North America Contraceptives Market Research Report – Segmented By Drugs( Oral Contraceptives ,Topical Contraceptives, Contraceptive Injectable ) Devices and Country (The United States, Canada and Rest of North America) - Industry Analysis, ( 2025 to 2033)

North America Contraceptives Market Size

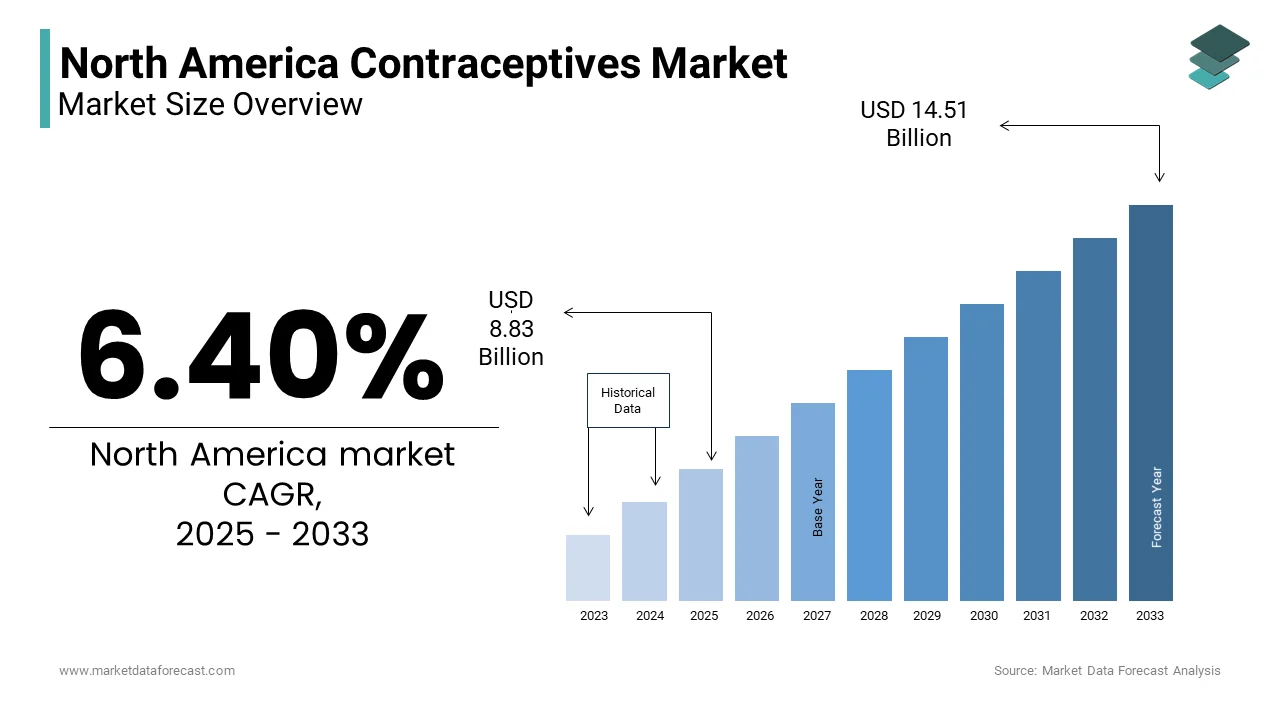

The North America Contraceptives Market was valued at USD 8.30 billion in 2024. The North America Contraceptives Market is expected to have a 6.40 % CAGR from 2024 to 2033 and be worth USD 14.51 billion by 2033 from USD 8.83 billion in 2025.

The North America contraceptives market covers products and services designed to prevent unintended pregnancies, including hormonal methods (such as oral contraceptive pills, patches, and injections), intrauterine devices (IUDs), barrier methods (like condoms and diaphragms), and permanent sterilization procedures. With increasing awareness about reproductive health, rising healthcare expenditure, and evolving consumer preferences, the market has seen significant growth over recent years.

According to the Centers for Disease Control and Prevention (CDC), nearly 65% of women in the United States between the ages of 15 and 49 use some form of contraception, highlighting the integral role these products play in personal and public health planning.

Moreover, the region’s robust regulatory framework, coupled with strong presence of leading pharmaceutical companies and continuous innovation in contraceptive technologies, further supports market development.

