North America Fruit Snacks Market Size, Share, Trends & Growth Forecast Report By Product Type (Sweet and Savory Chips, Candies and Bars, Dairy-based, Other Fruit Snacks), Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Specialist Retailers, Online Retailing, Other Distribution Channels), and Country (United States, Canada, Mexico, Rest of North America) – Industry Analysis From 2025 to 2033.

North America Fruit Snacks Market Size

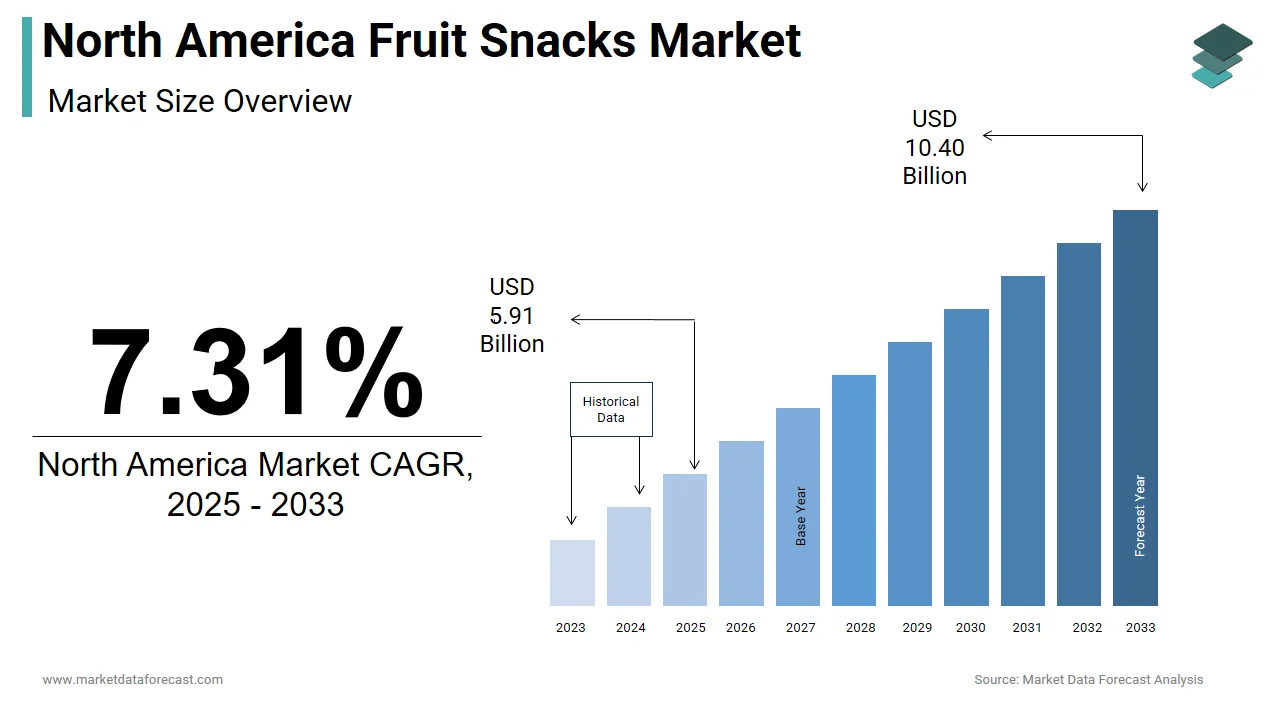

The size of the North America fruit snacks market was worth USD 5.51 billion in 2024. The North America market is anticipated to grow at a CAGR of 7.31% from 2025 to 2033 and be worth USD 10.40 billion by 2033 from USD 5.91 billion in 2025.

The North America fruit snacks market incorporates a variety of processed and packaged products that mimic or replicate the taste, texture, and appearance of natural fruits. These snacks are typically formulated using concentrated fruit purees, pectin, sugars, and preservatives, and are available in chewy, gummy, or dried forms. Positioned as convenient, on-the-go alternatives to fresh fruit, they appeal particularly to children and young adults. The market has evolved significantly over the past decade, with manufacturers increasingly emphasizing clean-label ingredients, organic formulations, and reduced sugar content to align with shifting consumer preferences.

This market is also influenced by broader health and wellness trends, with consumers seeking healthier snack options without compromising flavor or convenience. These evolving dynamics continue to shape the competitive landscape and drive innovation across the sector.

