North America Pharmaceutical Contract Packaging Market Size, Share, Trends & Growth Forecast Report By Type (Primary Packaging [Bottles, Vials, Ampoules, Blister Packs, Others], Secondary Packaging, Tertiary Packaging), Material (Plastics & Polymers, Paper & Paperboard, Glass, Aluminum Foil, Others), and Country (United States, Canada, Mexico, Rest of North America) – Industry Analysis From 2025 to 2033.

North America Pharmaceutical Contract Packaging Market Size

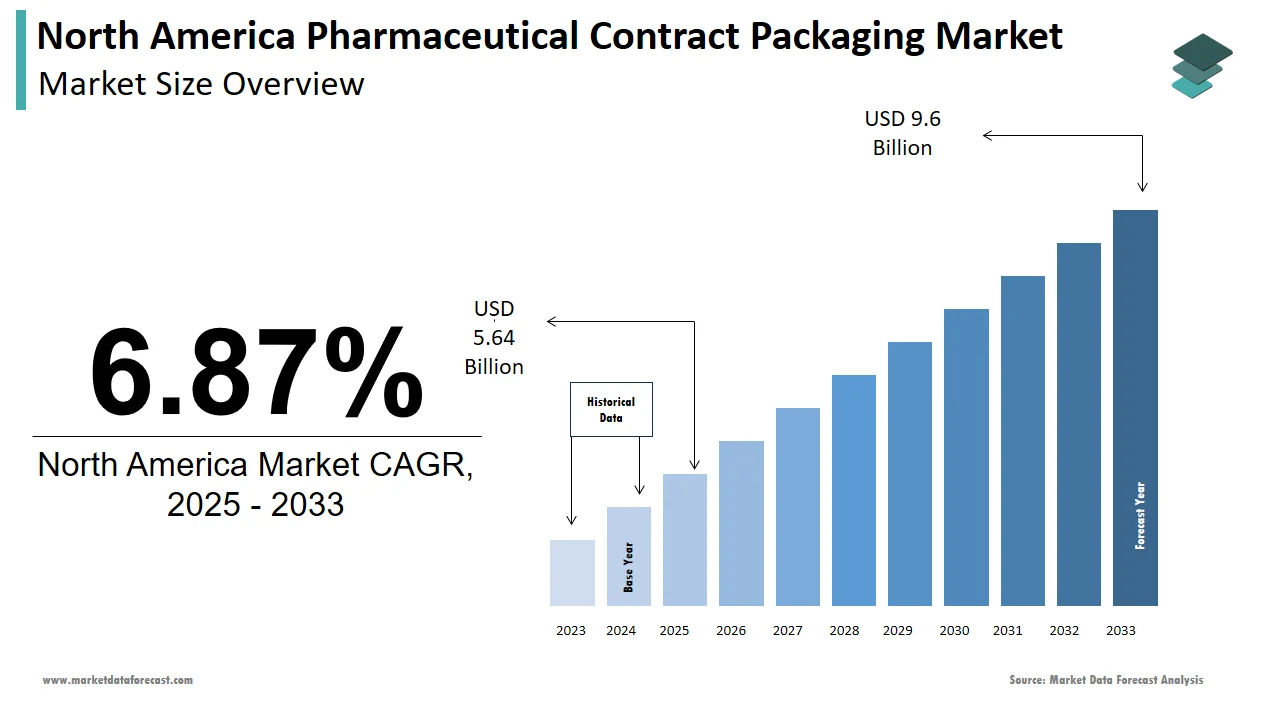

The size of the pharmaceutical contract packaging market in North America was valued at USD 5.28 billion in 2024. This market is expected to grow at a CAGR of 6.87% from 2025 to 2033 and be worth USD 9.6 billion by 2033 from USD 5.64 billion in 2025.

The North America pharmaceutical contract packaging market is driven by its ability to streamline operations and ensure compliance with stringent regulatory standards. The Food and Drug Administration (FDA) mandates rigorous packaging standards to ensure drug safety that is creating significant demand for specialized contract packaging services. As per Deloitte, advancements in sustainable materials and automated packaging technologies have expanded their usability across diverse applications. Furthermore, as per McKinsey, the integration of IoT-enabled tracking systems has improved supply chain transparency by positioning the region as a leader in innovative packaging solutions.