Additionally, telehealth platforms and digital pharmacies have emerged as new distribution channels, making contraceptives more accessible across both urban and rural areas.

MARKET DRIVERS

Increasing Awareness and Education on Reproductive Health

Surging awareness and emphasis on reproductive health education among individuals, particularly women is one of the most influential drivers of the North America contraceptives market. Educational campaigns led by public health agencies, non-profit organizations, and academic institutions have significantly contributed to informed decision-making regarding contraceptive options.

In line with the Guttmacher Institute, states that implemented comprehensive sex education programs saw a notable increase in contraceptive use among adolescent females compared to those without such initiatives. This pattern underscores the impact of knowledge dissemination in shaping responsible reproductive behaviors.

Also, digital health platforms and mobile applications have played a crucial role in enhancing accessibility to contraceptive information. Telemedicine services, which gained traction during the pandemic, continue to offer remote consultations and prescriptions, enabling users to explore and obtain suitable contraceptive methods without visiting a clinic.

Moreover, employer-sponsored wellness programs and insurance coverage under the Affordable Care Act have made contraceptives more affordable and widely used. These combined factors are not only driving demand but also encouraging the development of new and improved contraceptive solutions tailored to diverse user needs across North America.

Technological Advancements in Long-Acting Reversible Contraceptives (LARCs)

Technological innovation in long-acting reversible contraceptives (LARCs) has significantly influenced the expansion of the North America contraceptives market. LARCs, including intrauterine devices (IUDs) and contraceptive implants, have gained popularity due to their high efficacy, convenience, and cost-effectiveness over time.

According to data from the Centers for Disease Control and Prevention (CDC), the use of IUDs among U.S. women of reproductive age more than doubled between 2012 and 2022, reflecting increased confidence in these advanced methods.

A key factor behind this shift is the introduction of next-generation IUDs and implants that offer improved safety profiles, reduced side effects, and extended durations of protection—some lasting up to seven years. Companies like Bayer Healthcare and Merck & Co. have introduced copper-free, hormone-releasing IUDs that cater to patients seeking non-hormonal alternatives while maintaining effectiveness. In addition, innovations in insertion techniques and biocompatible materials have enhanced patient comfort and minimized complications, contributing to higher retention rates.

Medical professionals and family planning clinics have increasingly recommended LARCs as a first-line contraceptive option, especially for adolescents and postpartum women.

MARKET RESTRAINTS

Side Effects and Health Concerns Associated with Hormonal Methods

Concerns regarding potential side effects remain a significant restraint on market growth in North America. Many users report adverse reactions such as weight gain, mood swings, irregular bleeding, and decreased libido, which can lead to discontinuation or switching to alternative methods.

As indicated by a 2023 study published in the journal Contraception, notable share of women who initiated hormonal birth control discontinued its use within the first year due to perceived negative health impacts.

Serious health risks, including blood clots, cardiovascular complications, and changes in metabolic markers, have also raised caution among healthcare providers and consumers alike. The U.S. Food and Drug Administration (FDA) has issued multiple advisories on certain combined hormonal contraceptives, emphasizing the need for thorough patient screening before prescription. These concerns are particularly pronounced among older women, smokers, and individuals with pre-existing conditions such as hypertension or diabetes.

As a result, some consumers opt for less effective or non-prescription alternatives, such as barrier methods or fertility awareness-based approaches, which limits the overall penetration of advanced contraceptive products.

Regulatory and Policy Uncertainties Impacting Access and Distribution

Regulatory and policy dynamics in North America significantly influence the accessibility and affordability of contraceptive products, acting as a notable restraint on market growth. In the United States, contraceptive coverage policies have fluctuated due to legal challenges and shifting federal priorities.

For instance, the Supreme Court’s ruling in Little Sisters of the Poor v. Pennsylvania allowed employers to claim religious or moral exemptions from providing contraceptive coverage under the Affordable Care Act (ACA), limiting access for some insured populations. According to the Kaiser Family Foundation, an estimated 7 million women were affected by these exemptions in 2023, creating disparities in availability.