MARKET DRIVERS

Rising Demand for Convenient and Nutrient-Dense Snacks

One of the primary drivers fueling the North America fruit snacks market is the growing consumer preference for convenient yet nutrient-dense food options. Busy urban lifestyles, increasing participation of dual-income households, and rising school-going populations have collectively intensified demand for ready-to-eat snacks that offer both taste and nutritional benefits.

According to the U.S. Census Bureau, approximately 76% of American households include at least one working adult, reinforcing the need for quick meal and snack solutions.

Fruit snacks are often marketed as portable sources of vitamins and fiber, especially among children and fitness-conscious adults. Moreover, innovations such as fortified fruit chews enriched with vitamin C and probiotics have enhanced their appeal among health-focused consumers.

Additionally, the shift toward plant-based diets and clean-label products has prompted major brands to introduce organic and all-natural variants. This trend indicates a structural change in consumer expectations, where convenience is no longer the sole deciding factor but is accompanied by demands for transparency, nutrition, and functional benefits, factors that are significantly contributing to the sustained growth of the fruit snacks market in North America.

Expansion of E-commerce Platforms and Retail Distribution Channels

Another significant driver influencing the North America fruit snacks market is the rapid expansion of e-commerce platforms and modern retail distribution channels. Online grocery shopping has gained substantial traction, especially post-pandemic, enabling wider product visibility and accessibility.

This digital transformation has allowed both established and emerging fruit snack brands to reach a broader audience beyond traditional brick-and-mortar stores. Amazon Fresh, Instacart, and Walmart Grocery have become key online touchpoints for purchasing snack items, including premium and niche fruit snack varieties.

Simultaneously, mass merchandisers and club stores such as Costco and Sam’s Club have increased their shelf space allocation for branded and private-label fruit snacks, capitalizing on bulk purchasing behavior. As per the Food Marketing Institute, warehouse clubs recorded a 9% increase in snack food sales volume in 2023 compared to the previous year. This omnichannel retail strategy ensures consistent availability and affordability, encouraging repeat purchases and strengthening brand loyalty, key catalysts behind the robust expansion of the North America fruit snacks market.

MARKET RESTRAINTS

Growing Consumer Concerns Over Added Sugars and Artificial Ingredients

Despite their popularity, the North America fruit snacks market faces significant resistance due to increasing awareness about the health implications of excessive sugar intake and artificial additives. Many conventional fruit snacks contain high levels of added sugars, corn syrup, and synthetic colorants, raising concerns among health-conscious consumers and regulatory bodies alike.

According to the Centers for Disease Control and Prevention (CDC), a significant share of American adults are either overweight or obese, prompting greater scrutiny over the nutritional value of packaged foods, including snacks.

In response, organizations like the American Academy of Pediatrics have issued guidelines recommending limited consumption of sugary snacks among children, directly impacting parental purchasing decisions.

To address these concerns, several manufacturers have reformulated their products to include natural sweeteners such as stevia and monk fruit extract. However, transitioning to clean-label ingredients often results in higher production costs, which can limit price competitiveness in a highly saturated market.

These economic and health-related challenges pose considerable restraints on market expansion, compelling companies to invest heavily in R&D and marketing to maintain relevance amid evolving dietary preferences.

Intense Competition from Alternative Snack Categories

A critical restraint affecting the North America fruit snacks market is the intense competition posed by alternative snack categories, including protein bars, vegetable chips, nuts, and dairy-based snacks. Consumers are increasingly diversifying their snacking habits to include products perceived as more nutritionally balanced or satiating.

According to the U.S. Department of Agriculture’s Economic Research Service, per capita consumption of nuts and seeds rose between 2020 and 2023, while sales of Greek yogurt and plant-based protein bars surged during the same period.

These shifts are largely attributed to rising fitness consciousness and a growing emphasis on macronutrient balance. In contrast, traditional fruit snacks, often viewed as calorie-dense and low in protein, struggle to compete in this environment.

Moreover, the proliferation of private-label and store-brand snacks in major retailers such as Kroger and Target has introduced cost-effective alternatives that further erode the market share of leading national brands. This aggressive competition not only pressures profit margins but also necessitates continuous innovation and differentiation efforts from established players to retain consumer interest.

