Global Proteases Market By Source (Microbial, Plant And Animal), By Application (Food & Beverages, Laundry & Dish Washing Detergents, Feed Additives, Health Care And Other Applications), By Product (Plant, Animal And Microbial), and Region Analysis (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) - Global Industry Analysis, Size, Share, Growth, Trends, and Forecast (2022 – 2027)

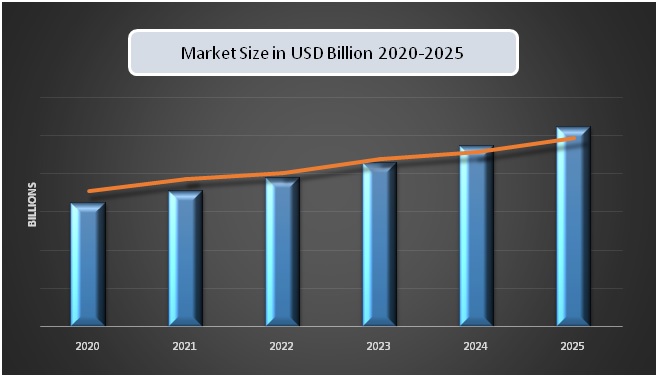

Proteases Market Growth and Forecast (2022-2027):

The Global Proteases Market size is estimated to reach over USD 2.13 billion by the end of the assessment period. The Proteases Market is likely to register moderate growth to record a CAGR of 6.15% throughout the forecast period 2022 - 2027.

Market Overview:

Proteases are enzymes that are of vital importance due to their many applications in the fields of the physiological and commercial market. Protease enzymes are used in many forms, mainly in the pharmaceutical and detergent industries, and later in the food industry. Given the current development of environmentally friendly technologies, protease enzymes are expected to have wide applications in leather processing and various biologically mediated processes. There is high variability in global enzyme requirements depending on the individual application. Microorganisms are the primary sources of enzymes since through an established fermentation method, and they can be grown in large quantities in a short time.

Microbial proteases occupy the first position of the three sources, viz. animal, plant and microbial. The method of obtaining the protease enzyme from plants is time-consuming, and the yield is very low, which also depends on several factors, such as the availability of land for cultivation and the suitability of climatic conditions. The protease enzyme used in the pharmaceutical industries needs further purification before being used and manufactured in small quantities. In contrast, the protease enzyme used in the detergent and food industries is produced in large numbers. The use of the protease enzyme replaces the use of chemicals used in detergents. More than half of the market share comes from industrial enzymes for the production of soaps, textiles and pulp and paper.

Recent Developments in Protease Industry:

- In September 2017, Marizyme, Inc. focused on acquiring a protease drug platform. Marizyme, Inc. has entered into an asset purchase agreement for a protease-based drug platform to develop an acute care company and clinical trials that can focus on life-saving responses to unmet medical needs, primarily acute care.

- In October 2016, BASF launched a new range of protease enzyme products called Lavergy. The new Lavergy protease would set the standard for liquid detergents. The modern enzyme-based liquid detergents have helped BASF enter a new range of products. This enzyme-based detergent is useful for industrial and institutional cleaning and home care industries.

Drivers and Restraints:

The increase in the diversity of functionalities in foods around the world is stimulating the demand in the global protease market. Furthermore, the feature of proteases in animal feed increases their consumption and in the livestock industry, which should also have a significant influence on the protease market. Furthermore, the application of proteases as a class of therapeutic agents is expected to have a substantial impact on the protease market. The growing demand and products that respect the environment and health, which in turn should generate untapped opportunities for market players. Food enzymes, primarily carbohydrate, protease, lipase, and others, have significantly strengthened their presence in an increasing number of food and beverage industries worldwide, thereby accelerating market growth. Alkaline proteases have been used in the preparation of high nutritional value protein hydrolyzes with a well-defined peptide profile. It also plays a vital role in tenderizing meat, especially beef.