Similarly, in Canada, while provincial healthcare plans generally cover certain contraceptive methods, inconsistencies exist across regions. Some provinces provide full subsidies for IUDs and implants, while others offer limited or no financial assistance for hormonal contraceptives. As per a 2024 report by the Canadian Women’s Health Network, lack of uniformity in funding models results in unequal access, particularly for low-income and Indigenous communities.

MARKET OPPORTUNITIES

Expansion of Over-the-Counter (OTC) Contraceptive Options

Growing movement toward making hormonal contraceptives available over the counter (OTC), eliminating the need for a physician’s prescription, is an emerging opportunity in the North America contraceptives market.

In 2023, the U.S. Food and Drug Administration (FDA) approved the first OTC daily oral contraceptive, marking a significant shift in accessibility. This change aligns with broader public health efforts to enhance reproductive autonomy and reduce barriers to contraceptive use.

Pharmaceutical companies are capitalizing on this trend by developing safe, effective, and user-friendly OTC formulations, including progestin-only pills and transdermal patches. Retail chains and pharmacy-led health clinics are also positioning themselves as primary access points, offering counseling and follow-up support alongside OTC dispensing. Walgreens and CVS Health have already announced strategic partnerships with manufacturers to facilitate nationwide availability.

The transition to OTC availability represents a transformative opportunity to reshape contraceptive access and utilization across North America.

Integration of Digital Health Platforms and Fertility Tracking Applications

The integration of digital health platforms and fertility tracking applications into contraceptive management presents a potential growth opportunity in the North America contraceptives market. With the proliferation of smartphones and wearable technology, consumers are increasingly relying on digital tools to monitor menstrual cycles, track fertility windows, and make informed decisions about birth control.

In line with a 2024 survey by the Pew Research Center, over 60% of women aged 18–35 use at least one health-related app, with fertility and contraceptive tracking apps experiencing the highest engagement.

Top contraceptive manufacturers are partnering with digital health startups to enhance user experience and improve adherence. Apps such as Natural Cycles and Clue have received FDA clearance as digital contraceptive methods, while others integrate with telehealth services for seamless prescription renewals.

Furthermore, telemedicine platforms now offer virtual consultations for contraceptive prescriptions, reducing reliance on in-person visits and improving access for remote populations. These developments are not only enhancing user engagement but also opening new revenue streams for pharmaceutical firms, positioning digital integration as a key driver of future market expansion.

MARKET CHALLENGES

Cultural and Religious Opposition Influencing Public Perception and Policy

Cultural and religious beliefs continue to pose a significant challenge to the North America contraceptives market, particularly in certain regions of the United States where conservative ideologies shape public opinion and legislative frameworks. Opposition to contraceptive use, especially among specific religious groups, has resulted in restrictive policies and limited access in several states.

According to the Guttmacher Institute, as of 2024, over a dozen U.S. states have enacted laws allowing healthcare providers and insurers to deny contraceptive coverage based on moral or religious objections. These policies disproportionately affect low-income individuals and young adults seeking affordable birth control options.

Moreover, misinformation and stigma surrounding hormonal contraceptives persist in some communities, leading to lower adoption rates and higher rates of unintended pregnancies. A 2023 study published in Women's Health Issues found that women residing in socially conservative areas were 25% less likely to use modern contraceptives compared to those in more progressive regions. This disparity highlights the influence of cultural narratives on individual health decisions.

Efforts by advocacy groups and public health organizations to counter misinformation and promote evidence-based education face resistance from entrenched belief systems.

Supply Chain Disruptions and Manufacturing Delays Affecting Product Availability

Supply chain disruptions have emerged as a pressing challenge for the North America contraceptives market, impacting the timely availability of essential products. The global shortage of raw materials, manufacturing bottlenecks, and logistical delays have affected production timelines for key contraceptive brands.

Manufacturers cite multiple causes for these disruptions, including dependency on offshore suppliers for active pharmaceutical ingredients (APIs) and packaging components. A single production delay at a major facility can ripple across the supply chain, causing regional stockouts and forcing patients to switch to less preferred alternatives.

