North America Dog Food Market Size, Share, Trends & Growth Forecast Report By Product (Food, Pet Nutraceuticals/Supplements, Pet Treats, Pet Veterinary Diets), Distribution Channel (Convenience Stores, Online Channel, Specialty Stores, Supermarkets/Hypermarkets, Other Channels), and Country (United States, Canada, Mexico, Rest of North America) – Industry Analysis From 2025 to 2033.

North America Dog Food Market Size

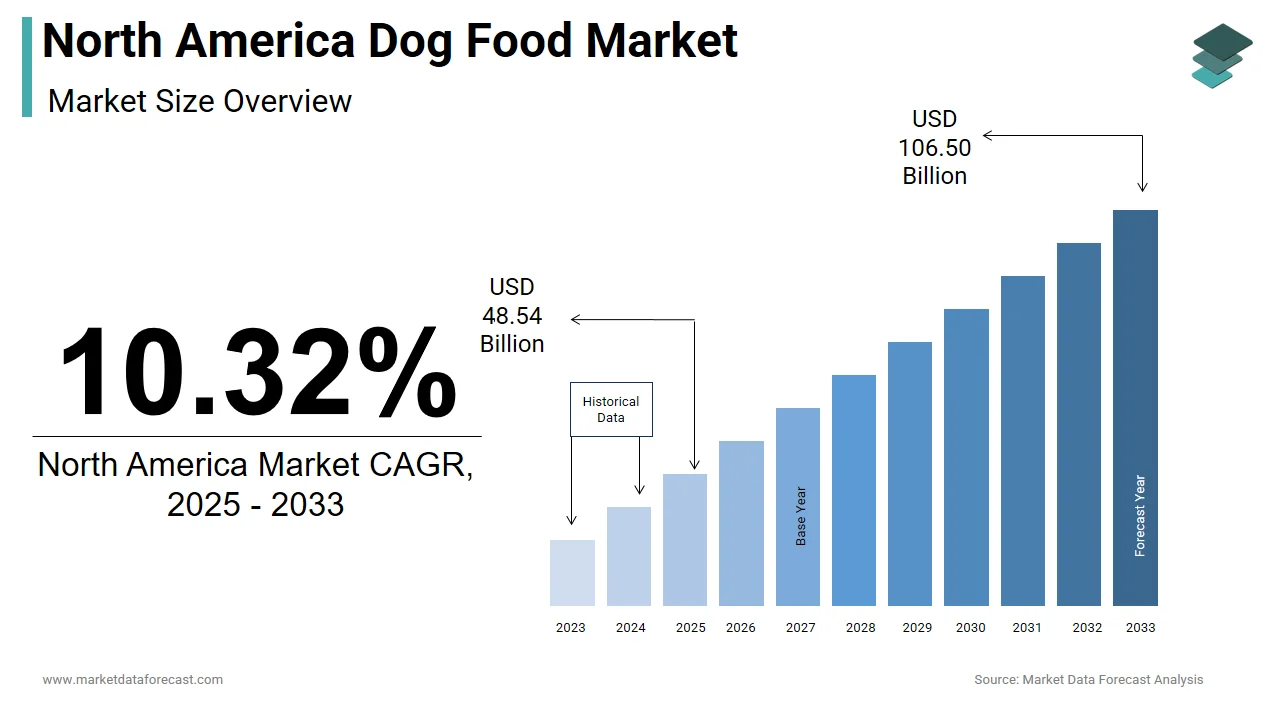

The size of the North America dog food market was worth USD 44 billion in 2024. The North America market is anticipated to grow at a CAGR of 10.32% from 2025 to 2033 and be worth USD 106.50 billion by 2033 from USD 48.54 billion in 2025.

