North America Orthopedic Devices Market Research Report - Segmented By Anatomical Location (Knee , Shoulder), Type Of Consumable ( Orthopedic Staples , Orthopedic Suture Anchors ), Country (United States, Canada and Rest of North America) - Industry Analysis on Size, Share, Trends & Growth Forecast (2025 to 2033)

North America Orthopedic Devices Market Size

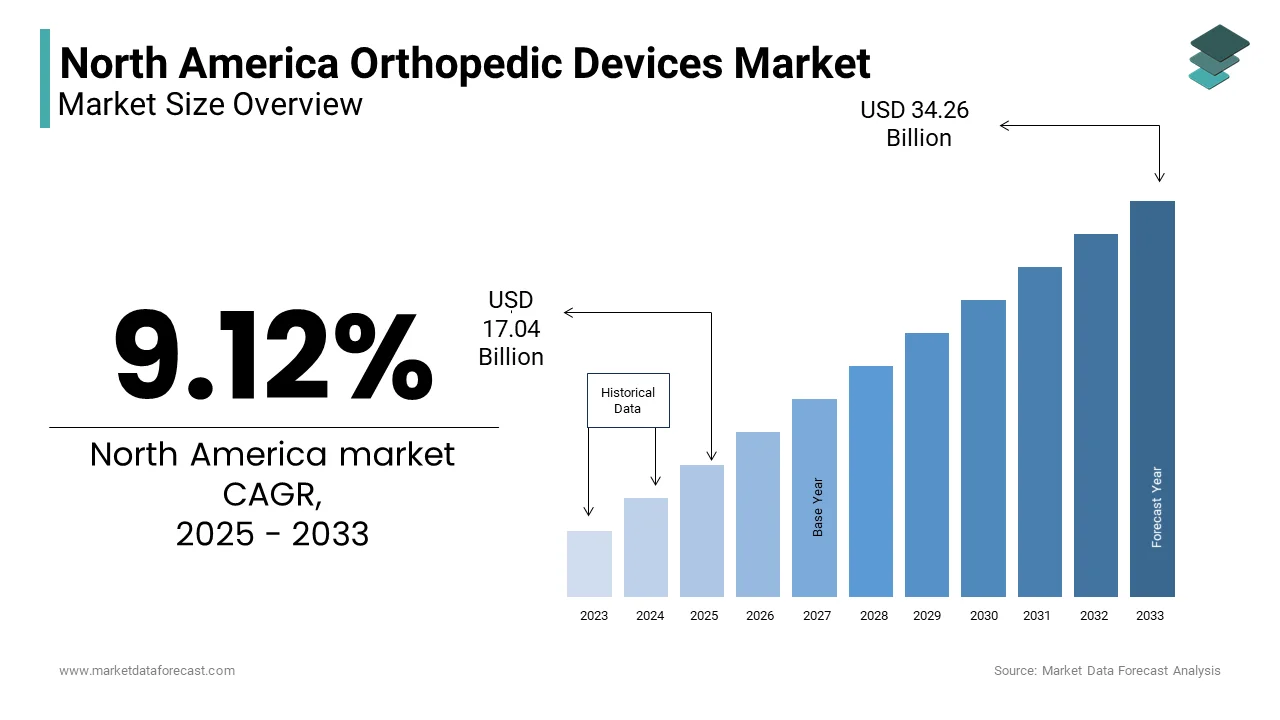

The North American orthopedic devices market was valued at USD 15.62 billion in 2024. The North American cardiac assist devices market is expected to have a 9.12 % CAGR from 2024 to 2033 and be worth USD 34.26 billion by 2033 from USD 17.04 billion in 2025.

