Global Wearable Technology Market Size, Share, Trends & Growth Forecast Report By Product (Wrist Wear, Headwear/Eyewear, Footwear, Neckwear and Bodywear), Type (Smart Textile and Non-Textile), Application (Consumer Electronics, Healthcare, Enterprise and Industrial) and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Wearable Technology Market Size

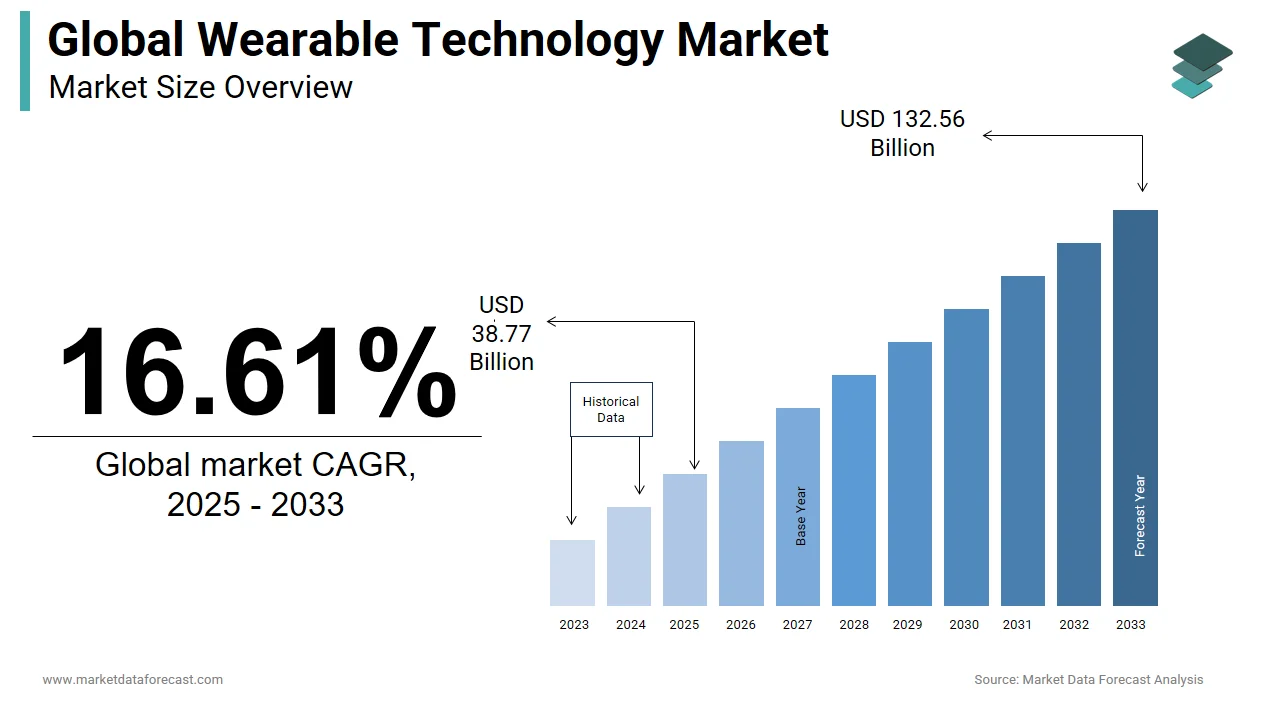

The global wearable technology market was worth USD 33.25 billion in 2024. The global market is anticipated to be worth USD 132.56 billion by 2033 from USD 38.77 billion in 2025, growing at a CAGR of 16.61% during the forecast period.

Currently, the wearable technology market is witnessing the introduction of several innovative products disrupting the industry dynamics. It has changed the way we communicate with the digital world and check our health. Smartwatches, fitness trackers, wireless earbuds, and smart rings are highly popular in the market and have become an integral component of our routine lives.

Moreover, the market also saw wearable products fitted out with sensors that can monitor huge amounts of important signs like oxygen saturation, blood pressure, and heart rate and even identify abnormalities in its beating. These features have made wearable technology more popular among Generation X and Generation Z customers.

MARKET DRIVERS

The rising health issues and the desire for a healthy lifestyle are some of the factors driving the global wearable technology market growth.

