North America Diagnostic Imaging Market Research Report – Segmented By Type ( X-ray, Molecular Imaging )Technology Application ( Cardiology , Oncology ) End User ( Hospitals , Diagnostic Imaging Centers ) & Country (The U.S., Canada and Rest of North America) - Industry Analysis (2025 to 2033)

North America Diagnostic Imaging Market Size

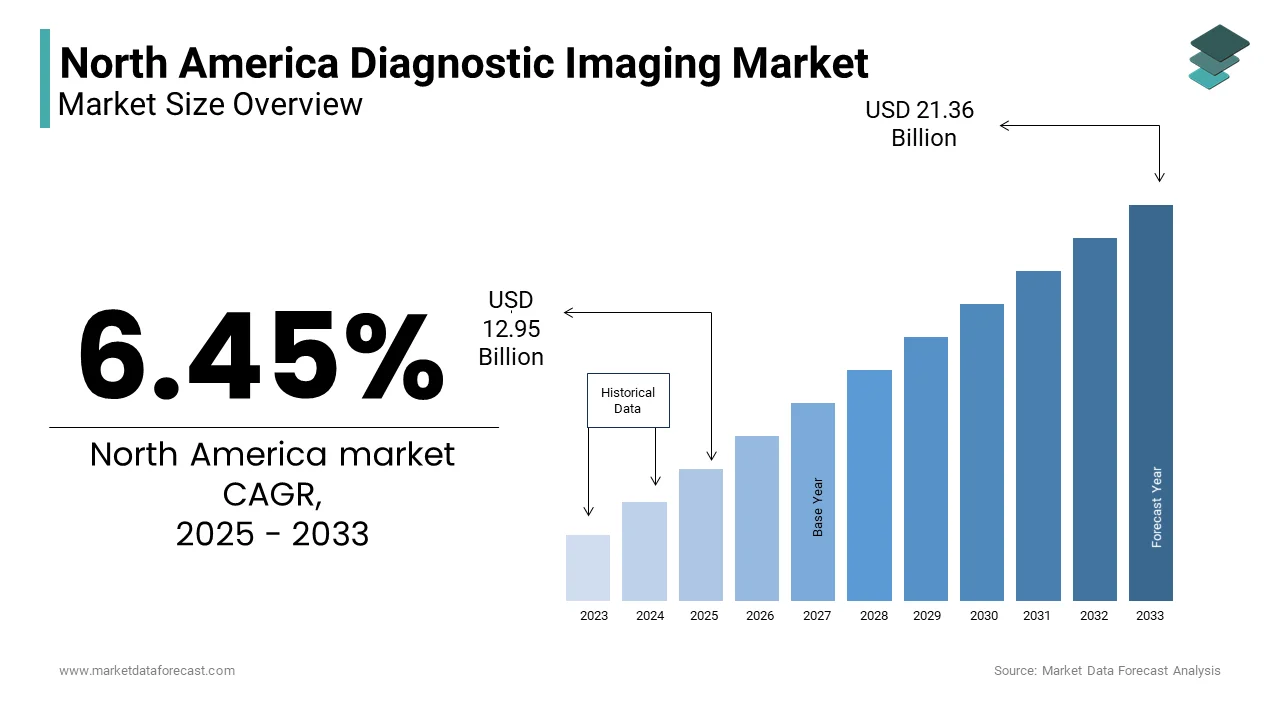

The North America Diagnostic Imaging Market was valued at USD 12.17 billion in 2024. The North America Diagnostic Imaging Market is expected to have a 6.45 % CAGR from 2024 to 2033 and be worth USD 21.36 billion by 2033 from USD 12.95 billion in 2025.

Medical imaging represents a foundational diagnostic pillar within North America’s digitally evolving health ecosystem. The sector is witnessing a transformation, catalyzed by AI, cloud-native workflows, and value-based care alignment. The market is undergoing structural convergence driven by AI-enabled diagnostics and outcome-centric policy shifts.

According to the American College of Radiology, over 300 million diagnostic imaging procedures are performed annually in the U.S., highlighting the integral role of medical imaging in patient diagnosis and treatment planning.