MARKET DRIVERS

Rising Outsourcing Trends among Pharmaceutical Companies

The increasing trend of outsourcing packaging operations is a primary driver propelling the North America pharmaceutical contract packaging market forward. According to a study by PwC, over 60% of pharmaceutical companies are outsourcing non-core activities such as packaging to reduce operational costs and improve efficiency. This shift is particularly evident among small and mid-sized enterprises, which lack the resources to invest in advanced packaging technologies. Additionally, as per a report by Deloitte, contract packaging organizations (CPOs) offer specialized expertise and scalable solutions by enabling pharmaceutical companies to focus on core competencies like research and development. The growing complexity of regulatory requirements, such as serialization and traceability under the Drug Supply Chain Security Act (DSCSA), further amplifies the need for reliable outsourcing partners.

Technological Advancements in Packaging Solutions

Technological advancements in pharmaceutical packaging represent another significant driver shaping the North America market. Innovations such as smart packaging with embedded sensors and tamper-evident seals have revolutionized product safety and patient adherence. According to a report by Frost & Sullivan, smart packaging reduces counterfeit drug incidents by up to 40% is making it indispensable for high-value medications. Additionally, as per a study by BCG, advancements in sustainable materials, such as biodegradable plastics, have expanded their usability, appealing to environmentally conscious consumers.

MARKET RESTRAINTS

High Costs of Advanced Packaging Technologies

The substantial costs associated with advanced packaging technologies pose a significant barrier to market growth, particularly for smaller pharmaceutical companies. According to a study by KPMG, the average cost of implementing smart packaging systems ranges from 500,000to2 million, depending on the scale and complexity. This financial burden often deters smaller entities from upgrading their packaging capabilities is limiting access to cutting-edge innovations. These expenditures are particularly challenging for facilities operating on tight budgets, where allocating resources for capital investments is a constant struggle. This economic disparity creates a fragmented market landscape is hindering uniform adoption rates.

Stringent Regulatory Requirements

Stringent regulatory requirements governing pharmaceutical packaging present another major restraint impacting the market. The U.S. Food and Drug Administration (FDA) mandates rigorous testing and compliance with safety standards, including serialization and traceability under the Drug Supply Chain Security Act (DSCSA). According to a study by Ernst & Young, the average time required to achieve full compliance with these regulations is approximately 2-3 years, significantly longer than other sectors. Additionally, as per a report by Deloitte, manufacturers must adhere to evolving guidelines, such as those outlined in ISO 9001, to ensure quality management systems are in place.

MARKET OPPORTUNITIES

Expansion into Emerging Therapeutic Areas

The growing demand for packaging solutions tailored to emerging therapeutic areas presents a transformative opportunity for the North America market. For instance, cold chain packaging solutions are increasingly required to maintain the integrity of temperature-sensitive drugs, addressing critical logistical challenges. According to a report by the International Society for Pharmaceutical Engineering (ISPE), over 30% of new drug approvals in 2022 involved biologics with the importance of specialized packaging. Additionally, as per PwC, advancements in tamper-evident seals and anti-counterfeiting technologies have expanded their usability is ensuring compliance with global standards.

Integration with Digital Supply Chain Solutions

The integration of pharmaceutical packaging with digital supply chain solutions offers a lucrative opportunity for the North America market. Connected systems, equipped with IoT sensors and blockchain technology, enable seamless tracking and verification of products throughout the supply chain. According to a report by Gartner, over 60% of pharmaceutical companies plan to adopt digital solutions by 2025, creating a strong demand for interoperable platforms. These technologies facilitate real-time monitoring, reducing counterfeit incidents by up to 50%.

MARKET CHALLENGES

Limited Skilled Workforce

A limited skilled workforce capable of operating advanced pharmaceutical packaging systems poses a significant challenge to the North America market. According to a study by the American Society for Quality (ASQ), there is a projected shortage of over 100,000 packaging specialists specializing in pharmaceutical applications by 2025. This shortage is exacerbated by the complexity of modern packaging systems, which require specialized training to operate effectively. Furthermore, as per a report by the Joint Commission, inadequate training leads to a 30% increase in packaging-related errors, undermining product safety and operational efficiency. Rural areas, in particular, face difficulties in recruiting qualified personnel, further widening the gap in access to advanced packaging technologies. Addressing this challenge requires targeted educational initiatives and partnerships between healthcare institutions and manufacturers to develop comprehensive training programs.

