Global Video Wall Market Size, Share, Trends, & Growth Forecast Report By Product (Video Wall Displays, Housing, Installation & Content Management), Application (Indoor, Outdoor, Menu Board and Billboard), Vertical (Retail, Hospitality, Transportation and Healthcare) and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Video Wall Market Size

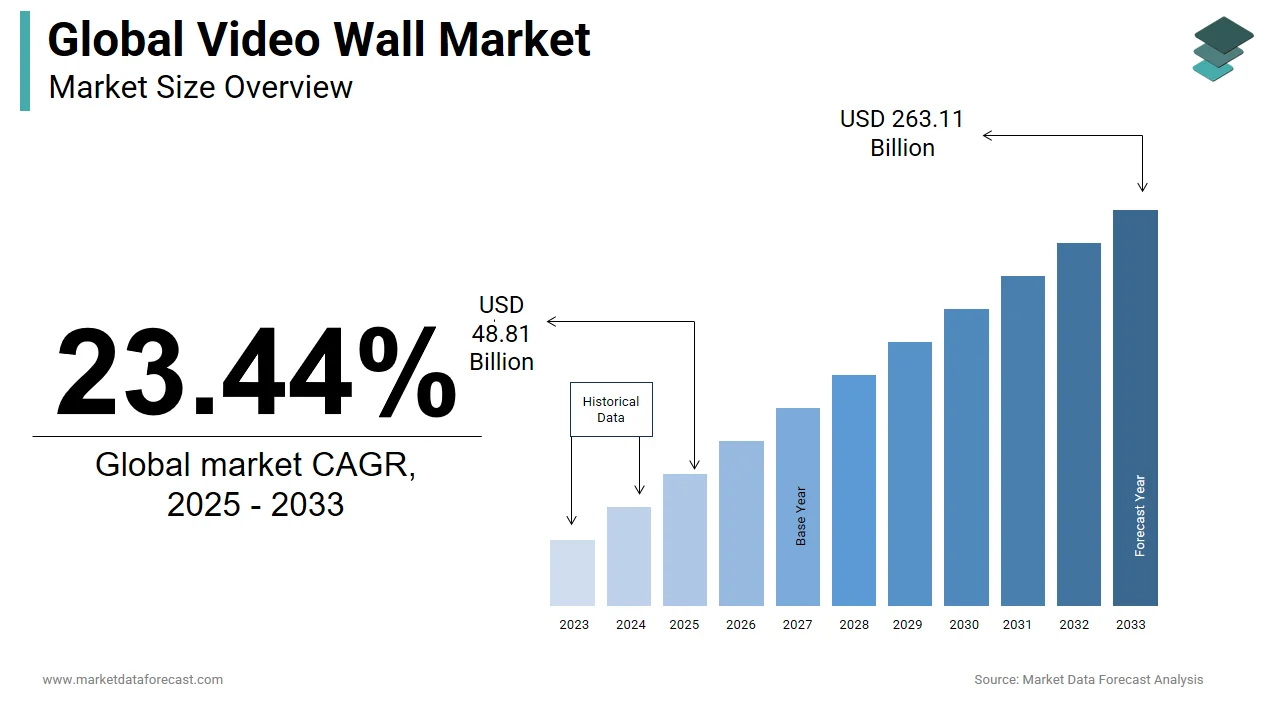

The global video wall market was worth USD 39.54 billion in 2024. The global market is predicted to reach USD 48.81 billion in 2025 and USD 263.11 billion in 2033, growing at a CAGR of 23.44% during the forecast period.

A video wall is a multi-screen wall created by linking multiple screens to display a larger image or multi-image windows. A video wall is as simple as a single source image spread across multiple screens. Or it can display multiple images from many sources, including live video feeds, on multiple screens. These video walls can be fitted on mobile mounting systems or the wall for permanent installation. Today, advertising has moved from traditional media to digital media, and with the emergence of digital outdoor advertising, the demand for video walls has driven market growth. In addition, the increase in tourism is one of the important factors in the demand for video walls globally. To keep the public informed, video walls for transportation have great utility in these places, so the adoption of video walls is higher.