As per data from the Centers for Disease Control and Prevention (CDC), chronic diseases such as cancer, cardiovascular disorders, and neurological conditions account for nearly 70% of all deaths in the U.S., necessitating early and accurate detection through advanced imaging tools. Therefore, the North America medical imaging market continues to evolve, supported by technological innovation and regulatory advancements.

MARKET DRIVERS

Rising Prevalence of Chronic Diseases

Chronic disease prevalence continues to drive systemic demand for early-stage imaging diagnostics, especially in oncology and cardiology. Imaging has transitioned from reactive diagnostics to proactive clinical management, underpinned by preventive care mandates. As per the Centers for Disease Control and Prevention (CDC), approximately six out of ten adults in the U.S. live with at least one chronic condition, many of which require regular imaging for diagnosis, monitoring, and treatment planning.

In Canada, the Public Health Agency reports that chronic illnesses contribute to over 65% of annual deaths, positioning diagnostic imaging as a cornerstone of disease interception strategies. The integration of imaging technologies in oncology, cardiology, and neurology has become essential for staging diseases and assessing treatment efficacy. Given the aging population and rising incidence of lifestyle-related ailments, the demand for medical imaging services is expected to grow steadily, directly fueling market expansion across North America.

Technological Advancements and AI Integration

AI-integrated platforms are redefining radiology workflows through algorithmic augmentation and predictive analytics. Next-gen imaging stacks, equipped with deep learning, are minimizing interpretation variance while streamlining diagnostic timelines. According to the Radiological Society of North America (RSNA), a large percentage of U.S. hospitals have adopted AI-assisted diagnostic tools in radiology departments, accelerating diagnostic throughput while elevating confidence intervals.

Additionally, companies like GE Healthcare, Siemens Healthineers, and Philips have introduced next-generation MRI and CT scanners equipped with deep-learning algorithms capable of detecting anomalies such as tumors or fractures with greater precision than traditional methods. These developments not only improve clinical decision-making but also drive market growth by encouraging investment in cutting-edge imaging infrastructure across North America.

MARKET RESTRAINTS

High Cost of Advanced Imaging Equipment

High CAPEX and long ROI cycles for modalities like PET-CT and 3T MRI systems constrain infrastructure scalability. Budgetary limitations among rural and tier-2 hospitals reinforce diagnostic access inequality. Moreover, operational costs—including software licensing, technician training, and facility upgrades—add further economic pressure. The Journal of the American College of Radiology reported that nearly 30% of community hospitals in the U.S. struggle to afford or sustain comprehensive imaging departments due to budget constraints. In Canada, the Canadian Institute for Health Information (CIHI) noted that provincial health budgets face challenges in scaling imaging infrastructure due to limited funding flexibility. These capital inefficiencies restrict cross-institutional imaging parity to advanced diagnostic tools, especially in underserved areas, thereby slowing the overall growth of the medical imaging market in North America.

Regulatory and Reimbursement Complexities

Protracted FDA review cycles and CMS reimbursement cuts are exerting downward pressure on market entry timelines. Jurisdictional misalignment in Canada and the U.S. impairs unified technology rollout, requiring extensive clinical validation before market entry. According to the U.S. Food and Drug Administration (FDA), the time for regulatory clearance of an advanced imaging device is several months, delaying commercialization and limiting patient access to innovative diagnostics.

Reimbursement policies also play a critical role in shaping market dynamics. Medicare and Medicaid Services (CMS) in the U.S. impose strict coverage criteria for imaging procedures, impacting utilization rates. A study published in Health Affairs found that reimbursement cuts under the Medicare Physician Fee Schedule led to a notable decline in outpatient imaging services between 2019 and 2022.

MARKET OPPORTUNITIES

Expansion of Point-of-Care and Portable Imaging Devices

POC and handheld imaging are unlocking decentralized diagnostics, especially in pre-hospital and ambulatory contexts. Portable ultrasound platforms are enabling diagnostic continuity across non-traditional care environments. According to the study, the use of handheld ultrasound devices in emergency departments increased majorly between 2020 and 2023, reflecting a shift toward decentralized and immediate diagnostic capabilities.

