North America Seed Market Size, Share, Trends & Growth Forecast Report Segmented By Crop Type, Seed Trait Type, And Country (US, Canada, Mexico, and Brazil), Industry Analysis From 2025 to 2033

North America Seed Market Size

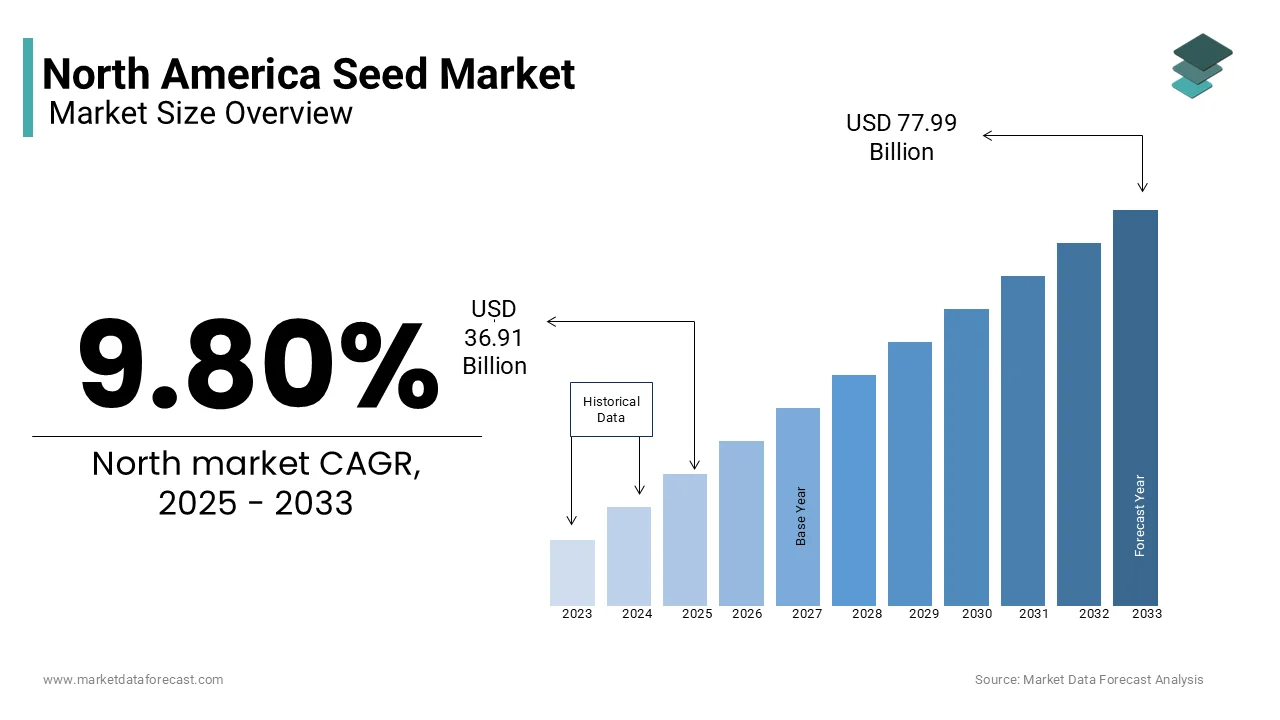

The North American seed market was valued at USD 36.62 billion in 2024 and is expected to reach USD 36.91 billion in 2025 and from USD 77.99 billion by 2033, growing at a CAGR of 9.80% during the forecast period from 2025 to 2033.

Seeds are used for the cultivation of various crops, including grains, vegetables, and fruits. The seed market in North America is characterized by its dynamic nature, driven by advancements in breeding technologies, increasing demand for food production, and a growing emphasis on sustainable agricultural practices. The market is segmented into various categories, including hybrid seeds, open-pollinated varieties, and genetically modified organisms (GMOs), each catering to specific agricultural needs and consumer preferences. According to the American Seed Trade Association, the U.S. seed industry is one of the most innovative sectors, investing heavily in research and development to enhance crop yields and resilience against pests and diseases. The increasing global population and changing dietary preferences are further driving the demand for high-quality seeds that can support sustainable agricultural practices. As the agricultural landscape evolves, the North America seeds market is poised for significant growth, reflecting the critical role of seeds in ensuring food security and agricultural sustainability.

MARKET DRIVERS

Increasing Demand for Food Production

The increasing demand for food production is majorly driving the growth of the North America seeds market. As the global population continues to grow, projected to reach nearly 9.7 billion by 2050 according to the United Nations, the need for efficient and sustainable agricultural practices becomes paramount. This surge in population is accompanied by changing dietary preferences, with a rising demand for protein-rich foods and fresh produce. According to the U.S. Department of Agriculture, U.S. agricultural exports reached a record $177 billion in 2021, highlighting the importance of enhancing domestic food production capabilities. To meet this demand, farmers are increasingly turning to high-quality seeds that offer improved yields, disease resistance, and adaptability to changing climate conditions. The adoption of advanced breeding techniques, such as hybridization and genetic modification, has led to the development of seeds that can significantly increase crop productivity. As consumers and governments alike prioritize food security and sustainability, the North America seeds market is expected to experience robust growth, driven by the urgent need to produce more food with fewer resources.