The North America dog food market incorporates a wide array of nutritionally balanced pet food products tailored to meet the dietary needs of dogs across different life stages, breeds, and health conditions. This includes dry kibble, wet canned food, semi-moist options, and specialized functional diets such as grain-free, hypoallergenic, and raw food formulations. The market is primarily driven by the increasing humanization of pets, where dogs are considered integral family members, prompting owners to invest in premium quality nutrition. According to the American Pet Products Association (APPA), over 65% of U.S. households own at least one pet, with dogs being the most commonly owned pets. As per Statistics Canada, pet ownership in Canada has been steadily rising, particularly among millennials and Gen Z consumers who prioritize health-conscious choices for their pets. This shift has led to a surge in demand for high-quality, natural, and organic dog food products, supported by strong retail distribution through both physical stores and e-commerce platforms. Apart from these, advancements in veterinary science and growing awareness of canine nutrition have contributed to product innovation and brand loyalty.

MARKET DRIVERS

Increasing Humanization of Pets Driving Premium Product Demand

A key driver of the North America dog food market is the growing trend of pet humanization, wherein pet owners increasingly view their dogs as family members and are willing to spend on premium food products that mirror their own dietary preferences. According to the American Pet Products Association (APPA), a significant portion of U.S. pet owners consider their pets as part of the family , directly influencing purchasing decisions toward high-quality, organic, and ethically sourced dog food. This behavioral shift has led to increased demand for premium and super-premium pet food categories, which now account for a significant portion of total sales. Retailers and manufacturers have responded by launching clean-label products free from artificial additives, fillers, and preservatives. Brands like Ollie, Wellness Natural Pet Foods, and Blue Buffalo have capitalized on this sentiment by promoting ingredients such as real meat, vegetables, and probiotics. In Canada, similar trends are observed, with companies emphasizing locally sourced ingredients and sustainable sourcing practices.

Rising Awareness of Canine Nutrition and Health Benefits

Another critical factor fueling the North America dog food market is the heightened awareness among pet owners regarding the importance of balanced nutrition and its impact on a dog’s overall health and longevity. As pet parents become more informed about ingredients, they are actively seeking functional foods that offer benefits such as improved digestion, joint support, skin health, and weight management. This knowledge-driven approach has spurred the development of specialized dog food formulas targeting specific health concerns. For instance, brands like Hill’s Science Diet and Royal Canin have introduced veterinary-recommended diets tailored for conditions such as kidney disease, diabetes, and allergies. Functional ingredients like glucosamine, omega-3 fatty acids, and prebiotic fibers are now standard features in many premium dog food lines.

MARKET RESTRAINTS

Economic Volatility and Rising Cost of Living Impacting Discretionary Spending

One of the primary constraints affecting the North America dog food market is the economic uncertainty and rising cost of living, which has led some pet owners to scale back on premium product purchases. According to the Federal Reserve Bank of St. Louis, inflation in the U.S. remained above 3% in early 2024, with essential expenses such as housing, utilities, and groceries consuming a larger share of household budgets. While pet ownership remains resilient, consumers are opting for more affordable alternatives or reducing the frequency of premium product purchases. Retailers have noted an uptick in private label and value-brand dog food sales, as price-sensitive shoppers seek budget-friendly yet nutritious options. As per a 2024 study by Deloitte Canada, nearly 45% of pet owners admitted to switching to lower-cost dog food brands due to financial pressures. Mass-market retailers like Walmart, Kroger, and Costco have capitalized on this trend by offering competitively priced pet food lines.

Regulatory Scrutiny and Ingredient Transparency Concerns

Regulatory scrutiny and concerns around ingredient transparency pose a notable restraint on the North America dog food market. Consumers are increasingly demanding clear labeling, ethical sourcing, and verification of health claims, which can create compliance challenges for manufacturers. According to the U.S. Food and Drug Administration (FDA), several pet food recalls were issued in 2023 due to undeclared allergens, contamination risks, and mislabeling issues. These incidents have eroded consumer trust and prompted calls for stricter oversight. Apart from these, the FDA’s ongoing investigation into potential links between certain grain-free diets and dilated cardiomyopathy (DCM) in dogs has created confusion among pet owners and led to cautious purchasing behaviors. This uncertainty has affected sales of previously popular product lines and forced companies to reformulate recipes or provide clearer nutritional explanations.