These supply constraints not only hinder patient adherence but also strain provider-patient relationships and erode brand loyalty. To mitigate these risks, industry players are exploring localized manufacturing, inventory diversification, and strategic supplier partnerships to ensure consistent product availability in a market where reliability is paramount.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.40 % |

|

Segments Covered |

By Drugs, Devices and Country. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Country Covered |

The U.S., Canada and Rest of North America |

|

Market Leader Profiled |

Bayer HealthCare AG, Teva Pharmaceutical Industries Limited, Medisafe Distribution Inc, Pace Pharmaceuticals Inc., Medicines360. |

SEGMENTAL ANALYSIS

By Drugs Insights

Oral contraceptives stood out as the most significant contributor to the North America contraceptives market, capturing 58.1% of total revenue in 2024. This lead position is primarily attributed to the long-standing acceptance and widespread use of birth control pills among women of reproductive age.

According to the Centers for Disease Control and Prevention (CDC), nearly 12 million U.S. women were using oral contraceptives as their primary method of birth control in 2023.

One key driver behind this dominance is the extensive range of available formulations, including combined estrogen-progestin pills and progestin-only mini-pills, catering to diverse medical needs and lifestyle preferences. The American College of Obstetricians and Gynecologists (ACOG) notes that oral contraceptives remain the most frequently prescribed contraceptive method due to their efficacy, reversibility, and ease of access through both traditional and digital healthcare platforms. Apart from these, the availability of generic versions has significantly lowered cost barriers, making them more accessible across different socioeconomic groups.

The contraceptive injectable segment is slated for strong expansion within the drugs category, exhibiting a CAGR of 6.9%. This rapid growth is driven by increasing preference for long-acting, user-independent methods that eliminate the need for daily adherence. Depot medroxyprogesterone acetate (DMPA), the most commonly used injectable contraceptive, offers protection for up to three months after a single administration, making it particularly appealing for individuals seeking convenience and discretion.

A 2023 survey conducted by the Guttmacher Institute found that injectable use increased by 14% among women aged 18–29 compared to the previous five years.

Another major factor fueling growth is the integration of injectables into public health programs aimed at reducing unintended pregnancies. In the United States, Title X clinics and Medicaid-funded family planning services have expanded access to free or low-cost injectables, particularly benefiting low-income populations. Besides, pharmaceutical companies are investing in next-generation formulations with reduced side effect profiles and longer durations of action, further enhancing market appeal and adoption rates across North America.

By Devices Insights

Condoms segment led the North America, accounting for 32.5% of total market share in 2024. This superiority is mainly credited to their dual function as both a contraceptive and a barrier against sexually transmitted infections (STIs), making them a preferred choice among sexually active individuals, particularly younger demographics.

As indicated by the Centers for Disease Control and Prevention (CDC), nearly 23% of sexually active U.S. adults reported using condoms as their primary method of contraception in 2023.

One of the primary drivers of condom usage is their accessibility and affordability, as they are widely available over-the-counter without a prescription. Public health initiatives, including free distribution programs in schools and community health centers, have also played a crucial role in promoting consistent use.

Moreover, technological advancements have led to the development of ultra-thin, lubricated, and non-latex variants, improving comfort and encouraging broader adoption. Companies such as Durex and Trojan have introduced innovative designs tailored to consumer preferences, further strengthening market presence.

Intrauterine devices (IUDs) are witness exponential growth in the North America contraceptives market, recording a projected CAGR of 8.3%. This accelerated rise is primarily fueled by rising awareness of IUDs as highly effective, reversible, and low-maintenance contraceptive options.

According to data from the Guttmacher Institute, IUD usage among U.S. women of reproductive age more than tripled between 2002 and 2022, reflecting growing physician recommendations and patient confidence in long-acting reversible contraceptives (LARCs).

An important driver behind this trend is the increasing adoption of copper and hormonal IUDs, which offer protection ranging from three to ten years depending on the brand. Medical professionals, including those affiliated with the American College of Obstetricians and Gynecologists (ACOG), now routinely recommend IUDs as first-line contraceptive choices, especially for adolescents and postpartum women.

Additionally, insurance coverage under the Affordable Care Act (ACA) has significantly reduced out-of-pocket costs, making IUDs more financially viable for a broader population.Manufacturers such as Bayer Healthcare and CooperSurgical have also contributed to market momentum by introducing next-generation IUDs with lower hormone doses and improved insertion techniques.

