Global Vaccine Contract Manufacturing Market Size, Share, Trends & Growth Forecast Report By Service Type, Product Type (Single Vaccine (Influenza Virus, Ebola Virus, Chickenpox, Tetanus, Tuberculosis, Polio, Smallpox and Others)) and Combination Type), Vaccine Type (Inactivated Vaccines, Conjugate Vaccines, Live Attenuated Vaccines, Toxoid Vaccines, Recombinant Vector Vaccines, Subunit Vaccines and Synthetic Vaccines) and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Vaccine Contract Manufacturing Market Size

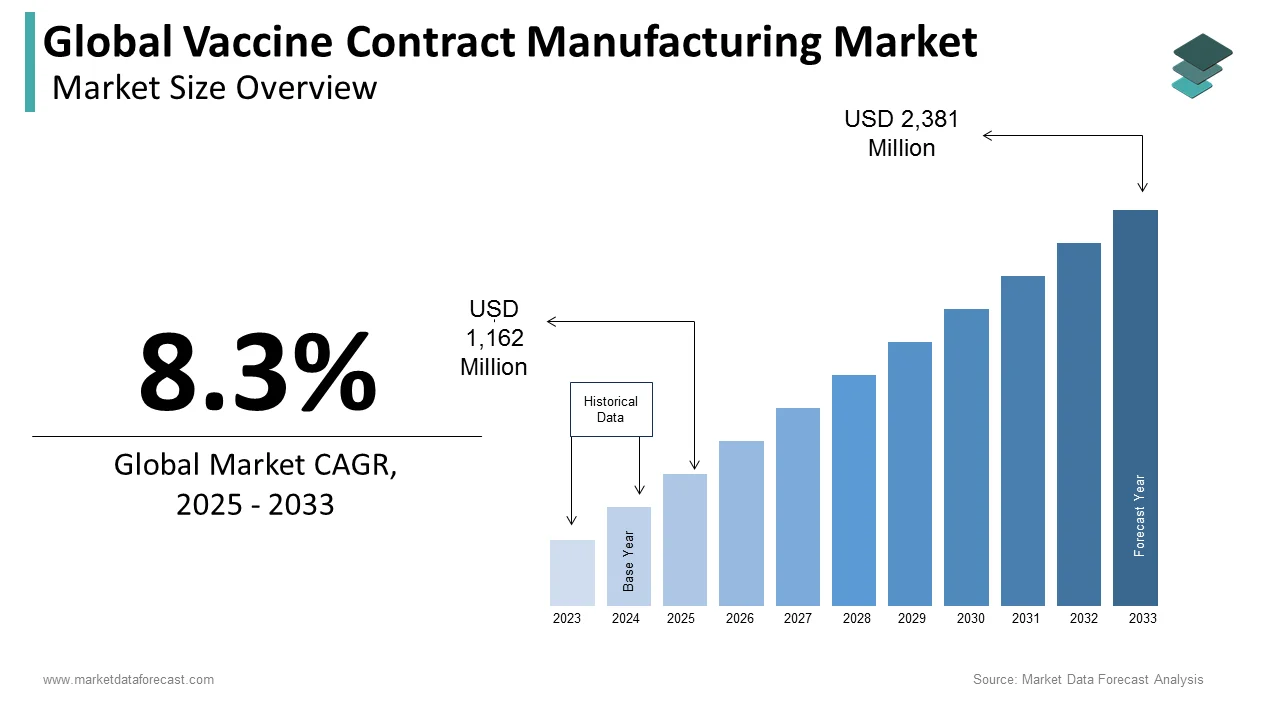

The size of the global vaccine contract manufacturing market was worth USD 1,162 million in 2024. The global market is anticipated to grow at a CAGR of 8.3% from 2024 to 2033 and be worth USD 2,381 million by 2033 from USD 1,162 million in 2025.

