Global Smartphone Market Size, Share, Trends & Growth Forecast Report Segmented By Operating System (Android, iOS and Others), Distribution Channel (OEM, Retail and E-Commerce), and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa), Industry Analysis From 2024 to 2033

Global Smartphone Market Size

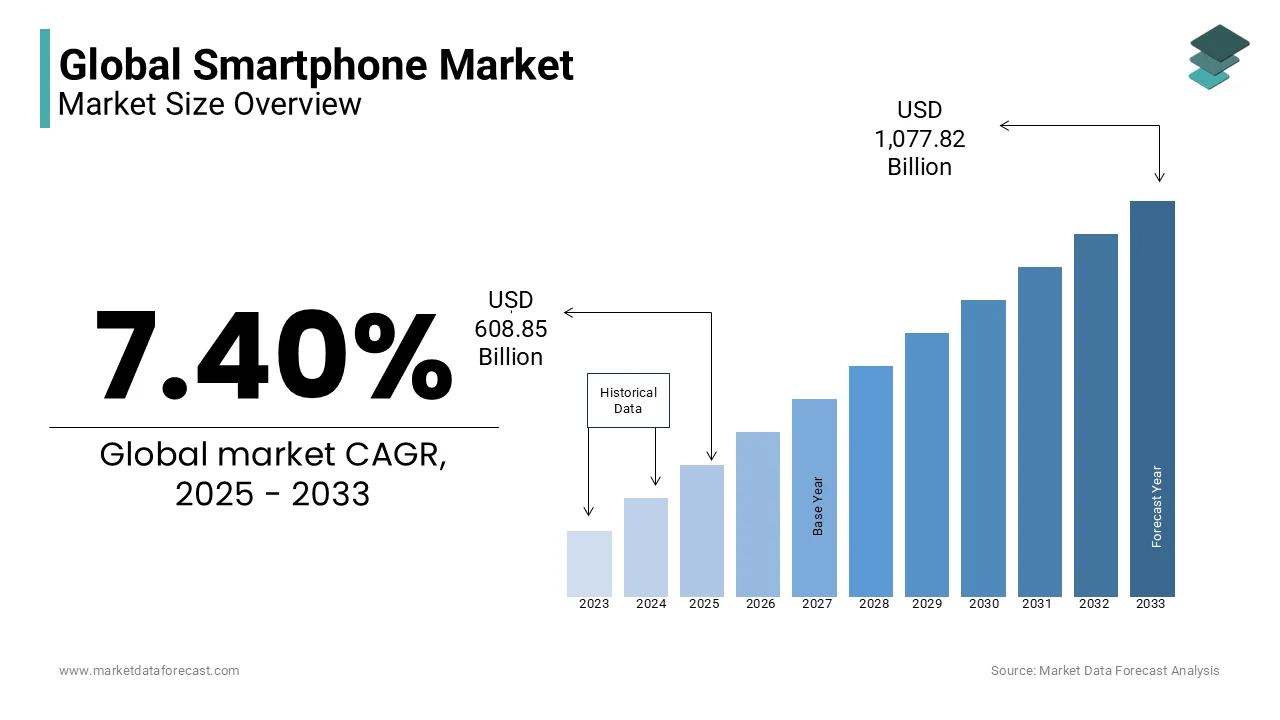

The global smartphone market was worth USD 566.90 billion in 2024. The global market is projected to reach USD 1,077.82 billion by 2033 from USD 608.85 billion by 2025, growing at a CAGR of 7.40% from 2025 to 2033.

Smartphones have become an indispensable part of modern society and serving as a primary tool for communication, entertainment, productivity, and commerce. Defined as mobile devices equipped with advanced computing capabilities, internet access, and multifunctional applications, smartphones have revolutionized personal and professional interactions. The demand for smartphones is driven by continuous advancements in artificial intelligence (AI), camera technology, battery efficiency, and connectivity, including the ongoing global rollout of 5G networks.