The orthopedic devices market in North America covers a wide range of products designed to diagnose, treat, and manage musculoskeletal conditions. These include joint reconstruction implants, spinal devices, trauma fixation systems, and sports medicine equipment. The region—primarily led by the United States and Canada—remains one of the most mature and technologically advanced markets globally for orthopedic solutions. According to the American Academy of Orthopaedic Surgeons (AAOS), over 130 million people in the U.S. suffer from some form of musculoskeletal condition, making orthopedic care a critical component of healthcare delivery. In 2023, approximately 16 million orthopedic procedures were performed in the U.S., reflecting the high clinical demand. Aging demographics are a key contributor; as per the U.S. Census Bureau, around 21% of the U.S. population was aged 65 or older in 2024, significantly increasing the prevalence of osteoarthritis, fractures, and degenerative diseases. Besedies, rising obesity rates have been linked to higher incidences of joint-related ailments, further driving device adoption. Technological advancements such as robotic-assisted surgeries and biocompatible implants are reshaping treatment paradigms.

MARKET DRIVERS

Rising Prevalence of Musculoskeletal Disorders

One of the primary drivers fueling the growth of the orthopedic devices market in North America is the escalating prevalence of musculoskeletal disorders (MSDs). Conditions such as osteoarthritis, rheumatoid arthritis, osteoporosis, and lower back pain have become increasingly common across the region. According to the Global Burden of Disease Study conducted by the Institute for Health Metrics and Evaluation (IHME), musculoskeletal conditions ranked among the top contributors to disability-adjusted life years (DALYs) in the U.S. This growing disease burden necessitates increased utilization of orthopedic interventions, including joint replacements, spinal fusion devices, and trauma fixation systems. Specially, knee and hip replacement surgeries have seen a significant surge. The aging demographic profile plays a pivotal role in this trend. As per the Centers for Disease Control and Prevention (CDC), the number of Americans aged 65 and older is projected to reach 80 million by 2040, more than doubling since 2000. Age-related wear and tear on joints, coupled with sedentary lifestyles and rising obesity levels, contribute significantly to the onset of MSDs. Moreover, increased awareness about minimally invasive surgical options and improved postoperative outcomes has enhanced patient willingness to undergo orthopedic procedures, further stimulating market expansion.

Technological Advancements in Orthopedic Implants and Surgical Techniques

Technological innovation remains a cornerstone driver of the orthopedic devices market in North America. The integration of robotics, artificial intelligence, 3D printing, and smart implants into orthopedic surgery has revolutionized the precision, safety, and efficacy of procedures. For instance, robotic-assisted joint replacement systems have demonstrated superior alignment accuracy and reduced revision rates compared to conventional methods. Apart from these, the adoption of additive manufacturing techniques has enabled the production of patient-specific implants, particularly in complex spinal and craniofacial applications. Another transformative development is the rise of sensor-integrated implants, which allow real-time monitoring of implant performance and patient recovery. Furthermore, augmented reality (AR)-assisted navigation systems are gaining traction in orthopedic operating rooms, enhancing surgical planning and execution.

MARKET RESTRAINTS

High Cost of Advanced Orthopedic Procedures and Devices

Despite the robust growth trajectory of the orthopedic devices market in North America, one of the most significant restraints is the high cost associated with advanced orthopedic procedures and implantable devices. Even with insurance coverage, patients often face substantial out-of-pocket expenses due to deductibles, co-payments, and ancillary costs. Although Medicare covers a large portion of orthopedic procedures for seniors, beneficiaries still encounter financial barriers, especially when opting for premium implants or robotic-assisted surgeries, which may not be fully covered. Additionally, the cost of next-generation orthopedic implants, such as those made from biocompatible materials or featuring integrated sensors, can be prohibitively expensive. While private payers and public health programs are gradually adapting reimbursement models, inconsistent coverage policies across states and insurers create financial uncertainty for both providers and patients, ultimately slowing down the uptake of advanced orthopedic technologies.