The space between patients and doctors or hospitals is filled by digital health technologies through telehealth services and online consultations. It helps medical professionals in analyzing patient situations and developing a precise treatment plan since it gives them access to real-time, current blood pressure, oxygen saturation, heart rate and blood sugar. Furthermore, wearable medical devices also perform remote monitoring of patients which lowers healthcare expenditure and hospital readmissions.

Technological advancements in sensor technology and miniaturization have provided the development of comfortable, lightweight and smaller devices. As a result, Consumer adoption and acceptability have grown greatly. Additionally, advancements such as battery life and 5G connectivity are transforming wearable devices into more powerful, versatile and user-friendly devices. The growing advances in immersive reality technology are also propelling the global wearable technology market. Augmented reality and virtual reality provide immersive digital experiences, interactive environments, simulation and engagement have completely changed learning techniques. However, these are in the emerging stage and will need some time, personalization and investment to meet the huge demand in education.

Growing technical developments present an excellent opportunity for the expansion of the global wearable technology market. The innovative advances in the fashion industry are contributing to market growth. Manufacturers have allowed the introduction of smart clothing, with major effects on the medical field, by incorporating state-of-the-art electronics into clothing. Furthermore, huge investments are made by established brands such as Nike and Adidas to create T-shirts with sensors to track heart rate, calories burned and other health-related metrics. The area of lower visibility of wearable devices also presents potential prospects for market expansion. Gadgets can look more like jewelry or clothes than like a fitness band or clip-on monitor. They could further be covered up from view by taking the shape of a strap or patch.

MARKET RESTRAINTS

The limited functionality of budget and basic devices is affecting the expansion of the global wearable technology market and may drift away the interest of tech-savvy customers in this technology. Also, the largest issue is that wearable typically has screens that are far smaller than those of smartphones. An app's user satisfaction is unlikely to be perfect and most users may never be completely satisfied with its appearance and functionality. Additionally, the lack of regular updates is another factor hindering market growth. In today’s connected devices world, the absence of multi-platform support is affecting the demand for wearable technology.

MARKET OPPORTUNITIES

Next-generation materials are expected to significantly boost the growth of the wearable technology market. The revolutionary developments in materials science target to transform the thinking and application of wearable devices, providing new heights of user comfort, integration, and functionality. A promising advancement is the rise of transient electronic systems, which can disintegrate, dissolve, or else disappear at controlled speeds after completing their purpose. These devices, especially bioresorbable electronics, are developed and engineered to be incorporated into the human body, enabling therapeutic and sensing characteristics in accordance with natural biological procedures. Simultaneously, gallium-based liquid metals (LM) are making space for conformal bioelectronic devices. So, this presents a huge opportunity for the wearable technology market.

MARKET CHALLENGES

Security and privacy concerns relating to the gathering and storage of customer’s sensitive health data continue to be the major challenge for the wearable technology market. The lack of strong security measures and legal frameworks by several governments around the world to safeguard people’s autonomy and confidentiality is the primary reason behind this problem. Navigating through the rising different and complex regulations and legislation is tough and sometimes time-consuming which derails the growth trajectory of this market. For instance, European laws are different from the US regulations.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

16.61% |

|

Segments Covered |

By Type, Product, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Fitbit, Inc. (U.S.), Apple, Inc. (U.S.), Xiaomi Technology Co. Ltd. (China), Garmin Ltd. (U.S.), Samsung Electronics Co., Ltd. (South Korea), Guangdong BBK Electronics Co., Ltd (China), Misfit, Inc. (U.S.), Alphabet, Inc. (U.S.), LG Electronics Inc. (South Korea), Qualcomm Technologies, Inc. (U.S.), Adidas Group (Germany), Sony Corporation (Japan), Jawbone, Inc. (U.S.), Lifesense Group (The Netherlands), and others |

SEGMENTAL ANALYSIS

By Type Insights

Based on type, the wearable non-textile segment dominated the market and accounted for the major share of the global wearable technology market in 2024 and the domination of the segment is expected to continue throughout the forecast period owing to the growing demand for health monitoring equipment to improve welfare and assist in the management of chronic diseases. Further expansion into healthcare, sports and business sectors is expected because of continuous advancements and a growing emphasis on personalization. Moreover, the seamless integration with various devices including smartphones and smart homes enhances functionality and provides convenience which is boosting the segment growth.