As of 2025, global smartphone penetration has reached approximately 80%, with over 6.5 billion smartphone users worldwide, according to estimates from the International Telecommunication Union (ITU). The rapid digitalization of services has led to an increase in average screen time, with studies from DataReportal indicating that individuals now spend an average of 4.5 hours per day on their smartphones. Additionally, mobile internet traffic accounts for nearly 60% of total web traffic globally, as reported by Statista, highlighting the central role smartphones play in information access and digital consumption.

Another significant trend is the impact of smartphone usage on consumer behavior and lifestyle. According to Pew Research, over 85% of users rely on smartphones for navigation and location-based services, while more than 70% utilize them for online shopping and financial transactions. Furthermore, the rise of health-conscious applications has led to an estimated 1 billion people globally using smartphones for fitness tracking, telemedicine, and wellness management, as per World Health Organization (WHO) findings.

With increasing concerns about e-waste, organizations like the United Nations Environment Programme (UNEP) report that electronic waste from smartphones and other devices is expected to surpass 75 million metric tons annually by 2030, emphasizing the growing need for sustainable practices in manufacturing and disposal. The smartphone industry continues to evolve, shaping digital trends and influencing everyday life in profound ways.

MARKET DRIVERS

Technological Advancements

The smartphone market is significantly propelled by rapid technological advancements. Innovations such as artificial intelligence (AI), augmented reality (AR), and enhanced camera systems have elevated user experiences, making smartphones indispensable in daily life. For instance, the integration of AI has led to smarter personal assistants and improved device performance. According to the International Data Corporation (IDC), the global smartphone market saw a 7.8% increase in purchases during the first quarter of 2024, indicating a strong consumer demand for technologically advanced devices. This surge reflects the industry's commitment to continuous innovation, catering to evolving consumer preferences.

Government Policies and Initiatives

Government policies and initiatives play a crucial role in shaping the smartphone market. Supportive measures, such as tax incentives and production-linked incentive (PLI) schemes, have been instrumental in fostering local manufacturing and attracting global players. In India, the PLI scheme has led to a massive 2,000% increase in mobile phone production, surging from ₹18,900 crore in 2014-15 to an estimated ₹4.10 lakh crore in FY24, as reported by the Economic Times. Such policies not only boost domestic production but also make smartphones more accessible to a broader population, thereby driving market growth.

MARKET RESTRAINTS

High Input Tariffs

The smartphone market faces significant challenges due to high input tariffs. In India, for instance, the average tariff on electronic components is approximately 7.4%, as reported by The Economic Times. These elevated tariffs increase production costs, making locally manufactured smartphones less competitive in the global market. Consequently, this hinders the growth of smartphone exports, despite initiatives like the Production-Linked Incentive (PLI) scheme aimed at boosting manufacturing. The industry has called for tariff reductions to align with global standards and enhance competitiveness.

Regulatory Challenges

Regulatory challenges also impede the smartphone market's expansion. Complex compliance requirements, such as local content mandates, can restrict market access for international brands. For example, Indonesia's enforcement of a 40% local content requirement led to a ban on Apple's iPhone 16, as reported by the Financial Times. Such regulations can limit consumer choices and discourage foreign investment, thereby restraining market growth.

MARKET OPPORTUNITIES

Adoption of 5G Technology

The smartphone market is poised for significant growth due to the increasing adoption of 5G technology. According to Deloitte, India is expected to have 1 billion smartphone users by 2026, with 5G devices contributing to 80% of the devices (about 310 million units) by that year. The rollout of 5G networks is anticipated to drive demand for new smartphones, as consumers seek to leverage the enhanced capabilities offered by this technology. This surge in demand presents a substantial opportunity for smartphone manufacturers to expand their market share by offering 5G-enabled devices that cater to evolving consumer preferences.

Initiatives by Government

Government initiatives aimed at boosting local manufacturing present another significant opportunity for the smartphone market. For instance, India's recent removal of import duties on key components such as printed circuit board assemblies, parts of camera modules, and USB cables is expected to benefit companies like Apple and Xiaomi. This policy change supports India's growing electronics production sector, which has more than doubled to $115 billion in 2024, making it the world's second-largest mobile phone manufacturer, as reported by Reuters. Such initiatives not only reduce production costs but also encourage global smartphone makers to establish and expand their manufacturing operations in emerging markets, thereby enhancing their competitiveness and market presence.

