Global Timing Devices Market Size, Share, Trends & Growth Forecast Report By Product Type (Oscillator, Resonator, Clock Generator, Jitter Attenuator, Clock Buffer), Material Type (Crystal, Ceramic, Silicon), Industry Vertical (Consumer Electronics, Automotive, IT and Telecommunication, Aerospace and Defense, Healthcare, Others) & Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa), Industry Analysis From 2025 to 2033

Global Timing Devices Market Size

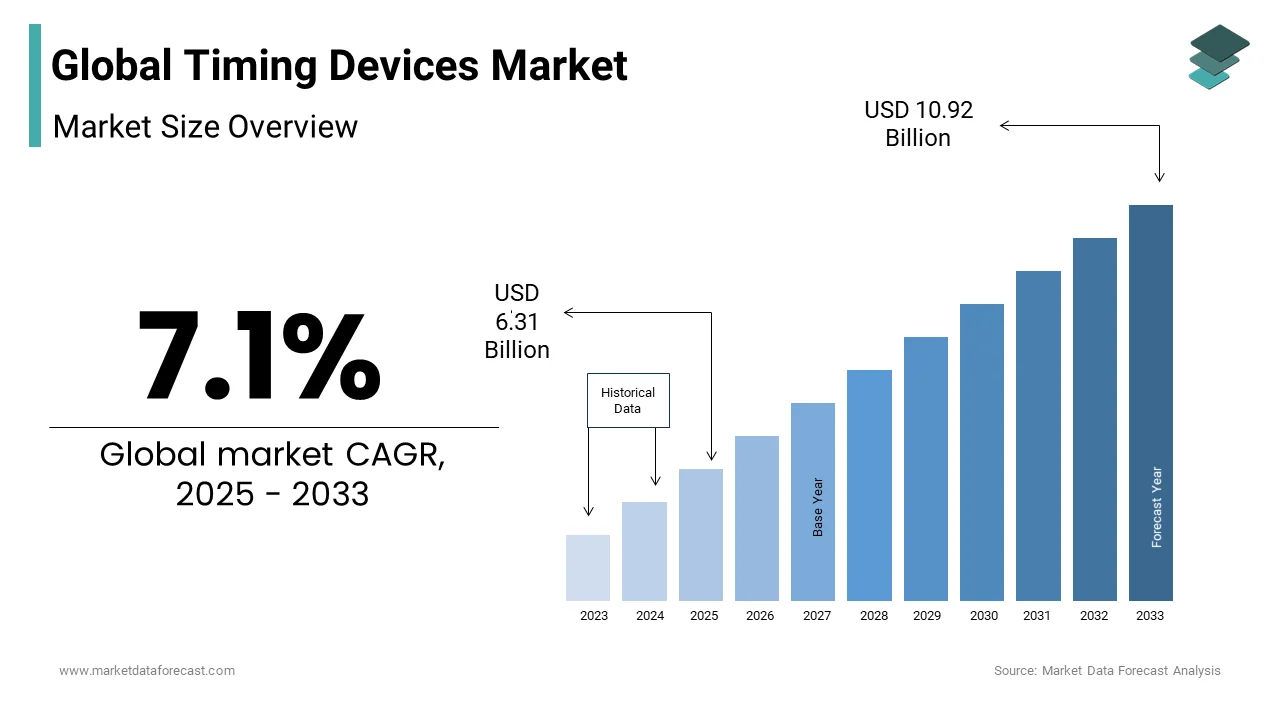

The size of the global timing devices market was worth USD 5.89 billion in 2024. The global market is anticipated to grow at a CAGR of 7.1% from 2025 to 2033 and be worth USD 10.92 billion by 2033 from USD 6.31 billion in 2025.

A timing device is a specialized type of watch used to measure the interval of time elapsed in hours, minutes, seconds, and a fraction of a second. Small timekeeping devices are pocket instruments with mechanical and hand movements, especially for displaying elapsed time. Timer devices are widely used in the consumer electronics industry for portable and portable electronic devices because they have low power consumption, a high degree of stability, and accuracy. Timing devices are instruments used to measure elapsed time intervals in segments such as hour, minute, second, and fraction of a second. Small timekeeping devices are made like pocket instruments and wrist instruments, usually with mechanical movements and in terms of hands to show elapsed time. Large center table timing devices and panel-mounted units are manufactured, including demo timers.

