Global OCTG Market Size, Share, Trends & Growth Forecast Report By Grade (API and Premium), By Products (Seamless, ERW) and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis 2024 to 20323

Global OCTG Market Size

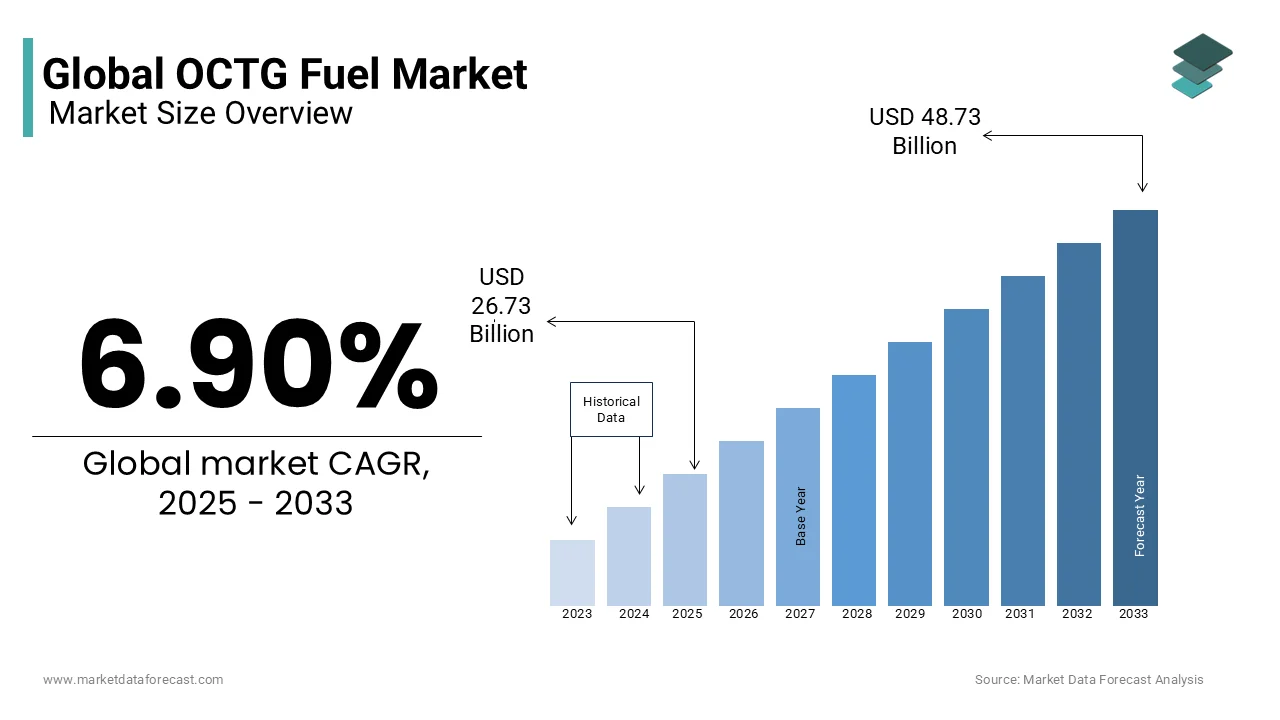

The Global Oil Country Tubular Goods (OCTG) Market was valued at USD 26.73 billion in 2024 and is anticipated to reach USD 48.73 billion by 2033 from USD 28.57 billion in 2025 and registering a CAGR of 6.90% during the foreseen period from 2025 to 2033.

The oil-based tubular products market is predicted to experience strong expansion throughout 2025-2033 due to increased drilling and production activities. The growing call for high-end pipes coupled with the advent of technologically advanced pipes. Proper selection of OCTG during drilling operations can lower overall costs and reduce the risk of causing hazards. Market expansion is also dependent on improved efficiency and advancement of well-drilling technology to improve the recoverability of oil and gas resources. The growing call for advanced tubular oilfield products in new unconventional resource areas has a potential opportunity for companies to invest in new product development to differentiate themselves from their competitors. OCTG (Oil country tubular goods) are the components employed in the production of oil and gas from the well. Proper use of OTCG could help reduce the likelihood of any incidents, hazards, and risks that ultimately lower your company's production costs. Includes, casing, drill pipes, tubes, etc. The OCTG market is a highly competitive industry and with the largest number of drilling and exploration activities in unconventional reserves, the competition has escalated to a higher level.

MARKET TRENDS

Oil and gas exploration and production activities are complex processes and require sophisticated equipment and technology, as this market is highly cyclical and volatile in nature. Falling commodity prices have secondary effects on the oil and gas value chain. Over the past few decades, the oil and gas industry has seen a number of active drilling rigs, creating a call for oilfield services around the world. The fall in oil prices has reduced the call for tubular products for oil countries. With the recovery in crude oil prices, the oil country tubular goods (OCTG) market has seen positive expansion, driven by increased shale production and increased horizontal and unconventional drilling activity.

MARKET DRIVERS

Expansion in drilling activity is predicted to drive the call for OCTG over the foreseen period.

