Global Vitamins Market Size, Share, Trends & Growth Forecast Report Segmented By Source (Natural & Synthetic), Type (Vitamin B, Vitamin E, Vitamin D, Vitamin C, Vitamin A & Vitamin K), Application, And Region (North America, Europe, APAC, Latin America, Middle East And Africa), Industry Analysis From 2025 to 2033

Global Vitamins Market Size

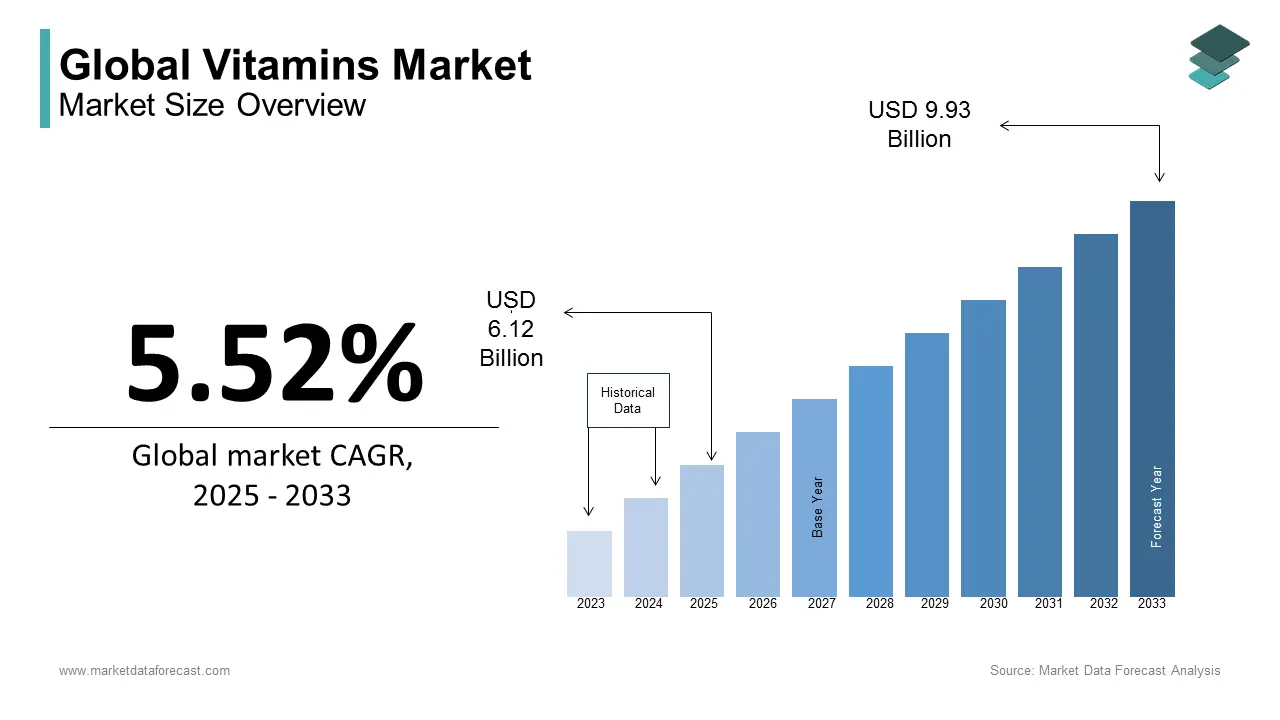

The global vitamins market size was calculated to be USD 6.12 billion in 2024 and is anticipated to be worth USD 9.93 billion by 2033 from USD 6.46 billion In 2025, growing at a CAGR of 5.52% during the forecast period.

Vitamins are the cornerstone of modern health and wellness, which reflects the growing reliance of humanity on dietary supplements to meet nutritional needs. These indispensable organic compounds that regulate bodily function, are now consumed not only to address deficiencies but also as part of a proactive approach to maintaining optimal health. Another relevant statistic is the widespread deficiency of Vitamin D which affects nearly 1 billion people globally, according to research published in the journal Nutrients. This deficiency is particularly concerning given its association with bone health, immune function, and chronic diseases such as diabetes and cardiovascular conditions. Similarly, iron-deficiency anemia, often linked to insufficient intake of Vitamin B12 and folate, remains one of the most common nutritional disorders and thereby impacting approximately 30% of women of reproductive age, as per data from the Centers for Disease Control and Prevention.