Stringent Regulatory Requirements and Lengthy Approval Processes

Another critical restraint impacting the North America orthopedic devices market is the stringent regulatory environment, particularly in the United States, governed by the Food and Drug Administration (FDA). The FDA enforces rigorous pre-market approval (PMA) and investigational device exemption (IDE) requirements for Class III medical devices, which include most implantable orthopedic products. As per the FDA’s Center for Devices and Radiological Health (CDRH), the average time required for PMA approval exceeds 30 months, with some novel devices facing delays extending beyond four years. Such prolonged timelines impede the commercialization of innovative orthopedic technologies and discourage smaller firms from entering the market. In contrast, regulatory pathways in other developed regions, such as the European Union’s CE marking process, typically require only six to twelve months. This disparity has led several manufacturers to prioritize international launches before seeking FDA clearance, delaying patient access in the U.S. market. Additionally, post-market surveillance and compliance audits add another layer of complexity. Moreover, recent recalls of certain orthopedic implants—such as the 2022 recall of specific metal-on-metal hip implants by Johnson & Johnson—have prompted the FDA to tighten oversight further.

MARKET OPPORTUNITIES

Expansion of Outpatient and Ambulatory Surgical Center (ASC) Settings

One of the most promising opportunities in the North America orthopedic devices market lies in the growing shift toward outpatient and ambulatory surgical center (ASC) settings for orthopedic procedures. Traditionally, orthopedic surgeries were performed in hospital inpatient departments, but recent trends indicate a strong migration toward ASCs due to cost efficiency, faster recovery times, and improved patient satisfaction. According to the Ambulatory Surgery Center Association (ASCA), over 50% of all orthopedic procedures in the U.S. were performed in ASCs in 2023, up from just 20% in 2015. This transition is being fueled by advancements in minimally invasive surgical techniques, improved implant designs, and better anesthesia protocols that reduce hospitalization needs. CMS (Centers for Medicare & Medicaid Services) expanded the list of approved procedures for ASC reimbursement in 2022, including total knee arthroplasty, which had previously been restricted to inpatient facilities. As per Definitive Healthcare, the number of ASCs in the U.S. surpassed 6,600 in 2024, with orthopedic specialties accounting for nearly 30% of all new centers established in the past three years. From a cost perspective, performing orthopedic surgeries in ASCs can reduce overall procedural costs by up to 40%, as reported by the Journal of Arthroplasty in 2023. This economic advantage is attracting both private equity investment and strategic acquisitions by major orthopedic device manufacturers, who are tailoring product portfolios specifically for outpatient use. Companies like Smith & Nephew and DePuy Synthes have introduced streamlined instrumentation kits and single-use disposable tools aimed at optimizing ASC workflows.

Integration of Artificial Intelligence and Predictive Analytics in Orthopedic Care

The integration of artificial intelligence (AI) and predictive analytics into orthopedic diagnostics, treatment planning, and postoperative management presents a significant opportunity for the North America orthopedic devices market. AI-powered platforms are increasingly being used to enhance diagnostic accuracy, personalize treatment plans, and improve surgical outcomes. For example, machine learning algorithms can analyze medical imaging data to detect early signs of osteoarthritis or vertebral deformities with greater precision than conventional methods. One notable application is in robotic-assisted surgery, where AI enhances intraoperative decision-making. Intuitive Surgical's Mako system, for instance, uses AI to generate patient-specific surgical plans based on preoperative CT scans, improving implant placement accuracy by up to 25%, as reported by the company in 2023. Beyond surgery, AI-enabled rehabilitation platforms are gaining traction. Companies like Hinge Health and Kaia Health offer digital therapeutics using AI to guide patients through personalized physical therapy regimens, reducing reliance on opioids and repeat surgeries. Predictive analytics is also transforming inventory and supply chain management for orthopedic device manufacturers

