Global Rodenticides Market Size, Share, Trends & Growth Forecast Report - Segmented By Type (Non-Anticoagulant, Anticoagulant), Mode Of Application (Pellets, Powders, Sprays), End-User (Agricultural Fields, Urban Centres, Warehouses, Pest Control Companies, Household Consumers), And Region (North America, Europe, APAC, Latin America, Middle East And Africa) – Industry Analysis From 2025 To 2033

Global Rodenticides Market Size

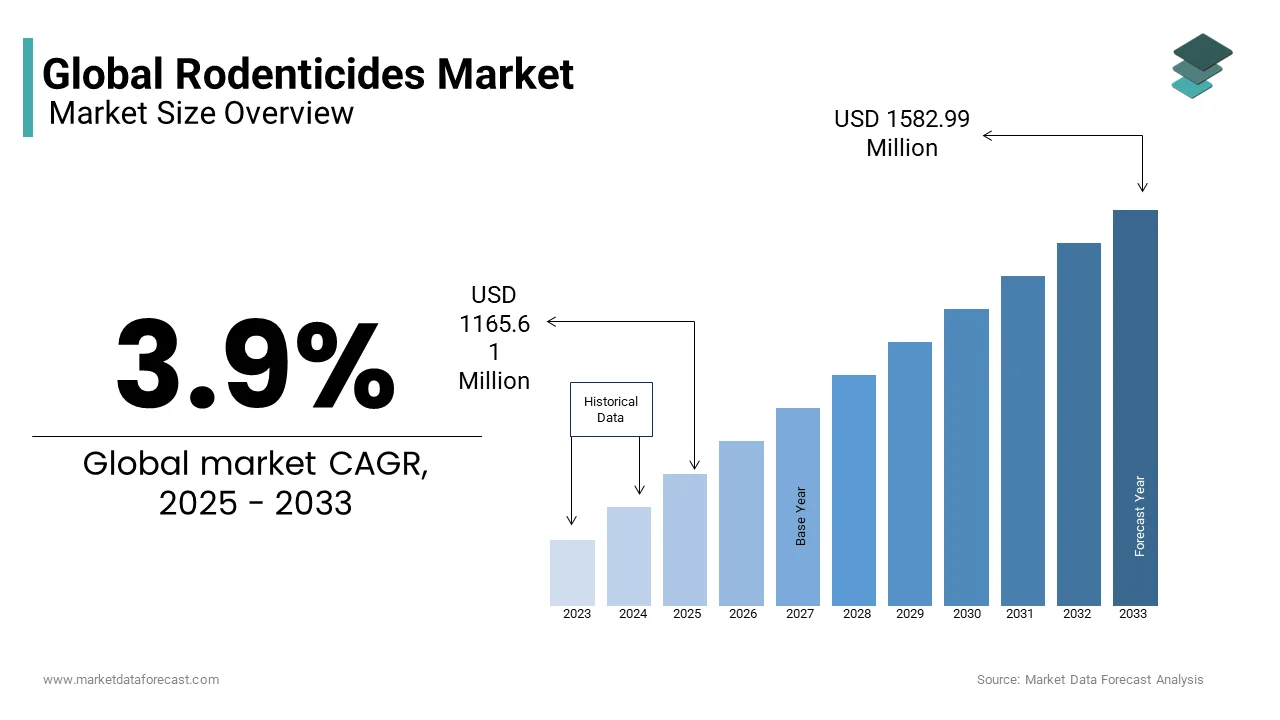

The global rodenticides market was valued at USD 1121.86 million in 2024 and is anticipated to reach USD 1165.61 million in 2025 from USD 1582.99 million by 2033, growing at a CAGR of 3.9% during the forecast period from 2025 to 2033.

CURRENT SCENARIO OF THE GLOBAL RODENTICIDES MARKET

Rodenticides are extensively used in agricultural fields, greenhouses, and warehouses. Pest control agencies are also among the major users. Increasing demand to protect crops, as well as food grains, is likely to have a positive effect on the global market over the forecast period. The growing agriculture sector in emerging nations such as China, India, and Brazil is expected to boost the market growth in the region.

MARKET DRIVERS

The rising demand for pesticides due to the growing agriculture sector is expected to drive the market over the next seven years. Food demand has been steadily increasing over the past few years on account of population growth in Africa, Asia, and Latin America. This trend is expected to further drive the global rodenticides market over the forecast period. Rising awareness amongst farmers and horticulturists concerning the adverse effects of rodents on crops and developing farming techniques are predicted to further supplement the global market growth. Strict regulations by governmental agencies over rodenticide usage and resulting soil contamination are further likely to challenge the global market. The toxicity of rodenticides on humans and animals has been a key factor restraining the growth of the market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

3.9% |

|

Segments Covered |

By Type, Mode of Application, End User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

BASF SE Bayer Crop Science Neogen Corp Impex Europa S.L J.T. Eaton & Co Liphatech Pelgar International Syngenta SA UPL Limited |

SEGMENT ANALYSIS

Global Rodenticides Market By End User

The non-anticoagulant rodenticides segment is projected to grow at the highest CAGR from 2022 - 2027. These rodenticides are referred to as acute toxicants. The metabolic poisons include fluoroacetamide, bromethalin, and fluoroacetate, which lead to paralysis and convulsions in rodents before death. These are more efficient in controlling rodent infestation.