These statistics underscore the critical role vitamins play in addressing public health challenges. Moreover, the increasing adoption of plant-based diets has raised concerns about adequate intake of certain vitamins such as B12 which is predominantly found in animal-derived foods. The relevance of vitamins in ensuring global health security becomes ever more apparent because these trends continue to shape dietary habits.

MARKET DRIVERS

Rising Prevalence of Chronic Diseases and Aging Population

The increasing incidence of chronic diseases, coupled with an aging global population, serves as a significant driver for the Vitamins Market. According to the World Health Organization, non-communicable diseases (NCDs) account for approximately 71% of all global deaths annually, with conditions like cardiovascular diseases, diabetes, and osteoporosis being closely linked to nutritional deficiencies. Furthermore, the United Nations estimates that by 2050, one in six people globally will be over the age of 65, up from one in eleven in 2019. This demographic shift has amplified the demand for vitamins such as B12 and D3, which are critical for maintaining bone density and cognitive function in aging populations.

Growing Awareness of Preventive Healthcare and Nutritional Gaps

The rising awareness of preventive healthcare and the importance of addressing nutritional gaps has significantly propelled the Vitamins Market. Additionally, the Global Burden of Disease Study reveals that poor diet is responsible for more deaths globally than any other risk factor, including tobacco use. This has spurred consumers to adopt proactive health measures, driving the demand for multivitamins and fortified foods. Moreover, the World Health Organization reports that iron deficiency anemia affects 30% of women worldwide, prompting increased consumption of iron-rich supplements and Vitamin C, which enhances iron absorption. As governments and health organizations continue to promote nutritional education, the emphasis on vitamins as a cornerstone of preventive care continues to grow.

MARKET RESTRAINTS

Stringent Regulatory Frameworks and Compliance Issues

The Vitamins Market faces significant hurdles due to stringent regulatory frameworks governing the production, labeling, and marketing of dietary supplements. The U.S. Food and Drug Administration (FDA) mandates rigorous testing and documentation to ensure product safety, which can be costly and time-consuming for manufacturers. According to a report by the FDA, nearly 73% of dietary supplements fail to meet quality standards during inspections, leading to recalls and reputational damage. Additionally, the European Food Safety Authority enforces strict regulations on health claims, limiting the ability of companies to market vitamins effectively. These regulatory barriers often disproportionately affect smaller firms with limited resources. Furthermore, the World Health Organization highlights that inconsistent global standards create challenges for international trade, complicating efforts to expand into emerging markets. Such compliance issues hinder innovation and increase operational costs, restraining market growth.

Adverse Effects of Overconsumption and Consumer Misinformation

Overconsumption of vitamins and misinformation about their benefits pose another major restraint for the market. The National Institutes of Health warns that excessive intake of fat-soluble vitamins like Vitamin A and D can lead to toxicity, causing serious health issues such as liver damage and hypercalcemia. Similarly, the Centers for Disease Control and Prevention reports that nearly 10% to 15% of supplement users exceed the recommended daily allowances, often due to misleading marketing or lack of awareness. This has led to increased scrutiny from health authorities and diminished consumer trust in certain products. Moreover, the World Health Organization emphasizes that over-reliance on supplements may discourage individuals from adopting balanced diets, exacerbating nutritional imbalances. Such adverse effects not only harm public health but also invite stricter regulations, further constraining the market’s potential.

MARKET OPPORTUNITIES

Expansion of Fortified Foods and Beverages

The growing demand for fortified foods and beverages presents a significant opportunity for the Vitamins Market. The Food and Agriculture Organization estimates that over 140 countries have mandatory fortification programs, primarily targeting staple foods like flour, rice, and salt, to combat micronutrient deficiencies. For instance, the Global Alliance for Improved Nutrition reports that fortifying wheat flour with folic acid has reduced neural tube defects by up to 70% in regions implementing these programs. Additionally, the Centers for Disease Control and Prevention highlights that fortified cereals contribute significantly to daily nutrient intake, particularly among children and adolescents. As urbanization accelerates, the convenience and accessibility of fortified products appeal to busy consumers seeking healthier options. With governments increasingly promoting food fortification as a cost-effective public health strategy, this segment offers immense growth potential for vitamin manufacturers.