COUNTRY LEVEL ANALYSIS

The United States held the top position in the North America contraceptives market, commanding a 78.2% of total regional revenue in 2024. This position is primarily attributable to the country’s high prevalence of contraceptive use, robust healthcare infrastructure, and strong presence of leading pharmaceutical and medical device manufacturers.

A key growth driver is the comprehensive coverage provided under the Affordable Care Act (ACA), which mandates that most private health plans cover all FDA-approved contraceptive methods without cost-sharing. Additionally, the rise of telehealth platforms offering virtual consultations and prescription renewals has made contraceptive care more convenient and discreet. Furthermore, the U.S. market benefits from continuous innovation, with companies like Pfizer, Merck & Co., and Teva Pharmaceutical Industries investing in new formulations and delivery mechanisms.

Canada emerged as a key growth pillar in the region. This market position is supported by progressive healthcare policies, increasing government funding for reproductive health services, and growing awareness around contraceptive options.

One of the primary factors driving market expansion is the implementation of provincial drug benefit programs that subsidize contraceptive costs for eligible individuals. For instance, Ontario and British Columbia have introduced universal pharmacare models that include full coverage for selected contraceptive products, reducing financial barriers for low-income populations.

Additionally, advocacy efforts by organizations such as Options for Sexual Health and the Society of Obstetricians and Gynaecologists of Canada (SOGC) have promoted evidence-based education and clinical guidelines, enhancing provider confidence in recommending long-acting reversible contraceptives (LARCs).

The Rest of North America, comprising Mexico and select Caribbean territories, represents a smaller but rapidly evolving segment of the contraceptives market. While historically overshadowed by the U.S. and Canada, this segment is witnessing increased adoption of modern contraceptive methods due to rising awareness, urbanization, and expanding healthcare access.

Mexico, in particular, has emerged as a key market with growing interest in reproductive health and family planning. Government-led initiatives such as Seguro Popular and the National Strategy for Comprehensive Sexual and Reproductive Health have facilitated greater access to subsidized contraceptives, particularly in rural regions.

Additionally, the introduction of over-the-counter oral contraceptives in select pharmacies has expanded availability beyond traditional healthcare settings. With continued investment in reproductive health education and expanding partnerships with international pharmaceutical firms, the Rest of North America presents promising opportunities for future market expansion.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Companies playing a prominent role in the North America contraceptives market are Bayer AG,Pfizer Inc.,Merck & Co. Inc.,Teva Pharmaceuticals Ltd,Agile Therapeutics,Allergan PLC,Ani Pharmaceuticals Inc.,,Church & Dwight Co. Inc.,Fuji Latex Co. Ltd,Johnson & Johnson Ltd.

The competition in the North America contraceptives market is characterized by a blend of established multinational pharmaceutical firms, generic drug manufacturers, and emerging players in the digital health space. With increasing demand for safe, effective, and accessible birth control options, companies are continuously innovating to differentiate their offerings and capture larger market shares. Established players dominate due to their extensive R&D capabilities, strong brand recognition, and well-developed distribution networks. However, generic manufacturers are gaining traction by offering cost-effective alternatives that appeal to price-sensitive consumers and healthcare providers under budgetary constraints.

In recent years, the market has seen a shift toward digital integration, with companies launching telehealth services, mobile apps, and online pharmacies to enhance consumer engagement and streamline prescription processes. This trend has intensified competition, as both traditional pharmaceutical firms and tech-driven startups seek to redefine how contraceptives are accessed and managed. Regulatory dynamics, evolving consumer preferences, and growing emphasis on reproductive autonomy further shape the landscape, requiring companies to remain agile in adapting to changing policies and societal expectations around contraceptive use.

Top Players in the Market

Pfizer Inc.

Pfizer is a leading global pharmaceutical company with a strong presence in the North America contraceptives market through its diverse portfolio of hormonal and non-hormonal contraceptive products. The company plays a pivotal role in developing and distributing oral contraceptives, emergency contraception, and long-acting reversible contraceptive (LARC) options. Pfizer’s commitment to innovation, regulatory compliance, and patient education has reinforced its leadership position. Additionally, its strategic partnerships with healthcare providers and digital health platforms have expanded access to contraceptive solutions across different demographics in the U.S. and Canada.