Supply Chain Disruptions

Supply chain disruptions have emerged as a critical challenge for the North America pharmaceutical contract packaging market during periods of heightened demand. According to a report by McKinsey, over 70% of packaging components are sourced internationally is making the supply chain vulnerable to geopolitical tensions and logistical bottlenecks. The COVID-19 pandemic vulnerabilities, with manufacturers experiencing delays of up to six months in securing essential parts. Furthermore, as per a study by Deloitte, fluctuations in raw material prices have increased production costs by 25%, impacting profitability. These disruptions not only hinder timely delivery of packaging solutions but also limit the ability to scale production during crises. Strengthening domestic manufacturing capabilities and diversifying supplier networks are essential to mitigate these risks. However, achieving these goals requires significant investment and collaboration across the industry.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Type, Material, and Region. |

|

Various Analyses Covered |

Global, Regional and Country-Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

United States, Canada, Mexico and Rest of North America. |

|

Market Leaders Profiled |

Amcor plc, BALL CORPORATION, Nipro Corporation, Daito Pharmaceutical Co. Ltd., Pfizer CentreOne, CELESTICA INC., West Pharmaceutical Services, Inc., WestRock Company, Patheon, Baxter BioPharma Solutions, and others. |

SEGMENTAL ANALYSIS

By Type Insights

The secondary packaging segment dominated the North America pharmaceutical contract packaging market by capturing 50.5% of the share in 2024. The growing prominence to ensure product safety and regulatory compliance during transportation and storage is propelling the growth of the segment. According to the Food and Drug Administration, secondary packaging accounts for over 60% of packaging-related recalls, driving demand for reliable systems. The advancements in tamper-evident seals and anti-counterfeiting technologies have enhanced their appeal. Hospitals and clinics are increasingly investing in these systems to ensure compliance with stringent regulatory standards and improve patient outcomes.

The primary packaging segment is likely to hit a fastest CAGR of 11.5% from 2025 to 2033. This rapid growth is fueled by the increasing demand for direct contact packaging solutions, which ensure drug stability and patient safety. Additionally, as per a report by PwC, advancements in biodegradable materials have expanded their usability is enabling sustainable solutions. The growing emphasis on patient-centric care has further accelerated adoption, with over 70% of providers exploring primary packaging options.

By Material Insights

The plastics and polymers segment was the largest in the North America pharmaceutical contract packaging market by accounting for 56.4% of the share in 2024. The growth of the segment is ascribed to fueled with their versatility and cost-effectiveness in applications requiring durability and flexibility. According to the Environmental Protection Agency (EPA), over 70% of pharmaceutical packaging utilizes plastics due to their lightweight and protective properties. Furthermore, as per a study by Deloitte, advancements in biodegradable polymers have enhanced their appeal is appealing to environmentally conscious consumers.

The paper and paperboard segment is expected to witness a fastest CAGR of 10.8% from 2025 to 2033. The growth of the segment is attributed to be driven by the increasing demand for sustainable packaging solutions, which reduce environmental impact. According to a study by Frost & Sullivan, paper-based packaging reduces carbon emissions by up to 30%, making them particularly appealing for eco-friendly initiatives. Additionally, as per a report by PwC, advancements in recyclable coatings have expanded their usability, enabling moisture-resistant applications. The growing emphasis on sustainability has further accelerated adoption, with over 60% of providers exploring paper-based options.

COUNTRY LEVEL ANALYSIS

The U.S. was the largest contributor in the North America pharmaceutical contract packaging market by accounting for 86.5% of the share in 2024 with the advanced healthcare system and high prevalence of outsourcing trends among pharmaceutical companies. As per a study by the FDA, over 60% of pharmaceutical companies outsource packaging operations, driving demand for specialized services. Investments in smart packaging and IoT-enabled systems are gaining traction, with over 70% of hospitals adopting these technologies.

Canada pharmaceutical contract packaging market is likely to exhibit a CAGR of 11.2% during the forecast period. The country’s publicly funded healthcare system presents unique challenges, including slower adoption rates of advanced packaging technologies. However, as per Statistics Canada, healthcare spending increased by 5% in 2022 is signaling growing interest in pharmaceutical packaging. Government initiatives to enhance drug safety have spurred adoption, with over 50% of hospitals upgrading their packaging protocols. According to a study by Frost & Sullivan, sustainable packaging solutions are gaining popularity, driven by their scalability and environmental benefits.

KEY MARKET PLAYERS

A few of the notable companies operating in the North America pharmaceutical contract packaging market profiled in this report are Amcor plc, BALL CORPORATION, Nipro Corporation, Daito Pharmaceutical Co. Ltd., Pfizer CentreOne, CELESTICA INC., West Pharmaceutical Services, Inc., WestRock Company, Patheon, Baxter BioPharma Solutions, and others.

