Global Rum Market Size, Share, Trends & Growth Forecast Report By Type (Golden, Dark, White and Spiced), Distribution channel (On-trade and Off-trade), And Region (North America, Europe, Asia Pacific, Latin America, Middle East & Africa), Industry Analysis From 2025 to 2033

Global Rum Market Size

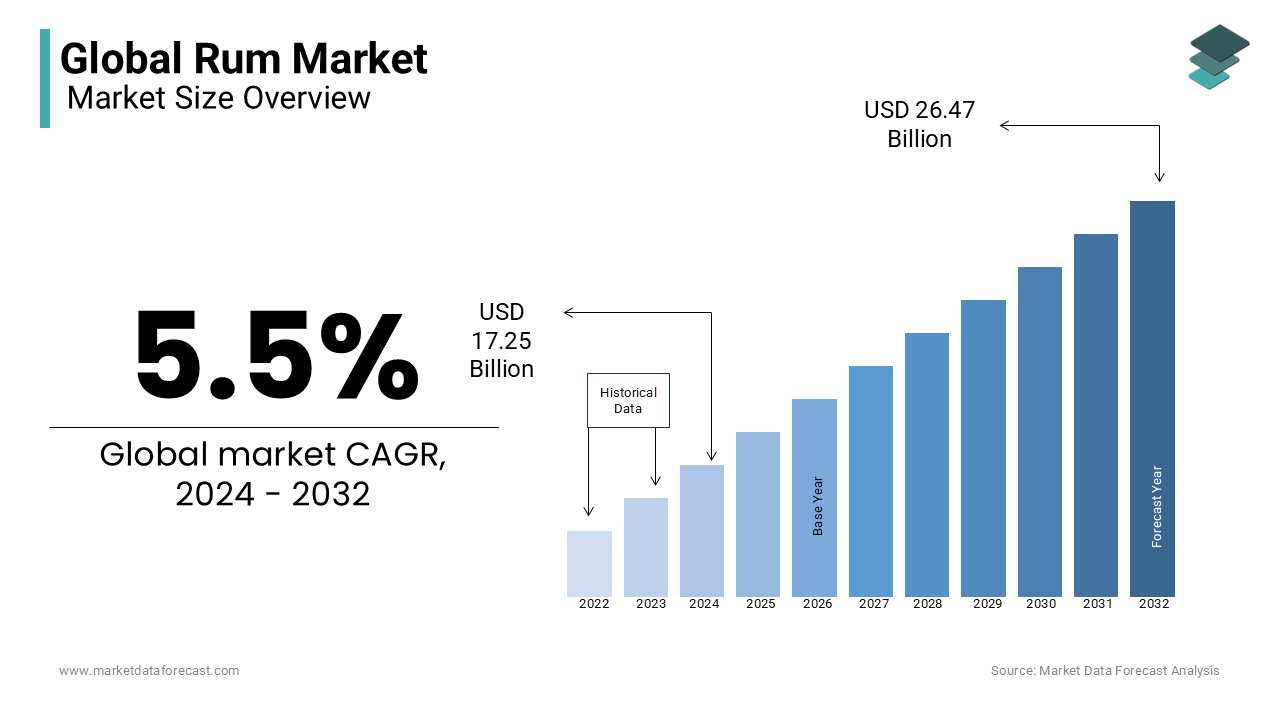

The global rum market size was worth USD 17.25 billion in 2024 and the global market size is further estimated to grow at a CAGR of 5.5% from 2025 to 2033 and be worth USD 27.93 billion by 2033 from USD 18.20 billion in 2025.