MARKET DRIVERS

The increasing use of these devices in automotive electronics is expected to drive the global timing device market during the forecast period. They are used in car navigation systems, audiovisual equipment in vehicles, safety control systems, and driving control systems. These are also used in Big Data Cloud applications due to their ability to interact with commonly used storage ICs, better synchronization, and improved system optimization. Most of these devices are temperature-sensitive and difficult to design.

MARKET RESTRAINTS

The cyclical nature of the semiconductor industry acts as a factor preventing the market for timing devices from reaching its full potential. The biggest challenge MEMS oscillators face is that they synthesize the output frequency of only a few MEMS resonator designs. The presence of a PLL between the MEMS resonator and the output does not actually generate a good quality signal like the quartz-based design. This acts as a restraining factor in the growth of the global timing devices market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

7.1% |

|

Segments Covered |

By Product type, Material type, and Industry vertical, and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Asahi Kasei Corp., Kyocera Corp., Microchip Technology Inc., Murata Manufacturing Co. Ltd., NXP Semiconductors NV, Oscilent Corp., Renesas Electronics Corp., Seiko Holdings Corp., STMicroelectronics NV, Texas Instruments Inc., and Others. |

SEGMENTAL ANALYSIS

By Product Type Insights

The oscillators segment is expected to be the fastest growing segment due to improved aid to the automotive and consumer electronics segment. The growth of the portable and portable electronics segment is supposed to drive demand for oscillators. MEMS oscillators combine low power consumption with accurate frequency output and are gaining more and more popularity. MEMS technology saves energy and miniaturizes electronics while providing high precision and stability. The market for timing devices is expected to grow due to the adoption of MEMS technology.

By Industry Vertical Insights

Timing devices are used in the automotive industry in audio systems, car navigation system, infotainment system, intelligent driver assistance system, and safety control systems. It is also used in industrial applications such as ultrasonic equipment, safety equipment, smart energy meters, and machine vision equipment.

