Global Plasma Fractionation Market Size, Share, Trends & Growth Analysis Report – Segmented By Product (Albumin, Immunoglobulin, Factor VIII and Protease Inhibitors), Application (Neurology, Hematology, Rheumatology, Pulmonology and Immunology), End-Users and Region (North America, Europe, APAC, Latin America, Middle East and Africa) – Industry Forecast (2025 to 2033).

Global Plasma Fractionation Market Size

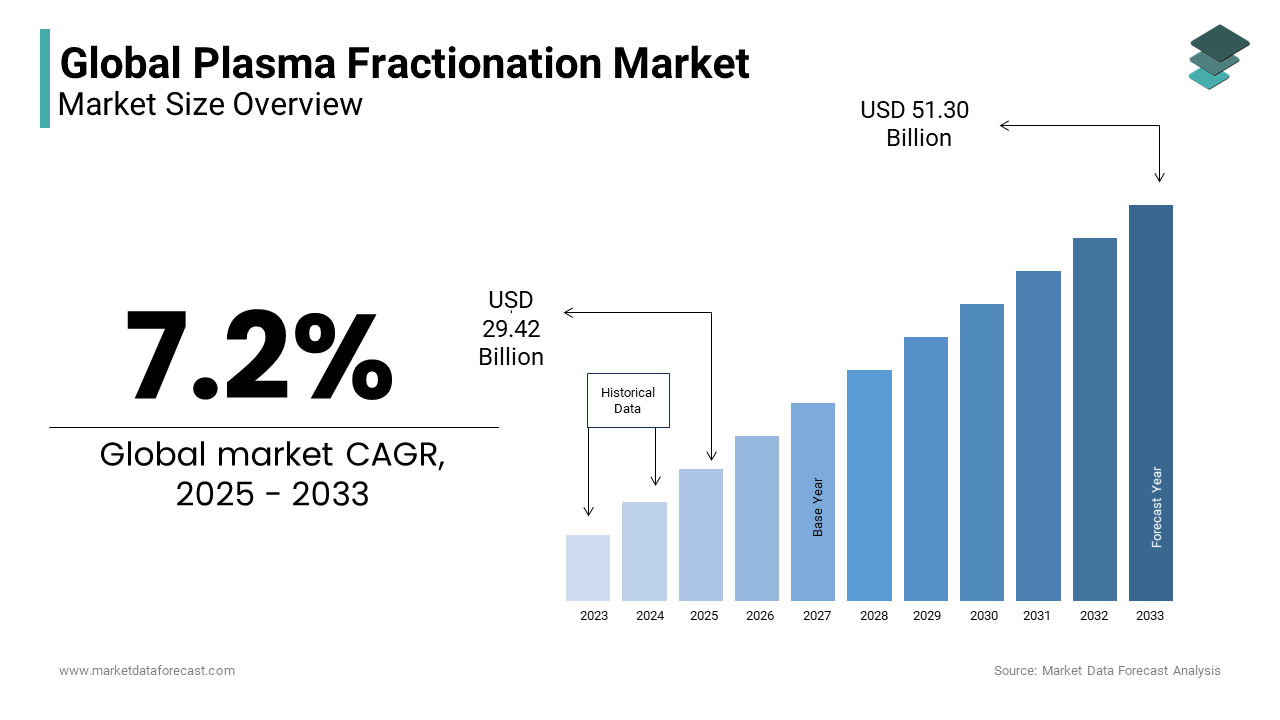

In 2024,the global plasma fractionation market was valued at USD 27.44 billion and it is expected to reach USD 51.30 billion by 2033 from USD 29.42 billion in 2025, growing at a CAGR of 7.2 % during the forecast period. of 2025 to 2033.

Plasma is the liquid portion of blood. It consists of red cells, white cells, and platelets suspended. It contains thousands of distinct proteins and other substances like electrolytes, minerals, hormones, and others, necessary for the human body's normal function. For example, plasma helps in maintaining blood pressure and body temperature regulation.

MARKET DRIVERS

Y-O-Y growth in the prevalence of respiratory diseases worldwide is another significant factor boosting the global plasma fractionation market growth.

