Global Vendor Neutral Archive (VNA) & PACS Market Size, Share, Trends & Growth Analysis Report – Segmented By Business Mode, Vendors, Mode Of Delivery, Type of Instruments & Region - Industry Forecast (2025 to 2033)

VNA & PACS Market Size

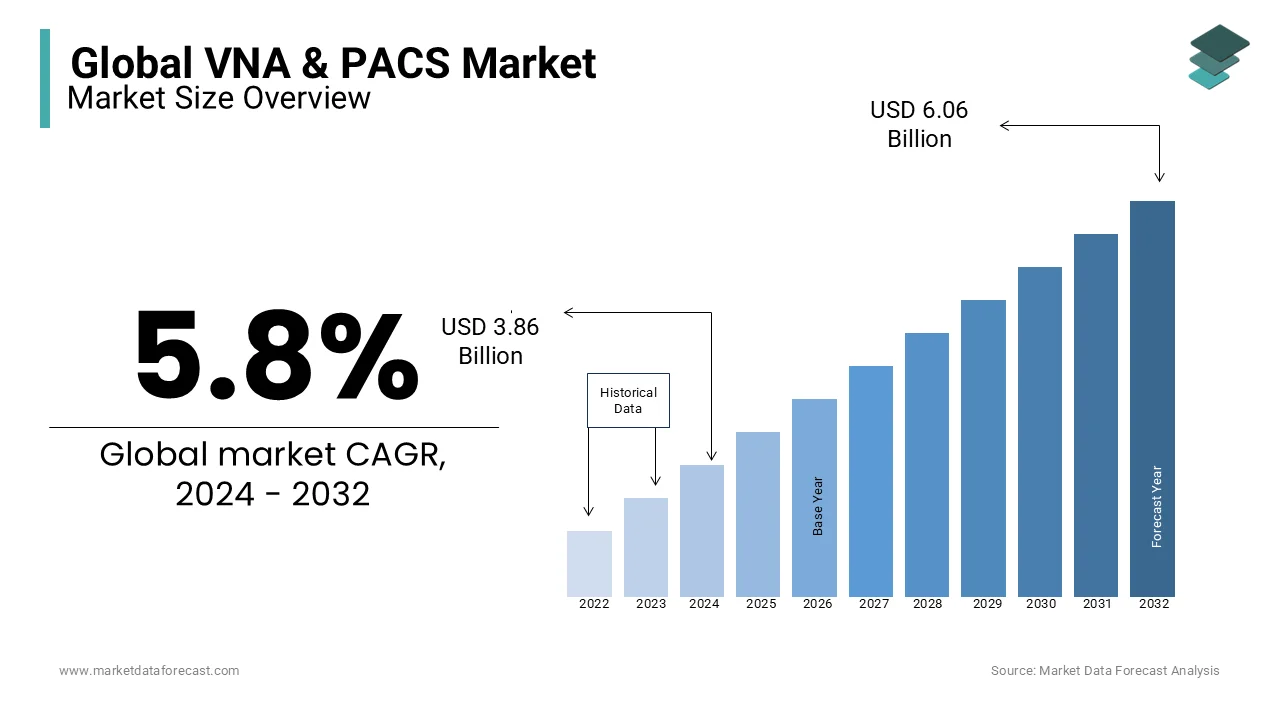

In 2024,the global vendor-neutral archive & picture archiving and communication system market was valued at USD 3.86 billion and it is expected to reach USD 6.41 billion by 2033 from USD 4.08 billion in 2025, growing at a CAGR of 5.8 % during the forecast period.

The vendor-neutral archive is a procedure that involves the collection, organization, and storage of medical images in sequential order while creating communication between multiple vendor PACS. Vendor-neutral archives and PACS are considered to be significant fields of the medical image management sector. There are two types of VNA, and they are on-premises VNA and hybrid VNA. Also, there are two types of PACS, and they are enterprise PACS and departmental PACS.

MARKET DRIVERS

The primary factor that boosts the global vendor-neutral archive and PACS market's growth is the availability of favorable policies and applicable regulations for the key market players.

Other factors such as rising demand for cost-cutting solutions, lifecycle management solutions, and standard options for the storage of medical images boost the growth of the vendor-neutral archive and PACS market across the world. Adopting advanced technologies for better management also increases the growth rate of the Global Vendor Neutral Archive (VNA) & PACS Market.