MARKET CHALLENGES

Reimbursement Policy Limitations and Coverage Variability

A persistent challenge confronting the North America orthopedic devices market is the inconsistency and limitations within reimbursement policies across different payers and geographic regions. Despite the high clinical demand for orthopedic interventions, reimbursement coverage often fails to keep pace with technological advancements, creating financial strain on both providers and patients. Medicare, which serves a large proportion of orthopedic patients, frequently updates its National Coverage Determinations (NCDs) and Local Coverage Determinations (LCDs), sometimes restricting coverage for emerging procedures unless backed by extensive clinical evidence. For example, the Centers for Medicare & Medicaid Services (CMS) initially limited reimbursement for outpatient total knee arthroplasty until policy revisions in 2022 allowed broader coverage, highlighting the evolving nature of payment structures. Private insurers exhibit even greater variability. A 2023 analysis by FAIR Health revealed that out-of-network charges for orthopedic procedures were up to 200% higher than in-network rates, leading to unexpected financial burdens for patients. Also, bundled payment models, though intended to curb costs, have pressured hospitals to adopt lower-cost implants, potentially limiting the adoption of premium-priced devices. According to a survey by the Healthcare Financial Management Association (HFMA), 41% of hospitals reported declining margins on orthopedic services due to inadequate reimbursement relative to procedural costs. These challenges underscore the need for more standardized, transparent, and adaptive reimbursement frameworks that support innovation without compromising patient access to advanced orthopedic care.

Supply Chain Disruptions and Manufacturing Constraints

Supply chain disruptions have emerged as a formidable challenge for the orthopedic devices market in North America, particularly in the aftermath of global events such as the COVID-19 pandemic and geopolitical tensions. The industry relies heavily on a complex network of raw material suppliers, contract manufacturers, and logistics partners, many of whom operate internationally. However, ongoing trade restrictions, semiconductor shortages affecting electronic surgical tools, and transportation bottlenecks have resulted in extended lead times and production delays. A 2024 report by Gartner highlighted that nearly 50% of medical device firms faced supply chain-related production halts lasting more than two weeks during the previous year. Additionally, the labor shortage in manufacturing sectors has compounded the issue. Inventory management has also become increasingly difficult due to fluctuating demand patterns. For instance, Zimmer Biomet reported a 12% increase in inventory holding costs in 2023 as a result of unpredictable procurement cycles. Moreover, regulatory changes such as the FDA’s Unique Device Identification (UDI) system have imposed additional compliance burdens, requiring manufacturers to overhaul tracking mechanisms and documentation processes.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

9.12 % |

|

Segments Covered |

By Anatomical Location , Type Of Consumable and Country. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Country Covered |

The U.S., Canada and Rest of North America |

|

Market Leader Profiled |

Medtronic,Stryker,Zimmer Inc.,DePuy,Synthes,Smith |

SEGMENTAL ANALYSIS

By Anatomical Location Insights

The knee segment held the largest share in the North America orthopedic devices market by accounting for 38.6% of total revenue in 2024. This dominance is primarily driven by the rising prevalence of osteoarthritis and sports-related injuries affecting the knee joint. According to the Centers for Disease Control and Prevention (CDC), over 32 million Americans suffer from osteoarthritis, with the knee being the most commonly affected joint. The aging demographic further exacerbates this trend—by 2030, nearly one in five Americans will be aged 65 or older, significantly increasing demand for knee replacement surgeries. Technological advancements such as robotic-assisted surgery and patient-specific implants have also contributed to higher adoption rates. Additionally, growing obesity rates are directly linked to increased mechanical stress on knee joints, further fueling demand for knee-related orthopedic interventions.

The spine orthopedic devices segment is swiftly emerging in the North America orthopedic devices market with a CAGR of 8.2% during the forecast period. This rapid expansion is driven by the increasing prevalence of degenerative spinal conditions, such as herniated discs, spinal stenosis, and spondylosis, which collectively affect nearly 12% of the U.S. population, according to the National Institute of Arthritis and Musculoskeletal and Skin Diseases. Sedentary lifestyles, prolonged screen time, and work-related stress have contributed to a rise in spinal disorders among younger adults by expanding the patient pool beyond the traditional elderly demographic. Technological advancements are also propelling this segment's growth, with innovations such as minimally invasive spinal surgeries, robotic-assisted systems, and biocompatible implants enhancing surgical precision and patient outcomes. Moreover, the increasing adoption of regenerative therapies, such as bone grafts and spinal fusion devices, is addressing unmet clinical needs and driving market expansion.