By Product Insights

Based on product, the wristwear segment had 48.7% of the global market share in 2024 and is expected to register prominent growth during the forecast period. To boost their product sales many smartwatch and fitness tracker companies specifically targeted athletes, adventure seekers and sports enthusiasts which is the key factor propelling the segmental growth. These gadgets offer indicators linked to fitness and promote a healthy way of living by giving details on calorie consumption, water breaks and step counting. On the other hand, the headwear/eyewear segment stood at the second position in the category due to the growing use of smart headwear and virtual reality and augmented reality headsets in the multimedia and healthcare sectors.

By Application Insights

Based on application, the consumer electronics segment is estimated to account for the major share of the global wearable technology market during the forecast period and the growth of the consumer electronics segment can be attributed to the rising adoption of wearable technologies such as fitness bands and AR/VR headsets. Products that give customers easy access to health information are in demand because of the evolving lifestyle of consumers. Fit and wellness applications have become more common owing to wearable technology. This covers smart clothing, smart health watches, smartwatch phones and others.

REGIONAL ANALYSIS

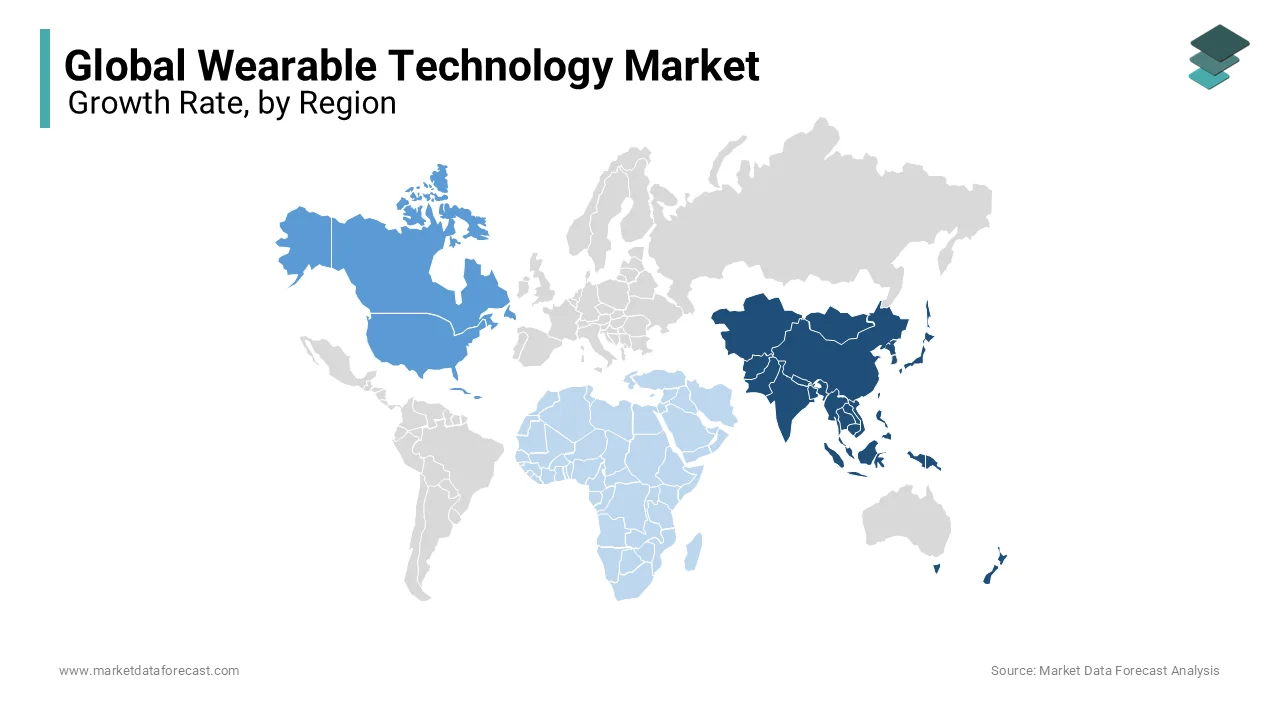

Asia Pacific is rapidly growing at a higher CAGR and presents diverse regional dynamics. The quantity and diversity of the user base attract wearable technology companies. Its strong focus on wellness and fitness has increased the demand for heartbeat-monitoring wearables, smartwatches, fitness trackers and others for keeping track of sleeping patterns, physical activity, etc. Moreover, the rising number of manufacturers to assist in the market expansion during the anticipated duration. Furthermore, In the first half of 2023, more than 57 million wearables were shipped to India which saw the market grow by over 53 percent year over year basis.

