Global PVC Market Size, Share, Trends, & Growth Forecast Report Segmented By Application (Construction, Consumer Goods, Packaging, Electrical &Electronics., Transportation), , and Region (Latin America, North America, Asia Pacific, Europe, Middle East and Africa), Industry Analysis from 2025 to 2033

Global Polyvinyl Chloride (PVC) Market Size

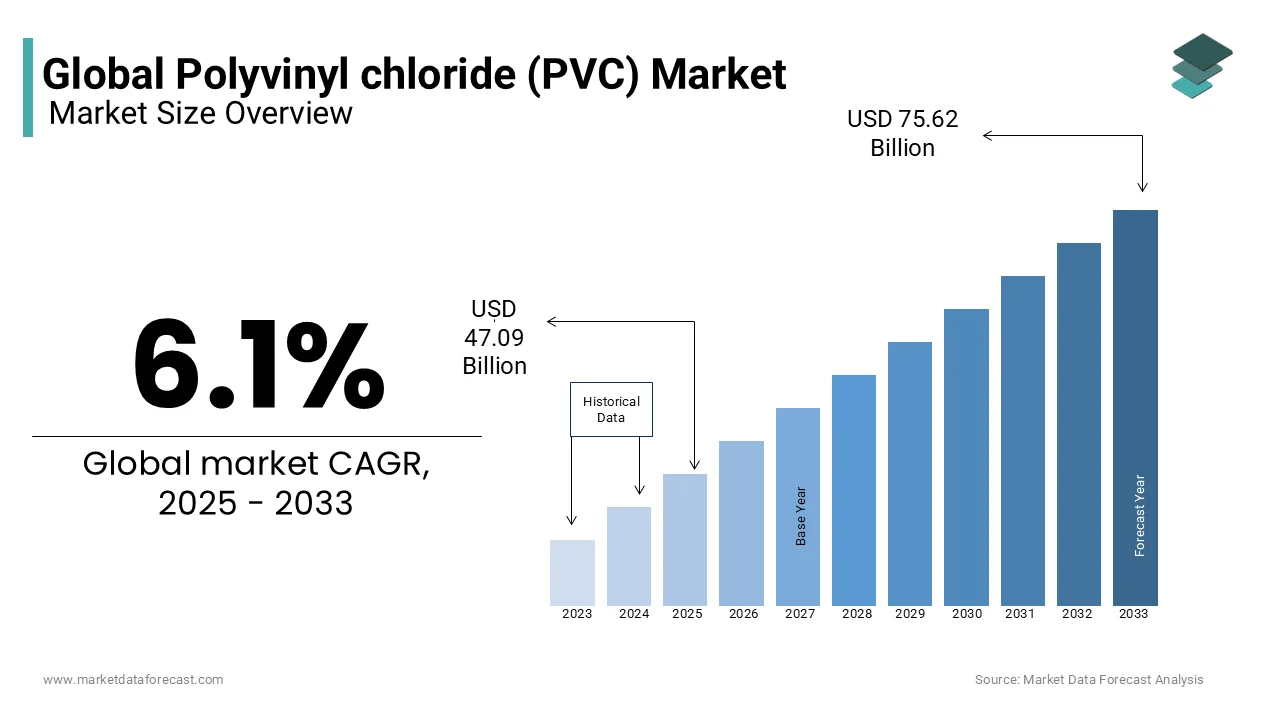

The Global Polyvinyl chloride (PVC) market size was valued at USD 44.38 billion in 2024 and is expected to reach USD 75.62 billion by 2033 from USD 47.09 billion in 2025. The market is projected to grow at a CAGR of 6.1%.