A vaccine is a biological element prepared to assist a person's immunity against one or several diseases. Contracted Vaccine manufacturing establishment has higher qualitative and quantitative controlling standards with a significant margin of fixed costs, and production & development linked difficulties have limited competition between vaccine manufacturers.

MARKET DRIVERS

The growing number of R&D activities for novel vaccines, rising biotechnology advancements, and the latest technological developments are majorly escalating the global vaccine contract manufacturing market.

The growing demand levels for vaccines and the growing incidence of infectious diseases are expected to result in the growth of the vaccine contract manufacturing market. For instance, the recent COVID-19 pandemic had a significant favorable impact on the growth of the vaccine contract manufacturing market. Governments of various nations made significant efforts to vaccinate the population of the countries to limit the spread of the virus and control the death rate from the coronavirus, which led to the growing demand for CMOs to accelerate the production of vaccines that meet the required level. In addition, diseases such as Zika and Ebola are contributing to the growing demand for vaccines, which is providing a growth opportunity to the contract manufacturing organizations as pharmaceutical companies are very interested in outsourcing the manufacturing activities of the vaccines to emphasize their core competencies and stay up to the date with the growing demand for vaccines. According to the International Federation of Pharmaceutical Manufacturers and Association (IFPMA), in 2020, research-based pharmaceutical industries have been engaged by 2 million and above for research and development and offer medicines that advance their lives globally. As a result, the demand for contract manufacturing is increasing significantly, which drives market growth globally.

In addition, factors such as the YOY growth in chronic disease incidence, growing adoption of technological advancements, regulatory support, and the emergence of new diseases further propel the global vaccine contract manufacturing market growth. Furthermore, the growing number of infectious diseases such as COVID-19 and hepatitis B accelerates the global vaccine contract manufacturing market growth rate. In addition, rising awareness levels regarding vaccine advantages among developed countries are expected to impact the vaccine contract manufacturing market growth positively.

MARKET RESTRAINTS

Issues associated with the manufacturing setups and vaccine production hinder the growth of the global vaccine contract manufacturing market. In addition, the costs associated with the vaccination and patent expiration may negatively impact the market growth during the forecast period. Furthermore, strict regulatory guidelines and prominent rigid price, production, and advancements-related hurdles have an incomplete contest between vaccine manufacturers.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Service Type, Product Type, Vaccine Type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa |

|

Key Market Players |

Thomas Jefferson University, Goodwin Biotechnology Inc., BioMARK, Emergent BioSolutions, Soligenix Inc., Catalent Biologics, Minneapolis Medical Research Foundation (MMRF), Bavarian Nordic A/S, and FUJIFILM Diosynth Biotechnologies. |

SEGMENTAL ANALYSIS

By Service Type Insights

The entire finish segment is expected to account for the most significant global vaccine contract manufacturing market share during the forecast period. The growing preference of pharmaceutical companies towards full-finished vaccine manufacturing from outsourcing companies is one of the major factors promoting the segment’s growth rate. In this process, the outsourcing companies are responsible for the entire vaccine manufacturing process, including the early stages of vaccine development, clinical testing, filling, finishing, and packaging. In addition, the benefits associated with the fill-finish vaccine manufacturing further contribute to the segment's growth.

By Product Type Insights

The single vaccine product type is more familiar in the vaccine contract manufacturing market, leading to the segment's domination. In most cases, pharmaceutical companies approach and make agreements with CMOs for single vaccine requirements. The growing prevalence of diseases is one factor that propels the segment’s rise. In addition, the cost and efficiency of producing a single vaccine are accelerating the segment's growth rate. Therefore, during the forecast period, the occupancy of the single vaccine segment in the global vaccine contract manufacturing market is expected to increase.

By Vaccine Type Insights

The live attenuated vaccines segment is estimated to grow at a substantial CAGR based on the vaccine type during the forecast period. In addition, due to many licensed oral or intranasal administration products, the segment's growth can induce appropriate handling circumstances for preservation.