Technological advancements in miniaturized sensors and wireless connectivity have enabled companies such as Butterfly Network and Fujifilm Sonosite to introduce affordable, FDA-approved portable ultrasound systems. These innovations are particularly beneficial in rural and remote healthcare settings where access to full-scale imaging facilities is limited. In Canada, the Ontario Telemedicine Network (OTN) has incorporated portable imaging into virtual consultations, delivering triage-ready imaging across geographically dispersed populations. This shifts presents a substantial growth avenue for medical imaging manufacturers seeking to meet evolving clinical demands beyond traditional hospital settings.

Increasing Adoption of Tele-radiology and Cloud-Based Imaging Platforms

Cloud-native PACS and tele-radiology platforms are centralizing multi-modality diagnostics and unlocking cross-specialty interpretive collaboration. These solutions address interpretive bottlenecks, especially in regions with limited radiologist density.

According to the American College of Radiology (ACR), over 60% of U.S. hospitals now utilize cloud-based Picture Archiving and Communication Systems (PACS), facilitating faster image retrieval and collaborative diagnosis.

Major vendors such as McKesson, Change Healthcare, and Carestream Health have expanded their digital imaging portfolios to include AI-integrated cloud solutions that streamline workflow and enhance reporting accuracy. The U.S. has implemented nationwide tele-radiology networks, reducing turnaround times for critical diagnoses. These developments not only enhance healthcare delivery but also strengthen their role as infrastructure cornerstones in next-gen diagnostic ecosystems. in North America.

MARKET CHALLENGES

Shortage of Skilled Radiologists and Technicians

Radiologist workforce gaps continue to bottleneck diagnostic throughput, particularly in underserved areas. Without scale-up in training pipelines, interpretive capacity risks falling behind imaging demand.

According to the American College of Radiology (ACR), there was a significant deficit of radiologists in the U.S., with rural and underserved regions facing the most severe staffing gaps. This shortage results in extended diagnostic latency windows impacting clinical decision cycles, extended wait times, and inefficient resource allocation.

In Canada, the Canadian Association of Radiologists (CAR) reported that radiologist vacancy rates in some provinces exceeded 15%, exacerbating backlogs in diagnostic imaging services. The situation is further compounded by the increasing complexity of modern imaging modalities, which require specialized training for optimal operation and interpretation.

Data Security and Patient Privacy Concerns

Data security and patient privacy concerns present a growing challenge for the North America medical imaging market. Escalating breach volume in imaging databases signals the urgent need for end-to-end encryption protocols and federated cloud security. Also, regulatory complexity is rising as decentralized imaging environments amplify data sovereignty risks.

The increasing reliance on cloud-based Picture Archiving and Communication Systems (PACS) and tele-radiology exposes sensitive patient information to potential cyber threats. The Ponemon Institute reported that the average cost of a healthcare data breach reached $9.8 million in the U.S. in 2024, making cybersecurity a top priority for healthcare providers. Ensuring robust data encryption, secure transmission protocols, and compliance with evolving privacy laws remains a persistent operational risk demanding proactive architectural hardening for stakeholders in the medical imaging industry.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.45 % |

|

Segments Covered |

By Type,Technology, Application, End User and Country. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Country Covered |

The U.S., Canada and Rest of North America |

|

Market Leader Profiled |

GE Healthcare,Siemens Healthineers,Philips Healthcare,Canon Diagnostic Systems Corporation |

SEGMENTAL ANALYSIS

By Type Insights

In 2024, X-ray emerged as the leading segment in the North America Diagnostic imaging market by capturing 35.3% of the total share. Its popularity is linked to its cost-effectiveness, wide accessibility, and ability to diagnose a variety of conditions like fractures and pneumonia. According to the Centers for Disease Control and Prevention, over 80 million X-ray procedures were conducted in the U.S. that year, showcasing its widespread use. X-rays are often the first choice for initial diagnosis is making them essential in healthcare settings. Innovations such as digital X-ray systems also contributed to their dominance by reducing radiation exposure by up to 70% compared to older methods , as noted by the National Institutes of Health. These factors ensured X-rays remained the most utilized imaging technology.