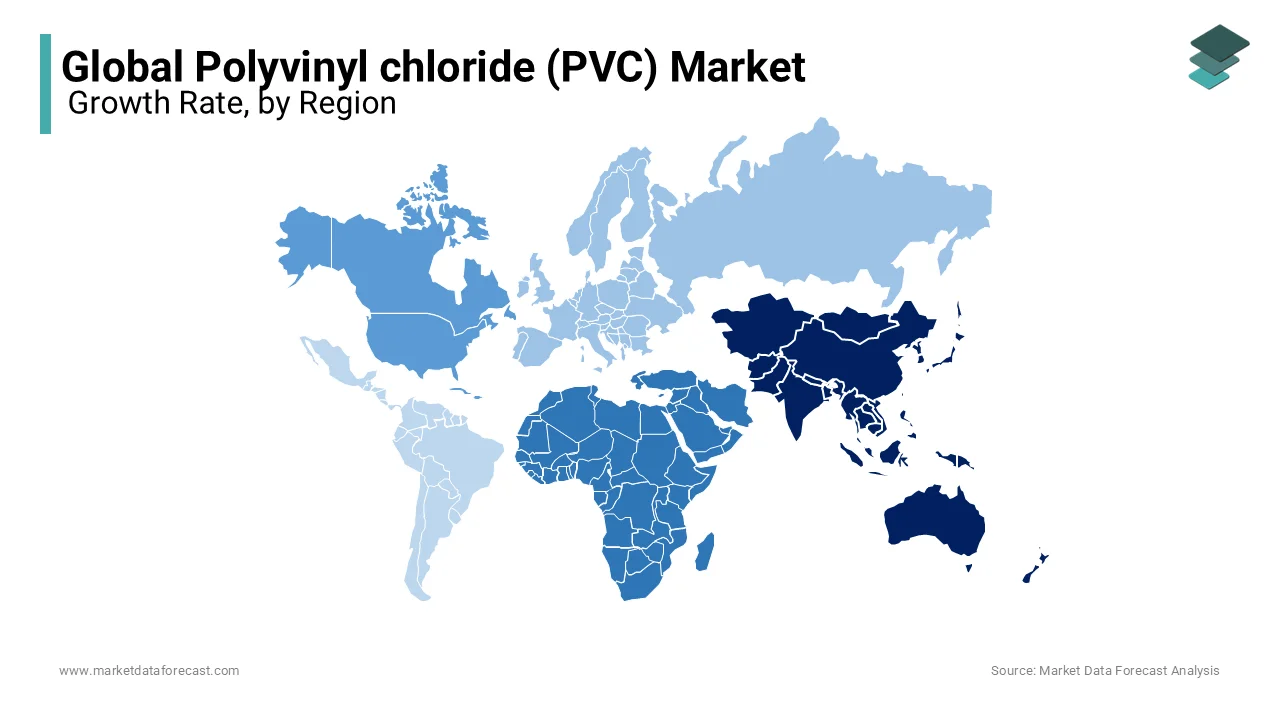

The polyvinyl chloride (PVC) market is likely to register exponential growth over the forecast period, with Asia-Pacific leading as the largest contributor. According to Statista, Asia-Pacific accounted for over 55% of global PVC production in 2022, driven by China’s dominance in manufacturing and India’s rapid industrialization. China alone produces approximately 40% of the world’s PVC, leveraging its vast chemical infrastructure and export capabilities. North America follows closely, supported by robust demand from construction and automotive sectors. The U.S., a key player, contributes significantly to global PVC exports, generating revenues exceeding $10 billion annually, as per the American Chemistry Council. Europe maintains steady growth, with Germany and Italy leading PVC consumption in construction applications like pipes, fittings, and cables. Meanwhile, emerging economies in Latin America and Africa are gaining traction due to urbanization and infrastructure development projects. For instance, Brazil’s PVC market grew at a CAGR of 6% from 2018 to 2022, fueled by affordable housing initiatives.

MARKET DRIVERS

Rising Demand in Construction Applications

The widespread use of PVC in the construction industry, particularly for durable and cost-effective solutions is one of the key factors propelling the growth of the polyvinyl chloride (PVC) market. The global construction sector has been growing steadily over the last few years and is creating significant opportunities for PVC products. Pipes and fittings, which account for nearly 30% of PVC applications, are critical for water distribution and sewage systems due to their corrosion resistance and longevity. Urbanization trends further amplify this demand. For example, India’s Smart Cities Mission aims to develop 100 smart cities by 2025, requiring extensive PVC-based infrastructure. Additionally, PVC’s versatility extends to flooring, roofing membranes, and window frames, making it indispensable in residential and commercial projects. A report by the International Energy Agency highlights that energy-efficient buildings incorporating PVC can reduce heating and cooling costs by 20%, appealing to sustainability-conscious developers.

