Global TV Studio Content Market Size, Share, Trends, & Growth Forecast Report Segmented By Content Type (Political, Economics, Entertainment and Others), Application (TV, Mobile Phones, Computers and Others), and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa), Industry Analysis From 2024 to 2033

Global TV Studio Content Market Size

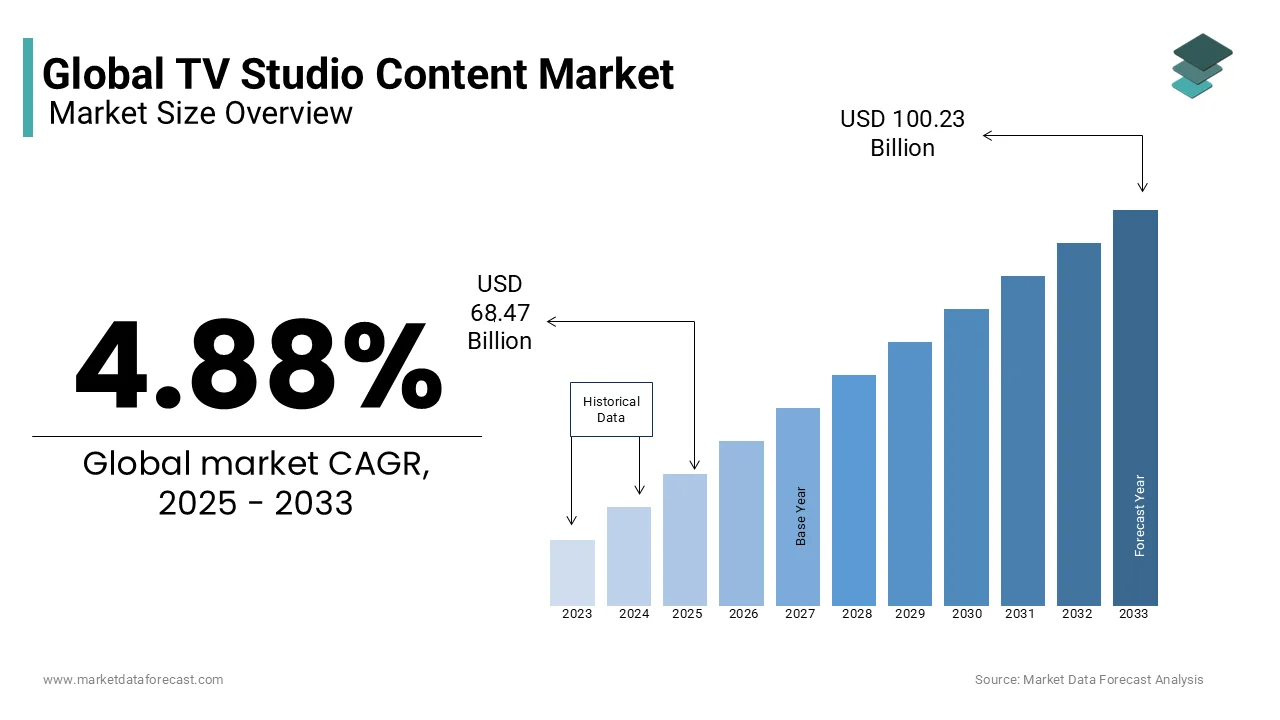

The global TV studio content market was worth USD 65.28 billion in 2024. The global market is expected to be worth USD 100.23 billion by 2033 from USD 68.47 billion in 2025, growing at a CAGR of 4.88% during the forecast period 2025 to 2033.

The content of a TV studio includes video productions for television transmission. Videos are aired over the air, through satellite, cable, or over the internet. News, ads, TV shows, trailers, and series are all examples of video content. With the rise of on-demand television, online web series, and the movement of the media landscape from the living room to mobile, how we engage with, discover, and participate in content has changed dramatically. The ability to create online communities around material and personalities is critical to the success of content. Platforms have essentially been limited to providing distribution and programming, with supplementary web content serving as the primary source of user acquisition and retention. Because influencers and curators are such an important component of the ecosystem, they must be thoroughly researched and targeted to gain the most traction with target audiences. Your material has the potential to reach a bigger audience with accurate targeting, educated content design, and data-driven distribution.

Currently, several regulations and self-regulatory mechanisms govern the material on television ("TV"). From a regulatory standpoint, television programming is separated into three categories: news and current affairs, non-news and current affairs (entertainment), and ads. For certain parts of television content, there is governmental regulation as well as self-regulation. The content of non-news and current affairs channels is overseen by a statute and committees established by various ministries. Furthermore, industry bodies have framed various self-regulations.

MARKET DRIVERS

The growing fusion of traditional linear TV material with online offers is a key factor driving the growth of the global TV studio content market.