MARKET DRIVERS

The significant aspects that drive the global market are easy-to-use and advanced video walls, advancement in education and government sectors, and adoption of innovative technologies at airports.

Many growing demands for highly interactive digital signage systems and emerging 3D video walls are lucrative opportunities to drive the market. Various applications such as outdoor and indoor video wall advertisements, menu boards, and billboards show impressive growth in the worldwide video wall market.

In recent years, interactive video walls have become more common at corporate events. Factors such as higher brightness, lower power consumption, and lightweight for easy transport increase demand. These factors will drive demand for LED display technology in the coming years. Explosive growth in the number of players is expected to occur, primarily among product and service providers and significant developments, over the next five years with the migration of established players to this ecosystem due to the vast potential of the revenue offered and the success of video walls.

Video walls are the most common digital technology used in the transport sector by critical centers of the transport industry, such as airports, railways, bus stations, etc. The growing need for digital content and information relevant to travelers has led to interactive video wall advertisements that have been a significant part of the growth in transportation revenues. Also, because of this, there is a change in consumer behavior in terms of customer engagement in all modes of transport, strategically building their brands on the customer mindset. This is expected to boost the video wall market during the forecast period. Businesses see opportunities, and suppliers create new products or team up for competitive advantages.

For example, airports such as Orlando International Airport have installed a 700-screen video wall that provides cinematic video contented and automatically updated flight information on the curb, at check-in, and in the large APM automatic transfer room) and orientation points of the APM and the north terminal. This helped deliver relevant visual content to passengers. Hence, these factors might drive the global video wall market in the transportation industry during the forecast period.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

23.44% |

|

Segments Covered |

By Product, Application, Vertical, And Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Adflow Networks (Canada), Au Optronics Corp (Taiwan), Philips Nv (Netherlands), Lg Display Co. Ltd. (South Korea), Navori Sa (Switzerland), Nec Display Solutions (United States), Omnivex Corporation (Canada), Panasonic Corporation (Japan), Samsung Electronics Co. Ltd. (South Korea) And Sony Corporation (Japan) and Others. |