Growth in Packaging and Healthcare Applications

The rapid adoption of PVC in packaging and healthcare sectors is further fueling the expansion of the global PVC market. Flexible PVC films dominate the packaging industry. Their lightweight, transparent, and tamper-proof properties make them ideal for food and pharmaceutical packaging, ensuring product safety and shelf-life extension. In healthcare, PVC is widely used in medical devices such as blood bags, IV tubing, and surgical gloves due to its biocompatibility and flexibility. A study published in the Journal of Medical Engineering & Technology states that PVC accounts for 25% of all polymers used in medical applications. The rise of telemedicine and home healthcare has further boosted demand for disposable PVC-based products, with global sales expected to reach $15 billion by 2027.

MARKET RESTRAINTS

Environmental Concerns and Regulatory Hurdles

The environmental impact associated with its production and disposal is one of the biggest restraints for the PVC market. According to the European Environment Agency, PVC production generates approximately 30% of total chlorine gas emissions, contributing to air pollution and health risks. End-of-life disposal poses another challenge, as incineration releases harmful dioxins, while landfilling takes centuries to degrade. Stringent regulations further compound these issues. For instance, the European Union’s REACH directive mandates strict compliance for hazardous substances, limiting PVC usage in certain applications. A report by Greenpeace highlights that over 5 million tons of PVC waste remains unrecycled annually, underscoring the need for sustainable alternatives. These barriers increase operational costs and limit market expansion, particularly in regions prioritizing eco-friendly practices.

Volatility in Raw Material Prices

The volatility in raw material prices, particularly for ethylene and chlorine that are key feedstocks for PVC production is further hindering the growth of the global polyvinyl chloride market. According to the International Energy Agency, fluctuations in crude oil prices directly impact ethylene costs, causing PVC prices to vary by up to 15% annually. This unpredictability affects profit margins, especially for small-scale manufacturers. Geopolitical tensions exacerbate this issue. For example, the Russia-Ukraine conflict disrupted natural gas supplies, a critical input for chlorine production, leading to a 20% spike in PVC prices globally in 2022, as reported by S&P Global Platts. Additionally, logistical inefficiencies, such as port congestion and shipping delays, further strain supply chains. These challenges not only impact operational efficiency but also limit accessibility for end consumers, creating obstacles to stable market growth.

MARKET OPPORTUNITIES

Expansion into Sustainable Products

The development of sustainable PVC products to address environmental concerns and regulatory pressures is one of the significant opportunities for the global PVC market. Recycled PVC, or rPVC, is gaining traction as a viable alternative, with a global recycling rate exceeding 6 million tons annually, according to VinylPlus. Innovations in mechanical and chemical recycling processes enhance material recovery, reducing reliance on virgin PVC and minimizing carbon footprints. For instance, companies like Veolia have partnered with PVC manufacturers to establish closed-loop recycling systems, achieving a 30% reduction in energy consumption during production. Additionally, bio-based PVC derived from renewable feedstocks like sugarcane ethanol offers a greener solution, aligning with consumer preferences for eco-friendly products. These advancements position sustainable PVC as a transformative force, fostering innovation and meeting evolving market demands.

Growth in Automotive Lightweighting

The increasing usage of polyvinyl chloride in automotive industry is another major opportunity in the market. PVC plays a critical role in lightweighting and enhancing fuel efficiency in the automotive industry. The demand for automotive plastics is growing significantly, with PVC accounting for a significant share due to its durability and cost-effectiveness. Interior components like dashboards, door panels, and upholstery rely heavily on PVC for aesthetic appeal and functionality. The shift toward electric vehicles (EVs) further accelerates this trend. Lightweight materials reduce vehicle weight, improving battery range by up to 10%, as stated by the International Council on Clean Transportation. For example, Tesla’s adoption of PVC-based interior designs has enhanced cabin insulation and reduced noise levels. By targeting niche yet high-growth applications, PVC manufacturers can tap into a burgeoning market, contributing to both innovation and sustainability in transportation.