Among shellfish, food enzymes, especially protease, are catalyzed to obtain the benefits like better oil separation and higher performance, which saves energy, improves the value of proteins and digestibility with better properties such as emulsification, solubility, fats, and water. Linking and enhancing the elimination of leftover meat, in order to obtain "clean" fish frames, for use as a source of calcium. Renin is an enzyme that digests proteins and dominates the animal products segment. Furthermore, renin is used for cheese preparation and milk production. Increased production of papain enzymes due to increasing health problems due to better digestion and an improved immune system could help grow the industry.

REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2021 – 2027 |

|

Base Year |

2021 |

|

Forecast Period |

2022 - 2027 |

|

CAGR |

6.15% |

|

Segments Covered |

By Application, Source, Product and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

DuPont, Chr. Hansen Holding A/S, Noor Enzymes Pvt. Ltd, Associated British Foods Plc, DSM N.V, Novozymes and Others. |

Geographical Segmentation Analysis:

- North America - the United States and Canada

- Europe - United Kingdom, Spain, Germany, Italy, and France

- The Asia Pacific - India, Japan, China, Australia, Singapore, Malaysia, South Korea, New Zealand, and Southeast Asia

- Latin America - Brazil, Argentina, Mexico, and Rest of LATAM

- The Middle East and Africa - Africa and Middle East (Saudi Arabia, UAE, Lebanon, Jordan, Cyprus)

Regional Share Insights:

The North American Proteases market was further segmented in the United States, Canada, and Mexico. The European Proteases market has been ranked in the United Kingdom, Germany, France, Italy, Spain and the rest of Europe. The Asia-Pacific Proteases market has been divided into China, India, Japan, Australia, and New Zealand, and the rest of the Asia-Pacific. The Proteases market in the rest of the world has been segmented into South America, the Middle East, and Africa.

Among all the regions, North America has dominated the market due to the presence of many developed industries in the area. The diversity of food functionalities, the increasing importance of laundry products, the rising demand for infant formula and the expanding production and consumption of meat products are assumed to drive the protease market during the forecast period. Asia-Pacific region is the speedy-growing region due to the operational and economic benefits of proteases. They have the unused potential for the protease enzymes' growth in the food, pharmaceutical industries, and detergent. The Asia Pacific protease market is multiplying due to the growing demand from the processed food and pet food industry in the region and the extensive applications of enzymes, including protease in the processed food industry, are stimulating the Asian region. Other developing countries in the Asia-Pacific region, such as Vietnam, China, Taiwan, and Japan, plan to open new growth opportunities. The Latin American and the Middle East and Africa regions are suspected of growing at a slower rate due to economic conditions.

Proteases Market Segmentation Analysis:

Based on Source:

- Microbial

- Plant

- Animal

Based on Application:

- Food & Beverages

- Laundry & Dish Washing Detergents

- Feed Additives

- Health Care

- Other Applications

Based on Product:

- Plant

- Animal

- Microbial

Impact of covid-19 on Global Proteases Market:

As the effects of COVID-19 are felt around the world, food and beverage companies face significantly reduced supply chain disruption and consumption challenges. While domestic consumption has peaked in the past two weeks, consumption has stagnated. Once the situation begins to normalize, out-of-home consumption will resume, but it is unlikely to be enough to cover lost sales in the coming months. With an impending economic downturn, food and beverage revenues are likely to be under pressure. Food and beverage companies should review their sourcing strategies, streamline their product lines, and assess the resilience and agility of their supply chains and market access routes. Electronic commerce and distribution networks must be optimized and rationalized. Given the impact of the change in commodity prices and other service costs, as well as the means to increase demand, companies will be forced to review their pricing and promotion strategies.

Leading Company

DuPont had the largest share of the Global Proteases Market in terms of sales and revenue in 2019.

Key Players in the Market:

Major Key Players in the Global Proteases Market are

- DuPont

- Chr. Hansen Holding A/S

- Noor Enzymes Pvt. Ltd

- Associated British Foods Plc

- DSM N.V

- Novozymes

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 1800

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]