Rising Adoption of Personalized Nutrition Solutions

Personalized nutrition is emerging as a transformative opportunity within the Vitamins Market, driven by advancements in genetic testing and data analytics. The National Institutes of Health notes that personalized approaches to nutrition can improve health outcomes by tailoring vitamin intake to individual genetic profiles, lifestyle factors, and health conditions. By leveraging cutting-edge technologies and collaborating with healthcare providers, vitamin manufacturers can capitalize on this trend to offer tailored products that meet evolving consumer expectations.

MARKET CHALLENGES

Counterfeit Products and Quality Concerns

The proliferation of counterfeit vitamins and substandard products poses a significant challenge to the market. The World Health Organization estimates that approximately 10.5% of medical products in low- and middle-income countries are either counterfeit or fail to meet quality standards. This issue undermines consumer trust and exposes users to potential health risks, such as ineffective treatments or harmful side effects. The U.S. Food and Drug Administration has identified numerous cases of adulterated supplements containing undisclosed ingredients or incorrect dosages, further complicating efforts to ensure product safety. Additionally, the Centers for Disease Control and Prevention warns that counterfeit vitamins often mimic legitimate brands, making it difficult for consumers to distinguish between authentic and fake products. Such challenges necessitate robust supply chain monitoring and investment in anti-counterfeiting technologies, which can strain manufacturers’ resources and slow market expansion.

Supply Chain Disruptions and Raw Material Scarcity

Supply chain disruptions and raw material scarcity represent another pressing challenge for the Vitamins Market. The United Nations Conference on Trade and Development reports that global supply chains were severely impacted by the COVID-19 pandemic, leading to shortages of critical raw materials like ascorbic acid and tocopherols, key components of Vitamins C and E. Additionally, geopolitical tensions and trade restrictions have exacerbated these issues, with China, a major supplier of raw materials, experiencing periodic export bans. The U.S. Department of Agriculture highlights that fluctuations in agricultural yields, driven by climate change, further threaten the availability of natural sources of vitamins. These disruptions not only increase production costs but also delay product launches, hindering market growth. To mitigate these risks, manufacturers must diversify sourcing strategies and invest in sustainable practices, though these measures often require substantial financial outlays.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.52% |

|

Segments Covered |

By Source, Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Nestle Health Science, Amway, Herbalife Nutrition, Bayer AG, GNC (General Nutrition Centres), Nature’s Bounty (NBTY, Inc.), DSM (Royal DSM), Abbott Laboratories, Now Foods, and Pfizer Consumer Healthcare |

SEGMENTAL ANALYSIS

By Source Insights

The synthetic vitamins segment dominated the market by capturing 708% of the global market share in 2024 owing to their widespread adoption is attributed to cost-effectiveness, consistent quality, and scalability in production compared to natural sources. For instance, in the Multiethnic Cohort study, 58% of men and 72% of women over the age of 45 reported using dietary supplements. This segment’s leadership stems from its ability to meet the high demand for affordable supplements, particularly in developing regions. Furthermore, the Centers for Disease Control and Prevention notes that synthetic vitamins play a critical role in addressing micronutrient deficiencies globally, making them indispensable in public health initiatives.

The natural vitamins segment is projected to grow at a CAGR of 9.5% over the forecast period due to the rising consumer preference for clean-label and organic products. The World Health Organization emphasizes that consumers increasingly associate natural vitamins with fewer side effects and higher efficacy, fueling demand. Studies show natural vitamin E is absorbed 2 times as efficiently as its synthetic counterpart. Additionally, the U.S. Department of Agriculture reports that the global organic food market, which often incorporates natural vitamins, is expanding rapidly, further propelling this segment. As governments promote sustainable agricultural practices, the availability of natural raw materials is increasing, enabling manufacturers to capitalize on this trend. This growth underscores the shift toward holistic health solutions.

By Type Insights

The Vitamin B segment led the market by occupying a share of 35% of the global market in 2024. This dominance is attributed to its critical role in energy metabolism, red blood cell formation, and nervous system function. The National Institutes of Health highlights that Vitamin B12 and folate deficiencies affect nearly 40% of pregnant women globally, driving demand for supplements. Moreover, the Food and Agriculture Organization notes that Vitamin B is extensively used in fortified cereals and infant formulas, ensuring widespread consumption. Its versatility across healthcare, food fortification, and dietary supplements makes it a cornerstone of the Vitamins Market, addressing both preventive and therapeutic needs effectively.