MARKET CHALLENGES

Competition from Alternative Materials

Competition from alternative materials is also challenging the expansion of the PVC market, particularly in applications where substitutes offer superior performance or environmental benefits. For instance, polypropylene (PP) and polyethylene terephthalate (PET) are increasingly replacing PVC in packaging due to their recyclability and lower toxicity. According to the Plastics Industry Association, PET demand is projected to grow at a CAGR of 5.2% through 2030, outpacing PVC in certain segments. Additionally, regulatory scrutiny favors alternatives like bio-based polymers, which align with circular economy goals. A study by McKinsey highlights that over 40% of consumers prefer eco-friendly packaging, driving brands to adopt greener options. These shifts threaten PVC’s market share, necessitating strategic investments in innovation and differentiation to remain competitive.

Limited Awareness of Recycling Solutions

Limited awareness about PVC recycling solutions remains a formidable barrier, hindering efforts to improve sustainability and public perception. Many businesses and consumers lack understanding of how PVC can be effectively recycled, leading to underutilization of existing technologies. According to a survey by the Vinyl Institute, less than 50% of PVC waste is currently recycled, despite advancements in mechanical and chemical recycling methods. This knowledge gap results in missed opportunities for resource recovery and environmental improvement. For example, municipalities often prioritize other plastics like PET and HDPE for recycling programs, leaving PVC underrepresented. Similarly, emerging markets struggle to implement scalable recycling infrastructure due to funding constraints. Without targeted educational campaigns and policy support, this lack of awareness stifles broader adoption of circular practices, impacting long-term viability.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.1% |

|

Segments Covered |

By Application, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Arkema S.A., China National Bluestar (Group) Co. Ltd., INEOS Group Ltd., KEM ONE, LG Chem Ltd., Mitsubishi Chemical Corporation, Occidental Petroleum Corporation, Shin-Etsu Chemical Co. Ltd., Westlake Chemical Corporation, Xinjiang Zhongtai Chemical Co., and others |

SEGMENTAL ANALYSIS

By Application Insights

The construction segment accounted for the leading share of 60.1% of the global market in 2024. The versatility of polyvinyl chloride in producing durable and cost-effective products like pipes, fittings, cables, and window frames is primarily driving the growth of the construction segment in the global market. According to the American Chemistry Council, global demand for PVC pipes alone exceeds 15 million tons annually, driven by infrastructure development projects. The rapid urbanization and government investments in affordable housing are further boosting the expansion of construction segment in the global market. For instance, India’s Smart Cities Mission aims to develop 100 smart cities by 2025, requiring extensive PVC-based infrastructure. Additionally, PVC’s energy-efficient properties reduce heating and cooling costs by 20%, making it a preferred choice for sustainable building solutions.

The electrical and electronics segment is anticipated to exhibit a CAGR of 8.4% over the forecast period owing to the increasing demand for PVC-based cables and wires in renewable energy projects and smart grid installations. Emerging trends in electrification and digitalization further accelerate adoption. For example, solar panel installations utilize PVC-insulated cables to withstand harsh weather conditions, enhancing durability and safety. Additionally, electric vehicle (EV) charging stations rely on PVC for its flame-retardant properties, ensuring compliance with international standards.

The transportation segment is estimated to witness a promising CAGR in the global PVC market over the forecast period due to the shift toward lightweight materials to improve fuel efficiency and reduce emissions. Lightweight PVC components contribute to a 10% reduction in vehicle weight, as stated by the International Council on Clean Transportation. Emerging applications in electric vehicles (EVs) further accelerate adoption. For instance, Tesla utilizes PVC-based interior designs to enhance cabin insulation and reduce noise levels. Additionally, PVC’s durability and cost-effectiveness make it a preferred choice for dashboards, door panels, and upholstery.

REGIONAL ANALYSIS

Asia-Pacific dominated the global PVC market by holding 40.9% of the global market share in 2024. China leads production, accounting for 40% of global output, while India and Japan are emerging as key players in specialty applications. A study by the Vinyl Institute reveals that Asia-Pacific consumes approximately 70% of all PVC globally, driven by urbanization and industrialization. Technological advancements further boost this dominance. For example, China’s adoption of automated polymerization reactors has improved yield efficiency by 20%, reducing production costs. Additionally, Japan’s expertise in medical-grade PVC supports its leadership in healthcare applications, with global sales exceeding $15 billion annually.