Respiratory disorders such as asthma, COPD, and new acute coronavirus disease. According to NIH, Plasma from COVID-19-recovered donors may produce antibodies to the severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2) that may help suppress the virus and alter the inflammatory response. More than 70,000 patients in the United States have received COVID-19 convalescent plasma through the Mayo Clinic's Expanded Access Program (EAP), which was created to provide widespread access to investigational convalescent plasma. The growing aging population with blood-related ailments is also set to drive the global plasma fraction market growth.

Globally, the population is aging at an alarming pace in emerging countries such as India, China, Japan, etc. World Health Organization (WHO) says people live longer lives worldwide. Between 2015 and 2050, the proportion of the world's population over 60 years old is expected to grow from 12% to 22%. By 2050, low- and middle-income countries will house 80% of the elderly.Increasing usage of immunoglobulins in different areas is a significant factor driving the global plasma fractionation market.

Factors such as the increasing incidence of immune and bleeding disorders, the growing prevalence of Alpha-1 Antitrypsin deficiency, and the increasing use of immunoglobulins, which are antibodies, propel the global plasma fractionation market. In addition, the emergence of novel and innovative products to treat immunological deficiencies, inherited metabolic disorders, and trauma and the rising number of FDA approvals provide lucrative opportunities for the growth of plasma fractionation globally.

MARKET RESTRAINTS

Increasing use of recombinant proteins and products that replace plasma products and the risk factors associated with them, escalating prices of plasma derivatives, unfavorable reimbursement policies, and increased use in prophylactic therapies are likely to restrain the global plasma fractionation market growth. In addition, regulatory authorities strictly govern plasma products since they are made from whole blood. Stringent regulations governing the manufacturing plant, the source of whole blood, and the isolation procedure, among other things, could limit the market's expansion. Such strict policies will affect the product's production and processing time and the market's growth in the coming years.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Analysed |

By Product, Application, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Analysed |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Market Leader Profiled |

CSL Ltd. (Australia), Grifols S.A (Spain), Baxalta Incorporated (U.S.), Octapharma AG (Switzerland), Kedrion S.p.A (Italy) |

SEGMENTAL ANALYSIS

By Product Insights

The immunoglobulin segment is expected to dominate the global plasma fractionation market by contributing a significant share based on the product during the forecast period. Factors such as the increasing focus of immunology research and the growing adoption of immunoglobulin in primary and secondary immune deficiencies, inflammatory diseases, and autoimmune diseases are helping this segment experience to accumulate significantly during the forecast period.

By Application Insights

The neurology segment dominated the plasma fractionation market accounting for the major market share in 2023 and is expected to be the rapidly growing segment during the forecast period owing to increasing demand for plasma fractionation products for the treatment and improving plasma fractionation applications products in the neurology field.