MARKET CHALLENGES

Competition from Domestic Manufacturers

The smartphone market faces significant challenges due to intensifying competition from domestic manufacturers in key regions. In China, for instance, foreign smartphone shipments, including those from major brands like Apple, experienced a substantial decline. According to data from the China Academy of Information and Communications Technology, November 2024 saw a 47.4% year-over-year decrease in foreign smartphone shipments, dropping to 3.04 million units. This decline marks the fourth consecutive month of reduced sales for foreign brands, underscoring the growing dominance of local competitors. Domestic companies such as Huawei have made significant strides, captured a larger share of the market and presenting formidable competition to established international brands.

Currency Fluctuations and Inflation

Economic factors, including currency fluctuations and inflation, pose additional challenges to the smartphone market. A stronger U.S. dollar can adversely affect the sales of companies like Apple, as reported by Reuters. In 2024, Apple’s revenue from markets outside the Americas fell by 12% due to currency fluctuations, making iPhones more expensive in foreign markets. Additionally, inflationary pressures have led to a 7% decrease in smartphone sales in the U.K., according to MobileTech UK. These economic conditions are prompting smartphone manufacturers, like Samsung, to adjust their pricing strategies, offering more affordable models to maintain market share and consumer demand.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

7.40% |

|

Segments Covered |

By Operating System, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Apple Inc. (U.S.), SAMSUNG (South Korea), Oppo (China), Huawei Device Co., Ltd. (China), OnePlus (China), Sony Group Corporation (Japan), Xiaomi (China), HTC Corporation (Taiwan), Google LLC (U.S.), and ZTE Corporation (China). |