MARKET OPPORTUNITIES

Expansion of Premium and Specialty Dog Food Segments

A major opportunity emerging in the North America dog food market is the growing demand for premium and specialty formulations that cater to specific dietary preferences and health requirements. Consumers are increasingly seeking products that align with their values, such as organic, non-GMO, grain-free, and ethically sourced ingredients as well as those that offer targeted health benefits. This trend is particularly evident among millennial and Gen Z pet owners, who prioritize wellness and sustainability in their purchasing decisions. Companies like Orijen, Acana, and ZiwiPeak have successfully positioned themselves as premium players by emphasizing high-protein content, minimal processing, and biologically appropriate ingredients. Moreover, functional dog food products addressing issues such as digestive health, mobility, and cognitive function are gaining traction.

Rise of Direct-to-Consumer and Subscription-Based Models

The increasing popularity of direct-to-consumer (DTC) and subscription-based business models presents a compelling opportunity for growth in the North America dog food market. Online platforms allow brands to build stronger relationships with pet owners by offering personalized meal plans, home delivery, and tailored recommendations based on breed, age, and health conditions. Startups such as The Farmer’s Dog, JustFoodForDogs, and Spot & Tails have leveraged this model to disrupt traditional retail channels and attract tech-savvy consumers who prefer seamless digital experiences. Established players like Mars Petcare and Nestlé Purina have also launched their own subscription services to compete in this evolving space. This shift enables brands to collect valuable consumer data, refine product offerings, and enhance customer retention through recurring revenue streams.

MARKET CHALLENGES

Supply Chain Disruptions Affecting Ingredient Availability and Production Timelines

Ongoing supply chain disruptions present a significant challenge to the North America dog food market, impacting raw material sourcing, production schedules, and final product availability. Also, delays in receiving key ingredients such as poultry, fishmeal, and plant-based proteins have increased significantly since early 2023, largely due to port congestion, labor shortages, and geopolitical tensions. Many pet food manufacturers rely on imported components, making them vulnerable to transportation bottlenecks and fluctuating commodity prices. These logistical hurdles have led to increased costs and longer lead times, forcing some brands to raise prices or delay new product launches. E-commerce retailers, which depend heavily on timely deliveries to meet consumer expectations, have been particularly affected. While some companies are reshoring production or diversifying supplier networks, these adjustments take time and require significant investment.

Misinformation and Confusion Around Pet Diets Influencing Consumer Behavior

A growing challenge in the North America dog food market is the spread of misinformation and conflicting advice regarding pet nutrition, which influences consumer choices and creates confusion among pet owners. Social media platforms, blogs, and online forums often feature unverified claims about the benefits or dangers of certain ingredients, such as grains, carbohydrates, and synthetic additive,s leading to inconsistent purchasing behaviors. According to a 2024 survey by the American Animal Hospital Association (AAHA), over 60% of pet owners admitted to changing their dog’s diet based on online information without consulting a veterinarian. This phenomenon has resulted in shifting demand patterns, with consumers frequently rotating between product types such as grain-free, raw, and homemade diets without fully understanding the nutritional implications. In some cases, this has led to unintended health consequences, prompting recalls and regulatory interventions. As reported by the U.S. Food and Drug Administration (FDA), concerns over potential links between grain-free diets and heart disease in dogs have caused widespread anxiety and reduced consumer confidence in certain product categories.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Pet Food Product, Distribution Channel, and Region. |

|

Various Analyses Covered |

Global, Regional and Country-Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

United States, Canada, Mexico, and the Rest of North America. |

|

Market Leaders Profiled |

Colgate-Palmolive Company (Hill's Pet Nutrition Inc.), General Mills Inc., Mars Incorporated, Nestle (Purina), The J. M. Smucker Company, and others. |