The market players adopt innovative strategies and collaborations to boost revenues, which are supposed to create lucrative growth opportunities for the growth of the vendor-neutral archive and PACS market. Benefits associated with VNA over PACS have led to a rise in VNA technology demand, which is assumed to offer growth opportunities for stakeholders in the market. The reformation of policies and encouragement from governments in various regions is likely to boost the market demand and increase growth opportunities for the key players in the vendor-neutral archive and PACS market. The integration of cloud technologies for VNA products and adopting a holistic approach to offering a better quality of healthcare are anticipated to provide lucrative opportunities for the growth of the VNA and PACS market during the outlook period.

MARKET RESTRAINTS

The lifecycles of VNA is very long, which is restraining the growth of vendor-neutral archive and PACS market. A rising account of data breaches and misinterpretation of VNA is also expected to slow down the growth rate of the vendor-neutral archive and PACS market during the forecast period.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

VNA Market – By Business Mode, Vendors, Mode of Delivery, and Region. PACS Market – By Business Mode, Type of Instruments, Mode of Delivery, Components, and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Acuo Technologies (U.S.), Agfa HealthCare (Belgium), Carestream Health (U.S.), Dell, Inc. (U.S.), BridgeHead Software (U.K.), Fujifilm Corporation (Japan), Merge Health (U.S.). |

SEGMENTAL ANALYSIS

By Mode of Delivery Insights

Based on the mode of delivery, the on-premise VNA segment is dominating the market. It contributes the largest share among the delivery modes due to data shared at a high level of security and better control over the data. The hybrid VNA segment is foreseen to witness rapid growth during the forecast period due to cloud technology adoption to store medical images considered a cost-cutting method.

By Business Mode Insights

The departmental PACS segment is projected to hold the highest share in the VNA and PACS market globally based on the business model. An extensive range of imaging applications in radiology, increasing growth in storage capacity, and capturing medical images escalate the segment growth. Growing adoption of imaging models, and rising imaging data among different fields such as radiology, cardiology, oncology, endoscopy, and many more contribute a major share to the growth of the PACS market.

The Enterprise PACS segment is predicted to grow with the highest CAGR over the analysis period. Better medical image availability is likely to mount the enterprise segment growth for the PACS market globally.

By Type of Instruments Insights

Based on the type of instruments, the Computed tomography PACS segment is expected to have the highest share in the PACS market globally. The requirement for CT devices during the pandemic and the high acquisition of telehealth is escalating the PACS market.

By Mode of Delivery Insights

Based on the mode of delivery, the Cloud-Based segment is forecasted to grow at a healthy rate during the forecast period. The segment is driven by factors like burgeoning demand for cloud-based solutions. These cloud-based PACS are majorly utilized in hospitals and diagnostic centers, especially in regions like Europe and Asia-Pacific. In the cloud-based PACS market, imaging modalities are the most commanding component globally.