SEGMENTAL ANALYSIS

By Operating System Insights

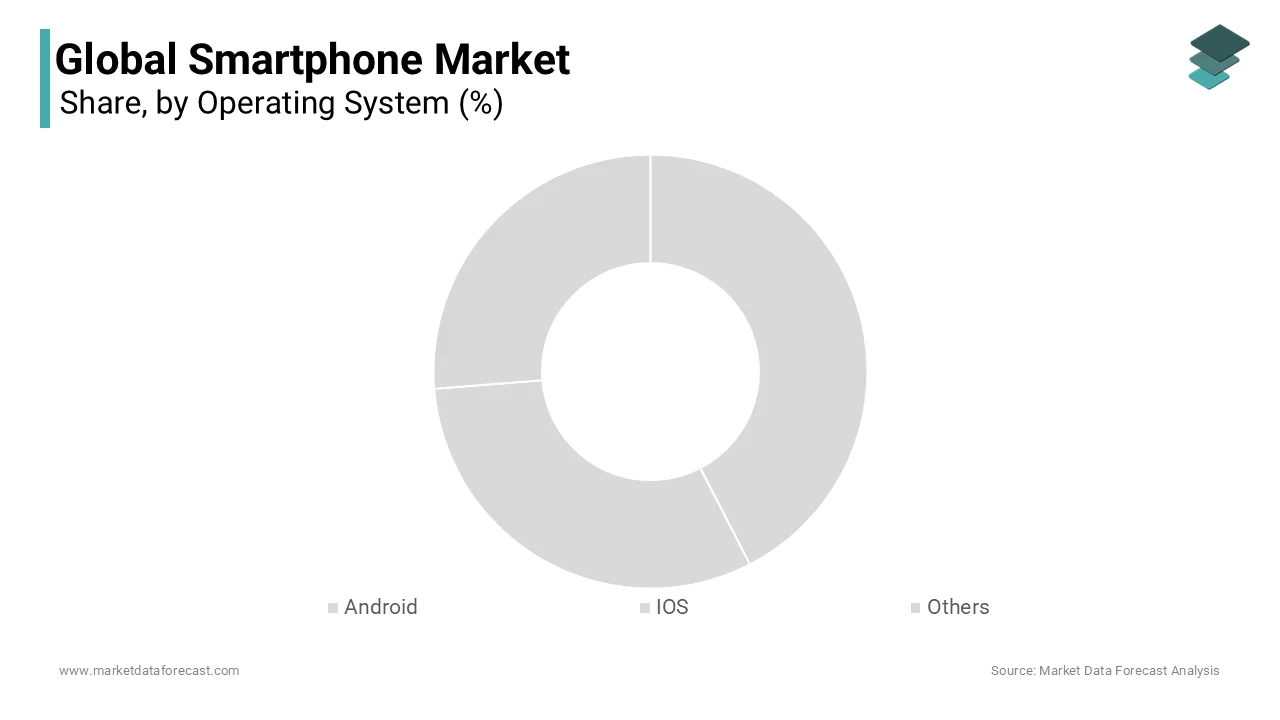

The Android segment ruled the market by holding 73.5% of the global market share in 2024 owing to the open-source nature of the operating system, which allows multiple smartphone manufacturers, including Samsung, Xiaomi, and Oppo, to adopt and customize Android. In 2024, Samsung shipped 280 million smartphones, with 95% of them running on Android, contributing significantly to its global share. Xiaomi also reported a 15% year-on-year growth in Android-powered devices. Android’s extensive app ecosystem and its flexibility in supporting a variety of hardware, especially in developing regions, solidify its market leadership, as per the 2024 data by GS StatCounter.

On the other hand, iOS segment is another notable segment and is predicted to register a CAGR of 5.5% over the forecast period. The continuous innovation of Apple, ecosystem integration, and a focus on privacy and security are propelling the growth of the iOS segment in the global market. Apple saw a 10% increase in iPhone sales in 2024, largely due to the strong demand for its premium devices like the iPhone 15 Pro Max and iPad Pro. iOS appeals to consumers who prioritize seamless interaction across devices, with Apple offering a robust ecosystem that includes iPhones, iPads, MacBooks, and other connected devices. The premium pricing strategy and brand loyalty contribute to sustained demand for iOS-based devices, according to the GS StatCounter.

By Distribution Channel Insights

The retailers segment occupied the leading market share of 47.1% in the global market in 2024 due to the extensive physical presence of retail stores, allowing consumers to experience products firsthand before purchasing. Best Buy, for example, reported that in 2024, nearly 40% of its smartphone sales came from in-store purchases, emphasizing the importance of physical retail. Walmart also saw a 15% year-on-year increase in smartphone sales, largely driven by its retail store network and customer service. Retailers provide immediate availability and customer service, which enhances the buying experience and supports their dominant position in the market.

The e-commerce segment is the rapidly expanding distribution channel and is anticipated to register the fastest CAGR of 12.2% from 2025 to 2033. This rapid growth can be attributed to the increasing consumer preference for online shopping, driven by convenience and competitive pricing. Amazon reported a 22% increase in smartphone sales in 2024, largely due to its vast selection and competitive pricing strategies. eBay also saw a 17% rise in mobile phone transactions, driven by its expanding e-commerce platform. The COVID-19 pandemic accelerated this trend, with Walmart's online sales growing by 35% in 2024, as more consumers turned to online shopping for safety and convenience.

REGIONAL ANALYSIS

The Asia-Pacific region held the largest share of the global smartphone market in 2024 by accounting for 55.3% of global market share. This dominance of Asia-Pacific in the global market is driven by substantial consumer bases in countries like China and India. In India, the smartphone market experienced a 7.2% year-over-year growth in the first half of 2024, with 69 million units shipped, as reported by the International Data Corporation (IDC). Factors such as increasing smartphone penetration, rising disposable incomes, and the expansion of 5G infrastructure contribute to the region's prominence.

The Middle East and Africa region is projected to be the flourishing segment in the global smartphone market with a CAGR of 9.3% from 2025 to 2033. This rapid growth is attributed to a young and expanding population, increasing urbanization, and improving economic conditions. Samsung reported a 30% increase in smartphone sales in South Africa in 2024, driven by demand for affordable smartphones. Huawei has also seen a 25% growth in the region, particularly in Kenya and Nigeria and is fueled by increasing mobile internet usage. Investments in telecommunications infrastructure, including 5G rollout in the UAE, further support the expansion of smartphone adoption in MEA.