Technological Advancements in Seed Development

Technological advancements in seed development is further propelling the growth of the North America seeds market. Innovations in biotechnology, genomics, and precision agriculture are transforming the way seeds are developed and utilized in farming practices. The introduction of genetically modified seeds has enabled farmers to cultivate crops that are resistant to pests, diseases, and environmental stresses, thereby enhancing overall productivity. According to the International Service for the Acquisition of Agri-biotech Applications, the area planted with biotech crops in the U.S. reached approximately 175 million acres in 2021, underscoring the widespread adoption of these technologies. Additionally, advancements in seed treatment technologies, such as coating and inoculation, are improving seed performance and germination rates. The integration of data analytics and precision farming techniques allows farmers to make informed decisions regarding seed selection and planting strategies, optimizing yields and resource use. As these technological innovations continue to evolve, they are expected to drive the growth of the North America seeds market, enabling farmers to meet the challenges of modern agriculture effectively.

MARKET RESTRAINTS

Regulatory Challenges and Compliance Costs

Regulatory challenges and compliance costs are hampering the growth of the North America seeds market. The seed industry is subject to stringent regulations governing the development, testing, and commercialization of new seed varieties, particularly those that are genetically modified. According to the U.S. Department of Agriculture, the regulatory process for biotech crops can take several years and involve substantial financial investments, often exceeding millions of dollars. These lengthy approval processes can delay the introduction of innovative seed varieties to the market, hindering the ability of seed companies to respond to evolving agricultural needs. Additionally, the costs associated with compliance, including safety assessments and environmental impact studies, can be prohibitive for smaller seed companies, limiting their competitiveness in the market. As regulatory frameworks continue to evolve, navigating these challenges will be crucial for seed manufacturers seeking to bring new products to market. Addressing the complexities of regulatory compliance while fostering innovation will be essential for sustaining growth in the North America seeds market.

Market Saturation and Competition

Market saturation and competition are also impeding the growth of the North America seeds market. The seed industry is characterized by a limited number of major players, leading to intense competition among established companies. According to a report by the American Seed Trade Association, the top five seed companies account for over 60% of the market share in the United States. This concentration can create barriers for new entrants and smaller companies, limiting their ability to compete effectively. Additionally, the proliferation of seed varieties and the increasing availability of open-pollinated and organic seeds have led to a fragmented market, making it challenging for companies to differentiate their products. As competition intensifies, price pressures may arise, impacting profit margins for seed manufacturers. To navigate this competitive landscape, companies must focus on innovation, quality, and customer service to maintain market share and drive growth. Developing unique seed traits and leveraging advanced technologies will be essential for companies seeking to thrive in the increasingly saturated North America seeds market.

MARKET OPPORTUNITIES

Growing Interest in Organic and Sustainable Farming

The growing interest in organic and sustainable farming is a significant opportunity for the North America seeds market. As consumers become more health-conscious and environmentally aware, the demand for organic produce has surged. According to the Organic Trade Association, U.S. organic food sales reached $62 billion in 2021, reflecting a 12.4% increase from the previous year. This trend is driving farmers to seek organic seeds that comply with certification standards and support sustainable agricultural practices. The development of organic seed varieties that are resistant to pests and diseases is becoming increasingly important as farmers strive to maintain productivity without relying on synthetic inputs. Additionally, the emphasis on regenerative agriculture, which focuses on improving soil health and biodiversity, is further fueling the demand for innovative seed solutions. As the market for organic and sustainable farming continues to expand, the North America seeds market is well-positioned to capitalize on this trend, fostering growth and innovation in seed development.

Advancements in Precision Agriculture

Advancements in precision agriculture is another promising opportunity for the North America seeds market. The integration of technology in farming practices, including data analytics, GPS, and remote sensing, is transforming the way seeds are planted, managed, and harvested. The demand for precision agriculture in North America is growing exponentially. This growth is driven by the increasing adoption of smart farming techniques that optimize resource use and enhance crop yields. Precision agriculture allows farmers to make data-driven decisions regarding seed selection, planting density, and nutrient management, leading to improved efficiency and sustainability. As farmers increasingly embrace these technologies, the demand for seeds that are compatible with precision agriculture practices is expected to rise. The North America seeds market stands to benefit from this trend, as manufacturers develop innovative seed solutions that align with the principles of precision agriculture, ultimately enhancing productivity and sustainability in the agricultural sector.

MARKET CHALLENGES

Climate Change and Environmental Factors

Climate change and environmental factors is one of the major challenges to the North America seeds market. The increasing frequency of extreme weather events, such as droughts, floods, and temperature fluctuations, can adversely affect crop yields and seed performance. According to the National Oceanic and Atmospheric Administration, the U.S. experienced 22 separate weather and climate disasters in 2021, each causing damages exceeding $1 billion. These environmental challenges necessitate the development of resilient seed varieties that can withstand changing climatic conditions. However, the research and development process for creating such seeds can be time-consuming and costly, potentially delaying their availability in the market. Additionally, farmers may face difficulties in adapting their planting strategies and crop management practices to cope with the impacts of climate change. Addressing these challenges will require collaboration between seed manufacturers, researchers, and farmers to develop innovative solutions that enhance crop resilience and ensure food security in the face of a changing climate.