The world rum market is thriving because the mental category is receiving a lot of attention. Rum is the second preferred beverage of all spirits. Consumers are increasingly interested in new flavor profiles in addition to those offered by dark rum and golden rum, and flavored rums are widely used in the production of cocktails, shakers, and drink mixes. The medicinal properties of rum saved the lives of troops and soldiers in war, not until decades ago. During World War I, 'Totorum' was used to keep soldiers healthy. Rum can increase bone density. In that sense, eating in moderation can help prevent osteoporosis and relieve arthritis symptoms. Rum can help prevent heart attacks and heart disease by increasing good cholesterol, also known as HDL cholesterol, and preventing clogging of the arteries. Rum is one of the oldest alcoholic beverages. Traditional rum consumers are looking for premium rum products with a unique flavor profile.

MARKET OVERVIEW

The rum is an alcoholic spirit that is distilled from the sugarcane residue or molasses fermented by yeast, retorted, and then matured in oak casks. Rum is traditional sugarcane liquor in many Caribbean and West Indies countries, such as Brazil and Jamaica. The major three types of rum are light, dark, and spiced or flavored. The global rum market has accounted for substantial growth in the past years and is anticipated to have prominent growth during the forecast period. The increasing desire for distinctive and unique alcoholic beverages among consumers, majorly millennials, is contributing to the market revenue expansion. The rum is estimated to have 40% ABV (minimum 57.7% ABV in overproof). The growing urban population and rising per capita income are enhancing investments in alcoholic beverages, and the rising demand for flavored and spiced rums among consumers is augmenting the market growth opportunities.

MARKET DRIVERS

The Rising Popularity of Cocktails and Mixology Culture and Growing Consumption of Rum in Developing Countries

The growing purchasing power of the middle-income population to promote rum sales and market growth in urban areas, the perception that high-pressure jobs and alcohol consumption are comfortable in mind, is resulting in a surge in the intake of rum. With disposable income increasing in emerging economies, as the urban population has grown, people have come to explore new forms of entertainment, such as spending time at night parties and bars, pubs, and lounges. It is an important factor in boosting sales of alcoholic beverages by young people with easy access to energy consumption, the impact on social media, and alcoholic beverages. Patented flavor and increased demand for flavor will be a key factor driving growth in the global rum market. The drastic preference of online retailers has a huge impact on the revenue generated by the rum market. Sales of alcoholic beverages are determined primarily by the individual's income, and the purchasing power of consumers is determined by income. According to the United Nations, the number of middle-class consumers has increased in recent years. Consumers in this category have a greater propensity for a better lifestyle as disposable income for food and beverages increases. This factor is expected to drive growth in the global rum market during the outlook period.

The Increasing Demand for Premium Varieties of Rum

Demand for premium rum is increasing among consumers as per capita income increases in developed and developing countries. The premium varieties of rum are known for their authenticity, flavor and brand. To meet this growing demand for rum of superior quality and flavor, various suppliers in the market offer a wide variety of rums. Consumers' willingness to spend more on premium quality rum will facilitate the growth of the rum market during the forecast period. Premium rum varieties are gaining popularity due to their authenticity, flavor, and brand. In addition, consumer preferences for premium rums worldwide have increased significantly due to an increase in per capita income for consumers in developed and developing countries. This encourages suppliers to introduce various types of premium rum to meet growing consumer demand. These factors are expected to accelerate the growth of the global rum market during the outlook period. Millennium Generation and Gen X Group consumers are increasingly interested in the authenticity of alcoholic beverages, including alcoholic beverages such as rum. Interest is fueled primarily by social media, word of mouth, and a growing group of multicultural consumers. These groups prefer artisanal products and require more than just taste and ease of purchase. The main factor influencing the global growth of the rum market is the launch of new products. Rise in product development and delivery expansion are increasing the demand for alcoholic drinks like rum. In recent years, more players are expected to grow the new rum market in the future. Also, manufacturers have been offering rum products in a variety of flavors. Most producers are focusing on offering sweet buttery butterscotch rum products, tropical fruit, and vanilla flavors with a smoky licorice and molasses finish. This is due to technological advances on the production line. In addition, the development of advertising has a great influence on consumers of alcoholic beverages. Companies further strengthen the growth of the global rum market by hiring famous celebrities to advertise their brands, improve sales, and increase brand awareness.