North America smartphone market is experiencing a period of stabilization with a focus on premium devices and technological innovations. Companies like Qualcomm are diversifying their portfolios to include advanced chips for personal computers, vehicles, and the Internet of Things, aiming for $4 billion in revenue from the PC sector by 2029, as reported by Barron's. This strategic shift reflects the region's emphasis on integrating cutting-edge technology into consumer electronics. However, challenges persist due to sluggish consumer demand, as highlighted by Micron Technology's recent forecast of lower-than-expected revenue, indicating a cautious market outlook.

Europe's smartphone market is witnessing intensified competition, particularly from Chinese manufacturers aiming to capture higher market segments. Brands such as Realme, Oppo, and Honor are introducing premium devices with advanced features like foldable screens and enhanced cameras. Honor has notably become the leading seller of foldable smartphones in Western Europe, surpassing Samsung, as reported by the Financial Times. In 2024, Honor achieved a 22% share of the foldable smartphone market in the region, with a 35% increase in sales year-on-year. Oppo also reported a 18% rise in sales of its premium devices in Germany and France, contributing to the dynamic competitive landscape in Europe.

Latin America's smartphone market has demonstrated significant growth with a 20% year-on-year increase in shipments, totaling 33.5 million units in the second quarter of 2024, according to Canalys. This marks the fourth consecutive quarter of double-digit annual growth. The surge is primarily driven by the popularity of devices priced below $200, which have reached their highest share since the second quarter of 2021. Samsung leads the market with a 30% share, followed by Xiaomi at 19%, and Motorola at 17%. The region's focus on affordable smartphones has been pivotal in driving this expansion.

Top 3 Players in the Market

Samsung:

Samsung maintains its leadership with an 18.3% market share, shipping 57.8 million units in Q3 2024. The company's strategic focus on premium models and AI integration has bolstered its position. Notably, Samsung's Galaxy AI-enabled devices have enhanced its presence in the premium segment, as reported by the International Data Corporation (IDC).

Apple:

Apple holds a 17.7% market share, shipping 56 million units in the same quarter. The launch of the iPhone 16 lineup and strong demand for previous models have driven this growth. Apple's emphasis on AI features and premium design continues to attract a loyal customer base, contributing to its substantial market share.

Xiaomi:

Xiaomi ranks third with a 13.5% market share, shipping 42.8 million units in Q3 2024. The company's competitive pricing strategy and expansion into emerging markets have been key drivers of its growth. Xiaomi's focus on delivering high-quality smartphones at affordable prices has resonated with a broad consumer base, enhancing its global presence.

Top Strategies Used by the Key Market Participants

Innovation and Product Diversification

Samsung focuses on innovation, product diversification, and strategic partnerships. The company leads in the development of foldable smartphones, offering the Galaxy Z Flip and Galaxy Z Fold series, which have been well-received in premium markets. Samsung’s continued investment in cutting-edge technologies such as 5G and AI, along with its proprietary Exynos chipsets, enhances device performance. Additionally, the company strengthens its position through extensive retail networks, particularly in emerging markets, while maintaining a strong presence in the budget and mid-range segments. Samsung's marketing strategies also target eco-conscious consumers by emphasizing sustainability in their product lifecycle.

Premium Product Differentiation and Brand Loyalty

Apple relies on premium product differentiation, brand loyalty, and ecosystem integration to maintain its dominance in the market. By offering seamless integration between iPhones, MacBooks, iPads, and other Apple devices, the company encourages consumers to remain within its ecosystem. Apple also invests heavily in the customer experience, both in terms of hardware and software, ensuring that users have a smooth, intuitive interface. Additionally, Apple's exclusive retail stores and online presence help drive sales, while their emphasis on privacy and data security sets them apart from competitors, further solidifying its premium brand image. Their foray into services like Apple Music and Apple TV+ also contributes to recurring revenue streams.

Cost Leadership and Aggressive Pricing

Xiaomi's strategy revolves around cost leadership, aggressive pricing, and market expansion. The company offers high-quality smartphones at competitive prices, primarily targeting price-sensitive markets in Asia, Latin America, and parts of Europe. Xiaomi follows a direct-to-consumer sales model through e-commerce and flash sales, which reduces costs and improves customer engagement. Its extensive product ecosystem, including IoT devices, wearables, and home appliances, increases its appeal in emerging markets. Moreover, Xiaomi's focus on delivering value through regular updates and customization options like MIUI (Xiaomi’s custom Android interface) enhances the user experience and cultivates a loyal customer base.