REGIONAL ANALYSIS

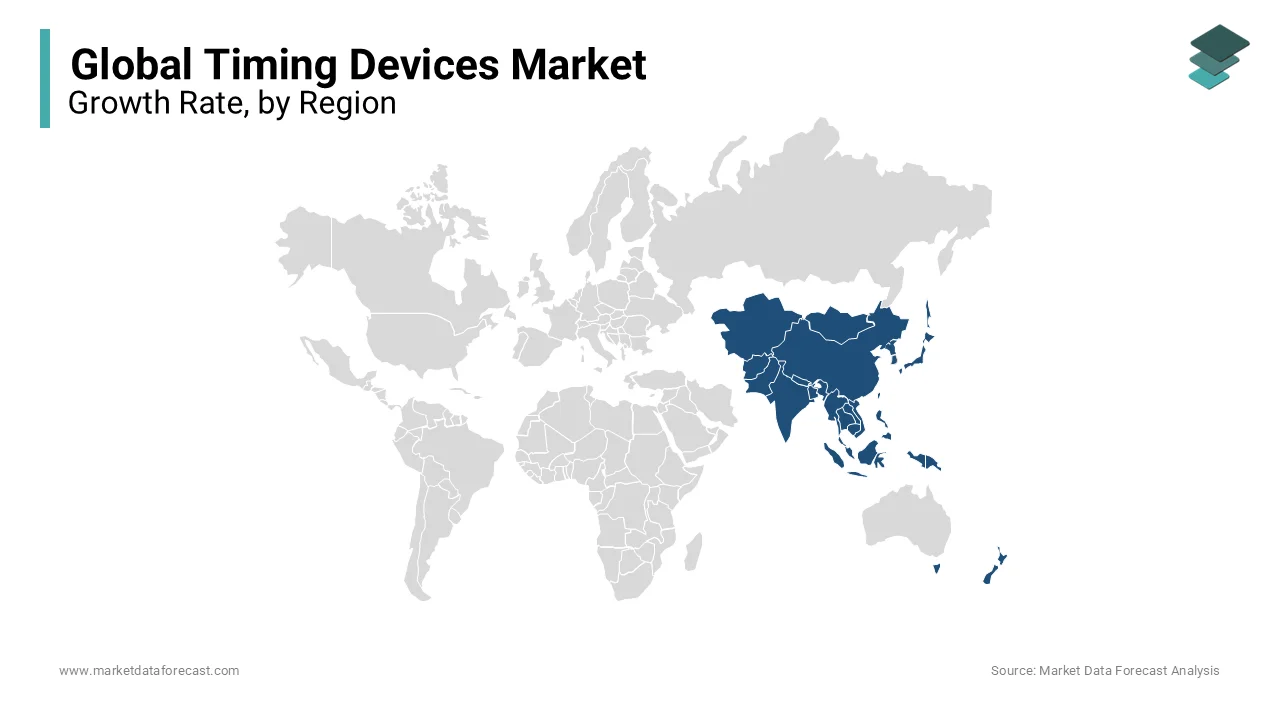

The market for timing devices in the United States was estimated at US $ 1.3 billion in 2020. China, the world's second-largest economy, is estimated to reach a projected market size of US $ 1.5 billion by 2027, with a compound annual rate of 9.4% during the foreseen period. Other notable geographies include Japan and Canada, each forecasting growth of 3.3% and 5.5% respectively. In Europe, Germany is estimated to grow at a 3.9% CAGR. Geographically, the market for timing devices is primarily driven by the Asia-Pacific region. The increasing call for timing ICs in the automotive and consumer electronics industries promotes the Asia-Pacific business. The increasing demand for MEMS and crystal oscillators in broadcast transmitters and mobile phones is expected to accelerate the market for timing devices rapidly. This region is expected to maintain its dominance in the market during the forecast period due to the presence of many manufacturers of consumer electronics equipment in countries such as China, South Korea, and Japan, among others.

KEY MARKET PLAYERS

Companies playing a prominent role in the global timing devices market include Asahi Kasei Corp., Kyocera Corp., Microchip Technology Inc., Murata Manufacturing Co. Ltd., NXP Semiconductors NV, Oscilent Corp., Renesas Electronics Corp., Seiko Holdings Corp., STMicroelectronics NV, Texas Instruments Inc., and Others.

RECENT HAPPENINGS IN THE MARKET

- Microchip Technology MCHP recently announced the acquisition of Tekron International Limited to increase its offerings in the Frequency and Timing Systems business division.

- Microchip Technology Inc. (Nasdaq: MCHP) announced the acquisition of Tekron International Limited, a world leader in providing high-precision GPS and atomic clock timing technologies and solutions for smart grid and other industrial applications. The terms of the agreement are confidential.

- Kyocera Corporation (President: Hideo Tanimoto) announced that it has successfully developed a proprietary technology to produce MEMS silicon resonators for the silicon MEMS market.

MARKET SEGMENTATION

This research report on the global timing devices market has been segmented and sub-segmented based on product type, material type, industry vertical, and region.

By Product Type

- Oscillator

- MEMS Oscillator

- Crystal Oscillator

- Resonator

- Clock Generator

- Jitter Attenuator

- Clock Buffer

By Material Type

- Crystal

- Ceramic

- Silicon

By Industry Vertical

- Consumer Electronics

- Automotive

- IT & Telecommunication

- Aerospace and Defense

- Healthcare

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions

What was the size of the global timing devices market in 2023, and what is the projected size by 2033?

The global timing devices market was valued at USD 5.5 billion in 2023 and is anticipated to reach USD 10.92 billion by 2033, with a CAGR of 7.1% during the forecast period.

What are timing devices, and how are they used in various industries?

Timing devices are specialized instruments used to measure elapsed time intervals in hours, minutes, seconds, and fractions of a second. They are commonly used in automotive electronics, consumer electronics, aerospace and defense, healthcare, and other industries for applications such as car navigation systems, audiovisual equipment, safety control systems, and industrial equipment.

What recent developments have occurred in the timing devices market, and how has COVID-19 impacted it?

Recent developments include Microchip Technology's acquisition of Tekron International Limited to expand its offerings in frequency and timing systems and Kyocera Corporation's development of MEMS silicon resonators. COVID-19 has impacted the market by disrupting supply chains and depressing end-market demand, leading to halted production and supply chain disruptions. However, increased demand for stopwatches in smart medical facilities has been observed.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com