The Vitamin D segment is the fastest-growing segment and is predicted to grow at a CAGR of 10.2% over the forecast period due to the rising awareness of its role in bone health, immune function, and chronic disease prevention. The Centers for Disease Control and Prevention reports that over 1 billion people worldwide suffer from Vitamin D deficiency, creating a substantial market opportunity. Additionally, the Global Burden of Disease Study highlights that low Vitamin D levels are linked to increased risks of osteoporosis and cardiovascular diseases, prompting governments to promote supplementation. With urbanization reducing sunlight exposure, reliance on fortified foods and supplements is escalating, positioning Vitamin D as a key driver of future market expansion.

By Application Insights

The healthcare products segment accounted for the largest share of 40.8% of the global market in 2024. The domination of the healthcare segment in the global market is driven by the widespread use of vitamins in dietary supplements, pharmaceuticals, and nutraceuticals. According to data from the Centers for Disease Control and Prevention (CDC), approximately 57.6% of U.S. adults aged 20 and over reported using dietary supplements in the past 30 days, with multivitamin-mineral supplements being the most commonly used, underscoring their role in preventive healthcare. Additionally, the National Institutes of Health notes that vitamins are integral to treating deficiencies and supporting recovery in clinical settings. With governments prioritizing public health initiatives, healthcare products remain the most significant application, addressing both therapeutic and wellness needs effectively.

The personal care products segment is estimated to be growing at the fastest CAGR of 11.8% over the forecast period due to the increasing incorporation of vitamins like Vitamin C and E in skincare formulations for their antioxidant properties. The World Health Organization emphasizes that consumer demand for anti-aging and skin-brightening solutions has surged, driving innovation in this space. A survey conducted by NewBeauty in 2024 revealed that 68.9% of respondents actively seek out vitamin C in their skincare products, highlighting a significant demand for vitamin-infused formulations. Furthermore, the rise of e-commerce platforms has expanded access to premium personal care products, accelerating adoption. As beauty trends emphasize natural ingredients, vitamins are becoming indispensable in this dynamic segment.

REGIONAL ANALYSIS

North America held the most dominating position in the global vitamins market and accounted for 35.3% of the global market share in 2024 owing to the high consumer awareness, robust healthcare infrastructure, and a strong preference for dietary supplements. The National Institutes of Health reports that over 70% of U.S. adults use dietary supplements, with vitamins being the most popular category. Additionally, stringent FDA regulations ensure product quality, fostering consumer trust. The region's aging population with over 54 million seniors as of 2022 is further driving demand for vitamins like B12 and D3. North America's dominance underscores its role as a hub for innovation and premium vitamin products.

Asia-Pacific is growing rapidly and is expected to witness the highest CAGR of 8.5% over the forecast period owing to the rapid urbanization, rising disposable incomes, and increasing health consciousness in countries like China and India. Additionally, in the East Asia and Pacific region, nearly one in seven children under five years old (14%) experience stunted growth, and more than half suffer from micronutrient deficiencies. Furthermore, government initiatives promoting food fortification, such as India’s mandatory iodized salt program, are accelerating adoption. With e-commerce platforms expanding access to affordable vitamins, this region is poised to become a key driver of global market expansion.

Europe represents a mature and stable segment of the global vitamins market. The region's aging population, with over 20% aged 65 or older, drives demand for vitamins like B12 and D3, which are essential for bone health and cognitive function. The World Health Organization highlights that micronutrient deficiencies remain prevalent in Eastern Europe, creating opportunities for fortified foods and supplements. Additionally, stringent EU regulations ensure high-quality standards, fostering consumer trust. Governments across Europe are increasingly promoting preventive healthcare, further boosting vitamin consumption. As health-conscious trends gain momentum, particularly in Western Europe, the region is likely to remain a key player in the global market.

Latin America is poised for steady growth in the Vitamins Market, driven by rising health awareness and increasing urbanization. Recent reports from Reuters indicate that hunger affected 41 million people, or 6.2% of the population, in the region in 2023. , creating significant demand for affordable vitamins. Countries like Brazil and Mexico are leading this growth, supported by government-led nutrition programs and expanding retail channels. According to the Food and Agriculture Organization, fortification initiatives targeting staple foods like maize flour and milk are gaining traction, further propelling the market. With a growing middle class and increased access to dietary supplements through e-commerce platforms This region’s potential lies in addressing nutritional gaps while capitalizing on evolving consumer preferences.