SEGMENTAL ANALYSIS

By Pet Food Product Insights

The dog food segment dominated the North America pet food market by capturing 68% of total market revenue in 2024. This is primarily driven by the essential nature of daily feeding routines among pet owners, who prioritize balanced and nutritious meals for their dogs. According to the American Pet Products Association (APPA), a significant portion of U.S. households own at least one dog, creating a vast and consistent demand base for commercial dog food products. This segment benefits from continuous product innovation, including premium formulations, functional ingredients, and specialized diets tailored to different life stages and health conditions. In Canada, Statistics Canada notes that pet food expenditures have steadily increased year-over-year, with dog food representing the largest portion of pet-related spending. The presence of major manufacturers such as Mars Petcare, Nestlé Purina, and Blue Buffalo further reinforces this dominance through extensive distribution networks and brand loyalty programs.

Pet nutraceuticals and supplements are emerging as the fastest-growing category in the North America dog food market, projected to expand at a CAGR of 10.4%. This quick development is fueled by increasing awareness among pet owners about preventive healthcare and the role of dietary supplements in enhancing canine well-being. Veterinary professionals are also playing a key role in driving adoption, often recommending omega-3 fatty acids, probiotics, glucosamine, and CBD-infused products to address specific health concerns. As per the Pet Industry Trends Report, the global market for pet supplements grew by 15% year-over-year, with North America leading in both innovation and consumption. Companies like VetriScience, Nutramax Laboratories, and Nordic Naturals have expanded their portfolios to include species-specific formulations, capitalizing on the growing demand for holistic pet care. Apart from these, direct-to-consumer e-commerce platforms have made it easier for consumers to access these products without requiring a prescription.

By Distribution Channel Insights

Supermarkets and hypermarkets had the biggest share in the North America dog food market by accounting for 42.9% of total retail distribution in 2024. This is credited to the convenience of one-stop shopping, where consumers can purchase pet food alongside household essentials, groceries, and personal care products. These large-format stores offer a broad selection of dog food brands across all price points, ranging from economy to premium segment,s making them accessible to a wide demographic. In Canada, Loblaw Companies Limited and Sobeys maintain strong shelf space for pet nutrition products, ensuring widespread availability. Also, frequent promotional campaigns, loyalty programs, and private label offerings contribute to the continued strength of this channel.

The online distribution channel is the fastest-growing segment in the North America dog food market, anticipated to grow at a CAGR of 12.1%. This expansion is driven by the increasing preference for digital shopping, particularly among millennial and Gen Z pet owners who seek convenience, customization, and doorstep delivery. E-commerce platforms such as Amazon, Chewy, and Petco.com have capitalized on this trend by offering personalized recommendations, auto-replenishment options, and exclusive product lines tailored to individual pet profiles. Direct-to-consumer startups like Ollie and The Farmer’s Dog have further disrupted traditional retail by emphasizing ingredient transparency and fresh, human-grade formulations.

COUNTRY-WISE ANALYSIS

The United States had the dominant position in the North America dog food market by capturing an estimated 84.1% of regional market value in 2024. This is attributed to a combination of high pet ownership rates, strong disposable incomes, and a mature retail infrastructure that supports both traditional and innovative pet food offerings. Major players such as Mars Petcare, Nestlé Purina, and Blue Buffalo have established extensive manufacturing and distribution networks, ensuring nationwide availability of diverse dog food products. Besides, the U.S. market has been at the forefront of introducing functional and premium pet foods, driven by heightened consumer awareness around canine nutrition. The influence of social media, veterinary endorsements, and celebrity pet culture further fuels brand loyalty and product experimentation.