REGIONAL ANALYSIS

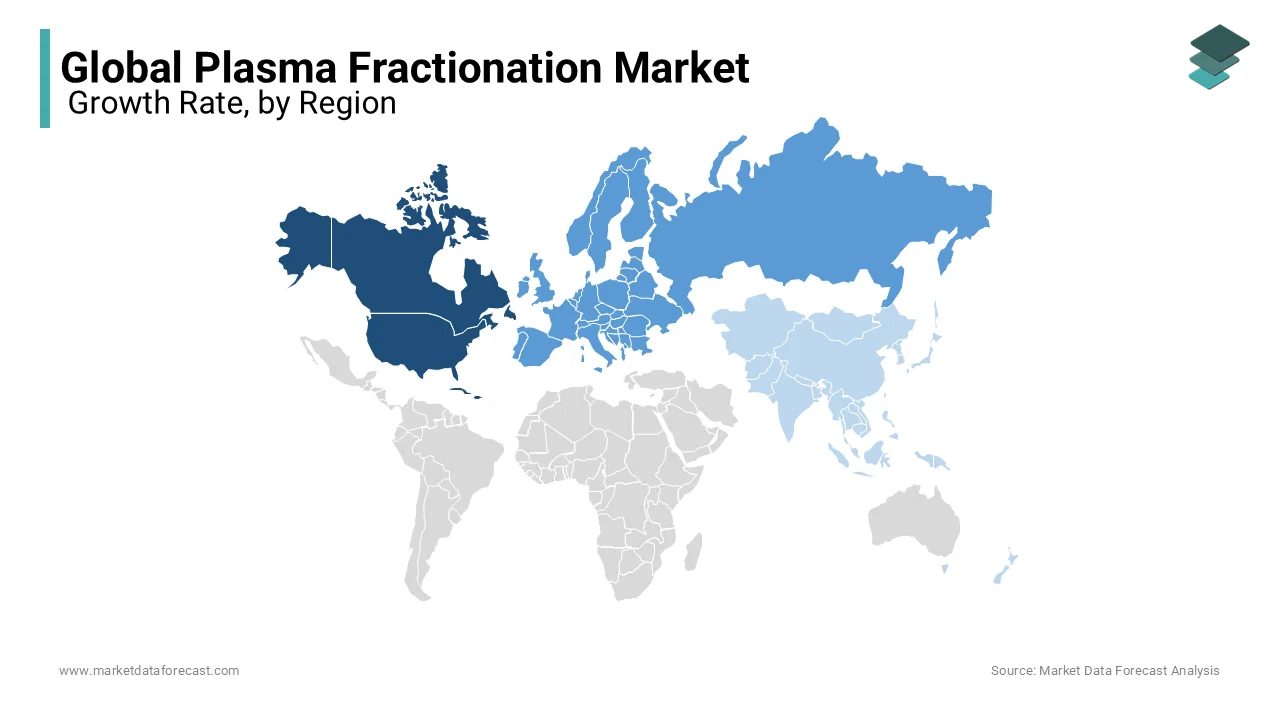

As of 2023, the North American region accounted for the major global market share, with the U.S. accounting for a significant share. The presence of a high number of registered hemophilic patients and the increasing use of immunoglobulins in neurologic disorders are supporting the market to growth in this region. Europe comes in second in market share due to rising awareness about blood-related diseases and the swift availability of treatment in terms of plasma fractionation.

Europe is projected to showcase a healthy CAGR during the forecast period. As a result, countries such as the UK, Germany, and France are predicted to hold a major share of the European market in the coming years.

On the other hand, the Asia-Pacific is estimated to grow at the highest CAGR during the forecast period, majorly because of the presence of more significant elderly population numbers leading to a higher incidence of blood disorders. As a result, India, China, and Japan are expected to account for the leading share of the regional market in the coming years.

KEY MARKET PLAYERS

Some of the notable companies playing a leading role in the global plasma fractionation market profiled in this report are CSL Ltd. (Australia), Grifols S.A (Spain), Baxalta Incorporated (U.S.), Octapharma AG (Switzerland), Kedrion S.p.A (Italy), Bio Products Laboratory (U.K.), Sanquin (Netherland), China Biologic Products, Inc. (China), Biotest AG (Germany), and Laboratoire Français du Fractionnement et des Biotechnologies (France).

KEY HAPPENINGS IN THE MARKET

-

In 2019, Shire Company was acquired by Takeda pharmaceutical company limited to expand its customer base and distribution network across the globe.

-

In 2018, Octapharma inaugurated a multi-function facility. This unit provides new production lines for immunoglobulin panzyga.

- In 2018, Grifols Company launched GamaSTAN immune globulin to treat the hepatitis A virus.

- In 2018, Biotest Corporation was acquired by Grifols to increase its plasma collection network in the U.S.

- In 2018, Guizhou Taibang biological products co. Ltd. received approval from the family planning commission and Hainan provincial health to build a new plasma collection station.

MARKET SEGMENTATION

This research report on the global plasma fractionation market has been segmented and sub-segmented based on the product, application, end-user, and region.

By Product

- Albumin

- Immunoglobulin

- Factor VIII

- Protease Inhibitors

By Application

- Neurology

- Hematology

- Rheumatology

- Pulmonology

- Immunology

By End-user

- Hospital

- Clinical Laboratories

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

How big is the plasma fractionation market?

The global market size for plasma fractionation was worth USD 27.44 billion in 2024 and is estimated to grow by USD 51.30 billion by 2033.

What is the growth rate of the global plasma fractionation market?

Yes, we have studied and included the COVID-19 impact on the global plasma fractionation market in this report.

Who are the major companies in the global plasma fractionation market?

CSL Ltd. (Australia), Grifols S.A (Spain), Baxalta Incorporated (U.S.), Octapharma AG (Switzerland), Kedrion S.p.A (Italy), Bio Products Laboratory (U.K.), Sanquin (Netherland), China Biologic Products, Inc. (China), Biotest AG (Germany.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com