The Middle East and Africa represent a region with untapped potential but face significant challenges due to economic disparities and limited healthcare infrastructure. The United Nations estimates that over 40% of the African population suffers from vitamin deficiencies, particularly Vitamin A, which contributes to high rates of childhood blindness. Government-led initiatives, such as Nigeria’s Vitamin A supplementation programs, aim to address these issues, albeit with inconsistent implementation. In the Middle East, rising disposable incomes and urbanization are driving demand for premium vitamins and fortified foods, particularly in Gulf Cooperation Council (GCC) countries. The World Health Organization emphasizes that partnerships between governments and private players are critical to overcoming barriers like affordability and accessibility. While growth in this region is expected to be gradual, it holds immense long-term potential, especially as public health initiatives gain momentum.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Major Players of the global vitamins market include Nestlé Health Science, Amway, Herbalife Nutrition, Bayer AG, GNC (General Nutrition Centers), Nature’s Bounty (NBTY, Inc.), DSM (Royal DSM), Abbott Laboratories, Now Foods, and Pfizer Consumer Healthcare

The global Vitamins Market is characterized by intense competition, driven by the presence of established multinational corporations and emerging regional players striving to capture market share. Key players such as DSM, BASF SE, and ADM dominate the industry, leveraging their extensive R&D capabilities, robust supply chains, and economies of scale to maintain leadership. According to the Food and Agriculture Organization, these companies collectively account for over 50% of the global market, focusing on high-quality synthetic and natural vitamins for diverse applications, including healthcare, food fortification, and animal nutrition. Their dominance is reinforced by strategic investments in innovation, such as bio-based formulations and microencapsulation technologies, which enhance product efficacy and appeal to health-conscious consumers.

However, the market also faces competition from smaller firms and regional manufacturers, particularly in Asia-Pacific, where companies like Zhejiang Medicine and North China Pharmaceutical are gaining traction by offering cost-effective solutions. The Centers for Disease Control and Prevention highlights that price sensitivity in developing regions has intensified competition, prompting larger players to adopt aggressive pricing strategies and expand their geographic footprint. Additionally, the rise of private-label supplements and e-commerce platforms has disrupted traditional distribution channels, creating opportunities for new entrants. To counter these challenges, key players emphasize sustainability and compliance with stringent regulatory standards, as noted by the European Food Safety Authority. Overall, the competitive landscape is shaped by innovation, strategic partnerships, and a focus on meeting evolving consumer preferences, ensuring dynamic growth and diversification in the Vitamins Market.

TOP STRATEGIES USED BY THE KEY MARKET PARTICIPANTS

Innovation and Product Diversification

Key players in the Vitamins Market, such as DSM, BASF SE, and ADM, prioritize innovation to meet evolving consumer demands. DSM has invested heavily in developing bio-based vitamins and clean-label solutions, aligning with the growing preference for natural and sustainable products. BASF SE focuses on advanced formulations, such as microencapsulated vitamins, which enhance stability and bioavailability, particularly in fortified foods and beverages. According to the National Institutes of Health, these innovations cater to niche markets like personalized nutrition and premium supplements, enabling companies to differentiate themselves. Additionally, ADM has expanded its portfolio to include organic and plant-based vitamins, targeting health-conscious consumers. By diversifying their product offerings, these players strengthen their competitive edge while addressing unmet needs in the market.

Strategic Partnerships and Collaborations

Collaborations with governments, NGOs, and private entities are a cornerstone strategy for key players. For instance, DSM partners with the World Food Programme to combat malnutrition in developing regions by supplying fortified food ingredients. Similarly, BASF collaborates with global health organizations to promote food fortification programs, as highlighted by the Food and Agriculture Organization. These partnerships not only enhance brand reputation but also expand market reach into underserved regions. Furthermore, mergers and acquisitions play a critical role; ADM’s acquisition of companies specializing in natural ingredients has bolstered its position in the clean-label segment. Such strategic alliances enable players to leverage complementary strengths and scale operations effectively.