TOP LEADING PLAYERS IN THE MARKET

Catalent Inc.

Catalent Inc. is a prominent player in the North America pharmaceutical contract packaging market, renowned for its innovative and reliable services tailored to diverse client needs. The company’s strengths lie in its ability to deliver scalable solutions, such as cold chain packaging and serialization services, which enhance product safety and regulatory compliance. Catalent’s commitment to innovation is evident in its strategic partnerships with research institutions to develop next-generation packaging systems.

Thermo Fisher Scientific

Thermo Fisher Scientific is a key contributor to the North America pharmaceutical contract packaging market, offering a comprehensive range of services tailored to the needs of hospitals and retail pharmacies. The company’s strengths include its scalable solutions and robust customer support services. Thermo Fisher’s focus on interoperability ensures seamless integration with existing healthcare IT systems, enhancing operational efficiency. Its strategic investments in sustainable materials have enabled the development of eco-friendly packaging.

WestRock Company

WestRock Company is a leading player in the North America pharmaceutical contract packaging market, known for its user-friendly platforms and advanced service offerings. The company’s strengths lie in its ability to deliver customizable solutions that cater to the unique needs of healthcare providers. WestRock’s emphasis on sustainability has resulted in the development of recyclable packaging, appealing to environmentally conscious buyers. Its strategic collaborations with digital health providers have expanded its reach by enabling it to address the growing demand for remote monitoring solutions.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

Key players in the North America pharmaceutical contract packaging market employ several strategies to maintain their competitive edge. Strategic acquisitions are a common approach, allowing companies to expand their service portfolios and enter new markets. Partnerships with technology firms, particularly those specializing in AI and IoT, are also prevalent, enabling the development of advanced packaging solutions. Additionally, investments in research and development drive innovation, ensuring compliance with evolving regulatory standards. Companies also focus on enhancing customer engagement through training programs and support services.

COMPETITION OVERVIEW

The North America pharmaceutical contract packaging market is characterized by intense competition, with numerous players vying for market share. Established companies leverage their extensive networks and technological expertise to maintain dominance, while emerging players focus on niche markets to differentiate themselves. The market is witnessing a wave of consolidation, with mergers and acquisitions becoming increasingly common. Additionally, the growing emphasis on digital transformation has intensified competition, as companies strive to offer innovative solutions that meet the evolving needs of healthcare providers.

TOP 5 MAJOR ACTIONS TAKEN BY COMPANIES

- In April 2024, Catalent Inc. launched a new cold chain packaging solution, enhancing temperature control capabilities and improving drug stability during transportation.

- In June 2023, Thermo Fisher Scientific partnered with a logistics provider to integrate IoT-enabled tracking systems into its packaging solutions is expanding its service offerings.

- In January 2024, WestRock Company introduced a recyclable packaging line designed for retail pharmacies is addressing the growing demand for sustainability.

- In September 2023, Sonoco Products acquired a startup specializing in biodegradable packaging, strengthening its position in the eco-friendly healthcare segment.

- In November 2023, AptarGroup collaborated with a research institution to develop next-generation tamper-evident seals is focusing on patient safety and regulatory compliance.

MARKET SEGMENTATION

This research report on the North America pharmaceutical contract packaging market is segmented and sub-segmented into the following categories.

By Type

- Primary Packaging

- Bottles

- Vials

- Ampoules

- Blister Packs

- Others

- Secondary Packaging

- Tertiary Packaging

By Material

- Plastics & Polymers

- Paper & Paperboard

- Glass

- Aluminum Foil

- Others

By Country

- United States

- Canada

- Mexico

- Rest of North America

Frequently Asked Questions

1. What is the projected growth of the North America pharmaceutical contract packaging market from 2025 to 2033?

The North America pharmaceutical contract packaging market is expected to grow at a compound annual growth rate (CAGR) of 6.87%, increasing from USD 5.64 billion in 2025 to USD 9.6 billion by 2033.

2. What factors are driving the growth of the pharmaceutical contract packaging market in North America?

Key drivers include stringent FDA regulations ensuring drug safety, advancements in sustainable materials and automated technologies, and the growing trend of outsourcing packaging operations to reduce costs and improve efficiency.

3. Which segments dominate the North America pharmaceutical contract packaging market?

The secondary packaging segment held the largest share (50.5%) in 2024 due to its role in ensuring product safety during transportation and storage.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com