Canada is positioning itself as another important player in the region. The country’s market growth is driven by rising pet ownership, particularly among urban dwellers and younger demographics who treat pets as family members and invest accordingly in premium nutrition. Canadian consumers exhibit a strong preference for natural, organic, and locally sourced pet food products, influencing product development strategies of both domestic and international brands. Retailers such as Loblaws, Pet Valu, and Costco have expanded their private-label pet food lines to cater to budget-conscious yet quality-driven shoppers. As reported by Deloitte Canada, over 50% of pet owners consider ingredient transparency when purchasing dog food, highlighting the importance of clean labeling and ethical sourcing. E-commerce is also gaining traction, with online pet retailers experiencing double-digit growth.

The remaining North American countries are still in the early stages of development. These markets present untapped opportunities due to rising pet ownership rates, increasing exposure to global pet care trends, and expanding retail infrastructure. In Mexico, cities like Mexico City, Monterrey, and Guadalajara have seen an influx of international pet food brands, while local manufacturers are launching premium formulations to meet evolving consumer preferences. Meanwhile, in the Caribbean, tourism-driven economies such as Puerto Rico and the Bahamas are witnessing increased demand for imported pet food products among expatriates and affluent locals.

MARKET KEY PLAYERS

Companies playing a dominant role in the North America dog food market profiled in this report are Colgate-Palmolive Company (Hill's Pet Nutrition Inc.), General Mills Inc., Mars Incorporated, Nestle (Purina), The J. M. Smucker Company, and others.

TOP LEADING PLAYERS IN THE MARKET

One of the leading players in the North America dog food market is Mars Petcare, a global leader in pet nutrition and veterinary health services. The company’s portfolio includes well-known brands such as Pedigree, Royal Canin, and Iams, which collectively offer a wide range of products tailored to different breeds, life stages, and dietary needs. Mars Petcare has significantly contributed to advancing pet nutrition through scientific research and partnerships with veterinary professionals.

Another key player is Nestlé Purina PetCare, recognized for its extensive product line that spans from everyday dry kibble to premium functional foods and veterinary diets. Purina’s commitment to innovation, sustainability, and pet wellness has made it a trusted name among pet owners. The company also plays a crucial role in shaping industry standards through responsible sourcing and investment in pet health research.

Blue Buffalo is another major contributor, known for pioneering the natural and holistic pet food movement in North America. Acquired by General Mills in recent years, Blue Buffalo continues to lead in clean-label formulations, emphasizing high-quality ingredients without artificial additives. Its influence has driven broader market shifts toward transparency, fueling consumer demand for healthier pet food options across the region.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

A primary strategy employed by key players in the North America dog food market is product innovation and diversification, where companies continuously develop new formulations targeting specific health concerns, breed requirements, and lifestyle preferences. This enables brands to cater to evolving consumer expectations while maintaining relevance in a competitive landscape.

Another critical approach is leveraging digital engagement and direct-to-consumer (DTC) models. Leading firms are investing in personalized subscription services, AI-driven recommendations, and online platforms that enhance customer experience and encourage brand loyalty through convenience and customization.

Lastly, strategic acquisitions and partnerships are frequently used to expand market presence and capabilities. Companies acquire emerging natural and premium pet food brands to tap into niche markets and strengthen their portfolios. Collaborations with veterinarians, pet influencers, and e-commerce platforms further reinforce brand positioning and drive long-term growth in the North American dog food sector.

COMPETITION OVERVIEW

The competition in the North America dog food market is highly dynamic, characterized by a mix of established multinational corporations, mid-tier regional players, and fast-emerging specialty brands vying for consumer attention across multiple channels. Traditional pet food giants continue to dominate due to their strong brand equity, extensive distribution networks, and significant R&D investments. However, the rise of boutique and natural pet food brands has introduced greater diversity and innovation, appealing to health-conscious and discerning pet owners.

Retailers are increasingly leveraging omnichannel strategies to provide seamless shopping experiences, combining physical stores with immersive online platforms. At the same time, the growing influence of social media and pet influencers is reshaping marketing approaches and purchasing behaviors. Sustainability, ingredient transparency, and functional nutrition have become key differentiators, influencing both brand loyalty and consumer trust. With constant innovation, aggressive marketing, and strategic collaborations shaping the landscape, the North America dog food market remains fiercely competitive and continuously evolving.