MARKET OPPORTUNITIES

Innovation in Functional and Fortified Fruit Snacks

A prominent opportunity emerging in the North America fruit snacks market lies in the development and commercialization of functional and fortified snack products tailored to meet specific dietary and wellness needs. With rising health consciousness and a growing focus on preventive healthcare, consumers are increasingly seeking snacks that deliver additional nutritional benefits beyond basic caloric intake.

Recognizing this trend, several manufacturers have begun introducing fruit snacks enriched with essential vitamins, minerals, prebiotics, and adaptogens.

Similarly, brands like YumEarth and Stretch Island have incorporated probiotics into their formulations, targeting digestive health.

Such innovations not only enhance product differentiation but also enable fruit snacks to enter new consumer segments, including aging populations and fitness enthusiasts. By aligning with broader wellness movements and leveraging scientific backing for health claims, the market is well-positioned to capture incremental demand, thereby unlocking significant growth potential in the evolving North American snack landscape.

Expansion into School and Institutional Meal Programs

An underexplored yet promising opportunity in the North America fruit snacks market is the integration of fruit-based snacks into school meal programs and institutional catering services. With increasing government initiatives aimed at improving childhood nutrition and reducing reliance on processed junk food, there is a growing push to incorporate healthier snack alternatives in educational and public institutions.

Several states have already implemented policies mandating the inclusion of fruit-based or whole-fruit snacks in school meals. For instance, California passed legislation in 2022 requiring schools to provide at least two servings of fruit or vegetable-based snacks per week, opening avenues for manufacturers to supply compliant products.

Beyond schools, hospitals, daycare centers, and workplace cafeterias are also revising snack menus to align with wellness standards. Brands that tailor portion sizes, reduce sugar content, and comply with federal nutrition guidelines stand to benefit from long-term contracts and stable demand cycles. This institutional channel represents a strategic avenue for scaling sales volumes while reinforcing the perception of fruit snacks as wholesome, everyday food choices.

MARKET CHALLENGES

Regulatory Scrutiny and Labeling Requirements

One of the foremost challenges confronting the North America fruit snacks market is the tightening regulatory environment surrounding food labeling, nutritional claims, and ingredient transparency. Governments and health agencies are increasingly scrutinizing product formulations to ensure that packaging accurately reflects nutritional content and avoids misleading marketing practices. According to the U.S. Food and Drug Administration (FDA), enforcement actions against false or deceptive health claims on packaged foods increased in 2023 compared to the previous year.

Specifically, the FDA has proposed stricter definitions for terms such as “natural,” “healthy,” and “organic,” which many fruit snack manufacturers have historically used in their branding. Such regulatory interventions not only delay product launches but also incur compliance costs, particularly for smaller brands lacking dedicated legal and regulatory teams.

Moreover, evolving state-level regulations, such as California’s Proposition 65 requirements for chemical disclosures, add another layer of complexity. Compliance with these varied mandates forces companies to reformulate products, redesign packaging, and conduct extensive testing, all of which can hinder agility and profitability.

Volatility in Raw Material Prices and Supply Chain Disruptions

Another critical challenge facing the North America fruit snacks market is the volatility in raw material prices and persistent supply chain disruptions. Key ingredients such as fruit concentrates, pectin, and natural sweeteners are subject to fluctuating costs driven by climatic conditions, agricultural yields, and global trade dynamics. According to the U.S. Department of Agriculture’s Economic Research Service, the average price of frozen orange concentrate, a common base for citrus-flavored fruit snacks, rose by 17% in 2023 due to adverse weather conditions in Florida and Brazil.

Supply chain bottlenecks, although less severe than during the pandemic, continue to impact production timelines and inventory management. Furthermore, labor shortages in domestic logistics sectors have led to delayed deliveries and increased warehousing costs.

These factors contribute to margin pressures, especially for mid-sized and independent manufacturers who lack the economies of scale enjoyed by larger competitors. To mitigate risks, companies are investing in local sourcing partnerships and vertical integration strategies. However, such transitions require time and capital, making short-term resilience difficult to achieve in an environment marked by ongoing economic and environmental uncertainties.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Product Type, Distribution Channel, and Region. |

|

Various Analyses Covered |

Global, Regional and Country-Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

United States, Canada, Mexico, Rest of North America |

|

Market Leaders Profiled |

Nims Fruit Crisps Limited, Rind Snacks, Brothers International Food Corporation (Fruit Crisps), PIM Brands (Welch's), Steele Brands (Crispy Green Inc.), and others. |

SEGMENTAL ANALYSIS

By Product Type Insights

Candies and Bars hold the largest market share, accounting for 38.3% of total sales volume in 2024. This segment includes chewy fruit strips, gummy-like candies, and pressed fruit bars that are often marketed as kid-friendly or on-the-go options.