Supply Chain Disruptions

Supply chain disruptions are also challenging the growth of the North America seeds market. The COVID-19 pandemic has exposed vulnerabilities in global supply chains, leading to shortages of essential materials and delays in production and distribution. According to the American Seed Trade Association, disruptions in logistics and transportation have impacted the timely delivery of seeds to farmers, hindering planting schedules and potentially affecting crop yields. Additionally, the reliance on global supply chains for raw materials, such as packaging and fertilizers, raises concerns about sustainability and ethical sourcing. As the demand for seeds continues to rise, addressing supply chain challenges will be crucial for ensuring the timely production and delivery of seed products. Manufacturers must explore strategies to enhance supply chain resilience, including diversifying suppliers and investing in local production capabilities, to mitigate the risks associated with supply chain disruptions.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

9.80% |

|

Segments Covered |

By Crop Type, Seed Trait and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

U.S, Canada, Mexico Rest of North America |

|

Market Leaders Profiled |

Monsanto, DuPont, Syngenta, AG, Dow AgroSciences LLC, Land O’Lakes Inc, and Bayer Crop Science |

COUNTRY ANALYSIS

The United States played the dominating role in the North America seeds market in 2024 by accounting for 77.8% of the regional market share. The dominance of the U.S. in the North American market is driven by a robust agricultural sector, significant investments in research and development, and a well-established seed industry. According to the American Seed Trade Association, the U.S. seed market was valued at around $8 billion in 2021, with over 200 million acres planted with various seed types. The extensive network of distribution channels and retail outlets further supports the growth of the seed market in the U.S. Additionally, the increasing focus on food security, sustainability, and technological innovation is prompting farmers to adopt high-quality seeds that enhance crop productivity. As the U.S. continues to lead in seed production and consumption, it plays a pivotal role in shaping the future of the North America seeds market.

Canada is another prominent market for seeds in North America. The Canadian seeds market has experienced steady growth, driven by a strong commitment to sustainable agriculture and government initiatives aimed at reducing greenhouse gas emissions. According to the Canadian Seed Trade Association, seed sales in Canada reached approximately $1.5 billion in 2021, reflecting a growing consumer preference for high-quality seeds. The Canadian government has set ambitious targets for seed innovation and sustainability, including a goal to increase the adoption of environmentally friendly farming practices. Additionally, the increasing average age of vehicles on the road is contributing to the demand for replacement tires. As Canadians increasingly seek reliable and sustainable seed options, the seeds market is well-positioned for continued expansion, reflecting the nation's commitment to agricultural innovation and environmental stewardship.

Mexico is emerging as a growing player in the North America seeds market. The increasing popularity of seeds among Mexican consumers, coupled with government initiatives to promote sustainable agriculture, has contributed to the market's expansion. According to the Mexican Association of Seed Producers, seed sales in Mexico have been on the rise, with a growing number of manufacturers entering the market. The country's agricultural sector is also experiencing significant growth, with major investments in crop production and technology. Additionally, the Mexican government's efforts to improve agricultural practices and promote food security are enhancing the appeal of high-quality seeds. As the market continues to develop, Mexico presents significant opportunities for growth, particularly in the context of cross-border trade and the increasing interest in sustainable agricultural practices.

KEY MARKET PLAYERS

Monsanto, DuPont, Syngenta, AG, Dow AgroSciences LLC, Land O’Lakes Inc, and Bayer Crop Science are some of the major key players involved in the North America seed market. Key strategies such as investments in R&D are being employed by major companies to meet the growing seed demand

MARKET SEGMENTATION

This research report on the North American seed market is segmented and sub-segmented into the following categories.

By Crop Type

- Oilseed

- Grain seed

- Fruit & Vegetable

- Other seed

By Seed Trait

- Herbicide Tolerant

- Insect Resistant

- Other Stacked Traits

By Country

- US

- Canada

- Rest of North America

Frequently Asked Questions

What is the current market size of the seed market in North America?

The North American seed market was valued at USD 36.91 billion in 2025, growing at a CAGR of 9.80% during the forecast period.

Which countries in North America are major contributors to the seed market?

The United States and Canada are major contributors to the seed market in North America, with their advanced agricultural sectors and diverse crop production.

Are there specific crops driving the demand for seeds in the Prairie provinces of Canada?

In the Prairie provinces, the demand for seeds is particularly high for crops such as canola, wheat, and barley, contributing significantly to the overall seed market.

How do international trade agreements impact seed imports and exports between the United States and Canada?

International trade agreements between the United States and Canada facilitate the exchange of seeds, promoting collaboration and contributing to the growth of the seed market.

How does the affordability of high-quality seeds compare between the United States and Canada?

The affordability of high-quality seeds varies between the United States and Canada and is influenced by economic conditions, exchange rates, and government support for the agricultural sector.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com