The inactivated vaccines segment was the market leader in 2024. These vaccines are protective and relatively more stable than other types.

The subunit vaccines segment is predicted to register a stable growth rate during the forecast period due to continuous research to develop re-combination subunit vaccines opposing the Hepatitis C virus.

REGIONAL ANALYSIS

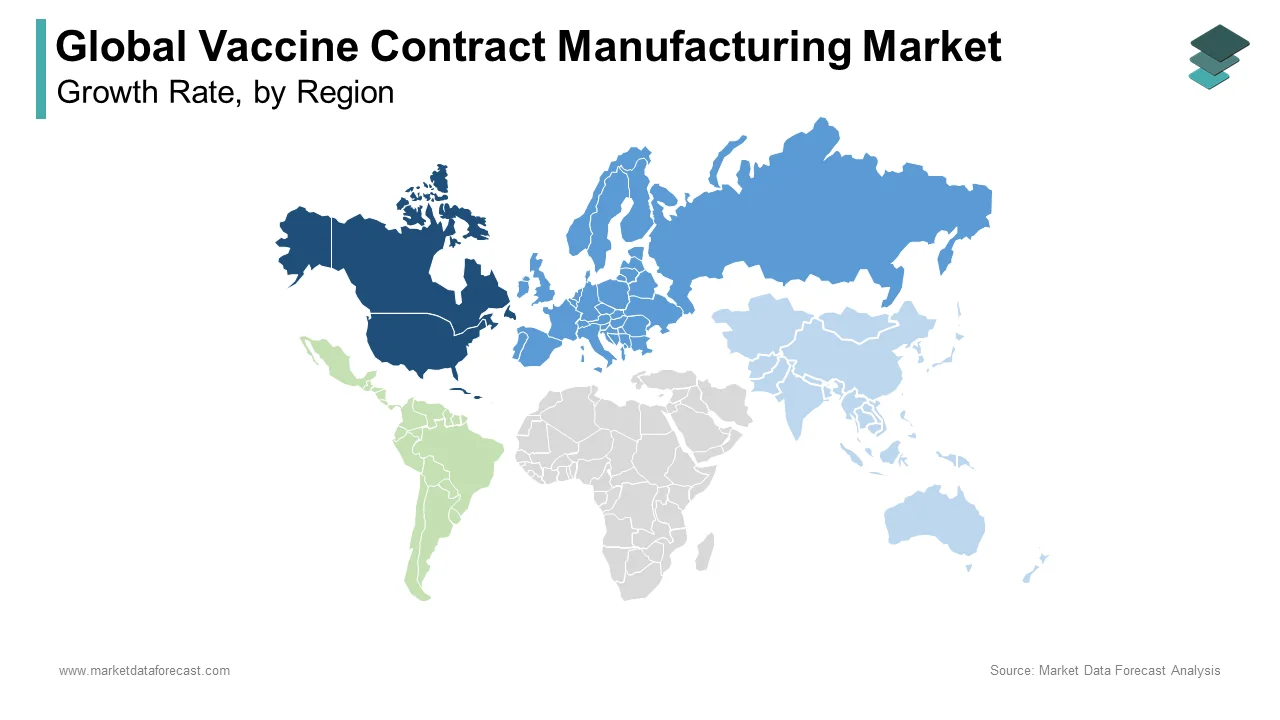

North America held the most significant share of the global market in 2024, and the region’s dominance is anticipated to continue throughout the forecast period. North America takeovers the global market, having the existence of many contract manufacturing organizations (CMOS). About 40 CMOs are present in diverse locations in the U.S. During the forecast period, the North American market is expected to be dominated by the United States owing to the presence of numerous key market participants and well-established healthcare infrastructure. On the other hand, the Canadian market is estimated to register a healthy CAGR during the forecast period.