The shoulder segment is projected to grow at the fastest CAGR of 7.4%. This rapid expansion is attributed to increasing awareness about minimally invasive shoulder procedures and a growing incidence of rotator cuff injuries and degenerative diseases. As per the American Shoulder and Elbow Surgeons (ASES), shoulder arthroplasty procedures grew between 2020 and 2023, outpacing other orthopedic segments. The rise in participation in overhead sports such as swimming, tennis, and weightlifting has led to a surge in labral tears and tendonitis cases, particularly among younger demographics. A 2024 study published in Orthopedics Today found that over 2.4 million shoulder-related injuries were treated in U.S. emergency rooms annually, with nearly 400,000 requiring surgical intervention. In addition, advancements in reverse total shoulder arthroplasty (RTSA) have improved outcomes for patients with severe rotator cuff deficiencies. Moreover, favorable reimbursement policies for shoulder surgeries in both the U.S. and Canada have encouraged greater procedural adoption, reinforcing the segment’s momentum within the broader orthopedic landscape.

By Type Of Consumable Insights

Orthopedic staples represented the largest segment within the consumables category of the North America orthopedic devices market by holding a 52.4% share in 2024. Their widespread use in trauma fixation, fracture repair, and soft tissue reattachment procedures underpins their dominant position. One key factor driving their adoption is their ease of application and superior fixation strength compared to traditional sutures in certain surgical contexts. The increasing number of road accidents and sports-related injuries has further bolstered demand. In addition, companies like Medtronic and B. Braun Melsungen AG have introduced bioabsorbable staples that reduce the need for secondary removal surgeries, enhancing patient compliance and surgeon preference.

Orthopedic suture anchors are emerging as the fastest-growing segment within the consumables category, recording a CAGR of 9.2%. This progressive is primarily fueled by the expanding use of these devices in arthroscopic and minimally invasive procedures, especially in shoulder and knee surgeries. Suture anchors allow secure attachment of tendons and ligaments to bone without the need for extensive incisions, aligning with the broader shift toward less invasive techniques. Leading manufacturers such as Arthrex and DePuy Synthes have introduced knotless and biocomposite anchor systems that enhance fixation strength while reducing surgical time. Furthermore, the growing geriatric population suffering from tendon degeneration and instability issues has amplified the need for durable and reliable fixation solutions.

The metallic suture anchors segment dominated the North America orthopedic devices market with share of 60.2% in 2024. Their prominence stems from their superior strength and reliability in securing soft tissues to bone during surgeries like rotator cuff repairs. According to the National Center for Biotechnology Information, over 250,000 rotator cuff repair procedures are performed annually in the U.S., with metallic anchors being the preferred choice due to their durability. These anchors are critical in ensuring long-term stability by making them indispensable in sports medicine and trauma care.

The resorbable suture anchors segment is likely to witness a fastest CAGR of 8.5% during the forecast period. This growth is driven by their ability to degrade naturally within the body by eliminating the need for secondary surgeries to remove implants. According to the Centers for Disease Control and Prevention, resorbable materials reduce post-operative complications, such as infections, which account for nearly 1% of all surgical cases. Furthermore, the National Institutes of Health emphasizes that advancements in biocompatible polymers have improved the mechanical strength and degradation rates of these anchors by making them ideal for pediatric and elderly patients.

COUNTRY LEVEL ANALYSIS

The United States stood as the undisputed leader in the North America orthopedic devices market, commanding an overwhelming 83% market share in 2024. This dominance is underpinned by a combination of advanced healthcare infrastructure, high prevalence of musculoskeletal disorders, and strong investment in research and development. The country benefits from a well-established reimbursement framework, particularly through Medicare and private insurance plans, which facilitates access to high-cost procedures such as joint replacements and spinal surgeries. In addition, the presence of major orthopedic device manufacturers such as Johnson & Johnson, Zimmer Biomet, and Stryker has fostered innovation and localized production capabilities.