The dominance of this category is primarily driven by its widespread appeal across age groups, especially among children and adolescents. Besides, major players like General Mills and Mondelēz International have invested heavily in branding and packaging innovations, ensuring high visibility and repeat purchase behavior.

Moreover, the segment benefits from extensive shelf placement in mass retailers and convenience stores, enhancing accessibility. With consistent new product launches, such as Welch’s Chewy Fruit Snacks and Betty Crocker Fruit Roll-Ups, this segment continues to maintain its leadership position through strong consumer engagement and strategic marketing.

The Dairy-Based Fruit Snacks segment is currently the fastest-growing within the North America fruit snacks market, projected to expand at a CAGR of 7.4%. Though still relatively small compared to other categories, this segment is gaining momentum due to shifting dietary preferences and rising demand for nutrient-dense snacking solutions.

A key driver behind this growth is the increasing popularity of hybrid snacks that combine dairy proteins with fruit-based textures to offer better satiety and nutritional value. According to the International Food Information Council, over 60% of consumers in North America now seek snacks that provide both flavor and functional health benefits, making dairy-infused fruit products an attractive option. Brands like Stonyfield Farm and Good & Gather have introduced yogurt-covered fruit bites and probiotic-enriched blends that align with digestive wellness trends.

Additionally, fitness-conscious millennials and Gen Z consumers are driving demand for portable, protein-rich snacks. According to the Sports & Fitness Industry Association, in 2023, daily protein intake among young adults rose by 12% over the past three years, reinforcing the appeal of dairy-fruit hybrids. As manufacturers continue to innovate with clean-label ingredients and plant-based alternatives, this segment is poised for sustained expansion.

By Distribution Channel Insights

Supermarkets and hypermarkets remained the dominant distribution channel in the North America fruit snacks market, capturing 43% of total retail sales in 2024. This segment includes major chains such as Walmart, Kroger, Safeway, and Albertsons, which collectively offer broad product assortments and competitive pricing.

One of the primary reasons for the continued dominance of this channel is the high footfall and purchasing frequency associated with grocery shopping. Within these stores, fruit snacks are strategically placed near candy aisles, checkout counters, and children's cereal sections to maximize impulse purchases.

Another key factor is the strong presence of private-label brands, which offer cost-effective alternatives to national brands. These offerings not only attract budget-conscious consumers but also allow retailers to control margins and shelf space allocation more effectively.

Furthermore, promotions such as multi-buy deals, loyalty discounts, and seasonal displays significantly boost trial and repeat purchases. Given the scale and reach of supermarkets, this distribution channel remains central to brand penetration and long-term market stability.

Online retailing is the fastest-growing distribution channel in the North America fruit snacks market, expected to grow at a CAGR of 10.2%. Although still a smaller portion of overall sales compared to physical retail, digital platforms are rapidly gaining traction due to evolving consumer behaviors and improved e-commerce infrastructure.

One of the main drivers of this growth is the rising adoption of online grocery shopping, particularly among urban and millennial demographics. Platforms such as Amazon Fresh, Instacart, and Shipt have made it easier for consumers to access niche and premium fruit snack variants without visiting a physical store.

Another contributing factor is the expansion of direct-to-consumer (DTC) models by emerging brands. Startups and specialty producers leverage social media and influencer marketing to drive traffic to their own websites and third-party marketplaces, bypassing traditional retail gatekeepers. With continuous improvements in logistics, subscription services, and personalized recommendations, the online retailing segment is well-positioned to sustain its rapid ascent in the coming years.

COUNTRY-LEVEL ANALYSIS

United States Fruit Snacks Market Insights

The United States held the largest share of the North America fruit snacks market at approximately 78.1% in 2024. This dominance is attributed to high consumption rates, robust brand presence, and a mature retail ecosystem that supports both traditional and innovative product formats.

A key driver of the U.S. market is the widespread integration of fruit snacks into daily eating habits, especially among children and working professionals. Additionally, school lunch programs and workplace wellness initiatives have encouraged healthier snacking, further boosting demand.

