North America Agricultural Biologicals Market Size, Share, Growth, Trends, And Forecasts Report, Segmented By Type, Application, Sources, Mode Of Application, By Country (The USA. Canada And Mexico), Industry Analysis From 2024 to 2032

North America Agriculture Biologicals Market Size

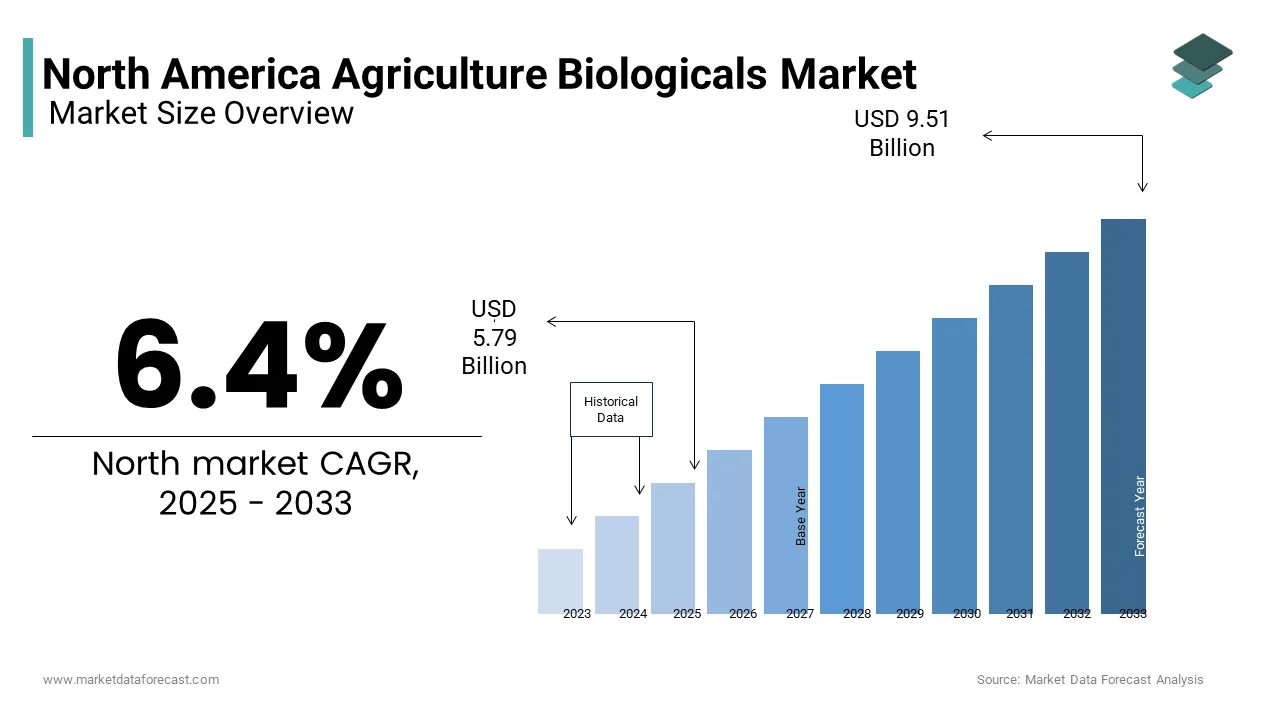

The North America agriculture biologicals market was valued at USD 5.44 billion in 2024 and is expected to reach USD 5.79 billion in 2025 from USD 9.51 billion by 2033, growing at a CAGR of 6.4% during the forecast period from 2025 to 2033.

Agricultural biologicals are mostly used in agricultural practices to maintain crop health. These products will minimize harmful environmental consequences. Agricultural biologicals combine innovation and science to increase the productivity of crops as well as enhance crop health. Agricultural biological products help replace conventional pesticides in the market due to their non-toxic quality and target-specific behavior. However, consumers' shift towards organic foods in the US leads to an increasing demand for these agricultural biological products and organic manures since these are prerequisites for the organic farming industry.

Increasing demand for organic products, a growing population, rapid growth in the use of these products in seed treatment, improving yield and productivity, increasing spending in R&D efforts, support from the government, and increasing health consciousness are the factors boosting the growth of the market. Factors such as a lack of awareness among farmers and reluctance to change from existing practices of chemical pesticides are hindering the growth of the market.

KEY MARKET PLAYERS

Some of the major companies dominating the market, by their products and services, include BASF, Bayer Crop Science, Syngenta, Novozymes A/S, Isagro, Arysta Lifescience Limited, Arysta LifeScience Corporation, Valent BioScience Corporation, Marrone Bio Innovations Inc., Certis U.S.A., and Koppert B.V.

MARKET SEGMENTATION

This research report on the North American agriculture biologicals market is segmented and sub-segmented into the following categories.

By Type Insights

- Bio Pesticides

- Bio Fertilizers

- Bio Stimulants

By Application Insights

- Cereals & Grains

- Oilseeds & Pulses

- Fruits & Vegetables

- Others

By Sources Insights

- Microbial

- Biorationals

- Others

By Mode of Application Insights

- Soil Treatment

- Seed Treatment

- Foliar Spray

By Country

- U.S

- Canada

Frequently Asked Questions

What are agricultural biologicals?

Natural crop inputs like microbes, extracts, or biochemicals used to enhance plant health and reduce chemical dependency.

Why is the North American market for biologicals growing?

Due to rising demand for organic produce, sustainable farming, and stricter chemical regulations.

Which types of agricultural biologicals are most used?

Biopesticides, biofertilizers, and biostimulants lead usage across various crop types.

What challenges affect adoption of biologicals?

Farmer awareness, inconsistent performance, and regulatory hurdles are key barriers.

What does the future look like for this market?

Tech-driven innovations and eco-farming trends are positioning biologicals as core to modern agriculture.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com