Expansion in drilling activity is predicted to drive the call for OCTG over the foreseen period. Activity in the oil and gas sector began to strengthen as raw materials recovered, followed by a multi-year price drop. With the recovery of oil and gas prices, companies have increased their investments that were previously blocked or delayed for the development of oil and gas projects. Suppliers of tubular products in oil-producing countries are predicted to benefit from increased business after the recovery. Intense competition among oil producers is also fueling escalating drilling activity around the world. The capital investment for the production of seamless OCTG is quite high, unlike the investment required for the production of welded products. The welded pipe segment is predicted to have the highest CAGR during the foreseen period due to the active participation of companies in improving product efficiency with an emphasis on cost-reduction strategies.

MARKET RESTRAINTS

The lack of a skilled workforce and the high initial investment are predicted to be the main obstacles to the OCTG market’s growth rate.

The growing inclination towards white-collar jobs away from blue-collar jobs in the last few years is one of the factors decreasing the industry’s growth. This can be linked to the safe working environment provided by the blue-collar positions apart from the tough conditions of an oilfield. Moreover, global warming and weather variability problems are discouraging the newer generations for example Gen Z from entering the oil and gas industry which discharges greenhouse gases and other pollutants. As per a survey conducted across all the verticals of this industry, about 45 per cent of the participants stated that oil and gas exploration and manufacturing operations in the upstream sector are encountering the maximum scarcity of skilled workers. Consequently, the tough situations and security risks while working on oil rigs are stopping the younger population from employing themselves in this market. This causes a gap in the worker’s proficiency in handling the activities in important upstream operations. Additionally, the high import duty in nations such as the United States, the unstable fuel prices in recent years and ecological concerns are hindering the expansion of the OCTG market during the estimation period.

Furthermore, the difficulties in OCTG pipe examination are hampering the market growth rate. This involves restricted access, pipe geometry complications, limited time for executing large industry orders and variability in material quality. The high incidences of security risks and mechanical failure are further constraining the OCTG market. This is due to pipes and tubes produced from interior quality steel or manufacturing defects. Also, these pipes and tubes are utilized in isolated surroundings like underground gas and oil wells. As a result, the complexities in inspection procedures because of their distant places, limited facilities for accessibility and lack of investments.

MARKET OPPORTUNITIES

The sharp drop in oil prices in 2019 severely affected the sector and reduced company revenues, leading to sharp spending cuts. Escalating the call for energy and production is one of the main expansion drivers in the oilfield tubular products (OCTG) market. The emergence of horizontal drilling methods and hydraulic fracturing technology in recent years has dramatically increased the call for oilfield tubular products. Offshore oil and gas account for a large portion of product revenue and escalating production from shale resources will drive the call for OCTG products during the foreseen period. The increase in the worldwide number of offshore platforms is predicted to boost this segment in the coming years. In addition, the substantial expansion of existing offshore wells in deep and ultra-deep waters, primarily in the Gulf of Mexico, the Persian Gulf, the North Sea, and the South China Sea, is predicted to drive the call for OCTG in the above segment. The government and private entities are showing great interest in discovering new oil well reserves to meet future energy calls. Much of the investment by leading companies to unlock large oil and gas reserves is predicted to drive the market for the tubular gods of oil countries. Also, the exploration of unconventional fuel sources. Furthermore, many countries are struggling to reduce foreign exchange on hydrocarbon imports by discovering conventional and unconventional reserves within their territorial borders, driving the OCTG market's expansion.

MARKET CHALLENGES

The OCTG market is facing several challenges. This includes the high raw material costs and uncertainty in the world’s economy. The rising input prices, geopolitical issues and trade limitations are affecting the supply chains and industry stability.

Further, the market growth is also slowing down due to the fast-changing technological landscape and delay in its application. For instance, the emergence of digital technologies like artificial intelligence (AI) and the Internet of Things (IoT) has attached another level of complexity to building upstream infrastructure. It also comprises the availability of appropriate inspection systems and qualified professionals to operate it.

In addition, regulatory or legal approvals for decreasing carbon footprints need extra proficiency from the oilfield services players. This is stagnating the market size.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 – 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2033 |

|

CAGR |

6.90% |

|

Segments Covered |

By Grade, Product, and Region. |

|

Various Analyses Covered |

Global, Regional, and country-level analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Nippon Steel & Sumitomo Metal Co. (Japan), Vallourec (France), Tenaris (Europe), National Oilwell Varco (U.S.), TMK (U.S.), Steel Tubular Products Inc (NA)., Iljin Steel Co (S. Korea), Continental Alloys (Malaysia), and Anhui Tianda Oil Pipe Company (China), and Others. |

SEGMENTAL ANALYSIS

By Grade Insights

The premium segment is a bigger category capturing a significant portion of the OCTG market owing to its growing application and superior quality than other grades. The rising threat and risk levels from regional wars and conflicts have also contributed to the segment’s market share growth—for example, the Nord Stream 2 Pipeline blast near the Danish island of Bornholm. In addition, there is increasing demand for premium tubes and casing for drilling operations in major oil and gas exporting countries like Saudi Arabia, Brazil and other Middle Eastern and Latin American nations. Further, the growing need for new and enhanced pipe management yards or solutions is influencing the demand for premium OCTG products.