Between 2025 and 2033, molecular imaging is projected to grow at the fastest pace, with a CAGR of 9.2%. This rapid growth will be fueled by increasing demand for early cancer detection and tailored treatment plans. The American Cancer Society predicts that over 2.1 million new cancer cases annually will require advanced imaging by 2030. Technologies like PET scans, a form of molecular imaging, are critical for identifying tumors in their early stages. Research from the National Cancer Institute shows that PET scans improve diagnostic accuracy by 20-30% compared to conventional methods. Additionally, advancements in AI and hybrid imaging systems are driving adoption. As healthcare shifts toward personalized medicine, molecular imaging’s ability to provide detailed insights into cellular activity will make it a cornerstone of modern diagnostics.

By Technology Insights

The X-ray devices sustained its superiority, accounting for a 35.6% of total revenue in 2024 owing to its high penetration and workflow simplicity. The continued reliance on X-ray technology stems from its cost-effectiveness, rapid image acquisition, and minimal procedural complexity compared to more advanced modalities like MRI or CT.

Additionally, digital radiography systems have replaced conventional film-based X-rays in most healthcare facilities, enhancing image quality while reducing radiation exposure. Like, X-ray imaging continues to serve as a cost-efficient frontline diagnostic tool across multiple specialties in triaging patients during emergency care scenarios.

Ultrasound’s portability and radiation-free benefits underpin its rapid expansion in point-of-care and primary care environments, projected to expand at a CAGR of 7.9% through 2033. This surge is largely attributed to its non-invasive nature, absence of ionizing radiation, and expanding applications in obstetrics, cardiology, musculoskeletal diagnostics, and point-of-care settings.

The proliferation of compact ultrasound devices suitable for emergency medicine, ambulatory care, and home diagnostics has significantly broadened the user base. Companies such as Butterfly Network and Fujifilm Sonosite have introduced FDA-approved handheld scanners, enabling real-time diagnostics outside traditional hospital environments. These factors, combined with favorable reimbursement policies and growing awareness of preventive healthcare, position ultrasound imaging as the fastest-growing segment in the North America medical imaging market.

By Application Insights

In the application-wise segmentation of the North America medical imaging market, oncology had the largest share, contributing a 38.1% of total demand in 2024. Oncology imaging remains central to patient stratification, biomarker validation, and real-time therapy response monitoring.

In Canada, the Canadian Cancer Society reported that over 240,000 new cancer cases were recorded in 2023, reinforcing the need for advanced imaging tools in oncology departments. Imaging modalities such as FDG-PET/CT scans are widely used in monitoring treatment response and detecting metastasis, especially in breast, lung, and colorectal cancers. With increasing investment in precision oncology and radiopharmaceuticals, the oncology segment continues to drive the largest portion of the North America medical imaging market.

Neurology

Neurology is accelerating, fueled by the rise of predictive diagnostics and early-intervention mandates for neurodegenerative disorders. It is poised to capture expanded clinical utility amid increasing complexity of neurological caseloads at a CAGR of 8.2% through 2033. This acceleration is fueled by the rising prevalence of neurological disorders such as Alzheimer's disease, Parkinson's disease, epilepsy, and stroke. According to the Centers for Disease Control and Prevention (CDC), over 6 million Americans suffer from Alzheimer’s disease, with annual diagnoses increasing due to aging demographics. Early and accurate diagnosis using MRI, CT, and functional imaging techniques is crucial for managing these conditions effectively.

In addition, the integration of AI-assisted neuroimaging tools has improved lesion detection and cognitive disorder mapping, enhancing clinical decision-making. These factors, coupled with government funding for neurological research and expanded insurance coverage for neuroimaging procedures, make neurology the fastest-growing application segment in the North America medical imaging market.

By End User Insights

The hospitals segment is the largest end-user segment in the North America Diagnostic imaging market by holding a 45.1% market share in 2024. This dominance was due to their role as primary healthcare providers, offering comprehensive diagnostic and treatment services under one roof. The Centers for Medicare & Medicaid Services reported that hospitals accounted for over 70% of all imaging procedures performed in the U.S. that year. Hospitals are equipped with advanced imaging systems like MRI and CT scanners, making them the go-to choice for complex cases. Also, the American Hospital Association highlighted that hospitals conducted nearly 130 million outpatient visits annually , many involving imaging diagnostics. This widespread use underscores their importance in delivering accessible and reliable imaging services.