Bayer AG

Bayer is a major player in the contraceptives sector, known for its well-established brands such as Mirena and Kyleena—leading intrauterine devices (IUDs) that have significantly influenced contraceptive adoption trends in North America. The company’s focus on research and development has led to the introduction of advanced LARCs that offer long-term efficacy with minimal side effects. Bayer also invests heavily in physician training, public awareness campaigns, and digital tools to enhance patient engagement. Its contributions extend beyond North America, shaping global contraceptive standards through continuous product innovation and clinical support.

Teva Pharmaceutical Industries Ltd.

Teva is a key contributor to the North America contraceptives market, particularly in the generic oral contraceptive segment. As one of the largest producers of generic medications worldwide, Teva ensures affordability and accessibility by offering cost-effective alternatives to branded pills. The company maintains a broad distribution network across the U.S. and Canada, ensuring widespread availability of essential contraceptive products. In addition to generics, Teva continues to develop new formulations and delivery systems aimed at improving user experience and adherence. Its emphasis on sustainable manufacturing and supply chain resilience further strengthens its market position and supports broader reproductive health goals.

Top Strategies Used by Key Players

One of the primary strategies employed by key players in the North America contraceptives market is product innovation and diversification , aimed at addressing evolving consumer preferences and medical needs. Companies are investing heavily in research and development to introduce next-generation hormonal and non-hormonal methods, including extended-cycle pills, biodegradable implants, and over-the-counter (OTC) formulations that enhance convenience and accessibility.

Another crucial approach is strategic collaborations and partnerships with healthcare providers, insurance companies, and telemedicine platforms. These alliances help manufacturers expand their reach, improve patient education, and integrate contraceptive services into mainstream digital health ecosystems. Collaborations also facilitate regulatory advocacy and ensure alignment with evolving policy landscapes regarding contraceptive coverage and access.

Lastly, brand positioning through digital marketing and direct-to-consumer engagement has become increasingly important. Leading firms are leveraging social media, mobile applications, and online consultation services to build brand awareness, foster trust, and empower users with accurate information, thereby strengthening their competitive edge in a dynamic and socially sensitive market environment.

RECENT HAPPENINGS IN THE MARKET

In January 2024, Pfizer launched a new line of extended-cycle oral contraceptives designed to reduce the frequency of menstrual periods, aiming to meet the growing demand for personalized contraceptive solutions and improve user adherence.

In March 2024, Bayer announced a partnership with a leading telehealth provider to integrate its contraceptive counseling services directly into digital health platforms, enhancing access to IUD consultations and post-insertion follow-ups for remote patients.

In May 2024, Teva Pharmaceutical expanded its production capacity at its North American manufacturing facility to address ongoing supply chain challenges and ensure consistent availability of generic oral contraceptives across retail and institutional channels.

In July 2024, Merck & Co. acquired a women’s health-focused biotech startup specializing in hormone-free contraceptive technology, signaling a strategic move toward next-generation, non-hormonal birth control innovations.

In October 2024, Agile Therapeutics introduced an updated version of its contraceptive patch with enhanced adhesion properties and lower hormone content, reinforcing its position in the transdermal contraceptive market and catering to patients seeking alternative delivery methods.

MARKET SEGMENTATION

This research report on the north america contraceptives market has been segmented and sub-segmented into the following.

By Drugs

- Oral Contraceptives

- Topical Contraceptives

- Contraceptive Injectable

By Devices

- Condoms

- IUDs

By Country

- The U.S.

- Canada

- Rest of North America.

Frequently Asked Questions

What are the major drivers of growth in the North America contraceptives market?

Key drivers include increasing awareness about family planning, rising prevalence of unintended pregnancies, favorable government initiatives, availability of a wide range of products, and technological advancements in contraceptive devices.

What are the key challenges facing the contraceptives market in North America?

Challenges include social stigma in certain communities, misinformation about side effects, access issues in rural areas, and political or legal restrictions affecting reproductive health funding and policies.

What is the current size of the North America contraceptives market?

The market size varies by year and source, but it is typically valued in the billions USD range. It includes a wide range of products such as oral pills, condoms, intrauterine devices (IUDs), implants, and emergency contraceptives.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com