Manufacturers such as General Mills and Mondelēz have capitalized on this trend by launching low-sugar and organic variants. Moreover, the proliferation of e-commerce channels has expanded product availability, allowing niche and regional brands to gain national exposure. Given the country’s established supply chain networks, regulatory clarity, and high disposable incomes, the U.S. is expected to maintain its leadership in the North America fruit snacks market throughout the forecast period.

Canada Fruit Snacks Market Insights

Canada is positioning it as a key secondary market with steady growth potential. Canadian consumers exhibit a growing preference for natural and minimally processed foods, aligning with global health trends that favor clean-label and fortified snacks.

One of the primary growth drivers is the increasing awareness around childhood nutrition and obesity prevention. This has prompted parents to seek healthier alternatives to conventional sweets, with fruit snacks being positioned as a viable substitute.

Major retailers such as Loblaws and Sobeys have responded by expanding their private-label fruit snack portfolios, emphasizing non-GMO, gluten-free, and vegan certifications.

Moreover, Canada’s bilingual population and proximity to the U.S. facilitate cross-border marketing strategies, enabling brands to test new formulations before broader North American rollouts. As regulatory frameworks tighten and consumer expectations evolve, Canada is emerging as a critical battleground for innovation and market differentiation.

Rest of North America

The Rest of North America is witnessing gradual expansion due to rising disposable incomes and urbanization trends.

In Mexico, for instance, urban middle-class households are increasingly adopting Western-style snacking habits, as noted by INEGI, the country’s national statistics institute. This shift has led to greater acceptance of packaged fruit snacks, particularly in large cities such as Mexico City and Monterrey, where modern retail formats like Walmart de México and Soriana are expanding.

Additionally, imported and branded fruit snacks are gaining traction among health-oriented consumers, with companies like Welch’s and Smucker’s entering through selective partnerships. However, economic disparities and limited cold-chain infrastructure hinder widespread distribution, restricting growth to select urban centers.

Despite these challenges, the region presents untapped opportunities for future expansion, especially as local manufacturers begin producing affordable domestic versions of popular fruit snacks. As trade agreements and food safety standards improve, the Rest of North America could become a more significant contributor to the broader regional market.

MARKET KEY PLAYERS

Companies playing a dominant role in the North America fruit snacks market profiled in this report are Nims Fruit Crisps Limited, Rind Snacks, Brothers International Food Corporation (Fruit Crisps), PIM Brands (Welch's), Steele Brands (Crispy Green Inc.), and others.

TOP LEADING PLAYERS IN THE MARKET

General Mills Inc.

General Mills is a leading player in the North America fruit snacks market, known for its well-established brand Betty Crocker Fruit Roll-Ups and Nature Valley fruit-based snack variants. The company has consistently focused on product innovation, introducing organic, non-GMO, and gluten-free options to align with evolving consumer preferences. By leveraging strong distribution networks and marketing campaigns targeting children and health-conscious consumers, General Mills has solidified its position as a dominant force in the category.

Mondelez International, Inc.

Mondelēz International plays a crucial role in shaping the North America fruit snacks landscape through its popular brand Trolli, which offers chewy and gummy fruit snacks. The company emphasizes flavor variety, texture experimentation, and packaging convenience to attract diverse age groups. Mondelēz invests heavily in R&D to develop clean-label products and expand its presence in premium retail and e-commerce channels, reinforcing its competitive edge in the market.

The J.M. Smucker Company

Best known for the Welch’s brand of fruit snacks, The J.M. Smucker Company has built a strong reputation by offering high-quality, recognizable fruit flavors that appeal to families and children. The company focuses on sustainability, sourcing real fruit ingredients and promoting nutritional transparency. With consistent product launches and strategic partnerships across retail and institutional sectors, Smucker continues to maintain a significant influence in the North American fruit snacks market.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

Product Innovation and Reformulation

Leading players continuously invest in developing new flavors, textures, and healthier formulations to cater to changing consumer demands. Brands are focusing on reducing sugar content, eliminating artificial additives, and incorporating functional ingredients like vitamins and probiotics to enhance perceived health benefits.

Expansion of Distribution Channels

To strengthen their market presence, companies are broadening their reach through supermarkets, club stores, and online platforms. Strategic partnerships with retailers and investment in direct-to-consumer models help brands increase visibility and accessibility across diverse consumer segments.