The rising disposable income in urban areas and the prominence of alcoholic beverages during social gatherings are attributed to showcase huge growth opportunities for the rum market. An increasing number of liquor manufacturing units in many countries and the rising number of liquor marts everywhere, especially in the most popular countries like India, China, and others, are likely to fuel the growth rate of the rum market. Some people prefer to drink rum for health benefits. Research studies from many years say that drinking rum in moderate form poses many health benefits, which reduce the risk of heart failure and lower blood pressure.

MARKET RESTRAINTS

The growing number of people suffering from various diseases like diabetes, high cholesterol, and other chronic diseases is impeding the growth rate of the market. Rum is limited for the people who are suffering from chronic illness where the rising prevalence of chronic illness. Drinking rum in moderate form or occasionally is safe, whereas a lack of awareness in drinking the rum in various forms is limiting the market’s growth rate. Stringent rules and regulations by the government to export or import alcoholic beverages additionally degrade the growth rate of the market. Government authorities are taking stringent action to prohibit the sale of unlicensed products in liquor, which is posing a negative impact on the growth rate of the market. Also, few countries have imposed restrictions on promoting various alcohol brands through advertisements that eventually hamper the growth rate of the rum market.

The manufacturing of rum with exact boiling temperatures and distillation processes requires proper units and equipment. The lack of proper equipment to produce high-quality rum in many countries is considered to be a challenging factor for the rum market. The lack of sufficient workers in the factories and difficulty in getting green flags for the newly launched products are quietly impeding the growth rate of the rum market to some extent. The easy availability of local brands that are produced with low-quality raw materials, which can cause severe adverse effects on consumers, is ascribed to a negative impact on the market’s growth rate.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.5% |

|

Segments Covered |

By Type, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Bacardi Global Brands Ltd, Asahi Group Holdings Ltd, Demerara Distillers Ltd, Davide Campari-Milano Spa, Suntory Holdings Ltd, LT Group Inc, Diageo Plc, Pernod Ricard SA, Nova ScotiaSpirit Co, William Grant & Sons Ltd and Others. |

SEGMENTAL ANALYSIS

By Product Type Insights

The golden segment dominated the global rum market with a prominent share and is anticipated to maintain dominance during the forecast period. The golden rum undergoes an extended aging process compared to other types of alcoholic beverages, which is gaining traction among consumers and leading to segment growth. The long-term aging contributes to enhanced flavors and velvety texture in the rum, which appeal to consumers. These factors are propelling the segment's growth rate.

The dark segment held the second-largest share in the global rum market due to increasing demand for aged alcohol. This segment is estimated to have significant growth in the coming years. Old age dark rum is gaining attention from millennial consumers due to high demand for its unique and smooth taste. Dark rum is widely known for its quality and value, which fuels the segment's growth. For Instance, in May 2022, Denizen Vatted Dark Rum from Guyana won two gold medals and the "Best Value of the Year" award at the San Francisco Bartender Spirits Awards 2022.

Spiced rum has been gaining traction in the past years due to its demand for cocktails, which is projected to have substantial growth for the segment in the coming years. The rising demand for flavored and spiced rum among consumers and manufacturers' continuous introduction of innovative products will propel the market growth rate. For Instance, in 2023, the famous brand Barcardi Rum introduced Mango Chile to the U.S. market.

By Distribution Channel Insights

The off-trade segment held the most significant share in the global rum market and is expected to grow substantially during the forecast period. The off-trade involves the convenience of purchasing products from supermarkets, liquor stores, hypermarkets, and specialty stores, contributing to the segment's dominant growth. Most consumers prefer to buy products from offline stores, especially from these channels with vast distribution networks, which fuel the segment growth. The growing introduction of new products and brands by various market players through the off-trade channels provides growth opportunities to the market in this segment.