Sustainability and ESG Initiatives

Sustainability has become a focal point for strengthening market position. DSM has committed to achieving net-zero emissions by 2050, investing in renewable energy and eco-friendly production processes. BASF SE emphasizes reducing its carbon footprint through innovative technologies, such as biocatalysis, which minimizes waste during vitamin synthesis. The United Nations Conference on Trade and Development notes that sustainability initiatives resonate strongly with environmentally conscious consumers, driving brand loyalty. Moreover, ADM has launched programs to source raw materials responsibly, ensuring traceability and ethical practices. By integrating Environmental, Social, and Governance (ESG) principles into their operations, these players not only comply with regulatory standards but also appeal to modern consumer values, reinforcing their leadership in the market.

TOP 3 PLAYERS IN THE MARKET

DSM (Royal DSM)

DSM, a Netherlands-based multinational, is one of the largest players in the global Vitamins Market, commanding a significant share of approximately 25% in key segments like Vitamin E and A, as per reports from the Food and Agriculture Organization. The company specializes in producing high-quality vitamins for food fortification, dietary supplements, and animal nutrition. DSM’s commitment to sustainability and innovation has positioned it as a leader in developing bio-based and clean-label solutions. The National Institutes of Health highlights DSM’s role in addressing global micronutrient deficiencies through partnerships with governments and NGOs, particularly in developing regions. Its cutting-edge research facilities and robust supply chain enable it to meet growing demand while maintaining stringent quality standards, making it indispensable to the global market.

BASF SE

BASF SE, a Germany-based chemical giant, is another dominant player, contributing significantly to the production of synthetic vitamins such as Vitamin C, B2, and E. According to the European Food Safety Authority, BASF holds an estimated 20% share in the global Vitamins Market, driven by its cost-effective manufacturing processes and extensive distribution network. BASF’s focus on innovation is evident in its development of advanced formulations tailored for specific applications, including healthcare and personal care products. The Centers for Disease Control and Prevention notes that BASF’s fortified ingredients are widely used in infant nutrition and clinical supplements, addressing critical public health needs. Additionally, BASF’s emphasis on sustainability, including reducing carbon emissions in its production processes, aligns with evolving consumer preferences, further solidifying its leadership.

ADM (Archer Daniels Midland Company)

ADM, headquartered in the United States, is a major contributor to the Vitamins Market, particularly in natural-sourced vitamins and fortified food ingredients. With an estimated 15% market share, ADM leverages its expertise in agricultural processing to produce vitamins like B-complex and Vitamin D, as reported by the U.S. Department of Agriculture. The company’s acquisition of innovative firms and strategic investments in R&D have enabled it to cater to the growing demand for clean-label and organic vitamins. The World Health Organization acknowledges ADM’s role in combating malnutrition through its participation in global fortification programs. ADM’s strong presence in North America and expanding footprint in Asia-Pacific, supported by e-commerce platforms, make it a pivotal player in shaping the future of the Vitamins Market.

RECENT HAPPENINGS IN THE MARKET

- In November 2024, Cipla Health Ltd. expanded its Maxirich brand by introducing two new products: Maxirich Vitamin C+ Zinc Chewable Tablets and Maxirich Gold Advanced Daily Supplement.

- In July 2024, Herbalife India entered the luxury skincare market with the launch of the Vritilife Outer Nutrition Range. This collection includes a facial cleanser, toner, serum, and moisturizer, all formulated with authentic botanicals and Ayurvedic-based ingredients.

MARKET SEGMENTATION

This research report on the global vitamins market has been segmented and sub-segmented based on source, type, application, and region.

By Source

- Natural

- Synthetic

By Type

- Vitamin B

- Vitamin E

- Vitamin D

- Vitamin C

- Vitamin A

- Vitamin K

By Application

- Healthcare products

- Food & Beverages

- Infant Foods

- Dairy products

- Bakery & confectionary products

- Beverages

- Others

- Feed

- Personal care products

By Region

- North America

- Europe

- The Asia Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

1. Which factors are contributing to the growth of the vitamins market?

Rising health awareness, demand for organic products, and e-commerce expansion are key growth drivers.

2. Who are the top players in the global vitamins market?

Companies like Nature Made, Centrum, and Herbalife, along with emerging direct-to-consumer brands, are leading the market.

3. What are the fastest-growing vitamin segments?

The fastest-growing segments include vegan supplements, gummies, and personalized vitamin packs tailored to individual needs.

4. How is technology influencing the vitamins market?

AI-driven personalized recommendations, smart supplements, and digital health tracking are transforming how consumers choose vitamins.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com