The diagnostic imaging centers segment is expected to grow at the rapid pace, with a CAGR of 9.8%. This growth will be driven by their affordability, shorter wait times, and specialized focus on imaging services. The National Center for Health Statistics projects that outpatient imaging procedures will increase by 15% annually , as patients seek cost-effective alternatives to hospitals. Diagnostic imaging centers also benefit from advancements in AI and teleradiology is enabling faster and more accurate diagnoses. A study by Deloitte notes that these centers are increasingly adopting cloud-based solutions, improving accessibility in rural areas. As healthcare shifts toward outpatient care, diagnostic imaging centers will play a pivotal role in expanding access to advanced imaging technologies across North America.

COUNTRY LEVEL ANALYSIS

The U.S. continues to anchor regional imaging innovation, supported by payer-led AI adoption and high procedural density. It captured 82.4% of regional revenue in 2024. As the world’s largest healthcare spender, the U.S. benefits from a well-established network of hospitals, diagnostic imaging centers, and academic medical institutions equipped with cutting-edge imaging technologies.

The country’s leadership is further reinforced by high patient awareness, favorable reimbursement policies, and robust R&D investments by major players such as GE Healthcare, Siemens Healthineers, and Philips. Also, the adoption of AI-driven radiology platforms and tele-radiology services has enhanced efficiency and accessibility, ensuring the U.S. remains the central hub for innovation and expansion in the North America medical imaging sector.

Canada is positioning itself as a key player in the region due to its publicly funded healthcare system and increasing emphasis on digital transformation in diagnostics. It’s national PACS integration strategy reflects a commitment to unified image repositories and equitable access.

The Canadian Agency for Drugs and Technologies in Health (CADTH) highlights that the adoption of Picture Archiving and Communication Systems (PACS) has streamlined workflow efficiency across hospitals and diagnostic centers.

Moreover, the rise in chronic diseases such as cancer and neurological disorders has driven demand for MRI and CT scans nationwide. Also, provincial governments have invested in AI-enabled radiology tools to reduce diagnostic delays. These developments, supported by regulatory reforms and cross-border collaborations, contribute to Canada’s steady growth trajectory within the North America medical imaging market.

The remaining North American countries, including Mexico and select Caribbean territories, collectively account for descent share of the regional medical imaging market in 2024. While relatively smaller in scale, this segment is showing potential for future growth due to improving healthcare access and government initiatives aimed at strengthening diagnostic capabilities.

Mexico’s modernization initiatives mark a transitional phase from analog to digital, opening entry points for mid-tier imaging vendors. Meanwhile, in the Caribbean, countries like Jamaica and the Bahamas are expanding their imaging capacities to support local healthcare needs and attract international patients. Although still developing, these markets present untapped opportunities for medical imaging vendors seeking diversification beyond the core U.S. and Canadian markets.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Companies playing a prominent role in the North America Diagnostic Imaging Market are GE Healthcare,Siemens Healthineers,Philips Healthcare,Canon Diagnostic Systems Corporation,Fujifilm Holdings Corporation,Hitachi, Ltd.,Mindray Diagnostic International Limited,Samsung Medison Co., Ltd.,Hologic, Inc.

The competition in the North America medical imaging market is characterized by intense rivalry among global technology leaders striving to maintain dominance through continuous innovation, strategic collaborations, and expanded service offerings. Established players leverage their strong R&D capabilities to introduce next-generation imaging systems embedded with artificial intelligence and predictive analytics. At the same time, emerging firms are gaining traction by offering specialized, cost-effective, and portable imaging solutions tailored for niche applications and point-of-care diagnostics. The market also sees increasing convergence between medical imaging and digital health platforms, fostering a competitive environment where software integration and data management play a pivotal role alongside hardware performance. Hospitals, imaging centers, and private clinics are becoming more selective, demanding not only high-quality imaging but also smart, scalable, and interoperable systems that can seamlessly integrate into evolving healthcare ecosystems. As a result, vendors must continuously adapt to shifting clinical needs, regulatory landscapes, and reimbursement policies to retain relevance and sustain growth.