KEY MARKET PLAYERS

The major players in the global smartphone market include Apple Inc. (U.S.), SAMSUNG (South Korea), Oppo (China), Huawei Device Co., Ltd. (China), OnePlus (China), Sony Group Corporation (Japan), Xiaomi (China), HTC Corporation (Taiwan), Google LLC (U.S.), and ZTE Corporation (China).

COMPETITIVE LANDSCAPE

The smartphone market is highly competitive, with numerous global players vying for market share. Key competitors include Samsung, Apple, Xiaomi, Oppo, and Huawei, each employing distinct strategies to cater to diverse consumer needs. Samsung and Apple dominate the premium segment, with Samsung continuing to innovate in foldable smartphones and Apple maintaining its strong brand loyalty through seamless integration across its product ecosystem. Xiaomi, on the other hand, has made significant inroads in emerging markets by offering high-quality, affordable smartphones with competitive features, allowing it to rapidly expand its market share.

Competition extends beyond hardware, with a focus on software and services. Companies are investing heavily in proprietary technologies, such as AI, 5G, and camera innovations, to differentiate their offerings. Additionally, software customizations, like Xiaomi’s MIUI and Samsung’s One UI, enhance user experience and customer loyalty.

Price sensitivity plays a crucial role in the competition, especially in price-conscious markets in Asia, Latin America, and Africa. Budget-friendly brands like Realme and Vivo are capitalizing on this trend, capturing a significant portion of the market by offering feature-rich smartphones at affordable prices.

RECENT HAPPENINGS IN THE MARKET

- In April 2024, Apple proposed a substantial $100 million investment in Indonesia over the next two years to lift a ban on its iPhone 16 sales. This investment aims to fulfill local content requirements and support domestic industries. The move underscores Apple's dedication to navigating regulatory challenges and strengthening its market presence in Indonesia.

- In April 2024, OnePlus announced plans to invest up to ₹6,000 crore (approximately $800 million) in its India operations under 'Project Starlight' over the next three years. This investment focuses on enhancing product innovation, improving customer service, and developing India-specific features. The initiative aims to strengthen OnePlus’s position in India, one of the world’s largest smartphone markets.

- In April 2024, Arm, known for its mobile chip designs, expanded into the AI sector through a strategic partnership with Nvidia. SoftBank, the majority owner of Arm, plans to build large AI data centers using Arm’s technology. This initiative positions Arm to capitalize on the growing AI demand in smartphones and other devices, shaping the future of mobile technology.

MARKET SEGMENTATION

This research report on the global smartphone market is segmented and sub-segmented into the following categories.

By Operating System

- Android

- iOS

- Others

By Distribution Channel

- OEM

- Retail

- E-Commerce

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What are the current trends in the global smartphone market?

The global smartphone market is currently seeing trends such as the adoption of 5G technology, the rise of foldable smartphones, increased focus on camera quality, and the use of AI and machine learning for enhanced user experiences. There's also a significant push towards sustainability, with companies focusing on eco-friendly materials and recycling programs.

What are the most important features consumers look for in a smartphone?

Consumers prioritize features such as battery life, camera quality, processing power, display quality, and storage capacity. Other important considerations include the operating system, brand reputation, price, and additional features like water resistance and fast charging.

How are smartphone manufacturers addressing environmental concerns?

Smartphone manufacturers are addressing environmental concerns by using recycled materials, reducing plastic packaging, implementing recycling programs, and improving the energy efficiency of their devices. Companies like Apple and Samsung have made commitments to carbon neutrality and reducing their overall environmental footprint.

What role does artificial intelligence (AI) play in modern smartphones?

AI plays a significant role in modern smartphones by enhancing various features such as camera performance, battery management, personalized user experiences, voice assistants, and security. AI algorithms help in optimizing system performance, improving photography through computational photography, and providing smart recommendations based on user behavior.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com