North America is predicted to account for a substantial share of the global PVC market over the forecast period, with the U.S. leading production and consumption trends. According to the American Chemistry Council, the U.S. exported over 5 million tons of PVC in 2022, leveraging its advanced chemical infrastructure and strategic trade agreements. Key drivers include robust demand from construction and automotive sectors, supported by government investments in infrastructure projects like the $1.2 trillion Infrastructure Investment and Jobs Act. The rise of sustainable practices in North America is also favoring the expansion of North American market. For example, companies like OxyChem have adopted energy-efficient manufacturing processes, reducing carbon emissions by 15% annually. Additionally, partnerships with recycling firms enhance circular economy initiatives, addressing environmental concerns.

Europe is predicted to register a prominent CAGR in the global PVC market during the forecast period, with Germany, Italy, and Spain emerging as key contributors. According to VinylPlus, Europe recycled over 771,000 tons of PVC in 2022, reflecting its commitment to sustainability. The European Union’s REACH directive mandates strict compliance for hazardous substances, driving innovation in eco-friendly PVC formulations. The rising demand for energy-efficient buildings in Europe is propelling the European PVC market forward. For instance, PVC-based thermal insulation systems reduce heating costs by 25%, as per the European Insulation Manufacturers Association. Additionally, collaborations between manufacturers and architects enhance product customization, meeting diverse customer needs.

Latin America is projected to hold a considerable share of the global PVC market over the forecast period, with Brazil and Mexico as primary contributors. According to the Brazilian Plastics Industry Association, Brazil produces over 1 million tons of PVC annually, supported by government subsidies and technological upgrades. Mexico follows closely, supplying cost-effective products to North American markets under trade agreements like USMCA. Key drivers include urbanization and infrastructure development. For example, Brazil’s affordable housing programs have increased PVC pipe consumption by 10% annually, as reported by the National Institute of Statistics. Additionally, advancements in formulation technologies enhance product durability, meeting international quality standards. These factors position Latin America as a growing player in the PVC market.

The PVC market in Middle East and Africa is expected to showcase a steady CAGR in the global PVC market over the forecast period, with Egypt and Saudi Arabia leading production. According to the African Development Bank, Egypt produces over 500,000 tons of PVC annually, supported by investments in chemical infrastructure. Meanwhile, Saudi Arabia’s Vision 2030 initiative emphasizes diversification into petrochemicals, boosting PVC exports. A major driver is the rise of infrastructure projects, such as Dubai’s Expo 2020, which utilized PVC-based materials for architectural facades. Additionally, collaborations with European firms enhance local expertise, ensuring compliance with international standards. These efforts highlight the region’s potential to address construction and industrial needs through PVC innovation.

KEY MARKET PARTICIPANTS AND COMPETITIVE LANDSCAPE

Arkema S.A., China National Bluestar (Group) Co. Ltd. (China National Chemical Corporation), Formosa Plastics Corporation, INEOS Group Ltd., KEM ONE, LG Chem Ltd., Mitsubishi Chemical Corporation, Occidental Petroleum Corporation, Saudi Basic Industries Corporation (Saudi Arabian Oil Co.), Shin-Etsu Chemical Co. Ltd., Westlake Chemical Corporation, Xinjiang Zhongtai Chemical Co. Ltd. are playing dominating role in the global polyvinyl chloride (PVC) market

The Omega-3 market is characterized by intense competition, with established giants and emerging players vying for dominance. Key participants leverage their expertise in sourcing, purification, and formulation to differentiate themselves. Consolidation through mergers and acquisitions is common, enabling companies to expand geographically and diversify product portfolios. For instance, BASF’s acquisition of Equateq strengthened its position in high-concentration Omega-3 supplements.

Meanwhile, startups disrupt traditional dynamics by introducing plant-based and algae-derived Omega-3 alternatives, appealing to vegan demographics. Regional players also pose a threat, capitalizing on localized expertise to challenge global leaders. This competitive landscape drives continuous innovation, benefiting end-users through improved product quality, affordability, and sustainability.

TOP 3 PLAYERS IN THE MARKET

Formosa Plastics Corporation

Formosa Plastics Corporation is a global leader in PVC production, known for its high-quality resins used in diverse applications like construction and packaging. The company operates state-of-the-art facilities, ensuring steady supply chain resilience. Formosa prioritizes sustainability, adopting energy-efficient processes that reduce carbon emissions by 15% annually. With a strong presence in Asia-Pacific and North America, Formosa continues to innovate, addressing shifting market demands effectively.