REGIONAL ANALYSIS

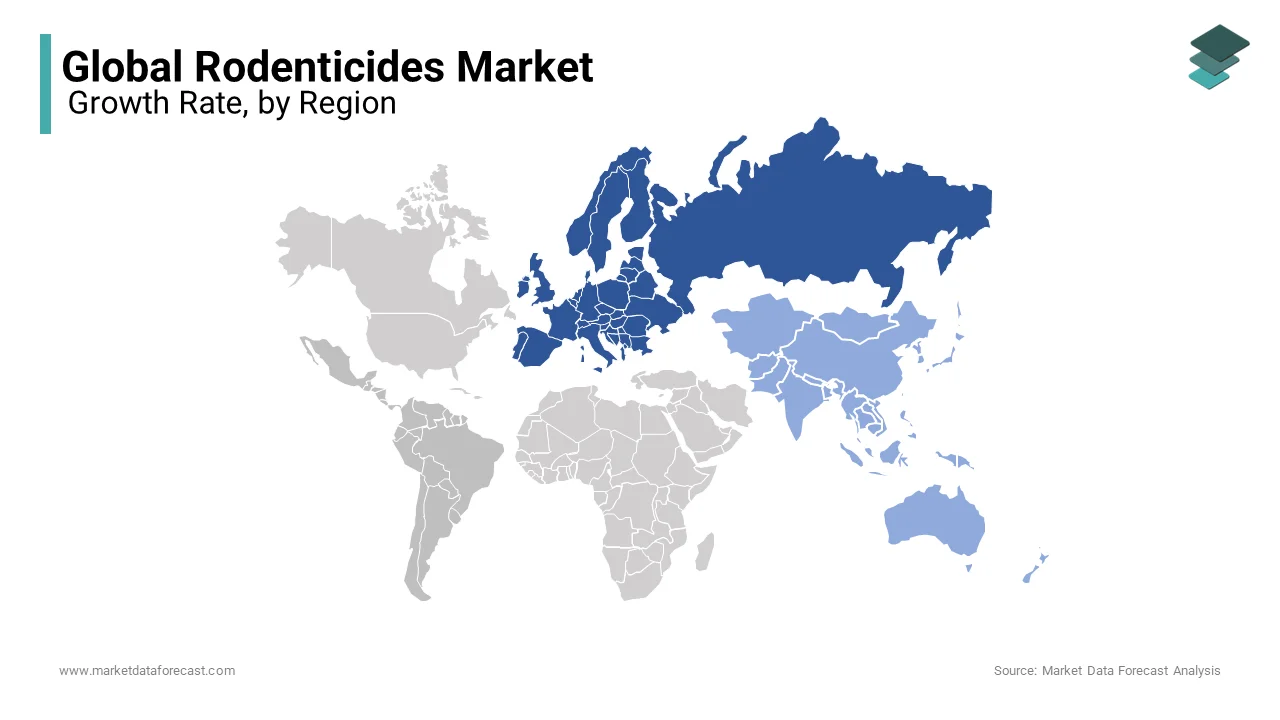

North America trailed by the Asia Pacific, is the major market for rodenticides. North America accounts for a major producer and exporter of corn, among others, and the rodenticides requirement to protect corn is expected to drive the market in the region. There is a high-growth perspective for rodenticide products in the Asia-Pacific region. This region has emerging economies, such as China and India, which have considerable cultivable land to grow crops. Furthermore, China is the second-largest country to hold a major share in the rodenticides market because of the technological growth and urbanization of agriculture.

KEY MARKET PLAYERS

BASF SE, Bayer Crop Science, Neogen Corp, Impex Europa S.L, J.T. Eaton & Co, Liphatech, Pelgar International, Syngenta SA, and UPL Limited are some of the market players dominate the global rodenticides market.

Significant companies are aggressively pursuing supply contracts to expand consumer reach and increase market presence. Companies such as Syngenta, BASF, and Bayer Crop Science have been involved in R&D to develop non-toxic rodenticides. The above is expected to open new possibilities to market participants and provide them with a competitive gain.

MARKET SEGMENTATION

This research report on the global rodenticides market is segmented and sub-segmented based on Type, Mode of Application, User, and Region.

By Type

- Non-Anticoagulant

- Anticoagulant

By Mode Of Application

- Pellets

- Powders

- Sprays

By End-User

- Agricultural Fields

- Urban Centres

- Warehouses

- Pest Control Companies

- Household Consumers

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle-East & Africa

Frequently Asked Questions

What is the current market size of the global rodenticide market?

The current market size of the global rodenticides market was valued at USD 1165.61 million in 2025

What are the market drivers that are driving the global rodenticides market?

Rising awareness amongst farmers and horticulturists concerning the adverse effects of rodents on crops and developing farming techniques are predicted to further supplement the global market growth.

Who are the market players that are dominate the global rodenticides market?

BASF SE, Bayer Crop Science, Neogen Corp, Impex Europa S.L, J.T. Eaton & Co, Liphatech, Pelgar International, Syngenta SA, and UPL Limited are some of the market players dominate the global rodenticides market.

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com