North America is the biggest market having a significant share and is expected to continue this trend in the forecast period. The demand for more powerful and sophisticated wearable technologies is growing as smart devices become further advanced. The high disposable income along with the rapid adoption and recognition of new technology are a few key drivers of the regional market. Furthermore, the region is home to major wearable companies including Apple, Fitbit and Garmin who are prime contributors to the market growth. However, the market has reached its maturity which is slowing down the regional growth rate.

The European wearable technology market is propelling forward at a consistent pace which is moving towards niche applications and specific segments. Key players including Google, Apple, Samsung, Withings, Qualcomm and Microsoft have made strategic investments in the health and fitness industry from which wearable technology is already experiencing significant market penetration. It is projected that more than 28 billion euros will be utilized for formulations and intermediate materials in the wearables supply chain by 2025 indicating its high level of dynamic activity. Additionally, AI and VR technological advancements will boost the demand for smart glasses and this will be extremely beneficial to Germany's wearable electronics sector.

Latin America's wearable technology market is in the emerging phase with promising prospects for the future. The high smartphone adoption rates in the region is driving the development of wearables powered by apps and seamless connectivity. The growing emphasis on health and wellness is increasing the widespread use of fitness trackers and health monitoring devices. Moreover, Government programs were implemented in Brazil and Mexico to promote wearable technology innovation and use.

Middle East and Africa saw considerable growth in terms of both unit and value in 2022. The Shipments to the region in 2022 increased 9.8% year over year (YoY) to more than 14 million units. The market's value increased by 25 percent to 2.86 billion dollars. In 2022, earwear device shipments increased by 13 percent YoY which accounted for half of total wearable shipments. Apple and Samsung held an overall share of almost 40 percent in the earwear segment with Apple ranking first and Samsung ranking second. Third place went to the Chinese seller Xiaomi.

KEY MARKET PLAYERS

Companies playing a notable role in the global wearable technology market include Fitbit, Inc. (U.S.), Apple, Inc.(U.S.), Xiaomi Technology Co. Ltd. (China), Garmin Ltd. (U.S.), Samsung Electronics Co., Ltd.(South Korea), Guangdong BBK Electronics Co., Ltd (China), Misfit, Inc. (U.S.), Alphabet, Inc. (U.S.), LG Electronics Inc.(South Korea), Qualcomm Technologies, Inc. (U.S.), Adidas Group (Germany), Sony Corporation (Japan), Jawbone, Inc. (U.S.), Lifesense Group (The Netherlands), and others.

RECENT MARKET HAPPENINGS

- In October 2023, Xiaomi introduced its Wrist ECG and Blood Pressure Recorder for monitoring and fall detection.

- In September 2023, Garmin introduced the Garmin Fenix 8 Pro Solar for multi-sports tracking which comes with advanced health metrics, solar charging and a sapphire glass display.

MARKET SEGMENTATION

This research report on the global wearable technology market has been segmented and sub-segmented based on type, product, application and region.

By Type

- Wearable Smart Textile

- Wearable Non-Textile

By Product

- Wristwear

- Headwear/Eyewear

- Footwear

- Neckwear

- Bodywear

By Application

- Consumer Electronics

- Healthcare

- Enterprise

- Industrial

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions

What are the main segments of the wearable technology market?

The main segments of the wearable technology market include smartwatches, fitness trackers, wearable cameras, smart clothing, and hearables. Smartwatches and fitness trackers dominate the market, with significant contributions from smart clothing and hearables.

What are the key drivers for the growth of the wearable technology market?

Key drivers include rising health consciousness among consumers, advancements in wearable technology such as improved sensors and connectivity, growing adoption of smartphones, and increased investments in research and development by key market players.

What innovations are currently emerging in the wearable technology market?

Innovations include the development of smart textiles and fabrics, augmented reality (AR) glasses, wearable medical devices for chronic disease management, and integration of artificial intelligence (AI) for predictive health analytics. Advancements in battery technology and miniaturization of components are also notable trends.

What is the future outlook for the wearable technology market?

The future outlook for the wearable technology market is positive, with expectations of continuous growth driven by technological advancements, increasing consumer awareness of health and fitness, and expanding applications in healthcare and other industries. The integration of wearables with other smart devices and the Internet of Things (IoT) will further enhance their functionality and market penetration.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com