RECENT MARKET DEVELOPMENTS

- In February 2024, Mars Petcare launched a new line of vet-developed functional dog food formulas designed to support joint health and digestive wellness, reinforcing its leadership in science-backed pet nutrition across North America.

- In May 2024, Nestlé Purina expanded its sustainable packaging initiative by introducing fully recyclable kibble bags made from post-consumer recycled materials, aligning with consumer demand for environmentally responsible pet food solutions.

- In July 2024, Blue Buffalo acquired a small clean-label startup specializing in grain-free freeze-dried raw dog food, enhancing its portfolio with innovative formats that cater to the rising preference for raw and minimally processed diets.

- In September 2024, The Farmer’s Dog, a prominent DTC fresh dog food brand, secured a major partnership with Chewy to distribute its refrigerated meals through the online pet giant’s fulfillment network, broadening its reach beyond direct subscriptions.

- In November 2024, General Mills Pet Partners announced a collaboration with a leading veterinary telehealth platform to integrate personalized nutrition recommendations based on pet health data, strengthening its connection between pet care and diet customization.

MARKET SEGMENTATION

This research report on the North America dog food market is segmented and sub-segmented into the following categories.

By Product

- Food

- Dry Pet Food

- Kibbles

- Other Dry Pet Food

- Wet Pet Food

- Dry Pet Food

- Pet Nutraceuticals/Supplements

- Milk Bioactives

- Omega-3 Fatty Acids

- Probiotics

- Proteins and Peptides

- Vitamins and Minerals

- Other Nutraceuticals

- Pet Treats

- Crunchy Treats

- Dental Treats

- Freeze-dried and Jerky Treats

- Soft & Chewy Treats

- Other Treats

- Pet Veterinary Diets

- Diabetes

- Digestive Sensitivity

- Oral Care Diets

- Renal

- Urinary Tract Disease

- Other Veterinary Diets

By Distribution Channel

- Convenience Stores

- Online Channel

- Specialty Stores

- Supermarkets/Hypermarkets

- Other Channels

By Country

- United States

- Canada

- Mexico

- Rest of North America

Frequently Asked Questions

1. What are the main growth drivers for the North America Dog Food Market?

Growth is driven by rising pet ownership, humanization of pets, demand for premium and functional foods, and e-commerce expansion

2. How big is the North America Dog Food Market and what is its growth outlook?

The market is valued at over $44 billion in 2024 and is projected to grow steadily, driven by health, sustainability, and premiumization trends

3. Which product types dominate the North America Dog Food Market

Dry dog food (kibble) leads the market, followed by wet/canned food, treats, and specialized diets for health conditions

4. How are consumer preferences changing in the North America Dog Food Market?

Consumers increasingly prefer natural, organic, grain-free, and high-protein dog foods, as well as products with functional ingredients like probiotics and omega fatty acids

5. What role does pet humanization play in the North America Dog Food Market?

Pet humanization drives demand for premium, human-grade, and health-focused dog foods as owners treat pets like family members

6. How important is sustainability in the North America Dog Food Market?

Sustainability is a growing focus, with consumers seeking eco-friendly packaging, ethically sourced ingredients, and plant-based or insect protein options

7. Which distribution channels are most significant in the North America Dog Food Market?

Specialty pet stores and online retailers are dominant, with online sales growing rapidly due to convenience and variety

8. What trends are shaping the North America Dog Food Market in 2025 and beyond?

Trends include personalized nutrition, subscription meal plans, functional supplements, and increased transparency in sourcing and labeling

How does the North America Dog Food Market address specific dog health needs?

The market offers veterinary diets and functional foods targeting issues like weight management, digestive health, allergies, and joint care

10. What are the main challenges facing the North America Dog Food Market?

Challenges include rising ingredient costs, regulatory compliance, supply chain disruptions, and the need for ongoing product innovation

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com