Canada is maintaining a stable growth trajectory driven by an aging population and increasing adoption of advanced surgical technologies. The country's publicly funded healthcare system ensures broad access to essential orthopedic treatments; however, wait times remain a concern, prompting interest in private ambulatory surgical centers (ASCs) as alternative care delivery models. Despite this challenge, government initiatives such as the Canada Foundation for Innovation (CFI) continue to fund medical device R&D, supporting domestic innovation. Companies like Povair Surgical and Star Hip International have capitalized on this environment by introducing cost-effective implant alternatives. Additionally, Canada’s alignment with international regulatory standards allows for faster integration of novel orthopedic technologies developed in the U.S. and Europe.

The Rest of North America, comprising Mexico and smaller Caribbean territories, represents a modest share of the regional orthopedic devices market in 2024. While relatively small compared to the U.S. and Canada, this segment is gradually gaining traction due to improving healthcare infrastructure and rising disposable incomes. Mexico has emerged as a growing destination for medical tourism, attracting patients from the U.S. seeking cost-effective orthopedic procedures. The country benefits from proximity to U.S.-based manufacturers, enabling quicker supply chain logistics and lower procurement costs. However, inconsistent reimbursement policies and limited public healthcare funding pose barriers to widespread device adoption. Nevertheless, recent collaborations between multinational device firms and local distributors have facilitated better market penetration. Companies like Becton Dickinson and Stryker have expanded their distribution networks in Mexico, signaling confidence in the region’s long-term potential.

Top Players in the market

Zimmer Biomet

Zimmer Biomet stands as a global leader in musculoskeletal healthcare, offering a comprehensive portfolio of orthopedic implants, surgical tools, and digital surgery solutions. The company plays a pivotal role in shaping innovation in joint reconstruction, spine, trauma, and sports medicine. With a strong presence across hospitals, ambulatory surgical centers, and research institutions, Zimmer Biomet has consistently introduced advanced technologies such as robotic-assisted systems and patient-specific implants. Its commitment to enhancing clinical outcomes through digital integration and personalized care has solidified its influence not only in North America but also globally.

Stryker Corporation

Stryker is one of the most influential players in the orthopedic devices sector, known for its robust product offerings and continuous investment in research and development. The company excels in areas such as reconstructive surgery, medical and surgical equipment, and neurotechnology. Stryker’s strategic acquisitions and partnerships have enabled it to maintain a competitive edge, particularly in robotic-assisted surgery and smart implant technologies. By focusing on innovation and expanding into outpatient settings, Stryker has reinforced its leadership position in the North American market and remains a key driver of global orthopedic advancements.

DePuy Synthes (a subsidiary of Johnson & Johnson)

As part of Johnson & Johnson, DePuy Synthes brings decades of expertise in orthopedic solutions, covering joint replacement, trauma fixation, spinal care, and sports medicine. The company's broad product range and emphasis on clinical excellence have made it a trusted name among surgeons and healthcare providers. DePuy Synthes continues to invest in next-generation technologies and minimally invasive procedures, ensuring sustained relevance in an evolving healthcare landscape. Its global reach and deep-rooted presence in North America make it a cornerstone player in the orthopedic devices industry.

Top strategies used by the key market participants

One of the primary strategies employed by leading orthopedic device manufacturers is continuous innovation and technology integration , particularly in robotics, AI-driven diagnostics, and smart implants. Companies are investing heavily in R&D to develop precision-guided surgical systems that enhance procedural accuracy and improve patient recovery times. This technological differentiation allows firms to capture premium segments of the market and align with modern surgical trends.

Another major strategy is expanding into outpatient and ambulatory surgical center (ASC) markets . As more orthopedic procedures shift from traditional hospital settings to ASCs, companies are tailoring their product portfolios to suit these environments—offering streamlined instrumentation, single-use disposables, and compact surgical tools that optimize efficiency and reduce costs.

