Global Smart Contracts Market Size, Share, Trends, & Growth Forecast Report By Platform (Bitcoin, Ethereum, NXT, and Sidechains); Technology (Ethereum, Namecoin, Ripple, Rootstock (RSK), and Others); Application (Automobile, Government, Supply Chain Management, and Others); & Region - Industry Forecast From 2025 to 2033

Global Smart Contracts Market Size

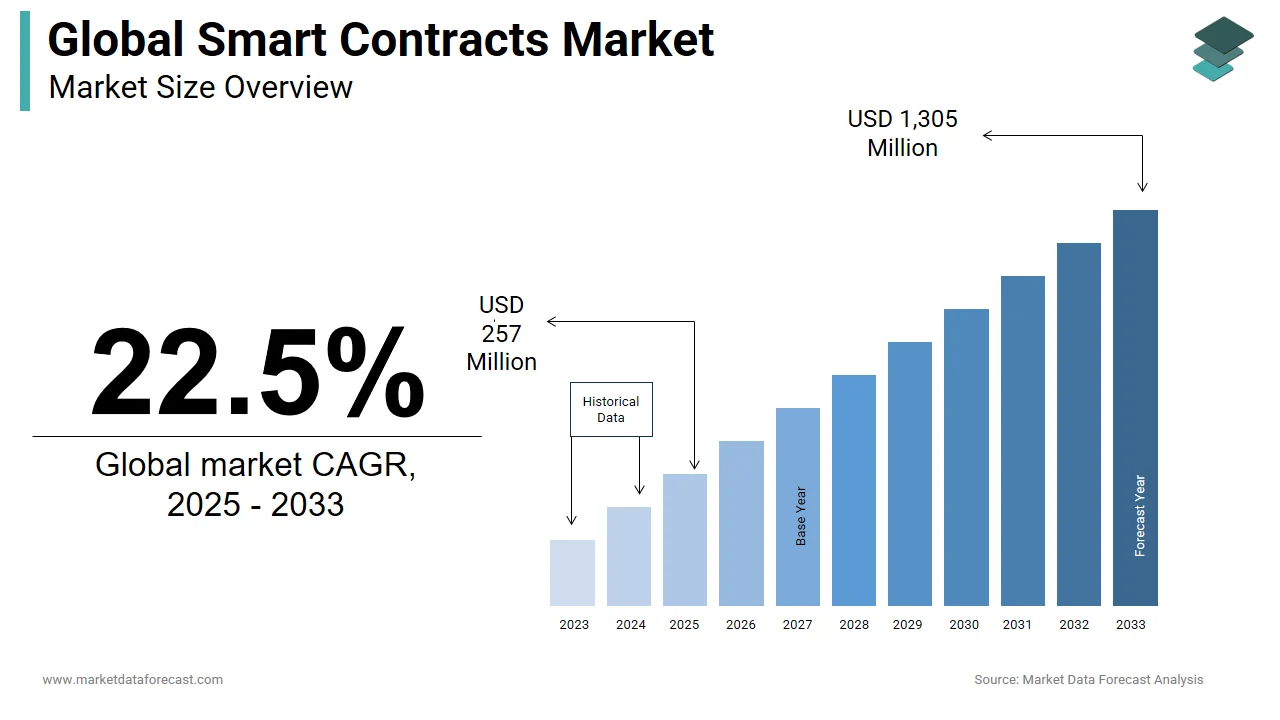

The global smart contracts market was worth USD 210 million in 2024. The global market is expected to reach USD 257 million in 2025 and USD 1,305 million in 2033, growing at a CAGR of 22.5% during the forecast period.

A smart contract is a self-executing agreement between a buyer and a seller that is written straight into lines of code. A distributed and decentralized Blockchain network contains the code and agreements included therein. The written code can govern execution, and transactions are traceable and irrevocable. The Blockchain processes smart contract transactions, which means they can be delivered automatically without the assistance of a third party.

Smart contracts have a wide range of applications, including financial derivatives, insurance premiums, property law, breach contracts, credit enforcement, financial services, crowdfunding agreements, and legal processes. Because smart contracts are kept on Blockchain, it is incredibly difficult for the system to be hacked because it would take massive computer power to take down the entire network.

Smart contracts include several fundamental qualities, including autonomy, decentralization, and self-sufficiency. Smart contracts can assist in resolving issues of mistrust between two or more persons and between business partners. Smart contracts are used in supply chain management because they can track ownership rights as products travel through the system. They can also be used to secure copyrighted content. Individuals can also own their digital identity, which includes digital assets and data, via smart contracts.

MARKET DRIVERS

The usage of smart contracts in automation comprises self-executing computer programs that allow for the automation of processes and payments to increase efficiency, which is fueling the global smart contracts market.