Branding and Consumer Engagement

Established players leverage strong branding, celebrity endorsements, and digital marketing to build emotional connections with consumers. Targeted advertising, especially toward parents and younger demographics, enhances brand loyalty and drives repeat purchases in a highly competitive environment.

COMPETITION OVERVIEW

The competition in the North America fruit snacks market is intense, characterized by the presence of both global giants and emerging regional brands vying for consumer attention. Established players dominate through extensive product portfolios, strong brand recognition, and widespread distribution networks. These companies often engage in aggressive marketing campaigns and continuous product innovation to differentiate themselves and maintain relevance in a crowded marketplace. Meanwhile, smaller and private-label brands are gaining traction by focusing on niche segments such as organic, vegan, and low-sugar alternatives. This dynamic creates a layered competitive environment where differentiation through formulation, packaging, and positioning becomes critical. Retailers also play a growing role by launching store-branded versions that challenge national brands on price and quality. As consumer preferences evolve towards healthier and more transparent snacking options, companies must remain agile, investing in research, sustainability, and digital engagement to stay ahead in this fast-moving sector.

RECENT MARKET DEVELOPMENTS

- In February 2024, General Mills launched a new line of plant-based fruit snacks under its Betty Crocker brand, formulated without gelatin and certified vegan, aiming to capture a growing segment of health-conscious and ethically driven consumers.

- In May 2024, Mondelēz International expanded its Trolli fruit snacks portfolio by introducing a tropical-flavored gummy variant designed specifically for millennial consumers seeking adventurous taste profiles and enhanced texture experiences.

- In August 2024, The J.M. Smucker Company partnered with a major U.S. school nutrition program to supply Welch’s branded fruit snacks in federally funded meal kits, significantly boosting brand visibility and long-term institutional sales potential.

- In November 2024, Nestlé USA entered the North America fruit snacks market with a limited-edition range of fruit-based bites under its Lean Cuisine sub-brand, targeting fitness-oriented adults looking for low-calorie, portable snack options.

- In January 2025, Private Label Advantage, a supplier to major grocery chains, introduced an exclusive line of clean-label fruit snacks for Kroger, emphasizing non-GMO certification and reduced sugar content, strengthening retailer control over pricing and product differentiation.

MARKET SEGMENTATION

This research report on the North America fruit snacks market is segmented and sub-segmented into the following categories.

By Product Type

- Sweet and Savory Chips

- Candies and Bars

- Dairy-based

- Other Fruit Snacks

By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Specialist Retailers

- Online Retailing

- Other Distribution Channels

By Country

- United States

- Canada

- Mexico

- Rest of North America

Frequently Asked Questions

What are the main drivers fueling growth in the North America Fruit Snacks Market?

Growth is driven by rising health consciousness, demand for convenient and nutritious snacks, and the popularity of clean label and organic products

Which product types are most popular in the North America Fruit Snacks Market?

Fruit gummies, strips, bars, dried fruits, bites, and innovative shapes are among the most popular product types, appealing to both children and adults

How do consumer health and wellness trends impact the North America Fruit Snacks Market?

Consumers are seeking low-calorie, low-sugar, gluten-free, and non-GMO options, pushing brands to innovate healthier and more transparent snack choices

What role does flavor innovation play in the North America Fruit Snacks Market?

Flavor innovation is key, with brands introducing strawberry, apple, mango, citrus, mixed fruit blends, and exotic flavors to attract diverse consumer segments

Which distribution channels are most significant for fruit snacks in North America?

Supermarkets, convenience stores, online platforms, specialty health food outlets, and vending machines are the main distribution channels

How is e-commerce changing the North America Fruit Snacks Market?

E-commerce is expanding rapidly, offering consumers convenience and access to a wider range of brands and flavors, and enabling personalized shopping experiences

What are the key challenges facing the North America Fruit Snacks Market?

Challenges include sugar content concerns, price sensitivity, competition from fresh fruits, and the need for ongoing product innovation

How do organic and plant-based trends influence the North America Fruit Snacks Market?

Organic and plant-based snacks are gaining popularity as consumers seek natural ingredients and sustainable choices, driving new product launches

Which consumer segments are driving demand in the North America Fruit Snacks Market?

Children, millennials, and health-conscious adults are the primary consumer segments, with busy lifestyles fueling demand for on-the-go snacks

What is the competitive landscape like in the North America Fruit Snacks Market?

The market features established brands and emerging players, with competition focused on flavor, health benefits, packaging, and brand reputation

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com