Similarly, in September 2023, indal Hunting Energy Services Ltd (JHESL) announced an investment of 25 million US dollars for the construction of India’s first Oil Country Tubular Goods (OCTG) factory in Nashik (India) for manufacturing and supplying tubes, pipes and premium connection. JHESL is a joint venture between Jindal SAW and Hunting Energy Services PLC, a US-based company. This will support them in substituting costly imports of 200 million dollars every year and also presents a big export opportunity for the Indian oil and gas industry.

By Product Insights

The seamless segment still holds a notable amount of the OCTG market share and is expected to grow at a faster pace during the forecast period. This is because of the increased utilization in the various oil and gas operations as they have high resistance against high pressure and offer equality and evenness while shaping pipes and tubes appropriate for vigorous and fierce activities like production and hydrogen exploration. Moreover, seamless pipes display greater tensile and yield power than ERW ones. It poses more hardness which is important for wear resistance and rust in such environments. Besides this, major companies are shifting to this type including, Tenaris S.A., Nippon Steel Corporation, JFE Steel Corporation, D.P Jindal Group, etc. Also, the industry is expected to move forward due to more emphasis on creating advanced materials and alloys to comply with the strict requirements for subsea and offshore uses.

Whereas, the ERW is usually used in pipelines, transmission lines and other infrastructure use cases for durability and high strength.

REGIONAL ANALYSIS

Geographically, the Asia-Pacific has the largest share due to growing deep-water and unconventional reserve exploration activities, which are attracting the attention of major market players. Escalating technological advances aimed at escalating productivity and reducing production costs also play a key role in the expansion of the region. North America follows the Asia-Pacific region, with the United States accounting for the largest share. This expansion is attributed to factors such as the expansion of offshore drilling activity in the Gulf of Mexico, the shale boom, and the sharp increase in the discovery of potential untapped oil and gas reserves. North America accounted for a significant market share in 2024.

The number of rigs has declined significantly worldwide since 2014, affecting the call for oil services in recent years. North American rigs remain the largest in quantity compared to the Middle East, followed by Latin America. The efficiency of platforms in the United States is escalating as they increase at a significant rate due to technological advances. OCTG consumption per rig and month has doubled since 2012, due to increased drilling complexity and longer side lengths. Well, production expansion and the drilling of new wells in the region are predicted to drive the call for oilfield tubular products in North America during the foreseen period.

KEY PLAYERS IN THE MARKET

Companies playing a prominent role in the global OCTG market include Nippon Steel & Sumitomo Metal Co. (Japan), Vallourec (France), Tenaris (Europe), National Oilwell Varco (U.S.), TMK (U.S.), Steel Tubular Products Inc (NA), Iljin Steel Co (S. Korea), Continental Alloys (Malaysia), Anhui Tianda Oil Pipe Company (China), and Others.

RECENT HAPPENINGS IN THE MARKET

- In June 2024, Vallourec won the contract for 1800 tons of premium carbon steel tubes with Glass Reinforced Epoxy Liners (GRE technology) to Petrobras for several offshore development wells. It will also deliver related top-of-the-range CRA (Corrosion Resistant Alloy) accessories.

- In June 2024, Oceaneering secured two agreements with Petrobras for the supply of steel tube and thermoplastic electro-hydraulic umbilicals for 362 kilometres and related hardware for subsea distribution in a project offshore Brazil.

- In April 2024, Maharashtra Seamless declared that it signed the contract to supply seamless pipes to the Oil and Natural Gas Corporation (ONGC). The order will be completed in period batches within 44 weeks.

- In April 2024, BENTELER Group press released the commencement of building a new threading factory at the Port of Caddo Bossier to improve and optimise supply chains for end-users in the oil and gas, energy and engineering sectors. For this, it will invest 21 million dollars which will generate 49 direct new job opportunities apart from 347 existing positions to be retained.

- In April 2024, Vallourec started the new Tubular Management Yard for Saudi Aramco. The latest Tubular Management Service (TMS) is located in Dammam. According to the contract, it will deliver casing, tubing and services to fulfil the requirements for premium OCTG solutions for their drilling activities.

MARKET SEGMENTATION

This research report on the global OCTG market has been segmented and sub-segmented based on grade, product, and region.

By Grade

- API

- Premium

By Product

- Seamless

- ERW

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions

1. What is the OCTG Market growth rate during the projection period?

The Global OCTG Market is expected to grow with a CAGR of 6.90% between 2025-2033.

2. What can be the total OCTG Market value?

The Global OCTG Market size is expected to reach a revised size of USD 48.73 billion by 2033.

Name any three OCTG Market key players?

Tenaris (Europe), National Oilwell Varco (U.S.), TMK (U.S.), and Steel Tubular Products Inc (NA) are the three OCTG Market key players.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]