Furthermore, the global smart contract market is benefiting from increased government involvement in blockchain technology. Smart contracts eliminate errors that occur as a result of the manual filling out of several forms. Because of the aforementioned advantages, demand for smart contracts is rapidly increasing, hence boosting the worldwide smart contract market's growth. The increasing use of smart contracts across a variety of industries, including banks, government, healthcare, financial services firms, and supply chains, is likely to drive market expansion. Furthermore, due to privacy concerns, the documents would only be accessible to a limited number of people. Smart contracts can also be used to research securely and confidentially.

MARKET RESTRAINTS

Although blockchain technology is used in smart contracts, the lack of standardization and interchangeability of blockchain technology makes establishing smart contracts difficult, and this aspect is expected to limit the global smart contracts market's growth. Furthermore, because contracts contain phrases that aren't always understood, smart contracts aren't always capable of managing perplexing terms and conditions.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

22.5% |

|

Segments Covered |

By Platform, Technology, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Monax (UK), Monetas (Switzerland), Coinbase (US), Coinify (US), Bitpay (US), Bitfinex (British Virgin Islands), Binance (Cayman Islands), CoinDCX (India), SoluLab (India), GoCoin (Singapore), and Others. |

SEGMENTAL ANALYSIS

By Platform Insights

Ethereum had the largest market share, 36.28% in 2020, with a market value of USD 52.59 million. It is predicted to grow at a long-term CAGR of 23.25 % throughout the forecast period. Bitcoin was the second-largest market, with a market valuation of USD 42.23 million in 2020.

By Technology Insights

Ethereum has the largest market share of 42.99% in 2020, with a market value of USD 62.32 million, and is predicted to grow at a long-term CAGR of 25.25% throughout the forecast period. With a market value of USD 40.38 million in 2020, Rootstock (RSK) was the second-largest market.

By Application Insights

The government segment held 36.66% of the market in 2020, with a market value of USD 53.14 million, and is expected to grow at a long-term CAGR of 25.71% over the forecast period. In 2020, Supply Chain Management was the second-largest market, with a market value of USD 37.06 million.

REGIONAL ANALYSIS

North America dominated the market because of robust technological advancements and favorable government regulations. Europe is the second largest market due to an increase in awareness; other regions are growing significantly, fueled by the recognition of smart contracts' transformative ability.

KEY MARKET PLAYERS

Monax (UK), Monetas (Switzerland), Coinbase (US), Coinify (US), Bitpay (US), Bitfinex (British Virgin Islands), Binance (Cayman Islands), CoinDCX (India), SoluLab (India), GoCoin (Singapore), and Others.

RECENT MARKET HAPPENINGS

-

Coinbase Wallet will soon support NFTs, allowing users to examine their collections and access prominent NFT marketplaces such as OpenSea.

-

Coinify ApS, a crypto payment system, was purchased by cryptocurrency broker Voyager Digital Ltd for USD 84 million. Coinify investors would receive 5.1 million Voyager shares worth $69 million in exchange for USD 15 million in cash. The arrangement was reached after the broker decided to expand its 1.75 million customer base by adding a global payment infrastructure to its digital environment.

-

El Salvador has secured an agreement with Blockstream and iFinex to expand its bitcoin market activities. El Salvador could issue USD 1 billion in Bitcoin bonds using Blockstream's Liquid Network. The bond proceeds might be used to fund the development of bitcoin mining driven by volcanoes.

-

BitPay has announced that Shiba Inu (SHIB) payments are now accepted on its platform, with users able to buy, store, and trade the digital currency via the BitPay Wallet app. SHIB has gone to the top of the list of coins to add, thanks to an active ShibArmy and answers from AMC Theatres and Newegg. On CoinMarketCap, Shiba Inu is now among the top 15 cryptocurrencies by market capitalization.

MARKET SEGMENTATION

This research report on the global smart contracts market has been segmented and sub-segmented based on the platform, technology, application, and region.

By Platform

- Bitcoin

- Ethereum

- NXT

- Sidechains

By Technology

- Ethereum

- Namecoin

- Ripple

- Rootstock (RSK)

- Others

By Application

- Automobile

- Government

- Supply Chain Management

- Others

By Region

- North America

- Europe

- Latin America

- Asia Pacific

- Middle East & Africa

Frequently Asked Questions

How do smart contracts impact traditional contract enforcement mechanisms globally?

Smart contracts automate many aspects of contract enforcement, reducing reliance on traditional mechanisms such as courts and legal intermediaries. This efficiency can result in faster dispute resolution and cost savings.

How scalable are smart contracts to accommodate the needs of a global market?

Scalability remains a concern for smart contracts, especially in the context of handling a large volume of transactions simultaneously. Various blockchain platforms are working on scalability solutions like layer 2 solutions and sharding to address these issues.

What are some notable use cases of smart contracts in emerging markets globally?

In emerging markets, smart contracts are being utilized for remittances, land registry systems, and supply chain traceability. These use cases address challenges such as inefficiency, corruption, and lack of transparency.

How do interoperability standards impact the adoption of smart contracts in the global market?

Interoperability standards enable smart contracts to communicate and interact seamlessly across different blockchain networks. Efforts to establish interoperability protocols are vital for fostering widespread adoption and enhancing the utility of smart contracts globally.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com