During the forecast period, Europe is expected to have decent occupancy in the global market. The European region is another hot spot for vaccine contract manufacturing worldwide, with about 20 CMOs in Germany, the U.K., and France. Between 2021 and 2026, the European market is predicted to grow at a staggering CAGR of 7.3%. Again, the UK and Germany are anticipated to register the most significant share in this region.

The Asia-Pacific is predicted to expand at a high growth rate throughout the forecast period due to the rapidly growing economies of India and China. During the forecast period, the APAC region is expected to establish itself as the most lucrative regional market worldwide. Better infrastructure in various APAC countries is predicted to encourage the growth rate of this regional market. India and China will showcase healthy growth rates during the forecast period.

Latin America is forecasted to grow steadily in the coming years. Brazil and Mexico lead the Latin American region during the forecast period. MEA is expected to hold a moderate global market share during the forecast period.

KEY MARKET PLAYERS

Some of the key competitors in the global vaccine contract manufacturing market profiled in this report are Thomas Jefferson University, Goodwin Biotechnology Inc., BioMARK, Emergent BioSolutions, Soligenix Inc., Catalent Biologics, Minneapolis Medical Research Foundation (MMRF), Bavarian Nordic A/S, and FUJIFILM Diosynth Biotechnologies.

Key market participants are expected to implement business expansion strategies and acquire new entrants during the forecast period to secure their leading position.

RECENT HAPPENINGS IN THIS MARKET

- In January 2024, HDT Bio Corp. established a partnership with Biomedical Advanced Research and Development Authority (BARDA) and as part of the partnership, HDT Bio Corp. received a contract worth USD 749000 to support in the production of Next Generation RNA vaccine.

- In January 2024, Emergent BioSolutions received a 5-year contract that worth USD 235.8 million from the U.S. Department of Defense. As per the contract, Emergent BioSolutions supplies BioThrax (anthrax vaccine) to the various branches of miliary for the next 5 years.

- In May 2023, Goodwin Biotechnology Inc. (GBI), which is one of the key players in the global vaccine contract manufacturing market, announced their first commercial contract. As part of this contract, GBI is planning to showcase their expertise to bring the product from clinical trials stage to commercial supply.

- In September 2023, WuXi Vaccines announced their launch of CDMO Site in Suzhou, China to expand the reach of their services and improve their capabilities. With this launch, the firm hoped to work with its partners worldwide to advance its pipelines.

MARKET SEGMENTATION

This research report on the global vaccine contract manufacturing market has been segmented and sub-segmented based on the service type, product type, vaccine type, and region.

By Service Type

- Bulk Product

- Fill Finish

By Product Type

- Single Vaccine

- Influenza Virus

- Ebola Virus

- Chickenpox

- Tetanus

- Tuberculosis

- Polio

- Smallpox

- Others

- Combination Type

By Vaccine Type

- Inactivated Vaccines

- Conjugate Vaccines

- Live Attenuated Vaccines

- Toxoid Vaccines

- Recombinant Vector Vaccines

- Subunit Vaccines

- Synthetic Vaccines

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

How much was the global vaccine contract manufacturing market worth in 2024?

The global vaccine contract manufacturing market size was worth USD 1,162 million in 2024.

Does this report include the impact of COVID-19 on the vaccine contract manufacturing market?

Yes, we have studied and included the COVID-19 impact on the global vaccine contract manufacturing market in this report.

Which region had the highest share in the vaccine contract manufacturing market?

The North American region had the largest share of the vaccine contract manufacturing market in 2024.

Who are the leading players in the vaccine contract manufacturing market?

Thomas Jefferson University, Goodwin Biotechnology Inc., BioMARK, Emergent BioSolutions, Soligenix Inc., Catalent Biologics, Minneapolis Medical Research Foundation (MMRF), Bavarian Nordic A/S, and FUJIFILM Diosynth Biotechnologies are some of the notable companies in the vaccine contract manufacturing market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]