patient needs. It also invests heavily in clinical training, digital engagement, and direct-to-consumer marketing, enhancing brand loyalty and professional adoption across medical spas, dermatology clinics, and cosmetic centers.

Cutera, Inc.

Cutera is a prominent innovator in energy-based aesthetic devices and plays a key role in shaping the North American market for laser and light-based treatments. The company develops advanced platforms for skin rejuvenation, body contouring, and hair removal, designed to meet the growing demand for non-invasive procedures. Cutera’s emphasis on user-friendly technology, flexible treatment options, and continuous R&D has positioned it as a preferred partner for aesthetic professionals. By focusing on device customization and integration with practice management tools, Cutera supports providers in delivering high-quality, efficient care that aligns with patient expectations.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

One of the primary strategies employed by leading players in the North America aesthetic medicine market is product innovation and portfolio expansion , aimed at addressing diverse patient needs and emerging aesthetic trends. Companies are investing heavily in R&D to develop next-generation injectables, advanced skincare formulations, and multi-modal treatment devices that offer superior efficacy and safety profiles.

Another crucial strategy is strategic collaborations and partnerships with healthcare professionals, academic institutions, and digital health platforms. These alliances help companies enhance their clinical validation, improve patient outreach, and integrate telemedicine into aesthetic consultations, thereby improving accessibility and service delivery.

Lastly, brand differentiation through digital marketing and direct-to-consumer engagement is playing an increasingly important role in strengthening market presence. Major players are leveraging social media, influencer endorsements, and educational campaigns to build brand awareness, drive consumer confidence, and foster long-term loyalty among a broad demographic base seeking aesthetic enhancements.

COMPETITION OVERVIEW

The competition in the North America aesthetic medicine market is marked by a dynamic interplay between global pharmaceutical giants, specialized device manufacturers, and regional aesthetic service providers. With rising consumer interest in non-invasive and minimally invasive treatments, the market has attracted a diverse array of players offering innovative products ranging from injectables and topical formulations to laser systems and body contouring technologies. Established multinational firms dominate due to their strong brand recognition, extensive distribution networks, and deep financial resources, allowing them to invest in continuous product development and marketing initiatives. However, smaller, niche-focused companies are gaining traction by introducing differentiated offerings tailored to specific applications or underserved segments. The competitive landscape is further intensified by increasing regulatory scrutiny, the need for ongoing clinical validation, and the growing influence of digital platforms in patient decision-making. As consumer preferences evolve toward personalized, safe, and cost-effective treatments, companies must continuously adapt their strategies to maintain relevance and capture market share in this rapidly expanding sector.

RECENT MARKET DEVELOPMENTS

- In March 2024, Allergan Aesthetics launched a new line of hyaluronic acid-based dermal fillers specifically formulated for ethnic skin tones, aiming to address unmet needs in diverse patient populations and expand its market reach across urban aesthetic clinics.

- In June 2024, Galderma announced a partnership with a leading telehealth platform to introduce virtual aesthetic consultations, enabling patients to receive personalized treatment recommendations and follow-up support remotely, enhancing accessibility and convenience.

- In August 2024, Cutera introduced an upgraded version of its multi-application laser system, incorporating AI-assisted diagnostics to optimize treatment planning and improve procedural consistency, reinforcing its leadership in energy-based aesthetic devices.

- In October 2024, Merz Aesthetics acquired a boutique skincare brand specializing in clean beauty formulations, allowing the company to broaden its consumer-facing offerings and tap into the growing demand for premium, science-backed skincare products.

- In December 2024, Alma Lasers expanded its U.S. presence by opening a dedicated training and innovation center in Dallas, focused on educating practitioners on advanced laser and radiofrequency techniques to enhance clinical outcomes and brand loyalty.

MARKET SEGMENTATION

This research report on the North America aesthetic medicine market is segmented and sub-segmented into the following categories.

By Product Type

- Aesthetic Laser Devices

- Ablative Skin Resurfacing Devices

- CO2 Laser

- Erbium Laser

- Others

- Non-Ablative fractional Laser Resurfacing Devices

- Radiofrequency

- Intense Pulsed Light

- Fractional Laser

- The Q-switched ND:YAG Laser

- Others

- Energy Devices

- Laser Surgery Devices

- Electrocautery devices

- Electrosurgery Devices

- Cryosurgery Devices

- Harmonic Scalpel

- Microwave Devices

- Body Contouring Devices

- Liposuction

- Nonsurgical Skin Tightening

- Cellulite Treatment

- Facial Aesthetic Devices

- Botox Injection

- Dermal Filler

- Natural Dermal Fillers

- Synthetic Dermal Fillers

- Collagen injections

- Chemical peel

- Facial Toning

- Fraxel

- Cosmetic Acupuncture

- Electrotherapy

- Microdermabrasion

- Permanent Makeup

- Aesthetic Implants

- Breast Augmentation

- Saline Implants

- Silicon Implants

- Buttock Augmentation

- Aesthetic Dental Implants

- Dental Titanium Implants

- Dental Zerconium Implants

- Facial Implants

- Soft Tissue Implants

- Transdermal Implant

- Others

- Skin Aesthetic Devices

- Laser Skin Resurfacing Devices

- Non Surgical Skin Tightening Devices

- Light Therapy Devices

- Tattoo Removal Devices

- Micro-Needling Products

- Thread Lift Products

- Nail Treatment Laser Devices

- Others

By Application

- Anti-Aging and Wrinkles

- Facial and Skin Rejuvenation

- Breast Enhancement

- Body Shaping and Cellulite

- Tattoo Removal

- Vascular Lesions

- Sears

- Pigment Lesions

- Reconstructive

- Psoriasis and Vitiligo

- Others

By End User

- Cosmetic Centers

- Dermatology Clinics

- Hospitals

- Medical Spas and Beauty Centers

By Distribution Channel:

- Direct

- Retail

By Country

- United States

- Canada

- Mexico

- Rest of North America

Frequently Asked Questions

1. What is the projected market size of the North America aesthetic medicine market by 2033?

The North America aesthetic medicine market is expected to reach USD 69.83 billion by 2033.

2. What factors are driving the growth of the North America aesthetic medicine market?

The market's growth is driven by the increasing prevalence of skin disorders, an aging population, and the growing influence of social media and celebrity culture.

3. Which demographic is increasingly contributing to the demand in the North America aesthetic medicine market?

Younger demographics, particularly millennials and Generation Z, are increasingly investing in preventive and subtle aesthetic treatments, contributing significantly to market demand.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com