Within the constantly increasing creative economy, film and television are booming. The expansion of TV Studio content market volume is fuelled by the penetration of pay TV, broadband, phone, and mobile services, as well as consumer adoption of new entertainment platforms. Trends in the industry include recent changes in traditional television viewers, the rise of internet video, and a variety of instances of different organizations working with new forms of television to establish a digital environment. Video-sharing sites, video-on-demand services, and the incorporation of video into social media sites have all contributed to an increase in online video viewing.

As digitalization and media convergence progress, television broadcasters must adapt their content to a variety of platforms and distribution methods. The internet is progressively taking on a central role for extra media as a convergent carrier medium. Traditional linear television is still vital, but it has evolved from a primary to a secondary medium for some populations. This has further increased the requirement for content as the number of platforms to showcase the content are increasing day by day.

The introduction of 5G, an increase in production spending, broadcasting, film projects, and the reconstruction of the television studio are all expected to open up new market opportunities. Players have navigated their interest in collaborating and partnering. Furthermore, broadcast solutions make use of a combination of integrated tools to produce a seamless end-to-end process that will transform your television production.

MARKET RESTRAINTS

Lack of awareness in rural areas and a lack of coverage are primarily hampering the growth of the global TV studio content market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.88% |

|

Segments Covered |

By Content Type, Application and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Sony TV, Keshet, Lionsgate, Viacom, ABC Studios, CBS TV Studios, Warner Bros TV, Lions Gate Entertainment, Twenty-First Century Fox, and others |

SEGMENTAL ANALYSIS

By Content-Type Insights

Based on content type, the politics segment is expected to dominate the TV studio content market during the forecast period. As one grows older, people become fonder of politics. Only one-third of the world population is below 20 years of age, and this is that segment that might choose entertainment over politics. However, others want to know about what is going on around the world and thus watch political news channels on a frequent basis. Nowadays, there are many web series also based on political genre. This leads to the development of interest amongst the young generation as well.

By Application Insights

Based on application, the TV segment has been leading the market and held the major share of the global market in 2023. However, in the coming years, mobile phones will be the market leader. With the launch of various Online Streaming platforms, it has been convenient for viewers to watch shows, movies, serials, etc. from anywhere they want to by using their smartphones. Also, with an increase in internet penetration, the use of smartphones has increased exorbitantly further promoting the chances of mobile phones to become the dominant player in the segment.

REGIONAL ANALYSIS

The North American region was the largest regional segment in the global market and accounted for the leading share of the global market in 2024. The surge in demand in the North American area has also made it a hub for many content creators to launch new shows and serials.

However, in the coming years, we will also witness, the quickly rising emerging economies, particularly China and India in terms of both economy and infrastructure, which have greatly raised the demand for TV Studio Content Market. In the Asia-Pacific area, the population is a big number and the rise in urbanization is promoting mobile phone usage which will further boost the Global TV Studio Content Market Industry.

Over the projection period, rising investment in the technology industry will increase content demand. The rise of the European TV Studio Content industry will be aided by increased investment in the smartphone and smart devices industry, as well as rising consumer expenditure on entertainment.

KEY PLAYERS IN THE MARKET

Sony TV, Keshet, Lionsgate, Viacom, ABC Studios, CBS TV Studios, Warner Bros TV, Lions Gate Entertainment and Twenty-First Century Fox are some of the major companies in the global TV studio content market.

RECENT HAPPENINGS IN THE MARKET

-

Sony acquired a majority investment in Bad Wolf, which includes the purchase of Sky/HBO and Access Entertainment's minority stakes in the company. The transaction also includes Bad Wolf's 30 percent share in Bad Wolf America LLC and the Wolf Studios Wales sound stage facility in Cardiff, Wales.

-

Cricket Australia (CA) has sent a three-member team to Mumbai to assess the Indian market and pursue a broadcasting agreement with Reliance Viacom Network. The meeting is critical since Reliance Viacom is expected to launch its Sports Channel in the coming month. According to sources, executives from the channel are meeting with officials from Cricket Australia to discuss a media rights deal for the next cycle.

MARKET SEGMENTATION

This research report on the global TV studio content market has been segmented and sub-segmented based on content type, application and region.

By Content-Type

- Politics

- Economics

- Entertainment

- Others

By Application

- TV

- Mobile Phone

- Computer

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions

What is the TV Studio Content Market?

The TV Studio Content Market is a platform where producers, distributors, and buyers of television content come together to buy, sell, and exchange TV shows, series, formats, and other media content. This market operates both physically through trade fairs and virtually via online marketplaces.

What types of content are available at the TV Studio Content Market?

The market features a wide range of content including drama series, comedies, documentaries, reality shows, animation, formats for adaptation, and more. Both finished content and concepts in development stages are available.

What are the benefits of participating in a TV Studio Content Market?

Benefits include exposure to a global audience, opportunities for co-productions and distribution deals, insights into industry trends, networking with key players, and the ability to promote and sell content directly to buyers.

What are the costs associated with attending a TV Studio Content Market?

Costs can include registration fees, travel and accommodation expenses (for physical events), promotional material creation, and possibly fees for using certain services within the market. Virtual markets might have lower costs but still require registration and promotional expenses.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]