The on-trade segment is estimated to grow rapidly during the forecast period due to the enlarging e-commerce sector. The pandemic influenced people to adopt online shopping, and most of the major suppliers focused on e-commerce portals to expand their revenue, propelling the segment growth. The growing digitalization, where consumers are focusing on buying online and expect doorstep delivery, augments the growth opportunities.

REGIONAL ANALYSIS

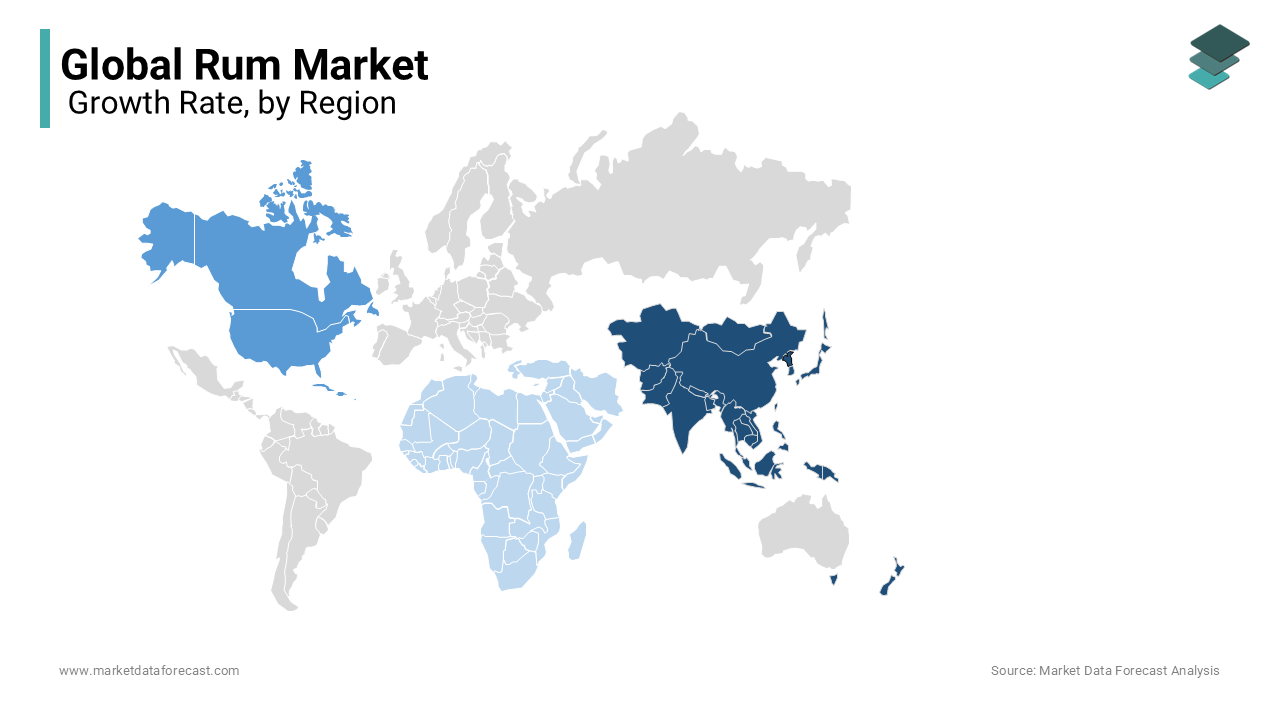

The Asia Pacific region dominated the global market with a prominent growth rate in the global rum market and is anticipated to maintain dominance during the forecast period. South Asia has been identified as one of the world's largest rum consumers. India and the Philippines are the most dominant countries in the South Asian rum market, with the most significant number of consumers. India and the Philippines are also significant producers of rum products. India is also experiencing strong growth in the premium rum category, which adds opportunities for regional market growth. The rising disposable incomes of the people, increasing demand for alcoholic beverages among consumers, and adoption of modern lifestyle are rising popularity for rum across the regional countries, contributing to the regional market size expansion.