REGIONAL ANALYSIS

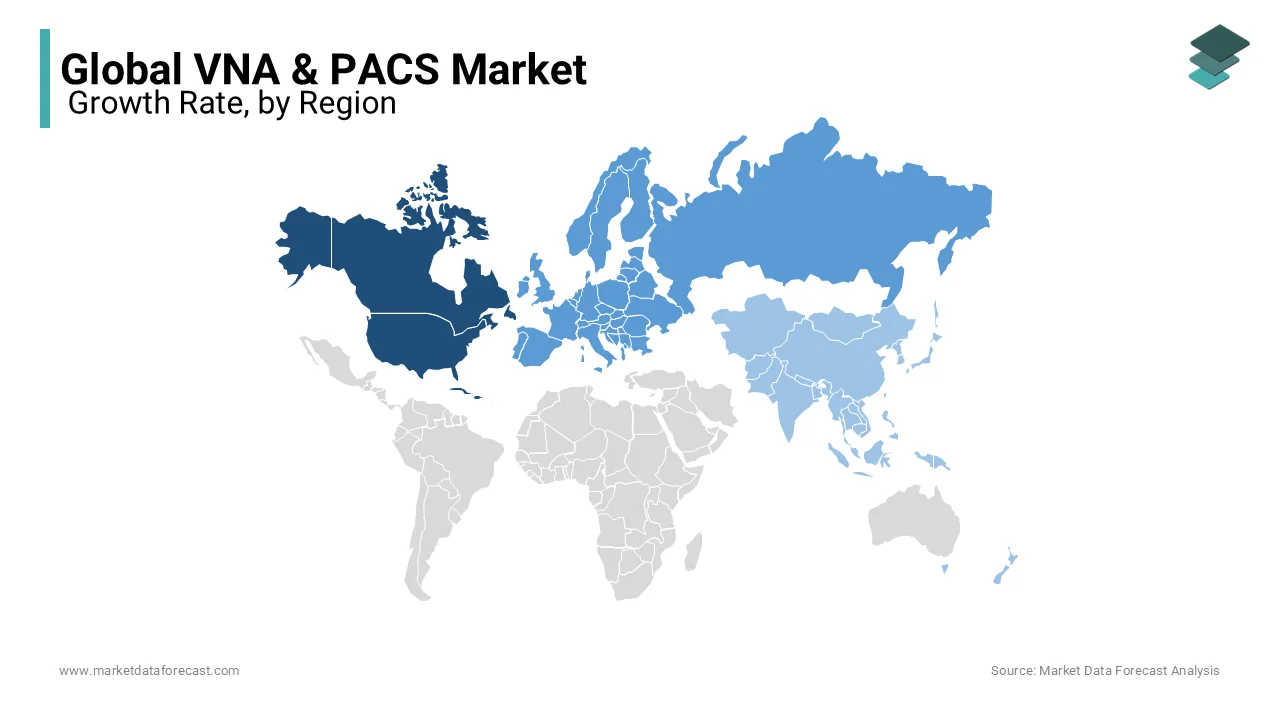

North America is dominating the global vendor-neutral archive (VNA) & PACS market. It is likely to grow at a high pace during the forecast period due to the increasing adoption of VNAs, hospital consolidations, and EHRs owing to acts such as ACA and HITECH. Europe is another significant segment dominating the market after North America due to the adoption of VNS at a large scale by the NHS trust. Asia Pacific is contributing a substantial share of revenues to the global market and is expected to continue the trend during the forecast period owing to the factors such as increasing government initiatives to provide a high quality of healthcare and increasing adoption of VNAs in emerging countries like China, Japan, India, and others.

KEY PLAYERS IN THE VNA & PACS MARKET

The major companies dominating the Global Vendor Neutral Archive (VNA) & PACS Market for its products and services are Acuo Technologies (U.S.), which leads the global VNA market, followed by Agfa HealthCare (Belgium), Carestream Health (U.S.), Dell, Inc. (U.S.), BridgeHead Software (U.K.), Fujifilm Corporation (Japan), Merge Health (U.S.), GE Healthcare (U.K.), Philips Healthcare (The Netherlands), Siemens Healthcare (Germany), McKesson Corporation (U.S.), and TeraMedica (U.S.).

The recent mergers and acquisitions trends show that smaller companies are working with bigger ones for advanced innovations by utilizing their core competencies. The future of this technology looks pretty optimistic as it offers enormous potential in the healthcare sector.

RECENT HAPPENINGS IN THIS MARKET

-

In Jan 2020, GE Healthcare inaugurated the Edison developer program, which can be implanted to boost the adoption of Artificial Intelligence for market providers. It provides access to various applications integrated with market-ready programs and algorithms to healthcare providers.

-

In May 2018, bridgehead software collaborated with Wales and England cricket boards to offer its clinical archive to all the players in the teams. This collaboration has enabled the players to manage their storage, improved accessibility, and share medical images. It has optimized treatment procedures by quickly identifying the course of action with the help of shared data to clinicians available in the teams.

MARKET SEGMENTATION

This research report on the global vendor-neutral archive (VNA) & PACS market has been segmented and sub-segmented into the following categories.

By Business Mode

- Enterprise

- Departmental

By Vendors

- Independent Vendors

- Commercial Vendors

By Mode of Delivery

- On-Premise VNA

- Hybrid VNA

- Complete Cloud-Hosted VNA

By Business Mode

- Enterprise

- Departmental

By Type of Instruments

- X-ray

- Computed Tomography

- Magnetic Resonance Imaging

- Nuclear Imaging

- Ultrasound

By Components

- Hardware

- Software

By Mode of Delivery

- Mobile Based

- Cloud-Based

- Client-Server Based

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

What is the current size of the VNA & PACS market?

The global VNA & PACS market is predicted to be worth USD 3.86 billion in 2024.

What are the challenges faced by the VNA & PACS market?

The high cost of implementation and maintenance, interoperability issues, and concerns related to data security and privacy are some of the challenges faced by the VNA & PACS market.

Who are the key players in the VNA & PACS market?

Some of the key players in the VNA & PACS market include GE Healthcare, Agfa-Gevaert Group, McKesson Corporation, Siemens Healthineers, and Philips Healthcare.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com