Lastly, strategic mergers, acquisitions, and partnerships are being leveraged to consolidate market presence and diversify offerings. Firms are acquiring smaller innovators or forming alliances with digital health platforms to integrate software solutions with hardware, thereby enhancing value-based care delivery and strengthening their foothold in the evolving orthopedic ecosystem.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Companies playing a leading role in the North American orthopedic devices market profiled in the report are Medtronic,Stryker,Zimmer Inc.,DePuy,Synthes,Smith & Nephew,Biomet.

The competition in the North America orthopedic devices market is characterized by a high degree of consolidation, with a few dominant players controlling a significant portion of the industry. These firms continuously strive to differentiate themselves through innovation, strategic collaborations, and expansion into new clinical and geographic territories. The market is highly dynamic, shaped by rapid technological advancements, shifting reimbursement policies, and increasing demand for cost-effective, minimally invasive solutions. While large multinational corporations maintain a stronghold through extensive distribution networks and well-established brand reputations, mid-sized and emerging companies are gaining traction by introducing niche products and leveraging digital health integrations. Additionally, the growing preference for outpatient surgeries and the rising adoption of robotic-assisted procedures are reshaping competitive dynamics. Manufacturers are under pressure to not only innovate but also adapt to evolving regulatory frameworks and demonstrate superior clinical outcomes. As healthcare systems emphasize value-based care models, companies are increasingly focusing on delivering integrated solutions that combine implants, surgical tools, and data analytics to improve patient outcomes and operational efficiencies.While large corporations hold significant market share, smaller firms and startups contribute to competition by introducing cost-effective and innovative solutions tailored to specific patient needs. This dynamic interplay between industry giants and emerging players fosters a highly competitive yet collaborative ecosystem, driving continuous advancements in orthopedic care.

RECENT HAPPENINGS IN THE MARKET

In January 2024, Zimmer Biomet launched its enhanced Persona IQ Smart Knee system, integrating real-time motion sensing capabilities to provide clinicians with postoperative insights into patient mobility and implant performance.

In March 2024, Stryker announced a strategic partnership with a leading artificial intelligence firm to develop predictive analytics tools aimed at improving pre-surgical planning and postoperative rehabilitation protocols for orthopedic patients.

In June 2024, DePuy Synthes expanded its manufacturing facility in Raynham, Massachusetts, to increase production capacity for advanced spinal implants and support growing demand for minimally invasive surgical solutions.

In September 2024, Smith & Nephew introduced a new line of bioabsorbable suture anchors designed specifically for use in arthroscopic shoulder and knee procedures, enhancing fixation strength while reducing the need for secondary removal surgeries.

In November 2024, Becton Dickinson acquired a biologics-focused startup specializing in regenerative orthopedic therapies, aiming to expand its portfolio beyond traditional implants and into the rapidly growing field of tissue engineering and cellular treatments.

MARKET SEGMENTATION

This research report on the north america orthopedic devices market has been segmented and sub-segmented into the following categories.

By Anatomical Location

- Knee

- Shoulder

- Foot

- Ankle

- Hip

- Spine

- Elbow

- Craniomaxillofacial

By Type Of Consumable

- Orthopedic Staples

- Orthopedic Suture Anchors

- Resorbable Suture Anchors

- Metallic Suture Anchors

By Country

- The U.S.

- Canada

- Rest of North America.

Frequently Asked Questions

What factors are driving the growth of the orthopedic devices market in North America?

Key drivers include an increasing geriatric population and a growing burden of orthopedic diseases.

What are the emerging trends in the orthopedic devices market?

Emerging trends include the adoption of minimally invasive techniques and robotic-assisted surgeries, enhancing surgical precision and patient outcomes.

What challenges does the orthopedic devices market face?

Challenges include increasing competition, market saturation in certain device categories, and the need for continuous innovation to meet patient demands.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com