The North American region is expected to grow fastest during the forecast period. The presence of various international market players and rising demand for premium rums are majorly driving the regional market growth. The market players' growing introduction of various flavored and spiced rums is gaining traction among consumers, leading to the expansion of the market revenue in the region. The increased demand for alcohol among the growing youngsters is enhancing the manufacturers' introduction of alcoholic products that meet the demand of consumers, providing market growth opportunities.

The European region is estimated to grow steadily during the forecast period with a significant CAGR. Britain and France finally revealed rum's potential as 'the next big thing.' These markets have shown that through well-targeted marketing and new product development, they can guide young consumers into a category that will stimulate future demand for rum and speed up the premiumization process. The German market held the largest share in the European region, and the U.K. market is projected to multiply.

The Latin American rum market is expected to proliferate in the coming years, with a steady growth rate due to increasing alcohol consumption. The increasing innovations by the manufacturers are providing opportunities for market expansion. The rising usage of rum in cocktails and the availability of various flavors are enhancing the market size growth.

The Middle East and African markets are projected to show moderate growth during the forecast period. The growing tourism industry and an increasing number of consumers propel market growth opportunities. The rising adoption of modern brewing techniques and the availability and accessibility of market players in the region are augmenting the region's market growth.

KEY MARKET PLAYERS

Companies playing a major role in the global rum market include Bacardi Global Brands Ltd, Asahi Group Holdings Ltd, Demerara Distillers Ltd, Davide Campari-Milano Spa, Suntory Holdings Ltd, LT Group Inc., Diageo Plc, Pernod Ricard SA, Nova ScotiaSpirit Co and William Grant & Sons Ltd.

RECENT HAPPENINGS IN THE MARKET

- In March 2024, BrewDog Distilling Co. announced the official launch of its DUO White Rum, which will join its existing rum SKUs, including DUO Spiced Rum and DUO Spiced with caramelized pineapple rum.

- In March 2024, in a strategic move to broaden its portfolio, Global Brands Ltd. announced its latest partnership with award-winning RedLeg Spiced Rum. This partnership will see Global Brands represent RedLeg in the U.K.'s major grocery and cash and carry channels.

- In January 2024, Platinum Equity announced the acquisition of premium rum blending specialist E&A Scheer from The Riverside Company. E&A Scheer is the largest global blender and bulk vendor of premium rum.

- In January 2023, Brown-Forman Corporation completed the acquisition of Diplomatico Rum Brand and related assets from Distillers United Group S.L.

MARKET SEGMENTATION

This research report on the global rum market has been segmented and sub-segmented based on type, distribution channel and region.

By Product Type

- Golden

- Dark

- White

- Spiced

By Distribution Channel

- On-trade

- Off-trade

By Region

- North America

- The United States

- Canada

- Rest of North America

- Europe

- The United Kingdom

- Spain

- Germany

- Italy

- France

- Rest of Europe

- The Asia Pacific

- India

- Japan

- China

- Australia

- Singapore

- Malaysia

- South Korea

- New Zealand

- Southeast Asia

- Latin America

- Brazil

- Argentina

- Mexico

- Rest of LATAM

- The Middle East and Africa

- Saudi Arabia

- UAE

- Lebanon

- Jordan

- Cyprus

Frequently Asked Questions

What can be the size of the global Rum market by 2029?

By 2029, it is predicted that the global Rum market can reach a valuation of US$ 22.54 billion.

What can be the compound annual growth rate of the global Rum market?

The global Rum market can expand with a CAGR of 5.5% during the forecast period.

Mention the major key players in the global Rum market?

Bacardi Global Brands Ltd, Asahi Group Holdings Ltd, Demerara Distillers Ltd, Davide Campari-Milano Spa, Suntory Holdings Ltd and Others.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com