LG Chem

LG Chem excels in producing specialty PVC grades, serving industries like automotive, healthcare, and electronics. The company’s focus on R&D has led to breakthroughs in bio-based PVC formulations, aligning with circular economy goals. LG Chem collaborates with global brands to develop eco-friendly solutions, enhancing brand reputation. Its strategic expansions in Europe and North America strengthen its competitive edge, ensuring broader accessibility.

Shin-Etsu Chemical

Shin-Etsu Chemical is Japan’s largest PVC manufacturer, known for its innovative products catering to niche markets like medical devices and semiconductors. The company supplies ultra-pure PVC resins, meeting stringent quality standards for critical applications. Shin-Etsu prioritizes sustainability, investing in recycling technologies that recover 90% of post-consumer PVC waste. With a focus on precision and reliability, Shin-Etsu continues to expand its footprint in emerging economies.

TOP STRATEGIES USED BY THE MARKET PLAYERS

Sustainability Initiatives

Leading players prioritize sustainability to address environmental concerns and regulatory pressures. For example, Formosa Plastics Corporation has invested in closed-loop recycling systems, achieving a 30% reduction in waste generation annually. These initiatives not only enhance brand reputation but also comply with stringent regulations, ensuring long-term competitiveness. Certifications like ISO 14001 reinforce their commitment to eco-friendly practices, attracting environmentally conscious buyers.

Product Innovation

To stay ahead, companies invest heavily in R&D to develop cutting-edge products. LG Chem, for instance, introduced bio-based PVC derived from sugarcane ethanol, reducing reliance on fossil fuels. Similarly, Shin-Etsu Chemical developed specialty grades for medical devices, ensuring compliance with biocompatibility standards. These innovations address unmet needs while fostering customer loyalty, positioning players as leaders in quality and performance.

Strategic Partnerships and Expansions

Strategic partnerships and geographic expansions strengthen market presence and operational efficiency. In April 2024, LG Chem partnered with a German recycling firm to enhance PVC recovery rates, achieving a 25% increase in recycled content. Such moves enhance supply chain resilience and foster knowledge sharing. Additionally, collaborations with local distributors ensure accessibility and affordability, meeting regional demands effectively.

RECENT HAPPENINGS IN THE MARKET

- In April 2024, BASF acquired Equateq, a Scottish producer of high-purity Omega-3 concentrates. This move expanded BASF’s product portfolio and solidified its leadership in the nutraceutical sector.

- In June 2024, DSM launched a new line of plant-based Omega-3 supplements derived from algae, targeting the growing vegan demographic. This initiative diversified its offerings and addressed shifting consumer preferences.

- In August 2024, Croda International partnered with a Norwegian biotech firm to develop sustainable Omega-3 extraction methods using microbial fermentation, reducing reliance on fish oil. This innovation aligned with sustainability goals and strengthened its competitive edge.

- In October 2024, Aker BioMarine announced a $100 million investment in krill harvesting technologies, improving yield and environmental performance. This reinforced its commitment to eco-friendly practices.

- In December 2024, Nutrinova signed a distribution agreement with Amazon, enabling direct-to-consumer sales of its Omega-3 capsules. This partnership expanded accessibility and tapped into the booming e-commerce segment.

MARKET SEGMENTATION

This research report on the global polyvinyl chloride (PVC) market has been segmented and sub-segmented based on application, and region.

By Application

- Construction

- Consumer Goods

- Packaging

- Electrical &Electronics

- Transportation

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

1. What is the current and projected market size of the global PVC market?

The global Polyvinyl Chloride (PVC) market was valued at USD 44.38 billion in 2024 and is expected to reach USD 75.62 billion by 2033, growing from USD 47.09 billion in 2025 at a CAGR of 6.1%.

2. What are the key challenges affecting the PVC market?

The PVC market faces major challenges like Volatility in raw material prices (ethylene and chlorine).and Competition from alternative materials like bio-based plastics and other polymers.

3. Which region holds the largest share in the global PVC market?

Asia-Pacific dominates the global PVC market, accounting for 56.1% of the market share in 2024.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com