SEGMENTAL ANALYSIS

By Product Insights

REGIONAL ANALYSIS

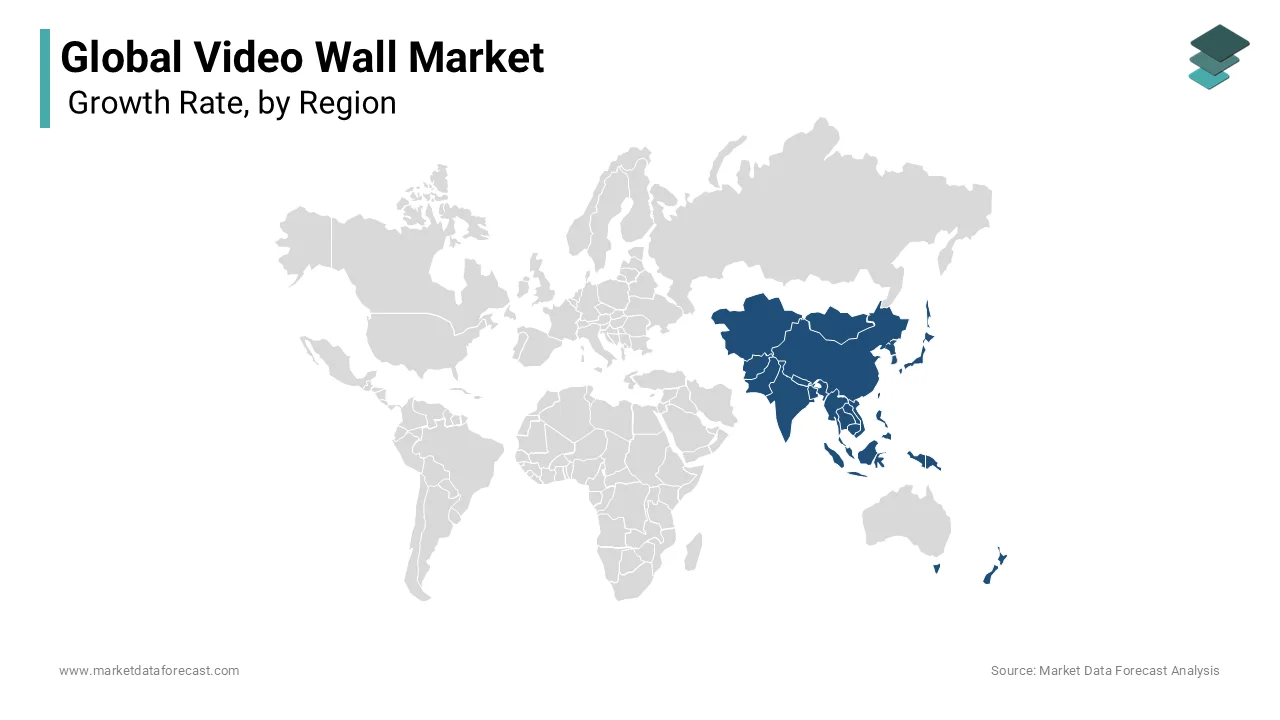

Asia Pacific is one of the fastest-growing markets, mainly due to changing consumer preferences and increasing innovation in the video wall industry. According to Zenith's ad spend report, the APAC region is also expected to become the most significant global ad spend market contributor, 33.8% by 2020, down from 32.6% in 2017. This should have a positive outlook on the local market. Due to significant regional opportunities, many global companies expand their presence by launching products or establishing strategic alliances.

KEY MARKET PARTICIPANTS

The major companies operating in the global video wall market include Adflow Networks (Canada), AU Optronics Corp (Taiwan), Philips NV (Netherlands), LG Display Co. Ltd. (South Korea), Navori SA (Switzerland), NEC Display Solutions (United States), Omnivex Corporation (Canada), Panasonic Corporation (Japan), Samsung Electronics Co. Ltd. (South Korea) and Sony Corporation (Japan).

RECENT MARKET HAPPENINGS

- In January 2020, LG Business Solutions USA launched two new 55-inch LCD video wall panels featuring a 0.44mm bezel for virtually hassle-free video wall installations and a new built-in intelligent calibration tool, which reduces installation and maintenance time. This reduces time savings and maintenance costs by up to 97%.

- In March 2019, Barco NV launched LVD5521B. The company has strengthened its product offering in the video wall segments through this launch. This video wall can be used in corporate lobbies, experience centers, control rooms, broadcast studios, meeting rooms, and other signages.

MARKET SEGMENTATION

This research report on the global video wall market has been segmented and sub-segmented based on the product, application, vertical and region.

By Product

- Video Wall Displays

- Housing

- Installation

- Content Management

By Application

- Indoor

- Outdoor

- Menu Board

- Billboard

By Vertical

- Retail

- Hospitality

- Transportation

- Healthcare

By Region

- North America

- The United States

- Canada

- Rest of North America

- Europe

- The United Kingdom

- Spain

- Germany

- Italy

- France

- Rest of Europe

- The Asia Pacific

- India

- Japan

- China

- Australia

- Singapore

- Malaysia

- South Korea

- New Zealand

- Southeast Asia

- Latin America

- Brazil

- Argentina

- Mexico

- Rest of LATAM

- The Middle East and Africa

- Saudi Arabia

- UAE

- Lebanon

- Jordan

- Cyprus

Frequently Asked Questions

What factors are driving the growth of the video wall market globally?

The increasing demand for large-scale displays in sectors such as retail, hospitality, and healthcare, coupled with advancements in display technologies and a surge in demand for 4K displays, are major growth drivers.

What industries are witnessing the highest adoption of video wall solutions globally?

Industries such as command and control centers, retail, hospitality, and transportation are among the leading sectors embracing video wall technology for enhanced visual communication and operational efficiency.

What are the key challenges faced by the global video wall market?

Challenges include the high initial costs associated with implementation, complexities in content management, and the need for skilled professionals for installation and maintenance.

How do government regulations influence the adoption of video wall technology globally?

Government initiatives promoting smart infrastructure, along with regulations encouraging the use of advanced display technologies in public spaces, contribute positively to the growth of the video wall market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com