Top Players in the market

GE Healthcare

GE Healthcare is a dominant force in the North America medical imaging market, offering a comprehensive range of diagnostic technologies including MRI, CT, X-ray, and ultrasound systems. The company plays a crucial role in advancing digital health through AI-powered imaging solutions that enhance diagnostic accuracy and streamline clinical workflows. With a strong presence across hospitals, research institutions, and outpatient centers, GE Healthcare drives innovation by integrating machine learning with imaging platforms to support precision medicine and early disease detection.

Siemens Healthineers

Siemens Healthineers is a key player known for its cutting-edge imaging technologies and holistic healthcare solutions tailored for North American hospitals and diagnostics centers. The company emphasizes integrated diagnostics, combining advanced hardware with data analytics and cloud-based tools to improve patient outcomes. Its focus on hybrid imaging systems such as PET-MRI and AI-assisted radiology has positioned it as a leader in transforming how medical imaging is used in clinical decision-making across oncology, cardiology, and neurology.

Philips Healthcare

Philips Healthcare is recognized for its innovative approach to personalized diagnostics and connected care in the medical imaging space. By embedding artificial intelligence into imaging equipment and developing remote monitoring capabilities, the company enhances efficiency and diagnostic consistency across North America’s diverse healthcare landscape. Philips continues to shape the future of imaging through its commitment to value-based healthcare, focusing on improved patient experiences while supporting clinicians with intelligent, data-driven imaging platforms.

Top strategies used by the key market participants

One major strategy employed by leading players in the North America medical imaging market is continuous innovation through AI and machine learning integration . Companies are enhancing their imaging platforms with intelligent algorithms that assist in faster and more accurate diagnosis, reducing human error and improving clinical efficiency. These advancements are particularly evident in oncology and neurology applications where precision is critical.

Another key approach is strategic acquisitions and partnerships aimed at expanding product portfolios and strengthening market foothold. Major firms are acquiring smaller tech-driven startups specializing in AI diagnostics or cloud-based imaging solutions to accelerate development and capture emerging opportunities in tele-radiology and digital pathology.

Lastly, companies are investing heavily in digital transformation and cloud-based infrastructure , enabling seamless image sharing, remote access, and collaborative diagnostics. This shift supports better interoperability within hospital networks and enhances patient-centric care models, positioning vendors for long-term growth in an increasingly connected healthcare ecosystem.

RECENT HAPPENINGS IN THE MARKET

In January 2024, GE Healthcare announced a new partnership with a leading U.S.-based AI diagnostics startup to embed real-time anomaly detection capabilities into its MRI and CT platforms, enhancing diagnostic speed and accuracy across major hospital networks.

In March 2024, Siemens Healthineers launched a dedicated AI-driven radiology suite tailored for community hospitals and outpatient imaging centers, aiming to expand its reach beyond large academic medical institutions and improve accessibility in regional healthcare settings.

In June 2024, Philips Healthcare introduced a cloud-based enterprise imaging platform designed to unify radiology, cardiology, and oncology imaging data under one interface, allowing seamless cross-specialty collaboration and remote diagnostics across North America.

In September 2024, Canon Medical Systems expanded its manufacturing facility in California to increase production capacity for high-field MRI systems, responding to rising demand from U.S. hospitals seeking advanced imaging solutions with reduced wait times.

In November 2024, Fujifilm Sonosite unveiled a next-generation handheld ultrasound device specifically designed for emergency and critical care use, targeting adoption in ambulatory care, trauma units, and rural healthcare facilities across North America.

MARKET SEGMENTATION

This research report on the north america diagnostic imaging market has been segmented and sub-segmented into the following categories.

By Type

- X-ray

- Molecular Imaging

By Technology

- X-ray Devices

- Ultrasound Imaging

By Application

- Cardiology

- Oncology

By End User

- Hospitals

- Diagnostic Imaging Centers

By Country

- The U.S.

- Canada

- Rest of North America.

Frequently Asked Questions

What is the size of the North America Diagnostic Imaging Market?

The market size varies annually, but it is a multi-billion-dollar industry driven by rising healthcare demand and technological advancements.

Which country leads the North America Diagnostic Imaging Market?

The United States dominates due to higher healthcare expenditure, advanced technology adoption, and a large patient base. Canada follows as a significant market player.

How is AI impacting the diagnostic imaging industry?

AI helps in early disease detection, enhances image analysis accuracy, speeds up diagnosis, and reduces human errors in radiology.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com